As filed with the U.S. Securities and Exchange Commission on December 2, 2024

Registration Statement No. [●]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

|

Bermuda

|

Not Applicable

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

S.E. Pearman Bldg. 2nd Floor

9 Par-la-Ville Road

Hamilton HM11

Bermuda

(Address of principal executive offices)

Share Option Scheme

(Full Title of the Plan)

Borr Finance LLC

8 The Green, Suite A City of Dover

Delaware, 19901

United States of America

+1 (441) 5004754

(Name and address, and telephone number, including area code, of agent for service)

Copies to:

James A. McDonald

Skadden, Arps, Slate, Meagher & Flom (UK) LLP

22 Bishopsgate

London EC2N 4BQ England

+44 (0)20 7519 7183

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer

|

☒ |

Accelerated filer

|

☐ |

Non-accelerated filer

|

☐ |

Smaller reporting company

|

☐ |

|

|

|

Emerging growth company

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided

pursuant to Section 7(a)(2)(B) of the Exchange Act. ☐

EXPLANATORY NOTE

Borr Drilling Limited, an exempted company incorporated under the laws of Bermuda, with registration number 51741 (the “Company” or the “Registrant”) is filing this registration statement on Form S-8 (this “Registration

Statement”) to register 12,638,327 shares, par value $0.10 (“Common Shares”) that may be issued upon the exercise of share options granted pursuant to the Company’s Share Option Scheme dated March 15, 2017 as amended on February 13, 2024 (the “Plan”).

PART I.

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The Registrant will send or give to all participants in the Plan the document(s) containing information required by Part I of Form S-8, as specified in Rule 428(b)(1) promulgated by the Securities and Exchange Commission

(the “Commission”) under the Securities Act of 1933 (the “Securities Act”). The Registrant has not filed such document(s) with the Commission, but such documents (along with the documents incorporated by reference into this Registration Statement

pursuant to Item 3 of Part II hereof) shall constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act. The Registrant shall maintain a file of such documents in accordance with the provisions of Rule 428(a)(2) under the

Securities Act. Upon request, the Registrant shall furnish to the Commission or its staff a copy or copies of all of the documents included in such file.

PART II.

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference

The following documents, previously filed by the Company with the Commission, are incorporated by reference in this Registration Statement:

|

(a)

|

The Company’s Annual Report on Form 20-F for the year ended December 31, 2023, filed with the Commission on March 27, 2024; |

|

(c)

|

The description of the Common Shares contained in the Company’s registration statement on Form 8-A filed with the Commission on July

29, 2019, pursuant to Section 12(b) of the Securities Exchange Act of 1934 (the “Exchange Act”), including the description of the Common Shares included as Exhibit 2.1 in the Company’s Annual Report on Form 20-F for the fiscal year ended December 31, 2021, filed with Commission on April 11, 2022, including any amendments or reports filed

for the purpose of updating such description. |

All documents subsequently filed by the Company pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, and, to the extent designated therein, certain reports on Form 6-K we submit to the Commission after the

date hereof, prior to the filing of a post-effective amendment which indicates that all Common Shares offered hereby have been sold or which deregisters all Common Shares then remaining unsold, shall be deemed to be incorporated by reference into this

Registration Statement and to be a part hereof from the date of filing of such documents.

Any statement contained in a document incorporated or deemed to be incorporated by reference into this Registration Statement will be deemed to be modified or superseded for purposes of this Registration Statement to the

extent that a statement contained herein or in any other subsequently filed or furnished document that is deemed to be incorporated by reference into this Registration Statement modifies or supersedes the statement. Any statement so modified or

superseded will not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement. In the case of a conflict or inconsistency between information contained in this Registration Statement and information

incorporated by reference into this Registration Statement, you should rely on the information contained in the document that was filed or furnished later.

Item 4. Description of Securities

Not applicable.

Item 5. Interests of Named Experts and Counsel

Not applicable.

Item 6. Indemnification of Directors and Officers

The Companies Act 1981 of Bermuda (the “Companies Act”) requires every officer, including directors, of a company in exercising powers and discharging duties, to act honestly in good faith with a view to the best

interests of the company, and to exercise the care, diligence and skill that a reasonably prudent person would exercise in comparable circumstances. The Companies Act provides that a Bermuda company may indemnify its directors in respect of any loss

arising or liability attaching to them as a result of any negligence, default, breach of duty or breach of trust of which they may be guilty. However, the Companies Act further provides that any provision, whether in the bye-laws of a company or in any

contract between the company and any officer or any person employed by the company as auditor, exempting such officer or person from, or indemnifying him against, any liability which by virtue of any rule of law would otherwise attach to him, in

respect of any fraud or dishonesty of which he may be guilty in relation to the company shall be void.

