Report of Foreign Issuer (6-k)

December 22 2014 - 2:33PM

Edgar (US Regulatory)

FORM 6-K

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

dated December 22, 2014

Commission File Number 1-15148

BRF S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s Name)

1400 R. Hungria, 5th Floor

Jd América-01455000-São Paulo – SP, Brazil

(Address of principal executive offices) (Zip code)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T

Rule 101(b)(7):

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes o No x

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

* * *

This material includes certain forward-looking statements that are based principally on current expectations and on projections of future events and financial trends that currently affect or might affect the Company’s business, and are not guarantees of future performance. These forward-looking statements are based on management’s expectations, which involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are beyond the Company’s control and any of which could cause actual financial condition and results of operations to differ materially fom those set out in the Company’s forward-looking statements. You are cautioned not to put undue reliance on such forward-looking statements. The Company undertakes no obligation, and expressly disclaims any obligation, to update or revise any forward-looking statements. The risks and uncertainties relating to the forward-looking statements in this Report on Form 6-K, including Exhibit 1 hereto, include those described under the captions “Forward-Looking Statements” and “Item 3. Key Information — D. Risk Factors” in the Company’s annual report on Form 20-F for the year ended December 31, 2012.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

Date: December 22, 2014 |

|

|

|

|

|

|

BRF S.A. |

|

|

|

|

|

|

|

|

By: |

/s/ Augusto Ribeiro Junior |

|

|

|

Name: |

Augusto Ribeiro Junior |

|

|

|

Title: |

CFO AND IRO

|

BRF S.A.

A PUBLICLY TRADED COMPANY WITH AUTORIZED CAPITAL

CNPJ 01.838.723/0001-27

NIRE 42.300.034.240

CVM 16269-2

SUMMARY OF THE MINUTES OF THE 12th /14 MEETING OF THE BOARD OF DIRECTORS

DATE, PLACE AND TIME: December 18, 2014, at 09:00 a.m., Rua Hungria, 1400 - 5th floor - São Paulo-SP. BOARD: Abilio dos Santos Diniz, Chairman; Edina Biava, Secretary. ATTENDANCE: The majority of members. RESOLUTIONS: The following subjects were decided by the Board of Directors: 1. Share Buyback Program - Approved the treasury stock buyback program, up to the limit of 16,260,163 common shares, which will be in force from the day January 5, 2015 until April 3, 2015 (89 days), and the Executive Board shall set the dates on which the Share Buyback Program will be effectively performed. Any acquisition of shares will comply with the legal and regulatory prohibition periods. The goal of the Share Buyback Program is to achieve efficient use of available funds in cash in order to maximize efficiency of result. The shares acquired under the Share Buyback Program will be canceled, used for implementation of the Stock Option Plan or for the other plans approved by the Company. 2. Approval of Shareholder Remuneration - The Board decide, upon the approval of the Fiscal Council, to approve management's proposal for the payment of R$ 376,765,000.00 (three hundred seventy-six million, seven hundred sixty-five thousand reais) as interest on shareholders' equity that will be levied on mandatory dividends, according to the laws. This amount is equivalent to R$ 0.43441923 gross per outstanding share, with a 15% withholding tax, except for exempt, according to the laws in force. It also adopted, additional distribution in the amount of R$ 86,489,000.00 (eighty-six million, four hundred and eighty-nine thousand reais), R$ 0.09972393 per share, as dividends, totaling R$ 463,254,000.00 (four hundred sixty-three million, two hundred and fifty-four thousand reais) of distribution of remuneration to shareholders in the 2nd half of 2014, R$ 0.53414316 per share, to be paid on 02.13.2015, ad referendum of the Special/Annual Shareholders' Meeting considering 867,284,349 outstanding shares. The shareholders will be entitled to receive such interest on the reference date of December 30, 2014. From January 2, shares will be traded "ex-right" to dividends to the date of payment. The payment will be on February 13, 2015. 3. Conesul - Demobilization Argentina - The Executive Board of Conesul was authorized to make the presented demobilization, according to attached I, which will be filed at the Company's headquarters. 4. Stock Option - Grant of Option - The Grant Proposal was approved to Executive Officers, representing 0.65% ofthe capital, considering 5,702,714 shares, according to the Stock Options Plan in force. 5. Closing of subsidiary - The Board approved the proposal and authorized the Statutory Executive Board to promote the closure of companies Avipal S.A.Construtora e Incorporadora and Avipal Centro-Oeste S.A. 6. Change of corporate names of BRF subsidiaries in Europe - The Board of Directors authorized the Statutory Executive Board to promote the change of corporate name of subsidiaries Plusfood to BRF in Europe, according to attached II, which will be filed at the Company's headquarters.7. Statutory Executive Board - The Statutory Executive Board was appointed for a period of two years, which shall be as follows since January 1st 2015: Global CEO, Pedro de Andrade Faria, brazilian, married, business administrator, registered with CPF No. 271.782.078-76 and RG No. 22.265.414-4 SSP-SP, resident and domiciled in the city of São Paulo, SP;

