As filed with the Securities and Exchange

Commission on May 16, 2023

Registration

No. 333-271328

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM S-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

CADRE HOLDINGS, INC.

(Exact name of registrant as specified in charter)

| Delaware |

|

38-3873146 |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

13386 International Pkwy

Jacksonville, FL 32218

(904) 741-5400

(Address, including zip code and telephone number,

including area code, of registrant’s principal executive offices)

Warren B. Kanders

Chief Executive Officer

Cadre Holdings, Inc.

13386 International Pkwy

Jacksonville, FL 32218

(904) 741-5400

(Name, address, including zip code and telephone

number, including area code, of agent for service of process)

Copy to:

Robert L. Lawrence, Esq.

Kane Kessler, P.C.

600 Third Avenue

35th Floor

New York, NY 10016

(212) 541-6222

Approximate Date of Commencement of Proposed

Sale to Public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this

Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than the securities

offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities

for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant

to General Instruction I.D. or a post effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following. ¨

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following. ¨

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company.

See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company”

in Rule 12b-2 of the Exchange Act:

Large accelerated filer ¨ Accelerated

filer x Non-accelerated filer ¨ Smaller

reporting company ¨ Emerging growth company x

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant

to said Section 8(a), may determine.

The information

in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed

with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it

is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION DATED

MAY 16, 2023.

PRELIMINARY PROSPECTUS

CADRE HOLDINGS, INC.

$300,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

3,000,000 Shares

Common Stock

Offered by the Selling Securityholders

This prospectus provides

a general description of securities of Cadre Holdings, Inc. (the “Company,” “Cadre,” “we,” “our,”

and “us”) that we may offer and the general manner in which we will offer them. We may offer, issue and sell, from time to

time, in one or more offerings and series, together or separately, shares of our common stock, shares of our preferred stock, debt securities,

or warrants up to an aggregate amount of $300,000,000.

Each time any of our securities

is offered using this prospectus, we and/or any of our selling securityholders, where applicable, will provide a prospectus supplement

and attach it to this prospectus. The applicable prospectus supplement will contain more specific information about the offering. The

applicable prospectus supplement will also contain information, where appropriate, about material United States federal income tax consequences

relating to, and any listing on a securities exchange of, the debt or equity securities covered by the prospectus supplement. The applicable

prospectus supplement may also add, update or change the information in this prospectus and will also describe the specific manner in

which we will offer such securities.

This prospectus may not

be used to offer or sell securities without a prospectus supplement which includes a description of the method and terms of the offering.

You should carefully read

this prospectus and any accompanying prospectus supplement, together with the documents we incorporate by reference, before you invest

in our securities.

We may offer and sell the

securities described in this prospectus and any prospectus supplement to or through one or more underwriters, dealers and agents, or directly

to purchasers, or through a combination of these methods. In addition, the selling securityholders may offer and sell shares of our common

stock from time to time, together or separately. If any underwriters, dealers or agents are involved in the sale of any of the securities,

their names and any applicable purchase price, fee, commission or discount arrangement between or among them will be set forth, or will

be calculable from the information set forth, in the applicable prospectus supplement. See the sections of this prospectus entitled “About

this Prospectus” and “Plan of Distribution” for more information. No securities may be sold without delivery of this

prospectus and the applicable prospectus supplement describing the method and terms of the offering of such securities.

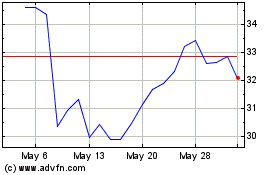

Our common stock is listed

on the New York Stock Exchange under the symbol “CDRE.” We will provide information in any applicable prospectus supplement

regarding any listing of securities other than shares of our common stock on any securities exchange.

