0001662774false00016627742024-08-132024-08-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________________

FORM 8-K

______________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 13, 2024

______________________

QUINCE THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

______________________

| | | | | | | | | | | | | | |

| Delaware | | 001-38890 | | 90-1024039 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

601 Gateway Boulevard , Suite 1250 South San Francisco, California | | 94080 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (415) 910-5717 |

Not Applicable

(Former name or former address, if changed since last report.)

______________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13d-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | | QNCX | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On August 13, 2024, Quince Therapeutics, Inc. (the “Company”) announced its financial results for the quarter ended June 30, 2024 and provided recent business highlights. A copy of the press release issued in connection with the announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in Item 2.02 of this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly provided by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| QUINCE THERAPEUTICS, INC. |

| | |

| By: | /s/ Dirk Thye |

| Date: August 13, 2024 | Name: | Dirk Thye |

| Title: | Chief Executive Officer and Chief Medical Officer |

Quince Therapeutics Provides Business Update and

Reports Second Quarter 2024 Financial Results

Strong cash position expected to provide sufficient operating runway into 2026;

Phase 3 topline results expected in the fourth quarter of 2025

SOUTH SAN FRANCISCO, Calif. – August 13, 2024 – Quince Therapeutics, Inc. (Nasdaq: QNCX), a late-stage biotechnology company dedicated to unlocking the power of a patient’s own biology for the treatment of rare diseases, today provided an update on the company’s development pipeline and reported financial results for the second quarter ended June 30, 2024.

Dirk Thye, M.D., Quince’s Chief Executive Officer and Chief Medical Officer, said, “We achieved a major clinical milestone during the second quarter of 2024 with the first patient enrolled in our pivotal Phase 3 NEAT clinical trial in Ataxia-Telangiectasia (A-T). As of today, we have enrolled seven patients with A-T across clinical sites in the U.S., U.K., and European Union. We are encouraged by this strong start and expect NEAT site activation and patient screening activities to accelerate over the next quarter.”

Pivotal Phase 3 NEAT Clinical Trial

•Dosed the first patient in the company’s Phase 3 NEAT (Neurologic Effects of EryDex on Subjects with A-T; IEDAT-04-2022/NCT06193200) clinical trial to evaluate the neurological effects of EryDex in patients with A-T in June 2024.

•Enrolled seven patients with A-T in the NEAT clinical trial to date. Quince plans to enroll approximately 86 patients with A-T ages six to nine years old (primary analysis population) and approximately 20 patients with A-T ages 10 years or older.

•NEAT is an international, multi-center, randomized, double-blind, placebo-controlled study to evaluate the neurological effects of the company’s lead asset, EryDex (dexamethasone sodium phosphate [DSP] encapsulated in autologous red blood cells), in patients with A-T.

•Pivotal Phase 3 NEAT clinical trial is being conducted under a Special Protocol Assessment agreement with the U.S. Food and Drug Administration (FDA).

•Participants will be randomized (1:1) between EryDex or placebo and treatment will consist of six infusions scheduled once every 21 to 30 days. The primary efficacy endpoint will be measured by the change from baseline to last visit completion in a rescored modified International Cooperative Ataxia Rating Scale (RmICARS) compared to placebo.

•Participants who complete the full treatment period, complete study assessments, and provide informed consent will be eligible to transition to an open label extension study.

•Expect to report Phase 3 NEAT topline results in the fourth quarter of 2025 with a potential New Drug Application (NDA) submission to the FDA and a Marketing Authorization Application (MAA) submission to the European Medicines Agency (EMA) in 2026, assuming positive study results.

Pipeline and Corporate Updates

•Granted Fast Track designation by the FDA for the company’s EryDex System for the treatment of patients with A-T based on the potential for EryDex to address a high unmet medical need in A-T.

