false

0001425287

0001425287

2024-08-20

2024-08-20

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 20, 2024

WORKHORSE GROUP INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-37673 |

|

26-1394771 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification Number) |

3600 Park 42 Drive, Suite 160E, Sharonville, Ohio

45241

(Address of principal executive offices) (zip code)

1 (888) 646-5205

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ☐ | Written communications pursuant to Rule 425 under the Securities

Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.001 par value per share |

|

WKHS |

|

The Nasdaq Capital Market |

Item 2.02.

Results of Operations and Financial Condition.

On

August 20, 2024, Workhorse Group Inc. (the “Company”) issued a press release regarding its financial results for the quarter

ended June 30, 2024. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The

information contained in this Item 2.02 shall not be deemed as “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933,

as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

WORKHORSE GROUP INC. |

| |

|

| Date: August 20, 2024 |

By: |

/s/ James D. Harrington |

| |

Name:

Title: |

James D. Harrington

General Counsel, Chief Compliance Officer and Secretary |

2

Exhibit 99.1

Workhorse Group Reports Second Quarter 2024

Results

CINCINNATI, August 20, 2024 -- Workhorse Group Inc. (Nasdaq:

WKHS) (“Workhorse” or “the Company”), an American technology company focused on pioneering the transition

to zero-emission commercial vehicles, today reported financial results for the second quarter ended June 30, 2024.

Management Commentary

“During the second quarter, we continued to advance our EV product

roadmap and worked diligently to gain momentum with prospective customers,” said Workhorse CEO Rick Dauch. “We successfully

executed field demonstrations with multiple national fleets, secured new dealer partnerships, and generated local and state governmental

interest through our recently awarded Sourcewell contract for procurement in the category of Class 4-8 cab chassis and related equipment,

accessories, and services. We are also doing the R&D work we believe is necessary to expand our product offering by introducing the

W56 208-inch wheelbase, 1200 cubic feet cargo capacity vehicle. Production for this truck is expected to begin in the fourth quarter of

this year, and we’ve already received our first order.”

Mr. Dauch concluded, “While we made important progress during

the quarter, our financial results reflect that we still have significant work ahead of us to achieve our goals. We continue to have productive

conversations with prospective customers and are optimistic that EV adoption rates will accelerate in 2025. At the same time, we are making

disciplined and thoughtful decisions to preserve our cash and extend our financial runway. We remain optimistic about the long-term market

opportunity for the transition to EV technology in the Class 4-6 work truck segment.”

Executing Strategic and Financial Actions

| ● | Delivering

to Customers: During the second quarter, the Company received a purchase order for 141

W4 CC cab chassis vehicles from Kingsburg Truck Sales in California (“KTS”).

Workhorse received payment for the first 30 trucks from KTS in the second quarter. However,

due to delays in the CARB HVIP voucher approval and payment process, KTS was unable to deliver

the trucks to end customers, limiting the revenue recognized by the Company in the second

quarter. Workhorse expects to recognize most, if not all, of the $2.3 million in deferred

revenue related to the sale of the first 30 W4CC trucks as revenue during the remainder of

2024. In June the Company delivered a W4 CC box truck to McAbee Trucking — a U.S. Postal

Service contractor. NorCal Transports, a last-mile delivery contractor based in Richmond,

CA, recently added a Workhorse flagship W56 step van to its fleet. In addition, two W56 step

vans recently joined the Stables by Workhorse fleet in Lebanon, OH. |

| ● | Advancing

EV Product Roadmap: The Company is finalizing the engineering and testing work necessary

to expand the W56 product offering, launching a 208-inch wheelbase, 1200 cubic feet capacity

step van, and expects to complete this work by year end. In addition, the Company expects

to introduce a 140kWh version of the 178-inch wheelbase W56 in early 2025. These new product

portfolio additions are the result of direct feedback received from potential fleet customers

after field demonstrations earlier in the year. |

| ● | Expanding

Dealer Network and Service Footprint: During the second quarter, the Company reached

a major milestone with the award of a Sourcewell contract for procurement in the category

of Class 4-8 chassis and cabs with related equipment, accessories, and services. This significant

achievement allows Workhorse to expand its reach to government, educational, and nonprofit

sectors within all 50 states and Canada. Workhorse also added three (3) new dealers to its

network: (i) Ziegler Truck Group, with locations in Minnesota, Iowa, and Wisconsin, (ii)

