UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934

Filed by the Registrant ¨ Filed

by a Party other than the Registrant x

| Check the appropriate box: |

| ¨ |

Preliminary Proxy Statement |

| ¨ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ |

Definitive Proxy Statement |

| ¨ |

Definitive Additional Materials |

| x |

Soliciting material Pursuant to §240.14a-12 |

Crown Castle Inc.

(Name of Registrant as Specified in Its Charter)

BOOTS PARALLEL 1, LP

BOOTS, LP

BOOTS GP, LLC

BOOTS CAPITAL MANAGEMENT, LLC

4M MANAGEMENT PARTNERS, LLC

4M INVESTMENTS, LLC

WRCB, L.P.

CHARLES CAMPBELL GREEN III

DAVID P. WHEELER

THEODORE B. MILLER, JR.

TRIPP H. RICE

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x |

No fee required. |

| ¨ |

Fee paid previously with preliminary materials. |

| ¨ |

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

On March 7, 2024, Theodore B. Miller, Jr.,

on behalf of Boots Capital Management, LLC (“Boots Capital”) and together with the other Participants named herein,

filed as an exhibit herewith an unredacted version of the presentation relating to Crown Castle Inc., a Delaware Corporation

(“Crown Castle” or the “Corporation”), that was previously filed with the Securities and Exchange Commission

as an exhibit to Form DFAN 14A on February 20, 2024.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

STATEMENTS

The information herein contains “forward-looking

statements.” Specific forward-looking statements can be identified by the fact that they do not relate strictly to historical or

current facts and include, without limitation, words such as “may,” “will,” “expects,” “believes,”

“anticipates,” “plans,” “estimates,” “projects,” “potential,” “targets,”

“forecasts,” “seeks,” “could,” “should” or the negative of such terms or other variations

on such terms or comparable terminology. Similarly, statements that describe the Participants’ (as defined below) objectives, plans

or goals are forward-looking. Forward-looking statements are subject to various risks and uncertainties and assumptions. There can be

no assurance that any idea or assumption herein is, or will be proven, correct. If one or more of the risks or uncertainties materialize,

or if the underlying assumptions of Boots Capital (as defined below) or any of the other Participants in the proxy solicitation described

herein prove to be incorrect, the actual results may vary materially from outcomes indicated by these statements. Accordingly, forward-looking

statements should not be regarded as a representation by Boots Capital or the other Participants that the future plans, estimates or expectations

contemplated will ever be achieved. You should not rely upon forward-looking statements as a prediction of actual results and actual results

may vary materially from what is expressed in or indicated by the forward-looking statements. Except to the extent required by applicable

law, neither Boots Capital nor any Participant will undertake and specifically declines any obligation to disclose the results of any

revisions that may be made to any projected results or forward-looking statements herein to reflect events or circumstances after the

date of such projected results or statements or to reflect the occurrence of anticipated or unanticipated events.

Certain statements and information included herein

have been sourced from third parties. Boots Capital and the other Participants do not make any representations regarding the accuracy,

completeness or timeliness of such third party statements or information. Except as may be expressly set forth herein, permission to cite

such statements or information has neither been sought nor obtained from such third parties. Any such statements or information should

not be viewed as an indication of support from such third parties for the views expressed herein.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Boots Capital and the other Participants (as defined

below) intend to file a preliminary proxy statement and accompanying GOLD universal proxy card (the “Proxy Statement”) with

the Securities and Exchange Commission (the “SEC”) to be used to solicit proxies for, among other matters, the election of

its slate of director nominees at the 2024 annual meeting of shareholders (the “2024 Annual Meeting”) of Crown Castle Inc.,

a Delaware corporation (“Crown Castle” or the “Corporation”).

The participants in the proxy solicitation are

currently anticipated to be Boots Parallel 1, LP, Boots, LP (and together with Boots Parallel 1, LP, the “Boots Funds”), Boots

Capital Management, LLC (“Boots Capital”), Boots GP, LLC (“Boots GP”), 4M Management Partners, LLC (“4M

Management Partners”), 4M Investments, LLC (“4M Investments”), WRCB, L.P. (“WRCB”), Theodore B. Miller,

Jr. and Tripp H. Rice (collectively, the “Boots Parties”); and Charles Campbell Green III and David P. Wheeler (together with

Mr. Miller and Mr. Rice, the “Boots Nominees,” and together with the Boots Parties, the “Participants”).

Boots GP, as the general partner of each of the

Boots Funds, and 4M Management Partners, as the investment advisor of each of the Boots Funds, may each be deemed to beneficially own

interests in an aggregate of 784,009 shares of the Corporation’s common stock, $0.01 par value (the “Common Stock”)

held in the Boots Funds (including interests in 182,997 shares of Common Stock underlying over-the-counter forward purchase contracts

and interests in 601,012 shares of Common Stock underlying over-the-counter share option contracts). WRCB beneficially owns interests

in 135 shares of Common Stock underlying a call option. Mr. Miller has direct ownership of 200 shares of Common Stock, which includes

100 shares of Common Stock held of record and 100 shares of Common Stock held of record as tenant in common with his wife. In addition,

Mr. Miller may be deemed to beneficially own interests in an aggregate of 784,716.958 shares of Common Stock (which includes interests

in 784,009 shares of Common Stock held by the Boots Funds, which Mr. Miller may be deemed to beneficially own as the President and managing

member of 4M Management Partners and a Manager and the President of Boots GP, interests in 400 shares of Common Stock underlying call

options owned beneficially and as a tenant in common with his wife, interests in 135 shares of Common Stock underlying a call option owned

beneficially by WRCB, which Mr. Miller may be deemed to beneficially own as sole member of one of the general partners of WRCB, and 172.958

shares of Common Stock held through the Corporation’s 401(k) Plan in the Crown Castle Stock Fund. Mr. Rice is the record holder

of 100 shares of Common Stock and, as the Vice President of 4M Management Partners and a Manager and the Vice President of Boots GP, Mr.

Rice may be deemed to beneficially own interests in 784,009 shares of Common Stock held by the Boots Funds. Mr. Green beneficially owns

1,736 shares of Common Stock in joint tenancy with his wife. All of the foregoing information is as of the date hereof unless otherwise

disclosed.

IMPORTANT INFORMATION AND WHERE TO FIND IT

BOOTS CAPITAL STRONGLY ADVISES ALL SHAREHOLDERS

OF CROWN CASTLE TO READ THE PRELIMINARY PROXY STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS TO SUCH PROXY STATEMENT, THE DEFINITIVE PROXY

STATEMENT, AS WELL AS PROXY MATERIALS FILED BY CROWN CASTLE AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS

PROXY SOLICITATION WILL PROVIDE COPIES OF THE PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD

BE DIRECTED TO THE PARTICIPANTS’ PROXY SOLICITOR.