Investing in our securities

involves a high degree of risks. Please refer to the “Risk Factors” section beginning on page 2 of this prospectus, “Item

1A – Risk Factors” of our most recent Annual Report on Form 10-K incorporated by reference herein, and under similar headings

in the applicable prospectus supplement and any other documents that are incorporated by reference herein or therein, for a description

of the risks you should consider when evaluating this investment.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2023.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part

of a “shelf” registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or the “SEC”,

under the Securities Act of 1933, as amended, or the Securities Act, using a “shelf” registration process. Under this shelf

registration process, we may, from time to time, offer and/or sell, in one or more offerings and series, together or separately, shares

of our common stock, preferred stock, debt securities, or warrants up to an aggregate amount of $300,000,000 and the selling securityholders

to be named in a supplement to this prospectus may, from time to time, sell up to 3,000,000 shares of common stock from time to time

in one or more offerings as described in this prospectus. This prospectus only provides you with a general description of the securities

that we and the selling securityholders may offer. Each time that we or the selling securityholders offer and sell any securities, we

or the selling securityholders will provide a prospectus supplement and attach it to this prospectus that contains specific information

about the securities being offered and sold and the specific terms of that offering. The prospectus supplement will contain more specific

information about the terms of the securities and the offering. The applicable prospectus supplement will also contain information, where

appropriate, about material United States federal income tax consequences relating to, and any listing on a securities exchange of, the

debt or equity securities covered by the prospectus supplement. The prospectus supplement may also add, update or change information

contained in this prospectus. Any statement that we make in this prospectus will be modified or superseded by any inconsistent statement

made by us or any of the selling securityholders in a prospectus supplement. This prospectus and the prospectus supplements provide you

with a general description of the Company and our securities as well as the securities to be sold by any of the selling securityholders.

Before purchasing any securities, you should read both this prospectus and any accompanying prospectus supplement together with the additional

information described under the headings “Where You Can Find More Information” and “Incorporation of Certain Information

by Reference.”

You should rely only on the

information contained in this prospectus or any prospectus supplement and those documents incorporated by reference in this prospectus

or any accompanying prospectus supplement. Neither we, nor the selling securityholders, have authorized anyone to provide you with information

that is in addition to, or different from, that contained in this prospectus or any accompanying prospectus supplement. If anyone provides

you with different or additional information, you should not rely on it. This prospectus may only be used where it is legal to sell these

securities, and neither we nor any of the selling securityholders have authorized anyone to make any representations in connection with

an offering other than those contained or incorporated by reference in this prospectus or any accompanying prospectus supplement. Neither

this prospectus nor any prospectus supplement is an offer to sell, or a solicitation of an offer to buy, in any state where the offer

or sale is prohibited. The information in this prospectus, any prospectus supplement or any document incorporated herein or therein by

reference is accurate as of the date contained on the cover of such documents. Neither the delivery of this prospectus or any prospectus

supplement, nor any sale made under this prospectus or any prospectus supplement will, under any circumstances, imply that the information

in this prospectus or any prospectus supplement is correct as of any date after the date of this prospectus or any such prospectus supplement.

References in this prospectus

to the “Company,” “Cadre,” “we,” “our,” and “us,” refer to Cadre Holdings,

Inc.

FORWARD-LOOKING STATEMENTS

Certain statements included

in this prospectus, any accompanying prospectus supplement and the documents incorporated by reference herein and therein are “forward-looking

statements” within the meaning of the federal securities laws. Forward-looking statements are made based on our expectations and

beliefs concerning future events impacting the Company and therefore involve a number of risks and uncertainties. In addition, any statements

that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions,

are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,”

“estimate,” “expect,” “intend,” “may,” “might,” “plan,” “possible,”

“potential,” “predict,” “project,” “should,” “would” and similar expressions

may identify forward-looking statements, but the absence of these words does not mean that a statement is not forward-looking. We

caution that forward-looking statements are not guarantees and that actual results could differ materially from those expressed or implied

in the forward-looking statements.