•Updated an initial patient sizing project based on third-party analysis from IQVIA Medical Claims (Dx), PharmetricsPlus (P+), and IQVIA Analytics, which confirmed that the number of diagnosed patients with A-T in the U.S. is estimated to be to approximately 4,600, an increase from previous estimates of approximately 3,400 diagnosed patients. There are currently no approved therapeutic treatments for A-T, and the market represents a $1+ billion peak commercial opportunity globally, based on the company’s internal estimates and assumptions.

•Generating proof-of-concept clinical trial study designs to evaluate EryDex for the potential treatment of patients with Duchenne muscular dystrophy (DMD), including those with corticosteroid intolerance, who

represent the majority of the DMD population. Quince plans to initiate a DMD proof-of-concept study in 2025, which the company expects to conduct utilizing capital efficient study approaches.

•Planned participation at upcoming scientific congresses, including a poster presentation of EryDex safety data at the upcoming 53rd Child Neurology Society Annual Meeting in November 2024. Quince will also be a sponsor of and participate at the 2024 International Congress for Ataxia Research in November 2024 with two poster presentations including growth and bone mineral density in patients with A-T treated with EryDex, and an analysis of the International Cooperative Ataxia Rating Scale (ICARS) subcomponent scores in patients with A-T.

•Strengthening of leadership team with the addition of Brent Roeck as Vice President of Program and Alliance Management and Katie George as Executive Director Clinical Operations, bringing more than 50 years of collective experience across rare disease and the pharmaceutical and biotech industry to support Quince’s pivotal Phase 3 NEAT study and focus on strategic business partnerships.

•Investigating other potential indications for EryDex where chronic corticosteroid treatment is – or has the potential to become – a standard of care, if there were not corticosteroid-related safety concerns. This evaluation process is expected to span across ataxias, neuromuscular indications, hematology, cancer, and autoimmune diseases, with a focus on rare diseases.

•Evaluating potential strategic partnerships to out-license ex-U.S. rights to extend operational runway to support potential NDA approval of EryDex in the U.S., as well as further advance other potential indications and programs using the company’s proprietary Autologous Intracellular Drug Encapsulation (AIDE) technology platform.

•Participating at the H.C. Wainwright 26th Annual Global Investment Conference the week of September 9, 2024. A webcast of the presentation will be accessible here.

Second Quarter and Year-to-Date 2024 Financial Results

•Reported cash, cash equivalents, and short-term investments of $59.4 million for the second quarter ended June 30, 2024. Quince expects its existing cash runway to be sufficient to fund the company’s capital efficient development plan through Phase 3 NEAT topline results into 2026.

•Expect strong cash position to fully fund lead asset, EryDex, through Phase 3 NEAT topline results in the fourth quarter of 2025 and prepare for potential NDA and MAA submissions in 2026, assuming positive study results. This includes approximately $20 million for the NEAT clinical trial and approximately $15 million in direct trial costs for an open label extension study.

•Reported research and development (R&D) expenses of $4.2 million for the second quarter ended June 30, 2024. R&D expenses during the quarter primarily included start-up costs related to Phase 3 NEAT clinical trial activities and related manufacturing costs.

•Reported general and administrative (G&A) expenses of $4.7 million for the second quarter ended June 30, 2024. G&A expenses for the quarter primarily included personnel-related and stock-based compensation expenses, commercial planning and new product planning expenses, and other professional administrative costs.

•Reported a net loss of $27.7 million, or a net loss of $0.64 per basic and diluted share, for the second quarter ended June 30, 2024. During the quarter, Quince recognized a non-cash goodwill impairment charge of $17.1 million as the quantitative analysis resulted in the company's fair value being below its carrying value. Weighted average shares outstanding for the quarter were 43.1 million.

•Reported net cash used in operating activities of $17.1 million for the six months ended June 30, 2024, which included a net loss of $38.9 million for the period, adjusted for $24.0 million of non-cash items, including a $4.8 million change in the fair value of contingent consideration liabilities, $2.5 million in stock-based compensation, and a net decrease in current assets of $2.3 million, offset by a net decrease in accounts payable, accrued expenses, and other current liabilities of $0.1 million compared to the same period last year.

