Filed by JEPLAN Holdings, Inc.

Pursuant to Rule 425 under the Securities Act of 1933,

as amended, and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: AP Acquisition Corp

Commission File No.: 001-41176

Filed October 17, 2023

This material below is an English translation of an article

first published in Japanese in the October 2023 issue of The Nikkei Magazine, released in Japan on October 6, 2023, local time.

Attempts to provide an accurate translation of the original article in Japanese have been made, but due to linguistic nuances, slight

differences may exist.

This translation was made as a matter of record only and does not constitute

an offer to sell or to solicit an offer to buy securities in the United States.

JEPLAN, a PET bottle recycling company, leverages collaboration

to enter the global market.

10/6/2023 5:00 p.m. Nihon Keizai Shimbun (electronic edition)

[photograph with caption]

JEPLAN (formerly Nippon Kankyo Sekkei, Kawasaki

City), a company that recycles PET bottles and other materials, will be listed on the New York Stock Exchange by January to March 2024.

JEPLAN has its own technology to chemically decompose used containers and other materials to regenerate plastic. Investors around the

world are focusing on JEPLAN since it will lead to a reduction in the amount of oil used. In collaboration with investment funds and partner

companies, JEPLAN will expand its recycling facilities in Japan and abroad.

“New York is the center of the capital markets

in the world. The potential is great with great number of waves”.

Mr. Masaki Takao, the President and Chief

Executive Officer of JEPLAN, explains the reason for aiming for listing on the New York Stock Exchange.

JEPLAN has been considering a stock listing for

some time. It was on January 12, 2022, that things took off. Through an introduction from a friend, Mr. Takao had his first

online meeting with an executive of Advantage Partners (AP, Minato-ku, Tokyo), a private equity (PE) fund that invests in unlisted companies.

Focus on technological development with funds raised from listing

AP established AP Acquisition, a special purpose

acquisition company (SPAC), with the objective of making long-term investments in renewable energy and other areas, and listed on the

New York Stock Exchange in 2021. After evaluating several dozen companies in Europe and Asia as potential investment targets, AP narrowed

the list down to five companies. After holding discussions with each company, AP finally selected JEPLAN. JEPLAN and APsigned a Letter

of Intent in November 2022 and continued negotiations. JEPLAN will soon merge with AP Acquisition and become a de facto listed company.

JEPLAN initially expected to list by the end of

this year, but has revised its target date. JEPLAN has had to hold discussions with investors due to the impact of higher interest rates

following the Federal Reserve Board's (FRB) policy rate hike, and the process has taken some time. JEPLAN will use the funds raised from

the listing for technology development. AP will send a director to JEPLAN to provide contacts and know-how to help it grow.

The chemical recycling of plastics has been in

winter for a long time, and there are only a limited number of players in the world. JEPLAN’s recycling project is focused on polyethylene

terephthalate (PET), a type of plastic.

[photograph with caption]

Used PET bottles and used clothes are chemically

decomposed down to the molecule level to make reanimated PET. The PET is used as a raw material for beverage bottles and polyester clothes.

In 2018, JEPLAN acquired PET Refine Technology (PRT, Kawasaki City), a company that operates a refining plant that had ceased operations

at that time.

In 2021, PRT restarted the plant for the first

time in about four years. PRT has the ability to produce about 22,000 tons of recycled PET pellets per year. The PET pellets are used

as raw material for beverage bottle producers such as Asahi and Suntory, among other producers of plastic goods.

The greenhouse gas emissions from PRT’s

chemical recycling of discarded PET into new PET products are a little more than half of emissions from the incineration of discarded

PET and production of PET from oil. Major consumer goods companies in the world are increasing the use of re-generated PET, and some estimate

that the global market in 2030 will be 1.5 times larger than that in 2022.

However, no matter how much technology you have,

it is difficult to grow unless a successful business is established. AP seems to have recognized JEPLAN's track record of proposing new

living habits to consumers in collaboration with a wide range of stakeholders, including business partners and local governments.

Collaboration with local governments to ensure procurement of used

bottles

In collecting used PET bottles, JEPLAN worked

with a number of local municipalities, including Kobe City, Kyoto City, and Fujisawa City in Kanagawa Prefecture, to increase the reliability

of raw material procurement. JEPLAN set up a system whereby household used bottles are recycled into beverage bottles, and local residents

can realize the benefits of recycling. JEPLAN anticipated that residents would be likely to cooperate in separating trash and resources.

