00017864312024FYfalse00017864312025-02-052025-02-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

_______________________________________________

FORM 8-K

_______________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 5, 2025

_______________________________________________

REYNOLDS CONSUMER PRODUCTS INC.

(Exact Name of Registrant as Specified in its Charter)

_______________________________________________

| | | | | | | | |

| Delaware | 001-39205 | 45-3464426 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | |

1900 W. Field Court Lake Forest, Illinois | 60045 |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (800) 879-5067

Not Applicable

(Former name or former address, if changed since last report)

_______________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 Par Value | | REYN | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02. Results of Operations and Financial Condition

On February 5, 2025, Reynolds Consumer Products Inc. (the “Company”) issued a press release announcing its financial results for the fourth quarter and fiscal year ended December 31, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information included in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section and shall not be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended, or the Exchange Act, except as otherwise expressly stated in such filing.

Item 9.01. Financial Statements and Exhibits

(d)Exhibits

| | | | | |

| Exhibit No. | Description |

| |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Date: February 5, 2025 | | |

| | |

| REYNOLDS CONSUMER PRODUCTS INC. |

| | |

| By: | /s/ David Watson |

| | David Watson |

| | General Counsel and Secretary |

Reynolds Consumer Products Reports Fourth Quarter and Full Year 2024 Financial Results; Provides 2025 Outlook

Net Income Grew 18% on Improved Margins

Retail Volumes Accelerated in Q4

Investing Strong Cash Flow in Future Revenue Growth and Additional Margin Expansion

LAKE FOREST, IL, February 5, 2025 – (BUSINESSWIRE) – Reynolds Consumer Products Inc. (the “Company”) (Nasdaq: REYN) today reported financial results for the fourth quarter and fiscal year ended December 31, 2024.

Fiscal Year 2024 Highlights

•Net Revenues of $3,695 million vs. $3,756 million in 2023

◦Retail Net Revenues of $3,518 million vs. $3,559 million in 2023

◦Non-Retail Net Revenues, which comprises aluminum sales to food service and industrial customers, of $177 million vs. $197 million in 2023

•Net Income and Adjusted Net Income of $352 million vs. $298 million in 2023

•EBITDA and Adjusted EBITDA of $678 million vs. $636 million in 2023

•Earnings Per Share and Adjusted Earnings Per Share of $1.67 vs. $1.42 in 2023

•Operating Cash Flow of $489 million; 72% conversion of Adjusted EBITDA

Retail volume decreased 1% for the year driven by a one-point headwind from product portfolio optimization.

Net Income increased 18% to $352 million. Adjusted EBITDA increased 7% to $678 million driven by lower operational costs, partially offset by the impact of lower Net Revenues. Net Income increased as a result of the same factors as well as lower interest expense.

The Company reduced Net Debt Leverage1 from 2.7x on December 31, 2023 to 2.3x on December 31, 2024, within the stated target leverage range of 2.0 to 2.5x.

“Our retail volume accelerated in the fourth quarter, and we have the team, business model and resources to drive strong growth, further margin expansion and consistently attractive shareholder returns,” said Scott Huckins, President and Chief Executive Officer. “Reynolds and Hefty are very strong brands, and we enter 2025 committed to executing new and existing programs to realize even more of RCP’s potential.”

1Net Debt is defined as current portion of long-term debt plus long-term debt less cash and cash equivalents. Net Debt Leverage is defined as Net Debt divided by Trailing Twelve Months Adjusted EBITDA. See “Use of Non-GAAP Financial Measures” for additional information.

Fourth Quarter 2024 Highlights

•Net Revenues of $1,021 million vs. $1,007 million in Q4 2023

◦Retail Net Revenues of $975 million vs. $972 million in Q4 2023

◦Non-Retail Net Revenues of $46 million vs. $35 million in Q4 2023

•Net Income and Adjusted Net Income of $121 million vs. $137 million in Q4 2023

•EBITDA and Adjusted EBITDA of $213 million vs. $238 million in Q4 2023

•Earnings Per Share and Adjusted Earnings Per Share of $0.58 vs. $0.65 in Q4 2023

Retail volume grew 1%, consistent with overall category performance, accelerated in all four business units and included a one-point headwind from product portfolio optimization.