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PRELIMINARY | SUBJECT TO FURTHER REVIEW AND EVALUATION

These materials may not be used or relied upon for any purpose other than as specifically contemplated by a written agreement.

Project Boots

OPPORTUNITY OVERVIEW |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

2

Disclaimer

This communication is being furnished to you by Boots Capital Management, LLC (together with its affiliates, “Boots”) on a

confidential basis and may not be reproduced or used for any other purpose. Your acceptance of this communication from Boots

constitutes your agreement to (i) keep confidential all the information contained in this communication, as well as any information

derived by you from the information contained in this communication (collectively, the “Confidential Information”) and not disclose

any such Confidential Information to any other person, (ii) not to use the Confidential Information for purposes of trading any

security, (iii) not copy this communication without the prior written consent of Boots and (iv) promptly return this communication

and any copies hereof to Boots, or destroy any electronic copies hereof, in each case subject to any material confidentiality

requirements. This communication is for discussion and informational purposes only. The views expressed herein represent the

opinions of Boots as of the date hereof. Boots reserves the right to change or modify any of its opinions expressed herein at any

time and for any reason and expressly disclaims any obligation to correct, update or revise the information contained herein or to

otherwise provide any additional materials.

All of the information contained herein is based on or derived from publicly available information with respect to Crown Castle Inc.

(the “Company”), including filings made by the Company with the Securities and Exchange Commission (“SEC”) and other

sources, as well as Boots’ analysis of such publicly available information. Boots has relied upon and assumed, without

independent verification, the accuracy and completeness of all data and information available from public sources, and no

representation or warranty is made that any such data or information is accurate. Boots recognizes that there may be

confidential or otherwise non-public information with respect to the Company that could alter the opinions of Boots were such

information known. No representation, warranty or undertaking, express or implied, is given as to the reliability, accuracy,

fairness or completeness of the information or opinions contained herein, and Boots and each of its directors, managers,

partners, officers, employees, representatives, agents and advisors expressly disclaim any liability which may arise from this

communication and any errors contained herein and/or omissions here from or from any use of the contents of this

communication.

Except for the historical information contained herein, the information and opinions included in this communication constitute

forward-looking statements, including estimates and projections prepared with respect to, among other things, the Company’s

anticipated operating performance, the value of the Company’s securities, debt or any related financial instruments that are

based upon or relate to the value of securities of the Company (collectively, “Company Securities”), general economic and

market conditions and other future events. You should be aware that all forward-looking statements, estimates and projections

are inherently uncertain and subject to significant economic, competitive, and other uncertainties and contingencies and have

been included solely for illustrative purposes. Actual results may differ materially from the information contained herein due to

reasons that may or may not be foreseeable. There can be no assurance that the Company Securities will trade at the prices

that may be implied herein, and there can be no assurance that any opinion or assumption herein is, or will be proven, correct. If

one or more of the risks or uncertainties materialize, or if Boots’s underlying assumptions prove to be incorrect, the actual results

may vary materially from outcomes indicated by any forward-looking statements. Accordingly, forward-looking statements should

not be regarded as a representation by Boots that the future plans, estimates or expectations contemplated herein will ever be

achieved.

This communication and any opinions expressed herein should in no way be viewed as advice on the merits of any investment

decision with respect to the Company, the Company Securities or any transaction. This communication is not (and may not be

construed to be) legal, tax, investment, financial or other advice. Each recipient should consult their own legal counsel and tax

and financial advisers as to legal and other matters concerning the information contained herein. This communication does not

purport to be all-inclusive or to contain all of the information that may be relevant to an evaluation of the Company, the Company

Securities or the matters described herein.

This communication does not constitute (and may not be construed to be) a solicitation or offer by Boots or any of its directors,

managers, partners, officers, employees, representatives, advisors or agents to take any action, including to buy or sell any

Company Securities or securities of any other person in any jurisdiction or an offer to sell an interest in funds that may be

managed by Boots. This communication does not constitute financial promotion, investment advice or an inducement or

encouragement (subject to the terms of any confidentiality agreement between you and Boots) to participate in any product,

offering or investment or to enter into any agreement with the recipient. No agreement, commitment, understanding or other

legal relationship exists or may be deemed to exist between or among Boots and any other person by virtue of furnishing this

communication. No representation or warranty is made that Boots’ investment processes or investment objectives will or are

likely to be achieved or successful or that Boots’ investments will make any profit or will not sustain losses. Past performance is

not indicative of future results.

Boots currently beneficially owns and/or has an economic interest in and may in the future beneficially own and/or have an

economic interest in, the Company Securities. Boots intends to review its investments in the Company on a continuing basis and

depending upon various factors, including without limitation, the Company’s financial position and strategic direction, the outcome

of any discussions with the Company, overall market conditions, other investment opportunities available to Boots, and the

availability of the Company Securities at prices that would make the purchase or sale of the Company Securities desirable, Boots

may from time to time (in the open market or in private transactions, including since the inception of Bootts’s position) buy, sell,

cover, hedge or otherwise change the form or substance of any of its investments (including the Company Securities) to any

degree in any manner permitted by law and expressly disclaims any obligation to notify others of any such changes unless

required by law. Boots also reserves the right to take any actions with respect to its investments in the Company as it may deem

appropriate.

Boots has not sought or obtained consent from any third party to use any statements or information contained herein. Any such

statements or information should not be viewed as indicating the support of such third party for the views expressed herein. All

trademarks and trade names used herein are the exclusive property of their respective owners. |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS 3

Important Information CERTAIN INFORMATION CONCERNING THE PARTICIPANTS Boots Capital Management, LLC (“Boots Capital”) and

the other Participants (as defined below) intend to file a preliminary proxy statement and accompanying GOLD universal proxy card (the

“Proxy Statement”) with the Securities and Exchange Commission (the “SEC”) to be used to solicit proxies for,

among other matters, the election of its slate of director nominees at the 2024 annual meeting of shareholders (the “2024 Annual

Meeting”) of Crown Castle Inc., a Delaware corporation (“Crown Castle” or the “Corporation”). The participants

in the proxy solicitation are currently anticipated to be Boots Parallel 1, LP, Boots, LP (and together with Boots Parallel 1, LP, the

“Boots Funds”), Boots Capital Management, LLC (“Boots Capital”), Boots GP, LLC (“Boots GP”), 4M Management

Partners, LLC (“4M Management Partners”), 4M Investments, LLC (“4M Investments”), WRCB, L.P. (“WRCB”),

Theodore B. Miller, Jr. and Tripp H. Rice (collectively, the “Boots Parties”); and Charles Campbell Green III and David P.

Wheeler (together with Mr. Miller and Mr. Rice, the “Boots Nominees,” and together with the Boots Parties, the “Participants”).

