0001603923false00016039232024-03-012024-03-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 1, 2024

Weatherford International plc

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Ireland | 001-36504 | 98-0606750 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | | | | | | | | | | | | | |

| 2000 St. James Place | , | Houston, | | Texas | | | 77056 |

| (Address of principal executive offices) | | | (Zip Code) |

Registrant’s telephone number, including area code: 713.836.4000

| | | | | | | | | | | | | | |

| N/A | |

| (Former Name or Former Address, if Changed Since Last Report) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Ordinary shares, $0.001 par value per share | WFRD | The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

On March 1, 2024, Weatherford International plc (the “Company”) filed a prospectus supplement to its Registration Statement on Form S-3ASR filed with the U.S. Securities and Exchange Commission (the “Commission”) on June 15, 2022 (No. 333-265636) (the “Registration Statement”), under the Securities Act of 1933, as amended, with respect to the resale of up to 844,702 ordinary shares of the Company, nominal value $0.001 per share (“Ordinary Shares”), by the selling shareholders named therein. The Ordinary Shares being offered by the selling shareholders are being issued in connection with the Company’s acquisition of ISI Holding Company, LLC and Probe Technologies Holdings, Inc.

In connection with the filing of the prospectus supplement, the Company is filing a legal opinion as Exhibit 5.1 to this current report on Form 8-K, which is incorporated by reference into the Registration Statement.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | | | | |

Exhibit Number | | Exhibit Description |

5.1 | | |

23.1 | | |

104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| Weatherford International plc |

Date: March 1, 2024 | |

| /s/ Scott C. Weatherholt |

| Scott C. Weatherholt |

| Executive Vice President, General Counsel,

and Chief Compliance Officer |

| | | | | | | | |

Weatherford International plc 70 Sir John Rogerson's Quay Dublin 2 D02 R296 Ireland Private and Confidential |

Our ref FBO/AOC 661725-56 | | 1 March 2024 |

| | |

Dear Sirs

Registration Statement on Form S-3 and Prospectus Supplement

We have acted as Irish counsel to Weatherford International plc, a public limited company incorporated under the laws of Ireland (company number 540406) (the "Company ") in connection with the re-sale, from time to time, by the selling shareholders of up to 844,702 ordinary shares of $0.001 each (nominal value) in the capital of the Company ("Ordinary Shares"), pursuant to the shelf-registration statement on Form S-3 filed by the Company on 15 June 2022 (Registration No. 333-265636) (the "Registration Statement") under the U.S. Securities Act of 1933, as amended (the "Securities Act") with the U.S. Securities Exchange Commission (the "Commission"), the prospectus included therein and a prospectus supplement dated 1 March 2024 (the "Prospectus Supplement").

The Ordinary Shares have been issued pursuant to (i) a merger agreement dated 1 February 2024, by and among the Company, ISI Holding Company, LLC, Weatherford Wireline One, LLC and Turnbridge Capital Management, LLC, as sellers’ representative (the "ISI Merger Agreement"), (ii) a merger agreement dated 1 February 2024, by and among the Company, Probe Technologies Holdings, Inc. ("Probe"), Weatherford Wireline Two, LLC and Turnbridge Capital Management, LLC, as sellers’ representative (the "Probe Merger Agreement") and (iii) those letter agreements listed in Schedule 1 to this Opinion (the "Transaction Bonus Agreements", and together with the ISI Merger Agreement and the Probe Merger Agreement, the "Agreements").

In connection with this Opinion, we have reviewed the corporate resolutions, records and other documents (including the corporate certificate) and searches listed in Schedule 2 to this Opinion (collectively, the "Documents").

Based solely on our review of the Documents and subject to the further assumptions, qualifications and limitations set out in this Opinion, we are of the opinion that the Ordinary Shares are validly issued, fully paid and non-assessable (“non-assessable” is a phrase which has no defined meaning under Irish law, but, for the purposes of this Opinion, shall mean the registered holders of the Ordinary Shares are not subject to calls for additional payments of capital on such shares).

For the purposes of this Opinion, we have assumed: (i) the Registration Statement is, and will remain, effective at all relevant times, (ii) the truth and accuracy of the contents of the Documents as to factual matters, but we have made no independent investigation regarding such factual matters, (iii) all signatures (including, for the avoidance of doubt, electronic signatures), initials, seals and stamps contained in, or on, the Documents submitted to us are genuine, (iv) all Documents submitted to us as originals are authentic and complete and that all Documents submitted to us as copies (including, without limitation, any Document submitted to us as a .pdf (or any other format) attachment to an email) are complete and conform to the originals of such Documents, and the originals of such Documents are authentic and complete, (v) the transactions provided for in the Agreements will be consummated on the terms provided for therein, (vi) the obligations expressed to be assumed by each party to the Agreements are legal, valid, binding and enforceable obligations under all applicable laws and in all applicable jurisdictions, other than, in the case of the Company, the laws of Ireland and the jurisdiction of Ireland and (vii) the Company has received the full consideration payable for the Ordinary Shares, as provided for in the Agreements.

