Form S-3ASR - Automatic shelf registration statement of securities of well-known seasoned issuers

November 14 2024 - 5:51AM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on November 14, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

Under

The Securities Act of 1933

ECHOSTAR CORPORATION

(Exact name of registrant as specified in its charter)

| |

Nevada

|

|

|

26-1232727

|

|

| |

(State or other jurisdiction of

incorporation or organization)

|

|

|

(I.R.S. Employer

Identification Number)

|

|

9601 S. Meridian Blvd.

Englewood, Colorado 80112

(303) 706-4000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Dean A. Manson

Chief Legal Officer and Secretary

EchoStar Corporation

601 S. Meridian Blvd.

Englewood, Colorado 80112

(303) 706-4000

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Michael A. Deyong

Daniel G. Dufner, Jr.

Michelle B. Rutta

White & Case LLP

1221 Avenue of the Americas

New York, New York 10020

(212) 819-8200

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. ☐

| |

Large Accelerated filer

☒

|

|

|

Accelerated filer

☐

|

|

| |

Non-accelerated filer

☐

|

|

|

Smaller reporting company

☐

|

|

| |

|

|

|

Emerging growth company

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

EchoStar Corporation

11,503,682 shares of Class A common stock

This prospectus relates to the offer and sale from time to time of up to 11,503,682 shares of our Class A common stock, par value $0.001 per share (“Class A common stock” or the “Shares”) beneficially owned by Mr. Charles W. Ergen, our Chairman, Mrs. Cantey M. Ergen, a Senior Advisor and member of our Board of Directors, and Telluray Holdings, LLC, an entity related to Mr. Ergen and Mrs. Ergen (collectively, the “Selling Shareholders”). EchoStar Corporation (“EchoStar”, “we”, “our” or “us”) and the Selling Shareholders are parties to a registration rights agreement with respect to the Shares. The shares of Class A common stock offered hereby constitute approximately 7.4% of the total outstanding shares of our Class A common stock, or approximately 4.0% of the total issued and outstanding shares of our common stock, as of the date of this prospectus.

We will not receive any proceeds from the sale of the Shares under this prospectus. The Selling Shareholders will receive all the proceeds from the resale of our Shares registered hereby. Our registration of the Shares covered by this prospectus does not mean that the Selling Shareholders will offer or sell any of the Shares. The Selling Shareholders may sell the Shares covered by this prospectus from time to time at fixed prices, at market prices or at negotiated prices, to or through underwriters, to other purchasers, through agents, or through a combination of these methods. The names of any underwriters may be stated in the applicable prospectus supplement, if any such prospectus supplement is prepared. See “Plan of Distribution” elsewhere in this prospectus for a more complete description of the ways in which the Shares may be sold by the Selling Shareholders.

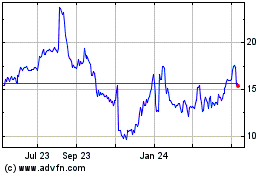

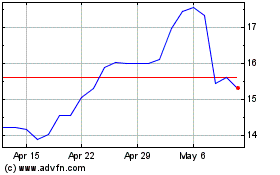

Our Class A common stock is listed on the Nasdaq Global Select Market (“NASDAQ”) under the symbol “SATS.” On November 12, 2024, the last reported sale price for our Class A common stock was $22.76 per share.

We have two classes of common stock: Class A common stock and Class B common stock, par value $0.001 per share (“Class B common stock”). Holders of the Class A common stock are entitled to one vote per share. Each holder of Class B common stock is entitled to ten votes for each share of Class B common stock on all matters submitted to a vote of the stockholders. Each share of Class B common stock is convertible at the option of the holder, into one share of Class A common stock. Charles W. Ergen, our Chairman, beneficially owns approximately 51.8% of our total equity securities (assuming conversion of the Class B common stock beneficially owned by Mr. Ergen into Class A common stock and giving effect to the exercise of options held by Mr. Ergen that are either currently exercisable as of, or may become exercisable within 60 days after, November 12, 2024) and beneficially owns approximately 90.6% of the total voting power of all classes of shares (assuming no conversion of any Class B common stock and giving effect to the exercise of options held by Mr. Ergen that are either currently exercisable as of, or may become exercisable within 60 days after, November 12, 2024). Through his beneficial ownership of our equity securities, Mr. Ergen has the ability to elect a majority of our directors and to control all other matters requiring the approval of our stockholders. Additionally, Mr. Ergen, Mrs. Ergen and certain entities established for the benefit of their family have agreed not to vote, or cause or direct to be voted, the Class A Common Stock beneficially owned by them, other than with respect to any matter presented to the holders of Class A Common Stock on which holders of Class B Common Stock are not entitled to vote, for three years following the closing of the merger between EchoStar and DISH Network. As a result of such agreement, Mr. Ergen’s effective total voting power is approximately 89.6% for such three-year period.

Investing in our Class A common stock involves risks. You should carefully read and consider the section of this prospectus captioned “Risk Factors” beginning on page 8 of this prospectus and the risk factors incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is November 14, 2024.

TABLE OF CONTENTS

| |

|

|

|

|

|

1 |

|

|

| |

|

|

|

|

|

2 |

|

|

| |

|

|

|

|

|

4 |

|

|

| |

|

|

|

|

|

8 |

|

|

| |

|

|

|

|

|

13 |

|

|

| |

|

|

|

|

|

15 |

|

|

| |

|

|

|

|

|

18 |

|

|

| |

|

|

|

|

|

21 |

|

|

| |

|

|

|

|

|

25 |

|

|

| |

|

|

|

|

|

28 |

|

|

| |

|

|

|

|

|

28 |

|

|

| |

|

|

|

|

|

28

|

|

|

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we filed with the U.S. Securities and Exchange Commission (the “Commission”) as a “well-known seasoned issuer” as defined in Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”), using a “shelf” registration process. By using a shelf registration statement, the Selling Shareholders may sell the Shares from time to time and in one or more transactions. This prospectus provides a general description of the Shares that may be offered. You should carefully read both this prospectus and any applicable prospectus supplement (and any applicable free writing prospectuses), together with the additional information described under the heading “Where You Can Find More Information and Incorporation by Reference.” To the extent there is a conflict between the information contained in this prospectus, on the one hand, and the information contained in any prospectus supplement, on the other hand, you should rely on the information in the prospectus supplement.

Neither we nor the Selling Shareholders have authorized anyone to provide you with any information or to make any representations other than those contained in this prospectus or by a Selling Shareholder, any applicable prospectus supplement or any free writing prospectuses prepared by or on behalf of us or to which we have referred you. Neither we nor the Selling Shareholders take any responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We will not make an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and any applicable prospectus supplement to this prospectus is accurate only as of the date on its respective cover, that the information appearing in any applicable free writing prospectus is accurate only as of the date of that free writing prospectus, and that any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus constitutes an offer to sell only under circumstances and jurisdictions where it is lawful to do so.

Unless otherwise stated or the context otherwise requires, references in this prospectus to “EchoStar,” “we,” “our” and “us” refer, collectively, to EchoStar Corporation, a Nevada corporation, and its consolidated subsidiaries.

FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated herein by reference contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including, in particular, statements about our plans, objectives and strategies, growth opportunities in our company’s industries and businesses, our expectations regarding future results, financial condition, liquidity and capital requirements, our estimates regarding the impact of regulatory developments and legal proceedings, and other trends and projections. Forward-looking statements are not historical facts and may be identified by words such as “future,” “anticipate,” “intend,” “plan,” “goal,” “seek,” “believe,” “estimate,” “expect,” “predict,” “will,” “would,” “could,” “can,” “may,” and similar terms. These forward-looking statements are based on information available to us as of the date of this prospectus and represent management’s current views and assumptions. Forward-looking statements are not guarantees of future performance, events or results and involve known and unknown risks, uncertainties and other factors, which may be beyond our control. Accordingly, actual performance, events or results could differ materially from those expressed or implied in the forward-looking statements due to a number of factors, including, but not limited to, the following:

•

risks relating to the consummation of the DIRECTV Transaction (as defined below) within the expected time frame or at all;

•

our ability to realize synergies from the Merger (as defined below) in the amounts anticipated, within expected timeframes or at all, and risks associated with the foregoing may also result from any extended delay in the integration of the Merger;

•

risks relating to our substantial debt outstanding and our ability to incur additional debt in the future, and the fact that a significant portion of our assets secure certain of our outstanding debt;

•

our ability and the ability of third parties with whom we engage to operate our business as a result of changes in the global business environment, including regulatory and competitive considerations;

•

our ability to implement and/or realize benefits of our investments and other strategic initiatives, including our investments to acquire certain wireless spectrum licenses and related assets;

•

significant risks related to our ability to launch, operate, and control our satellites, operational and environmental risks related to our owned and leased satellites, and risks related to our satellites under construction;

•

risks related to our foreign operations and other uncertainties associated with doing business internationally;

•

risks related to our dependency upon third-party providers, including supply chain disruptions and inflation;

•

risks related to cybersecurity incidents; and

•

risks related to our human capital resources.

The foregoing list of factors is not exclusive. Additional information concerning these and other risk factors is contained in EchoStar’s most recently filed Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, which are all incorporated by reference herein, and in this prospectus under the heading “Risk Factors.” All cautionary statements made or referred to herein should be read as being applicable to all forward-looking statements wherever they appear. You should consider the risks and uncertainties described or referred to herein and should not place undue reliance on any forward-looking statements. The forward-looking statements speak only as of the date made. We do not undertake, and specifically disclaim, any obligation to publicly release the results of any revisions that may be made to any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Although we believe that the expectations reflected in any forward-looking statements are reasonable, we cannot guarantee future results, events, levels of activity, performance or achievements. We do not assume responsibility for the accuracy and completeness of any forward-looking statements. We assume no

responsibility for updating forward-looking information contained or incorporated by reference herein or in any documents we file with the Commission, except as required by law.

Should one or more of the risks or uncertainties described herein or in any documents we file with the Commission occur, or should underlying assumptions prove incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements.

SUMMARY

Our Company

EchoStar Corporation is a holding company that was organized in October 2007 as a corporation under the laws of the State of Nevada. Our Class A common stock is publicly traded on Nasdaq under the symbol “SATS.” Our principal executive offices are located at 9601 South Meridian Boulevard, Englewood, Colorado 80112 and our telephone number is (303) 723-1000.

We currently operate four primary business segments: (1) Pay-TV; (2) Retail Wireless; (3) 5G Network Deployment; and (4) Broadband and Satellite Services. We offer pay-TV services under the DISH® brand and the SLING® brand. We also offer nationwide prepaid and postpaid retail wireless services to subscribers primarily under our Boost Mobile® and Gen Mobile® brands, as well as a competitive portfolio of wireless devices. We are continuing our 5G Network Deployment and commercializing and growing customer traffic on our 5G Network. We are transitioning our Retail Wireless segment to a mobile network operator as our 5G Network has become commercially available and we grow customer traffic on our 5G Network. We also provide broadband services to consumer customers, which include home and small to medium-sized businesses, and satellite, multi-transport technologies and managed network services to enterprise customers, telecommunications providers, aeronautical service providers and government entities, including civilian and defense. In December 2023, our EchoStar XXIV satellite began service, bringing additional broadband capacity across North and South America and is expected to be an integral part of our satellite service business.

Merger with DISH

On December 31, 2023, we completed the acquisition of DISH, pursuant to that certain Amended and Restated Agreement and Plan of Merger, dated as of October 2, 2023, among us, DISH and EAV Corp. (“Merger Sub”), our wholly-owned subsidiary (the “Merger Agreement”). At the effective time of the merger (the “Effective Time”) Merger Sub merged with and into DISH with DISH surviving as our wholly-owned subsidiary (the “Merger”).

On the terms and subject to the conditions set forth in the Merger Agreement, on December 31, 2023, at 11:59 p.m. ET (the “Effective Time”), each share of DISH Network Class A common stock, par value $0.01 per share (“DISH Network Class A Common Stock”) and DISH Network Class C common stock, par value $0.01 per share (“DISH Network Class C Common Stock”) outstanding immediately prior to the Effective Time, was converted into the right to receive a number of validly issued, fully paid and non-assessable shares Class A common stock equal to 0.350877 (the “Exchange Ratio”). On the terms and subject to the conditions set forth in the Merger Agreement, at the Effective Time, each share of DISH Network Class B common stock, par value $0.01 per share (“DISH Network Class B Common Stock” and, together with DISH Network Class A Common Stock and DISH Network Class C Common Stock, “DISH Network Common Stock”), outstanding immediately prior to the Effective Time was converted into the right to receive a number of validly issued, fully paid and non-assessable shares of Class B common stock, equal to the Exchange Ratio.

Concurrently with the entry into the Merger Agreement, we and DISH entered into an amended and restated support agreement (the “Amended Support Agreement”) with the Ergen EchoStar stockholders (as defined in the Amended Support Agreement) and the Ergen DISH stockholders (as defined in the Amended Support Agreement) (such Ergen EchoStar stockholders and Ergen DISH stockholders hereinafter collectively referred to as the “Ergen Stockholders”).

In connection with the completion of the Merger, and pursuant to the Amended and Restated Support Agreement, on December 31, 2023, we and the Ergen Stockholders entered into a registration rights agreement (the “Registration Rights Agreement”). The Registration Rights Agreement provides the Ergen Stockholders, and their affiliates who become parties thereto, with certain registration rights relating to the Shares, which they beneficially own, including: (i) the right to demand shelf registration as well as registration on long and short form registration statements and; (ii) “piggyback” registration rights to be included in future registered offerings by us of our equity securities, in each case, subject to certain requirements and customary conditions. The Registration Rights Agreement sets forth customary registration procedures,

including an agreement by us to make appropriate officers available to participate in roadshow presentations and cooperate as reasonably requested in connection with any underwritten offerings. We also agreed to indemnify the Ergen Stockholders and their affiliates with respect to liabilities resulting from untrue statements or omissions in any registration statement used in any such registration, other than untrue statements or omissions based on or contained in information furnished to us for use in a registration statement by a participating stockholder. This Registration Statement is being filed pursuant to the Registration Rights Agreement.

For more information and a copy of the Merger Agreement, the Amended Support Agreement and the Registration Rights Agreement, see our current reports on Form 8-K filed on October 3, 2023 and January 2, 2024.

