6 | See accompanying Notes

to Schedule of Investments.

Apollo Senior Floating Rate Fund Inc.

Schedule of Investments (continued)

September 30, 2019 (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share

Quantity

|

|

|

Value ($)

|

|

|

Common Stocks - 0.9%

|

|

|

|

|

|

|

|

|

|

|

|

BANKING, FINANCE, INSURANCE & REAL ESTATE - 0.6%

|

|

|

|

|

|

|

Medical Card System, Inc.(d)(l)

|

|

|

991,230

|

|

|

|

1,506,670

|

|

|

|

|

|

|

|

|

|

|

|

|

ENERGY: OIL & GAS - 0.3%

|

|

|

|

|

|

|

|

|

|

|

|

Ascent Resources Marcellus

Holdings, Inc.(l)

|

|

|

324,739

|

|

|

|

730,663

|

|

|

HGIM Corp.(d)(l)

|

|

|

9,820

|

|

|

|

120,295

|

|

|

Southcross Holdings Borrower,

GP LLC(d)(l)

|

|

|

129

|

|

|

|

—

|

|

|

Southcross Holdings Borrower,

L.P. Class

A-II(d)

|

|

|

129

|

|

|

|

61,275

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

912,233

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MEDIA: ADVERTISING, PRINTING & PUBLISHING - 0.0%

|

|

|

|

|

|

|

F & W Media, Inc.(d)(f)(l)

|

|

|

9,511

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RETAIL - 0.0%

|

|

|

|

|

|

|

|

|

|

|

|

Charming Charlie, LLC(d)(g)(l)

|

|

|

8,890,519

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Common Stocks

(Cost $2,032,380)

|

|

|

|

|

|

|

2,418,903

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share

Quantity

|

|

|

Value ($)

|

|

|

Preferred Stock - 0.4%

|

|

|

|

|

|

|

|

|

|

|

|

BANKING, FINANCE, INSURANCE & REAL ESTATE - 0.4%

|

|

|

|

|

|

|

Watford Holdings, Ltd. (Bermuda)

(LIBOR + 6.68%, 1.00% Floor),

|

|

|

|

|

|

|

|

|

|

8.78%(d)(e)

|

|

|

37,863

|

|

|

|

946,575

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Preferred Stocks

(Cost $927,643)

|

|

|

|

|

|

|

946,575

|

|

|

|

|

|

|

|

|

|

|

|

|

Warrants - 0.0%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ENERGY: OIL & GAS - 0.0%

|

|

|

|

|

|

|

|

|

|

|

|

Ascent Resources Marcellus

Holdings,

Inc.(d)(l)

|

|

|

84,077

|

|

|

|

2,522

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Warrants

(Cost $8,408)

|

|

|

|

|

|

|

2,522

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investments - 156.5%

|

|

|

|

|

|

|

|

(Cost of $422,569,672)

|

|

|

|

|

|

|

410,343,043

|

|

|

Other Assets &

Liabilities,

Net - (2.8)%

|

|

|

|

|

|

|

(7,423,051

|

)

|

|

Loan Outstanding - (53.7)%(m)(n)

|

|

|

|

|

|

|

(140,759,147

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Assets (Applicable to Common

Shares) - 100.0%

|

|

|

|

|

|

|

262,160,845

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

“Senior Loans” are senior, secured loans made to companies whose debt is below investment grade as well as

investments with similar economic characteristics. Senior Loans typically hold a first lien priority and, unless otherwise indicated, are required to pay interest at floating rates that are periodically reset by reference to a base lending rate plus

a spread. In some instances, the rates shown represent the weighted average rate as of September 30, 2019. Senior Loans are generally not registered under the Securities Act of 1933 (the “1933 Act”) and often incorporate certain

restrictions on resale and cannot be sold publicly. Senior Loans often require prepayments from excess cash flow or permit the borrower to repay at its election. The degree to which borrowers repay, whether as a contractual requirement or at their

election, cannot be predicted with accuracy. As a result, the actual maturity may be substantially less than the stated maturity.

