Amended Statement of Beneficial Ownership (sc 13d/a)

February 05 2020 - 3:56PM

Edgar (US Regulatory)

|

SECURITIES AND EXCHANGE COMMISSION

|

|

|

Washington, D.C. 20549

|

|

|

|

|

|

SCHEDULE 13D/A

|

|

|

|

Under the Securities Exchange Act of 1934

(Amendment No. 6)

|

|

|

|

Peabody Energy

Corporation

|

|

(Name of Issuer)

|

|

|

|

Common Stock,

$0.01 par value

|

|

(Title of Class of Securities)

|

|

|

|

704551100

|

|

(CUSIP Number)

|

|

|

|

Elliott Investment Management L.P.

40 West 57th Street

New York, NY 10019

with a copy to:

Eleazer Klein, Esq.

Marc Weingarten, Esq.

Schulte Roth & Zabel LLP

919 Third Avenue

New York, New York 10022

(212) 756-2000

|

|

(Name, Address and Telephone Number of Person

|

|

Authorized to Receive Notices and Communications)

|

|

|

|

February

4, 2020

|

|

(Date of Event Which Requires Filing of This Statement)

|

If the filing person has previously filed a

statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because

of Rule 13d-1(e), Rule 13d-1(f) or Rule 13d-1(g), check the following box. [ ]

(Page 1 of 5 Pages)

______________________________

* The remainder of this cover page shall be

filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any subsequent

amendment containing information which would alter disclosures provided in a prior cover page.

The information

required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities

Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

CUSIP No. 704551100

|

13D/A

|

Page 2 of 5 Pages

|

|

1

|

NAME OF REPORTING PERSON

Elliott Investment Management L.P.

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a) ¨

(b) ¨

|

|

3

|

SEC USE ONLY

|

|

4

|

SOURCE OF FUNDS

OO

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e)

|

¨

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH:

|

7

|

SOLE VOTING POWER

28,916,201

|

|

8

|

SHARED VOTING POWER

0

|

|

9

|

SOLE DISPOSITIVE POWER

28,916,201

|

|

10

|

SHARED DISPOSITIVE POWER

0

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

28,916,201

|

|

12

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

|

¨

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

29.9%

|

|

14

|

TYPE OF REPORTING PERSON

PN, IA

|

|

|

|

|

|

|

|

CUSIP No. 704551100

|

13D/A

|

Page 3 of 5 Pages

|

The following constitutes Amendment No. 6 to

the Schedule 13D ("Amendment No. 6"). This Amendment No. 6 amends the Schedule 13D as specifically set forth herein.

|

Item 4.

|

PURPOSE OF TRANSACTION

|

|

|

|

Item 4 is hereby amended and supplemented as follows:

|

|

|

|

|

On

February 4, 2020, the Reporting Person, Elliott Associates, L.P. and Elliott International, L.P. (collectively,

"Elliott") entered into an agreement (the "Agreement") with the Issuer. Pursuant to the

Agreement, the Issuer's board of directors (the "Board") will promptly: (i) increase the size of

the Board from 10 directors to 12 directors, resulting in a total of three vacancies; and (ii) appoint David Miller,

Samantha Algaze and Darren Yeates (the "Elliott Appointed Directors") to serve as directors of the Issuer to fill

such vacancies, each with a term expiring at the Issuer's 2020 Annual Meeting of Stockholders (the "2020 Annual

Meeting"). Mr. Miller and Ms. Algaze are employees of the Reporting Person. The Issuer and

Elliott have also agreed to promptly identify an additional, mutually agreed-upon candidate who is independent of both

the Issuer and Elliott to serve as a director of the Issuer (the "Additional Independent Director"). Following

the identification of the Additional Independent Director, the Board will promptly (x) increase the size of the

Board from 12 to 13 directors and (y) appoint the Additional Independent Director as a director of the

Issuer with a term expiring at the 2020 Annual Meeting. The Issuer has agreed to appoint (a) Mr.