Net Income decreased 12% to $121 million. Adjusted EBITDA decreased 11% to $213 million driven by the anticipated higher operational costs and lower pricing. Net Income decreased as a result of the same factors, partially offset by lower interest expense. Fourth quarter 2023 earnings were a company record and disproportionately contributed to the full year result relative to history.

Reynolds Cooking & Baking

•Net Revenues increased $17 million to $374 million reflecting retail and non-retail growth

•Adjusted EBITDA decreased $7 million to $82 million

Retail volume increased 3%, which included a one-point headwind from product portfolio optimization, driven by Reynolds Wrap share gains and growth of Reynolds Kitchens products.

The Adjusted EBITDA decrease was driven by higher operational costs and lower pricing, partially offset by the benefit of higher volume.

Hefty Waste & Storage

•Net Revenues increased $8 million to $245 million

•Adjusted EBITDA decreased $5 million to $68 million

Retail volume increased 3% with Hefty Waste & Storage outperforming its categories. Hefty Fabuloso® waste bags, Hefty Press to Close food bags and other new products continued to deliver strong growth while expanding distribution.

The Adjusted EBITDA decrease was driven by higher operational costs, partially offset by the benefit of higher volume.

Hefty Tableware

•Net Revenues decreased $8 million to $251 million

•Adjusted EBITDA decreased $6 million to $52 million

Retail volume decreased 2% as lower foam plate volume more than offset modest growth of other tableware products. Volume excluding foam plates outperformed its categories.

The Adjusted EBITDA decrease was driven by lower net revenues and higher operational costs.

Presto Products

•Net revenues were unchanged at $153 million

•Adjusted EBITDA decreased $4 million to $30 million

Retail volume was unchanged, which included a one-point headwind from product portfolio optimization.

The Adjusted EBITDA decrease was driven by higher operational costs.

Balance Sheet and Cash Flow Highlights

Cash and cash equivalents were $137 million at December 31, 2024, and debt was $1,686 million resulting in net debt of $1,549 million, which resulted in Net Debt Leverage of 2.3x on December 31, 2024.

Operating cash flow of $489 million for the year ended December 31, 2024 was driven by strong profitability and disciplined working capital management.

Capital expenditures were $120 million for the year ended December 31, 2024 compared to $104 million in the prior year, reflecting increased investment in automation and other cost savings programs to drive margin expansion and support additional growth.

Subsequent to quarter end, the Company made a voluntary principal payment of $50 million on its term loan facility.

“The strength of our balance sheet, cash flows and capital allocation discipline position us very well for increased investment, growth and profitability,” said Nathan Lowe, Chief Financial Officer. “We are applying our returns-based framework to a robust pipeline of product innovation and cost savings programs, and we look forward to unlocking even more of RCP’s potential in 2025 and over the long-term.”

Fiscal Year 2025 and First Quarter 2025 Outlook2

Full-year 2025 Net Revenues are expected to be down low single digits versus 2024 Net Revenues of $3,695 million, with retail volume at or above category performance. Full-year 2025 Adjusted EBITDA is expected to be between $670 million and $690 million. Full-year Adjusted EPS is expected to be $1.61 to $1.68.

First quarter 2025 Net Revenues are expected to be down low single digits versus first quarter 2024 Net Revenues of $833 million which considers the Easter timing shift. First quarter 2025 Adjusted EBITDA is expected to be approximately $115 million to $120 million. First quarter Adjusted EPS is expected to be $0.22 to $0.24.

Full-year 2025 Adjusted EBITDA and Adjusted EPS reflect the following estimated adjustments from Net Income: depreciation and amortization of approximately $130 million and $25 million to $35 million of pre-tax costs related to CEO transition and other investments in certain strategic initiatives.

Quarterly Dividend

The Company’s Board of Directors has approved a quarterly dividend of $0.23 per common share. The Company expects to pay this dividend on February 28, 2025, to shareholders of record as of February 14, 2025.

Earnings Webcast

The Company will host a live webcast this morning at 7:00 a.m. CT (8:00 a.m. ET). A link to the webcast and all related earnings materials will be available on the Company’s Investor Relations website at https://investors.reynoldsconsumerproducts.com.

About Reynolds Consumer Products Inc.

