Outbrain (NASDAQ: OB), a technology platform that drives business

outcomes through engagement, announced today it has entered into a

definitive agreement to acquire Teads, the global omnichannel video

platform.

The strategic combination will unite

two of the most recognized names in digital advertising to create

an end-to-end, omnichannel advertising solution for the open

internet. The transaction will combine Outbrain’s AI-driven

performance technology with Teads' leading video and branding

solutions, merging the companies’ highly-complementary capabilities

into a comprehensive full-funnel solution for advertisers.

The combined company will provide

advertisers with unified access to the most engaging and valuable

consumer media experiences, from CTV to online shopping. Once the

combination is completed, the company will represent a break from

established platform players that base their value primarily on

views and impressions. In contrast, the combined company plans to

focus on delivering more tangible outcomes such as attention, deep

engagement, and e-commerce conversions — across the multitude of

previously fragmented premium environments on the open internet,

including connected TV.

“This is a transformative transaction

to establish a true end-to-end, full-funnel platform for the open

internet,” said David Kostman, CEO of Outbrain. “The combination of

our highly-complementary offerings accelerates our vision to become

the preferred partner to deliver meaningful brand outcomes across

premium, quality media environments — while scaling the

industry-leading offerings Teads is known for. I’m incredibly proud

of what our team at Outbrain has created, and strongly believe that

with Teads we will build tremendous value for our customers,

employees, and partners. I believe this combination and the

transaction’s financial structure position Outbrain to deliver

significant shareholder value in the years to come.”

“This strategic combination presents

vast new opportunities for the advertising industry at large. We’ve

built a world-class team at Teads that has focused on driving the

best video and branding outcomes, and in the last several years

have successfully brought those strengths to CTV,” said Bertrand

Quesada, Co-Founder and Co-CEO of Teads.

Teads Co-CEO Jeremy Arditi added: “By

joining our expertise in omnichannel video with Outbrain’s

strengths in prediction and performance, we are poised to provide

our customers and partners with more value than ever before. Having

known the Outbrain team for a decade, we know we’re creating an

amazing combined company focused on innovation and excellence.”

The transaction reflects the

opportunity to revolutionize the advertising landscape by offering

a scaled platform that connects direct supply with direct demand,

nurturing audiences and optimizing marketing results from discovery

to purchase. This combination will address the self-limiting choice

between branding and performance that marketers currently face when

advertising on the open internet. As a result, the combined company

will be well positioned to compete in the estimated — and growing —

$175 billion open internet advertising opportunity.

Media owners stand to benefit from

robust monetization opportunities across diverse advertiser

budgets, providing critical revenue and growth to the world’s

premiere journalistic and entertainment outlets.

Key Combined

Strengths:

- Creation of one of the largest, direct supply paths across

premium environments on the open internet and CTV, expected to

reach over 2 billion monthly consumers at a global scale across 50+

combined markets.

- Combination of highly-complementary expertise and product

offerings: joining Teads' deep video and branding capabilities with

Outbrain’s leading performance solutions. Direct code-on-page and

pixel-on-advertiser-site integrations will create an end-to-end

solution that can continuously optimize outcomes.

- Powerful suite of data capabilities, gathered from contextual,

publisher environment, and advertiser performance signals — making

over 1 billion predictions per second.

- Unique, innovative ad experiences built by creative studio

teams, creating new opportunities to tell engaging brand stories

across the open internet, such as full-page takeovers, story

sequencing from CTV to digital, and more.

Transaction

Details:

- Total estimated consideration for the Teads acquisition is

approximately $1 billion, on a cash free, debt free basis,

including an upfront payment of $725 million, subject to standard

adjustments, and a deferred cash payment of $25 million.

- Outbrain intends to finance the transaction with existing cash

resources and $750 million in committed debt financing from Goldman

Sachs Bank USA, Jefferies Finance LLC and Mizuho Bank, Ltd.,

subject to customary funding conditions. Outbrain will also issue

to Altice 35 million shares of common stock, valued at

approximately $169 million based on a one-month volume-weighted

average price (VWAP) of Outbrain’s common stock as of July 30,

2024, of $4.82, and $105 million in convertible preferred

equity.

