UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 3, 2024

Crown Castle Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

001-16441 |

|

76-0470458 |

| (State or other jurisdiction |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

| of incorporation) |

|

|

|

|

|

|

8020 Katy

Freeway, Houston, Texas 77024-1908 |

|

|

| |

|

(Address of principal executive offices) (Zip Code) |

|

|

| |

|

|

|

|

| |

|

Registrant's telephone number, including area code: (713)

570-3000 |

|

|

| |

|

|

|

|

| |

|

|

|

|

| |

|

(Former name or former address,

if changed since last report.) |

|

|

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☒ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading

Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

CCI |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR

§240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

ITEM 1.01—ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On March 3, 2024, Crown Castle Inc. (the “Company”)

entered into an amendment (the “Amendment”) to that certain letter agreement, dated December 19, 2023 (the “Cooperation

Agreement”), by and among Elliott Investment Management L.P., Elliott Associates, L.P. and Elliott International, L.P. (together,

“Elliott”) and the Company. The Amendment also implements corresponding changes to the charters of the Fiber Review Committee

and the Chief Executive Officer Search Committee of the Board of Directors of the Company (the “Board”).

The Amendment eliminates limitations on the

size of the Board as well as the size of each of the Fiber Review Committee and the Chief Executive Officer Search Committee and expressly

provides that the Board may change the size of the Board or either committee.

The Amendment provides that Elliott will vote

at the Company’s 2024 Annual Meeting of Stockholders (the “2024 Annual Meeting”) any Company common stock beneficially

owned by it or certain of its affiliates pro rata in accordance with the vote of the other Company stockholders at the 2024 Annual

Meeting on any matter submitted to a vote of Company stockholders, subject to certain exceptions.

The Amendment further provides that if the

Board determines in good faith after consulting with counsel that its fiduciary duties require recommending a vote “against”

(or rescinding a recommendation “for”) either or both of Jason Genrich and Sunit Patel (each, a “Specified Director”),

then, among other things, the Board (i) may change its recommendation regarding either or both of the Specified Directors and (ii) will

have no obligation to solicit proxies with respect to any Specified Director whom it is no longer recommending. Under such circumstances,

Elliott will be permitted to solicit proxies in favor of any such Specified Director, make statements and

announcements, and otherwise engage in communications with shareholders in connection with such solicitation.

The foregoing summary of the Amendment does

not purport to be complete and is qualified in its entirety by reference to the full text of the Amendment and the Cooperation Agreement,

copies of which are filed as Exhibit 10.1 to this Current Report on Form 8-K, and as Exhibit 10.1 to the Current Report on Form 8-K filed

on December 20, 2023, both of which are incorporated herein by reference.

CAUTIONARY LANGUAGE REGARDING FORWARD-LOOKING STATEMENTS

This Form 8-K contains forward-looking statements

for purposes of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. Statements that are not historical

facts are hereby identified as forward-looking statements. In addition, words such as “estimate,” “anticipate,”

“project,” “plan,” “intend,” “believe,” “expect,” “likely,” “predicted,”

“positioned,” “continue,” “target,” “seek,” “focus” and any variations of

these words and similar expressions are intended to identify forward-looking statements. Examples of forward-looking statements include

(1) statements and expectations regarding the process and outcomes of Company’s Fiber Review Committee, including that it will help

enhance and unlock shareholder value, (2) statements and expectations regarding the process and outcomes of CEO Search Committee, including

that it will conduct the search to identify Crown Castle’s next CEO, (3) that the actions set forth in this Form 8-K best position

the Company for long term success, including our Board’s regular evaluation of all paths to enhance shareholder value, (4) that

the Company will benefit from the experience and insights of the newly appointed directors, and (5) that the Company will identify the

best path forward to capitalize on significant opportunities for growth in our industry. Such forward-looking statements should, therefore,

be considered in light of various risks, uncertainties and assumptions, including prevailing market conditions, risk factors described

in “Item 1A. Risk Factors” of the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (“2023 Form

10-K”) and other factors. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those expected.