Reynolds Consumer Products is a leading provider of household products that simplify daily life so consumers can enjoy what matters most. With a presence in 95% of households across the United States, Reynolds Consumer Products manufactures and sells products that people use in their homes across three broad categories: cooking, waste and storage, and disposable tableware. Iconic brands include Reynolds Wrap® aluminum foil and Hefty® tableware and trash bags, in addition to dedicated store brands which are strategically important to retail customers. Overall, Reynolds Consumer Products holds the No. 1 or No. 2 U.S. market share position in the majority of product categories it serves. For more information, visit https://investors.reynoldsconsumerproducts.com.

2The Company is not able to quantify certain other items that will be excluded from forward-looking Adjusted EBITDA and Adjusted EPS without reasonable efforts due to uncertainties and potential variability of those items. Such unavailable information is not expected to have a significant impact on the Company’s future GAAP financial results.

Forward Looking Statements

This press release contains statements reflecting our views about our future performance that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including our first quarter and fiscal year 2025 guidance. In some cases, you can identify these statements by forward-looking words such as “may,” “might,” “will,” “should,” “expects,” “intends,” “outlook,” “forecast”, “position”, “committed,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “model”, “assumes,” “confident,” “look forward,” “potential” “on track”, or “continue,” the negative of these terms and other comparable terminology. These forward-looking statements, which are subject to risks, uncertainties and assumptions about us, may include projections of our future financial performance, our anticipated growth and recovery of profitability, management of costs and other disruptions and other strategies, and anticipated trends in our business, including expected levels of commodity costs and volume. These statements are only predictions based on our current expectations and projections about future events. There are important factors that could cause our actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements, including but not limited to the risk factors set forth in our most recent Annual Report on Form 10-K and in our Quarterly Reports on Form 10-Q.

For additional information on these and other factors that could cause our actual results to materially differ from those set forth herein, please see our filings with the Securities and Exchange Commission, including our most recent Annual Report on Form 10-K and subsequent filings. Investors are cautioned not to place undue reliance on any such forward-looking statements, which speak only as of the date they are made. The Company undertakes no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise.

REYN-F

Investor Contact

Mark Swartzberg

Mark.Swartzberg@reynoldsbrands.com

(847) 482-4081

Reynolds Consumer Products Inc.

Consolidated Statements of Income

(amounts in millions, except for per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended | | For the Years Ended |

| December 31, | | December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Net revenues | $ | 1,000 | | | $ | 985 | | | $ | 3,618 | | | $ | 3,673 | |

| Related party net revenues | 21 | | | 22 | | | 77 | | | 83 | |

| Total net revenues | 1,021 | | | 1,007 | | | 3,695 | | | 3,756 | |

| Cost of sales | (741) | | | (698) | | | (2,717) | | | (2,814) | |

| Gross profit | 280 | | | 309 | | | 978 | | | 942 | |

| Selling, general and administrative expenses | (100) | | | (103) | | | (429) | | | (430) | |

| Other expense, net | — | | | — | | | — | | | — | |

| Income from operations | 180 | | | 206 | | | 549 | | | 512 | |

| Interest expense, net | (22) | | | (28) | | | (98) | | | (119) | |

| Income before income taxes | 158 | | | 178 | | | 451 | | | 393 | |

| Income tax expense | (37) | | | (41) | | | (99) | | | (95) | |

| Net income | $ | 121 | | | $ | 137 | | | $ | 352 | | | $ | 298 | |

| | | | | | | |

| Earnings per share | | | | | | | |

| Basic | $ | 0.58 | | | $ | 0.65 | | | $ | 1.68 | | | $ | 1.42 | |

| Diluted | $ | 0.58 | | | $ | 0.65 | | | $ | 1.67 | | | $ | 1.42 | |

| | | | | | | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 210.2 | | 210.0 | | 210.1 | | 210.0 |

| Diluted | 210.9 | | 210.0 | | 210.4 | | 210.0 |

Reynolds Consumer Products Inc.

