Filed Pursuant to Rule 424(b)(7)

Registration No. 333-265636

Prospectus supplement

(To Prospectus dated June 15, 2022)

EXPLANATORY NOTE

This prospectus supplement is being filed solely to amend the information in our prospectus supplement filed pursuant to Rule 424(b)(7) on March 1, 2024 (SEC Accession No. 0001603923-24-000065) to the Registration Statement on Form S-3 (File No. 333-265636) contained under the heading "Experts" to provide an updated description of the reports of KPMG LLP.

844,702 ordinary shares

Weatherford International plc

Ordinary Shares

This prospectus supplement relates to the resale from time to time of up to 844,702 ordinary shares of Weatherford International plc, nominal value $0.001 per share (“Ordinary Shares”), by the selling shareholders identified in this prospectus supplement in one or more offerings. We are not selling any Ordinary Shares pursuant to this prospectus supplement and will not receive any proceeds from the sale of shares offered by the selling shareholders.

The selling shareholders or any of their successors may sell Ordinary Shares directly or alternatively through underwriters, broker-dealers or agents they select and in one or more public or private transactions at market prices prevailing at the time of sale, at fixed prices, at negotiated prices, at various prices determined at the time of sale or at prices related to prevailing market prices, as further described herein. If the shares are sold through underwriters, broker-dealers or agents, the selling shareholders or purchasers of the shares will be responsible for underwriting discounts or commissions and broker-dealers’ or agents’ commissions. The timing and amount of any sale is within the sole discretion of the selling shareholders, subject to certain restrictions. For more information regarding the sales of shares by the selling shareholders pursuant to this prospectus supplement, please read “Plan of Distribution”.

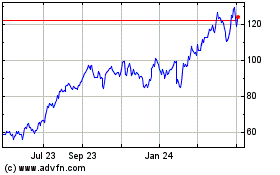

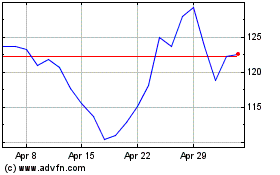

Our Ordinary Shares are traded on the Nasdaq Global Select Market (“Nasdaq”) under the symbol “WFRD”.

Investing in our securities involves risks. You should carefully read and consider the “Risk Factors” section on page S-6 of this prospectus supplement, as well as the other information contained in or incorporated by reference in this prospectus supplement and the accompanying prospectus, before investing in our Ordinary Shares. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus are truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus supplement dated March 1, 2024.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

Neither we nor the selling shareholders have authorized anyone to provide any information other than that contained or incorporated by reference in this prospectus supplement, the accompanying prospectus or in any free writing prospectus prepared by or on behalf of us or the selling shareholders or to which we have referred you. Neither we nor the selling shareholders take responsibility for, or can provide assurance as to the reliability of, any other information that others may give you. This prospectus supplement and the accompanying prospectus is an offer to sell only the Ordinary Shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus supplement, the accompanying prospectus, any free writing prospectus or any document incorporated by reference herein or therein is current only as of its date. Our business, financial condition, results of operations and prospects may have changed since that date.

ABOUT THIS PROSPECTUS SUPPLEMENT

This document consists of two parts. The first part is this prospectus supplement, which describes the specific terms of the offering. The second part is the accompanying prospectus, which describes more general information, some of which may not apply to the offering. You should read both this prospectus supplement and the accompanying prospectus, together with additional information described under the headings “Where You Can Find More Information” and “Incorporation by Reference” in this prospectus supplement. To the extent there is a conflict between the information contained in this prospectus supplement and the information contained in the accompanying prospectus or the information contained in any document incorporated by reference herein or therein, you should rely on the information in this prospectus supplement. In addition, any statement in a filing we make with the Securities and Exchange Commission (the “SEC”) that adds to, updates or changes information contained in an earlier filing we made with the SEC shall be deemed to modify and supersede such information in the earlier filing.

Except as otherwise indicated or required by the context, references in this prospectus supplement to “Weatherford,” “we,” “our,” “us” and “Company” refer to Weatherford International plc, an Irish public limited company, together with its consolidated subsidiaries.

This prospectus supplement and the accompanying prospectus dated June 15, 2022 are part of the Registration Statement (Registration No. 333-265636) that we filed with the SEC on June 15, 2022, using an automatic “shelf” registration process. This prospectus supplement relates to the offering and sale of Ordinary Shares by the selling shareholders from time to time.

Important Notice - European Economic Area

This prospectus is not, and is not intended to be, a prospectus for the purposes of Regulation (EU) 2017/1129 of the European Parliament and of the Council of June 14, 2017 on the prospectus to be published when securities are offered to the public or admitted to trading on a regulated market, as amended (the “EU Prospectus Regulation”), the European Union (Prospectus) Regulations 2019 of Ireland or any other legislation, regulations or rules of Ireland or any other member state of the European Economic Area (“EEA”) implementing or supplementing the EU Prospectus Regulation, and has not been, nor will it be, reviewed or approved by the Central Bank of Ireland or by any other competent or supervisory authority of any other member state of the EEA for the purposes of the EU Prospectus Regulation.

The Ordinary Shares are not intended to be offered, sold (including on a subsequent resale) or otherwise made available and should not be offered, sold (including on a subsequent resale) or otherwise made available to any person or entity in any member state of the EEA, other than (i) to persons or entities which are “qualified investors” for the purposes of the EU Prospectus Regulation (“EEA Qualified Investors”), (ii) for a total consideration of not less than €100,000 (or $ equivalent thereof) per investor and/or (iii) in any other circumstance set out in Article 1(4)(a)-(d) of the EU Prospectus Regulation. The Company has not authorized, nor does it authorize, the offering or sale (including any subsequent re-sale) of any Ordinary Shares to persons or entities in any member state of the EEA, including through financial intermediaries, in any circumstances that might obligate the Company to publish a prospectus pursuant to the EU Prospectus Regulation.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements made in this prospectus supplement and the accompanying prospectus and the documents incorporated herein and therein by reference and in other written or oral statements made by us or on our behalf are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 (“PSLRA”). These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “budget,” “strategy,” “plan,” “guidance,” “outlook,” “may,” “should,” “could,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions, although not all forward-looking statements contain these identifying words. In particular, these include statements relating to future financial performance and results, business strategy, plans, goals and objectives, including certain projections, business trends and other statements that are not historical facts. We claim the protection afforded by the safe harbor for forward-looking statements provided by the PSLRA.