Our filings with the SEC are available through

the SEC website at www.sec.gov or through our investor relations website at investor.crowncastle.com.

We use our investor relations website to disclose information about us that may be deemed to be material. We encourage investors, the

media and others interested in us to visit our investor relations website from time to time to review up-to-date information or to sign

up for e-mail alerts to be notified when new or updated information is posted on the site.

Important Stockholder Information

The Company intends to file a proxy statement

and a WHITE proxy card with the U.S. Securities and Exchange Commission (the “SEC”) in connection with its solicitation

of proxies for its 2024 Annual Meeting. THE COMPANY’S STOCKHOLDERS ARE STRONGLY ENCOURAGED TO READ THE DEFINITIVE PROXY STATEMENT,

THE ACCOMPANYING WHITE PROXY CARD, AND ANY AMENDMENTS AND SUPPLEMENTS TO THESE DOCUMENTS WHEN THEY BECOME AVAILABLE AS THEY

WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain the proxy statement, any amendments or supplements to the proxy statement,

and other documents as and when filed by the Company with the SEC without charge from the SEC’s website at www.sec.gov.

Participant Information

For participant information, see the Company’s

Schedule 14A filed with the SEC on February 14, 2024 and available here.

ITEM 9.01—FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

Exhibit Index

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CROWN CASTLE INC. |

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Edward B. Adams, Jr. |

|

| |

|

Name: |

Edward B. Adams, Jr. |

|

| |

|

Title: |

Executive Vice President

and General Counsel |

|

Date: March 4, 2024

EXHIBIT

10.1

Execution Version

Crown Castle Inc.

8020 Katy Freeway

Houston, Texas 77024-1908

DELIVERED BY E-MAIL

March 3, 2024

Elliott Associates, L.P.

Elliott International, L.P.

Elliott Investment Management L.P.

360 S. Rosemary Ave., 18th floor

West Palm Beach, FL 33401

Dear Sirs / Madams:

Reference is made to (i)

that certain letter agreement (the “Cooperation Agreement”), dated December 19, 2023, by and between Crown Castle Inc.,

a Delaware corporation (the “Company”), Elliott Investment Management L.P., a Delaware limited partnership (“Elliott

Investment”), Elliott Associates, L.P., a Delaware limited partnership (“Elliott Associates”), and Elliott

International, L.P., a Cayman Islands limited partnership (“Elliott International”) (Elliott Investment, Elliott Associates

and Elliott International, each an “Investor” and together the “Investors”), (ii) the Fiber Review

Committee Charter of the board of directors of the Company (the “Board”), as adopted by the Board on December 19, 2023

(the “Fiber Review Committee Charter”), and (iii) the Chief Executive Officer Search Committee Charter of the Board,

as adopted by the Board on February 21, 2024 (the “CEO Search Committee Charter”). Capitalized terms used herein and

not otherwise defined have the meanings ascribed to them in the Cooperation Agreement.

This letter (this “Amendment”)

amends the terms of the Cooperation Agreement as provided below.

| 1. | Paragraph 1 of the Cooperation Agreement is amended and restated as follows: |

As promptly as practicable following

the date hereof, the Company shall appoint Jason Genrich (the “New Investor Director”) and Sunit Patel (the “New Independent

Director” and together with the New Investor Director, the “New Directors”) to the board of directors of the Company

(the “Board”). Each of the New Directors shall serve as a director until the Company’s 2024 Annual Meeting of Shareholders

(the “2024 Annual Meeting”) and until a successor is duly elected and qualified or until the New Director’s earlier

death, resignation or removal from office. Unless the Board determines otherwise: (a) until the appointment of the New CEO (as defined

below), the size of the Board shall not exceed (i) twelve (12) directors prior to January 16, 2024 and (ii) eleven (11) directors from