Milea Truck Sales and Leasing in New York City, and (iii) Eco Auto in North Boston, Massachusetts,

bringing the Company’s total dealer count to 13. |

| ● | Completed

Divestiture of Aero Business: The Company completed the previously disclosed divestiture

of its Aero business on June 6, 2024. Workhorse expects this divestiture to provide monthly

cost savings of approximately $0.4 million and to enhance the Company’s ability to

concentrate on its commercial electric vehicle truck business. |

| ● | Regained

NASDAQ Minimum Bid Price Compliance: On July 3, 2024, the Company received notification

from NASDAQ that it had regained compliance with the minimum bid price requirement of $1.00

per share. This notification followed the Company’s 1-for-20 reverse stock split of

its outstanding shares of common stock, which was effective as of June 17, 2024. |

| ● | Conserving

Cash: Workhorse has continued to take steps to manage costs across the organization to

strengthen its financial position. Between previous reduction in force actions, voluntary

departures, Union City manufacturing facility furloughs, previously disclosed deferral of

executives’ cash compensation, and the divestiture of the Aero business, the Company

has achieved significant cost savings. |

Second Quarter Financial Results

Sales, net of returns and allowances, for the second quarter of 2024

were $0.8 million compared to $4.0 million in the same period last year. The decrease in sales was primarily due to lower W4 CC vehicle

sales compared with the same period a year ago, which was partially offset by an increase in other service revenue generated from operating

Stables by Workhorse, Drones as a Service before the Aero divestiture, and other service revenue.

Cost of sales decreased to $7.3 million in the second quarter compared

to $8.4 million in the same period last year. The decrease in cost of sales was primarily driven by a $4.4 million decrease in costs related

to direct materials as a result of lower sales volume and higher volume of vehicles being capitalized into finished goods. The decrease

was also due to a decrease in consulting expenses of $0.5 million as well as a $0.5 million decrease in employee compensation and related

expenses as result of previously announced furloughs. The decrease in cost of sales was partially offset by a $2.7 million increase in

inventory reserve expense and a $1.0 million increase in depreciation expense.

Selling, general, and administrative (“SG&A”) expenses

decreased to $12.1 million in the second quarter compared to $14.0 million in the same period last year. The decrease in SG&A expenses

was primarily driven by a $2.4 million decrease in employee compensation and related expenses primarily due to a lower headcount and a

decrease of $0.6 million in marketing expenses during the period, which was partially offset by a $0.2 million increase in depreciation

expense and a $0.3 million increase in information technology costs.

Research and development (“R&D”) expenses decreased

to $2.0 million in the second quarter compared to $5.1 million in the same period last year. The decrease in R&D expenses was primarily

driven by $2.0 million decrease in employee compensation and related expenses due to lower headcount and a $0.8 million decrease in consulting

expenses, which was partially offset a $0.4 million increase in prototype expenses driven by the W56 208-inch wheelbase program.

Net interest expense was $5.2 million compared to net interest income

of $0.5 million in the same period last year. Fair value loss in the second quarter was $0.6 million due to the warrants issued by the

Company. The fair value adjustment in the prior year period was zero.

Net loss was $26.3 million compared to $23.0 million in the same period

last year.

As of June 30, 2024, the Company had $5.3 million in cash and cash

equivalents, accounts receivable of $0.8 million, net inventory of $46.5 million, and accounts payable of $10.5 million.

Second Quarter Financial Overview

“We are taking diligent steps that we believe will strengthen

our balance sheet and liquidity position so we can execute on our product roadmap and deliver for our customers,” said Workhorse

CFO Bob Ginnan. “We’ve made significant cost reductions, completed the Aero divestiture, and recently regained listing compliance

with the NASDAQ minimum bid price requirement as a result of our reverse stock split. Looking ahead, we are optimistic in our ability

to generate additional purchase orders and revenue from our customers, while strengthening our financial position.”

Conference Call

Workhorse management will hold a conference call today, August 20,

2024 at 11:00 AM Eastern time (8:00 AM Pacific time) to discuss these results and answer related questions.

U.S. dial-in: 877-407-8289

International dial-in: 201-689-8341

Please call the conference telephone number 10 minutes prior to the

start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please

contact Gateway Group at 949-574-3860.

The conference call will be broadcast live and

available for replay here and via the Investor Relations section of Workhorse’s website.

A telephonic replay of the conference call will be available after

2:00 p.m. Eastern time on the same day through August 27, 2024.

Toll-free replay number: 877-660-6853

International replay number: 201-612-7415

Replay ID: 13748503

About Workhorse Group Inc.

Workhorse is a technology company focused on

providing electric vehicles to the last-mile delivery sector. As an American original equipment manufacturer, we design and build high

performance, battery-electric trucks. Workhorse also develops cloud-based, real-time telematics performance monitoring systems that are

fully integrated with our vehicles and enable fleet operators to optimize energy and route efficiency. All Workhorse vehicles are designed

to make the movement of people and goods more efficient and less harmful to the environment. For additional information visit workhorse.com.