Forward-looking statements reflect our beliefs and expectations based on current estimates and projections. While we believe these expectations, and the estimates and projections on which they are based, are reasonable and were made in good faith, these statements are subject to numerous risks and uncertainties. Accordingly, our actual outcomes and results may differ materially from what we have expressed or forecasted in the forward-looking statements. The forward-looking statements included herein are only made as of the date hereof, or if earlier, as of the date they were made, and we undertake no obligation to correct, update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except to the extent required under federal securities laws. The following, together with disclosures in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “2023 Form 10-K”), and to the extent applicable, other documents filed with the SEC, sets forth certain risks and uncertainties relating to our forward-looking statements that may cause actual results to be materially different from our present expectations or projections:

•global political, economic and market conditions, political disturbances, war, terrorist attacks, changes in global trade policies, weak local economic conditions and international currency fluctuations (including the military conflict between Russia and Ukraine (the “Russia Ukraine Conflict”);

•general global economic repercussions related to U.S. and global inflationary pressures and potential recessionary concerns;

•failure to ensure on-going compliance with current and future laws and government regulations, including but not limited to those related to the Russia Ukraine Conflict, and environmental and tax and accounting laws, rules and regulations;

•changes in, and the administration of, treaties, laws, and regulations, including in response to issues related to the Russia Ukraine Conflict such as nationalization of assets, and the potential for such issues to exacerbate other risks we face, including those related to the other risks and uncertainties listed or referenced;

•cybersecurity incidents, as our reliance on digital technologies increases, those digital technologies may become more vulnerable and/or experience a higher rate of cybersecurity attacks, intrusions or incidents in the current environment of remote connectivity, as well as increased geopolitical conflicts and tensions, including as a result of the Russia Ukraine Conflict;

•our ability to comply with, and respond to, climate change, environmental, social and governance and other “sustainability” initiatives and future legislative and regulatory measures both globally and in the specific geographic regions in which we and our customers operate;

•our ability to effectively and timely address the need to conduct our operations and provision of services to our customers more sustainably and with a lower carbon footprint;

•risks associated with disease outbreaks and other public health issues, including a pandemic, their impact on the global economy and the business of our company, customers, suppliers and other partners;

•further spread and potential for a resurgence of a pandemic in a given geographic region and related disruptions to our business, employees, customers, suppliers and other partners and additional regulatory measures or voluntary actions that may be put in place to limit the spread of a pandemic, including vaccination requirements and the associated availability of vaccines, restrictions on business operations or social distancing requirements, and the duration and efficacy of such restrictions;

•the price and price volatility of, and demand for, oil, natural gas and natural gas liquids;

•member-country quota compliance within the Organization of Petroleum Exporting Countries;

•our ability to realize expected revenues and profitability levels from current and future contracts;

•our ability to generate cash flow from operations to fund our operations;

•our ability to effectively and timely adapt our technology portfolio, products and services to address and participate in changes to the market demands for the transition to alternate sources of energy such as geothermal, carbon capture and responsible abandonment, including our digitalization efforts;

•increases in the prices and lack of availability of our procured products and services;

•our ability to timely collect from customers;

•our ability to realize cost savings and business enhancements from our revenue and cost improvement efforts;

•our ability to attract, motivate and retain employees, including key personnel;

•our ability to access to capital markets on terms that are commercially acceptable to the Company;

•our ability to manage our workforce, supply chain challenges and disruptions, business processes, information technology systems and technological innovation and commercialization, including the impact of our organization restructure, business enhancements, improvement efforts and the cost and support reduction plans;

•our ability to service our debt obligations;

•potential non-cash asset impairment charges for long-lived assets, intangible assets or other assets; and

•adverse weather conditions in certain regions of our operations.

Many of these factors are macro-economic in nature and are, therefore, beyond our control. Should one or more of these risks or uncertainties materialize, affect us in ways or to an extent that we currently do not expect or consider to be significant, or should underlying assumptions prove incorrect, our actual results, performance or achievements may vary materially from those described in this report as anticipated, believed, estimated, expected, intended, planned or projected.

Finally, our future results will depend upon various other risks and uncertainties, including, but not limited to, those detailed in our current and past filings with the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and the Securities Act of 1933, as amended (the “Securities Act”).

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the information and reporting requirements of the Exchange Act, and, accordingly, file annual, quarterly and periodic reports, proxy statements and other information with the SEC. Our SEC filings, including our registration statement on Form S-3, are available to you, free of charge, on the SEC’s website at www.sec.gov. Our SEC filings will also be available on our website at www.weatherford.com. The information contained on or linked to or from our website is not incorporated by reference into this prospectus supplement, the accompanying prospectus or the registration statement of which they form a part.

We have filed with the SEC an automatic shelf registration statement on Form S-3, including exhibits filed with the registration statement of which this prospectus supplement is a part, under the Securities Act, with respect to the Ordinary Shares offered hereby. This prospectus supplement and the accompanying prospectus do not contain all of the information set forth in the registration statement and exhibits to the registration statement. For further information with respect to our Company and the Ordinary Shares offered hereby, reference is made to the registration statement, including the exhibits to the registration statement. Statements contained in this prospectus supplement and the accompanying prospectus as to the contents of any contract or other document referred to in this prospectus supplement and the accompanying prospectus are not necessarily complete and, where that contract is an exhibit to the registration statement, each statement is qualified in all respects by the exhibit to which the reference relates. Copies of the registration statement, including the exhibits to the registration statement, may be reviewed through the SEC’s website, as described above.

INCORPORATION BY REFERENCE

This prospectus supplement is part of an automatic shelf registration statement on Form S-3 filed with the SEC. This prospectus supplement does not contain all of the information included in the registration statement, certain parts of which are omitted in accordance with the rules and regulations of the SEC.

The SEC allows us to “incorporate by reference” certain information into this prospectus supplement from certain documents that we filed with the SEC prior to the date of this prospectus supplement. By incorporating by reference, we are disclosing important information to you by referring you to documents we have filed separately with the SEC. The information incorporated by reference is deemed to be part of this prospectus supplement and the accompanying prospectus, except for information incorporated by reference that is modified or superseded by information contained in this prospectus supplement or the accompanying prospectus or in any other subsequently filed document that also is incorporated by reference herein. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to be part of this prospectus supplement and the accompanying prospectus. These documents contain important information about us, our business and our financial performance.

We also specifically incorporate by reference any documents filed by us with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date we file this prospectus supplement and prior to the termination of the offering of securities covered by this prospectus supplement, except for any document or portion thereof deemed to be “furnished” and not filed in accordance with SEC rules. The information relating to us contained in this prospectus supplement does not purport to be comprehensive and should be read together with the information contained in the documents incorporated or deemed to be incorporated by reference herein.

If you request, either orally or in writing, we will provide you with a copy of any or all documents that are incorporated by reference herein. Such documents will be provided to you free of charge, but will not contain any exhibits, unless those exhibits are incorporated by reference into the document. Requests can be made by writing to our U.S. Investor Relations Department at Weatherford International plc, Attention: Investor Relations, 2000 St. James Place, Houston, Texas 77056 or by phone at (713) 836-4000. The documents may also be accessed on our website at www.weatherford.com. Information contained on our website is not incorporated by reference into this prospectus supplement, the accompanying prospectus or the registration statement of which they form a part.

SUMMARY

This summary is not complete and does not contain all of the information that you should consider before investing in our Ordinary Shares. You should read carefully this entire prospectus supplement and the accompanying prospectus, including the information incorporated by reference from our 2023 Form 10-K and the other incorporated documents, including in particular the section entitled “Risk Factors” of this prospectus supplement and in such incorporated documents, as well as our consolidated financial statements, incorporated by reference in this prospectus supplement and the accompanying prospectus, before making any investment decision.

Company Overview

Weatherford is a leading global energy services company providing equipment and services used in the drilling, evaluation, well construction, completion, production, intervention and responsible abandonment of wells in the oil and natural gas exploration and production industry as well as new energy platforms.

We conduct business in approximately 75 countries, answering the challenges of the energy industry with 335 operating locations including manufacturing, research and development, service, and training facilities. Our operational performance is reviewed and managed across the life cycle of the wellbore, and we report in three segments (1) Drilling and Evaluation, (2) Well Construction and Completions, and (3) Production and Intervention.

