Radius Recycling, Inc. (NASDAQ: RDUS) today announced preliminary

results for its fiscal 2024 second quarter ended February 29, 2024.

Second Quarter Fiscal 2024 Expected

Performance

The Company anticipates:

- Net loss to be approximately $(35) million. Loss per share from

continuing operations to be in the range of $(1.19) - $(1.24).

- Adjusted EBITDA to be approximately $2 million, and adjusted

loss per share from continuing operations to be in the range of

$(1.05) - $(1.10).

Market Conditions, Prices, and Volumes. Tight

supply flows for recycled metals and unusually wet winter weather

impacted sales volumes and metal spreads for both recycled metals

and finished steel during the Company’s second quarter. Ferrous

sales volumes are expected to decrease sequentially by 15% due to

the lower supply flows including delays of certain bulk shipments

at quarter-end. Nonferrous sales volumes are expected to be down 3%

sequentially, but up 7% year-over-year supported by additional

production from the Company’s advanced nonferrous recovery

technologies and expansion of our platform.

Finished steel sales volumes are expected to increase by 5%

year-over-year and steel mill utilization is expected to be 81%

versus 75% in the prior year period, reflecting the continued

strength of non-residential and infrastructure demand in the

Western U.S. Sequentially, finished steel sales volumes are

expected to decrease by 11% due to seasonally lower construction

demand exacerbated by a prolonged period of rain on the West

Coast.

Average net selling prices for ferrous recycled metals are

expected to be up 8% sequentially, benefiting from the

strengthening in global prices in the early part of the quarter

driven by restocking, before softening due to lower demand

including continued elevated levels of Chinese steel exports.

Average net selling prices for nonferrous recycled metal are

expected to be up 3% sequentially and be flat for finished steel

products. Results for the second quarter are expected to include a

benefit from average inventory accounting of approximately $2 per

ferrous ton.

Productivity Initiatives and Cost Reductions.

During the second quarter, the Company implemented a plan to reduce

selling, general and administrative (“SG&A”) expense by 10% and

increase production cost efficiencies to deliver $40 million in

aggregate annual benefits, which are in addition to the $30 million

in annual benefits previously announced that were substantially

implemented in the second quarter. The new measures include

reductions in headcount and other employee-related expenses, as

well as decreases in non-trade procurement spend, transportation

and logistics, and other outside services. Approximately half of

the targeted quarterly run-rate benefits from these initiatives are

expected to be achieved in the third quarter, with substantially

all of the remainder by the end of the fiscal year. The Company

expects to incur related restructuring charges and other

exit-related costs in the range of $6 million, of which $3 million

are expected to be incurred during the second quarter.

Operating Cash Flow. Operating cash outflow for

the second quarter is expected to be in a range of $50 million to

$60 million, reflecting an increase in net working capital due

primarily to the timing of shipment and collections. Capital

expenditures are expected to be approximately $15 million for the

second quarter, and the Company projects fiscal 2024 capital

expenditures to be approximately $80 million. At the end of the

second quarter, total debt is expected to be approximately $374

million and net debt is expected to be approximately $360 million.

The effective tax rate for the second quarter is expected to be an

expense of approximately 4% on GAAP results and 8% on adjusted

non-GAAP results, both including the recognition of a valuation

allowance charge of $2 million on deferred tax assets in one of the

Company’s tax jurisdictions.

Tamara Lundgren, Chairman and Chief Executive Officer, said,

“Without question, current market conditions remain challenging as

cyclical headwinds are creating tighter supply flows and

compressing metal spreads. We have navigated effectively through

these periods of tight scrap availability before, and we are

focused on what we can control: costs, operating efficiencies, and

execution of our strategic priorities to increase our nonferrous

production and expand our recycling services platform.”