JEPLAN has proposed a new habit to residents

in conjunction with the practical application of a technology that recycles polyester fibers from used clothing to make new clothes.

The "BRING" is a collaboration with a number of retailers, including Ryohin Keikaku and Takashimaya, etc., to collect

used clothing by placing boxes marked with a bee in the storefront. JEPLAN has collected 3,000 tons of clothing, equivalent to 15 million

T-shirts (assuming 200 grams per T-shirt), by informing shoppers that “Unworn clothing can be reanimated and reused by placing

them in collection boxes while shopping”.

[photograph with caption]

JEPLAN also intends to work with certain French

group companies and customers to expand its recycling plant.

In preparation for the global expansion of the

plant, JEPLAN and the French company are jointly developing the technology to remove various impurities from plastic containers and products.

The type of impurities may vary from region to region. This is a development project that is necessary to produce high quality recycled

plastic anywhere, regardless of the location of the plant.

Jointly with a technology licensee to expand its plant

At foot, due in part to heavy development expenditures,

JEPLAN posted consolidated revenue of 6.3 billion yen for FY2022, but an operating loss of 1.9 billion yen. In the event of an expansion

of the plant, JEPLAN will license its technology to partner companies, thereby reducing its financial contribution. As of the beginning

of September 2023, more than 40 licensing inquiries have been received from Japan and abroad.

[Graphic detailing JEPLAN’s consolidated

revenue and consolidated operating loss for 2021 and 2022]

However, technological development and factory

expansions that leverage collaboration are also fraught with risk. If the relationship with the partner deteriorates, it could have a

negative impact on business operations and performance. To avoid deterioration, "we need to be patient and persistent in our negotiations,"

said Mr. Takao.

JEPLAN’s challenge may serve as a test to

see if it is possible to operate a business similar to a fabless type even in the recycling industry.

(Yasuko Mori)

Intellectual property rights and all other rights related to this service

are reserved by Nikkei Shimbun or its information providers. Unauthorized reproduction or reprinting of articles, photos, etc. published

in this service is prohibited.

NIKKEI – No reproduction without permission.

Photo 1 Caption

JEPLAN Group's

plant in Kawasaki City chemically decomposes used PET bottles and recycles them into raw materials for reuse as bottles. – Photograph

provided by JEPLAN.

Photo 2 Caption

PET resin is re-generated by removing impurities from used PET bottles

and shipped as granular pellets (May 2022, Kawasaki City)

Photo 3 Caption

JEPLAN has also developed a technology to take polyester fibers from

clothes and re-grow them to make clothing (April 2022, Koto-ku, Tokyo).

Forward-Looking Statements

This document contains certain forward-looking statements within the

meaning of the federal securities laws with respect to a potential business combination by and among JEPLAN Holdings, Inc., a Japanese

corporation (“PubCo”), AP Acquisition Corp, a Cayman Islands exempted company (“SPAC”), JEPLAN MS, Inc.,

a Cayman Islands exempted company, and JEPLAN, Inc., a Japanese corporation (“JEPLAN”) and related transactions (collectively,

the “Potential Business Combination”), including statements regarding the benefits of the Potential Business Combination,

the anticipated timing of the Potential Business Combination, the anticipated timing of a listing on the New York Stock Exchange, JEPLAN’s

business plans and growth strategies, the technologies and products and services offered by JEPLAN and the markets in which it operates,

JEPLAN’s business plans, and JEPLAN’s projected future results. These forward-looking statements generally are identified

by the words “believe,” “project,” “forecast,” “predict,” “expect,” “anticipate,”

“estimate,” “intend,” “seek,” “strategy,” “future,” “outlook,”

“target,” “opportunity,” “plan,” “potential,” “may,” “seem,” “should,”

