Filed by JEPLAN Holdings, Inc.

Pursuant to Rule 425 under the Securities Act of 1933,

as amended, and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: AP Acquisition Corp

Commission File No.: 001-41176

Filed June 16, 2023

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 16, 2023

AP Acquisition Corp

(Exact name of registrant as specified in its

charter)

| Cayman

Islands |

|

001-41176

|

|

98-1601227 |

(State

or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification Number) |

10 Collyer Quay,

#37-00 Ocean Financial Center

Singapore |

N/A |

| (Address

of principal executive offices) |

(Zip

Code) |

+65 6808 6510

Registrant’s telephone number, including

area code

Not Applicable

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation to the registrant under any of the following provisions:

| x |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on

which registered |

| Units,

each consisting of one Class A ordinary share, $0.0001 par value, and one-half of one redeemable warrant |

|

APCA-U |

|

New

York Stock Exchange |

| Class

A ordinary shares included as part of the units |

|

APCA |

|

New

York Stock Exchange |

| Redeemable

warrants included as part of the units, each whole warrant exercisable for one Class A ordinary share at an exercise price of

$11.50 |

|

APCA-W |

|

New

York Stock Exchange |

Indicate by check mark whether the registrant is

an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act

of 1934.

Emerging

growth company x

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 |

Entry Into A Material Definitive

Agreement. |

Business Combination Agreement

On June 16, 2023, (i) AP Acquisition Corp, an exempted company

limited by shares incorporated under the laws of the Cayman Islands (“SPAC”), (ii) JEPLAN Holdings, Inc.,

a Japanese corporation (kabushiki kaisha) incorporated under the laws of Japan (“PubCo”), (iii) JEPLAN

MS, Inc., an exempted company limited by shares incorporated under the laws of the Cayman Islands and a direct wholly-owned subsidiary

of PubCo (“Merger Sub”), and (iv) JEPLAN, Inc., a Japanese corporation (kabushiki kaisha)

incorporated under the laws of Japan (the “Company” or “JEPLAN”), entered into a

Business Combination Agreement (as it may be amended, supplemented or otherwise modified from time to time, the “Business

Combination Agreement”).

The Business Combination Agreement

and the transactions contemplated thereby were unanimously approved by the board of directors of each of SPAC and the Company.

The Business Combination Agreement

provides for, among other things, the following transactions: (i) the share exchange involving PubCo, the Company and all shareholders

of the Company (the “Share Exchange”) and other ancillary transactions in connection therewith (the “Pre-Merger

Reorganization”) such that the Company will become a wholly-owned subsidiary of PubCo upon completion of the Pre-Merger

Reorganization; and (ii) immediately following the completion of the Pre-Merger Reorganization, the merger of Merger Sub with and

into SPAC, with SPAC being the surviving entity and becoming a wholly-owned subsidiary of PubCo (the “Merger”).

The Pre-Merger Reorganization, the Merger and the other transactions contemplated by the Business Combination Agreement are hereinafter

referred to as the “Business Combination.”

The Business Combination

Subject

to, and in accordance with, the terms and conditions of the Business Combination Agreement, in connection with the Share Exchange, at

the effective time of the Share Exchange (the “Share Exchange Effective Time”), (a) each issued and outstanding

common share of the Company, including each share of the Company issued prior to the Share Exchange Effective Time in connection with

the conversion of all issued and outstanding convertible notes of the Company (each a “Company Share”), will

be exchanged for such fraction of a newly issued common share of PubCo (each a “PubCo Share”) equal to the

Exchange Ratio (as defined below and more fully defined in the Business Combination Agreement), provided that each shareholder of the

Company may elect to receive, in lieu of PubCo Shares, American depositary shares of PubCo, each representing one PubCo Share (each a

“PubCo ADS”) in connection with the Share Exchange; and (b) each issued and outstanding option of the

Company (each a “Company Option”) will be exchanged for an option to purchase such number of PubCo Shares equal

to such fraction of PubCo Shares that is equal to the Exchange Ratio (each such option,

a “PubCo Option”).

