false

0001559998

0001559998

2024-03-01

2024-03-01

0001559998

dei:FormerAddressMember

2024-03-01

2024-03-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report:

March

1, 2024

Gaucho

Group Holdings, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40075 |

|

52-2158952 |

State

of

Incorporation |

|

Commission

File Number |

|

IRS

Employer

Identification No. |

112

NE 41st Street, Suite 106

Miami,

FL 33137

Address

of principal executive offices

212-739-7700

Telephone

number, including area code

Former

name or former address if changed since last report

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

VINO |

|

The

Nasdaq Stock Market LLC |

Item

2.04. Triggering Events that Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

As

previously reported on our Current Report on Form 8-K filed on February 21, 2023, Gaucho Group Holdings, Inc. (the “Company”)

entered into a Securities Purchase Agreement (the “Purchase Agreement”) with 3i, LP (“3i”), pursuant to which

the Company sold to 3i a series of senior secured convertible notes of the Company in the aggregate original principal amount of $5,617,978

(the “Notes”), and a series of common stock purchase warrants of the Company, which warrants shall be exercisable into an

aggregate of 337,710 shares of common stock of the Company for a term of three years (the “Warrants,” and together with the

Purchase Agreement and Notes, the “Note Documents”). For the full description of the Note Documents, please refer to our

Current Report on Form 8-K and the exhibits attached thereto as filed with the SEC on February 21, 2023. All terms not defined herein

shall refer to the defined terms in the Note Documents.

On

March 6, 2024, the Company received an Event of Default notice from 3i regarding an Event of Default arising under the Note

Documents for failure to cure a Conversion Failure for a Conversion Notice submitted by 3i on February 20, 2024, and demanding immediate

payment of the Event of Default Redemption Price equal to a minimum of $3,460,510.33.

Please

also refer to our Current Reports on Forms 8-K as filed with the SEC on February 27, 2024 and March 1, 2024 regarding prior notices of

Events of Default arising under the Note Documents.

Upon

an Event of Default, the interest rate on the outstanding principal will automatically be increased from 7% to 18% per annum, and 3i

may require the Company to redeem all or any portion of the Note at a price equal to the greater of (i) the product of (A) the amount

to be redeemed multiplied by (B) the redemption premium of 115%, and (ii) the product of (X) the conversion rate in effect at such time

as 3i delivers an Event of Default redemption notice, multiplied by (Y) the product of (1) the redemption premium of 115% multiplied

by (2) the greatest closing sale price of the common stock on any trading day during the period commencing on the date immediately preceding

such Event of Default and ending on the date the Company makes the entire payment required to be made under the Note Documents.

Additionally,

3i may, at its option, convert the Note into shares of common stock of the Company at an alternate conversion price. The remedies provided

in the Note are cumulative and in addition to all other remedies available to 3i at law or in equity (including a decree of specific

performance and/or other injunctive relief).

In

addition to the remedies provided under the Note Documents, 3i also holds a security interest in all of the assets of the Company, including

intellectual property and the Company’s ownership interests in each of its subsidiaries, pursuant to that certain Security and

Pledge Agreement and Intellectual Property Security Agreement each dated February 21, 2023 (together, the “Security Agreement”).

Upon the occurrence of an Event of Default under the Note, the collateral agent appointed under the Security Agreement may exercise all

of the rights and remedies of a secured party upon default under the New York Uniform Commercial Code, and may, among other things, (i)

take absolute control of the collateral and receive, for the benefit of 3i, all payments made thereon, give all consents, waivers, and

ratifications in respect thereof and otherwise act with respect thereto as through it were the outright owner thereof, (ii) require each

grantor to make the collateral available to the collateral agent, and (iii) sell, lease, license, or dispose of the Collateral.

The

Company believes that this notice of an Event of Default from 3i is in response to the Company’s lawsuit filed in the United States

District Court for the District of Delaware alleging that 3i engaged in an unlawful securities transaction with the Company as an unregistered

dealer under U.S. securities laws. 3i is considered a “dealer” within the meaning set forth in Section 3(a)(5)(A) the Securities

Exchange Act of 1934 (“Exchange Act”) and, therefore, violated Section 15(a) by engaging in interstate securities transactions

with the Company absent effective dealer registration. Because of 3i’s violations of Section 15(a) of the Exchange Act, the Company

is seeking to have certain contracts between it and 3i declared void and transactions effectuated thereunder rescinded pursuant to Section

29(b) of the Exchange Act. Please see our Current Report on Form 8-K as filed with the SEC on February 20, 2024.

