VEON 2Q24 Trading Update: Double-Digit USD

Growth, Robust Operational Execution, Confirming Full Year

Guidance

Amsterdam, 8 August 2024 07:00AM CEST

VEON Q2 2024 Highlights

- Q2 revenue of USD 1,026 million, +12.1% YoY (+15.1% YoY in

local currency) and EBITDA of USD 459 million, +10.6% YoY (+13.9%

YoY in local currency)

- Q2 direct digital revenue of USD 108 million, +83.3% YoY

(+81.4% YoY in local currency)

- Q2 capex of USD 181 million, +5.8% YoY, with LTM capex

intensity of 18.0%

- Total cash and cash equivalents of USD 722 million, with USD

375 million at HQ; and gross debt at USD 4.0 billion (decreased by

USD 1.2 billion YoY), with net debt excluding lease liabilities at

USD 2.2 billion; VEON repaid its Revolving Credit Facility

- Maintaining FY 2024 revenue growth guidance in local currency

of 16-18%, EBITDA growth guidance in local currency of 18-20%, and

capex intensity of 18-19%

VEON Ltd. (NASDAQ: VEON, Euronext Amsterdam: VEON), a global

digital operator that provides converged connectivity and online

services, announces selected financial and operating results for

the second quarter and six months ended 30 June 2024.

In 2Q24, VEON continued to report growth in revenues in reported

currency terms with double-digit local and reported currency

top-line growth. Total revenues reached USD 1,026 million, an

increase of 12.1% YoY in reported currency (+15.1% YoY in local

currency). Service revenues amounted to USD 987 million, an

increase of 11.3% YoY in reported currency (+14.5% YoY in local

currency), and EBITDA of USD 459 million represented a 10.6% YoY

increase in reported currency terms (+13.9% YoY in local currency).

Capex in 2Q24 was USD 181 million, an increase of 5.8% YoY, and

reported capex intensity for the last twelve months was 18.0%

(-1.6p.p. YoY). Total cash and cash equivalents as of 30 June 2024

amounted to USD 722 million (excluding USD 140 million in cash

related to banking operations in Pakistan) with USD 375 million

held at the headquarters (“HQ”) level.

VEON maintains its FY 2024 guidance for revenue growth of

16%-18%, EBITDA growth of 18%-20%, both in local currency terms,

and group capex intensity of 18-19%, supported by execution of its

digital operator strategy.

Commenting on the results, Kaan Terzioğlu said:

“With 12.1% growth in topline and 10.9% growth in EBITDA in US

dollars, I am delighted to be back with a billion-dollar quarter.

Robust organic performance across our markets is driven by 10

million additional 4G customers, 111 million digital service users,

showcasing our capability to build new businesses in financial,

entertainment, healthcare, education, and enterprise services.

I am also happy to report for the first time the direct digital

revenues generated through our digital financial services,

entertainment services, healthcare services, advertising services

and Super apps. This quarter, our direct digital revenues exceeded

10% of our total revenues growing 77% year on year.

Our digital services are not only driving more consumption,

helping with retention, improving ARPU of our digital operators but

they now also directly contribute to our topline growth through

interest income, advertising revenues, subscription services,

platform commissions, and pay-per-view revenues.

Looking ahead, I am thrilled about our continued growth

trajectory as we enhance customer engagement with superior digital

experiences, further bolstered by cutting-edge technologies such as

artificial intelligence.”

Additional information

View the full 2Q24 trading update View 2Q24

trading update presentationView 2Q24 factbook

2Q24 results conference call

VEON will also host a results conference call with senior

management at 14:00 CEST (13:00 BST, 8:00 EST) today.

To register and access the event, please click here or copy and

paste this link to the address bar of your

browser: https://veon-q2-2024-trading-update.open-exchange.net/.

Once registered, you will receive registration confirmation on

the email address mentioned during registration with the link to

access the webcast and dial-in details to listen to the conference

call over the phone.

We strongly encourage you to watch the event through the webcast

link, but if you prefer to dial in, then please use the dial-in

details.