January 16, 2024 until the Expiration Date, and (b) if the New CEO is appointed to the Board, the size of the Board shall not exceed twelve

(12) directors from the date of such appointment until the Expiration Date; provided that nothing in this Agreement shall restrict

the ability of the Board to determine the size of the Board at any time. The Company represents and warrants that two directors have resigned

from the Board effective on the date of this Agreement.

| 2. | Paragraph 2 of the Cooperation Agreement is amended and restated as follows: |

As soon as reasonably

possible following the appointment of the New Directors (but in no event later than five (5) business days thereafter), the Board shall

take all action necessary to form a Fiber Review Committee of the Board to oversee and direct the Board and management’s review

of strategic and operational alternatives that may be available to the Company with respect to the Company’s fiber and small cell

business, including but not limited to potential sale, merger, spin-off, joint-venture and financing transactions as well as a range of

operational opportunities for improved value-creation (the “Fiber Review Committee”). The Fiber Review Committee shall

initially consist of five (5) directors, who shall be P. Robert Bartolo, Anthony J. Melone and Kevin A. Stephens (or, if any such director

ceases for any reason to be a member of such committee, such replacement director as shall be appointed by the Board) and the two (2)

New Directors. P. Robert Bartolo will initially serve as the Chair of the Fiber Review Committee. From and after the initial formation

of the Fiber Review Committee, the size of the Fiber Review Committee shall be determined by the Board. If any New Director is unable

or unwilling to serve as a member of the Fiber Review Committee, resigns as a member, is removed as a member or ceases to be a member

for any other reason prior to the Expiration Date, the Investors shall be entitled to select, in consultation with the Company and as

approved by the Board (such approval not to be unreasonably withheld, conditioned or delayed), a director serving on the Board at the

time of such selection (including a Replacement New Director appointed pursuant to paragraph 6) to serve on the Fiber Review Committee

as a replacement for such member (the “Replacement Fiber Review Committee Member”). Effective upon the appointment

of the Replacement Fiber Review Committee Member to the Fiber Review Committee, such Replacement Fiber Review Committee Member will be

considered a “New Director” solely for the purposes of the immediately preceding sentence. The charter of the Fiber Review

Committee shall be in the form attached to this Agreement as Exhibit A, and shall not be modified prior to the end of the Cooperation

Period (as defined below) except with the written consent of the Investors (such consent not to be unreasonably withheld, conditioned

or delayed). The Company shall publicly announce (the “Review Announcement”) the Board’s non-confidential determinations

with respect to the Fiber Review Committee’s recommendations on or prior to the later of (x) the date on which the Company holds

its analysts call with respect to second quarter earnings and (y) ninety (90) days after the date the New CEO takes office (such date

in clause (y), the “Outside Announcement Date”); provided that to the extent that on the Outside Announcement Date

(i) the Review Announcement has not yet occurred and (ii) the Company is engaged in active discussions with a third party concerning a

potential transaction involving the Company’s fiber and small cell business, the Company shall provide an appropriate public update

as promptly as practicable after the Outside Announcement Date and shall continue such review process until active discussions with such

third party have either culminated in a transaction or terminated.

| 3. | Paragraph 3 of the Cooperation Agreement is amended and restated as follows: |

As soon as reasonably

possible following the appointment of the New Directors (but in no event later than five (5) business days thereafter), the Board shall

take all action necessary to form a Chief Executive Officer Search Committee (the “CEO Search Committee”)

to

conduct a search

to identify candidates for and assist the Board in selecting the Company’s next chief executive officer and president (the

“New CEO”). The CEO Search Committee shall initially consist of four (4) directors, who shall be Tammy K. Jones, P.