- The convertible preferred equity to be issued to Altice will

accrue dividends on a quarterly basis at a rate of 10% per annum,

payable in cash or payment-in-kind at Outbrain’s option. The

initial conversion price is $10.00 per share (subject to customary

adjustments). The convertible preferred equity will be a perpetual

instrument and may be redeemed by Outbrain in whole, or in part, in

cash, prior to the five year anniversary of the issuance, subject

to payment of certain premiums, and after the fifth anniversary of

issuance without premium. Outbrain may also elect to convert all or

a portion of the preferred shares then outstanding after two years,

subject to certain share price thresholds.

- The $25 million deferred cash payment will be paid in one or

more installments after closing, subject to compliance with certain

covenants in the debt financing terms.(3)

- Additionally, Outbrain obtained commitments from Goldman Sachs

Bank USA, Jefferies Finance LLC and Mizuho Bank, Ltd. for a $100

million revolving credit facility, a portion of which will be

available to pay a portion of the cash consideration for the

transaction and related fees and expenses, and which will otherwise

be available for working capital and general corporate

purposes.

- The transaction is expected to be completed in the first

quarter of 2025 and is subject to customary closing conditions,

including the receipt of Outbrain stockholder approval and

regulatory approvals. The transaction has been unanimously approved

by the Boards of Directors of Outbrain and Teads.

- Goldman Sachs & Co. LLC. is acting as lead financial

advisor to Outbrain with Jefferies LLC and Mizuho also acting as

financial advisors. Meitar Law Offices, Bryan Cave Leighton Paisner

and Cravath Swaine & Moore are acting as legal advisors to

Outbrain.

Financial

Highlights:

- The combined company is expected to generate:

- Advertiser spend of more than $1.7 billion in 2024E.

- Adjusted EBITDA of $230 - $250(1)(2) million

based on combined 2024E Adjusted EBITDA of $180 -

$190(1)(2) million plus the impact of $50 - $60

million of year two expected realized synergies.

- Unlevered free cash flow of more than $150

million(1)(2) in 2024E, when including the impact

of year two expected realized synergies.

- Outbrain is also providing selected preliminary results for the

second quarter of 2024, as follows:

- Ex-TAC Gross Profit of $55 - $57 million(2),

above the lower end of the previously-issued guidance of $53

million(2).

- Adjusted EBITDA of at least $6 million(2),

above the upper end of the previously-issued guidance range of $1 -

$4 million(2).

- These preliminary results are based on currently available

information and do not present all necessary information for a

complete understanding of Outbrain’s results of operations for the

quarter ended June 30, 2024. Actual results will be reported at

Outbrain’s upcoming earnings release, scheduled for August 8, 2024,

and may differ from the preliminary results presented above.

_____________________________________________________(1)

Amounts are presented on a combined basis and do not reflect any

pro forma adjustments or other adjustments relating to integration

activities, cost savings or synergies, the alignment of accounting

policies, IFRS to US GAAP conversion, or the impacts of foreign

exchange rates. Pro forma results presented in accordance with

Article 11 of Regulation S-X could differ materially from the

amounts presented above.

(2) The above measures are forward-looking

non-GAAP financial measures for which a reconciliation to the most

directly comparable GAAP financial measure is not available without

unreasonable efforts.

(3) If the deferred payment is not paid by the

third anniversary of closing, then its balance will increase to

$37.5 million and will accrue interest annually at a rate of 10%

per annum.

Conference Call and

Webcast:

Outbrain will host an investor

conference call this morning, Thursday, August 1st at 8:30 am

ET. Interested parties are invited to listen to the conference call

which can be accessed live by phone by dialing 1-877-869-3847 or

for international callers, 1-201-689-8261. A replay will be

available two hours after the call and can be accessed by dialing

1-877-660-6853, or for international callers, 1-201-612-7415. The

passcode for the live call and the replay is 13747889. The replay

will be available until August 15, 2024. Interested investors and

other parties may also listen to a simultaneous webcast of the

conference call by logging onto the Investors Relations section of

the Company’s website at https://investors.outbrain.com. The online

replay will be available for a limited time shortly following the

call.