About Quince Therapeutics

Quince Therapeutics, Inc. (Nasdaq: QNCX) is a late-stage biotechnology company dedicated to

unlocking the power of a patient’s own biology for the treatment of rare diseases. For more information on the company and its latest news, visit www.quincetx.com and follow Quince on social media platforms LinkedIn, Facebook, X, and YouTube.

Forward-looking Statements

Statements in this news release contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 as contained in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor” created by those sections. All statements, other than statements of historical facts, may be forward-looking statements. Forward-looking statements contained in this news release may be identified by the use of words such as “believe,” “may,” “should,” “expect,” “anticipate,” “plan,” “believe,” “estimated,” “potential,” “intend,” “will,” “can,” “seek,” or other similar words. Examples of forward-looking statements include, among others, statements relating to current and future clinical development of EryDex, including for the potential treatment of Ataxia-Telangiectasia (A-T), Duchenne muscular dystrophy (DMD), and other potential indications, related development and commercial-stage inflection point for EryDex, and expansion of the company’s proprietary Autologous Intracellular Drug Encapsulation (AIDE) technology for treatment of other rare diseases; the strategic development path for EryDex; planned regulatory agency submissions and clinical trials and timeline, prospects, and milestone expectations; the timing, success, and reporting of results of the clinical trials and related data, including plans and the ability to initiate, fund, enroll, conduct, and/or complete current and additional studies; research and development costs; the company’s future development plans and related timing; cash position and projected cash runway; the company’s focus, objectives, plans, and strategies; and the potential benefits of EryDex, AIDE technology and the company’s market opportunity. Forward-looking statements are based on Quince’s current expectations and are subject to inherent uncertainties, risks, and assumptions that are difficult to predict and could cause actual results to differ materially from what the company expects. Further, certain forward-looking statements are based on assumptions as to future events that may not prove to be accurate. Factors that could cause actual results to differ include, but are not limited to, the risks and uncertainties described in the section titled “Risk Factors” in the company’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (SEC) on May 13, 2024, and other reports as filed with the SEC. Forward-looking statements contained in this news release are made as of this date, and Quince undertakes no duty to update such information except as required under applicable law.

| | |

Media & Investor Contact:

Stacy Roughan

Quince Therapeutics, Inc.

Vice President, Corporate Communications & Investor Relations

ir@quincetx.com |

QUINCE THERAPEUTICS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands except share amounts)

| | | | | | | | | | | |

| | June 30, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 7,890 | | | $ | 20,752 | |

| Short-term investments | 51,555 | | | 54,307 | |

| Prepaid expenses and other current assets | 3,993 | | | 2,381 | |

| Total current assets | 63,438 | | | 77,440 | |

| Property and equipment, net | 246 | | | 234 | |

| Operating lease right-of-use assets | 554 | | | 385 | |

| Goodwill | — | | | 17,625 | |

| Intangible assets | 61,793 | | | 63,672 | |

| Other assets | 8,798 | | | 8,544 | |

| Total assets | $ | 134,829 | | | $ | 167,900 | |

| | | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 2,405 | | | $ | 2,033 | |

| Short-term contingent consideration | 5,000 | | | 4,103 | |

| Accrued expenses and other current liabilities | 2,916 | | | 3,436 | |

| Total current liabilities | 10,321 | | | 9,572 | |

| Long-term debt | 13,834 | | | 13,429 | |

| Long-term operating lease liabilities | 453 | | | 321 | |

| Long-term contingent consideration | 57,471 | | | 53,603 | |

| Deferred tax liabilities | 5,173 | | | 5,304 | |

| Other long-term liabilities | 609 | | | 587 | |

| Total liabilities | 87,861 | | | 82,816 | |

| Stockholders’ equity: | | | |

Preferred stock, $0.001 par value, 10,000,000 authorized, (100,000 shares of which are designated as Series A Junior Participating Preferred Stock), no shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively. | — | | | — | |