Our Bye-Laws provide that we shall indemnify our officers and directors in respect of their actions and omissions, except in respect of their fraud or dishonesty, and that we may advance funds to our officers and

directors for expenses incurred in their defense upon the condition that the directors or officers repay the funds if any allegation of fraud or dishonesty is proved. Our Bye-Laws provide that the shareholders waive all claims or rights of action that

they might have, individually or in right of the Company, against any of the Company’s directors or officers for any act or failure to act in the performance of such director’s or officer’s duties, except in respect of any fraud or dishonesty of such

director or officer. The Companies Act permits us to purchase and maintain insurance for the benefit of any officer or director in respect of any loss or liability attaching to him in respect of any negligence, default, breach of duty or breach of

trust, whether or not we may otherwise indemnify such officer or director. We have purchased and maintain a directors’ and officers’ liability policy for such purpose.

We have agreed to indemnify our directors and executive officers against certain liabilities and expenses incurred by such persons in connection with claims made by reason of their being such a director or officer.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers or persons controlling us pursuant to the foregoing provisions, we have been informed that in the opinion

of the Commission such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable.

Item 7. Exemption from registration claimed

Not applicable.

Item 8. Exhibits

|

|

|

|

|

|

|

Memorandum of Association of Borr Drilling Limited (incorporated by reference from Exhibit 3.1 of the Registration Statement, filed on Form F-1, dated July 10, 2019)

|

|

|

|

Amended and Restated Bye-Laws adopted on September 27, 2019 (incorporated by reference from Exhibit 1.2 of the Company's Annual Report on Form 20-F for the year ended December 31, 2021)

|

|

Exhibit

Numbers

|

|

Description |

|

|

|

Share Option Scheme dated March 15, 2017 and amended on February 13, 2024

|

|

|

|

Opinion of Walkers

|

|

|

|

Consent of PricewaterhouseCoopers LLP, independent registered public accounting firm of Borr Drilling Limited

|

|

|

|

Consent of Walkers (included in Exhibit 5.1)

|

|

|

|

Powers of Attorney (included on the signature page hereto)

|

|

|

|

Filing Fee Table

|

Item 9. Undertakings.

The undersigned registrant hereby undertakes:

| (1) |

to file, during any period in which offers or sales are being made, a post-effective amendment to this Registration Statement:

|

|

(i) |

to include any prospectus required by Section 10(a)(3) of the Securities Act;

|

|

(ii) |

to reflect in the prospectus any facts or events arising after the effective date of this Registration Statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in

the information set forth in this Registration Statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and

any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more

than 20 percent change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective Registration Statement; and

|

|

(iii) |

to include any material information with respect to the plan of distribution not previously disclosed in this Registration Statement or any material change to such information in this Registration Statement,

|

provided, however, that paragraphs (i) and (ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in periodic reports filed with or furnished to the SEC by the registrant pursuant

to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the registration statement; and

| (2) |

that, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such

securities at that time shall be deemed to be the initial bona fide offering thereof; and

|

| (3) |

to remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

|

The registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Sections 13(a) or 15(d) of the Exchange Act (and, where

applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act) that is incorporated by reference in this Registration Statement shall be deemed to be a new registration statement relating

to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the

registrant has been advised that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities

(other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling

person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such

indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing the Registration Statement on Form S-8 and has duly

caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Hamilton, Bermuda on December 2, 2024.

|

|

BORR DRILLING LIMITED

|

|

|

|

|

|

By: /s/ Magnus Vaaler

|

|

|

Name: Magnus Vaaler

|

|

|

Title: Chief Financial Officer

|

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below severally constitutes and appoints Mr. Magnus Vaaler, as his or her true and lawful attorney-in-fact and agent, with full power of

substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any or all amendments (including post-effective amendments) to this registration statement and any and all related registration

statements pursuant to Rule 462(b) of the Securities Act, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Commission, hereby ratifying and confirming all that said attorney-in-fact and agent, or

their substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act, this registration statement has been signed by the following persons in the capacities and on the date indicated.

