Pactiv Evergreen Inc. (“Pactiv Evergreen” or the “Company”) today

reported results for the third quarter of 2024. Michael King,

President and Chief Executive Officer of Pactiv Evergreen, said,

“Our execution during the third quarter was solid and we made

meaningful progress on our long-term strategy. We maintained strict

cost discipline, optimized enterprise resources and overcame

challenges at the Pine Bluff, Arkansas mill during its final

quarter under our ownership. As we advance to the next phase of our

transformational journey, we intend to leverage our heritage of

product innovation and design to foster growth and assist our

customers in achieving their sustainability goals.”

King continued, “In late September and early

October, some of our teams and communities were significantly

impacted by Hurricanes Helene and Milton. The safety and well-being

of our team members remain our utmost priority. It’s been truly

inspiring to witness our teams swiftly activate contingency plans

in response to these severe weather events, showcasing their

commitment to serving our customers and supporting the affected

communities.”

Jon Baksht, Chief Financial Officer of Pactiv

Evergreen, added, “Our third quarter results reflect our efforts to

right size our operations and manage resources to align with the

broader demand environment. Our team has done an excellent job

reducing our cost to serve by implementing various initiatives to

set Pactiv Evergreen up for success. Compared to the prior quarter,

we reduced our leverage profile and are on track to deliver on the

cost savings targets we laid out in August. We are also continuing

to invest in areas of the business to drive growth for Pactiv

Evergreen and create value for our stockholders.”

___________________1 Adjusted EBITDA and

Adjusted EPS are non-GAAP measures. All references to Adjusted

EBITDA and Adjusted EPS are references to Adjusted EBITDA from

continuing operations and Adjusted EPS from continuing operations,

respectively. Refer to their definitions in the discussion on

non-GAAP financial measures and the accompanying reconciliations

below.

Third Quarter 2024 Results vs. Third

Quarter 2023 Results

Net revenues in the third quarter of 2024 were

$1,333 million compared to $1,379 million in the third quarter of

2023. The decrease was primarily due to lower sales volume,

partially offset by favorable pricing in the Foodservice segment,

mainly due to the pass through of higher material costs, and

favorable product mix in the Food and Beverage Merchandising

segment. Lower sales volume was mostly due to a focus on value over

volume in the Food and Beverage Merchandising segment and the

broader demand environment.

Net loss from continuing operations was $213

million, or $1.18 per diluted share, in the third quarter of 2024

compared to net income of $28 million, or $0.15 per diluted share,

in the third quarter of 2023. The change was principally due to the

$322 million impairment charge resulting from the divestiture of

our Pine Bluff, Arkansas mill and our Waynesville, North Carolina

extrusion facility (the “Mill Transaction”). The change also

reflects a $60 million decrease in tax expense largely as a result

of the aforementioned impairment charge.

Adjusted EBITDA1 was $214 million and Adjusted

EPS1 was $0.36 in the third quarter of 2024 compared to $227

million and $0.32, respectively, in the third quarter of 2023. The

decrease in Adjusted EBITDA1 reflects higher manufacturing costs

and lower sales volume, partially offset by lower incentive based

compensation costs, favorable product mix in the Food and Beverage

Merchandising segment and favorable pricing, net of material costs

passed through, in the Foodservice segment. The increase in

Adjusted EPS1 is primarily due to impacts of the

aforementioned Mill Transaction.

Segment Results

Foodservice

| |

|

For the Three Months Ended September 30, |

|

|

Components of Change in Net Revenues |

|

|

(In millions, except for %) |

|

2024 |

|

|

2023 |

|

|

Change |

|

|

Change % |

|

|

Price/Mix |

|

|

Volume |

|

|

Total segment net revenues |

|

$ |

670 |

|

|

$ |

675 |

|

|

$ |

(5 |

) |

|

|

(1 |

)% |

|

|

1 |

% |

|

|

(2 |

)% |

| Segment Adjusted EBITDA |

|

$ |

120 |

|

|

$ |

117 |

|

|

$ |

3 |

|

|

|

3 |

% |

|

|

|

|

|

|

| Segment Adjusted EBITDA

margin2 |

|

|

18 |

% |

|

|

17 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

2 For each segment, segment Adjusted EBITDA

margin is calculated as segment Adjusted EBITDA divided by total

segment net revenues.

The decrease in net revenues was mostly due to

lower sales volume, partially offset by favorable pricing, largely

due to the pass through of higher material costs. Lower sales

volume was due to the broader demand environment.

The increase in Adjusted EBITDA reflects

favorable pricing, net of material costs passed through, and lower

incentive based compensation costs, partially offset by higher

manufacturing costs.