Recent Developments

On September 29, 2024, EchoStar and DIRECTV Holdings, LLC (“Purchaser”) entered into an Equity Purchase Agreement (the “Purchase Agreement”), pursuant to which Purchaser agreed to acquire from EchoStar all of the issued and outstanding equity interests of DISH DBS Corporation (“DBS”), which operates EchoStar’s Pay-TV business (the “DBS Business” and such acquisition of the DBS Business, the “DIRECTV Transaction”). The DIRECTV Transaction is subject to a number of terms and conditions set forth in the Purchase Agreement. In connection with the DIRECTV Transaction, EchoStar and its subsidiaries entered into certain financing arrangements, as described in EchoStar’s Current Report on Form 8-K, filed on September 30, 2024 (the “Pending Transactions 8-K”).

On September 30, 2024, EchoStar entered into subscription agreements with certain accredited investors and CONX Corp. (“CONX”), an entity indirectly controlled by Charles W. Ergen, EchoStar’s chairman (the “PIPE Investors” and the subscription agreements, the “Subscription Agreements”), pursuant to which the PIPE Investors have agreed, subject to the terms and conditions set forth therein, to purchase from EchoStar an aggregate of 14.265 million shares (the “PIPE Shares”) of EchoStar’s Class A common stock at a purchase price of $28.04 per share, for an aggregate cash purchase price of approximately $400 million (such investment, the “PIPE Investment”). The portion of the PIPE Investment represented by the CONX Subscription Agreement represents an agreement to purchase from EchoStar an aggregate of 1,551,355 shares of EchoStar’s Class A common stock for an aggregate cash purchase price of approximately $43.5 million. The CONX Subscription Agreement was unanimously approved by the Audit Committee of EchoStar’s Board of Directors. The PIPE Investment was completed on November 12, 2024.

The foregoing description of the DIRECTV Transaction, the related financing transactions and the PIPE Investment is not complete and is qualified in its entirety by reference to the Pending Transactions 8-K, including the exhibits thereto. These transactions and the other transactions described in the Pending Transactions 8-K are collectively referred to as the “Pending Transactions.”

The Offering and Use of Proceeds

EchoStar Corporation

Up to 11,503,682 shares of Class A common stock.

Class A common stock outstanding immediately prior to this offering

154,757,718 shares of Class A common stock.

Class B common stock outstanding immediately prior to this offering

131,348,468 shares of Class B common stock

Each holder of our Class A common stock is entitled to one vote per share on all matters to be voted on by shareholders generally.

Each holder of Class B common stock is entitled to ten votes for each share of Class B common stock on all matters submitted to a vote of shareholders. Each share of Class B common stock is convertible, at the option of the holder, into one share of Class A common stock. The conversion ratio is subject to adjustment from time to time upon the occurrence of certain events, including: (A) dividends or distributions on Class A common stock payable in Class A common stock or certain other capital stock; and (B) subdivisions, combinations or certain reclassifications of Class A common stock.

Holders of our Class A and Class B common stock vote together as a single class on all matters presented to our shareholders for their vote or approval, except as otherwise required by applicable law.

Mr. Ergen beneficially owns approximately 51.8% of our total equity securities (assuming conversion of the shares of Class B common stock beneficially owned by Mr. Ergen into shares of Class A common stock and giving effect to the exercise of options held by Mr. Ergen that are either currently exercisable as of, or may become exercisable within 60 days after, November 12, 2024) and beneficially owns approximately 90.6% of the total voting power of all classes of shares (assuming no conversion of any shares of Class B common stock and giving effect to the exercise of options held by Mr. Ergen that are either currently exercisable as of, or may become exercisable within 60 days after, November 12, 2024). Additionally, Mr. Ergen, Mrs. Ergen and certain entities established for the benefit of their family have agreed not to vote, or cause or direct to be voted, the Class A Common Stock beneficially owned by them, other than with respect to any matter presented to the holders of Class A Common Stock on which holders of Class B Common Stock are not entitled to vote, for three years following the closing of the merger between EchoStar and DISH Network. As a result of such agreement, Mr. Ergen’s effective total voting power is approximately 89.6% for such three-year period. Through his beneficial ownership of our equity securities, Mr. Ergen has the ability to elect a majority of our directors and to control all other matters requiring the approval of our shareholders. As a result of Mr. Ergen’s voting power, we are a “controlled company” as defined in Nasdaq’s listing rules and, therefore, are not

subject to Nasdaq requirements that would otherwise require us to have: (i) a majority of independent directors; (ii) a nominating committee composed solely of independent directors; (iii) compensation of our executive officers determined by a majority of the independent directors or a compensation committee composed solely of independent directors; (iv) a compensation committee charter which provides the compensation committee with the authority and funding to retain compensation consultants and other advisors; and/or (v) director nominees selected, or recommended for the Board of Directors selection, either by a majority of the independent directors or a nominating committee composed solely of independent directors.

The shares are offered and sold by the Selling Shareholders identified in this prospectus. See “Selling Shareholders” on page 18 of this prospectus.

The Class A common stock is listed on Nasdaq under the symbol “SATS”.

All of the Class A common stock offered by this prospectus are being registered for the accounts of the Selling Shareholders. The Selling Shareholders will receive all the proceeds from the sale of the Shares registered hereby.

You should carefully consider all of the information set forth or incorporated by reference in this prospectus and, in particular, the specific factors in the section entitled “Risk Factors.”

“SATS”.

RISK FACTORS

An investment in any securities offered pursuant to this prospectus and any applicable prospectus supplement involves risks. Before deciding whether to invest in our securities, you should carefully consider the risk factors incorporated by reference to our most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q, and our recently filed Current Reports on Form 8-K, as well as any of our subsequent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q or Current Reports on Form 8-K that we file after the date of this prospectus, and all other information contained or incorporated by reference into this prospectus, as updated by our subsequent filings under the Exchange Act, and the risk factors and other information contained in any applicable prospectus supplement and any applicable free writing prospectus before acquiring any of such securities.

The risks and uncertainties we have described are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also affect our operations. Past financial performance may not be a reliable indicator of future performance, and historical trends should not be used to anticipate results or trends in future periods. If any of these risks actually occurs, our business, financial condition, prospects or results of operations could be adversely affected. In that event, the market price of our Class A common stock could decline, and you could lose part or all of your investment. Please also read the section herein entitled “Where You Can Find More Information and Incorporation by Reference.”

Risks Related to the Pending Transactions

We may not be able to successfully complete the DIRECTV Transaction.

The completion of the DIRECTV Transaction is subject to certain closing conditions, including, among others, the satisfaction of certain antitrust and other regulatory approvals and the successful completion of the Exchange Offers (as defined in the Pending Transactions 8-K) for certain DBS indebtedness, none of which have been satisfied, and the absence of legal restraints prohibiting the completion of the DIRECTV Transaction. The Exchange Offers expired on November 12, 2024 and were not completed. Governmental agencies may not approve the DIRECTV Transaction or may impose conditions to any such approval or require changes to the terms of the DIRECTV Transaction. Any such conditions or changes could have the effect of delaying completion of the DIRECTV Transaction, imposing costs on or limiting our revenues or otherwise reducing the anticipated benefits of the DIRECTV Transaction. Furthermore, under the Purchase Agreement, each party’s obligation to consummate the DIRECTV Transaction is also subject to the accuracy of the representations and warranties of the other party (subject to certain qualifications and exceptions) and the performance in all material respects of the other party’s covenants under the Purchase Agreement, including, with respect to us, certain covenants regarding the operation of our business prior to completion of the DIRECTV Transaction. As a result of these conditions, we cannot provide assurance that the DIRECTV Transaction will be completed on the terms or timeline currently contemplated, or at all. If such conditions are not fulfilled by the Outside Date (as defined in the Purchase Agreement) or, if for any other reason, the DIRECTV Transaction is not completed on or prior to the Outside Date, the Purchase Agreement may be terminated and the DIRECTV Transaction may not be completed.