Boots GP, as the general partner of each of the Boots Funds, and 4M Management Partners, as the investment advisor of each of the Boots

Funds, may each be deemed to beneficially own interests in an aggregate of 784,009 shares of the Corporation’s common stock, $0.01

par value (the “Common Stock”) held in the Boots Funds (including interests in 182,997 shares of Common Stock underlying over-the-counter

forward purchase contracts and interests in 601,012 shares of Common Stock underlying over-the-counter share option contracts). WRCB beneficially

owns interests in 135 shares of Common Stock underlying a call option. Mr. Miller has direct ownership of 200 shares of Common Stock,

which includes 100 shares of Common Stock held of record and 100 shares of Common Stock held of record as tenant in common with his wife.

In addition, Mr. Miller may be deemed to beneficially own interests in an aggregate of 784,716.958 shares of Common Stock (which includes

interests in 784,009 shares of Common Stock held by the Boots Funds, which Mr. Miller may be deemed to beneficially own as the President

and managing member of 4M Management Partners and a Manager and the President of Boots GP, interests in 400 shares of Common Stock underlying

call options owned beneficially and as a tenant in common with his wife, interests in 135 shares of Common Stock underlying a call option

owned beneficially by WRCB, which Mr. Miller may be deemed to beneficially own as sole member of one of the general partners of WRCB,

and 172.958 shares of Common Stock held through the Corporation’s 401(k) Plan in the Crown Castle Stock Fund. Mr. Rice is the record

holder of 100 shares of Common Stock and, as the Vice President of 4M Management Partners and a Manager and the Vice President of Boots

GP, Mr. Rice may be deemed to beneficially own interests in 784,009 shares of Common Stock held by the Boots Funds. Mr. Green beneficially

owns 1,736 shares of Common Stock in joint tenancy with his wife. All of the foregoing information is as of the date hereof unless otherwise

disclosed.IMPORTANT INFORMATION AND WHERE TO FIND IT BOOTS CAPITAL STRONGLY ADVISES ALL SHAREHOLDERS OF CROWN CASTLE TO READ THE PRELIMINARY

PROXY STATEMENT, ANY AMENDMENTS OR SUPPLEMENTS TO SUCH PROXY STATEMENT, THE DEFINITIVE PROXY STATEMENT, AS WELL AS PROXY MATERIALS FILED

BY CROWN CASTLE AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO

CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV. IN ADDITION, THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF THE

PROXY STATEMENT WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR COPIES SHOULD BE DIRECTED TO THE PARTICIPANTS’ PROXY

SOLICITOR.Soliciting Materials Disclaimer The presentation reflected in this document incorporates certain analysis prepared by Ernst

& Young LLP and provided to Boots Capital in support of its Management Plan. EY’s work for Boots Capital was limited to: (1)

proposing a financial model structure to assess potential impacts from scenarios and assumptions, as directed by Boots Capital, (2) a

tax analysis of potential tax implications of Crown Castle’s sale of fiber assets, and (3) a market study covering commercial and

operational aspects of Crown Castle’s tower business. EY did not use any internal information from Crown Castle for its analysis.

EY analysis, to the extent incorporated or referenced in this presentation should not be relied upon for investment advice nor does it

constitute due diligence for any potential transaction. |

| ©2023 | Strictly Confidential ©2024| Strictly Confidential | Strictly Confidential - Do Not Transfer or Reproduce

4

Overview

PROJECT BOOTS |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

5

Ted Miller

President, 4M Investments

Chuck Green

Founding Partner, Greenseas DWC LLC

Tripp Rice

Partner, 4M Investments

• Founder, previous Chairman and CEO of

Crown Castle International Corp.

• Former Airgas/Air Products Director

through sale to Air Liquide

• Former ACS Director through sale to

Xerox

• Founder & previous owner of lntercomp

Technologies, a BPO founded in Eastern

Europe in 1994 and sold to Elbrus

Capital in 2013

• Owner of M7 Aerospace from 2003 until

sale to Elbit Systems in 2011.

• Founder and Executive Chairman of

Visual Intelligence focused on digital

twins of telecom infrastructure

• Investor, BOD Member of PowerX

• Advisor to the Autonomy Institute

• 18 years focus on investment

valuation, due diligence and portfolio

company management experience

• Board Member of various 4M

companies

• Global towerco/telecom valuation and

due diligence experience

• Former Bear Stearns Investment

Banking Analyst in Leveraged

Finance/Financial Sponsors Group

• Former Associate, Wellspring Capital

Management - $3b PE Firm

• President and CFO of 4M HR

• President and CFO of Visual

Intelligence

• Investor, Advisory Board Member of

PowerX

A Seasoned

Execution

Team with a

Clear and

Actionable

Vision • Former CFO & EVP of CCI (1997-2002)

• Former Exec. Chair, CEO and Co-Founder of

Helios Towers Africa LLP (2009-2017)

• Former Independent Member, Supervisory

Board, Vantage Towers (2021-2023)

• Co-Founder of Helios Towers Nigeria, the

first ind Towerco in Africa (2005-2014)

• Former NED and Senior Advisor, Edotco,

largest Towerco in S. Asia (2013-2021)

• Shareholder, Strategic Advisor and NED of

PowerX (2022-Present)

• NED & Senior Advisor, Pinnacle Towers Pte

Ltd, (2021-Present)

• Over 50 years experience in asset

management, property, O&G and telecoms

• 26 years executive experience in the tower

industry, including 22 sale/leaseback

transactions in 15 countries on 4 continents |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Project Boots: Moving with Experience, Urgency and Focus to

Reboot CCI For the Long-Term

6

Fiber Sale Unlocks Significant Value –

CCI Rerates to 25x+

6-Month Head Start On Fiber Sale –

Close In 2024

2024 Fiber Sale – $1 Billion+ of

Potential Tax Benefits to CCI

Clear Direction/Strategy for Employees

and Stakeholders

25 Fiber Buyers/Financing Sources

Under NDA – Months of Diligence

Fiber Sale Structure and Financing Direct Engagement with

Existing/Prospective Shareholders

Bring Towers/Employee Ratio In Line

with and Exceed Peers

Leverage Proven Technology - Digital

Twins/AI/GIS - to Optimize Operations

for Strategy Focused Organization v2.0

Fiber Sale Use of Funds Strategy:

Paydown Debt; Buy Out ATT/TMO;