General Corporate Information

Weatherford is incorporated in Ireland and is the ultimate parent company of the Weatherford group of companies. Our principal executive offices are located at 2000 St. James Place, Houston, Texas and our telephone number is (713) 836-4000 and our website is www.weatherford.com.

RISK FACTORS

An investment in Ordinary Shares involves a high degree of risk. You should carefully consider all of the information contained in, or incorporated by reference into, this prospectus supplement and the accompanying prospectus, including the risk factors incorporated by reference in this prospectus supplement from our 2023 Form 10-K under the heading “Risk Factors” and the audited annual financial statements and notes thereto, as updated by our subsequent filings under the Exchange Act, before purchasing Ordinary Shares. See “Where You Can Find More Information” for information about how to obtain a copy of these documents. If any of those risks are realized, our business, financial condition, operating results and prospects could be materially and adversely affected. In that event, the price of Ordinary Shares could decline, and you could lose part or all of your investment.

USE OF PROCEEDS

All of the Ordinary Shares offered by this prospectus supplement will be sold by the selling shareholders. We will not receive any cash proceeds from any resale of Ordinary Shares by the selling shareholders.

SELLING SHAREHOLDERS

Up to 844,702 Ordinary Shares are being offered by this prospectus, all of which are being offered for resale for the account of the selling shareholders. The Ordinary Shares being offered by the selling shareholders were issued, or will be issued, as the case may be, in private placements in connection with our acquisition of ISI Holding Company, LLC (“ISI”) and Probe Technologies Holdings, Inc. (“Probe”) pursuant to those certain merger agreements, dated as of February 1, 2024, by and among the Company, ISI and Probe, respectively, and Turnbridge Capital Management, LLC, as sellers’ representative (collectively, the “Merger Agreements”), and pursuant to those certain transaction bonus letter agreements, by and between the Company and certain of the selling shareholders (the “Transaction Bonus Agreements”), collectively with the Merger Agreements, the “Transaction Documents”). The 844,702 Ordinary Shares issued pursuant to the Transaction Documents represent a portion of the base purchase price payable pursuant to the Merger Agreements, as well as shares issuable in connection with certain legacy change of control arrangements of Probe, as set forth in the Transaction Bonus Agreements.

Pursuant to the Transaction Documents, we are obligated to prepare and file a registration statement, or a prospectus supplement to an existing registration statement, to permit the resale from time to time as permitted by Rule 415 promulgated under the Securities Act, of Ordinary Shares acquired by the selling shareholders pursuant to the Transaction Documents. Accordingly, this prospectus supplement is being filed to register the resale of the Ordinary Shares described herein. We have agreed to use reasonable best efforts to maintain the effectiveness of the registration statement until all such Ordinary Shares have been sold or may be sold pursuant to Rule 144 without regard to volume or manner of sale limitations, public information requirements or notice of sale requirements.

As of the date of this prospectus supplement the distribution and sale of the Ordinary Shares are subject to “lock-up” restrictions, which expire on March 2, 2024. In addition, certain affiliates of Turnbridge Capital Management, LLC will be subject to “leak-out” restrictions pursuant to which distributions and sales by such affiliates will be limited to 20% of the aggregate number of Ordinary Shares received pursuant to the Merger Agreements during each successive calendar week following the expiration of the lock-up period.

The table below sets forth, as of the date of this prospectus, the name of each selling shareholder for whom we are registering shares for resale to the public, and the number of Ordinary Shares that each selling shareholder may offer pursuant to this prospectus. We have prepared this information and the following table based on information given to us by, or on behalf of, the selling shareholders on or before the date of this prospectus. We have not independently verified this information. Information about the selling shareholders may change over time. As used in this prospectus, unless otherwise noted or the context otherwise requires, the term “selling shareholders” includes the selling shareholders listed below and their respective transferees, pledgees, assignees, distributees, beneficiaries, donees and successors-in-interest and any other person named as a selling shareholder in any applicable prospectus supplement. We may amend or supplement this prospectus from time to time in the future to update or change information about the selling shareholders to identify any transferees, pledgees, assignees, distributees, beneficiaries, donees and successors-in-interest of Ordinary Shares. The registration of Ordinary Shares does not necessarily mean that the selling shareholders will sell all or any of the Ordinary Shares pursuant to this prospectus. In addition, the selling shareholders may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose of, at any time and from time to time, Ordinary Shares in transactions exempt from the registration requirements of the Securities Act after the date on which the selling shareholders provided the information set forth on the table below. To our knowledge, except as indicated in the footnotes to this table, the selling shareholders listed below have sole voting and investment power with respect to the indicated Ordinary Shares.

| | | | | | | | | | | | | | | | | |

| Ordinary Shares Beneficially Owned Prior to this Offering | | Ordinary Shares Beneficially Owned After this Offering(1) |

Name of Beneficial Owner | Number of Shares | Percentage of Class Beneficially Owned(2) | Total Number of Shares Being Registered | Number of Shares | Percentage of Class Beneficially Owned(2) |

TCP Impact Blocker, Inc.(3) | 69,828 | * | 69,828 | 0 | * |

Turnbridge Network Investors I, L.P.(4) | 14,695 | * | 14,695 | 0 | * |

Turnbridge Capital Partners I, L.P.(4) | 395,792 | * | 395,792 | 0 | * |

Turnbridge Capital Partners I-A, L.P. (4) | 20,963 | * | 20,963 | 0 | * |

TCP Probe CIV, L.P.(4) | 15,050 | * | 15,050 | 0 | * |

| Gary Cresswell | 7,883 | * | 7,883 | 0 | * |

| David Lane | 91,811 | * | 91,811 | 0 | * |

August Scherer(5) | 15,864 | * | 15,864 | 0 | * |

Jeffrey Kimberly(5) | 39,078 | * | 39,078 | 0 | * |

| James Massey | 4,934 | * | 4,933 | 1 | * |

John Charles Hall(5) | 38,343 | * | 38,343 | 0 | * |

Jason Allen Hradecky(5) | 38,365 | * | 38,365 | 0 | * |

Stephen A. Smith(5) | 15,187 | * | 15,187 | 0 | * |

Christopher Morgan(5) | 2,107 | * | 2,107 | 0 | * |

Alistair Inglis(5) | 2,268 | * | 2,268 | 0 | * |

| Adam Shuttleworth | 1,433 | * | 1,433 | 0 | * |

Melaina Frederick(5) | 795 | * | 795 | 0 | * |

Glenn Neblett(6) | 19,938 | * | 19,938 | 0 | * |

Victor Clark(5) | 18,210 | * | 18,210 | 0 | * |

Martin Barratt(5) | 3,474 | * | 3,474 | 0 | * |

Bulent Finci(5) | 3,474 | * | 3,474 | 0 | * |

Dallas Middlebrooks(5) | 3,474 | * | 3,474 | 0 | * |

| Kevin Gerland | 2,177 | * | 2,177 | 0 | * |

| Federico A. Casavantes Jr. | 11,141 | * | 11,141 | 0 | * |

Dodger Enterprises (5) (7) | 4,378 | * | 4,378 | 0 | * |

Archdog Enterprises(5) (8) | 821 | * | 821 | 0 | * |

South Forty Investment Group, LLC(5) (9) | 176 | * | 176 | 0 | * |

Cresswell Investments, LLC(10) | 3,044 | * | 3,044 | 0 | * |

* Represents less than 1%.

(1)Assumes that each selling shareholder will resell all of the Ordinary Shares offered hereunder.