This Opinion is based upon, and limited to, the laws of Ireland in effect on the date hereof and is based on legislation published and cases fully reported before that date and our knowledge of the facts relevant to the opinions contained herein. We have assumed, without enquiry, that there is nothing in the laws of any jurisdiction other than Ireland which would, or might, affect our opinions as stated herein. We have made no investigations of, and we express no opinion on, the laws of any jurisdiction other than Ireland, or the effect thereof. This Opinion is expressed as of the date hereof and we assume no obligation to update this Opinion.

This Opinion is furnished to you and the persons entitled to rely upon it pursuant to the applicable provisions of the Securities Act strictly for use in connection with the Registration Statement and the Prospectus Supplement and may not be relied upon by any other person without our prior written consent. This Opinion is confined strictly to the matters expressly stated herein and is not to be read as extending, by implication or otherwise, to any other matter.

We hereby consent to the filing of this Opinion as an exhibit to the current report on Form 8-K filed on 1 March 2024 2024 and to the reference to Matheson LLP under the caption "Legal Matters" in the Prospectus Supplement. In giving such consent, we do not admit that we are included in the category of persons whose consent is required under section 7 of the Securities Act, or the rules and regulations of the Commission promulgated thereunder.

This Opinion and the opinions given in it are governed by, and shall be construed in accordance with, the laws of Ireland.

Yours faithfully

/s/ Matheson LLP

MATHESON LLP

Schedule 1

The Transaction Bonus Agreements

1.Letter agreement dated 1 February 2024 by and among the Company, Probe and Victor "Trey" Clark.

2.Letter agreement dated 1 February 2024 by and among the Company, Probe and Bulent Finci.

3.Letter agreement dated 1 February 2024 by and among the Company, Probe and Kevin Gerland.

4.Letter agreement dated 1 February 2024 by and among the Company, Probe and Dallas "Dax" Middlebrooks.

5.Letter agreement dated 1 February 2024 by and among the Company, Probe and August Scherer.

6.Letter agreement dated 1 February 2024 by and among the Company, Probe and Martin Barratt.

7.Letter agreement dated 1 February 2024 by and among the Company, Probe, Gary Cresswell and Cresswell Investments, LLC.

8.Letter agreement dated 1 February 2024 by and among the Company, Probe and Federico Casavantes.

Schedule 2

The Documents

1.A certificate issued by the secretary of the Company dated 1 March 2024:

(a)attaching a copy of each of the following, certified as being true, complete and correct:

(i)the certificate of incorporation, certificate of incorporation on change of name and certificate of incorporation on re-registration as a public limited company of the Company, dated 3 March 2014, 20 March 2014 and 29 May 2014, respectively;

(ii)the current constitution of the Company, comprised of its memorandum and articles of association, adopted on 10 December 2019; and

(iii)written resolutions of the board of directors of the Company passed on 29 January 2024;

(b)certifying that the names of the relevant persons to whom Ordinary Shares were to be issued in accordance with the terms of the Agreements, have been entered in the register of members of the Company as the holders thereof; and

(c)certifying certain other matters, as set out therein, on which we have relied for the purposes of this Opinion.

2.The Registration Statement, including the prospectus contained therein.

3.The Prospectus Supplement.

4.Copies of the Agreements, as executed.

5.Searches carried out by independent law researchers on our behalf against the Company on 29 February 2024 in (a) the Index of Petitions and Winding-up Notices maintained at the Central Office of the High Court of Ireland, (b) the Judgments’ Office of the Central Office of the High Court of Ireland and (c) the Companies Registration Office in Dublin.

v3.24.0.1

Document and Entity Information

|

Mar. 01, 2024 |

| Document Information [Line Items] |

|

| Document Period End Date |

Mar. 01, 2024

|

| Document Type |

8-K

|

| Document Period End Date |

Mar. 01, 2024

|

| Entity Registrant Name |

Weatherford International plc

|

| Entity Incorporation, State or Country Code |

L2

|

| Entity File Number |

001-36504

|

| Entity Tax Identification Number |

98-0606750

|

| Entity Address, Address Line One |

2000 St. James Place

|

| Entity Address, City or Town |

Houston,

|

| Entity Address, State |

TX

|

| Entity Address, Postal Zip Code |

77056

|

| City Area Code |

713

|

| Local Phone Number |

836.4000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Ordinary shares, $0.001 par value per share

|

| Trading Symbol |

WFRD

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001603923

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

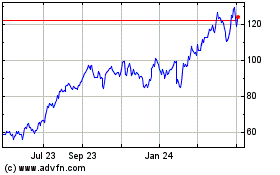

Weatherford (NASDAQ:WFRD)

Historical Stock Chart

From Mar 2024 to Apr 2024

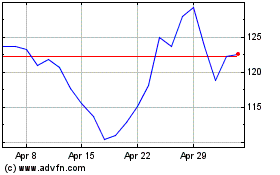

Weatherford (NASDAQ:WFRD)

Historical Stock Chart

From Apr 2023 to Apr 2024