Stran & Company, Inc. ("Stran" or the

"Company") (NASDAQ: SWAG) (NASDAQ: SWAGW), a leading outsourced

marketing solutions provider that leverages its promotional

products and loyalty incentive expertise, today provided a business

update and reported financial results for the year ended December

31, 2023.

Andy Shape, President and CEO of Stran,

commented, “We made meaningful progress throughout 2023, resulting

in record sales of approximately $75.9 million, a 28.7% increase

over the prior year. Additionally, our gross profit increased 50.2%

to approximately $24.9 million, with our gross margin increasing to

32.8% compared to 28.1% for 2022, while achieving profitability for

the full year. We also saw impressive results for the fourth

quarter of 2023 where our sales increased by 27.5% to a quarterly

record of approximately $23.3 million, our gross profit increased

by 63.5% to approximately $8.7 million, and our gross margin

increased to 37.4%, compared to 29.2% for the same period last

year. Our fourth quarter results also demonstrate the operating

leverage we are gaining, evidenced by a 156.1% increase to

approximately $1.1 million in operating income as well as $883,000

of net earnings for the fourth quarter of 2023. Moreover, we are

proud to have realized a 16.6% increase in organic sales for 2023.

We believe these achievements highlight our robust competitive

position, expanding market presence, growth within existing client

relationships, and the addition of a number of new first-class

customers.”

“During the year, we closed the T R Miller Co.,

Inc. (“T R Miller”) assets acquisition, which was our fourth

acquisition within less than two years, following assets

acquisitions from G.A.P. Promotions, LLC (“G.A.P. Promotions”),

Trend Promotional Marketing Corporation (d/b/a Trend Brand

Solutions) (“Trend Brand Solutions”), and Premier Business Services

(“Premier NYC”). Each acquisition has delivered crucial strategic

benefits to Stran and our operations, including the expansion of

our geographic reach, bolstering our warehousing and manufacturing

capabilities, and attracting esteemed clients to our already

impressive portfolio. While we continue to actively explore M&A

opportunities as they emerge, our primary focus is on nurturing our

organic growth and optimizing the benefits of our existing

acquisitions. In addition, our improved sales and marketing

initiatives, including more targeted SEO and demand generation

combined with an expanded sales leadership team, are having a

positive effect on our contract pipeline.”

“Overall, we have preserved a strong balance

sheet with approximately $18.5 million in cash and investments as

of December 31, 2023. We are very proud of the achievements we've

accomplished thus far, including profitability, securing new

contracts, and raising Stran's visibility. Most importantly, we are

beginning to realize greater efficiency and economies of scale that

will continue to enhance our profitability. We eagerly anticipate

further benefits from our growth initiatives and look forward to

sharing additional updates with shareholders as they unfold.”

Financial Results

Fourth Quarter 2023 Results

Sales increased 27.5% to approximately $23.3

million for the three months ended December 31, 2023, from

approximately $18.3 million for the three months ended December 31,

2022, resulting in the highest quarterly sales in the Company’s

history. As in many previous years, our net sales and profits were

impacted by the holiday selling season. The increase was primarily

due to increased sales and marketing as well as the acquisitions of

the assets of Premier NYC in December 2022 and T R Miller in June

2023.

Gross profit increased 63.5% to approximately

$8.7 million, or 37.4% of sales, for the three months ended

December 31, 2023, from approximately $5.3 million, or 29.2% of

sales, for the three months ended December 31, 2022. The increase

in the dollar amount of gross profit was due to increased sales,

partially offset by an increase in purchasing costs.

Net earnings for the three months ended December

31, 2023 was approximately $0.8 million compared to net earnings of

approximately $0.9 million for the three months ended December 31,

2022. This decrease was primarily due to tax provisions and

increased operating expenses.

Full Year 2023 Results

Sales increased 28.7% to approximately

$75.9 million for the year ended December 31, 2023, from

approximately $59.0 million for the year ended December 31,

2022. The increase was primarily due to higher spending from

existing clients as well as business from new customers.