Food and Beverage Merchandising

| |

|

For the Three Months Ended September 30, |

|

|

Components of Change in Net Revenues |

|

|

(In millions, except for %) |

|

2024 |

|

|

2023 |

|

|

Change |

|

|

Change % |

|

|

Price/Mix |

|

|

Volume |

|

|

Mill Closure |

|

|

Total segment net revenues |

|

$ |

667 |

|

|

$ |

712 |

|

|

$ |

(45 |

) |

|

|

(6 |

)% |

|

|

3 |

% |

|

|

(8 |

)% |

|

|

(1 |

)% |

| Segment Adjusted EBITDA |

|

$ |

111 |

|

|

$ |

130 |

|

|

$ |

(19 |

) |

|

|

(15 |

)% |

|

|

|

|

|

|

|

|

|

| Segment Adjusted EBITDA

margin |

|

|

17 |

% |

|

|

18 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The decrease in net revenues was primarily due

to lower sales volume, partially offset by favorable product mix.

Lower sales volume was due to a focus on value over volume and the

broader demand environment.

The decrease in Adjusted EBITDA reflects higher

manufacturing costs and lower sales volume, partially offset by

favorable product mix and lower incentive based compensation

costs.

Third Quarter 2024 Results vs. Second

Quarter 2024 Results

Net revenues in the third quarter of 2024 were

$1,333 million compared to $1,338 million in the second quarter of

2024. The decrease was mostly due to lower sales volume, partially

offset by favorable pricing in the Food and Beverage Merchandising

segment and favorable product mix in the Foodservice segment. Lower

sales volume was mainly due to seasonal trends in the Food and

Beverage Merchandising segment.

Net loss from continuing operations was $213

million, or $1.18 per diluted share, in the third quarter of 2024

compared to net income of $20 million, or $0.10 per diluted share,

in the second quarter of 2024. The change was principally due to

the $322 million Mill Transaction impairment charge. The change

also reflects a $49 million decrease in tax expense largely as a

result of the aforementioned impairment charge.

Adjusted EBITDA1 was $214 million and Adjusted

EPS1 was $0.36 in the third quarter of 2024 compared to $183

million and $0.17, respectively, in the second quarter of 2024. The

increase in Adjusted EBITDA1 and Adjusted EPS1 was mainly due to

lower manufacturing costs as a result of a planned mill outage

during the second quarter, favorable pricing, net of material costs

passed through, and favorable product mix, partially offset by

lower sales volume.

Segment Results

Foodservice

| |

|

For the Three Months Ended |

|

|

Components of Change in Net Revenues |

|

|

(In millions, except for %) |

|

September 30, 2024 |

|

|

June 30, 2024 |

|

|

Change |

|

|

Change % |

|

|

Price/Mix |

|

|

Volume |

|

|

Total segment net revenues |

|

$ |

670 |

|

|

$ |

668 |

|

|

$ |

2 |

|

|

|

— |

% |

|

|

1 |

% |

|

|

(1 |

)% |

| Segment Adjusted EBITDA |

|

$ |

120 |

|

|

$ |

109 |

|

|

$ |

11 |

|

|

|

10 |

% |

|

|

|

|

|

|

| Segment Adjusted EBITDA

margin |

|

|

18 |

% |

|

|

16 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

The increase in net revenues was mostly due to

favorable product mix, largely offset by lower sales volume.

The increase in Adjusted EBITDA was primarily

due to favorable product mix, favorable pricing, net of material

costs passed through, and lower incentive based costs, partially

offset by higher manufacturing costs.

Food and Beverage Merchandising

| |

|

For the Three Months Ended |

|

|

Components of Change in Net Revenues |

|

|

(In millions, except for %) |

|

September 30, 2024 |

|

|

June 30, 2024 |

|

|

Change |

|

|

Change % |

|

|

Price/Mix |

|

|

Volume |

|

|

Total segment net revenues |

|

$ |

667 |

|

|

$ |

674 |

|

|

$ |

(7 |

) |

|

|

(1 |

)% |

|

|

1 |

% |

|

|

(2 |

)% |

| Segment Adjusted EBITDA |

|

$ |

111 |

|

|

$ |

93 |

|

|

$ |

18 |

|

|

|

19 |

% |

|

|

|

|

|

|

| Segment Adjusted EBITDA

margin |

|

|

17 |

% |

|

|

14 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The decrease in net revenues was due to lower

sales volume which was attributable to seasonal trends, partially

offset by favorable pricing due to pricing actions.

The increase in Adjusted EBITDA reflects lower

manufacturing costs, mainly as a result of a planned mill outage

during the second quarter, favorable pricing, net of material costs

passed through, and lower incentive based costs, partially offset

by lower sales volume.