Forward-Looking Statements

The discussions in this press release contain forward-looking statements

reflecting our current expectations that involve risks and uncertainties. These statements are made under the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of 1995. When used in this presentation, the words “anticipate,”

“expect,” “plan,” “believe,” “seek,” “estimate” and similar expressions are

intended to identify forward-looking statements. These are statements that relate to future periods and include, but are not limited to,

statements about the features, benefits and performance of our products, our ability to introduce new product offerings and increase revenue

from existing products, expected expenses including those related to selling and marketing, product development and general and administrative,

our beliefs regarding the health and growth of the market for our products, anticipated increase in our customer base, expansion of our

products functionalities, expected revenue levels and sources of revenue, expected impact, if any, of legal proceedings, the adequacy

of liquidity and capital resources, and expected growth in business. Forward-looking statements are statements that are not historical

facts. Such forward-looking statements are subject to risks and uncertainties, which could cause actual results to differ materially from

the forward-looking statements contained in this presentation. Factors that could cause actual results to differ materially include, but

are not limited to: our ability to develop and manufacture our new product portfolio, including the W4 CC, W750, W56 and WNext platforms;

our ability to attract and retain customers for our existing and new products; risks associated with obtaining orders and executing upon

such orders; supply chain disruptions, including constraints on steel, semiconductors and other material inputs and resulting cost increases

impacting our company, our customers, our suppliers or the industry; our ability to capitalize on opportunities to deliver products to

meet customer requirements; our limited operations and need to expand and enhance elements of our production process to fulfill product

orders; the ability to protect our intellectual property; market acceptance for our products; our ability to control our expenses; potential

competition, including without limitation shifts in technology; volatility in and deterioration of national and international capital

markets and economic conditions; global and local business conditions; acts of war (including without limitation the conflicts in Ukraine

and Israel) and/or terrorism; the prices being charged by our competitors; our inability to retain key members of our management team;

our inability to raise additional capital to fund our operations and business plan; our ability to maintain compliance with the list requirements

of the Nasdaq Capital Market and otherwise maintain the listing of our securities thereon and the impact of steps we took to regain such

compliance, such as the reverse split of our common stock; our inability to satisfy our customer warranty claims; the outcome of any regulatory

or legal proceedings, including with Coulomb Solutions, Inc.; our ability to consummate and realize the benefits of a potential sale and

leaseback transaction of our Union City facility; and our liquidity and other risks and uncertainties and other factors discussed from

time to time in our filings with the Securities and Exchange Commission (“SEC”), including our annual report on Form 10-K

filed with the SEC. Forward-looking statements speak only as of the date hereof. We expressly disclaim any obligation or undertaking to

release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations

with regard thereto or any change in events, conditions or circumstances on which any such statement is based, except as required by law.

Media Contact:

Aaron Palash / Greg Klassen

Joele Frank, Wilkinson Brimmer Katcher

212-355-4449

Investor Relations Contact:

Tom Colton and Greg Bradbury

Gateway Group

949-574-3860

WKHS@gateway-grp.com

Workhorse Group Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

| | |

June 30,

2024 | | |

December 31,

2023 | |

| Assets | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 5,308,611 | | |

$ | 25,845,915 | |

| Restricted cash | |

| — | | |

| 10,000,000 | |

| Accounts receivable, less allowance for credit losses of $0.2 million and $0.2 million as of June 30, 2024 and December 31, 2023, respectively | |

| 760,504 | | |

| 4,470,209 | |

| Inventory, net | |

| 46,503,385 | | |

| 45,408,192 | |

| Prepaid expenses and other current assets | |

| 6,902,370 | | |

| 8,101,162 | |

| Total current assets | |

| 59,474,870 | | |

| 93,825,478 | |

| Property, plant and equipment, net | |

| 36,497,886 | | |

| 37,876,955 | |

| Lease right-of-use assets | |

| 9,227,564 | | |

| 9,795,981 | |

| Other assets | |

| 176,310 | | |

| 176,310 | |

| Total Assets | |

$ | 105,376,630 | | |

$ | 141,674,724 | |

| Liabilities | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 10,501,569 | | |

