Exagen Inc. (Nasdaq: XGN), a leading provider of autoimmune testing

solutions, today reported financial results for the quarter ended

September 30, 2024 and recent corporate updates.

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| (in thousands, except ASP

data) |

|

|

| Revenue |

|

$ |

12,507 |

|

|

$ |

13,416 |

|

|

$ |

41,986 |

|

|

$ |

38,783 |

|

| Gross margin |

|

|

55.8 |

% |

|

|

57.4 |

% |

|

|

58.7 |

% |

|

|

54.9 |

% |

| Operating expenses (including

COGS) |

|

$ |

17,170 |

|

|

$ |

18,485 |

|

|

$ |

52,239 |

|

|

$ |

56,473 |

|

| Operating loss |

|

$ |

(4,663 |

) |

|

$ |

(5,069 |

) |

|

$ |

(10,253 |

) |

|

$ |

(17,690 |

) |

| Net loss |

|

$ |

(5,028 |

) |

|

$ |

(5,415 |

) |

|

$ |

(11,354 |

) |

|

$ |

(18,116 |

) |

| Adjusted EBITDA |

|

$ |

(4,024 |

) |

|

$ |

(3,574 |

) |

|

$ |

(7,614 |

) |

|

$ |

(13,176 |

) |

| Cash and cash equivalents |

|

$ |

22,035 |

|

|

$ |

28,448 |

|

|

$ |

22,035 |

|

|

$ |

28,448 |

|

| Trailing-twelve-month average

selling price (ASP) |

|

$ |

404 |

|

|

$ |

320 |

|

|

$ |

404 |

|

|

$ |

320 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q3 2024 Highlights and Recent Corporate

Updates:

- Total revenue of $12.5 million in the third quarter of 2024

included the net negative impact of $1.2 million in one-time

adjustments. Prior to these adjustments, revenue was in line with

expectations.

- AVISE® CTD trailing twelve-month average selling price (ASP) of

$404, a 26% increase over the trailing twelve-month ASP in the

third quarter of 2023.

- Net Loss for the first three quarters of 2024 improved $6.8

million or 37% over the same period in 2023.

- Adjusted EBITDA loss for the first three quarters of 2024

improved $5.6 million or 42% over the same period in 2023.

- Cash and cash equivalents were $22.0 million as of

September 30, 2024, with net cash burn for the quarter of $2.5

million.

- Analytical validation completed for novel biomarkers to enhance

AVISE CTD and submitted to NY State Department of Health for

approval.

- Welcomed Jeff Black as Chief Financial Officer, effective as of

September 1, 2024.

“We've positioned ourselves for a strong finish to 2024 and laid

the groundwork for an exciting 2025, as we look to add new

proprietary biomarkers to enhance our flagship product, AVISE CTD.

We remain prudent with our cash as we drive towards profitable

growth and continue to shape Exagen as an industry leader in novel

autoimmune testing. This is the perfect time to have Jeff join our

leadership team and I welcome him as we deliver on the potential

that lies ahead,” said John Aballi, President and Chief Executive

Officer.

2024 Selected Unaudited Interim

Financial Results (in thousands)

Total revenue was $12.5 million (including the impact of $1.2

million in one-time adjustments) in the third quarter of 2024, and

$42.0 million for the first three quarters of 2024, compared to

$13.4 million in the third quarter of 2023 and $38.8 million for

the first three quarters of 2023. Gross margin was 55.8% (including

approximately 400 bps impact from one-time adjustments) in the

third quarter of 2024, compared to 57.4% in the third quarter of

2023.

Operating expenses were $17.2 million in the third quarter of

2024, compared with $18.5 million in the third quarter of 2023.

Operating expenses were $52.2 million in the first three quarters

of 2024, compared to $56.5 million in the first three quarters of

2023.

Net loss was $5.0 million in the third quarter of 2024, compared

to a net loss of $5.4 million in the third quarter of 2023. Net

loss for the first three quarters of 2024 was $11.4 million,

compared to $18.1 million in the first three quarters of 2023.

Adjusted EBITDA loss was $4.0 million in the third quarter of

2024, compared to a $3.6 million loss in the third quarter of 2023.

Adjusted EBITDA loss through the first three quarters of 2024 was

$7.6 million compared to a $13.2 million loss through the first

three quarters of 2023.