Item

3.02 Unregistered Sales of Equity Securities.

As

previously reported on our Current Report on Form 8-K filed on November 27, 2023, Gaucho Group Holdings, Inc. (the “Company”)

commenced a private placement of shares of common stock for gross proceeds of up to $4,000,000 at a price per share which equals the

Nasdaq Rule 5653(d) Minimum Price definition, but in no event at a price per share lower than $0.60 (the “Private Placement”).

On

March 1, 2024, pursuant to the Private Placement, the Company issued a total of 400,000 shares of common stock for gross proceeds of

$240,000 at $0.60 per share.

As

announced in our Current Report on Form 8-K filed with the SEC on March 1, 2024, on February 29, 2024, the stockholders of the Company

approved, for purposes of Nasdaq Rule 5635(d), the full issuance of shares of our common stock to be issued in a private placement of

common stock for gross proceeds of up to $7.2 million pursuant to Rule 506(b) of the Securities Act of 1933, as amended (the “Securities

Act”).

Each

investor in the Private Placement has certain anti-dilution protections for a period of 18 months following each closing of the Private

Placement. If, during the 18-month period following each closing of the Offering, the Company issues or sells any shares of common stock

of the Company (a “Dilutive Issuance”), then each participant in the Offering will automatically be issued such number of

shares of common stock as is necessary to maintain the percentage ownership that such participant would have had if the Dilutive Issuance

had not occurred. With respect to the issuance of any securities to 3i pursuant to the Securities Purchase Agreement dated February 21,

2023 and the Convertible Promissory Note dated February 21, 2023 as a result of Dilutive Issuances, the participant shall not be entitled

to any additional Dilutive Issuances beyond the initial Dilutive Issuance. Further, at such time that the participant disposes of its

shares acquired in the Private Placement, all rights to any Dilutive Issuance shall cease.

The

Private Placement is conducted pursuant to Section 4(a)(2) of the Securities Act and/or Rule 506(b) of Regulation D promulgated under

the Securities Act. The shares are only offered to a small select group of accredited investors, as defined in Rule 501 of Regulation

D, all of whom have a substantial pre-existing relationship with the Company. The Company filed a Form D on December 15, 2023, amended

on January 11, 2024, and amended on February 12, 2024.

This

current report on Form 8-K is issued in accordance with Rule 135c under the Securities Act, and is neither an offer to sell any securities,

nor a solicitation of an offer to buy, nor shall there be any sale of any such securities in any state or jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such state or jurisdiction.

Item

7.01 Regulation FD Disclosure.

The

information set forth in Item 2.04 of this Current Report on Form 8-K is incorporated herein by reference into this Item 7.01 in its

entirety.

The

information furnished with this Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934 (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, regardless

of any general incorporation language in such filing.

Item

8.01 Other Events.

On

March 5, 2024, Gaucho Group Holdings, Inc. issued a press release regarding the launch of the newly revised website for its subsidiary,

Algodon Wine Estates. The full text of the press release is furnished hereto as Exhibit 99.1 and incorporated herein by reference.

The

information furnished with this Item 8.01 and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section

18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in

any filing under the Securities Act or the Exchange Act, regardless of any general incorporation language in such filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized, on the 7th day of March 2024.

| |

Gaucho

Group Holdings, Inc. |

| |

|

|

| |

By: |

/s/

Scott L. Mathis |

| |

|

Scott

L. Mathis, President & CEO |

Exhibit

99.1

FOR

IMMEDIATE RELEASE

GAUCHO

GROUP HOLDINGS, INC. (NASDAQ:VINO) UNVEILS ENHANCED WEBSITE FOR ALGODON WINE ESTATES, INTEGRATING LUXURY REAL ESTATE SALES AND RESORT

BOOKINGS

Revamped

Portal Offers Effortless Access to Exclusive Homesites and Unforgettable Resort Stays

MIAMI,

FL / MARCH 05, 2024 / Gaucho Group Holdings, Inc. (NASDAQ:VINO), a company that includes a growing collection of e-commerce

platforms with a concentration on fine wines, luxury real estate, and leather goods and accessories (the “Company” or “Gaucho

Holdings”), today announced the launch of the newly revised website for its subsidiary, Algodon Wine Estates. Positioned as a premier

wine, wellness, culinary, and sport resort alongside a luxury residential development in San Rafael, Mendoza, Argentina, the website,

available at www.algodonwineestates.com, marks a significant milestone in the Company’s strategy to integrate its real estate

and hospitality offerings.