|

|

|

|

|

|

|

|

|

Director and Chairman of Board of Directors

|

|

December 2, 2024

|

|

Tor Olav Trøim

|

|

|

|

|

/s/ Alexandra Kate Blankenship

|

|

Director

|

|

December 2, 2024

|

|

Alexandra Kate Blankenship

|

|

|

|

|

|

|

|

Director

|

|

December 2, 2024

|

|

Jeffrey R. Currie

|

|

|

|

|

|

|

|

Director

|

|

December 2, 2024

|

|

Neil Glass

|

|

|

|

|

|

|

|

Director

|

|

December 2, 2024

|

|

Daniel W. Rabun

|

|

|

|

|

|

|

|

Director

|

|

December 2, 2024

|

|

Mi Hong Yoon

|

|

|

|

|

|

|

|

Director and Chief Executive Officer

|

|

December 2, 2024

|

|

Patrick Schorn

|

|

|

|

|

|

|

|

Chief Financial Officer

|

|

December 2, 2024

|

|

Magnus Vaaler

|

|

|

|

|

SIGNATURE OF AUTHORIZED REPRESENTATIVE IN THE UNITED STATES

Pursuant to the Securities Act of 1933, the undersigned, the duly authorized representative in the United States of Borr Drilling Limited has signed this registration statement or amendment thereto in Newark, Delaware,

U.S.A. on December 2, 2024.

|

|

Authorized U.S. Representative

|

|

|

|

|

|

By: /s/ Donald J. Puglisi

|

|

|

Name: Donald J. Puglisi

|

|

|

Title: Managing Director

|

Exhibit 4.3

THE RULES

OF

BORR DRILLING LIMITED's

SHARE OPTION SCHEME

(Approved by the board of directors on 15 March, 2017 and As Amended February 13, 2024)

1. DEFINITIONS

1.1 In these Rules, the following

words and expressions shall, when used in capitalised form, have the following meanings:

"Adoption Date" means the date on which the Scheme was approved by the Board;

"Auditors" means the auditors of the Company (acting as experts and not as arbitrators);

"Board" means the board of directors of the Company or the directors present at a duly convened meeting of the board of directors or of a duly constituted committee of the

board of directors at which a quorum is present;

"Change of Control Event" means an event whereby another entity gains control over the Company (i) by imposing a merger or consolidation in which the Company is not the

surviving company or (ii) by acquiring the majority of the Shares;

"Company" means Borr Drilling Limited, a limited company incorporated and registered in Bermuda;

"Company CSP" means the duly licensed holder of an unlimited license under the Corporate Service Provider Business Act 2012 engaged by the Company to provide corporate

services to the Company in Bermuda from time to time.

"Date of Grant" means the date on which a number of Options are granted by the Board to an Eligible Person pursuant to Clause 2 hereof;

"Eligible Person" means an individual who is, or who becomes, contracted to work at least 20 hours per week in the service of one or more Participating Companies or a

director of a Participating Company;

"Independent Expert" means either a firm of independent public accountants of recognised standing (who may be the Auditors) or an internationally recognised investment bank

selected by the Board;

"Option" means a right (but not an obligation) to subscribe for one Share granted to an Eligible Person within the scope of the Scheme;

"Option Certificate" means a certificate issued by the Company to an Option Holder evidencing the title of the Option Holder to the number of Options granted to such Option

Holder;

"Option Grant" means such number of Options as may be granted to an Eligible Person by the Board at any time;

"Option Holder" means an Eligible Person or a former Eligible Person who is the holder of Options which has neither been exercised nor lapsed and, where the context so

permits, a person entitled to rights under any such Options in consequence of the death of the original Option Holder;

"Option Share" means the Share in respect of which an Option may be exercised;

"Participating Company" means the Company and any Subsidiary;

"Rules" means these rules as varied from time to time in accordance with Clause 8 hereof;

"Scheme" means the Company's share option scheme as approved by the Board from time to time;

"Share" means a fully paid ordinary share of par value US$0.10 in the capital of the Company;

"Share Capital" means the fully paid, issued share capital of the Company;

"Subscription Cost" means, in relation to the exercise of a number of Options, the product of the number of Option Shares in respect of

which Options are exercised and the Subscription Price of such Option Shares;

"Subscription Price" means the price to be paid for each Option Share as the Board, from time to time, at its discretion, shall resolve

shall apply to an Option when such Option is granted provided that such price shall be reduced by such amount of dividends or other capital distributions declared by the Company on a per Share basis in the period from the Date of Grant until the date

the Option is exercised provided always that the Subscription Price cannot be lower than the par value of the Share;

"Subsidiary" means a company which, for the time being, is a subsidiary of the Company within the definition contained in Section 86 of

the Companies Act 1981 of Bermuda;

"Vesting Date" means the date on which an Option becomes exercisable and is the date the Board, in its discretion, may prescribe from

time to time when an Option is granted, provided that such date cannot be earlier than one day after the Date of Grant.

1.2 In these Rules:

a. words denoting the singular number shall include the

plural number and words denoting the masculine gender shall include the feminine gender; and

b.

any reference herein to any enactment or statutory provision shall be construed as a reference to that Bermudian enactment or provision as from time to time amended extended or

re-enacted.

except in so far as the context otherwise requires.