|

|

(b)

|

All or a portion of this Senior Loan position has not settled. Full contract rates do not take effect until settlement

date and therefore are subject to change.

|

|

(c)

|

The interest rate on this Senior Loan is subject to a base lending rate plus a spread. These base lending rates are

primarily the London Interbank Offered Rate (“LIBOR”) and secondarily the prime rate offered by one or more major U.S. banks (“Prime”). The interest rate is subject to a minimum floor, which may be less than or greater than the

prevailing period end LIBOR/Prime rate. As of September 30, 2019, the 1, 2, 3 and 6 month LIBOR rates were 2.02%, 2.07%, 2.09% and 2.06%, respectively, and the Prime lending rate was 5.00%. Senior Loans may contain multiple contracts of the

same issuer which may be subject to base lending rates of both LIBOR and Prime (“Variable”) in addition to the stated spread.

|

|

(d)

|

Fair Value Level 3 security.

|

|

(e)

|

Foreign issuer traded in U.S. dollars.

|

|

(f)

|

The issuer has filed for Chapter 11 bankruptcy protection as of March 10, 2019.

|

|

(g)

|

The issuer has filed for Chapter 11 bankruptcy protection as of July 11, 2019.

|

|

(i)

|

Securities exempt from registration pursuant to Rule 144A under the 1933 Act. These securities may only be resold in

transactions exempt from registration to qualified institutional buyers. At September 30, 2019, these securities amounted to $21,828,562, or 8.33% of net assets.

|

|

(j)

|

The issuer is in default of its payment obligations as of July 5, 2018.

|

|

(k)

|

The issuer is in default of its payment obligations as of May 5, 2015.

|

|

(l)

|

Non-income producing asset.

|

|

(m)

|

The Fund has granted a security interest in substantially all of its assets in the event of default under the credit

facility.

|

|

(n)

|

Principal of $141,000,000 less unamortized deferred financing costs of $240,853.

|

See accompanying Notes to Schedule

of Investments. | 7

Apollo Senior Floating Rate Fund Inc.

Notes to Schedule of Investments

September 30, 2019 (unaudited)

Security Valuation

Apollo Senior Floating Rate Fund Inc. (the “Fund”) values its investments primarily using the mean of the bid and ask prices provided by a

nationally recognized security pricing service or broker. Senior Loans, corporate notes and bonds, common stock, structured products, preferred stock, and warrants are priced based on valuations provided by an approved independent pricing service or

broker, if available. If market or broker quotations are not available, or a price is not available from an independent pricing service or broker, or if the price provided by the independent pricing service or broker is believed to be unreliable,

the security will be fair valued pursuant to procedures adopted by the Fund’s board of directors (the “Board”). In general, the fair value of a security is the amount that the Fund might reasonably expect to receive upon the sale of

an asset or pay to transfer a liability in an orderly transaction between willing market participants at the reporting date. Fair value procedures generally take into account any factors deemed relevant, which may include, among others, (i) the

nature and pricing history of the security, (ii) the liquidity or illiquidity of the market for the particular security, (iii) recent purchases or sales transactions for the particular security or similar securities and (iv) press

releases and other information published about the issuer. In these cases, the Fund’s net asset value (“NAV”) will reflect the affected portfolio securities’ fair value as determined in the judgment of the Board or its designee

instead of being determined by the market. Using a fair value pricing methodology to value securities may result in a value that is different from a security’s most recent sale price and from the prices used by other investment companies to

calculate their NAV. Determination of fair value is uncertain because it involves subjective judgments and estimates. There can be no assurance that the Fund’s valuation of a security will not differ from the amount that it realizes upon the

sale of such security.