Potential risks and uncertainties

that could cause the actual results of operations or financial condition of the Company to differ materially from those expressed or implied

by forward-looking statements in this prospectus, any accompanying prospectus supplement and the documents incorporated herein and therein

include, but are not limited to, the availability of capital to satisfy our working capital requirements;

anticipated trends and challenges in our business and the markets in which we operate; our

ability to anticipate market needs or develop new or enhanced products to meet those needs; our expectations regarding market acceptance

of our products; the success of competing products by others that are or become available in the markets in which we sell our products;

the impact of adverse publicity about the Company and/or its brands, including without limitation, through social media or in connection

with brand damaging events and/or public perception; changes in political, economic or regulatory conditions generally and in the markets

in which we operate; the impact of political unrest, natural disasters or other crises, terrorist acts, acts of war and/or military

operations, including, without limitation, the conflict between Russia and Ukraine; our ability

to maintain or broaden our business relationships and develop new relationships with strategic alliances, suppliers, customers, distributors,

or otherwise; our ability to retain and attract senior management and other key employees; our ability to quickly and effectively respond

to new technological developments; the effect of an outbreak of disease or similar public health threat, such as the COVID-19 pandemic,

on the Company’s business; logistical challenges related to supply chain disruptions and delays; the impact of inflationary

pressures and our ability to mitigate such impacts with pricing and productivity; the possibility

that the Company may be adversely affected by other political, economic, business, and/or competitive factors; the ability of our information

technology systems or information security systems to operate effectively, including as a result of security breaches, viruses, hackers,

malware, natural disasters, vendor business interruptions or other causes; our ability to properly maintain, protect, repair or upgrade

our information technology systems or information security systems, or problems with our transitioning to upgraded or replacement systems;

our ability to protect our trade secrets or other proprietary rights and operate without infringing upon the proprietary rights of others

and prevent others from infringing on the proprietary rights of the Company; our ability to maintain a quarterly dividend; and

the increased expenses associated with being a public company and the related increased disclosure and reporting obligations; and any

material differences in the actual financial results of the Company’s past and future acquisitions as compared with the Company’s

expectation. More information on potential factors that could affect the Company’s financial results is included from time to time

in the Company’s public reports filed with the SEC, including the Company’s Annual Report on Form 10-K, Quarterly Reports

on Form 10-Q and Current Reports on Form 8-K. All forward-looking statements included in this prospectus are based upon information available

to the Company as of the date of this prospectus, and speak only as the date hereof. We assume no obligation to update any forward-looking

statements to reflect events or circumstances after the date of this prospectus.

You should also read carefully

the factors described or referred to in the “Risk Factors” section of this prospectus, any accompanying prospectus supplement

and the documents incorporated by reference herein and therein, to better understand the risks and uncertainties inherent in our business

and underlying any forward-looking statements. Any forward-looking statements that we make in this prospectus, any accompanying prospectus

supplement and the documents incorporated by reference herein as well as other written or oral statements by us or our authorized officers

on our behalf, speak only as of the date of such statement, and we undertake no obligation to update such statements. Comparisons of results

for current and any prior periods are not intended to express any future trends or indications of future performance, unless expressed

as such, and should only be viewed as historical data.

THE COMPANY

Company Overview

For

over 55 years, we have been a global leader in the manufacturing and distribution of safety and survivability equipment for first

responders. Our equipment provides critical protection to allow its users to safely perform their duties and protect those around them

in hazardous or life-threatening situations. Through our dedication to superior quality, we establish a direct covenant with end users

that our products will perform and keep them safe when they are most needed. We sell a wide range of products including body armor, explosive

ordnance disposal equipment and duty gear through both direct and indirect channels. In addition, through our owned distribution, we serve

as a one-stop shop for first responders providing equipment we manufacture as well as third-party products including uniforms, optics,

boots, firearms and ammunition. The majority of our manufactured product offering is governed by rigorous safety standards and regulations.

Demand for our products is driven by technological advancement as well as recurring modernization and replacement cycles for the equipment

to maintain its efficiency, effective performance and regulatory compliance.

Market Overview

Our

target end user base includes domestic and international first responders such as state and local law enforcement, fire and rescue, explosive

ordnance disposal technicians, emergency medical technicians, fishing and wildlife enforcement and departments of corrections, as well

as federal agencies including the U.S. Department of State, U.S. Department of Defense, U.S. Department of Interior, U.S. Department of

Justice, U.S. Department of Homeland Security, U.S. Department of Corrections and numerous foreign government agencies. We have a large

and diverse customer base, with no individual customer representing more than 10% of our total revenue for the year ended December 31,

2022.