Miller to serve as a member of the Board's Executive Committee and Compensation Committee, (b) Ms. Algaze to

serve as a member of the Board's Nominating and Corporate Governance Committee, (c) Mr. Yeates to serve as a member

of the Board's Health, Safety, Security and Environmental Committee and the Audit Committee (or if Mr. Yeates is

determined by the Board not to meet the applicable independence requirements for service on the Audit Committee, then the

Nominating & Corporate Governance Committee) and (d) the Additional Independent Director

to serve on at least one standing committee of the Board. The Issuer has also agreed

to nominate each of the Elliott Appointed Directors and the Additional Independent Director for

election as directors of the Issuer at the 2020 Annual Meeting and to use its reasonable best

efforts to obtain the election of each of the Elliott Appointed Directors and the Additional

Independent Director at the 2020 Annual Meeting.

|

|

|

|

Under

the Agreement, until the Issuer's 2021 Annual Meeting of Stockholders (the "2021 Annual Meeting") Elliott

has the right to select for appointment to the Board, subject to the Issuer's consent (not to be unreasonably withheld,

conditioned or delayed), a substitute director to replace and serve the remainder of the term of any Elliott Appointed

Director. Pursuant to the Agreement, one or more of the Elliott Appointed Directors (including their replacements)

will be required to resign from the Board if Elliott's percentage ownership of the Issuer's outstanding common stock falls

below certain specified thresholds as set forth in the Agreement.

|

|

|

|

From the date of the Agreement until the date that is 30 days prior to the last day of the Issuer's notice period for the nomination of directors at the 2021 Annual Meeting (such period, the "Cooperation Period"), Elliott has agreed to vote all shares of Common Stock that it or its affiliates have the right to vote in favor of the election of directors nominated and recommended by the Board for election and otherwise in accordance with the recommendations of the Board, subject to certain exceptions and early termination upon certain specified events. Elliott has also agreed to certain customary standstill and mutual non-disparagement restrictions during the Cooperation Period, subject to certain exceptions and early termination upon certain specified events.

|

|

|

|

The

Issuer has further agreed to retain a consultant to conduct a review of the performance of the Issuer's Australian

mining operations.

|

|

|

|

The foregoing description of the Agreement is qualified in its entirety by reference to the full text of the Agreement, which is attached as Exhibit 99.3 hereto and is incorporated herein by reference.

|

|

CUSIP No. 704551100

|

13D/A

|

Page 4 of 5 Pages

|

|

Item 6.

|

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER

|

|

|

|

Item 6 is hereby amended and supplemented as follows:

|

|

|

|

The information set forth in Item 4 above is incorporated by reference in its entirety into this Item 6.

|

|

Item 7.

|

MATERIAL TO BE FILED AS EXHIBITS

|

|

|

|

Item 7 is hereby amended and supplemented as follows:

|

|

|

|

|

Exhibit 99.3:

|

Agreement (incorporated by reference to Exhibit 10.1 of the Form 8-K filed by the Issuer on February 5, 2020).

|

|

|

|

|

|

CUSIP No. 704551100

|

13D/A

|

Page 5 of 5 Pages

|

SIGNATURES

After reasonable

inquiry and to the best of its knowledge and belief, the undersigned certifies that the information set forth in this statement

is true, complete and correct.

DATE: February 5, 2020

|

Elliott Investment Management L.P.

|

|

|

|

|

|

|

|

/s/ Elliot Greenberg

|

|

|

|

Name: Elliot Greenberg

|

|

|

|

Title: Vice President

|

|

|

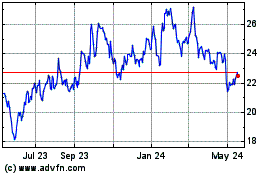

Peabody Energy (NYSE:BTU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Peabody Energy (NYSE:BTU)

Historical Stock Chart

From Apr 2023 to Apr 2024