Fair Value Measurements

The Fund

has performed an analysis of all existing investments to determine the significance and character of all inputs to their fair value determination. The levels of fair value inputs used to measure the Fund’s investments are characterized into a

fair value hierarchy. The three levels of the fair value hierarchy are described below:

Level 1 — Quoted unadjusted prices for identical

assets and liabilities in active markets to which the Fund has access at the date of measurement;

Level 2 — Quoted prices for similar

assets and liabilities in active markets, quoted prices for identical or similar assets and liabilities in markets that are not active, but are valued based on executed trades, broker quotations that constitute an executable price, and alternative

pricing sources supported by observable inputs which, in each case, are either directly or indirectly observable for the asset in connection with market data at the measurement date; and

Level 3 — Model derived valuations in which one or more significant inputs or significant value drivers are unobservable. In certain cases,

investments classified within Level 3 may include securities for which the Fund has obtained indicative quotes from broker-dealers that do not necessarily represent prices the broker may be willing to trade on, as such quotes can be subject to

material management judgment. Unobservable inputs are those inputs that reflect the Fund’s own assumptions that market participants would use to price the asset or liability based on the best available information.

At the end of each reporting period, management evaluates the Level 2 and Level 3 assets, if any, for changes in liquidity, including but not

limited to: whether a broker is willing to execute at the quoted price, the depth and consistency of prices from independent pricing services, and the existence of contemporaneous, observable trades in the market.

8 |

Apollo Senior Floating Rate Fund Inc.

Notes to Schedule of Investments (continued)

September 30, 2019

(unaudited)

The valuation techniques used by the Fund to measure fair

value at September 30, 2019 maximized the use of observable inputs and minimized the use of unobservable inputs. The inputs or methodologies used for valuing securities are not necessarily an indication of the risk associated with investing in

those securities. Transfers into and out of the levels are recognized at the value at the end of the period. A summary of the Fund’s investments categorized in the fair value hierarchy as of September 30, 2019 is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apollo Senior Floating Rate Fund Inc.

|

|

|

|

|

|

|

|

|

Total Fair Value at

September 30, 2019

|

|

Level 1

Quoted Price

|

|

Level 2

Significant

Observable

Inputs

|

|

Level 3

Significant

Unobservable

Inputs

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and Cash Equivalents

|

|

|

$

|

5,902,604

|

|

|

|

$

|

5,902,604

|

|

|

|

$

|

—

|

|

|

|

$

|

—

|

|

|

Senior Loans

|

|

|

|

384,062,287

|

|

|

|

|

—

|

|

|

|

|

378,028,525

|

|

|

|

|

6,033,762

|

|

|

Corporate Notes and Bonds

|

|

|

|

22,912,756

|

|

|

|

|

—

|

|

|

|

|

22,901,639

|

|

|

|

|

11,117

|

|

|

Common Stocks

|

|

|

|

2,418,903

|

|

|

|

|

—

|

|

|

|

|

730,663

|

|

|

|

|

1,688,240

|

|

|

Preferred Stock

|

|

|

|

946,575

|

|

|

|

|

—

|

|

|

|

|

—

|

|

|

|

|

946,575

|

|

|

Warrants

|

|

|

|

2,522

|

|

|

|

|

—

|

|

|

|

|

—

|

|

|

|

|

2,522

|

|

|

Unrealized appreciation on Unfunded Loan Commitments

|

|

|

|

2,280

|

|

|

|

|

—

|

|

|

|

|

2,280

|

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets

|

|

|

$

|

416,247,927

|

|

|

|

$

|

5,902,604

|

|

|

|

$

|

401,663,107

|

|

|

|

$

|

8,682,216

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following is a reconciliation of Level 3 holdings for which significant unobservable inputs were used in

determining fair value for the period January 1, 2019 through September 30, 2019:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apollo Senior Floating Rate Fund Inc.