Balance Sheet and Cash Flow

Highlights

The Company continues to deliver on its

commitment to strengthen its balance sheet. Since December 31,

2022, the Company has reduced its total outstanding debt by $641

million, and Net Debt3 declined by $278 million. The Company’s

Board of Directors declared a third quarter 2024 dividend on

November 8, 2024 of $0.10 per share of common stock, payable on

December 13, 2024 to shareholders of record as of December 2,

2024.

| (In

millions) |

|

As of September 30, 2024 |

|

|

(In

millions) |

|

For the Three Months Ended September 30,

2024 |

|

|

Total outstanding debt |

|

$ |

3,495 |

|

|

Net cash flow provided by operating activities |

|

$ |

244 |

|

| Cash and cash equivalents |

|

|

(168 |

) |

|

Capital expenditures |

|

|

(54 |

) |

| Net Debt3 |

|

$ |

3,327 |

|

|

Free Cash Flow3 |

|

$ |

190 |

|

| |

|

|

|

|

|

|

|

|

|

|

Outlook

“We have made significant progress on our

strategy this year, and as we look ahead to 2025, we believe we

have established a solid foundation for the next leg of our

transformational journey. We are dedicated to carefully

overseeing our operations, preserving a strong balance sheet and

driving growth, which includes innovation and identifying

opportunities to extend our reach beyond the conventional channels

we currently serve,” said Mr. King. “The Company is updating its

existing guidance range for full year 2024 Adjusted EBITDA1 to a

range of $800 million to $810 million in light of the performance

of the operations divested in the Mill Transaction prior to

closing,” he added.

The Company has not reconciled the non-GAAP

measure Adjusted EBITDA1 to the GAAP measure net income (loss) on a

forward-looking basis in this release because the Company does not

provide guidance for certain of the reconciling items on a

consistent basis, including but not limited to items relating to

restructuring, asset impairment and other related charges,

depreciation and amortization expense, net interest expense and

income taxes, which would be required to include a reconciliation

of Adjusted EBITDA1 to GAAP net income (loss), as the Company is

unable to quantify these amounts without unreasonable efforts.

Conference Call and Webcast Presentation

The Company will host a conference call and

webcast presentation to discuss these results on November 12, 2024

at 8:30 a.m. U.S. Eastern Time. Investors interested in

participating in the live call may register for the call here.

Participants may also access the live webcast and supplemental

presentation on the Pactiv Evergreen Investor Relations website at

https://investors.pactivevergreen.com/financial-information/sec-filings

under “News & Events.” The Company may from time to time use

this Investor Relations website as a means of disclosing material

non-public information and for complying with its disclosure

obligations under Regulation FD.

About Pactiv Evergreen Inc.

Pactiv Evergreen Inc. (NASDAQ: PTVE) is a leading manufacturer and

distributor of fresh foodservice and food merchandising products

and fresh beverage cartons in North America. The Company produces a

broad range of on-trend and feature-rich products that protect,

package and display food and beverages for today’s consumers. Its

products, many of which are made with recycled, recyclable or

renewable materials, are sold to a diversified mix of customers,

including restaurants, foodservice distributors, retailers, food

and beverage producers, packers and processors. Learn more at

www.pactivevergreen.com.

___________________3 Net Debt and Free Cash Flow

are non-GAAP measures. Refer to their definitions in the discussion

on non-GAAP financial measures below.

Note to Investors Regarding

Forward-Looking Statements

This press release contains forward-looking

statements. All statements contained in this press release other

than statements of historical fact are forward-looking statements,

including statements regarding our guidance as to future financial

and operational results, our ability to assist our customers in

achieving their sustainability goals, our ability to drive growth

and create value for stockholders and our ability to preserve a

strong balance sheet, innovate and identify opportunities to extend

our reach beyond our conventional channels. In some cases, you can

identify these statements by forward-looking words such as “may,”

“might,” “will,” “should,” “expects,” “plans,” “anticipates,”

“believes,” “estimates,” “predicts,” “potential,” “likely” or

“continue,” the negative of these terms and other comparable

terminology. These statements are only predictions based on our

expectations and projections about future events as of the date of

this press release and are subject to a number of risks,

uncertainties and assumptions that may prove incorrect, any of

which could cause actual results to differ materially from those

expressed or implied by such statements, including, among others,

those described under the heading “Risk Factors” in our Annual

Report on Form 10-K for the year ended December 31, 2023 filed with

the Securities and Exchange Commission, or SEC, and our Quarterly

Reports on Form 10-Q for the quarters ended March 31, 2024, June

30, 2024 and September 30, 2024 filed with the SEC. New risks

emerge from time to time, and it is not possible for our management

to predict all risks, nor can management assess the impact of all

factors on our business or the extent to which any factor, or

combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statement

the Company makes. Investors are cautioned not to place undue

reliance on any such forward-looking statements, which speak only

as of the date they are made. Except as otherwise required by law,

the Company undertakes no obligation to update any forward-looking

statement, whether as a result of new information, future events or

otherwise.