(2)Based on 72,319,168 Ordinary Shares outstanding as of February 26, 2024.

(3)TCP Impact Blocker, Inc. is a wholly owned subsidiary of Turnbridge Capital Partners I-A, L.P. Todd M. Tomlin is the President of TCP Impact Blocker Inc and may be deemed to have sole voting and investment power with respect to the shares held by TCP Impact Blocker, Inc. Turnbridge Capital GP I, LLC is the general partner of Turnbridge Capital Partners I-A, L.P., and J. Kent Sweezey, John Clarke, C. Mitchell Cox and Robert Horton are the members of Turnbridge Capital GP I, LLC. Each of these individuals disclaims beneficial ownership of the securities.

(4)Turnbridge Capital GP I, LLC is the general partner of Turnbridge Network Investors I, L.P., Turnbridge Capital Partners I, L.P., Turnbridge Capital Partners I-A, L.P., and TCP Probe CIV, L.P. J. Kent Sweezey, John Clarke, C. Mitchell Cox and Robert Horton are the members of Turnbridge Capital GP I, LLC and have shared voting and investment power with respect to the shares held by Turnbridge Network Investors I, L.P., Turnbridge Capital Partners I, L.P., Turnbridge Capital Partners I-A, L.P., and TCP Probe CIV, L.P., respectively. Each of these individuals disclaims beneficial ownership of the securities.

(5)Certain selling shareholders are legacy employees or consultants to ISI and Probe, and following the Closing may continue to provide services to ISI or Probe, respectively.

(6)Glenn Neblett is an affiliate of Texas Capital Securities, a registered broker-dealer. Mr. Neblett has represented that he acquired the Ordinary Shares in the ordinary course of business and for his own account, with no intention of distributing any of such Ordinary Shares or any arrangement or understanding with any other persons regarding the distribution of such Ordinary Shares.

(7)Lane Roberts has sole voting and investment power with respect to the shares held by Dodger Enterprises.

(8)Martin Barratt has sole voting and investment power with respect to the shares held by Archdog Enterprises.

(9)August Scherer has sole voting and investment power with respect to the shares held by South Forty Investment Group, LLC.

(10)Gary Cresswell and Sharon Cresswell have shared voting and investment power with respect to the shares held by Cresswell Investments, LLC.

PLAN OF DISTRIBUTION

The selling shareholders, including their transferees, pledgees, assignees, distributees, beneficiaries, donees and successors-in-interest, may from time to time offer some or all of the Ordinary Shares.

The selling shareholders will not pay any of the costs, expenses and fees in connection with the registration and sale of the Ordinary Shares covered by this prospectus supplement, but will be required to pay any and all underwriting discounts, selling commissions and share transfer taxes, if any, attributable to sales of the Ordinary Shares. We will not receive any proceeds from the sale of Ordinary Shares covered hereby.

The selling shareholders may sell the Ordinary Shares covered by this prospectus supplement from time to time, and may also decide not to sell all or any of the Ordinary Shares that it is allowed to sell under this prospectus supplement. The selling shareholders will act independently of us in making decisions regarding the timing, manner and size of each sale. These dispositions may be at fixed prices, at market prices prevailing at the time of sale, at prices related to such prevailing market prices, at varying prices determined at the time of sale, or at privately negotiated prices.

The selling shareholders may use any one or more of the following methods when selling shares:

•through underwriters, brokers or dealers or agents for resale to the public or to institutional investors at various times;

•in one or more underwritten offerings on a firm commitment or best efforts basis;

•through negotiated transactions, including, but not limited to, block trades in which the broker or dealer so engaged will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

•through brokers or dealers, who may act as agents or principals;

•on any national securities exchange or quotation service on which the shares may be listed or quoted at the time of sale at market prices prevailing at the time of sale, at prices related to such prevailing market prices, or at negotiated prices;

•sales in the over-the-counter market;

•in private transactions other than exchange or quotation service transactions;

•through short sales, purchases or sales of put, call or other types of options, forward delivery contracts, swaps, offerings of structured equity-linked securities or other derivative transactions or securities;

•through the writing or settlement of options or other hedging transactions, whether or not the options are listed on an options exchange;

•through offerings of securities exercisable, convertible or exchangeable for shares, including, without limitation, securities issued by trusts, investment companies or other entities;

•through offerings directly to one or more purchasers, including institutional investors;

•through distributions or transfers to their respective members, partners or shareholders;

•through ordinary brokerage transactions and transactions in which a broker solicits purchasers;

•in “at the market” offerings as defined in Rule 415 under the Securities Act, at negotiated prices, at prices prevailing at the time of sale or at prices related to such prevailing market prices, including sales made directly on a national securities exchange or sales made through a market maker other than on an exchange or other similar offerings through sales agents;

•through a combination of any such methods of sale; or

•through any other method permitted under applicable law.

The selling shareholders may also resell all or a portion of its Ordinary Shares in open market transactions in reliance upon Rule 144 under the Securities Act, provided it meets the criteria and conforms to the requirements of Rule 144 and all applicable laws and regulations.

The selling shareholders may, from time to time, pledge or grant a security interest in some or all of the Ordinary Shares and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the Ordinary Shares, from time to time, under this prospectus or under an amendment or supplement to this prospectus amending the list of selling shareholders to include the pledgees, transferees or other successors in interest as selling shareholders under this prospectus. The selling shareholders also may transfer the Ordinary Shares in other circumstances, in which case the transferees, pledgees, assignees, distributees, beneficiaries, donees and successors-in-interest will be the selling beneficial owners for purposes of this prospectus.

The selling shareholders may enter into sale, forward sale and derivative transactions with third parties, or may sell securities not covered by this prospectus supplement to third parties in privately negotiated transactions. In connection with those sale, forward sale or derivative transactions, the third parties may sell securities covered by this prospectus supplement, including in short sale transactions and by issuing securities that are not covered by this prospectus supplement but are exchangeable for or represent beneficial interests in the ordinary shares. The third parties also may use shares received under those sale, forward sale or derivative arrangements or shares pledged by the selling shareholders or borrowed from the selling shareholders or others to settle such third-party sales or to close out any related open borrowings of ordinary shares. The third parties may deliver this prospectus supplement in connection with any such transactions. Any third party in such sale transactions will be an underwriter and will be identified in a supplement or a post-effective amendment to the registration statement of which this prospectus supplement is a part as may be required.

In addition, the selling shareholders may engage in hedging transactions with broker-dealers in connection with distributions of Ordinary Shares or otherwise. In those transactions, broker-dealers may engage in short sales of securities in the course of hedging the positions they assume with the selling shareholders. The selling shareholders may also sell securities short and redeliver securities to close out such short positions. The selling shareholders may also enter into option or other transactions with broker-dealers which require the delivery of securities to the broker-dealer. The broker-dealer may then resell or otherwise transfer such securities pursuant to this prospectus supplement. The selling shareholders also may loan or pledge shares, and the borrower or pledgee may sell or otherwise transfer the Ordinary Shares so loaned or pledged pursuant to this prospectus supplement. Such borrower or pledgee also may transfer those Ordinary Shares to investors in our securities or the selling shareholders’ securities or in connection with the offering of other securities not covered by this prospectus supplement.