$ | 12,456,272 | |

| Accrued and other current liabilities | |

| 6,335,271 | | |

| 4,862,740 | |

| Deferred revenue, current | |

| 6,954,581 | | |

| 4,714,331 | |

| Warranty liability | |

| 642,326 | | |

| 1,902,647 | |

| Current portion of lease liabilities | |

| 3,028,889 | | |

| 3,560,612 | |

| Warrant liability | |

| 4,580,442 | | |

| 5,605,325 | |

| Current portion of convertible notes | |

| 9,649,030 | | |

| 20,180,100 | |

| Total current liabilities | |

| 41,692,108 | | |

| 53,282,027 | |

| Lease liabilities, long-term | |

| 5,047,565 | | |

| 5,280,526 | |

| Total Liabilities | |

| 46,739,673 | | |

| 58,562,553 | |

| Commitments and contingencies | |

| | | |

| | |

| Stockholders’ Equity: | |

| | | |

| | |

| Series A preferred stock, par value $0.001 per share, 75,000,000 shares authorized, zero shares issued and outstanding as of June 30, 2024 and December 31, 2023 | |

| — | | |

| — | |

| Common stock, par value $0.001 per share, 450,000,000 shares authorized, 20,738,091 shares issued and outstanding as of June 30, 2024 and 14,299,042 shares issued and outstanding as of December 31, 2023 (presented on a reverse stock split-adjusted basis) | |

| 20,738 | | |

| 14,299 | |

| Additional paid-in capital | |

| 865,660,256 | | |

| 834,666,123 | |

| Accumulated deficit | |

| (807,044,037 | ) | |

| (751,568,251 | ) |

| Total stockholders’ equity | |

| 58,636,957 | | |

| 83,112,171 | |

| Total Liabilities and Stockholders’ Equity | |

$ | 105,376,630 | | |

$ | 141,674,724 | |

See accompanying notes to the Condensed Consolidated

Financial Statements.

Workhorse Group Inc.

Condensed Consolidated Statements of Operations

(Unaudited)

| | |

Three Months Ended

June 30, | | |

Six Months Ended

June 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| Sales, net of returns and allowances | |

$ | 842,440 | | |

$ | 3,966,463 | | |

$ | 2,181,735 | | |

$ | 5,659,878 | |

| Cost of sales | |

| 7,301,348 | | |

| 8,427,377 | | |

| 14,744,126 | | |

| 13,755,496 | |

| Gross loss | |

| (6,458,908 | ) | |

| (4,460,914 | ) | |

| (12,562,391 | ) | |

| (8,095,618 | ) |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| Selling, general and administrative | |

| 12,066,553 | | |

| 14,002,517 | | |

| 26,161,831 | | |

| 28,692,360 | |

| Research and development | |

| 1,992,779 | | |

| 5,059,745 | | |

| 5,520,690 | | |

| 12,284,594 | |

| Total operating expenses | |

| 14,059,332 | | |

| 19,062,262 | | |

| 31,682,521 | | |

| 40,976,954 | |

| Loss from operations | |

| (20,518,240 | ) | |

| (23,523,176 | ) | |

| (44,244,912 | ) | |

| (49,072,572 | ) |

| Interest income (expense), net | |

| (5,158,859 | ) | |

| 505,500 | | |

| (6,791,326 | ) | |

| 1,055,859 | |

| Fair value adjustment (loss) on warrants | |

| (642,900 | ) | |

| — | | |

| (4,439,548 | ) | |

| — | |

| Loss before benefit for income taxes | |

| (26,319,999 | ) | |

| (23,017,676 | ) | |

| (55,475,786 | ) | |

| (48,016,713 | ) |

| Benefit for income taxes | |

| — | | |

| — | | |

| — | | |

| — | |

| Net loss | |

$ | (26,319,999 | ) | |

$ | (23,017,676 | ) | |

$ | (55,475,786 | ) | |

$ | (48,016,713 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss per share of common stock | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted* | |

$ | (1.40 | ) | |

$ | (2.40 | ) | |

$ | (3.26 | ) | |

$ | (5.40 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Weighted average shares used in computing net loss per share of common stock | |

| | | |

| | | |

| | | |

| | |

| Basic and Diluted* | |

| 18,855,034 | | |

| 9,283,015 | | |

| 16,992,697 | | |

| 8,822,674 | |

See accompanying notes to the Condensed Consolidated

Financial Statements.

| * | Prior periods presented have been adjusted to reflect the

1-for-20 reverse stock split which was effective on June 17, 2024. Additional information regarding the reverse stock split may be found

in Note 1 Summary of Business and Significant Accounting Principles. |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

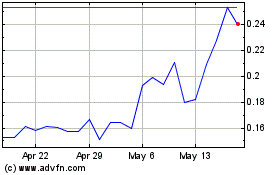

Workhorse (NASDAQ:WKHS)

Historical Stock Chart

From Dec 2024 to Jan 2025

Workhorse (NASDAQ:WKHS)

Historical Stock Chart

From Jan 2024 to Jan 2025