Additional

Information About the Transaction and Where to Find

It:

This press release may be deemed to be

solicitation material in respect of the stockholder approval (the

“Stockholder Approval”) to authorize the issuance of certain equity

securities of Outbrain as consideration for the proposed

transaction. In connection with a special meeting of its

shareholders for the Stockholder Approval, Outbrain intends to file

relevant materials with the SEC, including Outbrain’s proxy

statement in preliminary and definitive form. INVESTORS AND

STOCKHOLDERS ARE URGED TO READ THE DEFINITIVE PROXY STATEMENT AND

OTHER RELEVANT MATERIALS CAREFULLY IN THEIR ENTIRETY WHEN THEY

BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT OUTBRAIN, TEADS AND THE TRANSACTION. Investors and

stockholders may obtain a free copy of these materials (when

available) and other documents filed by Outbrain with the SEC

through the website maintained by the SEC at www.sec.gov. In

addition, free copies of these materials will be made available

free of charge through Outbrain’s website at

https://www.outbrain.com.

Participants

in the Solicitation:

Outbrain and its

directors and executive officers may be deemed to be participants

in the solicitation of proxies from the stockholders of Outbrain in

favor of the Stockholder Approval. Information regarding these

directors and executive officers and a description of their direct

and indirect interests, by security holdings or otherwise, is set

forth in Outbrain’s proxy statement for its 2024 annual meeting of

stockholders on Schedule 14A, which was filed with the SEC on April

26, 2024. To the extent holdings of Outbrain’s securities by its

directors or executive officers have changed since the amounts set

forth in such 2024 proxy statement, such changes have been or will

be reflected on Initial Statements of Beneficial Ownership on Form

3 or Statements of Change in Ownership on Form 4 filed with the

SEC. Additional information concerning the direct or indirect

interests, by security holdings or otherwise, of Outbrain’s

participants in the solicitation, which may, in some cases, be

different than those of Outbrain’s shareholders generally, will be

set forth in Outbrain’s proxy statement relating to the Stockholder

Approval when it becomes available.

Cautionary Note About

Forward-Looking Statements:

This press release contains

forward-looking statements within the meaning of the federal

securities laws and the Private Securities Litigation Reform Act of

1995, which statements involve substantial risks and uncertainties.

These statements are based on current expectations, estimates,

forecasts and projections about the industries in which Outbrain

and Teads operate, and beliefs and assumptions of Outbrain’s

management. Forward-looking statements may include, without

limitation, statements regarding possible or assumed future results

of our business, financial condition, results of operations,

liquidity, plans and objectives, expected synergies and statements

of a general economic or industry-specific nature. You can

generally identify forward-looking statements because they contain

words such as “may,” “will,” “should,” “expects,” “plans,”

“anticipates,” “could,” “intends,” “guidance,” “outlook,” “target,”

“projects,” “contemplates,” “believes,” “estimates,” “predicts,”

“foresee,” “potential” or “continue” or the negative of these terms

or other similar expressions that concern our expectations,

strategy, plans or intentions or are not statements of historical

fact. The outcome of the events described in these forward-looking

statements is subject to risks, uncertainties and other factors

including, but not limited to: the risk that the conditions to the

consummation of the transaction will not be satisfied (or waived);

uncertainty as to the timing of the consummation of the transaction

and Outbrain’s and Teads’ ability to complete the transaction; the

occurrence of any event, change or other circumstance or condition

that could give rise to the termination of the stock purchase

agreement; the failure to obtain, or delays in obtaining, required

regulatory approvals or clearances; the risk that any such approval

may result in the imposition of conditions that could adversely

affect Outbrain or Teads, or the expected benefits of the

transaction; the failure to obtain the necessary debt financing to

complete the transaction; the effect of the announcement or

pendency of the transaction on Outbrain’s or Teads’ operating

results and business generally; risks that the transaction disrupts

current plans and operations or diverts management’s attention from

its ongoing business; the initiation or outcome of any legal

proceedings that may be instituted against Outbrain or Teads, or

their respective directors or officers, related to the transaction;

unexpected costs, charges or expenses resulting from the

transaction; the risk that Outbrain’s stock price may decline

significantly if the transaction is not consummated; the effect of

the announcement of the transaction on the ability of Outbrain and

Teads to retain and hire key personnel and maintain relationships

with their customers, suppliers and others with whom they do

business; the ability of Outbrain to successfully integrate Teads’