Use of Non-GAAP Financial Measures

The Company uses the following financial

measures that are not calculated in accordance with generally

accepted accounting principles in the United States (“GAAP”):

Adjusted EBITDA from continuing operations, Adjusted EPS from

continuing operations, Free Cash Flow and Net Debt.

The Company defines Adjusted EBITDA from

continuing operations as net income (loss) from continuing

operations calculated in accordance with GAAP plus the sum of

income tax expense (benefit), net interest expense, depreciation

and amortization and further adjusted to exclude certain items,

including but not limited to restructuring, asset impairment and

other related charges, gains or losses on the sale of businesses

and noncurrent assets, non-cash pension income or expense,

unrealized gains or losses on derivatives, foreign exchange gains

or losses on cash and gains or losses on certain legal

settlements.

The Company defines Adjusted EPS from continuing

operations as diluted (loss) earnings per share from continuing

operations (“EPS”) calculated in accordance with GAAP adjusted for

the after-tax effect of certain items, including but not limited to

restructuring, asset impairment and other related charges, gains on

the sale of businesses and noncurrent assets, non-cash pension

income or expense, unrealized gains or losses on derivatives,

foreign exchange losses on cash, gains or losses on certain legal

settlements and gains or losses on debt extinguishments.

The Company defines Free Cash Flow as net cash

provided by operating activities, less capital expenditures.

The Company defines Net Debt as the sum of

current and long-term debt, less cash and cash equivalents.

The Company has provided herein a reconciliation

of (i) net income (loss) from continuing operations to Adjusted

EBITDA from continuing operations, (ii) diluted (loss) EPS from

continuing operations to Adjusted EPS from continuing operations,

(iii) net cash provided by operating activities to Free Cash Flow

and (iv) total debt to Net Debt, in each case representing the most

directly comparable GAAP financial measures.

The Company presents Adjusted EBITDA from

continuing operations to assist in comparing performance from

period to period and as a measure of operational performance. It is

a key measure used by its management team to generate future

operating plans, make strategic decisions and incentivize and

reward its employees. In addition, its management and Chief

Operating Decision Maker, who is the President and Chief Executive

Officer, use the Adjusted EBITDA from continuing operations of each

reportable segment to evaluate its respective operating

performance. Accordingly, the Company believes that Adjusted EBITDA

from continuing operations provides useful information to investors

and others in understanding and evaluating the Company’s operating

results in the same manner as its management and board of

directors. Like Adjusted EBITDA from continuing operations,

management believes Adjusted EPS from continuing operations is

useful to investors, analysts and others to facilitate operating

performance comparisons on a period-to-period basis because it

excludes variations primarily caused by changes in the items noted

above.

The Company presents Free Cash Flow to assist in

comparing liquidity from period to period and to provide a more

comprehensive view of the Company’s core operations and ability to

generate cash flow, and also, as with Adjusted EBITDA from

continuing operations, to generate future operating plans, make

strategic decisions and incentivize and reward its employees. The

Company believes that this measure is useful to investors in

evaluating cash available to service and repay debt, make other

investments and pay dividends. The Company presents Net Debt as a

supplemental measure to review the liquidity of its operations and

measure the Company’s credit position and progress toward leverage

targets. The Company also believes that investors find this measure

useful in evaluating its debt levels.

Non-GAAP information should be considered as

supplemental in nature and is not meant to be considered in

isolation or as a substitute for the related financial information

prepared in accordance with GAAP. In addition, our non-GAAP metrics

may not be the same as or comparable to similar non-GAAP financial

measures presented by other companies. Because of these and other

limitations, you should consider them alongside other financial

performance measures, including our net income and other GAAP

results. In addition, in evaluating Adjusted EBITDA from continuing

operations, Adjusted EPS from continuing operations and other

metrics derived from them, you should be aware that in the future

the Company will incur expenses such as those that are the subject

of adjustments in deriving Adjusted EBITDA from continuing

operations and Adjusted EPS from continuing operations and you

should not infer from our presentation of Adjusted EBITDA from

continuing operations and Adjusted EPS from continuing operations

that our future results will not be affected by these expenses or

any unusual or non-recurring items.

Contact:Curt

Worthington847.482.2040InvestorRelations@pactivevergreen.com

| |

|

Pactiv Evergreen Inc.Condensed

Consolidated Statements of (Loss) Income(in

millions, except per share

amounts)(unaudited) |

| |

| |

|

For the Three Months Ended |

|

| |

|

September 30, 2024 |

|

|

June 30, 2024 |

|

|

September 30, 2023 |

|

|

Net revenues |

|

$ |

1,250 |

|

|

$ |

1,255 |

|

|

$ |

1,286 |

|

| Related party net

revenues |

|

|

83 |

|

|

|

83 |

|

|

|

93 |

|

| Total net

revenues |

|

|

1,333 |

|

|

|

1,338 |

|

|

|

1,379 |

|

| Cost of sales |

|

|

(1,078 |

) |

|

|

(1,115 |

) |

|

|

(1,098 |

) |

| Gross

profit |

|

|

255 |

|

|

|

223 |

|

|

|

281 |

|

| Selling, general and

administrative expenses |

|

|

(115 |

) |

|

|

(122 |

) |

|

|

(137 |

) |

| Restructuring, asset

impairment and other related charges |

|

|

(338 |

) |

|

|

(6 |

) |

|

|

(28 |

) |

| Other income (expense),

net |

|

|

2 |

|

|

|

2 |

|

|

|

(3 |

) |

| Operating (loss)