If the DIRECTV Transaction is not completed for any reason, the price of our common stock may decline significantly, and our business, financial condition and results of operations may be impacted, including, but not limited to: to the extent that the market price of our common stock reflects positive market assumptions that each of these transaction will be completed and that the related benefits will be realized; based on the significant expenses, such as legal and financial advisory services, which generally must be paid regardless of whether the transactions are completed; and due to the risk that we may be unable to enter into an alternative transaction on terms as favorable as the DIRECTV Transaction or at all.

We have substantial debt outstanding, we incurred new debt in connection with the Pending Transactions and we may incur additional debt in the future.

As of December 31, 2023, our total long-term debt and finance lease obligations (including current portion) outstanding, including the debt of our subsidiaries, was $22.764 billion. On November 12, 2024,

the Company issued approximately $5.36 billion of 10.750% Senior Secured Spectrum Notes due 2029 and approximately $30 million of 3.875% Convertible Senior Secured Notes due 2030.

Our debt levels could have significant consequences, including, but not limited to:

•

making it more difficult to satisfy our obligations;

•

a dilutive effect on our outstanding equity capital or future earnings;

•

increasing our vulnerability to general adverse economic conditions, including, but not limited to, changes in interest rates; and

•

requiring us to devote a substantial portion of our cash to make interest and principal payments on our debt, thereby reducing the amount of cash available for other purposes.

As a result, we would have limited financial and operating flexibility to changing economic and competitive conditions. This could result in difficulty obtaining debt financing on attractive terms or at all, limiting our ability to raise additional debt and placing us at a disadvantage compared to our competitors that are less leveraged.

In addition, we may incur additional debt in the future. The terms of the indentures relating to our senior notes, senior secured notes and our existing convertible notes permit us to incur additional debt.

Risks Related to Ownership of Our Class A Common Stock

We are controlled by one principal stockholder who is our Chairman, and a Selling Stockholder in this offering.

Charles W. Ergen, our Chairman, beneficially owns approximately 51.8% of our total equity securities (assuming conversion of the Class B common stock beneficially owned by Mr. Ergen into Class A common stock and giving effect to the exercise of options held by Mr. Ergen that are either currently exercisable as of, or may become exercisable within 60 days after, November 12, 2024) and beneficially owns approximately 90.6% of the total voting power of all classes of shares (assuming no conversion of any Class B common stock and giving effect to the exercise of options held by Mr. Ergen that are either currently exercisable as of, or may become exercisable within 60 days after, November 12, 2024). Through his beneficial ownership of our equity securities, Mr. Ergen has the ability to elect a majority of our directors and to control all other matters requiring the approval of our stockholders. As a result of Mr. Ergen’s voting power, we are a “controlled company” as defined in the NASDAQ listing rules and, therefore, are not subject to NASDAQ requirements that would otherwise require us to have: (i) a majority of independent directors; (ii) a nominating committee composed solely of independent directors; (iii) compensation of our executive officers determined by a majority of the independent directors or a compensation committee composed solely of independent directors; (iv) a compensation committee charter which provides the compensation committee with the authority and funding to retain compensation consultants and other advisors; and/or (v) director nominees selected, or recommended for the Board of Directors selection, either by a majority of the independent directors or a nominating committee composed solely of independent directors.

Pursuant to the Amended Support Agreement (which was signed as part of the Merger), Mr. Ergen and the other Ergen Stockholders have agreed not to vote, or cause or direct to be voted, the shares of Class A common stock owned by them, other than with respect to any matter presented to the holders of Class A common stock on which holders of Class B common stock are not entitled to vote, for three years following the closing of the Merger, such that the Ergen Stockholders’ voting power of EchoStar is approximately 89.6% for such three-year period.

In addition, pursuant to the Amended Support Agreement, EchoStar and the Ergen Stockholders entered into the Registration Rights Agreement reasonably providing for the registration of the Ergen Stockholders’ shares of Class A common stock or Class B common stock received as part of the merger consideration and/or Class B common stock held by such stockholders immediately prior to the closing of the Merger, at EchoStar’s sole cost and expense. This Registration Statement is being filed pursuant to the Registration Rights Agreement.

Substantial blocks of our total outstanding shares may be sold into the market, including pursuant to sales under this prospectus. If there are substantial sales of shares of our common stock, or the perception that such sales could occur, the price of our Class A common stock could decline.

The price of our Class A common stock could decline if there are substantial sales of our common stock, particularly sales by the Ergen Stockholders, including by the Selling Stockholders pursuant to this prospectus, or if there is a perception that such sales could occur. This prospectus relates to the resale of up to 11,503,682 shares of Class A common stock, constituting approximately 7.4% of the total outstanding shares of our Class A common stock, or approximately 4.0% of the total issued and outstanding shares of our common stock, as of the date of this prospectus. In addition, the purchasers in the PIPE Investment will be able to resell under a separate prospectus up to 14,265,334 shares of Class A common stock, constituting approximately 9.2% of the total outstanding shares of Class A common stock, or approximately 5% of the total issued and outstanding shares of common stock, as of the date of this prospectus.

The Registration Rights Agreement provides the Ergen Stockholders, and their affiliates who become parties thereto, with certain registration rights relating to the shares of our common stock which they beneficially own, including: (i) the right to demand shelf registration as well as registration on long and short form registration statements; and (ii) “piggyback” registration rights to be included in future registered offerings by us of our equity securities, in each case, subject to certain requirements and customary conditions. The Registration Rights Agreement sets forth customary registration procedures, including an agreement by us to make appropriate officers available to participate in roadshow presentations and cooperate as reasonably requested in connection with any underwritten offerings. These registration rights would facilitate the resale of such securities into the public market, and any such resale would increase the number of shares of our Class A common stock available for public trading.

The market price of the shares of our Class A common stock could decline as a result of the sale of a substantial number of our shares of common stock in the public market or the perception in the market that such sales could occur.

Future issuances of our Class A common stock and hedging activities may depress the trading price of our Class A common stock.

Any issuance of equity securities after this offering, including the issuance of shares of Class A common stock upon conversion of EchoStar convertible notes being issued in the Pending Transactions, could dilute the interests of our existing stockholders, and could substantially decrease the trading price of our Class A common stock. We may issue equity securities in the future for a number of reasons, including to finance our operations and business strategy (including in connection with acquisitions, strategic collaborations or other transactions), to adjust our ratio of debt to equity, to satisfy our obligations upon the exercise of outstanding warrants or options or for other reasons. A substantial number of shares of our Class A common stock is reserved for issuance upon the exercise of stock options and settlement of restricted share units and stock units. In addition, the price of our Class A common stock could also be affected by possible sales of our Class A common stock by investors who view the EchoStar convertible notes as a more attractive means of equity participation in our company and by hedging or arbitrage trading activity that we expect to develop involving our Class A common stock.

Our Class A common stock price and trading volume has been and may continue to be volatile or may decline regardless of our operating performance, which could cause purchasers of our Class A common stock to incur substantial losses.

