Wearable Devices Ltd. (the “Company” or “Wearable Devices”)

(Nasdaq: WLDS, WLDSW), a technology growth company specializing in

artificial intelligence (“AI")-powered touchless sensing wearables,

today announced its financial results for the six months ended June

30, 2024.

First Half 2024 Financial Results and

Recent Company Highlights:

- Recognized initial revenue from the

sale of business-to-consumer (B2C) focused Mudra Band for Apple

Watch and business-to-business (B2B) collaborations, totaling

$394 thousand.

Mudra Band:

- Enhanced product

proposition for flagship product: We have introduced two

major new features for our Mudra Band: touchless gesture control

for Apple Watch, allowing users to manage tasks hands-free, and

integration with ChatGPT, enabling users to interact with AI

directly via predefined gestures and voice commands on their Apple

Watch. These innovations enhance convenience, accessibility, and

AI-powered functionality for on-the-go multitasking.

- Announced new innovative

and disruptive product- the Mudra Link: Currently

receiving preorders for Mudra Link, the first AI neural interface

wristband for Android and beyond, providing advanced neural input

technology for Android users. Official launch expected in the first

quarter of 2025.

- Expanded market potential

with range of new supported devices: Now supports the

Apple Vision Pro, in addition to other Apple devices including Mac,

iPad, Apple TV and iPhone, allowing Apple users to extend their

gesture control experience.

Global B2B collaborations:

- Signed an agreement with Qualcomm

Technologies (“Qualcomm”) to collaborate in elevating extended

reality (“XR”) experiences with Mudra neural technology and

successfully completed the first phase of integration of Mudra

technology with Qualcomm's Snapdragon Spaces XR developer

platform.

- Fortune 500 consumer electronics

corporation has purchased a special license for a state-of-the-art

Mudra Development Kit (“MDK”) to evaluate certain deep-level

capabilities of the MDK for developing next-generation user

interfaces.

- Announced successful demonstrations

of the Mudra technology on Lenovo's ThinkReality XR headset, at the

Augmented World Expo (AWE) 2024.

- Signed reseller agreement to

enhance licensing program presence in South Korea and China.

- Strengthened presence in the

defense sector and delivered custom touchless technology to global

defense company as part of an ongoing collaboration.

In the first half of 2024, Wearable Devices

continued recognizing revenue from the sale of Mudra Band for Apple

Watch, the Company’s flagship B2C product, which began shipping

towards the end of 2023. Revenues for the six months ended June 30,

2024 were $394 thousand, increasing from approximately $12 thousand

compared to the six months ended June 30, 2023. Net loss increased

to $4.2 million, or $(0.21) per basic and diluted share, in the six

months ended June 30, 2024, compared to net loss of $3.9 million,

or $(0.26) per basic and diluted share, for the six months ended

June 30, 2023, primarily related to an increase in the Company’s

operating expenses associated with its continued efforts to scale

its business activity.

Asher Dahan, Chairman of the Board and Chief

Executive Officer of Wearable Devices, commented, “In the first

half of 2024, we increased the delivery of our flagship B2C

product, the Mudra Band for Apple Watch. After an extended preorder

period during which the Mudra Band generated strong customer

interest, we began shipping the product towards the end of 2023 and

are pleased to have reached this important milestone.

Subsequent to the close of the first half of

2024, we announced the launch of our new Mudra Link wristband,

bringing our state-of-the-art neural input Mudra technology to a

broader range of operating system platforms, including iOS,

Android, Windows, and macOS. This has been a major initiative for

our business, and the logical next step in our growth trajectory.

With preorders now open and an official launch planned for the

first half of 2025, we expect the Mudra Link to significantly

expand our addressable market as we tap into the large and

expanding population of Android, Windows, and macOS users.

We continue to invest in our business, as

reflected in the modest increases in research and development,

sales and marketing, and general and administrative expenses in the

period. We’re still in the early stages of growth in the broader

wearables industry, and Wearable Devices is well positioned to be a

leader in the space given our patented AI-based neural input

interface technology.”

About Wearable Devices Ltd.

Wearable Devices Ltd. is a growth company

developing AI-based neural input interface technology for the B2C

and B2B markets. The Company’s flagship product, the Mudra Band for

Apple Watch, integrates innovative AI-based technology and

algorithms into a functional, stylish wristband that utilizes

proprietary sensors to identify subtle finger and wrist movements

allowing the user to “touchlessly” interact with connected devices.

The Company also markets a B2B product, which utilizes the same

technology and functions as the Mudra Band and is available to

businesses on a licensing basis. Wearable Devices Is committed to

creating disruptive, industry leading technology that leverages AI

and proprietary algorithms, software, and hardware to set the input

standard for the Extended Reality, one of the most rapidly

expanding landscapes in the tech industry. The Company’s ordinary

shares and warrants trade on the Nasdaq market under the symbols

“WLDS” and “WLDSW”, respectively.