income from continuing operations |

|

|

(196 |

) |

|

|

97 |

|

|

|

113 |

|

| Non-operating income

(expense), net |

|

|

1 |

|

|

|

— |

|

|

|

(2 |

) |

| Interest expense, net |

|

|

(56 |

) |

|

|

(66 |

) |

|

|

(61 |

) |

| (Loss) income from

continuing operations before tax |

|

|

(251 |

) |

|

|

31 |

|

|

|

50 |

|

| Income tax benefit

(expense) |

|

|

38 |

|

|

|

(11 |

) |

|

|

(22 |

) |

| (Loss) income from

continuing operations |

|

|

(213 |

) |

|

|

20 |

|

|

|

28 |

|

| Income from discontinued

operations, net of income taxes |

|

|

— |

|

|

|

— |

|

|

|

2 |

|

| Net (loss)

income |

|

|

(213 |

) |

|

|

20 |

|

|

|

30 |

|

| Income attributable to

non-controlling interests |

|

|

— |

|

|

|

(1 |

) |

|

|

(1 |

) |

| Net (loss) income

attributable to Pactiv Evergreen Inc. common

shareholders |

|

$ |

(213 |

) |

|

$ |

19 |

|

|

$ |

29 |

|

| (Loss) earnings per

share attributable to Pactiv Evergreen Inc. common

shareholders |

|

|

|

|

|

|

|

|

|

|

From continuing operations |

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(1.18 |

) |

|

$ |

0.11 |

|

|

$ |

0.15 |

|

|

Diluted |

|

$ |

(1.18 |

) |

|

$ |

0.10 |

|

|

$ |

0.15 |

|

| From discontinued

operations |

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

0.01 |

|

|

Diluted |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

0.01 |

|

| Total |

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(1.18 |

) |

|

$ |

0.11 |

|

|

$ |

0.16 |

|

|

Diluted |

|

$ |

(1.18 |

) |

|

$ |

0.10 |

|

|

$ |

0.16 |

|

| |

|

|

|

|

|

|

|

|

|

| Weighted-average shares

outstanding - basic |

|

|

179.9 |

|

|

|

179.7 |

|

|

|

178.7 |

|

| Weighted-average shares

outstanding - diluted |

|

|

179.9 |

|

|

|

181.0 |

|

|

|

179.7 |

|

| |

|

Pactiv Evergreen Inc.Condensed

Consolidated Balance Sheets(in

millions)(unaudited) |

| |

| |

|

As of September 30, 2024 |

|

|

As of June 30, 2024 |

|

|

As of September 30, 2023 |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

168 |

|

|

$ |

95 |

|

|

$ |

233 |

|

|

Accounts receivable, net |

|

|

463 |

|

|

|

486 |

|

|

|

470 |

|

|

Related party receivables |

|

|

28 |

|

|

|

37 |

|

|

|

38 |

|

|

Inventories |

|

|

760 |

|

|

|

881 |

|

|

|

846 |

|

|

Other current assets |

|

|

126 |

|

|

|

116 |

|

|

|

109 |

|

|

Assets held for sale |

|

|

99 |

|

|

|

— |

|

|

|

7 |

|

| Total current

assets |

|

|

1,644 |

|

|

|

1,615 |

|

|

|

1,703 |

|

|

Property, plant and equipment, net |

|

|

1,164 |

|

|

|

1,473 |

|

|

|

1,469 |

|

|

Operating lease right-of-use assets, net |

|

|

268 |

|

|

|

272 |

|

|

|

276 |

|

|

Goodwill |

|

|

1,807 |

|

|

|

1,815 |

|

|

|

1,815 |

|

|

Intangible assets, net |

|

|

959 |

|

|

|

974 |

|

|

|

1,019 |

|

|

Other noncurrent assets |

|

|

209 |

|

|

|

213 |

|

|

|

164 |

|

| Total

assets |

|

$ |

6,051 |

|

|

$ |

6,362 |

|

|

$ |

6,446 |

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

382 |

|

|

$ |

367 |

|

|

$ |

329 |

|

|

Related party payables |

|

|

7 |

|

|

|

7 |

|

|

|

10 |

|

|

Current portion of long-term debt |

|

|

6 |

|

|

|

20 |

|

|

|

18 |

|

|

Current portion of operating lease liabilities |

|

|

62 |

|

|

|

66 |

|

|

|

63 |

|

|

Income taxes payable |

|

|

3 |

|

|

|

12 |

|

|

|

5 |

|

|