She continued, “Scrap supply flows should improve with normal

seasonality and benefit as U.S. interest rates decline and global

manufacturing activity recovers. On the demand side,

decarbonization trends continue to be a positive driver for our

products and services. Many low carbon technologies are more metal

intensive than the technologies they are replacing and recycled

metals require less carbon to produce than mined metals. With our

100+ operating facilities producing recycled ferrous volumes of

over four million tons and nonferrous volumes of over 700 million

pounds annually, our low carbon and net zero carbon emission GRNTM

finished steel products, and our 3PRTM service and supply chain

solution that enables our customers to increase their recycling

rates, we are well-positioned to benefit from market improvements

and these positive structural demand trends.”

The preliminary information provided above is based on the

Company’s current estimates of its financial results for the

quarter ended February 29, 2024, and remains subject to change

based on final review of the Company’s second quarter financial

results.

Earnings Call Date

The Company will report financial results for its fiscal 2024

second quarter ended February 29, 2024 on Thursday, April 4, 2024.

The Company will host a webcast conference call to discuss the

results at 11:30 a.m. Eastern Time on the same day. The webcast of

the call and the accompanying slide presentation may be accessed at

www.radiusrecycling.com/company/investors on Radius Recycling’s

website under Company > Investors. The call will be hosted by

Tamara Lundgren, Chairman and Chief Executive Officer, and Stefano

Gaggini, Senior Vice President and Chief Financial Officer.

About Radius Recycling, Inc.

Radius Recycling, Inc. (formerly Schnitzer Steel Industries,

Inc.) is one of the largest manufacturers and exporters of recycled

metal products in North America with operating facilities located

in 25 states, Puerto Rico, and Western Canada. Radius has seven

deep water export facilities located on both the East and West

Coasts and in Hawaii and Puerto Rico. The Company’s integrated

operating platform also includes 50 stores which sell serviceable

used auto parts from salvaged vehicles and receive over 4 million

annual retail visits. The Company’s steel manufacturing operations

produce finished steel products, including rebar, wire rod, and

other specialty products. The Company began operations in 1906 in

Portland, Oregon.

Non-GAAP Financial Measures

This press release contains performance based on adjusted

diluted earnings per share from continuing operations attributable

to Radius shareholders, adjusted EBITDA, and debt, net of cash,

which are non-GAAP financial measures as defined under SEC rules.

As required by SEC rules, the Company has provided a reconciliation

of these measures for each period discussed to the most directly

comparable U.S. GAAP measure. Management believes that providing

these non-GAAP financial measures adds a meaningful presentation of

our results from business operations excluding adjustments for

restructuring charges and other exit-related activities, asset

impairment charges, charges for legacy environmental matters (net

of recoveries), amortization of capitalized cloud computing

implementation costs, business development costs not related to

ongoing operations including pre-acquisition expenses, and the

income tax benefit allocated to these adjustments, items which are

not related to underlying business operational performance, and

improves the period-to-period comparability of our results from

business operations. We believe that presenting debt, net of cash

is useful to investors as a measure of our leverage, as cash and

cash equivalents can be used, among other things, to repay

indebtedness. These non-GAAP financial measures should be

considered in addition to, but not as a substitute for, the most

directly comparable U.S. GAAP measures.

| Reconciliation of

adjusted diluted loss per share from continuing operations

attributable to Radius shareholders |

|

|

|

|

|

|

| ($ per share) |

|

|

|

|

|

|

2Q24 |

|

|

|

|

High |

|

|

Low |

|

|

As reported |

|

$ |

(1.19 |

) |

|

$ |

(1.24 |

) |

| Restructuring charges and

other exit-related activities |

|

|

0.11 |

|

|

|

0.11 |

|

| Asset impairment charges |

|

|

0.06 |

|

|

|

0.06 |

|

| Charges for legacy

environmental matters, net(1) |

|

|

0.01 |

|

|

|

0.01 |

|

| Business development

costs |

|

|

— |

|

|

|

— |

|

| Income tax benefit allocated

to adjustments(2) |

|

|

(0.03 |

) |

|

|

(0.03 |

) |

| Adjusted(3) |

|

$ |

(1.05 |

) |

|

$ |

(1.10 |

) |

- Legal and environmental charges, net of recoveries, for legacy

environmental matters including those related to the Portland

Harbor Superfund site and to other legacy environmental loss

contingencies.