Share Buyback

Optimized Balance Sheet

Rekindle Relationships

with Carriers |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Overview

Background Fiber Plan Towerco Plan

• Work began in August

• Initiative born out of frustration

with Company performance

• Seasoned team of industry

executives and advisors

• Detailed plan to sell fiber &

transition to a pure-play

Towerco

• Completed work gives CCI a 6-

month head start on fiber sale

• Need for proactive plan and

clear direction to combat tension

and uncertainty in market

• Sell fiber for between $12-15bn;

current model contemplates

$12.5bn sale price

• CCI retains 25% ownership to

decrease buyer capital requirement

and establish long term alignment

• Re-rate trading multiple to 25x

• Realize $1 billion+ of tax benefits

• Paydown debt/optimize balance

sheet

• Buyout ATT/TMO towers

• Execute share buyback

• Optimize headcount from 18 towers/EE to 23+

• Drive culture change to unlock value for shareholders

while quelling employee uncertainty

• Transition KPIs from backward-looking financial metrics

to forward-looking ops focus

• Rebuild carrier relationships

• CCI positioned to successfully compete with AMT and

SBA on opportunistic M&A

• Digitize assets and workflow processes

• Enhance investor relations with frequent, transparent

communication on new pure-play model

• Simplify financial reporting; no FX exposure relative to

peer set

Two-part plan to deliver near-term and long-term shareholder value

7 |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Boots Team: 6-Month Body of Work to Improve CCI

1. Fiber Qualitative Analysis

2. Fiber Carve-out Model

3. Fiber Enterprise Business Opportunity Analysis

4. Fiber Small Cell Business Opportunity Analysis

5. Fiber Sale Structure Strategy

6. Fiber Sale Tax Impact Analysis/Structuring

7. Fiber One-time Separation Cost Analysis

8. Fiber Sale Strategic Synergies (Generic Targets)

9. Fiber Sale Strategic Synergies (Specific Targets)

10. Fiber Sale Process – Buyer Due Diligence

11. Fiber Sale Process – Financing Strategy/Participants

12. Fiber Prospective CEO Candidate List

13. Towerco Go-forward Model

14. Towerco Revenue Benchmarking

15. Towerco Debt Restructuring Strategy

16. Towerco Dividend Analysis/Strategy

17. Towerco Dividend Yield Share Price Impact Analysis

18. Towerco SOTP Analysis Impact to Share Price

19. Towerco AFFO/FCF Analysis/Benchmarking

20. Towerco Headcount Benchmarking/Go-forward Strategy

21. Towerco GLBO Benchmarking/Go-forward Strategy

22. Towerco Technology Impact Analysis/Strategy

8 |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

9

Close the Value Gap

| | | | Vertical lines represent various fiber acquisitions. |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Market Remains Skeptical

10 |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Ted Miller: Benefits of Executive Chairman Role 11

Key Term Benefits

Executive Chairman

Ted Miller

• As Executive Chairman, Ted is the bridge between Board’s vision and Management’s

execution of that vision. He will work as an accelerant alongside Board, Management and the

interim CEO

• Objectives – Global expertise, experience, and leadership to guide the company toward

achieving its objectives

• Alignment – Effective communication and alignment between Board and Management

Objectives

Certainty, strategic leadership

and additional execution capacity

to Management during critical

transition period

• Fiber Sale – Ted is logical party to join fiber subcommittee given his substantive interactions

with potential fiber buyers and financing sources

• CEO Search – Ted’s engagement decouples CEO search from fiber carve-out. Allows CEO

search to focus on identifying most qualified long-term operator for Towerco

• Capital Allocation – Use fiber proceeds to optimize balance sheet, buyout ATT/TMO leases

and execute share buyback

• Operational Efficiencies – Optimize for towers per employee, drive tech innovation and

increase operating margins

Alignment

Increased transparency and

accountability to Board, driving

stakeholder confidence

• Shareholder/Market Confidence – Ted will build on recent conversations with shareholders

and demonstrate to market a clear direction, driving confidence in the Company

• Motivated Workforce – Clear, founder-led strategy and renewed shareholder value-based

incentive compensation

• Operational Efficiencies – Ted to interface directly with both Board and Management as

needed through critical transition period

• Economic Alignment – $100m position in stock

• Term – Two years or at the Board’s discretion |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Boots & CCI: Aligning Our Work and Interests 12

Topic Expectation/Considerations

Board of Directors • Ted Miller – Executive Chairman

• Chuck Green – Director

• Tripp Rice – Director

• David Wheeler – Director

Advisors/Work Product • CCI to review Boots diligence materials and market check potential fiber buyers/financing

sources

• CCI to onboard Boots advisors to larger advisory team

• Boots to assign NDAs w/ potential fiber buyers/financing sources

• CCI to assume cost for Boots work product

Management Team • Candidates available to hire or as advisors with world class knowledge:

• Engineering

• Organizational / Strategic / Comp and Metrics to build culture

• M&A expertise

• Operational Expertise

• Capability available to focus on every aspect of a Towerco

Compensation • Compensation aligned with shareholder base for value achievement - proposal available in

detail

Boots team/work product to be integrated into CCI’s existing advisory team and committee structure |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Two Paths Forward: Working Together vs Not Working Together

Plan A – CCI w/ Benefit of Boots Plan B – CCI w/o Benefit of Boots

• CCI adopts Boots work done to date into its committee

structure/process (Accelerate timeline by 6-months – 2024 closing)

• CCI begins work on fiber sale due diligence sensitivities and

conclusions (12-18 Month process extends into 2025 for CCI)

• Boots assigns to CCI 25 NDAs with potential fiber buyers/financing

sources that have been actively working for months

• CCI approaches all fiber buyers independently without Boots Fiber

NDAs, leading to fiber buyer/process confusion, risk and doubts

• Capture $1bn+ of tax benefits in 2024 for CCI and fiber buyers • Substantial and probable risk regarding loss of $1bn+ of tax benefits

• Expedited buyer regulatory review for 2024 closing • Delayed start to regulatory review

• Existing CCI advisors continue work through completion leveraging

Boots materials/process

• Comprehensive, world-class advisors, fiber experts and Company

founder and fiber experts excluded from CCI

• Engaged EY team is ready to transfer and support the go-forward+ • CCI advisors unnecessarily recreate completed Boots work

• Established team in place while formal CEO process continues • Continue formal CEO search during 2024 CCI proxy process

• Executive Chairman/Boots fills immediate leadership void • New CEO will need time to assess fiber sale, strategic plan, etc.

• Strategic plan vetted and direction defined • CCI Management/employee confusion continues, creating more

overall risk to 2024 fiber sale close, towers reboot and overall clarity

• Clear message to market/employees regarding leadership, strategy

and fiber

• Market confusion continues while CEO search, strategy, sale of fiber

and timing undefined – CCI proxy process uncertainty

13 |

| ©2023 | Strictly Confidential ©2024| Strictly Confidential | Strictly Confidential - Do Not Transfer or Reproduce

14

Fiber Plan: Sell Fiber/Small Cells

PROJECT BOOTS |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Crown Castle + Project Boots: Moving in the Same Direction

15

December

Matured potential fiber

buyers/financing sources in

their diligence. Multiple

attempts to contact Board

between the 15th-21st. Met

with Chairman/Interim CEO

on the 27th

August

Project Boots began

evaluation of fiber

and tower segments

of CCI. Reached out

to Board August 15

September

Assembled advisory

team. Surveyed

potential fiber

buyers/financing

sources for initial

valuation reads

Early October

Validated thesis with

advisory team.

