Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

September 27 2024 - 6:53AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16

or

15d-16 of the Securities Exchange Act of 1934

For the month of September 2024

Commission File Number: 001-39928

_____________________

Sendas Distribuidora S.A.

(Exact Name as Specified in its Charter)

Sendas Distributor S.A.

(Translation of registrant’s name into

English)

Avenida Ayrton Senna, No. 6,000, Lote 2, Pal 48959,

Anexo A

Jacarepaguá

22775-005 Rio de Janeiro, RJ, Brazil

(Address of principal executive offices)

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F: ý

Form 40-F: o

SENDAS

DISTRIBUIDORA S.A.

Publicly-Held Company with Authorized

Capital

CNPJ/MF no. 06.057.223/0001-71

NIRE 33.300.272.909

NOTICE TO PROMISSORY NOTES HOLDERS

SENDAS

DISTRIBUIDORA S.A., a publicly-held company registered with the Brazilian Securities and Exchange Commission (“CVM”),

with head offices in the City of Rio de Janeiro, State of Rio de Janeiro, at Avenida Ayrton Senna, nº 6.000, Lote 2, Pal 48959, Jacarepaguá,

Zip Code 22775-005, enrolled with the National Register of Legal Entities (“CNPJ”) under no. 06.057.223/0001-71 and

with the Board of Trade of the State of Rio de Janeiro (“JUCERJA”) under NIRE 33.3.002.7290-9 (“Company”),

pursuant to clause 7 of the certificates of the one thousand (1,000) “Notas Promissórias Comerciais, emitidas pela Companhia

em 27 de agosto de 2021, da sua 2ª (segunda) emissão, para distribuição pública com esforços restritos

de colocação, divididas igualmente em 2 (duas) séries” (“Certificates” and “Promissory

Notes”), hereby informs the holders of the Promissory Notes that it will perform the optional early redemption

of the Promissory Notes in circulation, corresponding to the totality of the 2nd series of its 2nd issue of Promissory Notes, with asset

code NC00210038W (“Optional Early Redemption”).

The terms starting in capital letters

that are not expressly defined in this Notice to Promissory Notes Holders will have the same meaning assigned to them in the Certificates.

Thus, we present below the information required by Clause

7.1 of the Certificates:

| (i) | Optional Early Redemption date and procedure: the Optional Early Redemption

will be performed on October 11th, 2024 (“Optional Early Redemption Date”), respecting, therefore, the minimum

advance notice of ten (10) Business Days from the present date, as provided for in the Certificates, and will be done: (a) through the

procedures adopted by B3 S.A. – Brasil, Bolsa, Balcão (“B3”) for the Promissory Notes held in electronic

custody at B3, and/or (b) upon deposit in checking accounts indicated by the Promissory Notes’ holders, to be made by the Settlement

Bank and Bookkeeper Agent, in the case of Promissory Notes that are not held in electronic custody at B3. |

| (ii) | Optional Early Redemption Value: the total amount of the Optional Early

Redemption will be equivalent to the balance of the Nominal Unit Value of the Second Series Promissory Notes plus the respective Remuneration,

calculated pro rata temporis incurred up to the Early Redemption Date and the Optional Early Redemption Premium; and |

| (iii) | Other relevant information: B3 and the Fiduciary Agent will be informed by the

Company regarding the Optional Early Redemption within five (5) Business Days prior to its performance. |

Rio de Janeiro, September 27th, 2024.

SENDAS

DISTRIBUIDORA S.A.

Vitor Fagá de Almeida

Vice President of Finance and

Investor Relations

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: September 27, 2024

Sendas Distribuidora S.A.

By: /s/ Vitor Fagá de Almeida

Name: Vitor Fagá de Almeida

Title: Vice President of Finance and Investor Relations

By: /s/ Gabrielle Helú

Name: Gabrielle Helú

Title: Investor Relations Officer

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These

statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances,

industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates",

"expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking

statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies

and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or

results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject

to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements

are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors.

Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

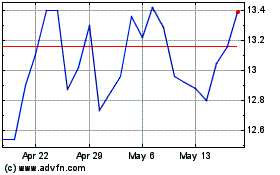

Sendas Distribuidora (NYSE:ASAI)

Historical Stock Chart

From Nov 2024 to Dec 2024

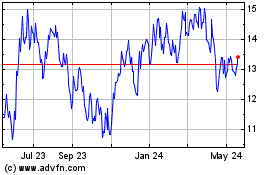

Sendas Distribuidora (NYSE:ASAI)

Historical Stock Chart

From Dec 2023 to Dec 2024