- ZTALMY® (ganaxolone) Q3 2024 net product revenue of $8.5

million representing growth of 56% versus Q3 2023

- Narrowing full year 2024 ZTALMY net product revenue guidance to

$33 to $34 million

- Reported results from Phase 3 TrustTSC trial and commenced

process to explore strategic alternatives

- Marinus continues to support the commercial growth of ZTALMY;

further ganaxolone clinical development has been suspended

- Scheduled to meet with FDA Q4 2024 to discuss a potential path

forward for IV ganaxolone in refractory status epilepticus

- Cost reduction plans implemented with cash runway expected into

Q2 2025; cash and cash equivalents of $42.2 million as of September

30, 2024

Marinus Pharmaceuticals, Inc. (Nasdaq: MRNS), a pharmaceutical

company dedicated to the development of innovative therapeutics to

treat seizure disorders, today reported business highlights and

financial results for the third quarter ended September 30,

2024.

“We are pleased to see continued commercial growth of ZTALMY

with more than 200 patients active on therapy and a steady increase

in demand,” said Scott Braunstein, M.D., Chairman and Chief

Executive Officer of Marinus. “In 2024, our Phase 3 data in status

epilepticus and tuberous sclerosis complex showed meaningful

clinical activity in certain refractory patients, however, the

trials did not meet the thresholds for statistical significance.

Given this outcome, we have made the difficult decision to explore

strategic alternatives with the goal of maximizing stockholder

value while supporting the growth of ZTALMY for patients with CDKL5

deficiency disorder (CDD).”

Dr. Braunstein continued, “I extend my deepest gratitude to our

dedicated employees for their significant contributions to our

work, and to the patients and clinicians who participated in our

trials. We are proud to have delivered the first-and-only

FDA-approved treatment for patients with seizures associated with

CDD and hope that our research will serve as a foundation for

future innovations in areas of high unmet need.”

ZTALMY® (ganaxolone) Oral

Suspension CV

- Generated net product revenue of $8.5 million for the third

quarter of 2024 representing 56% growth versus the third quarter of

2023.

- Narrowing full year 2024 net product revenue guidance to $33 to

$34 million from a range of $33 to $35 million.

- Announced issuance of new U.S. patent for ZTALMY oral titration

regimens covering the treatment of a range of epilepsies, expiring

September 2042.

Clinical Updates

- The U.S. Food and Drug Administration (FDA) granted Marinus a

Type C meeting, scheduled for the fourth quarter of 2024, to

discuss a potential path forward for intravenous (IV) ganaxolone in

refractory status epilepticus (RSE).

- Presented data from the Phase 3 RAISE trial evaluating IV

ganaxolone for the treatment of RSE at the Neurocritical Care

Society Annual Meeting in October 2024.

- Announced topline results from the Phase 3 TrustTSC trial of

oral ganaxolone in tuberous sclerosis complex (TSC) whereby the

trial did not achieve statistical significance in the primary

endpoint.

- Marinus will continue to support the commercial growth of

ZTALMY and activities required by the FDA and European Medicines

Agency specific to post-approval commitments related to the CDD

indication.

Ganaxolone development in the RAISE trial has been supported in

part by the Department of Health and Human Services; Administration

for Strategic Preparedness and Response; Biomedical Advanced

Research and Development Authority (BARDA) under contract number

75A50120C00159.

General Business and Financial

Update

- Marinus has commenced a process to explore strategic

alternatives with the goal of maximizing value for its stockholders

and has engaged Barclays as an advisor to assist in reviewing its

strategic alternatives.

- Full year 2024 guidance has been narrowed with projected ZTALMY

net product revenue between $33 and $34 million and combined

selling, general and administrative (SG&A) and research and

development (R&D) expenses in the range of approximately $135

to $138 million, including stock-based compensation expense of

approximately $20 million.

- Cost reduction activities were initiated in the fourth quarter

of 2024, including suspending further ganaxolone clinical

development and a workforce reduction of approximately 45%.

- Through the execution of the cost reduction plans, the Company

had cash and cash equivalents of $42.2 million as of September 30,

2024, to fund the Company’s operating expenses and capital

expenditure requirements into the second quarter of

2025.

Financial Results

- Recognized $8.5 million and $23.9 million in net product

revenue for the three and nine months ended September 30, 2024,

respectively, as compared to $5.4 million and $13.0 million for the

same periods in the prior year, respectively.