Assembled diligence

materials and

populated data room

September

CCI reaffirmed

commitment to fiber,

expressed optimism

about growth rates

November 27th/28th

Elliott released

Restoring the Castle

presentation and 220

demand

November

Continued to refine

long-term Towerco

approach, including

use of fiber proceeds,

cost structure and

technology roadmap

October 19th

CCI Q2 Earnings Call

– Continued support

for fiber strategy

Mid/Late October

Conducted formal

presentation w/

potential fiber

buyers/financing

sources. Signed

NDAs and granted

access to data room

December 7th

Jay Brown resigned

and Tony Melone

was appointed interim

CEO

December 20th

CCI announced

Cooperation

Agreement with Elliott.

Created Fiber Review

subcommittee

Project Boots

CCI Activities |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Fiber Plan: Carve-Out Fiber/Sale 16

Key Term Expectation/Considerations

Fiber Valuation Range • $12-15bn based on work completed with buyers

• Modeling work assumes $12.5bn sale price

CCI Retained Ownership • 25% rollover equity

• Strategic alignment/reduces sponsor check size

• Go-forward exposure

• Mitigates operational issues separating in place small cells from enterprise fiber footprint

• Selling small-cells and enterprise in combination contributes to growth profile for buyer

Process Timeline • Target close in 2024. Completed work accelerates timeline by 6 months, according to EY

Tax Implications • $1bn+ Incremental CCI tax benefits if closed in 2024

• Strategy to mitigate tax leakage

• Savings for Buyer if they are a taxpayer

Parties Contacted • 63

NDAs Executed • 25

Buyer Pool • Qualified/significant infrastructure funds and strategic buyers for fiber

• Partnering opportunities across funds and strategic buyers identified

PublicCo Spin

Taxable and Non-Taxable

• Not preferred direction

• Increased complexity/certainty concerns

• Increased deal and regulatory timeline

• Shareholder relations implications

• Public company comparable multiples not attractive

• Lower levels of up-front cash proceeds realized

• Less flexibility and potential differences in prospective returns associated with retained equity

• May require Private Letter Ruling from IRS |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Fiber Plan: Use of Proceeds 17

Sources Uses

Sale Proceeds (net) $11,161 Floating Rate Debt Paydown $2,707

Rollover Fiberco Equity $1,300 Fixed-Rate Debt Paydown/Buyout $3,779

Share Buyback $1,873

ATT/TMO Early Buyout $2,802

Fiberco Rollover Equity $1,300

Total Sources $12,461 Total Uses $12,461

The Plan Results

• Significant legal and financial due diligence has been

completed to optimize the use of proceeds

• Priority to maintain investment grade rating @ 5.4x leverage

• Payoff all floating rate debt

• Optimized paydown/buyback of debt to maximize financial

benefit to the Company – $1bn PV of interest savings

• Negotiate an early buyout of the ATT/TMO towers

• Share buyback

• Maintain investment grade rating

• No drawn floating rate interest exposure

• Reduced debt maturities between now and FYE 2026

• Negotiate for value with ATT/TMO and execute if appropriate

• Share buy-back to drive future total shareholder return

• Optimized balance sheet and capital structure: de-risked, more flexible

and lower cost of capital going forward

• EBITDA multiple/debt de-risking helps facilitate M&A opportunities |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Debt Portfolio Alternatives

500

2,650

4,957

2,600

1,900

750

2,850

750 750

3,750

1,750

1,000

1,000

2,000

3,000

4,000

5,000

6,000

2025 2026 2027 2028 2029 2030 2031 2033 2034 2041

and

beyond

Face Value of Debt ($mm)

Current and Pro Forma Maturity Profile

Current Portfolio

Payoff debt at Make-Whole

2027: Payoff $1.5bn

Revolver, $1.2 bn FRN,

$500mm 4.0% 2027 bonds

2028: Payoff $1bn 5.0%

and $600mm 4.8%

2034: Payoff

$750mm 5.8%

$0

$50

$100

$150

$200

$250

$300

$350

$400

2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035

($mm)

Interest Benefit ($mm)

Debt buyback

Synthetic Defease (Single-A Credit Fund)

Synthetic Defease (Treasuries)

Total Interest Savings: $1,128 mm

PV of Interest Savings: $995 mm

% Floating Paid Down: 40%

Total Interest Benefit: $452mm / $547mm

PV of Interest Benefit: $422mm / $511mm

% Floating Defeased: 40%

18 |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Fiber Sale Significantly Improves Towerco Fundamentals

19

$1,65

5

$285

82.8%

Total Capex

$1,43

0

$2,15

4

50.7 %

AFFO after Discretionary

Capex

$3.30

$5.13

55.6 %

AFFO after Discretionary

Capex per Share

($,1304)

$215

116.5%

AFFO after Disc. Capex

less Dividend 434 420

3.2%

Share Count

$23,2

18

$17,2

40

25.7%

Total Debt $2,70

7

-

100%

Floating Rate Debt

$3,42

1 $2,92

1

14.6%

Fixed Rate Maturities

through 2026

$957

$620

35.3%

Interest Expense

Before Project Boots

(2024)

After Project Boots

(2025) |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Fiber Plan: Qualitative Due Diligence Completed

• Evaluation of fiber assets known today. Comparison to industry peers in quality, scope, and size

• Review of fiber operations - sales, delivery, ongoing operations, support. Determining areas of known weakness and potential

for improvement. Compared to industry peers as well as best practices

• Review and evaluation of both enterprise fiber and small cell, operating as two unique but complementary assets. Insight into

whether they are or are not acting in a complementary fashion

• Review of deployment as well as operational costs and considerations for specific markets as related to both enterprise fiber

and small cells

• Review of sources of revenue today as well as opportunities for future growth. Compared to competitors and industry

knowledge

• Evaluation of present processes and internal systems as they stand today and determination on what may be improved upon

short and long-term

• Strategies that should be considered as part of any growth plan for enterprise fiber

• Review of small cell projects and comparing it against industry standard metrics using like kind cities

20

Evaluation conducted by consultant who has regularly been involved in advising

and operating fiber-based infrastructure companies for the last 15+ years |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Fiber & Towerco Due Diligence Items

21

Commercial and Operational Tax Corporate Finance

• Market size and growth (incl. small cell

and enterprise revenue forecasts)

• Fair-share potential and enterprise

penetration (incl. full-potential

customers MRR)

• Fiber and small cell capital

requirements

• SG&A and operating cost benchmarks

• Strategic and financial sponsor

segment analyses and materials

• Analysis to unlock Towerco tax value

that would maximize retained cash and

the exit value of Fiberco in a tax

neutral transaction

• Quantification of the benefits of the

transaction closing in 2024 vs 2025

• Tax-effected Fiberco REIT formation

scenarios

• Towerco share buyback analyses

• Comparable company and transaction

research and benchmarking

• Standalone Towerco and Fiberco

Financial models

• Estimate of returns to CCI

shareholders from sale of Fiber and

use of proceeds, including debt

paydown strategy, share buyback, cost

reduction initiatives and ground lease

buyouts

• Standalone Fiberco LBO model,

including scenario analysis on

enterprise growth and small cell node

deployment

Boots recommends that EY continue its support for the transaction by working directly with CCI |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Fiber Plan: Sale Timeline 22

Crown

Separation

Deal

Validation

Typical Market Timeline

…

Separation TowerCo

FiberCo

TowerCo

Perimeter

TSA/rTSA

Financials

Etc..