operations, technologies and employees; the ability to realize

anticipated benefits and synergies of the transaction, including

the expectation of enhancements to Outbrain’s services, greater

revenue or growth opportunities, operating efficiencies and cost

savings; overall advertising demand and traffic generated by

Outbrain and the combined company’s media partners; factors that

affect advertising demand and spending, such as the continuation or

worsening of unfavorable economic or business conditions or

downturns, instability or volatility in financial markets, and

other events or factors outside of Outbrain and the combined

company’s control, such as U.S. and global recession concerns,

geopolitical concerns, including the ongoing wars between

Ukraine-Russia and Israel-Hamas, supply chain issues, inflationary

pressures, labor market volatility, bank closures or disruptions,

and the impact of unfavorable economic conditions and other factors

that have and may further impact advertisers’ ability to pay;

Outbrain and the combined company’s ability to continue to

innovate, and adoption by Outbrain and the combined company’s

advertisers and media partners of expanding solutions; the success

of Outbrain and the combined company’s sales and marketing

investments, which may require significant investments and may

involve long sales cycles; Outbrain and the combined company’s

ability to grow their business and manage growth effectively; the

ability to compete effectively against current and future

competitors; the loss of one or more of large media partners, and

Outbrain and the combined company’s ability to expand advertiser

and media partner relationships; conditions in Israel, including

the ongoing war between Israel and Hamas and other terrorist

organizations, may limit Outbrain and the combined company’s

ability to market, support and innovate their products due to the

impact on employees as well as advertisers and advertising markets;

Outbrain and the combined company’s ability to maintain revenues or

profitability despite quarterly fluctuations in results, whether

due to seasonality, large cyclical events, or other causes; the

risk that research and development efforts may not meet the demands

of a rapidly evolving technology market; any failure of Outbrain

and the combined company’s recommendation engine to accurately

predict attention or engagement, any deterioration in the quality

of Outbrain and the combined company’s recommendations or failure

to present interesting content to users or other factors which may

cause us to experience a decline in user engagement or loss of

media partners; limits on Outbrain and the combined company’s

ability to collect, use and disclose data to deliver

advertisements; Outbrain and the combined company’s ability to

extend their reach into evolving digital media platforms; Outbrain

and the combined company’s ability to maintain and scale their

technology platform; the ability to meet demands on our

infrastructure and resources due to future growth or otherwise; the

failure or the failure of third parties to protect Outbrain and the

combined company’s sites, networks and systems against security

breaches, or otherwise to protect the confidential information of

Outbrain and the combined company; outages or disruptions that

impact Outbrain or the combined company or their service providers,

resulting from cyber incidents, or failures or loss of our

infrastructure; significant fluctuations in currency exchange

rates; political and regulatory risks in the various markets in

which Outbrain and the combined company operate; the challenges of

compliance with differing and changing regulatory requirements; the

timing and execution of any cost-saving measures and the impact on

Outbrain and the combined company’s business or strategy; and the

risks described in the section entitled “Risk Factors” and

elsewhere in Outbrain’s Annual Report on Form 10-K filed for the

year ended December 31, 2023 and in subsequent reports filed with

the SEC.

Accordingly, you should not

rely upon forward-looking statements as an indication of future

performance. Outbrain cannot assure you that the results, events

and circumstances reflected in the forward-looking statements will

be achieved or will occur, and actual results, events, or

circumstances could differ materially from those projected in the

forward-looking statements. The forward-looking statements made in

this communication relate only to events as of the date on which

the statements are made. Outbrain and the combined company may not

actually achieve the plans, intentions or expectations disclosed in

the forward-looking statements and you should not place undue

reliance on the forward-looking statements. Outbrain undertakes no

obligation, and does not assume, any obligation to update any

forward-looking statements, whether as a result of new information,

future events or circumstances after the date on which the

statements are made or to reflect the occurrence of unanticipated

events or otherwise, except as required by law.

About Teads

Teads is a global omnichannel platform

offering premium advertising solutions that drive business growth.

By combining quality media, data, and creative, Teads helps

advertisers reach their target audiences and optimizes monetization

for publishers. With a focus on brand safety and impactful

engagement, Teads ensures effective digital advertising across all

channels. Teads partners with the leading marketers, agencies and

publishers through a team of 1,200+ people in 50 offices across

more than 30 countries.