Robert Bartolo and Kevin T. Kabat (or, if any such director ceases for any reason to be a member of such committee, such replacement director

as shall be appointed by the Board) and the New Investor Director. Tammy K. Jones will initially serve as the Chair of the CEO Search

Committee. From and after the initial formation of the CEO Search Committee, the size of the CEO Search Committee shall be determined

by the Board. If the New Investor Director is unable or unwilling to serve as a member of the CEO Search Committee, resigns as a member,

is removed as a member or ceases to be a member for any other reason prior to the Expiration Date, the Investors shall be entitled to

select, in consultation with the Company and as approved by the Board (such approval not to be unreasonably withheld, conditioned or delayed),

a director serving on the Board at the time of such selection (including a Replacement New Director appointed pursuant to paragraph 6)

to serve on the CEO Search Committee as a replacement for such member (the “Replacement CEO Search Committee Member”).

Effective upon the appointment of the Replacement CEO Search Committee Member to the CEO Search Committee, such Replacement CEO Search

Committee Member will be considered a “New Investor Director” solely for the purposes of the immediately preceding sentence.

| 4. | Paragraph 9 of the Cooperation Agreement is amended and restated as follows: |

In connection with

the 2024 Annual Meeting (and any adjournments or postponements thereof), so long as the New Directors have been nominated by the Board

for re-election as directors, the Investors will cause to be present for quorum purposes and will vote or cause to be voted at the 2024

Annual Meeting any Company common stock beneficially owned by them or their controlling or controlled Affiliates and which they or such

controlling or controlled Affiliates have the right to vote on the record date for the 2024 Annual Meeting, pro rata in accordance

with the vote of the other stockholders of the Company at the 2024 Annual Meeting on any matter submitted to a vote of the stockholders

not related to an Extraordinary Transaction (as defined below); provided, that in the event that both Institutional Shareholder Services

and Glass Lewis & Co. (including any successors thereof) issue a voting recommendation that differs from the voting recommendation

of the Board with respect to any Company-sponsored proposal submitted to shareholders at a shareholder meeting (other than with respect

to the election of directors to the Board, the removal of directors from the Board, the size of the Board or the filling of vacancies

on the Board), the Investors and their Affiliates shall be permitted to vote in accordance with any such recommendation.

| 5. | The following shall be added as a new paragraph 30 of the Cooperation Agreement: |

If the Board in good faith determines (a

“Recommendation Determination”), after consultation with counsel, that the fiduciary duties of the members of the Board

as directors of the Company require that the Board (x) change or withhold a prior recommendation that the Company’s shareholders

vote “for”, or (y) recommend that the Company’s shareholders vote “against”, the election of a New Director

(a “Specified Director”), then:

| (a) | the Company shall notify Investors in writing of such Recommendation Determination as promptly as practicable,

and in any event within one (1) business day thereafter (the date such notice is delivered to Investors in accordance with paragraph 26,

the “Notice Date”), |

| (b) | following the Notice Date, notwithstanding paragraph 8 or any other provision of this Agreement, (i) the

Board shall be permitted to recommend that the Company’s shareholders vote in accordance with such Recommendation Determination

with respect to the election of the Specified Director, and the Company shall be permitted to disclose such Recommendation Determination

(including in the Company’s proxy statement and proxy card), and (ii) the Company shall have no obligation to solicit proxies to

vote “for” the Specified Director that is the subject of such Recommendation Determination, and |

| (c) | following the Notice Date, notwithstanding paragraph 13 or any other provision of this Agreement, the

Restricted Persons shall be permitted to (i) seek the election of the Specified Director as a director of the Company, and engage in a

“solicitation” (as such term is defined under the Exchange Act) of proxies with respect to the election of the Specified Director

as a director of the Company (collectively, the “Specified Director Solicitation”), and (ii) make statements and announcements,

and otherwise engage in communications with shareholders of the Company and others, in support of the election of the Specified Director

and the Specified Director Solicitation, provided that the Investors shall continue to comply with their obligations under paragraph 16. |

| 6. | The first paragraph under the heading “Constitution” of the Fiber Review Committee Charter

shall be amended and restated as follows: |

The Committee shall initially consist

of five (5) directors, who shall be P. Robert Bartolo, Anthony J. Melone and Kevin A. Stephens (or, if any such director ceases for any

reason to be a member of such committee, such replacement director as shall be elected by the Board), Jason Genrich and Sunit Patel. From

and after the initial formation of the Committee, the size of the Committee shall be determined by the Board. The process for selecting

replacements for any New Director (as defined in the Cooperation Agreement) is subject to the terms of the Cooperation Agreement.