Additionally, the acquisitions of the G.A.P. Promotions assets in

January 2022, the Trend Brand Solutions assets in August 2022, the

Premier NYC assets in December 2022, and the T R Miller assets in

June 2023 accounted for approximately $14.7 million, or 19.4%, of

sales, for 2023, compared to approximately $6.5 million, or 11.0%,

of sales for 2022. Recurring organic sales, defined as sales

excluding revenue from the acquisitions of the assets of each of

G.A.P. Promotions, Trend Brand Solutions, Premier NYC, and T R

Miller, increased 16.6%, or approximately $8.7 million, to $61.2

million for the year ended December 31, 2023, from approximately

$52.5 million for the year ended December 31, 2022.

Gross profit increased 50.2% to approximately

$24.9 million, or 32.8% of sales, for the year ended December 31,

2023, from approximately $16.6 million, or 28.1% of sales, for the

year ended December 31, 2022. The increase in the dollar amount of

gross profit was due to increased sales, partially offset by an

increase in purchasing and freight costs.

Net earnings for the year ended December 31,

2023 was approximately $35,000, compared to a net loss of $778,000

for the year ended December 31, 2022. This change was

primarily due to the increase in sales during 2023 from the

acquisition of the assets of each of G.A.P. Promotions, Trend Brand

Solutions, Premier NYC, and T R Miller, and the increase of

recurring organic sales during 2023 compared to 2022. These factors

were partially offset by an increase in operating expenses and

increase in purchasing costs.

Conference Call

The Company will host a conference call at 10:00

A.M. Eastern Time today to discuss the Company’s financial results

for the fourth fiscal quarter and fiscal year ended December 31,

2023, as well as the Company’s corporate progress and other

developments.

The conference call will be available via

telephone by dialing toll free 888-506-0062 for U.S. callers or +1

973-528-0011 for international callers and using entry code:

730645. A webcast of the call may be accessed

at https://www.webcaster4.com/Webcast/Page/2855/50019 or

on the Company’s Investors section of the

website: ir.stran.com/news-events/ir-calendar.

A webcast replay will be available on the

Investor Relations section of the Company’s website

(ir.stran.com/news-events/ir-calendar) through March 28, 2025. A

telephone replay of the call will be available approximately one

hour following the call, through April 11, 2024, and can be

accessed by dialing 877-481-4010 for U.S. callers or +1

919-882-2331 for international callers and entering conference ID:

50019.

About Stran

For over 28 years, Stran has grown to become a

leader in the promotional products industry, specializing in

complex marketing programs to help recognize the value of

promotional products, branded merchandise, and loyalty incentive

programs as a tool to drive awareness, build brands and impact

sales. Stran is the chosen promotional programs manager of many

Fortune 500 companies, across a variety of industries, to execute

their promotional marketing, loyalty and incentive, sponsorship

activation, recruitment, retention, and wellness campaigns. Stran

provides world-class customer service and utilizes cutting-edge

technology, including efficient ordering and logistics technology

to provide order processing, warehousing and fulfillment functions.

The Company’s mission is to develop long-term relationships with

its clients, enabling them to connect with both their customers and

employees in order to build lasting brand loyalty. Additional

information about the Company is available at: www.stran.com.

Forward Looking Statements

This press release contains “forward-looking

statements” that are subject to substantial risks and

uncertainties. All statements, other than statements of historical

fact, contained in this press release are forward-looking

statements. Forward-looking statements contained in this press

release may be identified by the use of words such as “anticipate,”

“believe,” “contemplate,” “could,” “estimate,” “expect,” “intend,”

“seek,” “may,” “might,” “plan,” “potential,” “predict,” “project,”

“target,” “aim,” “should,” "will” “would,” or the negative of these

words or other similar expressions, although not all

forward-looking statements contain these words. Forward-looking

statements are based on the Company’s current expectations and are

subject to inherent uncertainties, risks and assumptions that are

difficult to predict. Further, certain forward-looking statements

are based on assumptions as to future events that may not prove to

be accurate. These and other risks and uncertainties are described

more fully in the section titled “Risk Factors” in the Company’s

periodic reports which are filed with the Securities and Exchange

Commission. Forward-looking statements contained in this

announcement are made as of this date, and the Company undertakes

no duty to update such information except as required under

applicable law.