Pursuant to the Transaction Documents, the selling shareholders are subject certain “lock-up” restrictions that prohibit the sale, pledge, hedge or other disposal, directly or indirectly, of the Ordinary Shares received pursuant to the Transaction Documents for a period of 30 days following the Closing (as defined in the Merger Agreements), which is March 2, 2024. These restrictions do not apply to distributions to general or limited partners, members, stockholders, affiliates, or wholly-owned subsidiaries of any selling shareholder, or any investment fund or other entity controlled or managed by such selling shareholder in compliance with applicable securities laws. In addition, certain affiliates of Turnbridge Capital Management, LLC will be subject to “leak-out” restrictions pursuant to which distributions and sales by such affiliates will be limited to 20% of the aggregate number of Ordinary Shares received pursuant to the Transaction Documents during each successive calendar week following the expiration of the lock-up period.

To the extent necessary, the specific terms of the offering of Ordinary Shares, including the specific Ordinary Shares to be sold, the respective purchase prices and public offering prices, the names of any underwriter, broker-dealer or agent, if any, and any applicable compensation in the form of discounts, concessions or commissions paid to underwriters or agents or paid or allowed to dealers will be set forth in a supplement to this prospectus supplement or a post-effective amendment to this registration statement of which this prospectus supplement forms a part. The selling shareholders may, or may authorize underwriters, dealers and agents to, solicit offers from specified institutions to purchase Ordinary Shares from the selling shareholders at the public offering price listed in the applicable prospectus supplement. These sales may be made under “delayed delivery contracts” or other purchase contracts that provide for payment and delivery on a specified future date. Any contracts like this will be described in and be subject to the conditions set forth in a supplement to this prospectus supplement or a post-effective amendment to this registration statement of which this prospectus supplement forms a part.

Broker-dealers or agents may receive compensation in the form of commissions, discounts or concessions from the selling shareholders. Broker-dealers or agents may also receive compensation from the purchasers of Ordinary Shares for whom they act as agents or to whom they sell as principals, or both. Compensation as to a particular broker-dealer might be in excess of customary commissions and will be in amounts to be negotiated in connection with transactions involving securities. In effecting sales, broker-dealers engaged by the selling shareholders may arrange for other broker-dealers to participate in the resales.

In connection with sales of Ordinary Shares covered hereby, the selling shareholders and any underwriter, broker-dealer or agent, any other participating broker-dealer that executes sales for the selling shareholders may be deemed to be an “underwriter” within the meaning of the Securities Act. Accordingly, any profits realized by the selling shareholders and any compensation earned by such underwriter, broker-dealer or agent may be deemed to be underwriting discounts and commissions. If any selling

shareholder is an “underwriter” under the Securities Act, it must deliver this prospectus supplement and the accompanying prospectus in the manner required by the Securities Act.

We or the selling shareholders may agree to indemnify any underwriters, broker-dealers and agents against or contribute to any payments the underwriters, broker-dealers or agents may be required to make with respect to, civil liabilities, including liabilities under the Securities Act. Underwriters, broker-dealers and agents and their affiliates are permitted to be customers of, engage in transactions with, or perform services for us and our affiliates or the selling shareholders or its affiliates in the ordinary course of business.

In order to comply with applicable securities laws of some states or countries, the Ordinary Shares may only be sold in those jurisdictions through registered or licensed brokers or dealers and in compliance with applicable laws and regulations. In addition, in certain states or countries the Ordinary Shares may not be sold unless they have been registered or qualified for sale in the applicable state or country or an exemption from the registration or qualification requirements is available. Any Ordinary Shares covered by this prospectus supplement that qualify for sale pursuant to Rule 144 under the Securities Act may be sold in open market transactions under Rule 144 rather than pursuant to this prospectus supplement.

In connection with an offering of Ordinary Shares under this prospectus supplement, the underwriters may purchase and sell securities in the open market. These transactions may include short sales, stabilizing transactions and purchases to cover positions created by short sales. Short sales involve the sale by the underwriters of a greater number of securities than they are required to purchase in an offering. Stabilizing transactions consist of certain bids or purchases made for the purpose of preventing or retarding a decline in the market price of the securities while an offering is in progress.

The underwriters also may impose a penalty bid. This occurs when a particular underwriter repays to the underwriters a portion of the underwriting discount received by it because the underwriters have repurchased securities sold by or for the account of that underwriter in stabilizing or short-covering transactions.

These activities by the underwriters may stabilize, maintain or otherwise affect the market price of the Ordinary Shares offered under this prospectus supplement. As a result, the price of the Ordinary Shares may be higher than the price that otherwise might exist in the open market. If these activities are commenced, they may be discontinued by the underwriters at any time. These transactions may be effected on the New York Stock Exchange, the NASDAQ Stock Exchange or another securities exchange or automated quotation system, or in the over-the-counter market or otherwise.

Important Notice - European Economic Area

Pursuant to the EU Prospectus Regulation, securities may only be offered or sold (including on a subsequent resale) to the public in the EEA after prior publication of a prospectus prepared in accordance with the EU Prospectus Regulation and which has been approved by a competent authority of a member state of the EEA, save in circumstances where an exemption from the obligation to publish a prospectus applies.

An “offer of securities to the public” is broadly defined in the EU Prospectus Regulation as a communication to persons in any form and by any means, presenting sufficient information on the terms of the offer and the securities to be offered, so as to enable an investor to decide to purchase or subscribe for those securities. This definition also applies to the placing of securities through financial intermediaries.

Exemptions to the obligation to publish a prospectus include the circumstances set out in Article 1(4)(a)-(d) of the EU Prospectus Regulation:

(a) an offer of securities to EEA Qualified Investors;

(b) an offer of securities addressed to fewer than 150 natural or legal persons per member state of the EEA, other than EEA Qualified Investors;

(c) an offer of securities whose denomination per unit amounts to at least €100 000 (or $ equivalent thereof); and/or

(d) an offer of securities addressed to investors who acquire securities for a total consideration of at least €100 000 (or $ equivalent thereof) per investor, for each separate offer.

This prospectus is not, and is not intended to be, a prospectus for the purposes of the EU Prospectus Regulation, the European Union (Prospectus) Regulations 2019 of Ireland or any other legislation, regulations or rules of Ireland or any other member state of the EEA implementing or supplementing the EU Prospectus Regulation, and has not been, nor will it be, reviewed or approved by the Central Bank of Ireland or by any other competent or supervisory authority of any other member state of the EEA for the purposes of the EU Prospectus Regulation.

The Ordinary Shares are not intended to be offered, sold (including on a subsequent resale) or otherwise made available and should not be offered, sold (including on a subsequent resale) or otherwise made available to any person or entity in any member state of the EEA, other than (i) to EEA Qualified Investors, (ii) for a total consideration of not less than €100,000 (or $ equivalent

thereof) per investor and/or (iii) in any other circumstance set out in Article 1(4)(a)-(d) of the EU Prospectus Regulation. Any offer or sale (including a subsequent resale) of Ordinary Shares, including securities which were previously the subject of one or more of the types of exemption set out in Article 1(4)(a)-(d) of the EU Prospectus Regulation, would be considered as a separate offer for the purpose of determining whether that offer, sale or resale is an offer of securities to the public and may give rise to an obligation on the part of the seller to publish a prospectus pursuant to the EU Prospectus Regulation unless a relevant exemption applies.

The Company has not authorized, nor does it authorize, the offering or sale (including any subsequent re-sale) of any Ordinary Shares to persons or entities in any member state of the EEA, including through financial intermediaries, in any circumstances that might obligate the Company to publish a prospectus pursuant to the EU Prospectus Regulation.