|

|

|

|

|

|

|

|

|

Total

|

|

Senior

Loans

|

|

Corporate

Notes

and Bonds

|

|

Common

Stocks

|

|

Preferred

Stock

|

|

Warrants

|

|

|

|

|

|

|

Total Fair Value, beginning of period

|

|

|

$

|

12,903,157

|

|

|

|

$

|

8,720,408

|

|

|

|

$

|

3,066

|

|

|

|

$

|

532,168

|

|

|

|

$

|

3,644,993

|

|

|

|

$

|

2,522

|

|

|

Purchases, including capitalized PIK

|

|

|

|

4,842,917

|

|

|

|

|

4,842,917

|

|

|

|

|

—

|

|

|

|

|

—

|

|

|

|

|

—

|

|

|

|

|

—

|

|

|

Sales/Paydowns

|

|

|

|

(9,895,785

|

)

|

|

|

|

(6,842,360

|

)

|

|

|

|

—

|

|

|

|

|

—

|

|

|

|

|

(3,053,425

|

)

|

|

|

|

—

|

|

|

Accretion/(amortization) of discounts/(premiums)

|

|

|

|

339,143

|

|

|

|

|

339,143

|

|

|

|

|

—

|

|

|

|

|

—

|

|

|

|

|

—

|

|

|

|

|

—

|

|

|

Net realized gain/(loss)

|

|

|

|

126,391

|

|

|

|

|

65,322

|

|

|

|

|

—

|

|

|

|

|

—

|

|

|

|

|

61,069

|

|

|

|

|

—

|

|

|

Change in net unrealized appreciation/(depreciation)

|

|

|

|

1,128,734

|

|

|

|

|

(329,327

|

)

|

|

|

|

8,051

|

|

|

|

|

1,156,072

|

|

|

|

|

293,938

|

|

|

|

|

—

|

|

|

Transfers into Level 3

|

|

|

|

782,609

|

|

|

|

|

782,609

|

|

|

|

|

—

|

|

|

|

|

—

|

|

|

|

|

—

|

|

|

|

|

—

|

|

|

Transfers out of Level 3

|

|

|

|

(1,544,950

|

)

|

|

|

|

(1,544,950

|

)

|

|

|

|

—

|

|

|

|

|

—

|

|

|

|

|

—

|

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Fair Value, end of period

|

|

|

$

|

8,682,216

|

|

|

|

$

|

6,033,762

|

|

|

|

$

|

11,117

|

|

|

|

$

|

1,688,240

|

|

|

|

$

|

946,575

|

|

|

|

$

|

2,522

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets were transferred from Level 2 to Level 3 or from Level 3 to Level 2 as a result of changes in

levels of liquid market observability when subject to various criteria as discussed above. There were no transfers between Level 1 and Level 2 fair value measurement during the period shown. The net change in unrealized

appreciation/(depreciation) attributable to Level 3 investments still held at September 30, 2019 was $715,015.

| 9

Apollo Senior Floating Rate Fund Inc.

Notes to Schedule of Investments (continued)

September 30, 2019

(unaudited)

The following table provides quantitative measures used to

determine the fair values of the Level 3 investments as of September 30, 2019:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets

|

|

Fair Value at

September 30, 2019

|

|

Valuation Technique(s)(a)

|

|

Unobservable Input(s)

|

|

Range of

Unobservable

Input(s) Utilized

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Senior Loans

|

|

|

$

|

5,865,792

|

|

|

Independent pricing service and/or broker quotes

|

|

Vendor and/or broker quotes

|

|

N/A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

167,461

|

|

|

Recoverability(b)

|

|

Liquidation Proceeds(b)

|

|

$5.3m - $5.5m

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

509

|

|

|

Recoverability(b)

|

|

Liquidation Proceeds(b)

|

|

$11.1m

|

|

|

|

|

|

|

|

|

|

|

Corporate Notes and Bonds

|

|

|

|

11,117

|

|

|

Recoverability(b)(c)(d)

|

|

Liquidation Proceeds(b)

|

|

$6.1m

|

|

|

|

|

|

|

|

|

|

|

|

|

Estimated Transaction Value(c)