For more information, visit

https://www.teads.com.

About Outbrain

Outbrain (Nasdaq: OB) is a leading

technology platform that drives business results by engaging people

across the Open Internet. Outbrain predicts moments of engagement

to drive measurable outcomes for advertisers and publishers using

AI and machine learning across more than 8,500 online properties

globally. Founded in 2006, Outbrain is headquartered in New York

with offices in Israel and across the United States, Europe,

Asia-Pacific, and South America.

For more information, visit

https://www.outbrain.com.

Media Contact

press@outbrain.com

Investor Relations

Contact

IR@outbrain.com(332) 205-8999

Key Financial Metrics and

Projections

|

|

Year ended December 31, 2023 |

|

(in millions USD) |

Outbrain |

Teads(2) |

Combined CompanyPre-Synergies(3) |

|

Gross Profit |

$184.8 |

$383.7 |

$568.5 |

|

Ex-TAC Gross Profit(1) |

227.4 |

430.2 |

657.6 |

|

Net income |

10.2 |

95.8 |

106.0 |

|

Adjusted EBITDA(1) |

28.5 |

168.7 |

197.2 |

|

Operating Cash Flow(1) |

13.7 |

122.4 |

136.1 |

|

Free Cash Flow |

(6.5) |

109.3 |

102.8 |

|

|

Year ended December 31, 2024 Projections |

|

(in millions USD) |

Outbrain(4) |

Teads |

Combined CompanyPre-Synergies(3) |

|

Ex-TAC Gross Profit |

$238 - $248 |

$422 - $432 |

$660 - $680 |

|

Adjusted EBITDA |

$30 - $35 |

$150 - $155 |

$180 - $190 |

_______________________

(1) Adjusted EBITDA, Ex-TAC Gross Profit and

Free Cash Flow are non-GAAP financial measures. Ex-TAC Gross Profit

is calculated by adding back other cost of revenue to gross profit.

Adjusted EBITDA is defined as net income before gain related to

convertible debt; interest expense; interest income and other

income, net; provision for income taxes; depreciation and

amortization; stock-based compensation, and other income or

expenses that Outbrain does not consider indicative of its core

operating performance. Free Cash Flow is defined as cash flow

provided by operating activities, less capital expenditures and

capitalized software development costs. See “Non-GAAP

Reconciliations” in Outbrain’s 2023 Form 10-K, as filed with the

SEC on March 8, 2024, for limitations of these measures and

reconciliations to the most comparable GAAP financial

measures.(2) All amounts have been presented based

on Teads standalone financial statements and translated from Euros

to US Dollars using an exchange rate of 1.081.(3)

Amounts are presented on a combined basis and do not reflect any

pro forma adjustments or other adjustments relating to integration

activities, cost savings or synergies, the alignment of accounting

policies, IFRS to US GAAP conversion, or the impacts of foreign

exchange rates. Pro forma results presented in accordance with

Article 11 of Regulation S-X could differ materially from the

amounts presented above.(4) Represents the Full

Year 2024 guidance provided by Outbrain as of their most recent

earnings announcement, on May 9, 2024.

The projected financial results presented above are

forward-looking statements that are subject to a variety of

assumptions and estimates. Investors are cautioned not to place

undue reliance on the projected financial results as actual results

may differ from projected results, and those differences may be

material. Investors are encouraged to listen to the conference call

and to review the accompanying materials, which contain more

information about the transaction and the combined

company.

Non-GAAP Reconciliations:

The following table presents the reconciliation of Ex-TAC Gross

Profit to gross profit, the most directly comparable U.S. GAAP

measure. Ex-TAC Gross Profit may fluctuate in the future due to

various factors, including, but not limited to, seasonality and

changes in the number of media partners and advertisers, advertiser

demand or user engagements. We present Ex-TAC Gross Profit because

it is a key profitability measure used by our management and board

of directors to understand and evaluate our operating performance

and trends, develop short-term and long-term operational plans, and

make strategic decisions regarding the allocation of capital. There

are limitations on the use of Ex-TAC Gross Profit in that traffic

acquisition cost is a significant component of our total cost of

revenue but not the only component and, by definition, Ex-TAC Gross

Profit presented for any period will be higher than gross profit

for that period. A potential limitation of this non-GAAP financial

measure is that other companies, including companies in our

industry that have a similar business, may define Ex-TAC Gross

Profit differently, which may make comparisons difficult. As a

result, this information should be considered as supplemental in

nature and is not meant as a substitute for revenue or gross profit

presented in accordance with U.S. GAAP.