Q&A If you want to participate in the Q&A

session, we ask that you select the ‘Yes' option on the ‘Will you

be asking questions live on the call?’ dropdown. That will bring

you to a page where you can join the Q&A room by clicking

'Connect to meeting’.

You will be brought into a zoom webinar where you can listen to

the presentation and once Q&A begins, if you have a question,

please use the ‘raise hand button’ on the bottom of your zoom

screen. When it is your turn to speak, the moderator will announce

your name as well as sending a message to your screen asking you to

confirm you want to talk. Once accepted, please unmute your mic and

ask your question.

You can also submit your questions prior the webcast event to

VEON Investor Relations at ir@veon.com.

About VEON

VEON is a digital operator that provides converged connectivity

and digital services to nearly 160 million customers. Operating

across six countries that are home to more than 7% of the world’s

population, VEON is transforming lives through technology-driven

services that empower individuals and drive economic growth.

Headquartered in Amsterdam, VEON is listed on NASDAQ and Euronext.

For more information, visit: https://www.veon.com.

Notice to readers: financial information presented

VEON's results and other financial information presented in this

document are, unless otherwise stated, prepared in accordance with

International Financial Reporting Standards ("IFRS") based on

internal management reporting, are the responsibility of

management, and have not been externally audited, reviewed, or

verified. As such, you should not place undue reliance on this

information. This information may not be indicative of the actual

results for any future period.

Notice to readers: impact of the war in Ukraine

The ongoing war in Ukraine, and the resulting sanctions adopted

by the United States, member states of the European Union, the

European Union itself, the United Kingdom, Ukraine and certain

other nations, countersanctions and other legal and regulatory

responses, as well as responses by our service providers, partners,

suppliers and other counterparties, and the other indirect and

direct consequences of the war have impacted and, if the war, such

responses and other consequences continue or escalate, may

significantly impact our results and aspects of our operations in

Ukraine, and may significantly affect our results and aspects of

our operations in the other countries in which we operate. We are

closely monitoring events in Ukraine, as well as the possibility of

the imposition of further legal and regulatory restrictions in

connection with the ongoing war in Ukraine and any potential impact

the war may have on our results, whether directly or

indirectly.

Our operations in Ukraine continue to be affected by the war. We

are doing everything we can to protect the safety of our employees,

while continuing to ensure the uninterrupted operation of our

communications, financial and digital services.

Disclaimer

VEON's results and other financial information presented in this

document are, unless otherwise stated, prepared in accordance with

International Financial Reporting Standards ("IFRS") and have not

been externally reviewed and audited. The financial information

included in this document is preliminary and is based on a number

of assumptions that are subject to inherent uncertainties and

subject to change. The financial information presented herein is

based on internal management accounts, is the responsibility of

management and is subject to financial closing procedures which

have not yet been completed and has not been audited, reviewed or

verified. Certain amounts and percentages that appear in this

document have been subject to rounding adjustments. As a result,

certain numerical figures shown as totals, including those in the

tables, may not be an exact arithmetic aggregation of the figures

that precede or follow them. Although we believe the information to

be reasonable, actual results may vary from the information

contained above and such variations could be material. As such, you

should not place undue reliance on this information. This

information may not be indicative of the actual results for the

current period or any future period.

This document contains “forward-looking statements”, as the

phrase is defined in Section 27A of the U.S. Securities Act of

1933, as amended, and Section 21E of the U.S. Securities Exchange

Act of 1934, as amended. These forward-looking statements may be

identified by words such as “may,” “might,” “will,” “could,”

“would,” “should,” “expect,” “plan,” “anticipate,” “intend,”

“seek,” “believe,” “estimate,” “predict,” “potential,” “continue,”