Subject to, and in accordance

with, the terms and conditions of the Business Combination Agreement, immediately following the Share Exchange Effective Time and at

the effective time of the Merger (the “Merger Effective Time”), (a) each outstanding Class A ordinary

share of SPAC (including Class A ordinary shares of SPAC converted from the outstanding Class B ordinary shares of SPAC, but

excluding (i) Class A ordinary shares of SPAC held by shareholders who have validly exercised their redemption rights, (ii) treasury

shares held by SPAC, if any, and (iii) Class A ordinary shares of SPAC held by shareholders who have validly exercised their

dissenters’ rights, if any) will automatically be cancelled in exchange for the right to receive one PubCo ADS; (b) each outstanding

public warrant of SPAC will automatically cease to exist in exchange for one PubCo Series 1 warrant (each a “PubCo Series 1

Warrant”) to purchase PubCo Shares to be delivered in the form of PubCo ADSs pursuant to the terms and conditions of that

certain amended and restated warrant agreement to be entered into by and between PubCo and its warrant agent at the Merger Effective

Time in substantially the form annexed to the Business Combination Agreement as Exhibit H (the “PubCo Warrant Agreement”);

and (c) each outstanding private placement warrant of SPAC will automatically cease to exist in exchange for one PubCo Series 2

warrant (each a “PubCo Series 2 Warrant”, and each of PubCo Series 1 Warrants and PubCo Series 2

Warrants is referred to as a “PubCo Warrant”) to purchase PubCo Shares to be delivered in the form of PubCo

ADSs pursuant to the terms and conditions of the PubCo Warrant Agreement.

The “Exchange Ratio”

is a ratio determined by dividing the Price per Share (as described below and more fully defined in the Business Combination Agreement)

by $10.00. “Price per Share” is defined in the Business Combination Agreement to mean an amount equal to $300,000,000

divided by an amount equal to (a) the aggregate number of Company Shares (i) that are issued and outstanding immediately prior

to the Share Exchange Effective Time and (ii) that are issuable upon the exercise or settlement of all Company Options, warrants,

convertible notes and other equity securities of the Company that are issued and outstanding immediately prior to the Share Exchange

Effective Time, minus (b) the number of Company Shares held by the Company or any of its subsidiaries as treasury shares, if any.

Representations and Warranties

The Business Combination Agreement

contains representations and warranties of the parties thereto that are customary for transactions of this nature, including with respect

to, among other things: (i) organization, good standing and qualification; (ii) capitalization; (iii) authorization; (iv) consents;

no conflicts; (v) compliance with laws; consents; permits; (vi) tax matters; (vii) financial statements; (viii) absence

of changes; (ix) actions; (x) liabilities; (xi) material contracts and commitments; (xii) title; properties; (xiii) intellectual

property rights; (xiv) labor and employment matters; (xv) employee benefits; (xvi) brokers; (xvii) proxy/registration

statement; (xviii) environmental matters; (xix) insurance; (xx) related parties and (xxi) data protection. The representations

and warranties of the respective parties to the Business Combination Agreement will not survive the closing of the Merger.

Covenants

The

Business Combination Agreement includes customary covenants of the parties with respect to operation of their respective businesses

prior to consummation of the Business Combination and efforts to satisfy conditions to consummation of the Business Combination. The

Business Combination Agreement contains additional covenants of the parties, including, among others: (i) covenants with

respect to the preparation of the registration statement on Form F-4, including

the proxy statement contained therein, to be filed in connection with the Business Combination (the “Registration

Statement”), (ii) covenants providing that the parties shall take further actions as may be necessary, proper or

advisable to consummate and make effective the Business Combination, (iii) a covenant of SPAC to convene a meeting of

SPAC’s shareholders and to solicit proxies from its shareholders in favor of the approval of the Merger and other related

shareholder proposals, (iv) a covenant of the Company to convene a meeting of the Company’s shareholders and to seek

approval from its shareholders to approve the Business Combination and other related shareholder proposals, (v) covenants

requiring the Company to consult with SPAC in good faith and keep SPAC reasonably informed of the Company’s ongoing

Series E financing, (vi) covenants requiring PubCo, the Company and SPAC to use their commercially reasonable efforts to

consummate the transactions contemplated by the subscription agreements with investors for the subscription by such investors of

newly issued PubCo Shares or PubCo ADSs at a price of $10.00 per PubCo Share or PubCo ADS concurrently with closing of the Merger

(the “PIPE Investment”), (vii) a covenant of PubCo to take all such

action within its power as may be necessary or appropriate such that the composition of PubCo’s board of directors following

the Merger Effective Time will include one person designated by AP Sponsor LLC,

a Cayman Islands limited liability company (the “Sponsor”), pursuant to a written notice to be delivered

to PubCo sufficiently in advance of the Merger Effective Time and reasonably acceptable to the Company,

(viii) a covenant of the Company not to solicit, initiate, submit, facilitate, discuss or negotiate, directly or indirectly,

any inquiry, proposal or offer with any third-party with respect to a Company Acquisition Proposal (as defined in the Business

Combination Agreement), (ix) a covenant of SPAC not to solicit, initiate, submit, facilitate, discuss or negotiate, directly or

indirectly, any inquiry, proposal or offer with any third-party with respect to a SPAC Acquisition Proposal (as defined in the

Business Combination Agreement); and (x) covenant providing that the Company shall use its commercially reasonable efforts to

(1) obtain the consents from certain shareholders of the Company required under certain existing agreements between such

shareholders and the Company and keep SPAC informed of the progress thereof, (2) cause certain major shareholders of the Company

to enter into a lock-up agreement in substantially the same form as the Shareholder Lock-Up Agreement (as defined below), other than with respect to the Lock-up Period, and (3) if necessary, cause one or more shareholders of the Company to enter into one

or more shareholder support agreements, each in substantially the same form as the Shareholder Support Agreement (as defined below).