|

|

N/A

|

|

|

|

|

|

|

|

|

|

|

|

|

Discount Rate(d)

|

|

2.06%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

—

|

|

|

Recoverability(b)

|

|

Liquidation Proceeds(b)

|

|

$0

|

|

|

|

|

|

|

|

|

|

|

Common Stocks

|

|

|

|

—

|

|

|

Recoverability(b)

|

|

Liquidation Proceeds(b)

|

|

$5.3m - $5.5m

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

—

|

|

|

Recoverability(b)

|

|

Liquidation Proceeds(b)

|

|

$11.1m

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1,506,670

|

|

|

Market Comparable Approach(e)

|

|

EBITDA Multiple(e)

|

|

1.9x

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

181,570

|

|

|

Independent pricing service and/or broker quotes

|

|

Vendor and/or broker quotes

|

|

N/A

|

|

|

|

|

|

|

|

|

|

|

Preferred Stock

|

|

|

|

946,575

|

|

|

Discounted Cash Flow(f)

|

|

Discount Rate(f)

|

|

8.25%

|

|

|

|

|

|

|

|

|

|

|

Warrants

|

|

|

|

2,522

|

|

|

Independent pricing service and/or broker quotes

|

|

Vendor and/or broker quotes

|

|

N/A

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Fair Value

|

|

|

$

|

8,682,216

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

For the assets which have multiple valuation techniques, the Fund may rely on the techniques individually or in aggregate

based on a weight ranging from 0-100%.

|

|

(b)

|

The Fund utilized a recoverability approach to fair value these securities, specifically a liquidation analysis. There are

various, company specific inputs used in the valuation analysis that relate to the liquidation value of a company’s assets. The significant unobservable inputs used in the valuation model were liquidation proceeds. Significant increases or

decreases in the input in isolation may result in a significantly higher or lower fair value measurement.

|

|

(c)

|

The Fund utilized a recoverability approach to fair value this security. The significant unobservable input used in the

valuation model was an estimated transaction value. Significant increases or decreases in the input in isolation may result in a significantly higher or lower fair value measurement.

|

|

(d)

|

The Fund utilized a recoverability approach to fair value this security. The significant unobservable input used in the

valuation model was a discount rate. Significant increases or decreases in the input in isolation may result in a significantly higher or lower fair value measurement.

|

|

(e)

|

The Fund utilized a market comparable approach to fair value this security. The significant unobservable inputs used in

the valuation model were total enterprise value and earnings before interest, taxes, depreciation and amortization (“EBITDA”) based on comparable multiples for a similar investment with similar risks. Significant increases or decreases in

either of these inputs in isolation may result in a significantly higher or lower fair value measurement.

|

|

(f)

|

The Fund utilized a discounted cash flow model to fair value this security. The significant unobservable input used in the

valuation model was the discount rate, which was determined based on the market rates an investor would expect for a similar investment with similar risks. The discount rate was applied to present value the projected cash flows in the valuation

model. Significant increases in the discount rate may significantly lower the fair value of an investment; conversely, significant decreases in the discount rate may significantly increase the fair value of an investment.

|

10 |

Apollo Senior Floating Rate Fund Inc.

Notes to Schedule of Investments (continued)

September 30, 2019

(unaudited)

Federal Tax Information

Cost for U.S federal income tax purposes differs from book basis primarily due to the deferral of losses from wash sales. Unrealized appreciation and

depreciation on investments as of September 30, 2019 were as follows:

|

|

|

|

|

|

|

|

|

|

Apollo Senior

Floating Rate

Fund Inc.

