Amended Statement of Beneficial Ownership (sc 13d/a)

August 30 2022 - 4:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 14)*

Radius

Health, Inc.

(Name of Issuer)

Common Stock, $0.0001 par value

(Title of Class of Securities)

750469207

(CUSIP Number)

BB Biotech AG

Ivo Betschart

Schwertstrasse 6

CH-8200

Schaffhausen, Switzerland

+41 44 267 67 00

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

August 11, 2022

(Date of

Event Which Requires Filing of this Statement)

If the filing

person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box. ☐

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for

other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the

Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

CUSIP No.: 750469207

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons I.R.S.

Identification Nos. of Above Persons (Entities Only) BB Biotech

AG |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

WC |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization

Switzerland |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7. |

|

Sole Voting Power

0 shares |

| |

8. |

|

Shared Voting Power

0 shares |

| |

9. |

|

Sole Dispositive Power

0 shares |

| |

10. |

|

Shared Dispositive Power

0 shares |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

0 shares |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 0.0%(1) |

| 14. |

|

Type of Reporting

Person HC, CO |

| (1) |

The percentage ownership is based on 47,600,500 shares of Common Stock outstanding as of June 3, 2022, as

reported by Issuer in its Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission on June 6, 2022. |

Page 2 of 5 Pages

CUSIP No.: 750469207

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons I.R.S.

Identification Nos. of Above Persons (Entities Only) Biotech Target

N.V. |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (a) ☒ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds

AF |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Items 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization

Curacao |

|

|

|

|

|

|

|

| NUMBER OF

SHARES BENEFICIALLY

OWNED BY EACH

REPORTING PERSON

WITH |

|

7. |

|

Sole Voting Power

0 shares |

| |

8. |

|

Shared Voting Power

0 shares |

| |

9. |

|

Sole Dispositive Power

0 shares |

| |

10. |

|

Shared Dispositive Power

0 shares |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

0 shares |

| 12. |

|

Check if the Aggregate

Amount in Row (11) Excludes Certain Shares ☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row (11) 0.0%(1) |

| 14. |

|

Type of Reporting

Person CO |

| (1) |

The percentage ownership is based on 47,600,500 shares of Common Stock outstanding as of June 3, 2022, as

reported by Issuer in its Proxy Statement on Schedule 14A filed with the Securities and Exchange Commission on June 6, 2022. |

Page 3 of 5 Pages

Schedule 13D (Amendment No. 14)

EXPLANATORY NOTE: This Amendment No. 14 to Schedule 13D amends the statement on Schedule 13D relating to shares of common stock, $0.0001 par value (the

“Common Stock”) of Radius Health, Inc. (the “Issuer”), initially filed by BB Biotech AG (“BB Biotech”) and Biotech Growth, N.V. (“Biotech Growth”) with the Securities and Exchange Commission (“SEC”)

on June 3, 2011 (together with all amendments thereto, this “Schedule 13D”). The shares of the Common Stock previously held by Biotech Growth were held by Biotech Target N.V. (“Biotech Target”) until August 11, 2022.

Both Biotech Growth and Biotech Target are wholly-owned subsidiaries of BB Biotech. As a result of tender offer and related merger reported in Item 4 below, on August 11, 2022, each of BB Biotech and Biotech Target (collectively, the

“Reporting Persons”) ceased to be beneficial owners of any Common Stock of the Issuer. This Amendment No. 14 constitutes an exit filing for the Reporting Persons.

Each capitalized term used and not defined herein shall have the meaning assigned to such term in prior amendments to this Schedule 13D. Except as otherwise

provided herein, each Item of this Schedule 13D remains unchanged.