Conditions to the Consummation of the Transaction

Consummation

of the transactions contemplated by the Business Combination Agreement is subject to customary closing conditions, including approval

of the Business Combination by the shareholders of SPAC and the Company. The Business Combination Agreement also contains other conditions,

including, among others: (i) the accuracy of representations and warranties according to various standards, from no materiality

qualifier to a material adverse effect qualifier, (ii) no continuing and uncured material adverse effect (both for SPAC and the

Company); (iii) material compliance with pre-closing covenants, (iv) the delivery of customary closing certificates, (v) the

absence of a legal prohibition on consummating the transactions, (vi) PubCo’s

listing application with the New York Stock Exchange having been conditionally approved and the PubCo ADSs to be issued in connection

with the Business Combination having been approved for listing on the New York Stock Exchange, subject to official notice of issuance,

(vii) SPAC having at least $5,000,001 of net tangible assets remaining after redemption, unless the SPAC’s memorandum and

articles of association have been amended prior to the closing of the Merger to remove such requirement and (viii) the

amount of cash available in the trust account established for the purpose of holding the

net proceeds of SPAC’s initial public offering following the extraordinary general meeting

of SPAC’s shareholders (after deducting (x) the aggregate amount payable to SPAC’s

shareholders exercising their redemption rights, (y) all out-of-pocket fees and expenses paid or payable by SPAC, Sponsor

or their respective affiliates in connection with the Business Combination or otherwise in connection with any ordinary course business

activities and operations of SPAC and (z) all out-of-pocket fees and expenses paid or payable by the

Company or its affiliates in connection with the Business Combination), plus cash proceeds

from the PIPE Investment that have been funded to, or that will be funded in connection with

the closing of the Merger, in the aggregate equaling no less than $30,000,000 (the “Minimum

Cash Condition”).

Termination

The

Business Combination Agreement may be terminated under

customary and limited circumstances prior to the Share Exchange Effective Time, including, but not limited to: (i) by mutual written

consent of SPAC and the Company, (ii) by

either SPAC or the Company if there is a final and nonappealable Governmental Order (as

defined in the Business Combination Agreement) prohibiting the Business Combination, (iii) by

either SPAC or the Company if the vote of SPAC’s

shareholders to approve the Transaction Proposals (as defined in the Business Combination Agreement) has not been obtained,

provided that such termination right shall not be exercisable by SPAC if SPAC has materially breached any of its obligations with respect

to the joint covenants set forth in the Business Combination Agreement, (iv) by SPAC if there is any breach of any representation,

warranty, covenant or agreement on the part of the Company, PubCo or Merger Sub, such that

certain conditions to closing cannot be satisfied at the closing date of the Merger and such breach is not cured or cannot be cured within

certain specified time period, (v) by the Company if there is any breach of any representation,

warranty, covenant or agreement on the part of SPAC, such that certain conditions to closing cannot be satisfied at the closing date

of the Merger and such breach is not cured or cannot be cured within certain specified time period, (vi) by SPAC if the

Business Combination and other related proposals are not approved by the Company’s shareholders, (vii) by SPAC if any

shareholder of Merger Sub revokes, or seeks to revoke, the written resolution of the sole shareholder of Merger Sub approving the Business

Combination, (viii) by either SPAC or the Company if the Business Combination has not

been consummated by the deadline for SPAC’s completion of its initial business combination, subject to one or more extensions as

further described in the Business Combination Agreement (the “Business Combination Deadline”), or (ix) by

the Company if, based upon the final amount of redemptions by SPAC’s shareholders

in connection with the Merger, it has reasonably determined that the Minimum Cash Condition is unlikely to be satisfied by the Business

Combination Deadline.

The foregoing description of the Business Combination Agreement and

the Business Combination does not purport to be complete and is qualified in its entirety by the terms and conditions of the Business

Combination Agreement, a copy of which is attached hereto as Exhibit 2.1 and is incorporated herein by reference. The Business Combination

Agreement contains representations, warranties and covenants that the respective parties made to each other as of the date of such agreement

or other specific dates. The assertions embodied in those representations, warranties and covenants were made for purposes of the contract

among the respective parties and are subject to important qualifications and limitations agreed to by the parties in connection with

negotiating the Business Combination Agreement. The Business Combination Agreement has been included to provide investors with information

regarding its terms. It is not intended to provide any other factual information about the parties to the Business Combination Agreement.