2. GRANT OF OPTION

2.1 At any time after the Adoption Date the Board may, in its absolute discretion, resolve to grant a number

of Options to an Eligible Person on the terms and conditions set out in these Rules and in its resolution.

2.2 Immediately following the Date of Grant the Board shall notify the Eligible Person that he/she has

received an Option Grant, the number of Options covered thereby and the specific terms thereof.

2.3 The notice given by the Board pursuant to Clause 2.2 shall be in such form, not inconsistent with these

Rules, as the Board may determine and shall specify the number of Options granted, the terms applicable thereto other than as set out herein, the Date of Grant and the Subscription Price.

2.4 Not later than two weeks following the Date of Grant, the Option

Holder may, by a notice in writing, renounce his rights to any Options granted pursuant to Clause 2.1 in which event such Options shall be deemed for all purposes never to have been granted.

2.5 As soon as possible after the expiry of the two week notice period referred to in Clause 2.4, the Board

shall issue an Option Certificate documenting the Options granted in such Option Grant in such form, not inconsistent with these Rules, as the Board may determine.

3. LIMITATIONS

3.1 No Option shall be granted to any person unless he/she, at the Date of Grant, is an Eligible Person and

further, no Share shall be issued upon the exercise of any Option unless the requirements of clause 3.2 have been satisfied.

3.2 Prior to the issuance of any Option of Share, the Company shall have given no less than 5 days prior

written notice of the proposed issuance to the Company's CSP, and the Company's CSP shall have confirmed to the Company in writing that the Company's CSP has notified the Controller of Foreign Exchange of the issue of the Option or Share in accordance

with the Exchange Control Regulations 1973.

4. MAIN TERMS

4.1 No consideration shall be payable to the Company in exchange for an Option Grant.

4.2 Each Option shall entitle the Option Holder to subscribe for one Share at the Subscription Price on the

date the Option is exercised.

4.3 An Option which has not lapsed may be exercised at any time provided the earliest of the following events

has occurred:

a. the Vesting Date;

b. the death of the Option Holder;

c. a Change of Control Event.

4.4 An Option which has vested, shall lapse on the earliest of the following events:

a.

such date as the Board in its discretion may prescribe at the Date of Grant, provided that such date cannot be later than the fifth anniversary of the Date of Grant;

b. the first anniversary of the Option Holder’s death;

c. the first anniversary of the Option Holder’s retirement;

d. three months following the Option Holder ceasing to be

an Eligible Person (other than by reason of his death or retirement); and

e. one month after the Option has become exercisable in

accordance with Clause 7.1;

4.5 An Option which has not vested, shall lapse on the earliest of the following events:

a. the date of an Option Holder's death or retirement; and

b. the date an Option Holder ceases to be an Eligible

Person (other than by reason of his death or retirement).

5. EXERCISE OF OPTIONS

5.1 Exercise of an Option shall be effected by the Option Holder giving notice in writing to the Company

specifying the number of Options (not being less than 500, and being a multiple of 100, except in the case of final exercise of all Options held by the Option Holder) which is being exercised on that occasion and accompanied by the relevant Option

Certificate and otherwise in such form and manner as the Board, in its discretion, may prescribe from time to time, provided that such notice shall be deemed to have been exercised and to take effect on the date on which payment of the Subscription

Cost is received by the Company.

5.2 Subject to any necessary consents under applicable laws, stock exchange regulations or enactments for

the time being in force, compliance by the Option Holder with these Rules and receipt by the Company of the Subscription Cost, the Company shall, not later than thirty days after receipt of the notice referred to in Clause 5.1 above, allot and issue to

the Option Holder the number of Shares specified in the notice. If the number of Options exercised is less than that specified in the relevant Option Certificate, then the Company shall issue a balance Option Certificate in respect of the remainder of

such Options which are still capable of exercise.

5.3 Shares allotted as a consequence of an exercise of Options shall rank pari passu in all respects with the

Shares for the time being in issue save as regards any rights attaching by reference to a record date prior to the date on which the Options are exercised.

5.4 The Company shall have the right to settle an exercise of an Option by delivering Shares already in issue

(which are held in treasury) to the Option Holder. The Subscription Price shall, in such event, be paid as consideration for each such Option Share.

6. ADJUSTMENTS TO OPTION RIGHTS

6.1 In the event of any capitalisation or rights issue, any sub-division, consolidation or a reduction of the

Share Capital, the Board shall make appropriate adjustments with regard to:

a. the number of Shares the exercise of an Option shall result in;

b. the Subscription Price; or

c. the terms of any Option.

PROVIDED THAT:

d. any such adjustment has been confirmed in writing by an Independent Expert

to be in their opinion, fair and reasonable; and

e. the Subscription Price is not being increased.

