Upstart Unveils Enhanced Showroom and Auto Financing Solutions that Boost Dealership Sales, Elevate Customer Experience

January 15 2025 - 8:00AM

Business Wire

Upstart (NASDAQ: UPST), the leading AI lending marketplace,

today announced the largest and most significant set of product

enhancements to the In-Store and Financing solutions on its Auto

Retail platform. The enhancements empower dealerships to more

easily configure and efficiently manage the sales process, desk

deals, streamline financing workflows, and close sales more

quickly.

With consumer confidence and vehicle sales on the rise, and the

majority of car buyers still preferring to complete their purchase

at a dealership, the ability to deliver a high-quality in-store

experience—including financing—is imperative for dealers. Upstart’s

new In-Store and Financing capabilities make that possible by

saving crucial time in the showroom and generating deals with

higher margins.

“Upstart Auto Retail has vastly improved how our sales and

F&I teams operate, speeding up the deal process and making it

easier to get customers the financing they need to buy the car they

want,” said Chad Bouchard, General Manager of Ron Bouchard Honda

and Kia. “Now, we’re selling as many as five more cars per

salesperson per month.”

Upstart Auto Retail offers a fully connected and customized

retailing platform that can cut the deal time in half and drive

more sales—whether dealers sell using a single point of contact or

multiple teams, or credit first or pencil first. The new

enhancements include:

Faster, Flexible Desking: A redesigned layout puts

critical profit information and key workflows upfront for easy

access. Sales managers can adjust all deal details—including

multiple down payment options and finance, lease, and cash

options—in one view with just a few clicks. These details can be

presented to customers through an easily customizable digital

payment worksheet. The result: Salespeople can now desk deals in

under a minute.

Deeper Credit Insights: A new credit dashboard offers

initial, complimentary FICO Auto Scores on soft pulls, a

downloadable credit report, and fraud and compliance checks for

every customer at credit app submission—all within Upstart Auto

Retail. This enables dealers to better prepare for a customer’s

visit to the showroom, make informed financing decisions, and

streamline approvals without the need to switch between multiple

service providers.

More Efficient, Profitable Financing: In addition to

halving the number of steps needed to complete a loan, a new

AI-powered offer and rehashing module displays approvals from

Upstart and other lenders. Offers with lower APRs or better terms

are proactively highlighted so finance managers pick the right

offer to close the deal. Upstart dealer partners have leveraged

these features to generate loan-to-value ratios as high as 185% and

realize higher profits overall.

"Upstart is delivering innovative, modular solutions that

address the evolving needs of dealers and their customers, from car

shopping to financing," said Alex Rouse, Upstart’s General Manager

of Auto. "By further optimizing the desking and financing

processes, we now offer an even more seamless and efficient

car-buying experience—from the customer’s couch to the showroom

floor."

The In-Store and Financing enhancements are available to

dealerships nationwide. To learn more, and see the desking tool in

action, go here.

Upstart will showcase its full auto retail platform at the

National Automobile Dealers Association Show (NADA) in New Orleans,

Jan. 23-26. Visit us at Booths 2119 and 2127 to see a

demonstration.

About Upstart

Upstart (NASDAQ: UPST) is the leading AI lending marketplace,

connecting millions of consumers to more than 100 banks and credit

unions that leverage Upstart’s AI models and cloud applications to

deliver superior credit products. With Upstart AI, lenders can

approve more borrowers at lower rates across races, ages, and

genders, while delivering the exceptional digital-first experience

customers demand. More than 80% of borrowers are approved

instantly, with zero documentation to upload. Founded in 2012,

Upstart’s platform includes personal loans, automotive retail and

refinance loans, home equity lines of credit, and small-dollar

“relief” loans. Upstart is based in San Mateo, California, and also

has offices in Columbus, Ohio and Austin, Texas.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250115673226/en/

Tom Brennan press@upstart.com

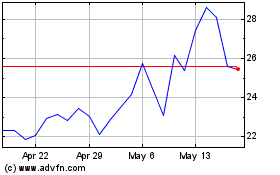

Upstart (NASDAQ:UPST)

Historical Stock Chart

From Dec 2024 to Jan 2025

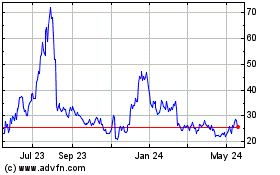

Upstart (NASDAQ:UPST)

Historical Stock Chart

From Jan 2024 to Jan 2025