In particular, the representations, warranties, covenants and agreements contained in the Business Combination Agreement, which were

made only for purposes of the Business Combination Agreement and as of specific dates, were solely for the benefit of the parties to

the Business Combination Agreement, may be subject to limitations agreed upon by the contracting parties (including being qualified by

confidential disclosures made for the purposes of allocating contractual risk among the parties to the Business Combination Agreement

instead of establishing these matters as facts) and may be subject to standards of materiality applicable to the contracting parties

that differ from those applicable to investors and reports and documents filed with the U.S. Securities and Exchange Commission (the

“SEC”). Investors should not rely on the representations, warranties, covenants and agreements, or any descriptions

thereof, as characterizations of the actual state of facts or condition of any party to the Business Combination Agreement. In addition,

the representations, warranties, covenants and agreements and other terms of the Business Combination Agreement may be subject to subsequent

waiver or modification. Moreover, information concerning the subject matter of the representations and warranties and other terms may

change after the date of the Business Combination Agreement, which subsequent information may or may not be fully reflected in SPAC’s

or PubCo’s public disclosures.

Other Agreements

Sponsor Support Agreement

Concurrently with the execution of the Business Combination Agreement,

the Sponsor, the Company, SPAC, PubCo and certain directors and officers of SPAC listed thereto

entered into a sponsor support agreement and deed (the “Sponsor Support Agreement”),

pursuant to which each of the Sponsor and the independent directors of SPAC has agreed to, among other things, (i) vote all

Class B ordinary shares of SPAC held by such person as of the date of the Sponsor Support

Agreement and any ordinary shares of SPAC acquired by such person after the date of the

Sponsor Support Agreement (collectively, the “Sponsor Party Subject Shares”) in favor of the transactions contemplated

by the Business Combination Agreement and related transaction documents and transaction proposals, (ii) vote against any transactions,

proposals or amendment of the organizational documents of the SPAC that would be reasonably likely to in any material respect, interfere

with, delay or attempt to discourage, frustrate the purposes of, result in a breach by SPAC of, prevent or nullify any provision of the

Business Combination Agreement or any other related transaction document, the Merger or any other transaction contemplated by the

Business Combination Agreement and related transaction documents, or change the voting rights of any class of SPAC’s share

capital in any manner, (iii) not sell, transfer, tender, grant, pledge, assign or otherwise dispose of (including by gift, tender

or exchange offer, merger or operation of law), encumber, hedge or utilize a derivative to transfer the economic interest in (collectively,

“Transfer”), or enter into any contract, option or other arrangement with respect to the Transfer of, any Sponsor

Party Subject Shares or warrants of the SPAC held by such person until termination of the Sponsor Support Agreement, subject to

certain exceptions, (iv) waive or not otherwise perfect any anti-dilution or similar protection with respect to any Sponsor Party

Subject Shares, (v) not exercise such person’s redemption rights with respect to

any Sponsor Party Subject Shares in connection with the Business Combination, and (vi) not

exercise any dissenters’ rights with respect to any share of SPAC in connection with the Business Combination. In addition,

from the date of the Business Combination Agreement through the earlier of the closing or termination of the Business Combination Agreement,

Sponsor will use its commercially reasonable efforts to (i) retain funds in the trust account and minimize and mitigate the redemption

amount by SPAC’s public shareholders in connection with their redemption right, including entering into non-redemption agreements

with certain SPAC shareholders and (ii) raise the PIPE Investment, including cooperating with SPAC and the Company as required and

necessary in connection with the PIPE Investment; provided, however, that, in each case, Sponsor will be under no obligation to cancel

or transfer any of its Sponsor shares or otherwise fund incentives in connection with such commercially reasonable efforts. Each

of the Sponsor and the independent directors of SPAC has also agreed, for the period commencing on the Merger Effective Time and

ending on the earliest of (A) the date falling 12 months after the closing of the Merger,

(B) the date on which the last reported sale price of the PubCo ADSs equals or exceeds $12.00 per PubCo ADS, as adjusted, for any

20 trading days within a 30-trading day period commencing at least 150 days after the closing of

the Merger; and (C) the date following the closing of the Merger on which PubCo

completes a liquidation, merger, share exchange or other similar transaction that results in all shareholders of PubCo having the right

to exchange their PubCo Shares (including PubCo Shares in the form of PubCo ADSs) for cash, securities or other property (the “Lock-up

Period”), not to Transfer the PubCo Shares (including PubCo Shares in the form of PubCo ADSs) acquired by such person in

connection with the Merger, subject to certain exceptions. In addition, they have agreed that, for the period commencing on the Merger

Effective Time and ending on the date falling 30 days after the closing of the Merger, not

to Transfer the PubCo Warrants acquired by each such person in connection with the Merger and any PubCo Shares (including any PubCo Shares

in the form of PubCo ADSs) received by them upon the exercise of these PubCo Warrants, subject to certain exceptions.