6.2 The Board shall give notice in writing to each Option Holder affected by any adjustment made pursuant to

Clause 6.1 and may, at its discretion, deliver to him a revised Option Certificate in respect of his Options.

7. WINDING-UP

7.1 If notice is given by the Board to the shareholders in the Company of a members’ resolution for the

voluntary winding-up of the Company, notice of the same shall forthwith be given by the Board to the Option Holders.

Each of the Option Holders shall be entitled, within one month following such notice, to give notice in writing to the Company (such notice being accompanied by payment of the

relevant Subscription Cost) that such Option Holder wishes to be treated as if all or any of his Options had been exercised immediately before the commencement of the winding-up procedure. In such event the Option Holder will be entitled to participate

in the assets available in the winding-up on a pari passu basis with the shareholders in the Company as if he were a shareholder in relation to such number of Shares as he/she would have been entitled to had his/her Options been so exercised. Subject

thereto all Options shall lapse on the commencement of the winding-up.

7.2 Option rights shall lapse immediately in the event of the Company being wound-up otherwise than in the

event of a voluntary winding-up.

8. VARIATION OF THE SCHEME

8.1 Subject to Clause 9.2 the Board may at any time alter or add to these Rules in any respect, provided

that:

a.

the Board may not cancel an Option except where (i) the Option Holder has breached the provisions of Clause 9.5 or (ii) the Option Holder has previously agreed; and

b. (subject as herein provided) the Board may not modify

the terms of an Option already granted otherwise than with the consent of the Option Holder.

8.2 The Board shall give notice in writing to each Option Holder of any alteration or addition

to the Rules made pursuant to this Clause 8 and may, at its discretion, deliver to each Option Holder a revised Option Certificate in respect of his/her Options.

9. GENERAL PROVISIONS

9.1 The Company shall maintain a Register of Option Holders which shall be kept at the registered office of

the Company's CSP. The Register of Option Holders shall not form part of the Register of Shareholders. For each Option Holder, the Company shall record in the Register of Option Holders the name and address of such Option Holder, the Date of Grant of

Options granted to such Option Holder, the date of exercise of Options by such Option Holder and the number of Options held by such Option Holder from time to time.I

9.2 The Company shall at all times keep available sufficient authorised but unissued Shares to satisfy the

exercise in full of all Options for the time being capable of being exercised.

9.3 The Board may from time to time make and vary such regulations and establish such procedures for the

administration and implementation of these Rules as it thinks fit. In the event of any dispute or disagreement as to the interpretation of these Rules or as to the question of rights arising from or related to the Scheme, the decision of the Board

shall (except as regards any matter required to be determined by the Auditors hereunder) be final and binding upon all persons.

9.4 The cost of the administration and implementation of the Scheme shall be borne by the Company.

9.5 The rights and obligations of an Eligible Person under the terms on which the Eligible Person holds his

office or employment with a Participating Company shall not be affected by his participation in the Scheme or by any right he may have to participate therein, and the Scheme shall afford an Eligible Person no rights to compensation or damages in

connection with the termination of such office or employment for any reason whatsoever.

9.6 The rights and obligations of an Option Holder shall be personal to the Option Holder and no Option nor

the benefit thereof may be transferred, assigned, charged or otherwise alienated save that nothing in this Clause shall prohibit the transmission of an Option or the benefit thereof by operation of law.

9.7 For so long as the Shares are listed on a stock exchange, the Company shall apply to the appropriate

authorities of such stock exchange for all Shares subscribed for under the Scheme to be admitted for trading thereon on par with the other Shares.

9.8 Any notice or other document to be served by the Company on an Eligible Person or Option Holder may be

served personally or by e-mail or by sending it through the post in a prepaid letter addressed to him at his address as last known to the Company.

Any notice or other document to be served on the Company under the Scheme may be served by an Eligible Person or Option Holder by leaving it at the registered office for the

time being of the Company or by e-mail or by sending it through the post in a prepaid letter addressed to such registered office.

Where any notice or other document is served or sent by first class post it shall be deemed to have been received at the expiration of seven days (excluding Saturdays, Sundays

or public holidays in Bermuda), after the time when cover containing the same was put in the post properly addressed and stamped. Any notice or document sent by e-mail shall be deemed to have been received at the time of transmission to the party to

which it is addressed.

9.9 The Insider Trading Regulations of the Company are applicable to the Shares received as a consequence of

the exercise of Options.

10. TERMINATION OF THE SCHEME

10.1 The Scheme shall terminate on the date determined by the Board to be the date of termination of the

Scheme.

10.2 Following termination of the Scheme pursuant to Clause 10.1 above, no further Options shall be granted but

the subsisting rights and obligations of existing Option Holders will continue in force as if the Scheme had not terminated.