As of September 30, 2024, cash and cash equivalents were

$22.0 million and our accounts receivable balance was $9.4

million.

Reconciliations of non-GAAP adjusted EBITDA to GAAP net loss,

the closest GAAP financial measures, are provided in the financial

schedules that are part of this press release. An explanation of

these non-GAAP financial measures is also included below under the

heading “Use of Non-GAAP Financial Measures (unaudited).”

2024 Guidance

The Company now expects 2024 full-year revenue of $55 million to

$56 million, primarily reflecting the impact of one-time

adjustments in the third quarter and reiterates adjusted EBITDA

loss expectations of better than $12 million.

Conference Call

A conference call to review third quarter 2024 financial results

and to provide a business update is scheduled for today, November

12, 2024 at 8:30 AM Eastern Time (5:30 AM Pacific Time). Interested

parties may access the conference call by dialing (201) 389-0918

(U.S.) or (877) 407-0890 (international). Additionally, a link to a

live webcast of the call will be available in the Investor

Relations section of Exagen's website at investors.exagen.com.

Participants are asked to join a few minutes prior to the call

to register for the event. A replay of the conference call will be

available until Tuesday, November 26, 2024, at 11:59 PM Eastern

Time (8:59 PM Pacific Time). Interested parties may access the

replay by dialing (201) 612-7415 (U.S.) or (877) 660-6853

(international) using passcode 13749452. A link to the replay of

the webcast will also be available in the Investor Relations

section of Exagen's website.

Use of Non-GAAP Financial Measures

(UNAUDITED)

In this release, we use the metrics of adjusted EBITDA, which is

not calculated in accordance with generally accepted accounting

principles in the United States (GAAP) and is a non-GAAP financial

measure. Adjusted EBITDA excludes net loss interest income

(expense), depreciation and amortization expense, and stock-based

compensation expense.

We use adjusted EBITDA internally because we believe these

metrics provide useful supplemental information in assessing our

operating performance reported in accordance with GAAP. We believe

adjusted EBITDA may enhance an evaluation of our operating

performance because it excludes the impact of prior decisions made

about capital investment, financing, investing and certain expenses

we believe are not indicative of our ongoing performance. However,

this non-GAAP financial measure may be different from non-GAAP

financial measures used by other companies, even when the same or

similarly titled terms are used to identify such measures, limiting

their usefulness for comparative purposes.

This non-GAAP financial measure is not meant to be considered in

isolation or used as a substitute for net loss reported in

accordance with GAAP, should be considered in conjunction with our

financial information presented in accordance with GAAP, has no

standardized meaning prescribed by GAAP, is unaudited, and is not

prepared under any comprehensive set of accounting rules or

principles. In addition, from time to time in the future, there may

be other items that we may exclude for purposes of these non-GAAP

financial measures, and we may in the future cease to exclude items

that we have historically excluded for purposes of these non-GAAP

financial measures. Likewise, we may determine to modify the nature

of adjustments to arrive at these non-GAAP financial measures.

Because of the non-standardized definitions of non-GAAP financial

measures, the non-GAAP financial measure as used by us in this

press release and the accompanying reconciliation table have limits

in their usefulness to investors and may be calculated differently

from, and therefore may not be directly comparable to, similarly

titled measures used by other companies. Accordingly, investors

should not place undue reliance on non-GAAP financial measures.

About Exagen

Exagen Inc. (Nasdaq: XGN) is a leading provider of autoimmune

diagnostics, committed to transforming care for patients with

chronic and debilitating autoimmune conditions. Based in San Diego

County, California, Exagen’s mission is to provide clarity in

autoimmune disease decision making and improve clinical outcomes

through its innovative testing portfolio. The Company’s flagship

product, AVISE® CTD, enables clinicians to more effectively

diagnose complex autoimmune conditions such as lupus, rheumatoid

arthritis, and Sjögren’s syndrome earlier and with greater

accuracy. Exagen’s laboratory specializes in the testing of

rheumatic diseases, delivering precise and timely results,

supported by a full suite of AVISE-branded tests for disease

diagnosis, prognosis, and monitoring. With a focus on research,

innovation, education, and patient-centered care, Exagen is

dedicated to addressing the ongoing challenges of autoimmune

disease management.

For more information, please visit Exagen.com or follow

@ExagenInc on X (formally known as Twitter).