|

|

|

|

|

|

|

Federal tax basis, cost

|

|

|

$

|

423,511,563

|

|

|

|

|

|

|

|

|

|

Unrealized appreciation

|

|

|

|

5,011,226

|

|

|

Unrealized depreciation

|

|

|

|

(18,179,747

|

)

|

|

|

|

|

|

|

|

|

Net unrealized appreciation/(depreciation)*

|

|

|

$

|

(13,168,521

|

)

|

|

|

|

|

|

|

|

General Commitments and Contingencies

As of September 30, 2019, the Fund had unfunded loan commitments outstanding, which could be extended at the option of the borrower, as detailed

below:

|

|

|

|

|

|

|

|

Borrower

|

|

Unfunded Loan

Commitments

|

|

|

|

|

|

|

Allied Universal Holdco, LLC Delayed Draw Term Loan

|

|

|

$

|

180,180

|

|

|

Aveanna Healthcare, LLC Bridge Term Loan

|

|

|

|

2,455,444

|

|

|

Centene Corporation Bridge Term Loan TR 1

|

|

|

|

511,013

|

|

|

Centene Corporation Bridge Term Loan TR 2

|

|

|

|

471,705

|

|

|

Zayo Group Holdings, Inc. Backstop Term Loan

|

|

|

|

2,745,037

|

|

|

Zayo Group Holdings, Inc. Bridge Term Loan

|

|

|

|

1,347,254

|

|

|

|

|

|

|

|

|

|

Total unfunded loan commitments

|

|

|

$

|

7,710,633

|

|

|

|

|

|

|

|

|

For more information with regard to significant accounting policies, see the Fund’s most recent semi-annual report

filed with the Securities and Exchange Commission.

| 11

Item 2. Controls and Procedures.

|

(a)

|

The Registrant’s principal executive and principal financial officers, or persons performing similar functions,

have concluded that the Registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the “1940 Act”)) (17 CFR 270.30a-3(c)) are effective as of a date within 90 days of the filing date of this report, based on the evaluation of these controls and procedures required by

Rule 30a-3(b) under the 1940 Act (17 CFR 270.30a-3(b)) and Rule 13a-15(b) or

Rule 15d-15(b) under the Securities Exchange Act of 1934, as amended (17 CFR 240.13a-15(b) or 240.15d-15(d)).

|

|

(b)

|

There were no changes in the Registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act) (17 CFR 270.30a-3(d)) that occurred during the Registrant’s last fiscal quarter that have materially affected, or are reasonably

likely to materially affect, the Registrant’s internal control over financial reporting.

|

Item 3. Exhibits.

Separate certifications for each principal executive officer and principal financial officer of the Registrant as required by Rule 30a-2(a) under the 1940 Act (17 CFR 270.30a-2(a)), are attached as Exhibit 99.CERT.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly

caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

(Registrant) Apollo Senior Floating Rate Fund

Inc.

|

|

|

|

By (Signature and Title) /s/ Joseph

Moroney

|

|

|

|

Joseph Moroney, President

|

|

|

|

(principal executive officer)

|

|

|

|

Date

11/14/2019

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act

of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

|

|

|

|

|

By (Signature and Title) /s/ Joseph

Moroney

|

|

|

|

Joseph Moroney, President

|

|

|

|

(principal executive officer)

|

|

|

|

Date

11/14/2019

|

|

|

|

By (Signature and Title) /s/ Frank

Marra

|

|

|

|

Frank Marra, Treasurer and Chief Financial Officer

|

|

|

|

(principal financial officer)

|

|

|

|

Date

11/14/2019

|

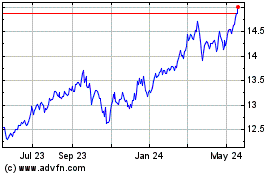

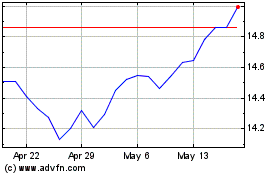

Apollo Senior Floating R... (NYSE:AFT)

Historical Stock Chart

From Jun 2024 to Jul 2024

Apollo Senior Floating R... (NYSE:AFT)

Historical Stock Chart

From Jul 2023 to Jul 2024