LEGAL MATTERS

The validity of the Ordinary Shares offered hereby has been passed upon for us by our special Irish counsel, Matheson LLP.

EXPERTS

The consolidated financial statements of Weatherford International plc and subsidiaries as of December 31, 2023 and 2022, and for each of the years in the three-year period ended December 31, 2023, and management's assessment of the effectiveness of internal control over financial reporting as of December 31, 2023 have been incorporated by reference herein in reliance upon the reports of KPMG LLP, independent registered public accounting firm, incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing.

PROSPECTUS

Weatherford International plc

(an Irish public limited company)

Ordinary Shares

Options

Warrants

Share Purchase Contracts

Share Purchase Units

Guarantees of Debt Securities

| | | | | | | | | | | | | | | | | |

| Weatherford International Ltd. (a Bermuda exempted company) | | | Weatherford International, LLC (a Delaware limited liability company) | |

| Debt Securities

Guarantees of Debt Securities | | | Debt Securities

Guarantees of Debt Securities | |

Weatherford International plc, a public limited company organized under the laws of Ireland (“Weatherford Ireland”), Weatherford International Ltd., a Bermuda exempted company (“Weatherford Bermuda”), and Weatherford International, LLC, a Delaware limited liability company (“Weatherford Delaware”), may offer the above listed securities, together, separately or in any combination thereof, and sell from time to time in one or more offerings, at prices and on terms determined at the time of any such offering, to or through one or more underwriters, dealers and agents, or directly to purchasers, on a continuous or delayed basis.

This prospectus describes some of the general terms that may apply to these securities and the general manner in which they may be offered. The specific terms of any securities to be offered, and the specific manner in which they may be offered, will be described in a supplement to this prospectus. You should read this prospectus and the accompanying prospectus supplement carefully before you make any investment decision. This prospectus may not be used to consummate sales of securities of Weatherford Ireland, Weatherford Bermuda or Weatherford Delaware, unless it is accompanied by a prospectus supplement.

The ordinary shares of Weatherford Ireland are traded on the Nasdaq Global Select Market (“Nasdaq”) under the symbol “WFRD”.

_______________________________________________________________________________

Investing in our securities involves risk. You should carefully review the risks and uncertainties described under the headings “Forward-Looking Statements” on page 4 and “Risk Factors” on page 7 herein and in the applicable prospectus supplement and the risk factors included in our periodic reports that we file with the Securities and Exchange Commission before you invest in our securities. _____________________________________________________________________________

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

June 15, 2022.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-3 that we filed with the U.S. Securities and Exchange Commission, which we refer to as the “SEC,” under the U.S. Securities Act of 1933, as amended, which we refer to as the “Securities Act,” using a “shelf” registration process under applicable SEC rules. Under this shelf registration process, Weatherford Ireland, Weatherford Bermuda or Weatherford Delaware may, over time, offer and sell the securities described in this prospectus in one or more offerings. This prospectus describes some of the general terms that may apply to the securities that Weatherford Ireland, Weatherford Bermuda or Weatherford Delaware may offer and the general manner in which the securities may be offered. Each time Weatherford Ireland, Weatherford Bermuda or Weatherford Delaware offers securities, Weatherford Ireland, Weatherford Bermuda or Weatherford Delaware, as the case may be, will provide one or more prospectus supplements that will contain specific information about the terms of the securities being offered and the manner in which they may be offered. A prospectus supplement may also add, update or change information contained in this prospectus or in documents we have incorporated by reference into this prospectus. If there is any inconsistency between the information in this prospectus and the applicable prospectus supplement, you must rely on the information in the prospectus supplement. We urge you to read both this prospectus and any prospectus supplement, together with the additional information incorporated by reference as described under the heading “Where You Can Find More Information” in this prospectus. You should rely only on the information incorporated by reference or provided in this prospectus and the applicable prospectus supplement. We have not authorized anyone else to provide you with different information. We are not making an offer to sell in any jurisdiction in which the offer is not permitted.

You should not assume that the information in this prospectus, any prospectus supplement, any related free writing prospectus and any document incorporated by reference is accurate as of any date other than the dates of those documents. Neither the delivery of this prospectus or any applicable prospectus supplement or other offering material (including any free writing prospectus) nor any distribution of securities pursuant to such documents shall, under any circumstances, create any implication that there has been no change in the information set forth in this prospectus or any applicable prospectus supplement or other offering material or in our affairs since the date of this prospectus or any applicable prospectus supplement or other offering material.

Important - EEA Investors

This document is not, and is not intended to be, a prospectus for the purposes of Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017 on the prospectus to be published when securities are offered to the public or admitted to trading on a regulated market (as amended) (the “EU Prospectus Regulation”), the European Union (Prospectus) Regulations 2019 of Ireland or any other legislation, regulations or rules of Ireland or any other member state of the European Economic Area (“EEA”) implementing the EU Prospectus Regulation.

This document has not been reviewed or approved by the Central Bank of Ireland nor by any other competent or supervisory authority of any other member state of the EEA for the purposes of the EU Prospectus Regulation. No offer to the public of securities of Weatherford Ireland, Weatherford Bermuda or Weatherford Delaware is being, or shall be, made in Ireland or any other member state of the EEA Area on the basis of this document or, otherwise, in circumstances that would require a prospectus to be published pursuant to the EU Prospectus Regulation. Any investment in securities of Weatherford Ireland, Weatherford Bermuda or Weatherford Delaware does not have the status of a bank deposit in Ireland and is not within the scope of the deposit protection scheme operated by the Central Bank of Ireland.

Prohibition of sales to EEA retail investors: No securities of Weatherford Ireland, Weatherford Bermuda or Weatherford Delaware are intended to be offered, sold or otherwise made available to or should be offered, sold or otherwise made available to any retail investor in the EEA. For these purposes, a retail investor means a person who is one (or more) of: (i) a retail client as defined in point (11) of Article 4(1) of Directive 2014/65/EU (as amended) (“MiFID II”); or (ii) a customer within the meaning of Directive (EU) 2016/97 (as amended) where that customer would not qualify as a professional client as defined in point (10) of Article 4(1) of MiFID II; or (iii) not a qualified investor as defined in the EU Prospectus Regulation. Consequently, no key information document required by Regulation (EU) No. 1286/2014 (as amended) (the “PRIIPs Regulation”) for offering or selling securities or otherwise making them available to retail investors in the EEA has been prepared and therefore offering or selling securities or otherwise making them available to any retail investor in the EEA may be unlawful under the PRIIPs Regulation.

Unless the context requires otherwise or unless otherwise noted, as used in this prospectus or any prospectus supplement:

•“Weatherford Ireland” refers to Weatherford International plc, an Irish public limited company.

•“Weatherford Bermuda” refers to Weatherford International Ltd., a Bermuda exempted company and wholly owned, indirect subsidiary of Weatherford Ireland.

•“Weatherford Delaware” refers to Weatherford International, LLC, a Delaware limited liability company and wholly owned, indirect subsidiary of Weatherford Ireland.

•“We,” “us” or “our” refers to Weatherford Ireland and its subsidiaries (including Weatherford Bermuda and Weatherford Delaware) on a consolidated basis.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at the SEC’s website at www.sec.gov and at our website at www.weatherford.com. The information contained on or linked to or from our website is not incorporated by reference into this prospectus and should not be considered a part of this prospectus or of any prospectus supplement.