Volatility in the market price of our Class A common stock may prevent you from being able to sell your shares at or above the price you paid for them. The market price of our Class A common stock has fluctuated, and may continue to fluctuate widely due to many factors, some of which may be beyond our control. Many factors may cause the market price of our Class A common stock to fluctuate significantly, including those described elsewhere in this “Risk Factors” section and the documents incorporated by reference in this prospectus supplement, as well as the following:

•

pandemics, crises or disasters;

•

our operating and financial performance and prospects;

•

our quarterly or annual earnings or those of other companies in our industry compared to market expectations;

•

future announcements or press coverage concerning our business or our competitors’ businesses;

•

the public’s reaction to our press releases, other public announcements, and filings with the SEC;

•

the size of our public float;

•

coverage by or changes in financial estimates by securities analysts or failure to meet their expectations;

•

market and industry perception of our success, or lack thereof, in pursuing our business strategies;

•

strategic actions by us or our competitors, such as acquisitions or restructurings;

•

changes in laws or regulations which adversely affect our industry or us;

•

changes in accounting standards, policies, guidance, interpretations, or principles;

•

changes in senior management or key personnel;

•

issuances, exchanges or sales, or expected issuances, exchanges, or sales of our capital stock or other securities;

•

adverse resolution of new or pending litigation against us; and

•

changes in general market, economic, and political conditions in the United States and global economies or financial markets, including those resulting from natural disasters, terrorist attacks, acts of war, and responses to such events.

As a result, volatility in the market price and trading volume of our Class A common stock may prevent investors from being able to sell their shares of Class A common stock at or above their purchase price, or at all. These fluctuations may be unrelated or disproportionate to our operating performance or prospects and may materially reduce the market price of our Class A common stock. If the market price of our Class A common stock experiences significant volatility, including substantial decreases, you could incur a substantial or complete loss on your investment.

We do not intend to pay dividends on our Class A common stock for the foreseeable future.

We currently have no intention to pay dividends on our Class A common stock at any time in the foreseeable future. Any decision to declare and pay dividends in the future will be made at the discretion of our Board of Directors and will depend on, among other things, our results of operations, financial condition, cash requirements, contractual restrictions, and other factors that our Board of Directors may deem relevant. Certain of our debt instruments contain covenants that restrict our ability and the ability of our subsidiaries to pay dividends and in the future we may enter into new instruments with similar or more restrictive covenants. In addition, despite our current indebtedness, we may still be able to incur additional debt in the future, and such indebtedness may restrict or prevent us from paying dividends on our Class A common stock.

It may be difficult for a third party to acquire us, even if doing so may be beneficial to our shareholders, because of our capital structure.

Certain provisions of our articles of incorporation and bylaws may discourage, delay or prevent a change in control of our Company that a shareholder may consider favorable. These provisions include the following:

•

a capital structure with multiple classes of common stock: a Class A that entitles the holders to one vote per share; a Class B that entitles the holders to ten votes per share; a Class C that entitles the holders to one vote per share, except upon a change in control of our company in which case the holders of Class C are entitled to ten votes per share; and a non-voting Class D;

•

a provision that authorizes the issuance of “blank check” preferred stock, which could be issued by our Board of Directors to increase the number of outstanding shares and thwart a takeover attempt;

•

a provision limiting who may call special meetings of shareholders; and

•

a provision establishing advance notice requirements for nominations of candidates for election to our Board of Directors or for proposing matters that can be acted upon by shareholders at shareholder meetings.

As discussed above, as of November 12, 2024, Mr. Ergen beneficially owns approximately 51.8% of our total equity securities and approximately 90.6% of the total voting power of all classes of shares and such ownership may make it impractical for any third party to obtain control of us.

Our articles of incorporation designate the Eighth Judicial District Court of Clark County of the State of Nevada as the sole and exclusive forum for certain types of actions and proceedings that may be initiated by our stockholders, which could limit our stockholders’ ability to obtain a favorable judicial forum for disputes with us or our directors, officers, employees or agents.

Any person purchasing or otherwise acquiring any interest in any shares of our capital stock shall be deemed to have notice of and to have consented to this provision of our articles of incorporation. This choice of forum provision may limit our stockholders’ ability to bring certain claims, including, but not limited to, claims against our directors, officers or employees, in a judicial forum that the stockholder finds favorable and therefore the choice of forum provision may discourage lawsuits or increase costs with respect to such claims.

USE OF PROCEEDS

All shares of Class A common stock offered hereby are being registered for the accounts of the Selling Shareholders. We will not receive any proceeds from the sale of the Shares under this prospectus.

DIVIDEND POLICY

We have not paid any cash dividends on our common stock in the past two years. We currently do not intend to declare dividends on our common stock. Payment of any future dividends will depend upon, among other things, our earnings, capital requirements, contractual restrictions and other factors the Board of Directors considers appropriate. Our ability to declare dividends is affected by the covenants in our subsidiary’s indentures.

DESCRIPTION OF CAPITAL STOCK

The summary of the general terms and provisions of the capital stock of EchoStar set forth below does not purport to be complete and is subject to and qualified in its entirety by reference to EchoStar’s Amended and Restated Articles of Incorporation (as amended from time to time, the “Articles”) and Amended and Restated Bylaws (as amended from time to time, the “Bylaws” and together with the Articles, the “Charter Documents”), each incorporated herein by reference and filed as an exhibit to EchoStar’s most recent Annual Report on Form 10-K filed with the Commission. For additional information, please read our Charter Documents and the applicable provisions of the Nevada Revised Statutes (“NRS”).

General

We are authorized to issue the following capital stock:

•

4,000,000,000 shares of common stock, par value $0.001 per share, of which 1,600,000,000 shares are designated Class A common stock, 800,000,000 shares are designated Class B common stock, 800,000,000 shares are designated Class C common stock, par value $0.001 per share (“Class C common stock”), and 800,000,000 shares are designated Class D common stock, par value $0.001 per share (“Class D common stock”); and

•

20,000,000 shares of preferred stock, par value $0.001 per share.

As of November 12, 2024, there are 154,757,718 shares of our Class A common stock issued and outstanding, 131,348,468 shares of our Class B common stock issued and outstanding, and there are no shares of our Class C common stock or Class D common stock issued and outstanding.

A summary of the powers, preferences and rights of the shares of each class of common stock and preferred stock is described below.

Our Class A Common Stock

Each holder of Class A common stock is entitled to one vote for each share owned of record on all matters submitted to a vote of stockholders. Except as otherwise required by law or the terms of any preferred stock, the holders of the Class A common stock vote together, without regard to class, with the holders of Class B common stock, the holders of Class C common stock and the holders of preferred stock on all matters submitted to a vote of stockholders. Subject to the preferential rights of any outstanding series of preferred stock and to any restrictions on the payment of dividends imposed under the terms of our indebtedness, the holders of Class A common stock are entitled to such dividends as may be declared from time to time by our board of directors from legally available funds and, together with the holders of the Class B common stock and the Class C common stock, are entitled, after payment of all prior claims, to receive pro rata all of our assets upon a liquidation. The holders of Class A common stock have no redemption, conversion or preemptive rights.

Our Class A common stock is listed on NASDAQ under the symbol “SATS”.

Computershare Trust Company, N.A. serves as the transfer agent and registrar of our Class A common stock.