| 7. | The paragraph under the heading “Composition” of the CEO Search Committee Charter shall be

amended and restated as follows: |

The Committee shall initially consist

of four members, who shall be Tammy K. Jones, P. Robert Bartolo, Kevin T. Kabat (or, if any such director ceases for any reason to be

a member of the Committee, such replacement director as shall be appointed by the Board in accordance with the Company’s By-laws,

as may be restated and amended from time to time (“By-laws”)), and Jason Genrich. Tammy K. Jones will serve as the initial

Chair of the Committee. From and after the initial formation of the Committee, the size of the Committee shall be determined by the Board.

The process for selecting replacements for

any New Investor Director (as defined in

the Cooperation Agreement) is subject to the terms of the Cooperation Agreement.

Except as provided in this

Amendment, no other modification of each of the Cooperation Agreement, Fiber Review Committee Charter or CEO Search Committee Charter

is intended to be effected by this Amendment and each, as amended by this Amendment, shall remain in full force and effect.

This Amendment may be executed

by the parties in separate counterparts (including by fax, jpeg, .gif, .bmp and .pdf), each of which when so executed shall be an original,

but all such counterparts shall together constitute one and the same instrument.

[Signature page follows]

If the terms of this Amendment

are in accordance with your understanding, please sign below, whereupon this Amendment shall constitute a binding agreement among us.

| |

Yours truly, |

|

| |

|

|

| |

CROWN CASTLE INC. |

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Edward B. Adams, Jr. |

|

| |

|

Name: |

Edward B. Adams, Jr. |

|

| |

|

Title: |

Executive Vice President and General Counsel |

|

[Signature Page to Letter Agreement Amendment]

| Accepted and agreed to as of the date first written above: |

|

| |

|

|

| |

|

|

| |

|

|

| ELLIOTT ASSOCIATES, L.P. |

|

|

| |

|

|

|

|

| By: |

Elliott Investment Management L.P., |

|

|

| |

as Attorney-in-Fact |

|

|

| |

|

|

|

|

| |

|

|

|

|

| By: |

/s/ Elliott Greenberg |

|

|

| |

Name: |

Elliott Greenberg |

|

|

| |

Title: |

Vice President |

|

|

| ELLIOTT INTERNATIONAL, L.P. |

|

|

| |

|

|

|

|

| By: |

Elliott Investment Management L.P., |

|

|

| |

as Attorney-in-Fact |

|

|

| |

|

|

|

|

| |

|

|

|

|

| By: |

/s/ Elliott Greenberg |

|

|

| |

Name: |

Elliott Greenberg |

|

|

| |

Title: |

Vice President |

|

|

| ELLIOTT INVESTMENT MANAGEMENT L.P. |

|

|

| |

|

|

|

|

| |

|

|

|

|

| By: |

/s/ Elliott Greenberg |

|

|

| |

Name: |

Elliott Greenberg |

|

|

| |

Title: |

Vice President |

|

|

[Signature Page to Letter Agreement Amendment]

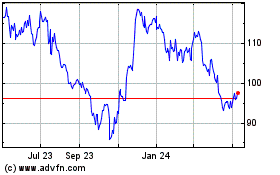

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

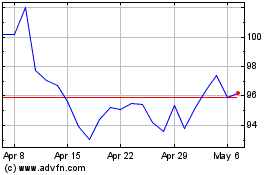

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Apr 2023 to Apr 2024