BRF S.A.

A PUBLICLY TRADED COMPANY WITH AUTORIZED CAPITAL

CNPJ 01.838.723/0001-27

NIRE 42.300.034.240

CVM 16269-2

CFO and Investor Relations Officer, Augusto Ribeiro Júnior, brazilian, married, engineer, registered with CPF 888.162.309-91 and RG No. 1993384-SSP/SC, resident and domiciled in Santana do Parnaíba - SP; Vice-Presidents: Flavia Moyses Faugeres, brazilian, married, business administrator, registered with CPF 159.738.148-90 and RG No. 17455871-5 SSP-SP, resident and domiciled in the city of São Paulo, SP; Gilberto Antonio Orsato, brazilian, married, business administrator, registered with CPF 356.481.390-04 and RG No. 1019124121 SSP-RS, resident and domiciled in the city of São Paulo, SP; Hélio Rubens Mendes dos Santos, brazilian, married, engineer, registered with CPF 472.238.200-04 and RG No. 5056775-6, domiciled in the City of São Paulo, SP; José Roberto Pernomian Rodrigues, brazilian, married, lawyer, registered with CPF 058.787.588-73 and RG No. 19329278-6 SSP-SP, resident and domiciled in the city of São Paulo, SP; Rodrigo Reghini Vieira, brazilian, married, engineer, registered with CPF 246.825.328-04 and RG No. 21982325 SSP-SP, resident and domiciled in the city of São Paulo, SP. 7.1. Changes in the Executive Board - Mr. Claudio Galeazzi resigns from the Company. Also, Mr. Sergio Mandin Fonseca and Mr. Ely David Mizrahi leave the positions of Vice-Presidents, remaining in the Company's staff. The Board gave vote of distinction in special thanks to the executive officers who played a key role in the Company's history. 8. Joint Venture - The Executive Board of the Company is authorized to sign - Binding memorandum of understanding ("MOU") with PT Indofood Suskes Makmur Tbk ("Indofood"), for the merger by BRF and Indofood ("Parties") of a joint venture ("JV"), which will explore the business of poultry and processed foods in Indonesia. The JV will represent BRF's entry in Indonesia, a market with over 250 million inhabitants and with significant growth in the consumption of proteins. BRF and Indofood will have each a 50% interest in the JV and, subject to the fulfillment of certain conditions precedent to be set forth in the final agreements, will invest together about US$ 200 million over the next three years. 9. Other internal matters of the Company. This is part of the summary of the Meeting of the Board of Directors and was signed by the attending members. Abilio Diniz, Chairman; Sérgio Ricardo Silva Rosa, Vice-Chairman; Eduardo Silveira Mufarej; José Carlos Reis Magalhães Neto; Luiz Fernando Furlan; Manoel Cordeiro Silva Filho; Paulo Assunção de Sousa; Vicente Falconi Campos; Walter Fontana Filho. São Paulo - SP, December 19, 2014. (I certify that this is an extract from the original minutes transcribed in Book 4, folios 22 to 27, of the minutes of the Ordinary and Extraordinary Meetings of the Company’s Board of Directors).

EDINA Biava

Secretary

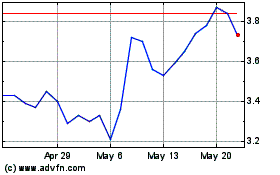

BRF (NYSE:BRFS)

Historical Stock Chart

From Mar 2024 to Apr 2024

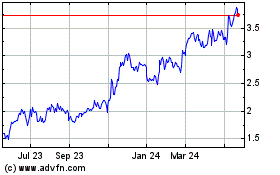

BRF (NYSE:BRFS)

Historical Stock Chart

From Apr 2023 to Apr 2024