• Outside-in deal models (complete)

• Outside-in validation (complete)

• Quantitative validation (complete)

• Investor validation (complete)

• Governance model (proposed)

• Sector/functional/deal team (already engaged)

• Bidder feedback (incorporated)

• Economic antitrust evaluation (started)

FiberCo

TowerCo

TSA

rTSAs

• Market study foundation (started)

• Tax analyses (mostly complete)

• Perimeter definition (mostly complete)

• Carve-out financials (started)

• Operational separation planning (started)

• Experienced deal team (already engaged)

• Economic antitrust evaluation (started)

• Proprietary EY pre-sign accelerator tools

A. Separation acceleration

FiberCo

TowerCo

Separation

Preparation

Data Room

Etc.

A.2

B

A.3

B. Towerco Value Realization Workstreams from Boots and EY analyses completed in tandem to support full potential value for TowerCo (RemainCo)

B B

• Proprietary EY sign-to-close accelerator tools

• Familiarity with bidders and bidder sets from

prior strategy & transaction engagements

• Proven workaround solutions to enable

timely deal closing

• Expertise with antitrust economics

Bidder

Signs

Close

A.1

A.1 A.2 A.3

Info Memorandum

Diligence Reports

Data Room Population

Management Presentations

Deal Rationale

Synergy Identification

Financial Models

Bidder Feedback

Day-1 Readiness

Operationalization Plans

TSAs/rTSAs/MSAs

..

Key

Outputs

Boots Accelerated Timeline 1-2 Mo.

3-4 Mo

~4 Mo

6+ Mo

4-6 Mo

6-8 Mo

8-12 Mo

14-18 Mo

TSA Exit

Stage: Pre-Deal Stage: Pre-Sign Stage: Sign-to-Close1 Stage: Post-Close |

| ©2023 | Strictly Confidential ©2024 | Strictly Confidential | Strictly Confidential - Do Not Transfer or Reproduce

23

Towerco Plan:

Operational Excellence

PROJECT BOOTS |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Towerco Plan: Back to Ops Basics

Optimize Headcount Restore Culture KPI Methodology Carrier Relationships

• Currently 18 towers/EE

• AMT Operates US with 23

towers/EE

• AMT Operates globally with

38 towers/EE

• In 2013, CCI Operated 40k

towers with 1,400 EEs (29

towers/EE)

• Today, CCI Operates 40k

towers with 2,200 EEs (18

towers/EE)

• Capitalize on global virtual

workforce to lower costs

• Outsource work that is a

commodity and not strategic

• As a seasoned leader and

the founder of the company,

Ted is uniquely qualified to

reset the culture and rally the

team behind the renewed

focus on a core Towerco

• Focus on efficiency and

shareholder return will be

central to the go-forward

strategy

• Re-institute proven

framework to transition from

lagging financial metrics to

forward looking KPIs

• Innovation leader engaged

and has been working

through due diligence with

our team

• Fiber drove carrier

relationship narrative

• Reinvigorate relationships

with customers and openly

leverage CCI’s renewed

balance sheet to improve

long-term relationships that

drive additional CCI profit

24 |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Towerco Plan: Back to Ops Basics

M&A Ground Interests PA Corporate Campus Technology Initiatives

• CCI positioned to

successfully compete with

AMT and SBA on

opportunistic M&A

• Fiber constrained M&A

• CCI will benefit from M&A

in current rate environment

vs. competition that

executed during 0% rates

• Ground interests core to

CCI’s business

• Continue acquisition of

ground leases

• Premature to shut down PA

• Near-term it is important to

employee morale and

corporate stability to

continue to operate PA

• Significant digitization/

automation of lead-to-cash

• Current tenant onboarding

timelines > 12 months

• Asset condition monitoring

processes are antiquated

• Benefits ESG/HSE:

reducing truck rolls and

tower climbs

• Automated revenue

assurance reduces costly

and time-consuming

dispute resolutions

25

“Companies can no longer rely on leverage and cheap money to fuel returns… companies must source

good deals make operational improvements” - GS Asset Management Chief Marc Nachmann |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

The New CCI Tower of Value

26

Financial

Results

Carrier / Customer

Results

Process

& Technology

Results

People

Results

Strategic

Partnership

Increase Enterprise Value – Stock Price

Reduce

Costs

Optimize

Capex Reduce Portfolio Risk Increase Revenue

Create Stickiness Via

Self-Service Portal

Improve Customer

Service Scores

Partner Strategically with Carriers on

Network Planning/ Rollouts

Achieve 100% Regulatory Compliance

/ Disclosures (OSHA, FAA, SEC)

Reduce Cycle Time for

Upgrades by 33%

Improve On-Time

Delivery

Enable Instant

Access to Portfolio

Assimilate New Tower

Acquisitions Seamlessly

Identify and Mitigate

High Risk (Load) Towers

Create 100% Accurate

Design Drawings

Achieve 100% Standardization

Of Records

Reduce Time, Frequency,

& Cost of Inspections

Enable Virtual

Workforce

Improve

Productivity

Attract & Retain

Knowledge Workers

Improve Quality / Reduce

Human Error

Create a Digital Twin / GIS Database |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Digital Impact to Tower Lifecycle Management