Forward-Looking Statement Disclaimer

This press release contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, that are intended to be covered by the “safe

harbor” created by those sections. Forward-looking statements,

which are based on certain assumptions and describe our future

plans, strategies and expectations, can generally be identified by

the use of forward-looking terms such as “believe,” “expect,”

“may,” “should,” “could,” “seek,” “intend,” “plan,” “goal,”

“estimate,” “anticipate” or other comparable terms. For example, we

are using forward-looking statements when we discuss our growth

trajectory; the launch of the Mudra Link and its benefits and

advantages, including significant potential increase in the

Company’s total available market; future investment in our

business; and our position as a leader in the space of wearable

devices. All statements other than statements of historical facts

included in this press release regarding our strategies, prospects,

financial condition, operations, costs, plans and objectives are

forward-looking statements. Forward-looking statements are neither

historical facts nor assurances of future performance. Instead,

they are based only on our current beliefs, expectations and

assumptions regarding the future of our business, future plans and

strategies, projections, anticipated events and trends, the economy

and other future conditions. Because forward-looking statements

relate to the future, they are subject to inherent uncertainties,

risks and changes in circumstances that are difficult to predict

and many of which are outside of our control. Our actual results

and financial condition may differ materially from those indicated

in the forward-looking statements. Therefore, you should not rely

on any of these forward-looking statements. Important factors that

could cause our actual results and financial condition to differ

materially from those indicated in the forward-looking statements

include, among others, the following: the trading of our ordinary

shares or warrants and the development of a liquid trading market;

our ability to successfully market our products and services; the

acceptance of our products and services by customers; our continued

ability to pay operating costs and ability to meet demand for our

products and services; the amount and nature of competition from

other security and telecom products and services; the effects of

changes in the cybersecurity and telecom markets; our ability to

successfully develop new products and services; our success

establishing and maintaining collaborative, strategic alliance

agreements, licensing and supplier arrangements; our ability to

comply with applicable regulations; and the other risks and

uncertainties described in our annual report on Form 20-F for the

year ended December 31, 2023, filed on March 15, 2024 and our other

filings with the SEC. We undertake no obligation to publicly update

any forward-looking statement, whether written or oral, that may be

made from time to time, whether as a result of new information,

future developments or otherwise.

IMS Investor Relations 203.972.9200

wearabledevices@imsinvestorrelations.com

|

|

|

|

|

INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED) |

|

|

|

U.S. dollars (in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

December 31, |

|

|

|

|

2024 |

|

2023 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

3,103 |

|

810 |

|

|

Short-term bank deposits |

|

57 |

|

4,045 |

|

|

Account receivable |

|

47 |

|

- |

|

|

Governmental grant receivable |

|

7 |

|

108 |

|

|

Other receivables and prepaid expenses |

|

306 |

|

757 |

|

|

Inventories |

|

1,218 |

|

1,032 |

|

|

|

|

|

|

|

|

|

TOTAL CURRENT ASSETS |

|

4,738 |

|

6,752 |

|

|

|

|

|

|

|

|

|

NON-CURRENT ASSETS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Long-term bank deposits |

|

- |

|

54 |

|

|

Right-of-use assets |

|

458 |

|

592 |

|

|

Property and equipment, net |

|

176 |

|

194 |

|

|

|

|

|

|

|

|

|

TOTAL NON-CURRENT ASSETS |

|

634 |

|

840 |

|

|

|

|

|

|

|

|

|

TOTAL ASSETS |

|

5,372 |

|

7,592 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INTERIM CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED) |

|

|

|

|

|

|

U.S. dollars (in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

December 31, |

|

|

|

|

2024 |

|

2023 |

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

Accounts payables |

|

175 |

|

410 |

|

|

Advance payments |

|

101 |

|

312 |

|

|

Accrued payroll and other employment related accruals |

|

641 |

|

579 |

|

|

Convertible promissory note |

|

1,934 |

|

- |

|

|

Accrued expenses |

|

386 |

|

190 |

|

|

Lease liabilities |

|

296 |

|

297 |

|

|

TOTAL CURRENT LIABILITIES |

|

3,533 |

|

1,788 |

|

|

Lease liabilities |

|

144 |

|

278 |

|

|

TOTAL LIABILITIES |

|

3,677 |

|

2,066 |

|

|

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

Ordinary shares, NIS 0.01 par value: |

|

58 |

|

57 |

|

|

Authorized 50,000,000 as of June 30, 2024 and December 31, 2023;

issued and outstanding 20,887,428 shares as of June 30, 2024 and

20,387,428 shares as of December 31, 2023 |

|

|

Additional paid-in capital |

|

27,070 |

|

26,692 |

|

|

Accumulated losses |

|

(25,433) |

|

(21,223) |

|

|

|

|

|

|

|

|

|

TOTAL SHAREHOLDERS’ EQUITY |

|

1,695 |

|

5,526 |

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

5,372 |

|

7,592 |

|

|

|

|

|

|

|

|

|

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE

LOSS (UNAUDITED) |

|

|

|

|

|

|

U.S. dollars (in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six months endedJune 30,2024 |