The

revamped Algodon Wine Estates website represents a strategic move to consolidate both the luxury real estate sales and resort experiences,

providing patrons with a seamless platform to explore and engage with both aspects of the business. Visitors can now effortlessly browse

exclusive homesites for sale while also booking unforgettable stays at the resort, all within a unified online environment.

Scott

Mathis, CEO, and Founder of Gaucho Group Holdings, commented, “We are thrilled to introduce the enhanced Algodon Wine Estates website,

which reflects our commitment to delivering unparalleled luxury experiences to our clientele. By integrating our real estate and resort

offerings into a cohesive online platform, we aim to elevate accessibility and engagement, further solidifying our position as a leading

destination for discerning travelers and investors alike.”

About

Gaucho Group Holdings, Inc.

For

more than ten years, Gaucho Group Holdings, Inc.’s (gauchoholdings.com) mission has been to source and develop opportunities

in Argentina’s undervalued luxury real estate and consumer marketplace. Our company has positioned itself to take advantage of

the continued and fast growth of global e-commerce across multiple market sectors, with the goal of becoming a leader in diversified

luxury goods and experiences in sought after lifestyle industries and retail landscapes. With a concentration on fine wines (algodonfinewines.com

& algodonwines.com.ar), hospitality (algodonhotels.com), and luxury real estate (algodonwineestates.com)

associated with our proprietary Algodon brand, as well as the leather goods, ready-to-wear and accessories of the fashion brand Gaucho

– Buenos Aires™ (gaucho.com), these are the luxury brands in which Argentina finds its contemporary expression.

Cautionary

Note Regarding Forward-Looking Statements

The

information discussed in this press release includes “forward looking statements” within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical facts,

included herein concerning, among other things, changes to exchange rates and their impact on the Company, planned capital expenditures,

future cash flows and borrowings, pursuit of potential acquisition opportunities, our financial position, business strategy and other

plans and objectives for future operations, are forward looking statements. Although we believe that the expectations reflected in these

forward-looking statements are reasonable, they do involve certain assumptions, risks and uncertainties and are not (and should not be

considered to be) guarantees of future performance. Refer to our risk factors set forth in our reports filed on Edgar. The Company disclaims

any obligation to update any forward-looking statement made here.

Media

Relations:

Gaucho

Group Holdings, Inc.

Rick

Stear

Director

of Marketing

212.739.7669

rstear@gauchoholdings.com

v3.24.0.1

Cover

|

Mar. 01, 2024 |

| Entity Addresses [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 01, 2024

|

| Entity File Number |

001-40075

|

| Entity Registrant Name |

Gaucho

Group Holdings, Inc.

|

| Entity Central Index Key |

0001559998

|

| Entity Tax Identification Number |

52-2158952

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

112

NE 41st Street

|

| Entity Address, Address Line Two |

Suite 106

|

| Entity Address, City or Town |

Miami

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33137

|

| City Area Code |

212

|

| Local Phone Number |

739-7700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock

|

| Trading Symbol |

VINO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Former Address [Member] |

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

FL 33137

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

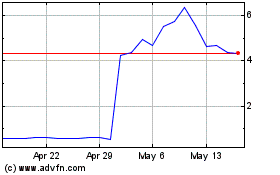

Gaucho (NASDAQ:VINO)

Historical Stock Chart

From Apr 2024 to May 2024

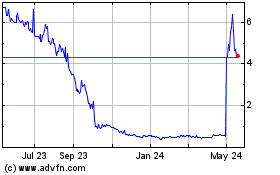

Gaucho (NASDAQ:VINO)

Historical Stock Chart

From May 2023 to May 2024