Forward-Looking Statements

Exagen cautions you that statements contained in this press

release regarding matters that are not historical facts are

forward-looking statements. These statements are based on Exagen’s

current beliefs and expectations. Such forward-looking statements

include, but are not limited to, statements regarding: Exagen’s

goals, strategies and ambitions; potential future financial and

business performance; the potential utility and effectiveness of

Exagen’s services and testing solutions; updates to be made to

AVISE® CTD; potential shareholder value and growth and full-year

2024 guidance. The inclusion of forward-looking statements should

not be regarded as a representation by Exagen that any of its plans

will be achieved. Actual results may differ from those set forth in

this press release due to the risks and uncertainties inherent in

Exagen’s business, including, without limitation: delays in

reimbursement and coverage decisions from Medicare and third-party

payors and in interactions with regulatory authorities, and delays

in ongoing and planned clinical trials involving its tests; changes

in laws and regulations related to Exagen’s regulatory

requirements; Exagen’s commercial success depends upon attaining

and maintaining significant market acceptance of its testing

products among rheumatologists, patients, third-party payors and

others in the medical community; Exagen’s ability to successfully

execute on its business strategies; third-party payors not

providing coverage and adequate reimbursement for Exagen’s testing

products, including Exagen’s ability to collect on funds due;

Exagen’s ability to obtain and maintain intellectual property

protection for its testing products; regulatory developments

affecting Exagen’s business; and other risks described in Exagen’s

prior press releases and Exagen’s filings with the Securities and

Exchange Commission (“SEC”), including under the heading “Risk

Factors” in Exagen’s Annual Report on Form 10-K for the year ended

December 31, 2023, filed with the SEC on March 18, 2024, its

Quarterly Report on Form 10-Q for the quarter ended September 30,

2024, filed with the SEC on November 12, 2024 and any

subsequent filings with the SEC. You are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date hereof, and Exagen undertakes no obligation to

update such statements to reflect events that occur or

circumstances that exist after the date hereof. All forward-looking

statements are qualified in their entirety by this cautionary

statement, which is made under the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995.

Contact:Ryan DouglasExagen Inc.ir@exagen.com

760.560.1525

|

Exagen Inc.Unaudited Condensed Statements

of Operations(in thousands, except share and per

share data) |

| |

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

| Revenue |

|

$ |

12,507 |

|

|

$ |

13,416 |

|

|

$ |

41,986 |

|

|

$ |

38,783 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

Costs of revenue |

|

|

5,526 |

|

|

|

5,710 |

|

|

|

17,351 |

|

|

|

17,472 |

|

|

Selling, general and administrative expenses |

|

|

10,163 |

|

|

|

11,375 |

|

|

|

31,169 |

|

|

|

35,212 |

|

|

Research and development expenses |

|

|

1,481 |

|

|

|

1,400 |

|

|

|

3,719 |

|

|

|

3,789 |

|

|

Total operating expenses |

|

|

17,170 |

|

|

|

18,485 |

|

|

|

52,239 |

|

|

|

56,473 |

|

| Loss from operations |

|

|

(4,663 |

) |

|

|

(5,069 |

) |

|

|

(10,253 |

) |

|

|

(17,690 |

) |

| Interest expense |

|

|

(562 |

) |

|

|

(557 |

) |

|

|

(1,671 |

) |

|

|

(1,769 |

) |

| Interest income |

|

|

197 |

|

|

|

211 |

|

|

|

570 |

|

|

|

1,343 |

|

| Net loss |

|

$ |

(5,028 |

) |

|

$ |

(5,415 |

) |

|

$ |

(11,354 |

) |

|

$ |

(18,116 |

) |

| Net loss per share, basic and

diluted |

|

$ |

(0.28 |

) |

|

$ |

(0.31 |

) |

|

$ |

(0.63 |

) |

|

$ |

(1.03 |

) |

| Weighted-average number of

shares used to compute net loss per share, basic and diluted |

|

|

18,254,937 |

|

|

|

17,692,603 |

|

|

|

18,127,549 |

|

|

|

17,626,686 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exagen Inc.Unaudited Condensed Balance