Accrued and other current liabilities |

|

|

372 |

|

|

|

321 |

|

|

|

447 |

|

|

Liabilities held for sale |

|

|

22 |

|

|

|

— |

|

|

|

— |

|

| Total current

liabilities |

|

|

854 |

|

|

|

793 |

|

|

|

872 |

|

|

Long-term debt |

|

|

3,489 |

|

|

|

3,572 |

|

|

|

3,593 |

|

|

Long-term operating lease liabilities |

|

|

222 |

|

|

|

223 |

|

|

|

225 |

|

|

Deferred income taxes |

|

|

185 |

|

|

|

226 |

|

|

|

255 |

|

|

Long-term employee benefit obligations |

|

|

56 |

|

|

|

57 |

|

|

|

59 |

|

|

Other noncurrent liabilities |

|

|

156 |

|

|

|

155 |

|

|

|

138 |

|

| Total

liabilities |

|

$ |

4,962 |

|

|

$ |

5,026 |

|

|

$ |

5,142 |

|

| Total equity

attributable to Pactiv Evergreen Inc. common

shareholders |

|

|

1,085 |

|

|

|

1,332 |

|

|

|

1,300 |

|

|

Non-controlling interests |

|

|

4 |

|

|

|

4 |

|

|

|

4 |

|

| Total

equity |

|

|

1,089 |

|

|

|

1,336 |

|

|

|

1,304 |

|

| Total liabilities and

equity |

|

$ |

6,051 |

|

|

$ |

6,362 |

|

|

$ |

6,446 |

|

| |

|

Pactiv Evergreen Inc.Condensed

Consolidated Statements of Cash Flows(in

millions)(unaudited) |

| |

| |

|

For the Three Months Ended |

|

| |

|

September 30, 2024 |

|

|

June 30, 2024 |

|

|

March 31, 2024 |

|

|

December 31, 2023 |

|

|

September 30, 2023 |

|

| Operating

Activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

|

$ |

(213 |

) |

|

$ |

20 |

|

|

$ |

10 |

|

|

$ |

22 |

|

|

$ |

30 |

|

| Adjustments to reconcile net

(loss) income to operating cash flows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

75 |

|

|

|

80 |

|

|

|

79 |

|

|

|

82 |

|

|

|

85 |

|

|

Deferred income taxes |

|

|

(38 |

) |

|

|

(5 |

) |

|

|

(11 |

) |

|

|

(26 |

) |

|

|

— |

|

|

Asset impairment and restructuring related non-cash charges (net of

reversals) |

|

|

323 |

|

|

|

1 |

|

|

|

1 |

|

|

|

12 |

|

|

|

3 |

|

|

Non-cash portion of operating lease expense |

|

|

21 |

|

|

|

21 |

|

|

|

21 |

|

|

|

20 |

|

|

|

20 |

|

|

Other non-cash items, net |

|

|

8 |

|

|

|

8 |

|

|

|

5 |

|

|

|

12 |

|

|

|

13 |

|

|

Change in assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable, net |

|

|

29 |

|

|

|

(17 |

) |

|

|

(51 |

) |

|

|

51 |

|

|

|

(3 |

) |

|

Inventories |

|

|

16 |

|

|

|

30 |

|

|

|

(60 |

) |

|

|

(7 |

) |

|

|

75 |

|

|

Accounts payable |

|

|

13 |

|

|

|

39 |

|

|

|

35 |

|

|

|

(28 |

) |

|

|

(15 |

) |

|

Operating lease payments |

|

|

(21 |

) |

|

|

(21 |

) |

|

|

(21 |

) |

|

|

(20 |

) |

|

|

(19 |

) |

|

Accrued and other current liabilities |

|

|

63 |

|

|

|

(35 |

) |

|

|

(55 |

) |

|

|

(52 |

) |

|

|

43 |

|

|

Other assets and liabilities |

|

|

(32 |

) |

|

|

(27 |

) |

|

|

14 |

|

|

|

15 |

|

|

|

6 |

|

| Net cash provided by

(used in) operating activities |

|

|

244 |

|

|

|

94 |

|

|

|

(33 |

) |

|

|

81 |

|

|

|

238 |

|

| Investing

Activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Acquisition of property, plant and equipment |

|

|

(54 |

) |

|

|

(57 |

) |

|

|

(41 |

) |

|

|

(107 |

) |

|

|

(62 |

) |

|

Purchase of investments |

|

|

— |

|

|

|

— |

|

|

|

(23 |

) |

|

|

— |

|

|

|

— |

|

|

Receipt of refundable exclusivity payment |

|

|

— |

|

|

|

10 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Other investing activities |