Our Class B Common Stock

Each holder of Class B common stock is entitled to ten votes for each share of Class B common stock on all matters submitted to a vote of stockholders. Except as otherwise required by law or the terms of any preferred stock, the holders of the Class B common stock vote together, without regard to class, with the holders of the Class A common stock, the holders of the Class C common stock and the holders of the preferred stock on all matters submitted to a vote of the stockholders. Each share of Class B common stock is convertible, at the option of the holder, into one share of Class A common stock. The conversion ratio is subject to adjustment from time to time upon the occurrence of certain events, including: (A) dividends or distributions on Class A common stock payable in Class A common stock or certain other capital stock; and (B) subdivisions, combinations or certain reclassifications of Class A common stock. Each share of Class B common stock is entitled to receive dividends and distributions upon liquidation on a basis equivalent

to that of the Class A common stock and Class C common stock. In addition, in case EchoStar shall declare a dividend or distribution upon the Class A common stock payable other than in cash out of earning or surplus or other than in Class A common stock, then thereafter each holder of Class B common stock will be entitled to receive, upon conversion of such Class B common Stock into Class A common stock, the property which such holder would have received as a dividend in connection with such dividend or distribution.

Our Class C Common Stock

Each holder of Class C common stock is entitled to one vote for each share of Class C common stock on all matters submitted to a vote of stockholders, except in the event of a change in control, in which case each holder of Class C common stock is entitled to ten votes per share. Except as otherwise required by law or the terms of any preferred stock, the holders of the Class C common stock vote together, without regard to class, with the holders of the Class A common stock, the holders of the Class B common stock and the holders of the preferred stock on all matters submitted to a vote of stockholders. Each share of Class C common stock is convertible, at the option of the holder, into Class A common stock on the same terms as the Class B common stock. Each share of Class C common stock is entitled to receive dividends and distributions upon liquidation on a basis equivalent to that of the Class A common stock and Class B common stock. In addition, in case EchoStar shall declare a dividend or distribution upon the Class A common stock payable other than in cash, out of earning or surplus or other than in Class A common stock, then thereafter each holder of Class C common stock will be entitled to receive, upon conversion of such Class C common Stock into Class A common stock, the property which such holder would have received as a dividend in connection with such dividend or distribution.

Our Class D Common Stock

Each holder of Class D common stock is not entitled to a vote on any matter. Each share of Class D common stock is entitled to receive dividends and distributions upon liquidation on a basis equivalent to that of the Class A common stock.

Our Preferred Stock

Our board of directors is authorized to designate one or more series of our preferred stock and, with respect to each series, to determine the preferences and rights and the qualifications, limitations or restrictions of the series, including the dividend rights, conversion rights, voting rights, redemption rights and terms, liquidation preferences, sinking fund provisions, exchange rights, the number of shares constituting the series and the designation of such series. Our board of directors may, without stockholder approval, issue preferred stock with voting and other rights that could adversely affect the voting power of the holders of common stock.

The provisions authorizing our board of directors to issue preferred stock without stockholder approval and the issuance of such stock could have the effect of delaying, deferring or preventing a change in our control or the removal of our existing management.

Nevada Law and Limitations on Changes in Control

Nevada Business Combination Statutes

Nevada’s “combinations with interested stockholders” statutes (NRS 78.411 through 78.444, inclusive) prohibit specified types of business “combinations” between certain Nevada corporations and any person deemed to be an “interested stockholder” for two years after such person first becomes an “interested stockholder” unless the corporation’s board of directors approves the combination (or the transaction by which such person becomes an “interested stockholder”) in advance, or unless the combination is approved by the board of directors and sixty percent of the corporation’s voting power not beneficially owned by the interested stockholder, its affiliates and associates. Further, in the absence of prior approval certain restrictions may apply even after such two-year period. However, these statutes do not apply to any combination of a corporation and an interested stockholder after the expiration of four years after the person first became an interested stockholder.

For purposes of these statutes, an “interested stockholder” is any person who is (A) the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the outstanding voting shares of the Company, or (B) an affiliate or associate of the Company and at any time within the two previous years was the beneficial owner, directly or indirectly, of ten percent or more of the voting power of the then outstanding shares of the Company. The definition of the term “combination” is sufficiently broad to cover most significant transactions between a corporation and an “interested stockholder.”

The provisions of the NRS relating to combinations with interested stockholders could have the effect of delaying, deferring or preventing a change in our control or the removal of our existing management.

Nevada Control Share Acquisition Statutes

Nevada’s “acquisition of controlling interest” statutes (NRS 78.378 through 78.3793, inclusive) contain provisions governing the acquisition of a controlling interest in certain Nevada corporations. These “control share” laws provide generally that any person that acquires a “controlling interest” in certain Nevada corporations may be denied voting rights, unless a majority of the disinterested stockholders of the corporation elects to restore such voting rights. These laws provide that a person acquires a “controlling interest” whenever a person acquires shares of a subject corporation that, but for the application of these provisions of the NRS, would enable that person to exercise (A) one fifth or more, but less than one third, (B) one third or more, but less than a majority or (C) a majority or more, of all of the voting power of the corporation in the election of directors. Once an acquirer crosses one of these thresholds, shares which it acquired in the transaction taking it over the threshold and within the ninety days immediately preceding the date when the acquiring person acquired or offered to acquire a controlling interest become “control shares” to which the voting restrictions described above apply.

The Nevada control share law, if applicable, could have the effect of delaying, deferring or preventing a change in our control or the removal of our existing management.

Directors Duties During a Potential Change in Control

NRS 78.139 also provides that directors may resist a change or potential change in control of the corporation if the board of directors determines that the change or potential change is opposed to or not in the best interest of the corporation upon consideration of any relevant facts, circumstances, contingencies or constituencies pursuant to NRS 78.138(4).

Exclusive Forum

Our Articles of Incorporation provide that unless we otherwise consent in writing, the Eighth Judicial District Court of Clark County, Nevada (or if the Eighth Judicial District Court of Clark County, Nevada does not have jurisdiction, any other state district court located in the State of Nevada, and in the event that that no state district court in the State of Nevada has jurisdiction, any federal court in the State of Nevada) will be the sole and exclusive forum for any action or proceeding brought in our name or right or on our behalf, any action asserting a claim for breach of any fiduciary duty owed by any of our directors, officers, employees or agents to us or our stockholders, any action asserting a claim arising pursuant to any provision of NRS Chapters 78 or 92A, our Articles of Incorporation or our Bylaws, any action to interpret, apply, enforce or determine the validity of our Articles of Incorporation or our Bylaws or any action asserting a claim governed by the internal affairs doctrine.

SELLING SHAREHOLDERS

The following table sets forth information as of November 12, 2024 with respect to the beneficial ownership of the Selling Shareholders. The amounts and percentages of shares beneficially owned are reported on the basis of Commission regulations governing the determination of beneficial ownership of securities. Under Commission rules, a person is deemed to be a “beneficial owner” of a security if that person has or shares voting power or investment power, which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days of the determination date. Securities that can be so acquired are deemed to be outstanding for purposes of computing such person’s ownership percentage, but not for purposes of computing any other person’s percentage. Under these rules, more than one person may be deemed to be a beneficial owner of the same securities and a person may be deemed to be a beneficial owner of securities as to which such person has no economic interest.