Digital

Twin

Site

Visit

Upgrade

Request

General

Arrangement

Drawings

Upgrade

Approvals

Site Climb

Down

Structural

Analysis

Detailed

Design Pack

Fabrication

Drawings

Site Handover

Construction

Process

Start

7

days

7

days

7

days

7

days

7

days

7

days

14

days

28

days

Process

Start

7

days

0

days

28

days

7

days

14

days

$0 $1,050

6 ppl @ $175

$450

6 ppl @ $75

$1,200

6 ppl @ $75 + $750

$1,500

3rd party designer

$1,500

2 ppl structural team

$500

Est. drawings

$3,000

DD’s & Cons Pack

na

Construction Cost

$1,050

3

days

3

days

3

days

3

days

7

days

$0 $999

Drone capture

$450

6 ppl @ $75

$575

6 ppl @ $75 + $125

$700

VI solution

$0

Not required

$250

Est. drawings

$1,500

DD’s & Con Pack

na

Construction Cost

$725

Initial call off by

client as request for

upgrade

Site Provider,

Construction, RF,

Tx, Planner, Acq &

designer

Each member has

to review and add

an approval or

rejection

Drawings then

created and also

distributed to all for

approval

Capacity Check on

the structure by

design analysis

required

Where structure

needs mods, a visit

to measure for

member size

Fabrication

Drawings for

replacement items

need to be created

Full detailed design

for construction and

connection created

Site Teams rectify

and install new

upgrade on the site

location

2 or more visits for

handover and

inspection to the

client required

Initial call off by

client as request for

upgrade

UAV Operator

ONLY

Each member has

to review and add

an approval or

rejection

Drawings then

created with the

model in 3D with

Drawings Available

Structure

automatically

checked by VI

All information

available in the

structural model

from Capture

Available from the

3D digital twin for

measure and

extract.

Reduced detailed

design for

construction and

connection created

Site Teams rectify

and install new

upgrade on the site

location

Just 1 visit for

handover and

inspection to the

client required

~63 days

~$10,250

~$6,200*

~98 days

*Software and As-Built Handover Scan included.

Traditional Upgrade Process

Upgrade Process with Engineering Class Drone Data

27 |

| ©2023 | Strictly Confidential ©2024 | Strictly Confidential | Strictly Confidential - Do Not Transfer or Reproduce

28

Valuation Implications

PROJECT BOOTS |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Key Model Assumptions: 2025-2028

29

Variable Assumption Considerations

Revenue CAGR 4.5% • In line with analysts’ outlooks, inclusive of discontinuation of installation

services

EBITDA Margin 69% • Peer benchmarking identified improvement opportunities

• Conservatively, margins can be increased to 71% or $70mm/yr

• Headcount reduction: Towers/EE from 18 to 23 (in line with AMT US)

• Non-headcount efficiencies

• $50mm/year increase in GLBOs (from current $50mm base)

Capex $300mm • In line with historical tower segment spend

Net

Debt/Leverage

5.4x • Focused on maintaining IG status

• If increased to 6.0x, $2b of incremental 2025 borrowing increasing

~$1bn/yr

• Debt includes ATT/TMO towers discounted at 8.2%

Dividend 90% • 2024 dividend maintained at existing level (funded with debt)

• Set using AFFO after discretionary capex or ~82% of AFFO

• 2025 Dividend: $4.62/share with 6-7% annual growth (funded with cash

flows) |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

EBITDA Bridge 2024-2026: Headcount Reduction to AMT US

30 |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Implied US EBITDA Multiple Calculations

31

AMT: Calculated Segment Level 2024E Adj. EBITDA

Geography % Adj. EBITDA (a) 2024E Adj. EBITDA Multiple (b) EV (c) GPCs considered in multiple (d)

Data Centers 6.0% 431 21.6x 9,336 Equinix, DigitalBridge, Digital Realty Trust

LatAm 16.0% 1,150 8.8x 10,158 Telesites, Sitios

Europe 6.0% 431 14.7x 6,344 Cellnex, INWIT, EuroTeleSites

Africa 10.0% 719 5.9x 4,213 IHS, Helios

APAC 4.0% 288 10.5x 3,018 Protelindo, Tower Bersama

US 58.0% 4,170 25.7x 107,098 n/a - calculation

Total 100.0% $7,190 19.5x $140,168

2024E AMT Adj. EBITDA (e) $7,190

SBAC: Calculated Segment Level 2024E Adj. EBITDA

Geography % Adj. EBITDA (f) 2024E Adj. EBITDA Multiple (b) EV (c) GPCs considered in multiple (d)

US 79.8% 1,565 22.1x 34,530 n/a - calculation

International 20.2% 397 8.8x 3,508 Telesites, Sitios

Total 100.0% $1,962 19.4x $38,038

2024E SBAC Adj. EBITDA (e) $1,962

Footnotes

(a) Source: HSBC analysis.

(b) Selected multiple: 2024E Adj. EBITDA. Blended international multiple is based on weighted average of country multiples. Source: Capital IQ.

(c) EV calculated as: market capitalization + LT debt + capital leases - cash & cash equivalents + minority interest + preferred stock. EV excludes the impact of operating leases.

(d) Multiples calculated as a simple average of the GPCs' EV/EBITDA multiples per geography based on selected time period.

(e) Source: JP Morgan analysis; SBAC Adj. EBITDA removes the impact of straight-line revenue and expenses to align with AMT Adj. EBITDA.

(f) Source: Historical company financials.

(g) Stock prices as of 1/16/24

Detailed SOTP Indicates 25x EBITDA Multiple is Appropriate |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Fundamental Value Heatmap

32

2025-2028 CAGR / Average

Towerco AMT SBAC Towerco AMT SBAC

US Tower Metrics

US Revenue Per Tower 2 1 3 122,582 129,844 111,001

US Revenue Growth Per Tower 1 2 3 4.5% 2.6% 2.4%

US EBITDA Per Tower 2 1 3 86,944 101,534 85,252

US EBITDA Growth Per Tower 1 2 3 4.6% 2.8% 2.2%

US EBITDA Margin Per Tower 3 1 2 70.9% 78.2% 76.8%

Total Company Performance

Total Revenue Growth 2 1 3 4.5% 5.3% 3.4%

EBITDA Growth 2 1 3 4.6% 5.4% 3.2%

EBITDA Margin 1 3 2 70.9% 61.4% 69.5%

Unlevered Free Cash Flow Growth 2 1 3 5.5% 7.4% 2.6%

Dividend Payout as a % of AFFO 1 2 3 81.6% 61.1% 26.1%

Dividend Payout as a % of AFFO after Discretionary 1 2 3 90.0% 88.8% 36.1%

FX Exposure and Leverage

% of Non-US EBITDA 1 3 2 0.0% 46.0% 21.9%

% of Non-US Revenue 1 3 2 0.0% 57.6% 29.4%

Net Debt / EBITDA 2 1 3 4.72 4.41 6.04

Note: For Dividend Payout as a % of AFFO Before/After Discretionary, we have run out the 2023 metrics for AMT/SBA and are using the projection metrics for Towerco.