The

foregoing description of the Sponsor Support Agreement does not purport to be complete and is qualified in its entirety by the terms

and conditions of the Sponsor Support Agreement, a copy of which is attached hereto as Exhibit 10.1 and

is incorporated herein by reference.

Shareholder Support Agreement

Concurrently with the execution of the Business Combination Agreement,

SPAC, PubCo, the Company and certain shareholders of the Company entered into a shareholder support

agreement (the “Shareholder Support Agreement”), pursuant to which

each such shareholder of the Company has agreed to, among other things, (i) vote all Company Shares held by such shareholder

as of the date of the Shareholder Support Agreement and Company Shares acquired by such person after the date, and during the term, of

the Shareholder Support Agreement (collectively, the “Shareholder Subject Shares”) in favor of the transactions

contemplated by the Business Combination Agreement and related transaction documents, (ii) vote against any transactions, proposals

or amendment of the organizational documents of the Company that would be reasonably likely to in any material respect impede, interfere

with, delay or attempt to discourage, frustrate the purposes of, result in a breach by the Company of, prevent or nullify any provision

of the Business Combination Agreement or any other related transaction document, the Pre-Merger Reorganization, the Merger or any other

transaction contemplated by the Business Combination Agreement and related transaction documents,

and (iii) not Transfer any Company Share until termination of the Shareholder Support

Agreement, subject to certain exceptions.

The

foregoing description of the Shareholder Support Agreement does not purport to be complete and is qualified in its entirety by the terms

and conditions of the Shareholder Support Agreement, a copy of which is attached hereto as Exhibit 10.2 and

is incorporated herein by reference.

Shareholder Lock-Up Agreement

Concurrently with the execution of the Business Combination Agreement,

SPAC, PubCo, the Company and certain shareholders of the Company entered into a shareholder lock-up

agreement (the “Shareholder Lock-Up Agreement”), pursuant to which

each such shareholder of the Company has agreed to, among other things, within the Lock-up Period and subject to certain exceptions,

not tender, transfer, grant, assign, offer, sell, contract to sell, pledge or otherwise dispose of (including by gift, tender or exchange

offer, merger or operation of law), encumber, hedge or utilize a derivative to transfer the economic interest in, or make a public announcement

of any intention to effect such Transfer in, any PubCo Shares (including PubCo Shares in the form of PubCo ADSs) acquired by such person

in connection with the Pre-Merger Reorganization, including any PubCo Shares (including PubCo Shares in the form of PubCo ADSs) that

such person may acquire upon the exercise of any PubCo Options in connection with the Pre-Merger Reorganization.

The

foregoing description of the Shareholder Lock-Up Agreement does not purport to be complete and is qualified in its entirety by the terms

and conditions of the Shareholder Lock-Up Agreement, a copy of which is attached hereto as Exhibit 10.3 and

is incorporated herein by reference.

Registration Rights Agreement

At

the closing of the Merger, PubCo, the Sponsor, the independent directors of SPAC (the “SPAC Holders”)

and certain shareholders of the Company (the “Company Holders”)

will enter into a registration rights agreement in

substantially the form annexed to the Business Combination Agreement (the “Registration Rights Agreement”),

pursuant to which, among other things, PubCo will agree to undertake certain resale shelf registration obligations in accordance with

the U.S. Securities Act of 1933, as amended (the “Securities Act”) and the Sponsor, the SPAC Holders and the

Company Holders will be granted customary demand and piggyback registration rights.

The

foregoing description of the Registration Rights Agreement does not purport to be complete and is qualified in its entirety by the terms

and conditions of the Registration Rights Agreement, a form of which is attached hereto as Exhibit 10.4 and

is incorporated herein by reference.

Warrant Assumption Agreement

At the closing of the Merger,

SPAC, PubCo, Continental Stock Transfer & Trust Company (“Continental”), Computershare Inc. and Computershare

Trust Company, N.A. (“Computershare Trust”, and together with Computershare Inc., collectively, “Computershare”)

will enter into a Warrant Assignment and Assumption Agreement in substantially the form annexed to the Business Combination Agreement

(the “Warrant Assumption Agreement”), which will provide, among other things, that at the Merger Effective

Time, Computershare will serve as the successor warrant agent in place of Continental and PubCo will assume SPAC’s obligations

under the Warrant Agreement, dated as of December 16, 2021, by and between SPAC and Continental (the “Existing Warrant

Agreement”).