- Recognized $0.1 million and $0.3 million in Biomedical Advanced

Research and Development Authority (BARDA) federal contract revenue

for the three and nine months ended September 30, 2024,

respectively, as compared to $1.9 million and $10.8 million for the

same periods in the prior year, respectively. The decrease was

primarily driven by activity associated with the start-up of the

API onshoring initiative in the first quarter of 2023 and

completion of the BARDA base period funding in the fourth quarter

of 2023.

- R&D expenses were $16.3 million and $61.3 million for the

three and nine months ended September 30, 2024, respectively, as

compared to $23.7 million and $73.0 million for the same periods in

the prior year, respectively. The reduction was due primarily to

reduced costs in 2024 associated with the RAISE trial completion

and costs associated with start-up of the API onshoring effort in

the first quarter of 2023.

- SG&A expenses were $12.6 million and $47.9 million for the

three and nine months ended September 30, 2024, respectively, as

compared to $14.9 million and $45.8 million for the same periods in

the prior year, respectively. The primary drivers of the decrease

for the three month period were decreased personnel and consulting

expenses, while the drivers of the increase for the nine month

period were increased stock-based compensation expense and

commercial expense.

- The Company had net losses of $24.2 million and $98.7 million

for the three and nine months ended September 30, 2024,

respectively; cash used in operating activities decreased to $87.8

million for the nine months ended September 30, 2024, compared to

$91.0 million for the same period a year ago.

- At September 30, 2024, the Company had cash and cash

equivalents of $42.2 million, compared to cash, cash equivalents

and short-term investments of $150.3 million at December 31,

2023.

Readers are referred to, and encouraged to read in its entirety,

the Company’s Quarterly Report on Form 10-Q for the quarterly

period ended September 30, 2024, to be filed with the Securities

and Exchange Commission, which includes further detail on the

Company’s business plans, operations, financial condition, and

results of operations.

Selected Financial Data (in thousands, except share and per

share amounts)

September 30, 2024

(unaudited)

December 31, 2023

ASSETS

Cash and cash equivalents

$

42,184

$

120,572

Short-term investments

-

29,716

Other assets

21,440

20,620

Total assets

$

63,624

$

170,908

LIABILITIES AND STOCKHOLDERS’

(DEFICIT) EQUITY

Current liabilities

$

34,504

$

40,624

Long term debt, net

41,713

61,423

Revenue interest financing payable,

net

36,039

33,766

Other long-term liabilities

18,108

18,330

Total liabilities

130,364

154,143

Total stockholders’ (deficit) equity

(66,740)

16,765

Total liabilities and stockholders’

(deficit) equity

$

63,624

$

170,908

Three Months Ended September

30,

Six Months Ended September

30,

2024 (Unaudited)

2023 (Unaudited)

2024 (Unaudited)

2023 (Unaudited)

Revenue:

Product revenue, net

$

8,468

$

5,429

$

23,928

$

13,010

Federal contract revenue

56

1,891

295

10,753

Collaboration revenue

17

18

53

36

Total revenue

8,541

7,338

24,276

23,799

Expenses:

Research and development

16,334

23,661

61,349

73,006

Selling, general and administrative

12,573

14,868

47,909

45,794

Restructuring Costs

-

-

1,950

-

Cost of product revenue

714

455

2,205

1,047

Total expenses:

29,621

38,984

113,413

119,847

Loss from operations

(21,080

)

(31,646

)

(89,137

)

(96,048

)

Interest income

598

1,895

3,169

6,366

Interest expense

(3,843

)

(4,242

)

(12,806

)

(12,597

)

Other income, net

100

1,021

52

1,105

Loss before income taxes

(24,225

)

(32,972

)

(98,722

)

(101,174

)

Benefit for income taxes

-

-

-

1,538

Net loss applicable to common

shareholders

$

(24,225

)

$

(32,972

)

$

(98,722

)

$

(99,636

)

Per share information:

Net loss per share of common stock—basic

and diluted

$

(0.42

)

$

(0.61

)

$

(1.73

)

$

(1.89

)

Basic and diluted weighted average shares

outstanding

57,229,229

53,920,109

57,049,038

52,755,114

Other comprehensive loss

Unrealized gain (loss) on

available-for-sale securities

-

43

20

(71

)

Total comprehensive loss

$

(24,225

)

$

(32,929

)

$

(98,702

)

$

(99,707

)

About Marinus Pharmaceuticals

Marinus is a commercial-stage pharmaceutical company dedicated

to the development of innovative therapeutics for seizure

disorders. The Company’s product, ZTALMY® (ganaxolone) oral

suspension CV, is an FDA-approved prescription medication

introduced in the U.S. in 2022. For more information, please visit

www.marinuspharma.com and follow us on LinkedIn, X and

Facebook.