PF CCI #1 or #2 Except Margin/Tower |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Share Px Bridge: 25x 2025 - Headcount Reduction to AMT US

33 |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Share Price Sensitivity Tables

34

EBITDA Multiple Sensitivity 2025-2026

EBITDA % Price Change

EBITDA Multiple 2025 2026 2025 2026

23.0x $136.14 $143.34 22.7% 29.1%

24.0x $143.76 $151.25 29.5% 36.3%

25.0x $151.36 $159.15 36.4% 43.4%

26.0x $158.95 $167.06 43.2% 50.5%

27.0x $166.54 $174.96 50.0% 57.6%

28.0x $174.13 $182.86 56.9% 64.7%

Dividend Yield Sensitivity 2025-2026

Dividend Payout % Price Change

Div. Yield 2025 2026 2025 2026

3.00 % $153.95 $162.86 38.7% 46.7%

3.25 % $142.11 $150.33 28.0% 35.4%

3.50 % $131.96 $139.60 18.9% 25.8%

3.75 % $123.16 $130.29 11.0% 17.4%

4.00 % $115.46 $122.15 4.0% 10.0%

4.25 % $108.67 $114.96 -2.1% 3.6%

4.50 % $102.63 $108.57 -7.5% -2.2%

SOTP Analysis: 25x EBITDA - 2025 Trough EBITDA Used for Conservatism |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Towerco Plan: AFFO After Discretionary Capex

35

Interest savings impact to AFFO of $330mm more than bridges the $200mm top line impact of 2025 Sprint Churn |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Towerco Plan: Fiber Sale Price Sensitivity

Stock Price Calculation ($) as of December 2024

Assumed Tower Multiple (of 2025E Tower EBITDA)

18.0 x 19.0 x 20.0x 21.0 x 22.0 x 23.0 x 24.0 x 25.0 x 26.0 x 27.0 x 28.0 x

Fiber at Calc Fiber

Value ($)

9.3 x 10,488 94.90 102.24 109.58 116.92 124.25 131.59 138.93 146.26 153.60 160.94 168.27

10.1 x 11,334 96.29 103.74 111.18 118.63 126.07 133.51 140.96 148.40 155.85 163.29 170.74

11.1 x 12,461 98.21 105.80 113.39 120.99 128.58 136.17 143.76 151.36 158.95 166.54 174.13

12.1 x 13,589 100.20 107.95 115.69 123.44 131.19 138.93 146.68 154.43 162.17 169.92 177.67

13.1 x 14,716 102.28 110.18 118.09 126.00 133.91 141.81 149.72 157.63 165.53 173.44 181.35

14.1 x 15,844 104.44 112.52 120.59 128.66 136.74 144.81 152.89 160.96 169.04 177.11 185.18

% Calculated Stock Price Increase (%)

Assumed Tower Multiple

18.0 x 19.0 x 20.0 x 21.0 x 22.0 x 23.0 x 24.0 x 25.0 x 26.0 x 27.0 x 28.0 x

Fiber at

9.3 x -14.5% -7.9% -1.3% 5.3% 11.9% 18.5% 25.2% 31.8% 38.4% 45.0% 51.6%

10.1 x -13.3% -6.5% 0.2% 6.9% 13.6% 20.3% 27.0% 33.7% 40.4% 47.1% 53.8%

11.1 x -11.5% -4.7% 2.2% 9.0% 15.8% 22.7% 29.5% 36.4% 43.2% 50.0% 56.9%

12.1 x -9.7% -2.7% 4.2% 11.2% 18.2% 25.2% 32.1% 39.1% 46.1% 53.1% 60.1%

13.1 x -7.9% -0.7% 6.4% 13.5% 20.6% 27.8% 34.9% 42.0% 49.1% 56.3% 63.4%

14.1 x -5.9% 1.4% 8.6% 15.9% 23.2% 30.5% 37.7% 45.0% 52.3% 59.6% 66.8%

36

2025E EBITDA

Used for

Conservatism

Given Trough for

Sprint Churn.

Fiber Value ~$12,500 and Tower Multiple

Expansion to 25.0x |

| ©2023 | Strictly Confidential ©2024 | Strictly Confidential | Strictly Confidential - Do Not Transfer or Reproduce

37

Conclusion

PROJECT BOOTS |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Two Paths Forward: Working Together vs Not Working Together

Plan A – CCI w/ Benefit of Boots Plan B – CCI w/o Benefit of Boots

• CCI adopts Boots work done to date into its committee

structure/process (Accelerate timeline by 6-months – 2024 closing)

• CCI begins work on fiber sale due diligence sensitivities and

conclusions (12-18 Month process extends into 2025 for CCI)

• Boots assigns to CCI 25 NDAs with potential fiber buyers/financing

sources that have been actively working for months

• CCI approaches all fiber buyers independently without Boots Fiber

NDAs, leading to fiber buyer/process confusion, risk and doubts

• Capture $1bn+ of tax benefits in 2024 for CCI and fiber buyers • Substantial and probable risk regarding loss of $1bn+ of tax benefits

• Expedited buyer regulatory review for 2024 closing • Delayed start to regulatory review

• Existing CCI advisors continue work through completion leveraging

Boots materials/process

• Comprehensive, world-class advisors, fiber experts and Company

founder and fiber experts excluded from CCI

• Engaged EY team is ready to transfer and support the go-forward+ • CCI advisors unnecessarily recreate completed Boots work

• Established team in place while formal CEO process continues • Continue formal CEO search during 2024 CCI proxy process

• Executive Chairman/Boots fills immediate leadership void • New CEO will need time to assess fiber sale, strategic plan, etc.

• Strategic plan vetted and direction defined • CCI Management/employee confusion continues, creating more

overall risk to 2024 fiber sale close, towers reboot and overall clarity

• Clear message to market/employees regarding leadership, strategy

and fiber

• Market confusion continues while CEO search, strategy, sale of fiber

and timing undefined – CCI proxy process uncertainty

38 |

| ©2023 | Strictly Confidential ©2024 | Strictly Confidential | Strictly Confidential - Do Not Transfer or Reproduce

39

Q & A

PROJECT BOOTS |

| ©2023 | Strictly Confidential ©2024 | Strictly Confidential | Strictly Confidential - Do Not Transfer or Reproduce

40

Let’s Work Together to Formalize and Accelerate Next Steps

PROJECT BOOTS |

| ©2023 | Strictly Confidential ©2024| Strictly Confidential | Strictly Confidential - Do Not Transfer or Reproduce

41

Appendix

PROJECT BOOTS |

| ©2024 | Strictly Confidential - Do Not Transfer or Reproduce

PROJECT BOOTS

Towers per Employee

42

18

23

29

38

0

5

10

15

20

25

30

35

40

CCI - Current AMT - US CCI - 2013 AMT - Global |

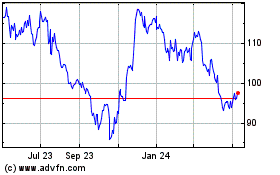

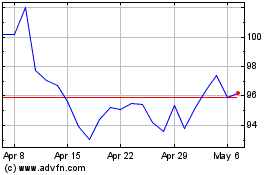

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Crown Castle (NYSE:CCI)

Historical Stock Chart

From Apr 2023 to Apr 2024