The

foregoing description of the Warrant Assumption Agreement does not purport to be complete and is qualified in its entirety by the terms

and conditions of the Warrant Assumption Agreement, a form of which is attached hereto as Exhibit 10.5 and

is incorporated herein by reference.

PubCo Warrant Agreement

At the closing

of the Merger, PubCo and Computershare will enter into the PubCo Warrant Agreement to amend and restate the Existing Warrant Agreement,

which will provide, among other things, that from and after the Merger Effective Time, each outstanding PubCo Warrant exchanged from

warrants of SPAC at the closing of the Merger shall be exercisable for PubCo Shares to be delivered in the form of PubCo ADSs, subject

to the terms and conditions of the PubCo Warrant Agreement.

The

foregoing description of the PubCo Warrant Agreement does not purport to be complete and is qualified in its entirety by the terms and

conditions of the PubCo Warrant Agreement, a form of which is attached hereto as Exhibit 10.6 and

is incorporated herein by reference.

The disclosure contained in

Item 2.03 is incorporated by reference in this Item 1.01.

| Item 2.03 |

Creation of a Direct Financial

Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant. |

On June 16, 2023, SPAC issued an unsecured promissory note in

the aggregate principal amount of $1,725,000 (the “Promissory Note”) to the Sponsor and received $1,725,000.

The Sponsor will deposit $1,725,000 into SPAC’s trust account on or prior to June 21, 2023 in order to extend the deadline

by which SPAC must complete an initial business combination from June 21, 2023 to September 21, 2023. The Promissory Note does

not bear interest and matures upon the closing of the Merger. The Promissory Note will not be repaid in the event that SPAC is unable

to complete a business combination unless there are funds available outside the trust account to do so.

The

foregoing description of the Promissory Note does not purport to be complete and is qualified

in its entirety by the terms and conditions of the Promissory Note, a copy of which is attached

hereto as Exhibit 10.7 and is incorporated herein by reference.

| Item 7.01 |

Regulation FD Disclosure. |

On June 16, 2023, SPAC issued a press release announcing the

execution of the Business Combination Agreement and its intention to extend the deadline by which it must complete an initial business combination from June 21, 2023 to September 21,

2023. The press release is attached hereto as Exhibit 99.1 and incorporated by

reference herein.

The foregoing (including Exhibit 99.1) is being furnished pursuant

to Item 7.01 and shall not be deemed to be filed for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended

(the “Exchange Act”), or otherwise be subject to the liabilities of that section, nor shall it be deemed to

be incorporated by reference into any filing of SPAC under the Securities Act or the Exchange Act, regardless of any general incorporation

language in such filings. This Current Report will not be deemed an admission as to the materiality of any of the information in this

Item 7.01, including Exhibit 99.1.

Forward-Looking Statements

This

Current Report, including the exhibits filed or furnished herewith, contains certain forward-looking statements within the meaning of

the federal securities laws with respect to the Business Combination, including statements regarding the benefits of the Business

Combination, the anticipated timing of the Business Combination, the technologies and products and services offered by JEPLAN and the

markets in which it operates, and JEPLAN’s business plans. These forward-looking statements generally are identified by the words

“believe,” “project,” “forecast,” “predict,” “expect,” “anticipate,”

“estimate,” “intend,” “seek,” “strategy,” “future,” “outlook,”

“target,” “opportunity,” “plan,” “potential,” “may,” “seem,”

“should,” “will,” “would,” “will be,” “will continue,” “will likely

result,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters.

Forward-looking statements include, but are not limited to, predictions, projections and other statements about future events that are

based on current expectations and assumptions of JEPLAN’s, PubCo’s and SPAC’s management, whether or not identified

in this Current Report, and, as a result, are subject to risks and uncertainties. These forward-looking statements are provided for illustrative

purposes only and are not intended to serve as, and must not be relied on by an investor as, a guarantee, an assurance, a prediction,

or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ

from assumptions. Many actual events and circumstances are beyond the control of JEPLAN, PubCo, and SPAC. Many factors could cause actual

future events to differ materially from the forward-looking statements in this Current Report, including, but not limited to: (i) the

risk that the Business Combination may not be completed in a timely manner or at all, which may adversely affect the price of PubCo’s

securities, (ii) the risk that the Business Combination may not be completed by SPAC’s business combination deadline and the

potential failure to obtain an extension of the business combination deadline if sought by SPAC, (iii) the failure to satisfy the