Forward-Looking Statements

To the extent that statements contained in this press release

are not descriptions of historical facts regarding Marinus, they

are forward-looking statements reflecting the current beliefs and

expectations of management made pursuant to the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Words such as "may", "will", "expect", "anticipate", "estimate",

"intend", "believe", and similar expressions (as well as other

words or expressions referencing future events, conditions or

circumstances) are intended to identify forward-looking statements.

Examples of forward-looking statements contained in this press

release include, among others, our expectations regarding the

review and exploration of strategic alternatives and their

potential impact on stockholder value; our expectations regarding

the future of the company’s operations; our net product revenue and

other financial guidance and projections; statements regarding our

expected clinical development plans, enrollment in our clinical

trials, and regulatory communications, and the timing thereof; our

expected cash runway; our expectations and beliefs regarding the

FDA and EMA with respect to our product candidates; our

expectations regarding our cost reduction plans; the potential

safety and efficacy of ganaxolone; and other statements regarding

the company's future operations, financial performance, financial

position, prospects, objectives and other future event.

Forward-looking statements in this press release involve

substantial risks and uncertainties that could cause our clinical

development programs, future results, performance or achievements

to differ significantly from those expressed or implied by the

forward-looking statements. Such risks and uncertainties include,

among others, the risk that exploration of strategic alternatives

may not result in any definitive transaction or enhance stockholder

value and may create a distraction or uncertainty that may

adversely affect our operating results, business, or investor

perceptions; uncertainties regarding future costs and expenses;

Marinus’ ability to continue as a going concern; Marinus’ ability

to maintain compliance with its debt covenants and risks and

uncertainties regarding the ability to do; unexpected market

acceptance, payor coverage or future prescriptions and revenue

generated by ZTALMY; the pricing and reimbursement process can be

time consuming and may delay commercialization of ZTALMY in one or

more European countries; our dependence on Orion to commercialize

ZTALMY in Europe pursuant to the exclusive collaboration agreement;

unexpected actions by the FDA or other regulatory agencies with

respect to our products; competitive conditions and unexpected

adverse events or patient outcomes from being treated with ZTALMY,

the company’s cash and cash equivalents may not be sufficient to

support its operating plan for as long as anticipated; our ability

to comply with the FDA’s requirement for additional post-marketing

studies in the required time frames; the size and growth potential

of the markets for the company’s products, and the company’s

ability to service those markets; the company’s expectations,

projections and estimates regarding expenses, future revenue,

capital requirements, and the availability of and the need for

additional financing; delays, interruptions or failures in the

manufacture and supply of our product; the company’s ability to

obtain additional funding to support its programs; and the

company’s ability to protect its intellectual property. This list

is not exhaustive and these and other risks are described in our

periodic reports, including the annual report on Form 10-K,

quarterly reports on Form 10-Q and current reports on Form 8-K,

filed with or furnished to the Securities and Exchange Commission

and available at www.sec.gov. Any forward-looking statements that

we make in this press release speak only as of the date of this

press release. We assume no obligation to update forward-looking

statements whether as a result of new information, future events or

otherwise, after the date of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241112598483/en/

Company Contacts

Investors Sonya Weigle Chief People

and Investor Relations Officer Marinus Pharmaceuticals, Inc.

sweigle@marinuspharma.com

Media Molly Cameron Director,

Corporate Communications & Investor Relations Marinus

Pharmaceuticals, Inc. mcameron@marinuspharma.com

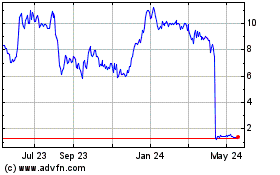

Marinus Pharmaceuticals (NASDAQ:MRNS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Marinus Pharmaceuticals (NASDAQ:MRNS)

Historical Stock Chart

From Dec 2023 to Dec 2024