|

|

Year ended December 31, 2023 |

|

(in millions USD) |

Outbrain |

Teads |

Combined CompanyPre-Synergies |

|

Gross profit |

$ |

184.8 |

$ |

383.7 |

$ |

568.5 |

|

Other cost of revenue |

|

42.6 |

|

46.5 |

|

89.1 |

|

Ex-TAC Gross Profit |

$ |

227.4 |

$ |

430.2 |

$ |

657.6 |

The following table presents the reconciliation of Adjusted

EBITDA to net income, the most directly comparable U.S. GAAP

measure. Our calculation of Adjusted EBITDA is not necessarily

comparable to non-GAAP information of other companies. Adjusted

EBITDA should be considered as a supplemental measure and should

not be considered in isolation or as a substitute for any measures

of our financial performance that are calculated and reported in

accordance with U.S. GAAP.

|

|

Year ended December 31, 2023 |

|

(in millions USD) |

Outbrain |

Teads |

Combined CompanyPre-Synergies |

|

Net income |

$ |

10.2 |

|

$ |

95.8 |

|

$ |

106.0 |

|

|

Interest expense |

|

5.4 |

|

|

– |

|

|

5.4 |

|

|

Interest income and other income, net |

|

(7.7 |

) |

|

(3.6 |

) |

|

(11.3 |

) |

|

Gain related to convertible debt |

|

(22.6 |

) |

|

- |

|

|

(22.6 |

) |

|

Provision for income taxes |

|

6.1 |

|

|

42.2 |

|

|

48.3 |

|

|

Depreciation and amortization |

|

20.7 |

|

|

12.1 |

|

|

32.8 |

|

|

Stock-based compensation |

|

12.1 |

|

|

17.9 |

|

|

30.0 |

|

|

Regulatory matter costs, net of insurance |

|

0.8 |

|

|

- |

|

|

0.8 |

|

|

IPO and M&A related costs |

|

- |

|

|

1.4 |

|

|

1.4 |

|

|

Severance costs |

|

3.5 |

|

|

3.7 |

|

|

7.2 |

|

|

IFRS to US GAAP adjustment for leases |

|

- |

|

|

(0.8 |

) |

|

(0.8 |

) |

|

Adjusted EBITDA |

$ |

28.5 |

|

$ |

168.7 |

|

$ |

197.2 |

|

The following table presents the reconciliation of free cash

flow to net cash provided by operating activities, the most

directly comparable U.S. GAAP measure. Our calculation of free cash

flow is not necessarily comparable to non-GAAP information of other

companies. Free cash flow should be considered as a supplemental

measure and should not be considered in isolation or as a

substitute for any measures of our financial performance that are

calculated and reported in accordance with U.S. GAAP.

|

|

Year ended December 31, 2023 |

|

(in millions USD) |

Outbrain |

Teads |

Combined CompanyPre-Synergies |

|

Net cash provided by operating activities |

$ |

13.7 |

|

$ |

122.4 |

|

$ |

136.1 |

|

|

Purchases of property and equipment |

|

(10.1 |

) |

|

(0.9 |

) |

|

(11.0 |

) |

|

Capitalized software development costs |

|

(10.1 |

) |

|

(12.2 |

) |

|

(22.3 |

) |

|

Free cash flow |

$ |

(6.5 |

) |

$ |

109.3 |

|

$ |

102.8 |

|

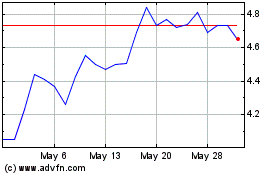

Outbrain (NASDAQ:OB)

Historical Stock Chart

From Oct 2024 to Nov 2024

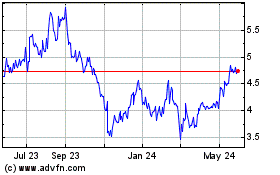

Outbrain (NASDAQ:OB)

Historical Stock Chart

From Nov 2023 to Nov 2024