- Income tax allocated to the aggregate adjustments reconciling

reported and adjusted diluted loss per share from continuing

operations attributable to Radius shareholders is determined based

on a tax provision calculated with and without the

adjustments.

- May not foot due to rounding.

| Reconciliation of

adjusted EBITDA |

|

|

| ($ in millions) |

|

|

| |

|

|

| |

2Q24 |

|

|

Net loss |

$ |

(35 |

) |

|

Plus loss from discontinued operations, net of tax |

|

— |

|

|

Plus interest expense |

|

6 |

|

|

Plus income tax expense |

|

1 |

|

|

Plus depreciation and amortization |

|

24 |

|

|

Plus restructuring charges and other exit-related activities |

|

3 |

|

|

Plus asset impairment charges |

|

2 |

|

|

Plus charges for legacy environmental matters, net(1) |

|

— |

|

|

Plus amortization of cloud computing software costs(2) |

|

— |

|

|

Plus business development costs |

|

— |

|

| Adjusted EBITDA(3) |

$ |

2 |

|

- Legal and environmental charges, net of recoveries, for legacy

environmental matters including those related to the Portland

Harbor Superfund site and to other legacy environmental loss

contingencies.

- Amortization of cloud computing software costs

consists of expense resulting from amortization of capitalized

implementation costs for cloud computing IT systems. This

expense is not included in depreciation and amortization.

- May not foot due to rounding.

| Reconciliation of

debt, net of cash |

|

|

|

|

|

|

| ($ in millions) |

|

|

|

|

|

|

|

|

|

February 29, 2024 |

|

|

August 31, 2023 |

|

|

Total debt |

|

|

374 |

|

|

|

249 |

|

| Less: cash and cash

equivalents |

|

|

14 |

|

|

|

6 |

|

|

Total debt, net of cash |

|

$ |

360 |

|

|

$ |

243 |

|

Forward Looking Statements

Statements and information included in this press release that

are not purely historical are forward-looking statements within the

meaning of Section 21E of the Securities Exchange Act of 1934 and

are made pursuant to the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995. Except as noted herein or

as the context may otherwise require, all references in this press

release to “we,” “our,” “us,” “the Company,” “Radius Recycling,”

and “Radius” refer to Radius Recycling, Inc. (formerly Schnitzer

Steel Industries, Inc.) and its consolidated subsidiaries.

Forward-looking statements in this press release include

statements regarding future events or our expectations, intentions,

beliefs, and strategies regarding the future, which may include

statements regarding the impact of equipment upgrades, equipment

failures, and facility damage on production, including timing of

repairs and resumption of operations; the realization of insurance

recoveries; the Company’s outlook, growth initiatives, or expected

results or objectives, including pricing, margins, volumes, and

profitability; completion of acquisitions and integration of

acquired businesses; the progression and impact of investments in

processing and manufacturing technology improvements and

information technology systems; the impacts of supply chain

disruptions, inflation, and rising interest rates; liquidity

positions; our ability to generate cash from continuing operations;

trends, cyclicality, and changes in the markets we sell into;

strategic direction or goals; targets; changes to manufacturing and

production processes; the realization of deferred tax assets;

planned capital expenditures; the cost of and the status of any

agreements or actions related to our compliance with environmental

and other laws; expected tax rates, deductions, and credits; the

impact of sanctions and tariffs, quotas, and other trade actions

and import restrictions; the impact of pandemics, epidemics, or

other public health emergencies, such as the coronavirus disease

2019 (“COVID-19”) pandemic; the impact of labor shortages or

increased labor costs; obligations under our retirement plans;

benefits, savings, or additional costs from business realignment,

cost containment, and productivity improvement programs; the

potential impact of adopting new accounting pronouncements; and the

adequacy of accruals.