7

Exhibit 5.1

|

2 December 2024

|

Our Ref: PO/CO/jm/L15498

|

| |

|

Borr Drilling Limited

2nd Floor, S.E. Pearman Building 9 Par-la-Ville Road

Hamilton, HM11 Bermuda

|

|

Dear Addressees

BORR DRILLING LIMITED

We have been asked to provide this legal opinion to you with regard to the laws of Bermuda in connection with the Registration Statement (as defined in

Schedule 1, which term does not include any other document or agreement whether or not specifically referred to therein or attached as an exhibit or schedule thereto) by Borr Drilling Limited (the “Company”).

For the purposes of giving this opinion, we have examined and relied upon the originals or copies of the documents listed in Schedule 1.

We are Bermuda Barristers and Attorneys and express no opinion as to any laws other than the laws of Bermuda in force and as interpreted at the date

of this opinion. We have not, for the purposes of this opinion, made any investigation of the laws, rules or regulations of any other jurisdiction. Except as explicitly stated herein, we express no opinion in relation to any representation or

warranty contained in the Documents (as defined in Schedule 1) nor upon matters of fact or the commercial terms of the transactions contemplated by the Documents.

Based upon the foregoing examinations and the assumptions and qualifications set out below and upon such searches as we have conducted and having

regard to legal considerations which we consider relevant, and under the laws of Bermuda, we give the following opinions in relation to the matters set out below.

|

1. |

The Company is an exempted company duly incorporated under the Companies Act, 1981 (as amended) (the “Companies Act”) and validly exists as a

company limited by shares in Bermuda. Based solely on the Certificate of Compliance referred to in Schedule 1, the Company is in good standing under the laws of Bermuda.

|

|

2. |

With respect to the Plan Shares, upon the issue of the Plan Shares (by the entry of the name of the registered owner thereof in the Register of Members of the Company confirming that

such Plan Shares have been issued credited as fully paid), delivery and payment therefor in accordance with the Plan and the Memorandum and Bye-Laws (as defined in Schedule 1) and in the manner contemplated by the Registration Statement (as

each term is defined in Schedule 1), the Plan Shares will be duly authorised, validly issued, fully paid and non- assessable (meaning that no additional sums may be levied in respect of such Plan Shares on the holder thereof by the Company).

|

Walkers The Scalpel, 11th Floor, 52 Lime Street, London, EC3M 7AF, UK T +44 (0)20 7220 4999 www.walkersglobal.com

Bermuda | British Virgin Islands | Cayman Islands | Dubai | Guernsey | Hong Kong | Ireland | Jersey | London | Singapore

The foregoing opinions are given based on the following assumptions.

|

1. |

The originals of all documents examined in connection with this opinion are authentic. The signatures, initials and seals on the Documents are genuine and are those of a person or

persons given power to execute the Documents under the Resolutions (as defined in Schedule 1). All documents purporting to be sealed have been so sealed. All copies are complete and conform to their originals. The Documents conform in every

material respect to the latest drafts of the same produced to us and, where provided in successive drafts, have been marked up to indicate all changes to such Documents.

|

|

2. |

The Memorandum and Bye-Laws reviewed by us will be the memorandum of association and bye-laws of the Company in effect upon the consummation of the issuance and sale of the Plan Shares.

|

|

3. |

The Company Records (as defined in Schedule 1) are complete and accurate and all matters required by law and the Memorandum and Bye-Laws to be recorded therein are completely and

accurately so recorded.

|

|

4. |

The accuracy and completeness of all factual representations made in the Registration Statement, the Plan, the US Sub-Plan and all other documents reviewed by us.

|

|

5. |

The Company will receive consideration in money or money’s worth for each Plan Share offered by the Company when issued at the agreed issue price as per the terms of the Registration

Statement and the Plan (and the US Sub-Plan, if applicable), such price in any event not being less than the stated par or nominal value of each Plan Share.

|

|

6. |

The Resolutions (defined in Schedule 1) are and shall remain in full force and effect and have not been and will not be rescinded or amended. The Resolutions have been duly executed by

or on behalf of each director of the Company and the signatures and initials thereon are those of a person or persons in whose name the Resolutions have been expressed to be signed.

|

|

7. |

Each of the Registration Statement, the Plan and the US Sub-Plan will be duly authorised, executed and delivered by or on behalf of all relevant parties prior to the issue and sale of

the Plan Shares and will be legal, valid, binding and enforceable against all relevant parties in accordance with their terms under all relevant laws (other than the laws of Bermuda).

|

|

8. |

All preconditions to the obligations of the parties to the Plan and the US Sub-Plan will be satisfied or duly waived prior to the issue and sale of the Plan Shares and there will be no

breach of the terms of the Plan or the US Sub-Plan.