“will,” “would,” “will be,” “will continue,” “will likely result,” and similar

expressions that predict or indicate future events or trends or that are not statements of historical matters. Forward-looking statements

include, but are not limited to, predictions, projections and other statements about future events that are based on current expectations

and assumptions of JEPLAN’s, PubCo’s and SPAC’s management, whether or not identified in this document, and, as a result,

are subject to risks and uncertainties. These forward-looking statements are provided for illustrative purposes only and are not intended

to serve as, and must not be relied on by an investor as, a guarantee, an assurance, a prediction, or a definitive statement of fact or

probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events

and circumstances are beyond the control of JEPLAN, PubCo, and SPAC. Many factors could cause actual future events to differ materially

from the forward-looking statements in this document, including, but not limited to: (i) the risk that the Potential Business Combination

may not be completed in a timely manner or at all, which may adversely affect the price of PubCo’s securities, (ii) the risk

that the Potential Business Combination may not be completed by SPAC’s business combination deadline and the potential failure to

obtain an extension of the Potential Business Combination deadline if sought by SPAC, (iii) the failure to satisfy the conditions

to the consummation of the Potential Business Combination, including the adoption of the Potential Business Combination agreement by the

respective shareholders of SPAC and JEPLAN, the satisfaction of the minimum cash amount following redemptions by SPAC’s public shareholders

and the receipt of certain governmental and regulatory approvals, (iv) the lack of a third party valuation in determining whether

or not to pursue the Potential Business Combination, (v) the occurrence of any event, change or other circumstance that could give

rise to the termination of the Potential Business Combination agreement, (vi) the effect of the announcement or pendency of the Potential

Business Combination on JEPLAN’s business relationships, performance, and business generally, (vii) risks that the Potential

Business Combination disrupts current plans of JEPLAN and potential difficulties in its employee retention as a result of the Potential

Business Combination, (viii) the outcome of any legal proceedings that may be instituted against JEPLAN or SPAC related to the Potential

Business Combination agreement or the Potential Business Combination, (ix) failure to realize the anticipated benefits of the Potential

Business Combination, (x) the inability to maintain the listing of SPAC’s securities or to meet listing requirements and maintain

the listing of PubCo’s securities on the New York Stock Exchange, (xi) the risk that the price of PubCo’s securities

may be volatile due to a variety of factors, including changes in the highly competitive industries in which PubCo plans to operate, variations

in performance across competitors, changes in laws, regulations, technologies, natural disasters or health epidemics/pandemics, national

security tensions, and macro-economic and social environments affecting its business, and changes in the combined capital structure,

(xii) the inability to implement business plans, forecasts, and other expectations after the completion of the Potential Business

Combination, identify and realize additional opportunities, and manage its growth and expanding operations, (xiii) the risk that

JEPLAN may not be able to successfully expand its products and services domestically and internationally, (xiv) the risk that JEPLAN

and its current and future collaborative partners are unable to successfully market or commercialize JEPLAN’s proposed licensing

solutions, or experience significant delays in doing so, (xv) the risk that JEPLAN may never achieve or sustain profitability, (xvi) the

risk that JEPLAN will need to raise additional capital to execute its business plan, which many not be available on acceptable terms or

at all, (xvii) the risk relating to scarce or poorly collected raw materials for JEPLAN’s PET recycling business; (xviii) the

risk that JEPLAN may not be able to consummate planned strategic acquisitions, including joint ventures in connection with its proposed

licensing business, or fully realize anticipated benefits from past or future acquisitions, joint ventures, or investments; (xix) the

risk that JEPLAN’s patent applications may not be approved or may take longer than expected, and that JEPLAN may incur substantial

costs in enforcing and protecting its intellectual property; (xx) the risk that JEPLAN may be subject to competition from current

collaborative partners in the use of jointly developed technology once applicable collaborative arrangements expire; (xxi) risks

relating to JEPLAN’s ability to continue as a going concern; and (xxii) risks related to the equipment malfunction that occurred

at JEPLAN’s PRT Plant in August 2023, including that another operational malfunction or other disruption at JEPLAN’s

recycling facilities may occur. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors,

any other factors discussed in this document and the other risks and uncertainties described in the “Risk Factors” sections

of PubCo’s Registration Statement on Form F-4, as filed with the SEC on September 8, 2023, and as amended from time to

time (the “Registration Statement”), as such factors may be updated from time to time in PubCo’s filings with the SEC.