Consolidated Balance Sheets

As of December 31

(amounts in millions, except for per share data)

| | | | | | | | | | | |

| 2024 | | 2023 |

| Assets | | | |

| Cash and cash equivalents | $ | 137 | | | $ | 115 | |

| Accounts receivable, net | 337 | | | 347 | |

| Other receivables | 7 | | | 7 | |

| Related party receivables | 6 | | | 7 | |

| Inventories | 567 | | | 524 | |

| Other current assets | 47 | | | 41 | |

| Total current assets | 1,101 | | | 1,041 | |

| Property, plant and equipment, net | 758 | | | 732 | |

| Operating lease right-of-use assets, net | 90 | | | 56 | |

| Goodwill | 1,895 | | | 1,895 | |

| Intangible assets, net | 972 | | | 1,001 | |

| Other assets | 57 | | | 55 | |

| Total assets | $ | 4,873 | | | $ | 4,780 | |

| Liabilities | | | |

| Accounts payable | $ | 319 | | | $ | 219 | |

| Related party payables | 34 | | | 34 | |

| Current operating lease liabilities | 20 | | | 16 | |

| Income taxes payable | 5 | | | 22 | |

| Accrued and other current liabilities | 161 | | | 187 | |

| Total current liabilities | 539 | | | 478 | |

| Long-term debt | 1,686 | | | 1,832 | |

| Long-term operating lease liabilities | 73 | | | 42 | |

| Deferred income taxes | 342 | | | 357 | |

| Long-term postretirement benefit obligation | 14 | | | 16 | |

| Other liabilities | 77 | | | 72 | |

| Total liabilities | $ | 2,731 | | | $ | 2,797 | |

| Stockholders’ equity | | | |

| Common stock, $0.001 par value; 2,000 shares authorized; 210.2 shares issued and outstanding | — | | | — | |

| Additional paid-in capital | 1,413 | | | 1,396 | |

| Accumulated other comprehensive income | 35 | | | 50 | |

| Retained earnings | 694 | | | 537 | |

| Total stockholders’ equity | 2,142 | | | 1,983 | |

| Total liabilities and stockholders’ equity | $ | 4,873 | | | $ | 4,780 | |

Reynolds Consumer Products Inc.

Consolidated Statements of Cash Flows

For the Years Ended December 31

(amounts in millions)

| | | | | | | | | | | |

| 2024 | | 2023 |

| Cash provided by operating activities | | | |

| Net income | $ | 352 | | | $ | 298 | |

| Adjustments to reconcile net income to operating cash flows: | | | |

| Depreciation and amortization | 129 | | | 124 | |

| Deferred income taxes | (11) | | | (5) | |

| Stock compensation expense | 19 | | | 14 | |

| Change in assets and liabilities: | | | |

| Accounts receivable, net | 11 | | | — | |

| Other receivables | 1 | | | 7 | |

| Related party receivables | 1 | | | — | |

| Inventories | (42) | | | 198 | |

| Accounts payable | 95 | | | (31) | |

| Related party payables | — | | | (12) | |

| Income taxes payable / receivable | (17) | | | 9 | |

| Accrued and other current liabilities | (26) | | | 42 | |

| Other assets and liabilities | (23) | | | — | |

| Net cash provided by operating activities | 489 | | | 644 | |

| Cash used in investing activities | | | |

| Acquisition of property, plant and equipment | (120) | | | (104) | |

| Acquisition of business | — | | | (6) | |

| Net cash used in investing activities | (120) | | | (110) | |

| Cash used in financing activities | | | |

| Repayment of long-term debt | (150) | | | (262) | |

| Dividends paid | (192) | | | (192) | |

| Other financing activities | (4) | | | (3) | |

| Net cash used in financing activities | (346) | | | (457) | |

| Effect of exchange rate changes on cash and cash equivalents | (1) | | | — | |

| Cash and cash equivalents: | | | |

| Increase (decrease) in cash and cash equivalents | 22 | | | 77 | |

| Balance as of beginning of the year | 115 | | | 38 | |

| Balance as of end of the year | $ | 137 | | | $ | 115 | |

| | | |

| Cash paid: | | | |

| Interest – long-term debt, net of interest rate swaps | 98 | | | 114 | |

| Income taxes | 125 | | | 90 | |

Reynolds Consumer Products Inc.