|

|

9. |

That on the date of issuance of any of the Plan Shares the Company will have sufficient authorised but unissued common shares.

|

|

10. |

That shares of the Company are and will continue to be listed on an appointed stock exchange, as defined in the Companies Act 1981, as amended, and the consent to the issue and free

transfer of shares and securities of the Company given by the Bermuda Monetary Authority will not have been revoked or amended at the time of issuance of any Plan Shares.

|

|

11. |

That there is no provision of any award agreement or any sub-plan nor any variation or amendment to the Scheme (as defined in the Plan) or the Plan (other than the US Sub-Plan) which

would or might affect any of the opinions set forth above.

|

|

12. |

There is nothing under any law (other than the laws of Bermuda) which would or might affect any of the opinions set forth above.

|

We have relied upon the statements and representations of directors, officers and other representatives of the Company as to factual matters.

Our opinion as to good standing is based solely upon receipt of the Certificate of Compliance (as defined in Schedule 1) issued by the Registrar of

Companies, which confirms only that the Company has neither failed to make any filing with any Bermuda governmental authority nor failed to pay any Bermuda government fee or tax, which might make it liable to be struck off the Register of Companies.

“Non-assessability” is not a legal concept under Bermuda law. Reference in this opinion to shares being “non-assessable” shall mean, in relation to

fully-paid shares of the Company and subject to any contrary provision in any agreement in writing between the Company and the holder of shares, that no member shall be:

|

(a) |

obliged to contribute further amounts to the capital of the Company, either in order to complete payment for their shares, to satisfy claims of creditors of the Company, or otherwise;

and

|

|

(b) |

bound by an alteration of the Memorandum or Bye-laws of the Company after the date on which they became a member, if and so far as the alteration requires them to take, or subscribe for

additional shares, or in any way increases their liability to contribute to the share capital of, or otherwise to pay money to, the Company.

|

This opinion is limited to the matters referred to herein and shall not be construed as extending to any other matter or document not referred to herein.

This opinion is given solely for your benefit and the benefit of your legal advisers acting in that capacity in relation to this transaction and may not be relied upon by any other person, other than persons entitled to rely upon it pursuant to the

provisions of the Securities Act, without our prior written consent.

This opinion shall be construed in accordance with the laws of Bermuda.

We hereby consent to the filing of this opinion as an exhibit to the Registration Statement. We also consent to the identification of our firm in the

Registration Statement.

Yours faithfully

WALKERS

SCHEDULE 1

LIST OF DOCUMENTS EXAMINED

|

1. |

The Certificate of Incorporation as issued on 9 August 2016, Certificate of Incorporation on Change of Name, Memorandum of Association, Bye-laws of the Company as adopted on 27

September 2019(together the “Memorandum and Bye-laws”), and Register of Directors and Officers, in each case of the Company, copies of which have been provided to us by its in Bermuda (together the “Company Records”).

|

|

2. |

The public records of the Company on the Register of Companies, examined on 29 November 2024.

|

|

3. |

A Certificate of Compliance dated 28 November 2024 issued by the Registrar of Companies for the Ministry of Finance in relation to the Company (the “Certificate

of Compliance”).

|

|

4. |

A copy of executed written resolutions of the board of directors of the Company dated 29 November 2024 (the “Resolutions”).

|

|

5. |

Copies of the following documents (the “Documents”):

|

|

(a) |

the Registration Statement on Form S-8, originally filed on 2 December 2024 by the Company with the United States Securities and Exchange Commission (“SEC”)

in respect of the registration of 12,638,327 shares, par value $0.10 each (“Common Shares”) that may be issued upon the exercise of share options granted pursuant to the Plan (the “Plan Shares”) under the United States Securities Act of 1933, as amended (the “Securities Act”) (the “Registration Statement”);

|

|

(b) |

a United States sub-plan to the Share Option Scheme which shall only apply to holders who are subject to U.S. federal income tax (the “US Sub-Plan”);

and

|

|

(c) |

the Company’s Share Option Scheme noted as approved by the board on 15 March 2017 as amended on 13 February 2024 (the “Plan”).

|

Exhibit 23.1

|

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

|

|

We hereby consent to the incorporation by reference in this Registration Statement on Form S-8 of Borr Drilling Limited of our report

dated March 27, 2024 relating to the financial statements and the effectiveness of internal control over financial reporting, which appears in Borr Drilling Limited's Annual Report on Form 20-F for the year ended December 31, 2023.

|

|

/s/ PricewaterhouseCoopers LLP

|

Exhibit 107

Calculation of Filing Fee Table

FORM S-8

(Form Type)