The beneficial ownership percentages are based on 154,757,718 shares of our Class A common stock outstanding as of November 12, 2024, and 131,348,468 shares of Class B common stock outstanding. Shares of Class B common stock are convertible into shares of Class A common stock on a one-for-one basis.

Except as otherwise indicated in the footnotes to this table, the beneficial owner listed has, to our knowledge, sole voting and investment power with respect to the indicated shares of common stock.

| |

|

|

Prior to the Offering

|

|

|

|

|

|

|

|

|

After the Offering(5)

|

|

Name of Selling

Shareholder

|

|

|

Shares of

Class A

Common

Stock(1)

|

|

|

% of

Class A

Common

Stock

Outstanding(1)

|

|

|

Shares of

Class B

Common

Stock

|

|

|

% of

Class B

Common

Stock

Outstanding

|

|

|

% of

Combined

Voting

Power

|

|

|

Shares of

Class A

Common

Stock

Registered

for Resale

|

|

|

Shares of

Class A

Common

Stock(1)

|

|

|

% of

Class A

Common

Stock

Outstanding(1)

|

|

|

Shares of

Class B

Common

Stock

|

|

|

% of

Class B

Common

Stock

Outstanding

|

|

|

% of

Combined

Voting

Power

|

|

|

Charles W. Ergen(2)

|

|

|

|

|

148,890,148 |

|

|

|

|

|

51.8% |

|

|

|

|

|

131,348,468 |

|

|

|

|

|

100% |

|

|

|

|

|

90.6% |

|

|

|

|

|

9,152,830 |

|

|

|

|

|

137,386,466 |

|

|

|

|

|

47.8% |

|

|

|

|

|

131,348,468 |

|

|

|

|

|

100% |

|

|

|

|

|

89.8% |

|

|

|

Cantey M. Ergen(3)

|

|

|

|

|

147,399,686 |

|

|

|

|

|

51.5% |

|

|

|

|

|

131,348,468 |

|

|

|

|

|

100% |

|

|

|

|

|

90.6% |

|

|

|

|

|

156 |

|

|

|

|

|

135,896,004 |

|

|

|

|

|

47.5% |

|

|

|

|

|

131,348,468 |

|

|

|

|

|

100% |

|

|

|

|

|

89.8% |

|

|

|

Telluray Holdings, LLC(4)

|

|

|

|

|

37,541,562 |

|

|

|

|

|

19.8% |

|

|

|

|

|

35,190,866 |

|

|

|

|

|

26.8% |

|

|

|

|

|

24.1% |

|

|

|

|

|

2,350,696 |

|

|

|

|

|

35,190,866 |

|

|

|

|

|

18.5% |

|

|

|

|

|

35,190,866 |

|

|

|

|

|

26.8% |

|

|

|

|

|

24.0% |

|

|

(1)

For the shares of Class A common stock, the calculation assumes the conversion of only the shares of Class B common stock owned by the applicable beneficial owner into shares of Class A common stock and gives effect to the exercise of options and vesting of restricted stock units, if any, held by the applicable beneficial owner that are either currently exercisable or vested, or may become exercisable or vest within 60 days after November 12, 2024.

(2)

Mr. Ergen’s beneficial ownership consists of: (i) 11,353,060 shares of Class A common stock beneficially owned directly by Mr. Ergen; (ii) 11,280 shares of Class A common stock beneficially owned indirectly by Mr. Ergen in the DISH Network Corporation (“DISH Network”) 401(k) Employee Savings Plan (the “DISH Network 401(k) Plan”); (iii) 80,125 shares of Class B common stock beneficially owned directly by Mr. Ergen; (iv) 1,497,478 shares of Class A common stock deemed to be beneficially owned under Rule 13d-3(d)(1) because Mr. Ergen has the right to acquire beneficial ownership of such shares within 60 days of November 12, 2024; (v) 213 shares of Class A common stock beneficially owned directly by Mr. Ergen’s spouse, Cantey M. Ergen; (vi) 1,189 shares of Class A common stock beneficially owned indirectly by Mrs. Ergen in the DISH Network 401(k) Plan; (vii) 9,966 shares of Class A common stock beneficially owned by one of Mr. Ergen’s children; (viii) 766,443 shares of Class A

common stock beneficially owned by a charitable foundation for which Mr. Ergen is an officer and for which he shares voting and dispositive power with Mrs. Ergen; (ix) 2,350,696 shares of Class A common stock and 35,190,866 shares of Class B common stock held by Telluray Holdings, LLC (“Telluray Holdings”), for which Mrs. Ergen has sole voting power as a manager of Telluray Holdings and for which Mr. Ergen and Mrs. Ergen share dispositive power as the managers of Telluray Holdings; (x) 5,181,574 shares of Class B common stock owned beneficially by Mrs. Ergen solely by virtue of her position as trustee of the Ergen Two-Year December 2022 SATS GRAT (the “2022 December GRAT”); (xi) 7,563,458 shares of Class B common stock owned beneficially by Mrs. Ergen solely by virtue of her position as trustee of the Ergen Two-Year May 2023 DISH GRAT (the “2023 May DISH GRAT”); (xii) 6,927,672 shares of Class B common stock owned beneficially by Mrs. Ergen solely by virtue of her position as trustee of the Ergen Two-Year June 2023 SATS GRAT (the “2023 June GRAT”); (xiii) 15,104,784 shares of Class B common stock owned beneficially by Mrs. Ergen solely by virtue of her position as trustee of the Ergen Two-Year June 2023 DISH GRAT (the “2023 June DISH GRAT”); (xiv) 28,799,989 shares of Class B common stock owned beneficially by Mrs. Ergen solely by virtue of her position as trustee of the Ergen Two-Year December 2023 SATS GRAT (the “2023 December GRAT”); (xv) 6,000,000 shares of Class B common stock owned beneficially by Mrs. Ergen solely by virtue of her position as trustee of the Ergen Two-Year May 2024 SATS GRAT (the “2024 May GRAT”); (xvi) 26,500,000 shares of Class B common stock owned beneficially by Mrs. Ergen solely by virtue of her position as trustee of the Ergen Two-Year July 2024 SATS GRAT (the “2024 July GRAT”); and (xvii) 1,551,355 shares of Class A common stock held by CONX and beneficially owned indirectly by Mr. Ergen through nXgen Opportunities, LLC (“nXgen”), which controls CONX. Because each Class B Share is convertible on a one-for-one basis into a Class A Share, assuming conversion of all outstanding Class B Shares into Class A Shares and giving effect to the exercise of options held by Mr. Ergen that are either currently exercisable as of, or may become exercisable within 60 days after, November 12, 2024, the percentage of Class A Shares that Mr. Ergen may be deemed to beneficially own would be approximately 51.8%. Because each share of Class B common stock is entitled to 10 votes per share, Mr. Ergen may be deemed to beneficially own equity securities of EchoStar representing approximately 90.6% of the voting power of EchoStar (assuming no conversion of any Class B common stock and giving effect to the exercise of options held by Mr. Ergen that are either currently exercisable as of, or may become exercisable within 60 days after, November 12, 2024). Pursuant to the Amended and Restated Support Agreement dated as of October 2, 2023 (the “Amended Support Agreement”), Mr. Ergen, Mrs. Ergen and certain entities established for the benefit of their family have agreed not to vote, or cause or direct to be voted, the Class A common stock beneficially owned by them, other than with respect to any matter presented to the holders of Class A common stock on which holders of Class B common stock are not entitled to vote, for three years following the closing of the merger between EchoStar and DISH. As a result, Mr. Ergen’s effective total voting power in such circumstances as of November 12, 2024 is approximately 89.6% for such three-year period.