Segment Results

(amounts in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Reynolds

Cooking

& Baking | | Hefty

Waste &

Storage | | Hefty

Tableware | | Presto

Products | | Unallocated(1) | | Total |

| Revenues | |

| Three Months Ended December 31, 2024 | $ | 374 | | | $ | 245 | | | $ | 251 | | | $ | 153 | | | $ | (2) | | | $ | 1,021 | |

| Three Months Ended December 31, 2023 | 357 | | | 237 | | | 259 | | | 153 | | | 1 | | | 1,007 | |

| Year Ended December 31, 2024 | 1,247 | | | 959 | | | 918 | | | 596 | | | (25) | | | 3,695 | |

| Year Ended December 31, 2023 | 1,273 | | | 942 | | | 967 | | | 593 | | | (19) | | | 3,756 | |

| Adjusted EBITDA | | | | | | | | | | | |

| Three Months Ended December 31, 2024 | $ | 82 | | | $ | 68 | | | $ | 52 | | | $ | 30 | | | $ | (19) | | | $ | 213 | |

| Three Months Ended December 31, 2023 | 89 | | | 73 | | | 58 | | | 34 | | | (16) | | | 238 | |

| Year Ended December 31, 2024 | 222 | | | 272 | | | 147 | | | 130 | | | (93) | | | 678 | |

| Year Ended December 31, 2023 | 184 | | | 261 | | | 174 | | | 112 | | | (95) | | | 636 | |

(1)The unallocated net revenues include elimination of inter-segment revenues and other revenue adjustments. The unallocated Adjusted EBITDA represents the combination of corporate expenses which are not allocated to our segments and other unallocated revenue adjustments.

Components of Change in Net Revenues for the Three Months Ended December 31, 2024 vs. the Three Months Ended December 31, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Price | | Volume/Mix | | Total | |

| | | Retail | | Non-Retail | | | |

| Reynolds Cooking & Baking | (1) | % | 3 | % | 3 | % | 5 | % |

| Hefty Waste & Storage | — | % | 3 | % | — | % | 3 | % |

| Hefty Tableware | (1) | % | (2) | % | — | % | (3) | % |

| Presto Products | — | % | — | % | — | % | — | % |

| Total RCP | (1) | % | 1 | % | 1 | % | 1 | % |

Components of Change in Net Revenues for the Twelve Months Ended December 31, 2024 vs. the Twelve Months Ended December 31, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Price | | Volume/Mix | | Total | |

| | | Retail | | Non-Retail | | | |

| Reynolds Cooking & Baking | — | % | (1) | % | (1) | % | (2) | % |

| Hefty Waste & Storage | 1 | % | 1 | % | — | % | 2 | % |

| Hefty Tableware | (2) | % | (3) | % | — | % | (5) | % |

| Presto Products | 1 | % | — | % | — | % | 1 | % |

| Total RCP | (1) | % | (1) | % | — | % | (2) | % |

Use of Non-GAAP Financial Measures

We use non-GAAP financial measures “Adjusted EBITDA,” “Adjusted Net Income,” “Adjusted Earnings Per Share,” “Net Debt,” “Net Debt to Trailing Twelve Months Adjusted EBITDA,” “Free Cash Flow,” and “Conversion of Adjusted EBITDA” in evaluating our past results and future prospects. We define Adjusted EBITDA as net income calculated in accordance with GAAP, plus the sum of income tax expense, net interest expense, depreciation and amortization and further adjusted to exclude IPO and separation-related costs, as well as other non-recurring costs. We define Adjusted Net Income and Adjusted Earnings Per Share (“Adjusted EPS”) as Net Income and Earnings Per Share (“EPS”) calculated in accordance with GAAP, plus IPO and separation-related costs, as well as other non-recurring costs. We define Net Debt as the current portion of long-term debt plus long-term debt less cash and cash equivalents. We define Net Debt to Trailing Twelve Months Adjusted EBITDA as Net Debt (as defined above) as of the end of the period to Adjusted EBITDA (as defined above) for the period. We define Free Cash Flow as net cash provided by operating activities in the period minus the acquisition of property, plant and equipment in the period. We define Conversion of Adjusted EBITDA as the ratio of net cash provided by operating activities in the period to Adjusted EBITDA (as defined above) for the period, expressed as a percentage.

We present Adjusted EBITDA because it is a key measure used by our management team to evaluate our operating performance, generate future operating plans and make strategic decisions. In addition, our chief operating decision maker uses Adjusted EBITDA of each reportable segment to evaluate the operating performance of such segments. We use Adjusted Net Income and Adjusted Earnings Per Share as supplemental measures to evaluate our business’ performance in a way that also considers our ability to generate profit without the impact of certain items. We use Net Debt as we believe it is a more representative measure of our liquidity. We use Net Debt to Trailing Twelve Months Adjusted EBITDA because it reflects our ability to service our debt obligations. We use Free Cash Flow because it measures our ability to generate additional cash from our business operations. We present Conversion of Adjusted EBITDA as it measures our management of working capital and profit conversion to cash. Accordingly, we believe presenting these measures provide useful information to investors and others in understanding and evaluating our operating results in the same manner as our management team and board of directors.