Contacts:

Investor Relations Contact:Crescendo

Communications, LLCTel: (212) 671-1021SWAG@crescendo-ir.com

Press Contact:Howie Turkenkopf

press@stran.com

|

BALANCE SHEETS |

|

|

|

|

|

|

|

|

|

December 31, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

CURRENT ASSETS: |

|

|

|

|

|

|

Cash & Cash Equivalents |

$ |

7,988,803 |

|

|

$ |

15,253,756 |

|

|

Investments |

|

10,463,799 |

|

|

|

9,779,355 |

|

|

Accounts Receivable, Net |

|

20,465,564 |

|

|

|

14,442,626 |

|

|

Deferred Income Taxes |

|

841,000 |

|

|

|

841,000 |

|

|

Inventory |

|

6,639,358 |

|

|

|

6,867,564 |

|

|

Prepaid Corporate Taxes |

|

16,800 |

|

|

|

87,459 |

|

|

Prepaid Expenses |

|

952,691 |

|

|

|

386,884 |

|

|

Deposits |

|

1,717,444 |

|

|

|

910,486 |

|

|

|

|

49,085,459 |

|

|

|

48,569,130 |

|

|

|

|

|

|

|

|

|

|

|

PROPERTY AND EQUIPMENT, NET: |

|

1,520,933 |

|

|

|

1,000,090 |

|

|

|

|

|

|

|

|

|

|

|

OTHER ASSETS: |

|

|

|

|

|

|

|

|

Intangible Assets - Customer Lists, Net |

|

9,659,481 |

|

|

|

6,272,205 |

|

|

Right of Use Asset - Office Leases |

|

1,335,653 |

|

|

|

784,683 |

|

|

|

|

10,995,134 |

|

|

|

7,056,888 |

|

|

|

$ |

61,601,526 |

|

|

$ |

56,626,108 |

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDER’S EQUITY |

|

|

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

Current Portion of Contingent Earn-Out Liabilities |

$ |

2,870,274 |

|

|

$ |

1,809,874 |

|

|

Current Portion of Lease Liability |

|

527,548 |

|

|

|

324,594 |

|

|

Accounts Payable and Accrued Expenses |

|

4,316,198 |

|

|

|

4,051,657 |

|

|

Accrued Payroll and Related |

|

2,563,238 |

|

|

|

608,589 |

|

|

Unearned Revenue |

|

5,171,479 |

|

|

|

633,148 |

|

|

Rewards Program Liability |

|

875,000 |

|

|

|

6,000,000 |

|

|

Sales Tax Payable |

|

343,944 |

|

|

|

365,303 |

|

|

Note Payable - Wildman |

|

- |

|

|

|

162,358 |

|

|

|

|

16,667,681 |

|

|

|

13,955,523 |

|

|

|

|

|

|

|

|

|

|

|

LONG-TERM LIABILITIES: |

|

|

|

|

|

|

|

|

Long-Term Contingent Earn-Out Liabilities |

|

4,586,765 |

|

|

|

2,845,944 |

|

|

Long-Term Lease Liability |

|

797,558 |

|

|

|

460,089 |

|

|

|

|

5,384,323 |

|

|

|

3,306,033 |

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS’ EQUITY: |

|

|

|

|

|

|

|

|

Common Stock, $.0001 Par Value; 300,000,000 Shares Authorized,

18,534,073 and 18,475,521 Shares Issued and Outstanding as of

December 31, 2023 and December 31, 2022, respectively |

|

1,854 |

|

|

|

1,848 |

|

|

Additional Paid-In Capital |

|

38,429,057 |

|

|

|

38,279,151 |

|

|

Retained Earnings |

|

1,118,611 |

|

|

|

1,083,553 |

|

|

|

|

39,549,522 |

|

|

|

39,364,552 |

|

|

|

$ |

61,601,526 |

|

|

$ |

56,626,108 |

|

|

STATEMENTS OF EARNINGS (LOSS) AND RETAINED

EARNINGSTHREE AND TWELVE MONTHS ENDED DECEMBER 31,

2023 AND 2022 |

|

|

|

|

Three Months

EndedDecember 31,2023 |

|

|

Three Months EndedDecember

31,2022 |

|

|

Twelve Months EndedDecember

31,2023 |

|

|

Twelve Months EndedDecember

31,2022 |

|

| |

(Unaudited) |

|

|

(Unaudited) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

SALES |

$ |

23,344,183 |

|

|

$ |

18,310,908 |

|

|

$ |

75,893,871 |

|

|

$ |

58,953,467 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COST OF SALES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchases |

|

12,962,024 |

|

|

|

11,548,916 |

|

|

|

45,399,202 |

|

|

|

37,391,939 |

|

|

Freight |

|

1,642,901 |

|

|

|

1,418,024 |

|

|

|

5,613,169 |

|

|

|

4,991,854 |

|

|

|

|

14,604,925 |

|

|

|

12,966,940 |

|

|

|

51,012,371 |

|

|

|

42,383,793 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GROSS PROFIT |

|

8,739,258 |

|

|

|

5,343,968 |

|

|

|

24,881,500 |

|

|

|

16,569,674 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

General and Administrative Expenses |

|

7,660,067 |

|

|

|

4,922,595 |

|

|

|

26,030,030 |

|

|

|

18,075,369 |

|

|

|

|

7,660,067 |

|

|

|

4,922,595 |

|

|

|

26,030,030 |

|

|

|

18,075,369 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EARNINGS (LOSS) FROM OPERATIONS |

|

1,079,191 |

|

|

|

421,373 |

|

|

|

(1,148,530 |

) |

|

|

(1,505,695 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME AND (EXPENSE): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Income (Expense) |

|

61,325 |

|

|

|

20,383 |

|

|

|

375,063 |

|

|

|

112,507 |

|

|

Interest Income (Expense) |

|

102,972 |

|

|

|

103,803 |

|

|

|

570,387 |

|

|

|

94,680 |

|

|

Unrealized Gain (Loss) on Short-Term Investments |

|

135,235 |

|

|

|

51,994 |

|

|

|

269,587 |

|

|

|

(179,120 |

) |

|

|

|

299,532 |

|

|

|

176,180 |

|

|

|

1,215,037 |

|

|

|

28,067 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EARNINGS (LOSS) BEFORE INCOME TAXES |

|

1,378,723 |

|

|

|

597,553 |

|

|

|

66,507 |

|

|

|

(1,477,628 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROVISION FOR INCOME TAXES |

|

495,406 |

|

|

|

(305,415 |

) |

|

|

31,449 |

|

|

|

(699,187 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET EARNINGS (LOSS) |

|

883,317 |

|

|

|

902,968 |

|

|

|

35,058 |

|

|

|

(778,441 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET EARNINGS PER COMMON SHARE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

0.05 |

|

|

$ |

0.05 |

|

|

$ |

0.00 |

|

|

$ |

(0.04 |

) |

|

Diluted |

$ |

0.03 |

|

|

$ |

0.03 |

|

|

$ |

0.00 |

|

|

$ |

(0.04 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED-AVERAGE COMMON SHARES OUTSTANDING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

18,528,074 |

|

|

|

19,202,619 |

|

|

|

18,519,615 |

|

|

|

19,202,619 |

|

|

Diluted |

|

29,461,665 |

|

|

|

29,668,865 |

|

|

|

29,453,206 |

|

|

|

19,202,619 |

|

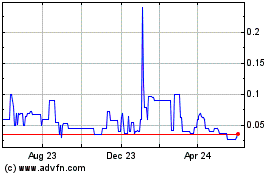

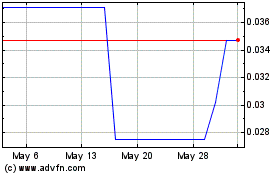

Stran (NASDAQ:SWAGW)

Historical Stock Chart

From Oct 2024 to Nov 2024

Stran (NASDAQ:SWAGW)

Historical Stock Chart

From Nov 2023 to Nov 2024