The SEC allows us to “incorporate by reference” the information that we file with the SEC into this prospectus, which means that we can disclose important information to you by referring you to other documents we have filed separately with the SEC. The information incorporated by reference is an important part of this prospectus, and information that we file later with the SEC will automatically update and supersede this information. We incorporate by reference the following documents:

In addition, all documents that we subsequently file with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the U.S. Securities Exchange Act of 1934, as amended, which we refer to as the “Exchange Act”, after the date of this prospectus and prior to the termination of the offering of the applicable securities, shall be deemed to be incorporated by reference into this prospectus. We are not, however, incorporating, in each case, any documents (or portions thereof) or information that we are deemed to furnish and not file in accordance with SEC rules unless expressly stated otherwise. Any statement in this prospectus, in any prospectus supplement, or in any document incorporated by reference that is different from any statement contained in any later-filed document should be regarded as changed by that later statement.

Once so changed, the earlier statement is no longer considered part of this prospectus or any prospectus supplement.

You may request a copy of these filings (other than an exhibit to a filing unless that exhibit is specifically incorporated by reference into that filing), at no cost, by writing to us at our U.S. Investor Relations Department at the following address or calling the following number:

Weatherford International plc

Attention: Investor Relations

2000 St. James Place

Houston, Texas 77056

(713) 836-4000

FORWARD-LOOKING STATEMENTS

This prospectus includes, and any accompanying prospectus supplement may include, various statements relating to future financial performance and results, including certain projections, business trends and other statements that are not historical facts. These statements constitute “Forward-Looking Statements,” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act and Section 21E of the Exchange Act, and are generally identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “budget,” “strategy,” “plan,” “guidance,” “outlook,” “may,” “should,” “could,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions, although not all forward-looking statements contain these identifying words.

Forward-looking statements reflect our beliefs and expectations based on current estimates and projections. While we believe these expectations, and the estimates and projections on which they are based, are reasonable and were made in good faith, these statements are subject to numerous risks and uncertainties. Accordingly, our actual outcomes and results may differ materially from what we have expressed or forecasted in the forward-looking statements. Furthermore, from time to time, we update the various factors we consider in making our forward-looking statements and the assumptions we use in those statements. However, we undertake no obligation to correct, update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except to the extent required under federal securities laws. The following sets forth various assumptions we use in our forward-looking statements, as well as risks and uncertainties relating to those statements. Certain of these risks and uncertainties may cause actual results to be materially different from projected results contained in forward-looking statements in this prospectus and in our other disclosures. These risks and uncertainties include, but are not limited to, those described below under “Risk Factors” and the following:

•global political, economic and market conditions, political disturbances, war, terrorist attacks, changes in global trade policies, weak local economic conditions and international currency fluctuations (including the ongoing military conflict between Russia and Ukraine (“Russia Ukraine Conflict”));

•failure to ensure on-going compliance with current and future laws and government regulations and sanctions, including but not limited to those related to the Russia Ukraine Conflict, and environmental and tax and accounting laws, rules and regulations;

•changes in, and the administration of, treaties, laws, and regulations, including in response to issues related to the Russia Ukraine Conflict and the potential for such issues to exacerbate other risks we face;

•our ability to comply with, and respond to, climate change, ESG and other “sustainability” initiatives and future legislative and regulatory measures both globally and in the specific geographic regions in which we and our customers operate;

•our ability to effectively and timely address the need to conduct our operations and provision of services to our customers more sustainably and with a lower carbon footprint;

•risks associated with disease outbreaks and other public health issues, including the COVID-19 pandemic, their impact on the global economy and the business of our company, customers, suppliers and other partners;

•further spread and potential for a resurgence of the COVID-19 pandemic in a given geographic region and related disruptions to our business, employees, customers, suppliers and other partners and additional regulatory measures or voluntary actions that may be put in place to limit the spread of the COVID-19 pandemic, including vaccination requirements and the associated availability of vaccines, restrictions on business operations or social distancing requirements, and the duration and efficacy of such restrictions;

•the price and price volatility of, and demand for, oil, natural gas and natural gas liquids;

•member-country quota compliance within the Organization of Petroleum Exporting Countries;

•our ability to realize expected revenues and profitability levels from current and future contracts;

•our ability to generate cash flow from operations to fund our operations;

•our ability to effectively and timely adapt our technology portfolio, products and services to address and participate in changes to the market demands for the transition to alternate sources of energy such as geothermal, carbon capture and responsible abandonment, including our digitalization efforts;

•increases in the prices and lack of availability of our procured products and services;

•our ability to timely collect from customers;

•our ability to realize cost savings and business enhancements from our revenue and cost improvement efforts;

•our ability to attract, motivate and retain employees, including key personnel;

•our ability to access to capital markets on terms that are commercially acceptable to Weatherford Ireland;

•our ability to manage our workforce, supply chain and business processes, information technology systems and technological innovation and commercialization, including the impact of our organization restructure, business enhancements, improvement efforts and the cost and support reduction plans;

•our ability to service our debt obligations;

•potential non-cash asset impairment charges for long-lived assets, intangible assets or other assets; and

•adverse weather conditions in certain regions of our operations.

Finally, our future results will depend upon various other risks and uncertainties, including, but not limited to, those detailed in our other filings with the SEC under the Exchange Act, and the Securities Act. For additional information regarding risks and uncertainties, see “Where You Can Find More Information.” These factors are not necessarily all of the important factors that could cause our actual results, performance or achievements to differ materially from those expressed in or implied by any of our forward-looking statements. Other unknown or unpredictable factors, many of which are beyond our control, also could harm our results, performance, or achievements. All forward-looking statements contained in this prospectus and any accompanying prospectus supplement, including the information incorporated by reference into this prospectus and any accompanying prospectus supplement, are expressly qualified in their entirety by the cautionary statements set forth above.

ABOUT US

We are a leading global energy services company providing equipment and services used in the drilling, evaluation, well construction, completion, production, intervention and responsible abandonment of wells across the broad spectrum of energy sources. Many of our businesses, including those of our predecessor companies, have been operating for more than 50 years. We conduct operations in approximately 75 countries, answering the challenges of the energy industry with 350 operating locations including manufacturing, research and development, service, and training facilities. Our principal business is to provide equipment and services to the oil and natural gas exploration and production industry as well as new energy platforms across our three product line segments: (1) drilling and evaluation, (2) well construction and completions and (3) production and intervention. All of our segments are enabled by a full suite of digital, monitoring, optimization and artificial intelligence solutions providing services throughout the well life cycle, including responsible abandonment.

Weatherford Ireland is incorporated in Ireland and is the ultimate parent company of the Weatherford group of companies. Weatherford Bermuda and Weatherford Delaware are each indirect, wholly owned subsidiaries of Weatherford Ireland. Weatherford Ireland currently conducts all of its operations through its subsidiaries, including Weatherford Bermuda and Weatherford Delaware.

Our principal executive offices are located at 2000 St. James Place, Houston, Texas and our telephone number is (713) 836-4000.