|

|

1 |

|

|

|

5 |

|

|

|

6 |

|

|

|

2 |

|

|

|

9 |

|

| Net cash used in

investing activities |

|

|

(53 |

) |

|

|

(42 |

) |

|

|

(58 |

) |

|

|

(105 |

) |

|

|

(53 |

) |

| Financing

Activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Term loan debt proceeds |

|

|

— |

|

|

|

372 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Term loan debt repayments |

|

|

(70 |

) |

|

|

(725 |

) |

|

|

— |

|

|

|

(24 |

) |

|

|

(229 |

) |

|

Revolver proceeds |

|

|

— |

|

|

|

373 |

|

|

|

18 |

|

|

|

— |

|

|

|

— |

|

|

Revolver repayments |

|

|

(25 |

) |

|

|

(18 |

) |

|

|

(18 |

) |

|

|

— |

|

|

|

— |

|

|

Deferred financing transaction costs |

|

|

— |

|

|

|

(7 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Dividends paid to common shareholders |

|

|

(18 |

) |

|

|

(18 |

) |

|

|

(18 |

) |

|

|

(17 |

) |

|

|

(18 |

) |

|

Other financing activities |

|

|

(3 |

) |

|

|

(3 |

) |

|

|

(8 |

) |

|

|

(5 |

) |

|

|

(3 |

) |

| Net cash used in

financing activities |

|

|

(116 |

) |

|

|

(26 |

) |

|

|

(26 |

) |

|

|

(46 |

) |

|

|

(250 |

) |

| Effect of exchange rate

changes on cash, cash equivalents and restricted cash |

|

|

(2 |

) |

|

|

(2 |

) |

|

|

1 |

|

|

|

— |

|

|

|

(4 |

) |

| Increase (decrease) in cash,

cash equivalents and restricted cash |

|

|

73 |

|

|

|

24 |

|

|

|

(116 |

) |

|

|

(70 |

) |

|

|

(69 |

) |

| Cash, cash equivalents and

restricted cash, including amounts classified as held for sale, as

of beginning of the period |

|

|

95 |

|

|

|

71 |

|

|

|

187 |

|

|

|

257 |

|

|

|

326 |

|

| Cash, cash equivalents

and restricted cash as of end of the period |

|

$ |

168 |

|

|

$ |

95 |

|

|

$ |

71 |

|

|

$ |

187 |

|

|

$ |

257 |

|

| Cash, cash equivalents

and restricted cash are comprised of: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