Non-GAAP information should be considered as supplemental in nature and is not meant to be considered in isolation or as a substitute for the related financial information prepared in accordance with GAAP. In addition, our non-GAAP financial measures may not be the same as or comparable to similar non-GAAP financial measures presented by other companies.

Guidance for fiscal year and first quarter 2025, where adjusted, is provided on a non-GAAP basis. While the Company is providing estimated amounts for certain of the expected adjustments in this release, the Company cannot provide full reconciliations for its expected first quarter and fiscal year 2025 Adjusted EBITDA and Adjusted EPS to expected Net Income and expected EPS under “Fiscal Year 2025 and First Quarter 2025 Outlook” without unreasonable effort because certain items that impact Net Income and EPS and other reconciling metrics are out of the Company’s control and/or cannot be reasonably predicted at this time, which unavailable information is not expected to have a significant impact on the Company’s GAAP financial results.

Please see reconciliations of non-GAAP measures used in this release (with the exception of our first quarter 2025 Adjusted EBITDA and Adjusted EPS outlook, as described above) to the most directly comparable GAAP measures, beginning on the following page.

Reynolds Consumer Products Inc.

Reconciliation of Net Income to EBITDA and Adjusted EBITDA

(amounts in millions)

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended December 31, | | For the Years Ended December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (in millions) | | (in millions) |

| Net income – GAAP | $ | 121 | | | $ | 137 | | | $ | 352 | | | $ | 298 | |

| Income tax expense | 37 | | | 41 | | | 99 | | | 95 | |

| Interest expense, net | 22 | | | 28 | | | 98 | | | 119 | |

| Depreciation and amortization | 33 | | | 32 | | | 129 | | | 124 | |

| EBITDA and Adjusted EBITDA (Non-GAAP) | $ | 213 | | | $ | 238 | | | $ | 678 | | | $ | 636 | |

Reynolds Consumer Products Inc.

Reconciliation of Total Debt to Net Debt and Calculation of Net Debt to Trailing Twelve Months Adjusted EBITDA

(amounts in millions, except for Net Debt to Trailing Twelve Months Adjusted EBITDA)

| | | | | |

| As of December 31, 2024 | |

| Current portion of long-term debt | $ | — | |

| Long-term debt | 1,686 | |

| Total debt | 1,686 | |

| Cash and cash equivalents | (137) | |

| Net debt (Non-GAAP) | $ | 1,549 | |

| For the twelve months ended December 31, 2024 | |

| Adjusted EBITDA (Non-GAAP) | $ | 678 | |

| |

| Net Debt to Trailing Twelve Months Adjusted EBITDA | 2.3x |

| | | | | |

| As of December 31, 2023 | |

| Current portion of long-term debt | $ | — | |

| Long-term debt | 1,832 | |

| Total debt | 1,832 | |

| Cash and cash equivalents | (115) | |

| Net debt (Non-GAAP) | $ | 1,717 | |

| For the twelve months ended December 31, 2023 | |

| Adjusted EBITDA (Non-GAAP) | $ | 636 | |

| |

| Net Debt to Trailing Twelve Months Adjusted EBITDA | 2.7x |

Reynolds Consumer Products Inc.

Reconciliation of Net Cash Provided by Operating Activities to Free Cash Flow

(amounts in millions)

| | | | | | | | | | | |

| For the Years Ended December 31 |

| 2024 | | 2023 |

Net cash provided by operating activities | $ | 489 | | | $ | 644 | |

Acquisition of property, plant and equipment | (120) | | | (104) | |

Free cash flow | $ | 369 | | | $ | 540 | |

v3.25.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

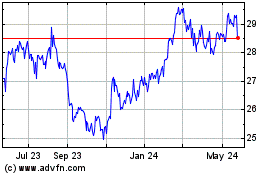

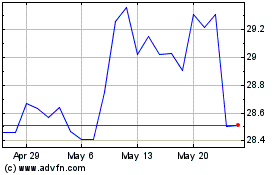

Reynolds Consumer Products (NASDAQ:REYN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Reynolds Consumer Products (NASDAQ:REYN)

Historical Stock Chart

From Feb 2024 to Feb 2025