– Provides Scaled Aggregates-Led Platform with Revenues of $283

Million, Adjusted EBITDA of $100 Million, and Margin Accretive to

Construction Products Segment

– Extends Footprint into Nation's Largest MSA

– Financing to Include New Long-Term Debt with Clear Path to

Deleveraging

– Additionally, Executed Definitive Agreement to Divest Steel

Components Business and Completed Sale of Other Non-Core Assets for

Total Consideration of $137 Million

– Transactions Accelerate Shift to Higher Margin Construction

Products While Advancing Strategy to Reduce Complexity and

Cyclicality of Overall Portfolio

– Arcosa Will Host a Conference Call to Discuss These

Transactions and Its Second Quarter 2024 Results at 8:30 AM ET on

Friday, August 2nd

Arcosa, Inc. (NYSE: ACA) (“Arcosa,” the “Company,” “We,” or

“Our”), a provider of infrastructure-related products and

solutions, today announced portfolio actions that advance the

Company's long-term strategy.

Acquisition of Stavola

Arcosa has entered into a definitive agreement to acquire the

construction materials business of Stavola Holding Corporation and

its affiliated entities ("Stavola") for $1.2 billion in cash,

subject to customary post-closing adjustments. Founded in 1948,

Stavola is an aggregates-led and vertically integrated construction

materials company primarily serving the New York-New Jersey

Metropolitan Statistical Area (“MSA”) through its network of five

hard rock natural aggregates quarries, twelve asphalt plants, and

three recycled aggregates sites. For the last twelve months ended

June 30, 2024 (“LTM”), Stavola generated revenues of $283 million

and Adjusted EBITDA of $100 million, representing a 35% Adjusted

EBITDA Margin. The aggregates business contributed 56% to Stavola’s

LTM Adjusted EBITDA. The structure of the transaction is expected

to create tax benefits attributable to Arcosa with a net present

value of approximately $125 million.

Commenting on the acquisition, Antonio Carrillo, Arcosa’s

President and Chief Executive Officer, noted, "Since becoming an

independent public company in 2018, Arcosa has successfully

executed against its long-term vision to grow in attractive markets

and reduce the complexity and cyclicality of the overall business

through strategic acquisitions and select divestitures. Over that

time, we have expanded our Construction Products business both

organically and inorganically, deploying approximately $1.5 billion

on value enhancing acquisitions to date and increasing our

aggregates presence in the top 50 MSAs.

“The acquisition of Stavola accelerates Arcosa’s strategic

transformation by adding a premier aggregates-led platform in the

nation’s largest MSA with favorable attributes from its exposure to

lower volatility infrastructure-led end-markets. Pro forma for the

transactions, Construction Products represents 65% of Arcosa’s LTM

Adjusted EBITDA, and consolidated LTM Adjusted EBITDA Margin

expands approximately 220 basis points. Stavola brings an

experienced management team, a reputation for strong customer

service, and a successful track record.”

Strategic Divestitures

Divestiture of Steel Components

Arcosa has also entered into a definitive agreement to sell its

steel components business to Stellex Capital Management LLC, a New

York-based private equity firm.

With a 150+ year legacy, Arcosa’s steel components business is a

leading supplier of railcar coupling devices, railcar axles, and

circular forgings. Based in Pennsylvania and operating under the

brands McConway & Torley, Standard Forged Products, and McKees

Rock Forgings, the business serves rail, mining, and other

infrastructure-related industries. Reported within the Company’s

Transportation Products segment, LTM revenues were $150 million for

the steel components business.

Additional Portfolio Actions

During the second quarter of 2024, the Company took additional

actions to optimize its portfolio and improve margins:

– Divested its single-location subscale asphalt and paving

operation located in Tennessee that was operating at a modest

loss

– Sold a non-operating facility within Engineered Structures

– Exited a small underperforming natural aggregates operation

serving the Permian Basin in west Texas and redeployed the

equipment.

Total consideration for the divestitures was $137 million, which

will be used to pay down debt.

Commenting on the portfolio actions, Carrillo continued,

"Today’s announcements underscore the strength of our company and

our confidence in the growth opportunities ahead of us.

Construction Products and Engineered Structures are benefitting

from increased scale and more resilient platforms and are

well-positioned to benefit from infrastructure-driven tailwinds.

Additionally, our two remaining cyclical businesses, wind towers

and barge, command industry-leading positions with solid backlog

visibility in place and anticipated multi-year market recoveries

underway.

“We have committed financing in place to fund the purchase of

Stavola that will result in initial net leverage above our targeted

range. Our permanent financing strategy will allow for rapid

deleveraging at an attractive cost of capital. Based on the

anticipated strength of our cash flow generation, our goal is to

return to our long-term net leverage targeted range within 18

months."

Carrillo concluded, “We believe these portfolio actions

underscore our commitment to increasing long-term shareholder value

and our disciplined approach to capital allocation. We look forward

to welcoming the Stavola team and customer base to Arcosa, and

express our gratitude to the employees of our steel components

business for their dedication and contributions to Arcosa.”