Common stock, $0.001 par value, 100,000,000 shares authorized, 43,276,606 and 42,973,215 issued and outstanding as of June 30, 2024 and December 31, 2023, respectively. | 43 | | | 43 | |

| Additional paid in capital | 404,360 | | | 401,638 | |

| Accumulated other comprehensive income | 1,087 | | | 3,047 | |

| Accumulated deficit | (358,522) | | | (319,644) | |

| Total stockholders’ equity | 46,968 | | | 85,084 | |

| Total liabilities and stockholders’ equity | $ | 134,829 | | | $ | 167,900 | |

QUINCE THERAPEUTICS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

Operating expenses: | | | | | | | |

Research and development | $ | 4,147 | | | $ | 1,353 | | | $ | 7,849 | | | $ | 4,583 | |

General and administrative | 4,695 | | | 4,231 | | | 9,666 | | | 8,057 | |

Goodwill impairment charge | 17,130 | | | — | | | 17,130 | | | — | |

Intangible asset impairment charge | — | | | — | | | — | | | 5,900 | |

Fair value adjustment for contingent consideration | 2,220 | | | — | | | 4,765 | | | — | |

Total operating expenses | 28,192 | | | 5,584 | | | 39,410 | | | 18,540 | |

Loss from operations | (28,192) | | | (5,584) | | | (39,410) | | | (18,540) | |

Fair value adjustment for long-term debt | (415) | | | — | | | (803) | | | — | |

Interest income | 823 | | | 805 | | | 1,710 | | | 1,505 | |

Other income (expense), net | 91 | | | (107) | | | (308) | | | (353) | |

Net loss before income tax benefit | (27,693) | | | (4,886) | | | (38,811) | | | (17,388) | |

Income tax (expense) benefit | (36) | | | — | | | (67) | | | 248 | |

Net loss | (27,729) | | | (4,886) | | | (38,878) | | | (17,140) | |

| | | | | | | |

Net loss per share - basic and diluted | $ | (0.64) | | | $ | (0.14) | | | $ | (0.90) | | | $ | (0.48) | |

Weighted average shares of common stock outstanding - basic and diluted | 43,096,374 | | 35,917,592 | | 43,053,351 | | 35,886,568 |

(1) Expenses include the following amount of non-cash stock-based compensation expense.

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| General and administrative expense | $ | 1,142 | | | $ | 946 | | | $ | 2,310 | | | $ | 2,069 | |

| Research and development expense | 81 | | | 375 | | | 187 | | | 734 | |

| Total stock-based compensation | $ | 1,223 | | | $ | 1,321 | | | $ | 2,497 | | | $ | 2,803 | |

Cover

|

Aug. 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 13, 2024

|

| Registrant Name |

QUINCE THERAPEUTICS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38890

|

| Entity Tax Identification Number |

90-1024039

|

| Entity Address, Address Line One |

601 Gateway Boulevard

|

| Entity Address, Postal Zip Code |

94080

|

| Entity Address, Address Line Two |

Suite 1250

|

| Entity Address, City or Town |

South San Francisco

|

| Entity Address, State or Province |

CA

|

| Local Phone Number |

910-5717

|

| City Area Code |

415

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

QNCX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Central Index Key |

0001662774

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

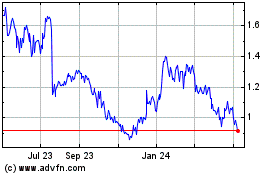

Quince Therapeutics (NASDAQ:QNCX)

Historical Stock Chart

From Nov 2024 to Dec 2024

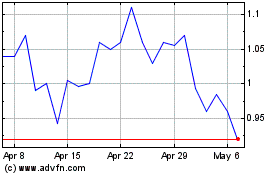

Quince Therapeutics (NASDAQ:QNCX)

Historical Stock Chart

From Dec 2023 to Dec 2024