These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially

from those contained in the forward-looking statements. There may be additional risks that neither JEPLAN, PubCo, nor SPAC presently knows

or that JEPLAN, PubCo, and SPAC currently believe are immaterial that could also cause actual results to differ from those contained in

the forward-looking statements. Forward-looking statements reflect JEPLAN’s, PubCo’s, and SPAC’s expectations, plans,

or forecasts of future events and views only as of the date they are made. JEPLAN, PubCo, and SPAC anticipate that subsequent events and

developments will cause JEPLAN’s, PubCo’s, and SPAC’s assessments to change. However, while JEPLAN, PubCo, and SPAC

may elect to update these forward-looking statements at some point in the future, JEPLAN, PubCo, and SPAC specifically disclaim any obligation

to do so. These forward-looking statements should not be relied upon as representing JEPLAN’s, PubCo’s, and SPAC’s assessments

of any date subsequent to the date of this document. Accordingly, readers are cautioned not to put undue reliance on forward-looking statements,

and JEPLAN, PubCo, and SPAC assume no obligation and do not intend to update or revise these forward-looking statements, whether as a

result of new information, future events, or otherwise, unless required to by applicable securities law. Neither JEPLAN, PubCo, nor SPAC

gives any assurance that PubCo will achieve its expectations.

Additional Information and Where to Find It

This document relates to the Potential Business Combination by and

among PubCo, SPAC, Merger Sub, and JEPLAN. PubCo filed the Registration Statement with the SEC on September 8, 2023, which includes

a proxy statement/prospectus of SPAC. The proxy statement/prospectus will be sent to all SPAC and JEPLAN shareholders. PubCo and SPAC

also will file other documents regarding the Potential Business Combination with the SEC. This document does not contain all the information

that should be considered concerning the Potential Business Combination and is not intended to form the basis of any investment decision

or any other decision in respect of the Potential Business Combination. Before making any voting decision, investors and security holders

of SPAC and JEPLAN are urged to read the Registration Statement, the proxy statement/prospectus contained therein and all other relevant

documents filed or that will be filed with the SEC in connection with the Potential Business Combination as they become available because

they will contain important information about JEPLAN, SPAC, PubCo, and the Potential Business Combination.

Investors and security holders will be able to obtain free copies of

the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by PubCo and SPAC through the

website maintained by the SEC at www.sec.gov. In addition, the documents filed by PubCo and SPAC may be obtained free of charge

by written request to PubCo at 12-2 Ogimachi, Kawasaki-ku, Kawasaki-shi, Kanagawa, Japan or by telephone at +81 44-223-7898, and

to SPAC at 10 Collyer Quay, #14-06 Ocean Financial Centre, Singapore or by telephone at +65 6808-6510.

Participants in Solicitation

JEPLAN, PubCo, and SPAC and their respective directors and officers

and other members of management may, under SEC rules, be deemed to be participants in the solicitation of proxies from SPAC’s shareholders

with the Potential Business Combination and the other matters set forth in the Registration Statement. Information about SPAC’s

directors and executive officers and their ownership of SPAC’s securities is set forth in SPAC’s filings with the SEC, including

SPAC’s 2022 Form 10-K. To the extent that holdings of SPAC’s securities by its directors and executive officers have

changed since the amounts reflected in the 2022 Form 10-K, such changes will be reflected on Statements of Change in Ownership on

Form 4 filed with the SEC. Additional information regarding the interests of those persons and other persons who may be deemed participants

in the Potential Business Combination may be obtained by reading the proxy statement/prospectus regarding the Potential Business Combination

when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph.

No Offer or Solicitation

This document shall not constitute a “solicitation” as

defined in Section 14 of the U.S. Securities Exchange Act of 1934, as amended. This document shall not constitute an offer to sell

or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering

of securities in the Potential Business Combination shall be made except by means of a prospectus meeting the requirements of the U.S.

Securities Act of 1933, as amended.

Contacts:

For AP Acquisition Corp

Keiichi Suzuki, CEO

Email: info@apacquisitioncorp.com

For JEPLAN, Inc.

Email: info@jeplan.co.jp

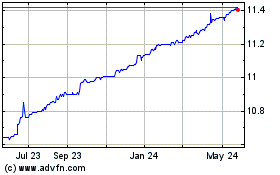

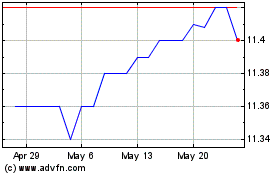

AP Acquisition (NYSE:APCA)

Historical Stock Chart

From Nov 2024 to Dec 2024

AP Acquisition (NYSE:APCA)

Historical Stock Chart

From Dec 2023 to Dec 2024