Strategic and Financial Rationale for Portfolio

Actions

– Extends Construction Products footprint into the nation’s

largest MSA with a scaled and vertically integrated aggregates and

FOB asphalt operation. Stavola operates in an attractive region

with increased exposure to lower volatility, infrastructure-led end

markets. Competitive advantages include a difficult to replicate

leadership position underpinned by long-term customer relationships

and an estimated 350 million tons of hard rock aggregates reserves

commanding industry-leading profitability metrics.

– Represents attractive valuation for a scaled aggregates-led

business with premium financial attributes. The $1.2 billion

purchase price reflects a 10.7x multiple of Stavola’s LTM Adjusted

EBITDA, net of the present value of tax attributes created from the

acquisition, and 12.0x on a gross basis.

– Increases Arcosa's exposure to higher margin Construction

Products Adjusted EBITDA. Stavola enhances the scale and margin

profile of our Construction Products segment. On a pro forma LTM

basis, Construction Products revenues increase 28% to $1.3 billion

and Adjusted Segment EBITDA grows 42% to $342 million, resulting in

260 basis points of Adjusted Segment EBITDA margin improvement.

– Reduces the complexity and cyclicality of the

portfolio. Divestiture of the steel components business, along

with the other recent strategic actions, results in reduced

exposure to cyclical end-markets and improved margin.

– Enhances Arcosa's overall profitability and financial

profile. Pro forma for the transactions, Construction Products

will represent 65% of Arcosa’s Adjusted EBITDA excluding corporate

costs, and the Company’s LTM Adjusted EBITDA Margin expands

approximately 220 basis points. Today’s announcements are decisive

actions to optimize our portfolio, enhance the quality of our

earnings, and deliver superior value for our shareholders.

– Portfolio resilience supports Arcosa’s ability to maintain

a healthy balance sheet through prudent deleveraging. Upon

completion of the acquisition of Stavola, the Company’s pro forma

LTM Net Debt to Adjusted EBITDA is approximately 3.7x. The

increased scale of our growth businesses and anticipated market

recovery in our cyclical businesses, bolstered by current backlog

visibility, gives us line of sight to increased cash flow

generation. With debt reduction as our near-term capital allocation

priority, our goal is to de-lever to our long-term target of 2.0 to

2.5x within 18 months.

Financing

Arcosa has obtained $1.2 billion of committed secured bridge

loan financing in connection with the execution of the agreement to

acquire Stavola, as well as a backstop to its existing $600 million

revolving credit facility. Prior to the transaction close, the

Company anticipates accessing the long-term debt capital markets

for permanent financing with a mix of secured and unsecured debt

that incorporates prepayment flexibility.

Approvals and Timing

The actions announced today have been unanimously approved by

the Company’s Board of Directors. Arcosa has obtained all necessary

regulatory approvals for the acquisition of Stavola and the

divestiture of the steel components business. The Company

anticipates the acquisition will be completed in the fourth quarter

and the divestiture is expected to close during the third

quarter.

Advisors

Barclays and Evercore served as financial advisors to Arcosa on

the acquisition of Stavola. Evercore also served as financial

advisor to Arcosa on the divestiture of the steel components

business. Kirkland & Ellis served as legal advisor to the

Company on the acquisition, and Gibson, Dunn, & Crutcher served

as legal advisor to Arcosa on the divestiture. J.P. Morgan, Bank of

America Securities and Barclays have provided committed financing

to Arcosa in connection with the acquisition of Stavola. Baker

Botts served as the Company’s legal advisor on the committed

financing.

Conference Call Details

A conference call is scheduled for 8:30 a.m. Eastern Time on

August 2, 2024 to discuss the transactions and our second quarter

2024 results announced today in a separate release. To listen to

the conference call webcast, please visit the Investor Relations

section of Arcosa’s website at https://ir.arcosa.com. A slide

presentation for this conference call will be posted on the

Company’s website in advance of the call at https://ir.arcosa.com.

The audio conference call number is 800-343-1703 for domestic

callers and 785-424-1116 for international callers. The conference

ID is ARCOSA and the passcode is 24246. An audio playback will be

available through 11:59 p.m. Eastern Time on August 16, 2024, by

dialing 800-839-1162 for domestic callers and 402-220-0398 for

international callers. A replay of the webcast will be available

for one year on Arcosa’s website at

https://ir.arcosa.com/news-events/events-presentations.

About Arcosa

Arcosa, Inc., headquartered in Dallas, Texas, is a provider of

infrastructure-related products and solutions with leading

positions in construction, engineered structures, and

transportation markets. Arcosa reports its financial results in

three principal business segments: Construction Products,

Engineered Structures, and Transportation Products. For more

information, visit www.arcosa.com.

Some statements in this release, which are not historical facts,

are “forward-looking statements” as defined by the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements include statements about Arcosa’s estimates,

expectations, beliefs, intentions or strategies for the future.

Arcosa uses the words “anticipates,” “assumes,” “believes,”

“estimates,” “expects,” “intends,” “forecasts,” “may,” “will,”

“should,” “guidance,” “outlook,” “strategy,” “plans,” “goal,”and

similar expressions to identify these forward-looking statements.