“contemplate,” “possible” and other similar words. Forward-looking

statements include statements relating to, among other things,

VEON’s plans to implement its strategic priorities, including

operating model and development plans; anticipated performance,

including VEON’s growth trajectory and ability to generate

sufficient cash flow; VEON’s intended expansion of its digital

experience including through technologies such as artificial

intelligence; VEON’s assessment of the impact of the war in

Ukraine, including related sanctions and counter-sanctions, on its

current and future operations and financial condition; future

market developments and trends; operational and network development

and network investment, including expectations regarding the

roll-out and benefits of 3G/4G/LTE networks, as applicable;

spectrum acquisitions and renewals; the effect of the acquisition

of additional spectrum on customer experience; VEON’s ability to

realize the acquisition and disposition of any of its businesses

and assets and to execute its strategic transactions in the

timeframes anticipated, or at all; VEON’s ability to realize

financial improvements, including an expected reduction of net

pro-forma leverage ratio following the successful completion of

certain dispositions and acquisitions; its dividends; and VEON’s

ability to realize its targets and commercial initiatives in its

various countries of operation.

The forward-looking statements included in this document are

based on management’s best assessment of VEON’s strategic and

financial position and of future market conditions, trends and

other potential developments. These discussions involve risks and

uncertainties. The actual outcome may differ materially from these

statements as a result of, among other things: further escalation

in the war in Ukraine, including further sanctions and

counter-sanctions and any related involuntary deconsolidation of

our Ukrainian operations; demand for and market acceptance of

VEON’s products and services; our plans regarding our dividend

payments and policies, as well as our ability to receive dividends,

distributions, loans, transfers or other payments or guarantees

from our subsidiaries; continued volatility in the economies in

VEON’s markets; governmental regulation of the telecommunications

industries; general political uncertainties in VEON’s markets;

government investigations or other regulatory actions; litigation

or disputes with third parties or regulatory authorities or other

negative developments regarding such parties; the impact of export

controls and laws affecting trade and investment on our and

important third-party suppliers' ability to procure goods, software

or technology necessary for the services we provide to our

customers; risks associated with our material weakness in internal

control over financial reporting; risks associated with data

protection or cyber security, other risks beyond the parties’

control or a failure to meet expectations regarding various

strategic priorities, the effect of foreign currency fluctuations,

increased competition in the markets in which VEON operates and the

effect of consumer taxes on the purchasing activities of consumers

of VEON’s services.

Certain other factors that could cause actual results to differ

materially from those discussed in any forward-looking statements

include the risk factors described in VEON’s Annual Report on Form

20-F for the year ended 31 December 2022 filed with the U.S.

Securities and Exchange Commission (the “SEC”) on 24 July 2023 and

other public filings made from time to time by VEON with the SEC.

Other unknown or unpredictable factors also could harm our future

results. New risk factors and uncertainties emerge from time to

time and it is not possible for our management to predict all risk

factors and uncertainties, nor can we assess the impact of all

factors on our business or the extent to which any factor, or

combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statements.

Under no circumstances should the inclusion of such forward-looking

statements in this document be regarded as a representation or

warranty by us or any other person with respect to the achievement

of results set out in such statements or that the underlying

assumptions used will in fact be the case. Therefore, you are

cautioned not to place undue reliance on these forward-looking

statements. The forward-looking statements speak only as of the

date hereof. We cannot assure you that any projected results or

events will be achieved. Except to the extent required by law, we

disclaim any obligation to update or revise any of these

forward-looking statements, whether as a result of new information,

future events or otherwise, after the date on which the statements

are made, or to reflect the occurrence of unanticipated events.

Furthermore, elements of this document contain or may contain,

“inside information” as defined under the Market Abuse Regulation

(EU) No. 596/2014.

Contact Information

VEONInvestor RelationsFaisal Ghoriir@veon.com

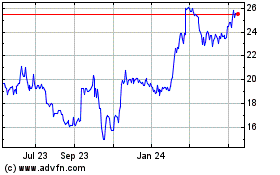

VEON (NASDAQ:VEON)

Historical Stock Chart

From Oct 2024 to Nov 2024

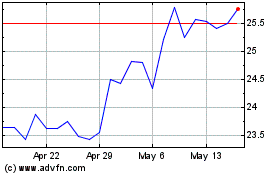

VEON (NASDAQ:VEON)

Historical Stock Chart

From Nov 2023 to Nov 2024