Sheets(in thousands, except share and per share

data) |

| |

|

September30, 2024 |

|

December31, 2023 |

| |

|

|

|

|

| Assets |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

22,035 |

|

|

$ |

36,493 |

|

|

Accounts receivable, net |

|

|

9,387 |

|

|

|

6,551 |

|

|

Prepaid expenses and other current assets |

|

|

4,135 |

|

|

|

4,797 |

|

|

Total current assets |

|

|

35,557 |

|

|

|

47,841 |

|

| Property and equipment,

net |

|

|

4,855 |

|

|

|

5,201 |

|

| Operating lease right-of-use

assets |

|

|

2,630 |

|

|

|

3,286 |

|

| Other assets |

|

|

563 |

|

|

|

616 |

|

|

Total assets |

|

$ |

43,605 |

|

|

$ |

56,944 |

|

| Liabilities and

Stockholders' Equity |

|

|

|

|

| Current liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

1,105 |

|

|

$ |

3,131 |

|

|

Accrued and other current liabilities |

|

|

6,177 |

|

|

|

7,531 |

|

|

Operating lease liabilities |

|

|

1,065 |

|

|

|

976 |

|

|

Borrowings-current portion |

|

|

430 |

|

|

|

264 |

|

|

Total current liabilities |

|

|

8,777 |

|

|

|

11,902 |

|

| Borrowings-non-current

portion, net of discounts and debt issuance costs |

|

|

19,823 |

|

|

|

19,231 |

|

| Non-current operating lease

liabilities |

|

|

1,952 |

|

|

|

2,760 |

|

| Other non-current

liabilities |

|

|

185 |

|

|

|

357 |

|

|

Total liabilities |

|

|

30,737 |

|

|

|

34,250 |

|

| Commitments and contingencies

(Note 5) |

|

|

|

|

| Stockholders' equity: |

|

|

|

|

|

Preferred stock, $0.001 par value; 10,000,000 shares authorized, no

shares issued or outstanding as of September 30, 2024 and

December 31, 2023 |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.001 par value; 200,000,000 shares authorized as of

September 30, 2024 and December 31, 2023; 17,520,335 and

17,045,954 shares issued and outstanding as of September 30,

2024 and December 31, 2023, respectively |

|

|

18 |

|

|

|

17 |

|

|

Additional paid-in capital |

|

|

303,420 |

|

|

|

301,893 |

|

|

Accumulated deficit |

|

|

(290,570 |

) |

|

|

(279,216 |

) |

|

Total stockholders' equity |

|

|

12,868 |

|

|

|

22,694 |

|

| Total liabilities and

stockholders' equity |

|

$ |

43,605 |

|

|

$ |

56,944 |

|

| |

|

|

|

|

|

|

|

|

Exagen Inc.

Reconciliation of Non-GAAP Financial

Measures (UNAUDITED)

The table below presents the reconciliation of adjusted EBITDA,

which is a non-GAAP financial measure. See “Use of Non-GAAP

Financial Measures (UNAUDITED)” above for further information

regarding the Company's use of non-GAAP financial measures.

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| (in thousands) |

|

|

| Adjusted

EBITDA |

|

|

|

|

|

|

|

|

| Net loss |

|

$ |

(5,028 |

) |

|

$ |

(5,415 |

) |

|

$ |

(11,354 |

) |

|

$ |

(18,116 |

) |

|

Other (Income) Expense |

|

|

(197 |

) |

|

|

(211 |

) |

|

|

(570 |

) |

|

|

(1,343 |

) |

|

Interest Expense |

|

|

562 |

|

|

|

557 |

|

|

|

1,671 |

|

|

|

1,769 |

|

|

Depreciation and amortization expense |

|

|

422 |

|

|

|

604 |

|

|

|

1,309 |

|

|

|

1,660 |

|

|

Stock-based compensation expense |

|

|

217 |

|

|

|

891 |

|

|

|

1,330 |

|

|

|

2,854 |

|

| Adjusted EBITDA

(Non-GAAP) |

|

$ |

(4,024 |

) |

|

$ |

(3,574 |

) |

|

$ |

(7,614 |

) |

|

$ |

(13,176 |

) |

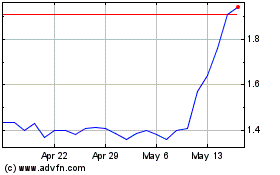

Exagen (NASDAQ:XGN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Exagen (NASDAQ:XGN)

Historical Stock Chart

From Dec 2023 to Dec 2024