(3)

Mrs. Ergen’s beneficial ownership consists of: (i) 213 shares of Class A common stock beneficially owned directly by Mrs. Ergen; (ii) 1,189 shares of Class A common stock beneficially owned indirectly by Mrs. Ergen in the DISH Network 401(k) Plan; (iii) 2,350,696 shares of Class A common stock and 35,190,866 shares of Class B common stock held by Telluray Holdings, for which Mrs. Ergen has sole voting power as a manager of Telluray Holdings and for which Mr. Ergen and Mrs. Ergen share dispositive power as the managers of Telluray Holdings; (iv) 5,181,574 shares of Class B common stock owned beneficially by Mrs. Ergen solely by virtue of her position as trustee of the 2022 December GRAT; (v) 7,563,458 shares of Class B common stock owned beneficially by Mrs. Ergen solely by virtue of her position as trustee of the 2023 May DISH GRAT; (vi) 6,927,672 shares of Class B common stock owned beneficially by Mrs. Ergen solely by virtue of her position as trustee of the 2023 June GRAT; (vii) 15,104,784 shares of Class B common stock owned beneficially by Mrs. Ergen solely by virtue of her position as trustee of the 2023 June DISH GRAT; (viii) 28,799,989 shares of Class B common stock owned beneficially by Mrs. Ergen solely by virtue of her position as trustee of the 2023 December GRAT; (ix) 6,000,000 shares of Class B common stock owned beneficially by Mrs. Ergen solely by virtue of her position as trustee of the 2024 May GRAT; (x) 26,500,000 shares of Class B common stock owned beneficially by Mrs. Ergen solely by virtue of her position as trustee of the 2024 July GRAT; (xi) 7,016 shares of Class A common stock deemed to be beneficially owned under Rule 13d-3(d)(1) because Mrs. Ergen has the right to acquire beneficial ownership of such shares within 60 days of November 12, 2024; (xii) 11,353,060 shares of Class A common stock beneficially

owned directly by Mrs. Ergen’s spouse, Mr. Ergen; (xiii) 11,280 shares of Class A common stock beneficially owned indirectly by Mr. Ergen in the DISH Network 401(k) Plan; (xiv) 80,125 shares of Class B common stock beneficially owned directly by Mr. Ergen; (xv) 9,966 shares of Class A common stock beneficially owned by one of Mrs. Ergen’s children; (xvi) 766,443 shares of Class A common stock beneficially owned by a charitable foundation for which Mrs. Ergen is an officer and for which she shares voting and dispositive power with Mr. Ergen; and (xvii) 1,551,355 shares of Class A common stock held by CONX and beneficially owned indirectly by Mrs. Ergen’s spouse, Mr. Ergen, through nXgen, which controls CONX. Because each share of Class B common stock is convertible on a one-for-one basis into a share of Class A common stock, assuming conversion of only the shares of Class B common stock beneficially owned by Mrs. Ergen into Class A common stock and giving effect to the exercise of options held by Mrs. Ergen that are either currently exercisable as of, or may become exercisable within 60 days after, November 12, 2024, the percentage of Class A Shares that Mrs. Ergen may be deemed to beneficially own would be approximately 51.5%. Because each share of Class B common stock is entitled to 10 votes per share, Mrs. Ergen may be deemed to beneficially own equity securities of EchoStar representing approximately 90.6% of the voting power of EchoStar (assuming no conversion of any Class B common stock and giving effect to the exercise of options held by Mrs. Ergen that are either exercisable as of, or may become exercisable within 60 days after, November 12, 2024). Pursuant to the Amended Support Agreement, Mr. Ergen, Mrs. Ergen and certain entities established for the benefit of their family have agreed not to vote, or cause or direct to be voted, the Class A common stock beneficially owned by them, other than with respect to any matter presented to the holders of Class A common stock on which holders of Class B common stock are not entitled to vote, for three years following the closing of the merger between EchoStar and DISH. As a result, Mr. Ergen’s effective total voting power in such circumstances as of November 12, 2024 is approximately 89.6% for such three-year period.

(4)

Telluray Holdings’ beneficial ownership consists of 2,350,696 shares of Class A common stock and 35,190,866 shares of Class B common stock.

(5)

Assumes the sale of all shares of Class A common stock registered for resale pursuant to this prospectus.

MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS FOR NON-U.S. HOLDERS

The following is a discussion of material U.S. federal income tax consequences of the ownership and disposition of our Class A common stock to a non-U.S. holder (as defined below) that purchases shares of our Class A common stock in this offering. This discussion applies only to a non-U.S. holder that holds our Class A common stock as a capital asset within the meaning of Section 1221 of the U.S. Internal Revenue of 1986, as amended (the “Code”) (generally, property held for investment). For purposes of this discussion, a “non-U.S. holder” means a beneficial owner of our Class A common stock who or that is, for U.S. federal income tax purposes, an individual, corporation, estate or trust other than:

•

an individual citizen or resident of the United States, as defined for U.S. federal income tax purposes;

•

a corporation or other entity treated as a corporation for U.S. federal income tax purposes created or organized in the U.S. or under the laws of the United States, any state thereof or the District of Columbia;

•

an estate whose income is subject to U.S. federal income tax regardless of its source; or

•

a trust if it (1) is subject to the primary supervision of a court within the U.S. and one or more U.S. persons have the authority to control all substantial decisions of the trust or (2) has a valid election in place to be treated as a U.S. person for U.S. federal income tax purposes;

but generally does not include an individual who is present in the United States for 183 days or more in the taxable year of the disposition of our Class A common stock. If you are such an individual, you are urged to consult your own tax advisor regarding the U.S. federal income tax consequences of the ownership or disposition of our Class A common stock.

In the case of a beneficial owner that is classified as a partnership for U.S. federal income tax purposes, the tax treatment of a partner in such partnership generally will depend upon the status of the partner and the activities of the partner and the partnership. If you are a partnership considering an investment in our Class A common stock or if you are a partner in such partnership, then you should consult your tax advisor regarding the tax consequences to you of such an investment.

This discussion is based upon the provisions of the Code, the Treasury regulations promulgated thereunder and administrative and judicial interpretations thereof, all as of the date hereof. Those authorities are subject change or differing interpretations, possibly with retroactive effect, so as to result in U.S. federal income tax consequences different from those summarized below. No opinion of counsel or ruling from the U.S. Internal Revenue Service (“IRS”) has been, or is intended to be obtained or given, with respect to any of the considerations discussed herein. No assurances can be given that the IRS would not assert, or that a court would not sustain, a position different from any of the tax considerations discussed below.

This discussion does not address all aspects of U.S. federal income taxes that may be relevant to non-U.S. holders in light of their personal circumstances, and does not deal with federal taxes other than the U.S. federal income tax (such as U.S. federal estate and gift tax laws or the Medicare tax on certain investment income) or with any U.S. state or local or non-U.S. tax considerations. This discussion also does not address all of the different consequences that may be relevant to certain investors subject to special treatment under U.S. federal income tax laws, such as:

•

former citizens or residents of the United States;

•

banks or other financial institutions;

•

insurance companies;

•

tax-qualified retirement plans;

•