Borr Drilling Limited

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

| Security Type | Security Class Title | Fee Calculation Rule (1) | Amount Registered (2) | Proposed Maximum Offering Price Per Unit (1) | Maximum Aggregate Offering Price (1) | Fee Rate | Amount of Registration Fee |

| Equity | Common shares, par value $0.10 | Other | 12,638,327 | $3.72 | $47,014,576.44 | 0.00015310 | $7,197.93 |

| Total Offering Amounts | | $47,014,576.44 | | $7,197.93 |

| Total Fee Offsets | | | | — |

| Net Fee Due | | | | $7,197.93 |

(1)

Estimated in accordance with Rule 457(c) and (h) under the Securities Act of 1933, as amended, solely for purposes of calculating the registration fee, based on the average of the high and low sales prices of the common shares, par value $0.10 (“Common Shares”) of Borr Drilling Limited as reported on the New York Stock Exchange on November 26, 2024.

(2)

Represents Common Shares that may be issued upon the exercise of share options granted pursuant to the Company’s Share Option Scheme dated March 15, 2017, as amended on February 13, 2024.

Table 2: Fee Offset Claims and Sources

Not applicable.

0001715497

EX-FILING FEES

0001715497

2024-12-02

2024-12-02

0001715497

1

2024-12-02

2024-12-02

xbrli:shares

iso4217:USD

xbrli:pure

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_FeeExhibitTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:feeExhibitTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissionLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_SubmissnTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

v3.24.3

Offerings - Offering: 1

|

Dec. 02, 2024

USD ($)

shares

|

| Offering: |

|

| Fee Previously Paid |

false

|

| Other Rule |

true

|

| Security Type |

Equity

|

| Security Class Title |

Common shares, par value $0.10

|

| Amount Registered | shares |

12,638,327

|

| Proposed Maximum Offering Price per Unit | shares |

3.72

|

| Maximum Aggregate Offering Price | $ |

$ 47,014,576.44

|

| Fee Rate |

0.01531%

|

| Amount of Registration Fee | $ |

$ 7,197.93

|

| Offering Note |

(1) Estimated in accordance with Rule 457(c) and (h) under the Securities Act of 1933, as amended, solely for purposes of calculating the registration fee, based on the average of the high and low sales prices of the common shares, par value $0.10 (“Common Shares”) of Borr Drilling Limited as reported on the New York Stock Exchange on November 26, 2024.

(2)

Represents Common Shares that may be issued upon the exercise of share options granted pursuant to the Company’s Share Option Scheme dated March 15, 2017, as amended on February 13, 2024.

|

| X |

- DefinitionThe amount of securities being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_AmtSctiesRegd |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTotal amount of registration fee (amount due after offsets). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe rate per dollar of fees that public companies and other issuers pay to register their securities with the Commission. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeeRate |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:percentItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCheckbox indicating whether filer is using a rule other than 457(a), 457(o), or 457(f) to calculate the registration fee due. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesOthrRuleFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum aggregate offering price for the offering that is being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxAggtOfferingPric |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative100TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe maximum offering price per share/unit being registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_MaxOfferingPricPerScty |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegativeDecimal4lItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingNote |

| Namespace Prefix: |

ffd_ |

| Data Type: |

dtr-types:textBlockItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe title of the class of securities being registered (for each class being registered). Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTitl |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionType of securities: "Asset-backed Securities", "ADRs/ADSs", "Debt", "Debt Convertible into Equity", "Equity", "Face Amount Certificates", "Limited Partnership Interests", "Mortgage Backed Securities", "Non-Convertible Debt", "Unallocated (Universal) Shelf", "Exchange Traded Vehicle Securities", "Other" Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_OfferingSctyTp |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:securityTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_OfferingTable |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- References

+ Details

| Name: |

ffd_PrevslyPdFlg |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

ffd_OfferingAxis=1 |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

v3.24.3

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_FeesSummaryLineItems |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_NetFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

xbrli:monetaryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlFeeAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOfferingAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- ReferencesReference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

| Name: |

ffd_TtlOffsetAmt |

| Namespace Prefix: |

ffd_ |

| Data Type: |

ffd:nonNegative1TMonetary2ItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

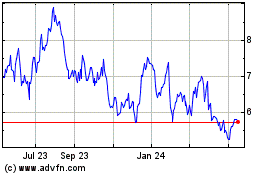

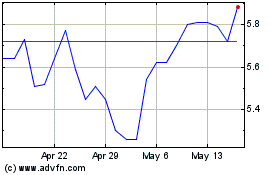

Borr Drilling (NYSE:BORR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Borr Drilling (NYSE:BORR)

Historical Stock Chart

From Dec 2023 to Dec 2024