RISK FACTORS

Investing in our securities involves risk. There are important factors that could cause our actual results, level of activity or performance to differ materially from our past results of operations or from the results, level of activity or performance implied by the forward-looking statements contained in this prospectus or in any prospectus supplement. In particular, you should carefully consider the risk factors described under the caption “Risk Factors” in our most recent Annual Report on Form 10-K, along with any risk factors contained in our quarterly reports on Form 10-Q, which are incorporated by reference into this prospectus. Other sections of this prospectus, any prospectus supplement and the documents incorporated by reference may include additional factors which could adversely impact our business and financial performance. Moreover, we operate in a very competitive and rapidly changing environment. New risk factors emerge from time to time, and it is not possible for us to predict all risk factors, nor can we assess the impact of all risk factors on our business or the extent to which any factor or combination of factors may cause actual results to differ materially from those contained in any forward-looking statements. These risks could materially and adversely affect our business, future prospects, financial condition or operating results and could result in a partial or complete loss of your investment.

USE OF PROCEEDS

Unless otherwise specified in a prospectus supplement, we will use the net proceeds received by us from the sale of the securities offered by this prospectus and the accompanying prospectus supplement for general corporate purposes. We may invest funds not required immediately for such purposes in marketable securities and short-term investments. Further details relating to the use of the net proceeds from the offering of securities under this prospectus will be set forth in the applicable prospectus supplement.

DESCRIPTION OF OUR ORDINARY SHARES

The following description of the ordinary shares of Weatherford Ireland is a summary. The complete text of our Constitution comprising our Memorandum of Association and Articles of Association (the “Articles”), as adopted on December 10, 2019, which sets forth further detail as to the rights of holders of our ordinary shares, have been filed as exhibits to our periodic reports filed with the SEC, and each are incorporated by reference as exhibits to the registration statement of which this prospectus forms a part. As used in this section only, “we,” “our” and “us” refers only to Weatherford Ireland.

Authorized Share Capital

As of June 14, 2022, our authorized share capital is $1,356,000 divided into 1,356,000,000 ordinary shares with a nominal value of $0.001 per share. As of June 14, 2022, there were approximately 73 shareholders of record and 70,545,415 ordinary shares issued and outstanding. The actual number of shareholders is considerably greater than the number of shareholders of record and includes shareholders who are beneficial owners but whose ordinary shares are held in street name by brokers and other nominees.

Voting Rights

Each holder of our ordinary shares is entitled to one vote for each ordinary share registered in his or her name in the register of members (shareholders). A person must be entered on the register by the record date specified for a general meeting in order to vote, and any change to an entry on the register after such record date shall be disregarded in determining the right of any person to attend and vote at the meeting.

Every holder of our ordinary shares entitled to attend, speak and vote at a general meeting may appoint a proxy to attend, speak and vote on his or her behalf and may appoint more than one proxy to attend, speak and vote at the same meeting.

General Meetings

We are required to hold an Annual General Meeting in each calendar year at intervals of no more than 15 months from our previous Annual General Meeting and no more than nine months after our fiscal year-end. There is no legal requirement to hold general meetings in Ireland, except that where a general meeting of shareholders is held outside Ireland, Weatherford Ireland has a duty to make arrangements for shareholders of record to participate at the meeting by technological means without leaving Ireland. No business shall be transacted at any general meeting unless a quorum is present, which requires representation of more than 50% of the total voting rights attaching to our ordinary shares. Abstentions and broker non-votes are counted for the purposes of determining whether there is a quorum.

Director Elections

Directors may be appointed by our shareholders at the Annual General Meeting or at any extraordinary general meeting called for that purpose and by our Board of Directors in accordance with our Articles.

Each of our directors shall (unless his or her office is earlier vacated in accordance with our Articles) serve for a one-year term concluding on the latter of (i) the Annual General Meeting after such director was last appointed or re-appointed and (y) until his or her successor is elected and qualified.

Any director retiring at an Annual General Meeting will be eligible for re-appointment.

Each director shall be elected by a simple majority of the votes cast, in person or by proxy, at a general meeting of shareholders (referred to under Irish law as an ordinary resolution), provided that, if the number of director nominees exceeds the number of directors to be elected (a “contested election”), each of those nominees shall be voted upon as a separate resolution and the directors shall be elected by a plurality of the votes cast, in person or represented by proxy, at such meeting and entitled to vote on the election of directors.

Under our Articles, in an uncontested election (where the number of director nominees does not exceed the number of directors to be elected), any nominee for election to the Board of Directors who is then serving as a director and who receives a greater number of “against” votes than “for” votes shall promptly tender his or her resignation following certification of the vote. The Board of Directors (excluding the director who has so tendered his or her resignation) is then obliged to consider the resignation offer and decide whether to accept or reject the resignation, or whether other action should be taken.

Issuance of Ordinary Shares

We may allot and issue ordinary shares subject to the maximum authorized share capital contained in our Articles. The authorized maximum may be increased or reduced by an ordinary resolution of shareholders.

Under Irish law, our Board of Directors may issue new ordinary shares having the rights provided for in our Articles without shareholder approval once authorized to do so by the Articles or by an ordinary resolution adopted by the shareholders at a general meeting, subject at all times to the maximum authorized share capital. The authorization may be granted for a maximum period of five years, at which point it must be renewed by the shareholders by an ordinary resolution. We have been authorized in our Articles to issue new ordinary shares without shareholder approval for a period of five years ending December 9, 2024, up to an aggregate nominal value of $170,000 (170,000,000 ordinary shares) as follows:

•up to $83,000 (83,000,000 ordinary shares), together with any ordinary shares authorized for allotment pursuant to the authority detailed in the bullet point immediately below relating to our bankruptcy that were not allotted (or otherwise counted for the purposes of that authority), which may be allotted as our directors see fit; and

•up to $87,000 (87,000,000 ordinary shares) for the purposes of allotting relevant securities contemplated in (i) the examiner’s scheme of arrangement under Part 10 of the Companies Act 2014 of Ireland, as amended (the “Irish Companies Act”) approved by the Irish High Court on December 12, 2019 and (ii) a scheme of arrangement in respect of Weatherford International Ltd. pursuant to the Companies Act 1981 of Bermuda.

On that basis, taking account of ordinary shares that have been allotted or issued since December 10, 2019 or that are otherwise reserved for issuance, as of the date of this registration statement, our Board of Directors is authorized to issue an additional 83,622,267 ordinary shares without shareholder approval for the balance of the period of five years ending on December 9, 2024.

Preemption Rights, Share Warrants and Options

Under Irish law, certain statutory preemption rights apply automatically in favor of shareholders when shares are to be issued for cash. As permitted under Irish law, we opted-out of these preemption rights in our Articles adopted at the time of emergence from bankruptcy in respect of the 170,000,000 ordinary shares our directors were authorized to allot pursuant to the allotment authority referenced above. Irish law requires this opt-out to be renewed at least every five years by a qualified 75% majority of the votes cast, in person or by proxy, at a general meeting of our shareholders at which a quorum is present (referred to under Irish law as a special resolution). A special resolution of the shareholders is also required for any increase in the number of shares covered by the opt-out. If the opt-out is not renewed, shares to be issued for cash must be offered to our existing shareholders on a pro rata basis to their existing shareholding before the shares may be issued to any new shareholders.

Statutory preemption rights do not apply: (i) where shares are issued for non-cash consideration (such as in a stock-for-stock acquisition), (ii) to the issue of non-equity shares (that is, shares that have the right to participate only up to a specified amount in any income or capital distribution) or (iii) where shares are issued pursuant to employee equity compensation plans.

Our Articles provide that, subject to the provisions contained therein relating to the allotment of new shares and the Irish Companies Act, our directors may allot, grant options over or otherwise dispose of them to such persons, on such terms and conditions and at such times as they may consider to be in the best interests of Weatherford Ireland and its shareholders.

Dividends