|

|

Six monthsendedJune 30,2023 |

|

|

|

|

|

|

|

|

|

|

U.S. dollars |

|

in thousands |

|

|

|

(except per share amounts) |

|

|

|

|

|

|

|

| Revenues |

|

394 |

|

|

12 |

|

Expenses: |

|

|

|

|

|

| Cost of revenues |

|

(315) |

|

|

(3) |

| Research and development,

net |

|

(1,616) |

|

|

(1,560) |

| Sales and marketing

expenses |

|

(1,083) |

|

|

(1,050) |

| General and administrative

expenses |

|

(1,601) |

|

|

(1,453) |

| OPERATING

LOSS |

|

(4,221) |

|

|

(4,054) |

| FINANCING INCOME,

NET |

|

11 |

|

|

158 |

| |

|

|

|

|

|

| NET LOSS AND TOTAL

COMPREHENSIVE LOSS |

|

(4,210) |

|

|

(3,896) |

| |

|

|

|

|

|

| Net loss per ordinary

share, basic and diluted |

|

(0.21) |

|

|

(0.26) |

| |

|

|

|

|

|

| Weighted average

number of ordinary shares outstanding basic and

diluted |

|

20,392,984 |

|

|

15,254,457 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INTERIM CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED) U.S. dollars (in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six months ended |

|

|

June 30, |

|

|

|

2024 |

|

|

2023 |

|

| CASH FLOWS FROM

OPERATING ACTIVITIES: |

|

|

|

|

|

|

| Net loss |

|

(4,210) |

|

|

(3,896) |

|

|

|

|

|

|

|

|

|

|

Adjustments required to reconcile net loss to net cash used

in operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation |

|

54 |

|

|

23 |

|

|

Accrued interest on deposits |

|

39 |

|

|

*(19) |

|

|

Interest expenses on convertible promissory note |

|

14 |

|

|

- |

|

|

Share based compensation expenses |

|

112 |

|

|

109 |

|

|

Unrealized gain from foreign currency derivative activities |

|

61 |

|

|

- |

|

|

|

|

|

|

|

|

|

|

Changes in operating assets and liabilities items: |

|

|

|

|

|

|

|

Increase in inventory |

|

(186) |

|

|

(6) |

|

|

Increase in accounts receivables |

|

(47) |

|

|

- |

|

|

Decrease (increase) in governmental grants receivables |

|

101 |

|

|

(29) |

|

|

Decrease (increase) in other receivables and prepaid expenses |

|

380 |

|

|

(95) |

|

|

(Decrease) increase in advance payments |

|

(211) |

|

|

20 |

|

|

Decrease in deferred revenues |

|

- |

|

|

(12) |

|

|

Decrease in accounts payable |

|

(236) |

|

|

(44) |

|

|

Increase in accrued payroll and other employment related

accruals |

|

62 |

|

|

163 |

|

|

Increase in accrued expenses |

|

206 |

|

|

48 |

|

|

Net cash used in operating activities |

|

(3,861) |

|

|

(3,738) |

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM

INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

Purchase of property and equipment |

|

(36) |

|

|

(93) |

|

|

Proceeds (investments) associated with deposits, net |

|

4,003 |

|

|

*(2,036) |

|

|

Net cash (used in) provided by investing activities |

|

3,967 |

|

|

(2,129) |

|

|

|

|

|

|

|

|

|

| CASH FLOWS FROM

FINANCING ACTIVITIES: |

|

|

|

|

|

|

| Proceeds from issuance of

convertible promissory note |

|

1,920 |

|

|

- |

|

| Proceeds from issuance of

ordinary shares as a result of exercise of warrants |

|

- |

|

|

1,448 |

|

| Proceeds from issuance of

ordinary shares associated with the SEPA |

|

267 |

|

|

|

|

|

Net cash provided by financing activities |

|

2,187 |

|

|

1,448 |

|

|

|

|

|

|

|

|

|

| NET INCREASE

(DECREASE) IN CASH AND CASH

EQUIVALENTS |

|

2,293 |

|

|

(4,419) |

|

|

CASH AND CASH EQUIVALENTS AT BEGINNING OF

PERIOD |

|

810 |

|

|

10,373 |

|

|

CASH AND CASH EQUIVALENTS AT END OF PERIOD |

|

3,103 |

|

|

5,954 |

|

|

|

|

|

|

SUPPLEMENTAL DISCLOSURES OF CASH FLOW

INFORMATION: |

|

|

|

Interest received from deposits |

110 |

|

|

|

159 |

|

|

Right-of-use asset recognized against lease liability |

- |

|

|

|

446 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Reclassified |

|

|

|

|

|

|

|

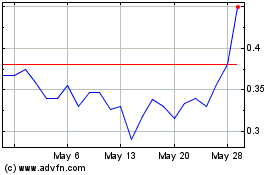

Wearable Devices (NASDAQ:WLDS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Wearable Devices (NASDAQ:WLDS)

Historical Stock Chart

From Nov 2023 to Nov 2024