conditions to the consummation of the Business Combination, including the adoption of the business combination agreement by the respective

shareholders of SPAC and JEPLAN, the satisfaction of the minimum cash amount following redemptions by SPAC’s public shareholders

and the receipt of certain governmental and regulatory approvals, (iv) the lack of a third party valuation in determining whether

or not to pursue the Business Combination, (v) the occurrence of any event, change or other circumstance that could give rise to

the termination of the business combination agreement, (vi) the effect of the announcement or pendency of the Business Combination

on JEPLAN’s business relationships, performance, and business generally, (vii) risks that the Business Combination disrupts

current plans of JEPLAN and potential difficulties in its employee retention as a result of the Business Combination, (viii) the

outcome of any legal proceedings that may be instituted against JEPLAN or SPAC related to the business combination agreement or the Business

Combination, (ix) failure to realize the anticipated benefits of the Business Combination, (x) the inability to maintain the

listing of SPAC’s securities or to meet listing requirements and maintain the listing of PubCo’s securities on the New York

Stock Exchange, (xi) the risk that the price of PubCo’s securities may be volatile due to a variety of factors, including

changes in the highly competitive industries in which PubCo plans to operate, variations in performance across competitors, changes in

laws, regulations, technologies, natural disasters or health epidemics/pandemics, national security

tensions, and macro-economic and social environments affecting its business, and changes in the combined capital structure, (xii) the

inability to implement business plans, forecasts, and other expectations after the completion of the Business Combination, identify and

realize additional opportunities, and manage its growth and expanding operations, (xiii) the risk that JEPLAN may not be able to

successfully expand its products and services domestically and internationally, (xiv) the risk that JEPLAN and its current and future

collaborative partners are unable to successfully market or commercialize JEPLAN’s proposed licensing solutions, or experience

significant delays in doing so, (xv) the risk that JEPLAN may never achieve or sustain profitability, (xvi) the risk that JEPLAN

will need to raise additional capital to execute its business plan, which many not be available on acceptable terms or at all, (xvii) the

risk relating to scarce or poorly collected raw materials for JEPLAN’s PET recycling business; (xviii) the risk that JEPLAN

may not be able to consummate planned strategic acquisitions, including joint ventures in connection with its proposed licensing business,

or fully realize anticipated benefits from past or future acquisitions, joint ventures, or investments; (xix) the risk that JEPLAN’s

patent applications may not be approved or may take longer than expected, and that JEPLAN may incur substantial costs in enforcing and

protecting its intellectual property; and (xx) the risk that JEPLAN may be subject to competition from current collaborative partners

in the use of jointly developed technology once applicable collaborative arrangements expire. The foregoing list of factors is not exhaustive.

You should carefully consider the foregoing factors, any other factors discussed in this Current Report and the other risks and uncertainties

described in the “Risk Factors” sections of SPAC’s Annual Report on Form 10-K for the year ended December, 31,

2022, which was filed with the SEC on March 3, 2023 (the “2022 Form 10-K”), as such factors may be updated from

time to time in SPAC’s filings with the SEC, the Registration Statement and proxy statement/prospectus contained therein. These

filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially

from those contained in the forward-looking statements. There may be additional risks that neither JEPLAN, PubCo, or SPAC presently know

or that JEPLAN, PubCo, and SPAC currently believe are immaterial that could also cause actual results to differ from those contained

in the forward-looking statements. Forward-looking statements reflect JEPLAN’s, PubCo’s, and SPAC’s expectations, plans,

or forecasts of future events and views only as of the date they are made. JEPLAN, PubCo, and SPAC anticipate that subsequent events

and developments will cause JEPLAN’s, PubCo’s, and SPAC’s assessments to change. However, while JEPLAN, PubCo, and

SPAC may elect to update these forward-looking statements at some point in the future, JEPLAN, PubCo, and SPAC specifically disclaim

any obligation to do so. These forward-looking statements should not be relied upon as representing JEPLAN’s, PubCo’s, and

SPAC’s assessments of any date subsequent to the date of this Current Report. Accordingly, readers are cautioned not to put undue

reliance on forward-looking statements, and JEPLAN, PubCo, and SPAC assume no obligation and do not intend to update or revise these

forward-looking statements, whether as a result of new information, future events, or otherwise, unless required to by applicable securities

law. Neither JEPLAN, PubCo, nor SPAC gives any assurance that PubCo will achieve its expectations.