Forward-looking statements speak only as of the date of this

release, and Arcosa expressly disclaims any obligation or

undertaking to disseminate any updates or revisions to any

forward-looking statement contained herein, except as required by

federal securities laws. Forward-looking statements are based on

management’s current views and assumptions and involve risks and

uncertainties that could cause actual results to differ materially

from historical experience or our present expectations, including

but not limited to assumptions, risks and uncertainties regarding

failure to successfully complete and integrate acquisitions,

including Ameron and Stavola, or divest any business, including the

steel components business, or failure to achieve the expected

benefits of acquisitions or divestitures; market conditions and

customer demand for Arcosa’s business products and services; the

cyclical nature of, and seasonal or weather impact on, the

industries in which Arcosa competes; competition and other

competitive factors; governmental and regulatory factors; changing

technologies; availability of growth opportunities; market

recovery; ability to improve margins; the impact of inflation and

costs of materials; assumptions regarding achievements of the

expected benefits from the Inflation Reduction Act; the delivery or

satisfaction of any backlog or firm orders; the impact of pandemics

on Arcosa’s business; and Arcosa’s ability to execute its long-term

strategy, and such forward-looking statements are not guarantees of

future performance. For further discussion of such risks and

uncertainties, see “Risk Factors” and the “Forward-Looking

Statements” section of “Management's Discussion and Analysis of

Financial Condition and Results of Operations” in Arcosa's Form

10-K for the year ended December 31, 2023 and as may be revised and

updated by Arcosa's Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K.

TABLES TO FOLLOW

Reconciliation of Stavola and Steel Components Adjusted

EBITDA (in millions) (unaudited)

“EBITDA” is defined as net income plus interest, taxes,

depreciation, depletion, and amortization. “Adjusted EBITDA” is

defined as EBITDA adjusted for certain items that are not

reflective of normal earnings. GAAP does not define EBITDA or

Adjusted EBITDA and they should not be considered as alternatives

to earnings measures defined by GAAP, including net income. We

believe Adjusted EBITDA assists investors in comparing a company's

performance on a consistent basis without regard to depreciation,

depletion, amortization, and other items which can vary

significantly depending on many factors.

Twelve Months Ended

June 30, 2024

Stavola:

Net income

$

71.8

Add:

Interest expense, net

0.8

Provision for income taxes

—

Depreciation, depletion, and amortization

expense

18.9

EBITDA

91.5

Non-recurring adjustments

9.0

Stavola Adjusted EBITDA

$

100.5

Twelve Months Ended

June 30, 2024

Steel components business:

Operating profit

$

11.3

Add: Depreciation and amortization

9.6

Steel components EBITDA

20.9

Steel components Adjusted EBITDA

$

20.9

Reconciliation of Net Debt to Adjusted EBITDA ($ in

millions) (unaudited)

GAAP does not define “Net Debt” and it should not be considered

as an alternative to cash flow or liquidity measures defined by

GAAP. The Company uses Net Debt, which it defines as total debt

minus cash and cash equivalents to determine the extent to which

the Company’s outstanding debt obligations would be satisfied by

its cash and cash equivalents on hand. The Company also uses “Net

Debt to Adjusted EBITDA”, which it defines as Net Debt divided by

Adjusted EBITDA for the trailing twelve months as a metric of its

current leverage position. We present this metric for the

convenience of investors who use such metrics in their analysis and

for shareholders who need to understand the metrics we use to

assess performance and monitor our cash and liquidity

positions.

June 30, 2024(1)

Pro forma Stavola

Pro forma June 30,

2024

Total Debt, excluding debt issuance

costs

$

710.4

$

1,200.0

$

1,910.4

Cash and cash equivalents

103.7

—

103.7

Net Debt

$

606.7

$

1,200.0

$

1,806.7

Adjusted EBITDA (last twelve

months)(1)

$

393.3

$

100.5

$

493.8

Net Debt to Adjusted EBITDA

1.5

3.7

(1) See separate press release announcing

Arcosa's second quarter 2024 earnings results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240801867077/en/

INVESTOR CONTACTS

Gail M. Peck Chief Financial Officer

Erin Drabek Director of Investor Relations

T 972.942.6500 InvestorResources@arcosa.com

David Gold ADVISIRY Partners

T 212.661.2220 David.Gold@advisiry.com

MEDIA CONTACT

Media@arcosa.com

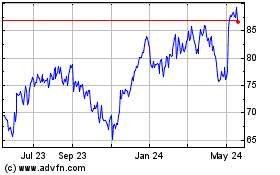

Arcosa (NYSE:ACA)

Historical Stock Chart

From Dec 2024 to Jan 2025

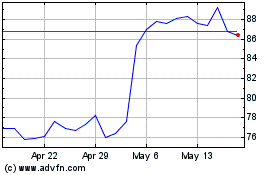

Arcosa (NYSE:ACA)

Historical Stock Chart

From Jan 2024 to Jan 2025