Forward-looking statements by their nature address matters that

are, to different degrees, uncertain, and often contain words such

as “outlook,” “target,” “aim,” “believes,” “expects,”

“anticipates,” “intends,” “assumes,” “estimates,” “evaluates,”

“may,” “will,” “should,” “could,” “opinions,” “forecasts,”

“projects,” “plans,” “future,” “forward,” “potential,” “probable,”

and similar expressions. However, the absence of these words or

similar expressions does not mean that a statement is not

forward-looking.

We may make other forward-looking statements from time to time,

including in reports filed with the Securities and Exchange

Commission, press releases, presentations, and on public conference

calls. All forward-looking statements we make are based on

information available to us at the time the statements are made,

and we assume no obligation to update any forward-looking

statements, except as may be required by law. Our business is

subject to the effects of changes in domestic and global economic

conditions and a number of other risks and uncertainties that could

cause actual results to differ materially from those included in,

or implied by, such forward-looking statements. Some of these risks

and uncertainties are discussed in “Item 1A. Risk Factors” of Part

I of our most recent Annual Report on Form 10-K. Examples of these

risks include: potential environmental cleanup costs related to the

Portland Harbor Superfund site or other locations; the impact of

goodwill impairment charges; the impact of equipment upgrades,

equipment failures, and facility damage on production; failure to

realize or delays in realizing expected benefits from capital and

other projects, including investments in processing and

manufacturing technology improvements and information technology

systems; the cyclicality and impact of general economic conditions;

the impact of inflation, rising interest rates, and foreign

currency fluctuations; changing conditions in global markets

including the impact of sanctions and tariffs, quotas, and other

trade actions and import restrictions; increases in the relative

value of the U.S. dollar; economic and geopolitical instability

including as a result of military conflict; volatile supply and

demand conditions affecting prices and volumes in the markets for

raw materials and other inputs we purchase; significant decreases

in recycled metal prices; imbalances in supply and demand

conditions in the global steel industry; difficulties associated

with acquisitions and integration of acquired businesses; supply

chain disruptions; reliance on third-party shipping companies,

including with respect to freight rates and the availability of

transportation; the impact of impairment of assets other than

goodwill; the impact of pandemics, epidemics, or other public

health emergencies, such as the COVID-19 pandemic; inability to

achieve or sustain the benefits from productivity, cost savings,

and restructuring initiatives; inability to renew facility leases;

customer fulfillment of their contractual obligations; potential

limitations on our ability to access capital resources and existing

credit facilities; restrictions on our business and financial

covenants under the agreement governing our bank credit facilities;

the impact of consolidation in the steel industry; product

liability claims; the impact of legal proceedings and legal

compliance; the impact of climate change; the impact of not

realizing deferred tax assets; the impact of tax increases and

changes in tax rules; the impact of one or more cybersecurity

incidents; the impact of increasing attention to environmental,

social, and governance matters; translation risks associated with

fluctuation in foreign exchange rates; the impact of hedging

transactions; inability to obtain or renew business licenses and

permits; environmental compliance costs and potential environmental

liabilities; increased environmental regulations and enforcement;

compliance with climate change and greenhouse gas emission laws and

regulations; the impact of labor shortages or increased labor

costs; reliance on employees subject to collective bargaining

agreements; and the impact of the underfunded status of

multiemployer plans in which we participate.

Company Contact:

|

Investor Relations: |

|

Michael Bennett |

|

(503) 323-2811 |

|

mcbennett@rdus.com |

| |

| Company

Info: |

|

www.radiusrecycling.com |

|

ir@rdus.com |

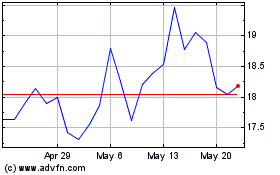

Radius Recycling (NASDAQ:RDUS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Radius Recycling (NASDAQ:RDUS)

Historical Stock Chart

From Mar 2024 to Mar 2025