Additional Information and Where to Find It

This

Current Report relates to the Business Combination by and among PubCo, SPAC, Merger Sub, and JEPLAN. If the Business Combination

is pursued, PubCo intends to file with the SEC Registration Statement, which will include a proxy statement/prospectus of SPAC. The proxy

statement/prospectus will be sent to all SPAC and JEPLAN shareholders. PubCo and SPAC also will file other documents regarding the Business

Combination with the SEC. Before making any voting decision, investors and security holders of SPAC and JEPLAN are urged to read the

Registration Statement, the proxy statement/prospectus contained therein and all other relevant documents filed or that will be filed

with the SEC in connection with the Business Combination as they become available because they will contain important information about

JEPLAN, SPAC, PubCo, and the Business Combination.

Investors

and security holders will be able to obtain free copies of the proxy statement/prospectus and all other relevant documents filed or that

will be filed with the SEC by PubCo and SPAC through the website maintained by the SEC at www.sec.gov. In addition, the documents

filed by PubCo and SPAC may be obtained free of charge by written request to PubCo at 12-2 Ogimachi, Kawasaki-ku, Kawasaki-shi, Kanagawa,

Japan or by telephone at +81 44-223-7898, and to SPAC at 10 Collyer Quay, #37-00

Ocean Financial Center, Singapore or by telephone at +65 6808-6510.

Participants in Solicitation

JEPLAN,

PubCo, and SPAC and their respective directors and officers and other members of management may, under SEC rules, be deemed to be participants

in the solicitation of proxies from SPAC’s shareholders with the Business Combination and the other matters set forth in

the Registration Statement. Information about SPAC’s directors and executive officers and their ownership of SPAC’s securities

is set forth in SPAC’s filings with the SEC, including SPAC’s 2022 Form 10-K. To the extent that holdings of SPAC’s

securities by its directors and executive officers have changed since the amounts reflected in the 2022 Form 10-K, such changes

will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests

of those persons and other persons who may be deemed participants in the Business Combination may be obtained by reading the proxy statement/prospectus

regarding the Business Combination when it becomes available. You may obtain free copies of these documents as described in the preceding

paragraph.

No Offer or Solicitation

This Current Report shall not constitute a “solicitation”

as defined in Section 14 of the Exchange Act. This Current Report shall not constitute an offer to sell or the solicitation of an

offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale

would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities

in the Business Combination shall be made except by means of a prospectus meeting the requirements of the Securities Act.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

Exhibit

No. |

|

Exhibit |

| 2.1* |

|

Business

Combination Agreement, dated as of June 16, 2023, by and among JEPLAN Holdings, Inc., AP Acquisition Corp, JEPLAN MS, Inc.

and JEPLAN, Inc. |

| 10.1* |

|

Sponsor

Support Agreement and Deed, dated as of June 16, 2023, by and among JEPLAN Holdings, Inc., AP Acquisition Corp, AP Sponsor

LLC, JEPLAN, Inc. and the other parties named therein. |

| 10.2* |

|

Shareholder

Support Agreement, dated as of June 16, 2023, by and among JEPLAN Holdings, Inc., AP Acquisition Corp, JEPLAN, Inc.

and the other parties named therein. |

| 10.3* |

|

Shareholder

Lock-Up Agreement, dated as of June 16, 2023, by and among JEPLAN Holdings, Inc., AP Acquisition Corp, JEPLAN, Inc.

and the other parties named therein. |

| 10.4 |

|

Form of

Registration Rights Agreement. |

| 10.5 |

|

Form of

Warrant Assignment and Assumption Agreement. |

| 10.6 |

|

Form of

Amended and Restated Warrant Agreement. |

| 10.7 |

|

Promissory

Note, dated as of June 16, 2023, issued by AP Acquisition Corp to AP Sponsor LLC. |

| 99.1 |

|

Press

Release, dated as of June 16, 2023. |

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document). |

| * |

The schedules to this Exhibit have

been omitted in accordance with Regulation S-K Item 601(b)(2). SPAC hereby undertakes to furnish supplementally a copy of any omitted

schedule to the SEC upon its request; provided, however, that SPAC may request confidential treatment for any such schedules so furnished. |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: June 16, 2023

| |

AP Acquisition

Corp |

| |

|

| |

/s/

Keiichi Suzuki |

| |

Name: |

Keiichi Suzuki |

| |

Title: |

Chief Executive Officer and Director |

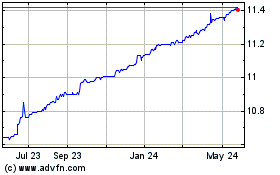

AP Acquisition (NYSE:APCA)

Historical Stock Chart

From Nov 2024 to Dec 2024

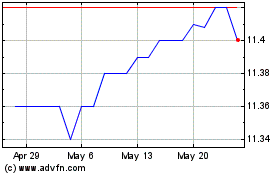

AP Acquisition (NYSE:APCA)

Historical Stock Chart

From Dec 2023 to Dec 2024