Item 4. Purpose of Transaction

Item 4 is hereby supplemented to add the following:

Pursuant to

that certain Agreement and Plan of Merger (the “Merger Agreement”) dated June 23, 2022, by and among the Issuer, Ginger Acquisition, Inc. (“Parent”) and Ginger Merger Sub, Inc. (“Purchaser”), the Issuer merged with

and into Purchaser on August 15, 2022, following a tender offer by Purchaser (the “Offer”) to purchase each outstanding share of Common Stock in exchange for (i) $10.00, in cash, without interest and less applicable tax withholdings,

plus (ii) one contractual contingent value right, which represents the right to receive a contingent payment of $1.00 (without interest thereon) upon the satisfaction of certain conditions (collectively, the “Offer Price”). The

Reporting Persons tendered all of their beneficially owned Common Stock into the Offer. After the expiration of the Offer, the Purchaser accepted all shares of Common Stock that were validly tendered and not validly withdrawn on August 11,

2022, and the Reporting Persons became entitled to receive the Offer Price per share. The number of shares of Common Stock tendered in the Offer satisfied the Minimum Condition (as defined in the Merger Agreement) and on August 15, 2022,

following consummation of the Offer and pursuant to the Merger Agreement, the Purchaser merged with and into the Issuer.

Accordingly, as of

August 11, 2022, the Reporting Persons ceased to be beneficial owners of any Common Stock.

Item 5. Interest in Securities of the Issuer

Items 5 is hereby amended and restated in its entirety as follows:

| |

(a) |

As a result of the tender offer and merger reported in Item 4 above, neither of the Reporting Persons owns any

shares of Common Stock. To the best knowledge of BB Biotech and Biotech Target, no director or executive officer of BB Biotech or Biotech Target owns any shares of the Common Stock. |

| |

(c) |

Except as set forth in Item 4 above, none of the Reporting Persons has effected any transaction in the Common

Stock of the Issuer during the last 60 days. To the best knowledge of the Reporting Persons, no director or executive officer of BB Biotech and Biotech Target has effected any transaction in the Common Stock during the last 60 days.

|

| |

(e) |

Each of the Reporting Persons ceased to be a beneficial owner of more than five percent of the Common Stock on

August 11, 2022. |

Page 4 of 5 Pages

Item 7. Material to Be Filed as Exhibits

Item 7 of the Schedule 13D is amended and supplemented as follows:

|

|

|

| Exhibit A |

|

List of each executive officer and director of BB Biotech and Biotech Target and their respective name, business address, present principal occupation, and citizenship* |

|

|

| Exhibit B |

|

Agreement regarding joint filing of Schedule 13D* |

| * |

Previously filed as an exhibit to BB Biotech and Biotech Target’s Schedule 13D filed with the Securities

and Exchange Commission on May 19, 2020. |

Page 5 of 5 Pages

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

|

|

|

|

|

|

| BB Biotech AG |

|

|

|

|

|

|

|

|

|

|

| Date: August 29, 2022 |

|

|

|

By: |

|

/s/ Martin Gubler |

|

|

|

|

|

|

Signatory Authority |

|

|

|

|

Name: |

|

Martin Gubler |

|

|

|

|

Title: |

|

Signatory Authority |

|

|

|

|

| Date: August 29, 2022 |

|

|

|

By: |

|

/s/ Ivo Betschart |

|

|

|

|

|

|

Signatory Authority |

|

|

|

|

Name: |

|

Ivo Betschart |

|

|

|

|

Title: |

|

Signatory Authority |

|

|

|

|

| Biotech Target N.V. |

|

|

|

|

|

|

|

|

|

|

| Date: August 29, 2022 |

|

|

|

By: |

|

/s/ Jan Bootsma |

|

|

|

|

|

|

Signatory Authority |

|

|

|

|

Name: |

|

Jan Bootsma |

|

|

|

|

Title: |

|

Signatory Authority |

|

|

|

|

| Date: August 29, 2022 |

|

|

|

By: |

|

/s/ Hugo van Neutegem |

|

|

|

|

|

|

Signatory Authority |

|

|

|

|

Name: |

|

Hugo van Neutegem |

|

|

|

|

Title: |

|

Signatory Authority |

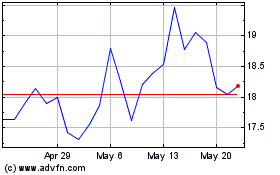

Radius Recycling (NASDAQ:RDUS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Radius Recycling (NASDAQ:RDUS)

Historical Stock Chart

From Dec 2023 to Dec 2024