168 |

|

|

|

95 |

|

|

|

71 |

|

|

|

164 |

|

|

|

233 |

|

| Restricted cash classified as

other current assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2 |

|

|

|

— |

|

| Restricted cash classified as

other noncurrent assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

21 |

|

|

|

24 |

|

| Cash, cash equivalents

and restricted cash as of end of the period |

|

$ |

168 |

|

|

$ |

95 |

|

|

$ |

71 |

|

|

$ |

187 |

|

|

$ |

257 |

|

| |

|

Pactiv Evergreen Inc.Reconciliation of

Reportable Segment Net Revenues to Total Net

Revenues(in

millions)(unaudited) |

| |

| |

|

For the Three Months Ended |

|

|

|

|

September 30, 2024 |

|

|

June 30, 2024 |

|

|

September 30, 2023 |

|

| Reportable segment net

revenues |

|

|

|

|

|

|

|

|

|

|

Foodservice |

|

$ |

670 |

|

|

$ |

668 |

|

|

$ |

675 |

|

|

Food and Beverage Merchandising |

|

|

667 |

|

|

|

674 |

|

|

|

712 |

|

| Intersegment revenues |

|

|

(4 |

) |

|

|

(4 |

) |

|

|

(8 |

) |

| Total net

revenues |

|

$ |

1,333 |

|

|

$ |

1,338 |

|

|

$ |

1,379 |

|

| |

|

Pactiv Evergreen Inc.Reconciliation of

Reportable Segment Adjusted EBITDA to Adjusted

EBITDA(in

millions)(unaudited) |

| |

| |

|

For the Three Months Ended |

|

|

|

|

September 30, 2024 |

|

|

June 30, 2024 |

|

|

September 30, 2023 |

|

| Reportable segment

Adjusted EBITDA |

|

|

|

|

|

|

|

|

|

|

Foodservice |

|

$ |

120 |

|

|

$ |

109 |

|

|

$ |

117 |

|

|

Food and Beverage Merchandising |

|

|

111 |

|

|

|

93 |

|

|

|

130 |

|

| Unallocated |

|

|

(17 |

) |

|

|

(19 |

) |

|

|

(20 |

) |

| Adjusted EBITDA

(Non-GAAP) |

|

$ |

214 |

|

|

$ |

183 |

|

|

$ |

227 |

|

| |

|

Pactiv Evergreen Inc.Reconciliations of

Net (Loss) Income from Continuing Operations to Adjusted EBITDA and

Diluted EPS from Continuing Operations to Adjusted

EPS(in millions, except per share

amounts)(unaudited) |

| |

| |

|

For the Three Months Ended |

|

|

|

|

September 30, 2024 |

|

|

June 30, 2024 |

|

|

September 30, 2023 |

|

| |

|

Net income to Adjusted EBITDA |

|

|

Diluted EPS to Adjusted EPS |

|

|

Net income to Adjusted EBITDA |

|

|

Diluted EPS to Adjusted EPS |

|

|

Net loss to Adjusted EBITDA |

|

|

Diluted EPS to Adjusted EPS |

|

|

Net (loss) income from continuing operations / Diluted EPS

from continuing operations (Reported GAAP Measure) |

|

$ |

(213 |

) |

|

$ |

(1.18 |

) |

|

$ |

20 |

|

|

$ |

0.10 |

|

|

$ |

28 |

|

|

$ |

0.15 |

|

| Income tax (benefit) expense |

|

|

(38 |

) |

|

|

|

|

|

11 |

|

|

|

|

|

|

22 |

|

|

|

|

| Interest expense, net (excluding

loss on extinguishment of debt) |

|

|

56 |

|

|

|

|

|

|

60 |

|

|

|

|

|

|

61 |

|

|

|

|

| Loss on extinguishment of

debt |

|

|

— |

|

|

|

— |

|

|

|

6 |

|

|

|

0.02 |

|

|

|

— |

|

|

|

— |

|

| Depreciation and amortization

(excluding restructuring-related charges) |

|

|

70 |

|

|

|

|

|

|

75 |

|

|

|

|

|

|

81 |

|

|

|

|

| Beverage Merchandising

Restructuring charges(1) |

|

|

336 |

|

|

|

1.51 |

|

|

|

7 |

|

|

|

0.03 |

|

|

|

32 |

|

|

|

0.15 |

|

| Footprint Optimization

charges(2) |

|

|

4 |

|

|

|

0.02 |

|

|

|

3 |

|

|

|

0.01 |

|

|

|

— |

|

|

|

— |

|

| Other restructuring and asset

impairment charges |

|

|

2 |

|

|

|

0.01 |

|

|

|

2 |

|

|

|

0.01 |

|

|

|

— |

|

|

|

— |

|

| Loss on sale of businesses and

noncurrent assets |

|

|

— |

|

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Non-cash pension (income)

expense(3) |

|

|

(1 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2 |

|

|

|

0.01 |

|

| Unrealized gains on commodity

derivatives |

|

|

(1 |

) |

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

| Foreign exchange (gains) losses

on cash |

|

|

(1 |

) |

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

|

|

2 |

|

|

|

0.01 |

|

| Adjusted EBITDA /

Adjusted EPS(4) (Non-GAAP Measure) |

|

$ |

214 |

|

|

$ |

0.36 |

|

|

$ |

183 |

|

|

$ |

0.17 |

|

|

$ |

227 |

|

|

$ |

0.32 |

|

|

(1) |

|

Reflects charges related to the Beverage Merchandising

Restructuring, including $322 million of non-cash Mill Transaction

impairment charges recorded during the three months ended September

30, 2024. Also includes $3 million, $3 million and $4 million of

accelerated depreciation expense for the three months ended

September 30, 2024, June 30, 2024 and September 30, 2023,

respectively. |

| (2) |

|

Reflects charges related to the Footprint Optimization, including

$2 million and $3 million of accelerated depreciation expense for

the three months ended September 30, 2024 and June 30, 2024,

respectively. |

| (3) |

|

Reflects the non-cash pension (income) expense related to our

employee benefit plans. |

| (4) |

|

Income tax (benefit) expense, interest expense, net (excluding loss

on extinguishment of debt) and depreciation and amortization

(excluding restructuring-related charges) are not adjustments from

diluted EPS to calculate Adjusted EPS. Adjustments were tax

effected using the applicable effective income tax rate for each

period. For the three months ended September 30, 2024, June 30,

2024 and September 30, 2023, the tax effect of the adjustments were

income of $0.34 per diluted share, income of $0.02 per diluted

share and income of $0.03 per diluted share, respectively. |

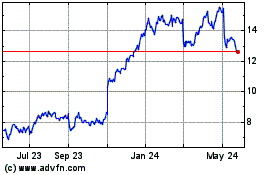

Pactiv Evergreen (NASDAQ:PTVE)

Historical Stock Chart

From Feb 2025 to Mar 2025

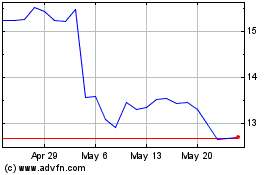

Pactiv Evergreen (NASDAQ:PTVE)

Historical Stock Chart

From Mar 2024 to Mar 2025