The

market for safety and survivability equipment serving first responders focuses on providing a diverse set of protective and mission enhancing

products and solutions to our target end users. The market is driven by multiple factors including customer refresh cycles, the growing

number of personnel employed by first responder organizations, equipment replacement and modernization trends, greater emphasis on public

and first responders’ safety and demographic shifts.

Body

armor, explosive ordnance disposal equipment and duty gear comprise the core product areas in the safety and survivability equipment market,

and law enforcement personnel growth is a significant driver for our business. The U.S. Bureau of Labor Statistics projects the number

of law enforcement personnel in the U.S. to increase at a faster rate than broader labor market growth over the 10-year period from 2019

to 2029, or 5%, from 813,500 in 2019 to 854,200 in 2029. Demand for first responder safety and survivability equipment is also fueled

by increasing law enforcement budgets.

In

addition to the macro industry trends, each of these product segments experiences unique drivers in and of themselves. Increasing mandatory

body armor use and refresh policies, evolving technical standards and increases in tactical or special weapons and tactics (“SWAT”)

law enforcement personnel act as tailwinds to the body armor market. Meanwhile, the explosive ordnance disposal equipment market is driven

by the continued emergence of new global threats while duty gear is primarily driven by product use, firearms accessories (lights and

red-dot sights) and replacement cycles.

Our

management estimates the annual addressable market for soft body armor (including tactical soft armor) to be approximately $870 million.

We also estimate explosive ordnance disposal equipment to have an addressable market of approximately $245 million over the seven-to-ten

year life cycle of the products’ installed base. Finally, the annual addressable market for holsters for the global law enforcement

and military and consumer markets is estimated to be approximately $380 million.

The

international market is also poised for growth as foreign governments face increasingly complex safety challenges and seek to replace

legacy equipment. Additionally, we foresee the demand for safety and survivability equipment from overseas markets to increase due to

heightened awareness of the importance and effectiveness of such products as countries are exposed to new threats. Our management estimates

our addressable number of total law enforcement personnel outside the U.S. to be approximately 9.7 million, representing a substantial

market opportunity.

Our

management team believes that the safety and survivability equipment industry for first responders represents a stable and growing market

with long-term opportunities. Given our strong market standing, direct connection to the end users, extensive distribution network, long

history of innovations and high-quality standards, we believe we are well positioned to capitalize on the positive market dynamics.

Corporate Overview

Cadre

Holdings, Inc. was incorporated in the State of Delaware on April 12, 2012.

Our

principal executive offices are located at 13386 International Pkwy, Jacksonville, Florida 32218 and our telephone number is (904) 741-5400.

Our website address is www.cadre-holdings.com. The information on, or that may be accessed through, our website is not a part of this

prospectus (other than the documents that we file with the SEC that are expressly incorporated by reference into this prospectus) and

the inclusion of our website address in this prospectus is an inactive textual reference only. See “Where You Can Find More Information”

and “Incorporation of Certain Information by Reference.”

RISK FACTORS

Investment

in any securities offered pursuant to this prospectus and the applicable prospectus supplement involves risks. Please carefully consider

the risk factors described in our periodic and current reports filed with the SEC, which are incorporated by reference in this prospectus,

as well as any risks that may be set forth in or incorporated by reference into the prospectus supplement relating to a specific security.

Before making an investment decision, you should carefully consider these risks as well as other information we include or incorporate

by reference in this prospectus or include in any applicable prospectus supplement. The risks and uncertainties we have described are

not the only risks and uncertainties we face. Additional risks and uncertainties not presently known to us or that we currently deem immaterial

may also affect our business operations. The occurrence of any of these risks could materially affect our business, results of operations

or financial condition and cause the value of our securities to decline. You could lose all or part of your investment.

USE OF PROCEEDS

The

use of proceeds from the sale of our securities will be specified in the applicable prospectus supplement.

Unless

stated otherwise in an accompanying prospectus supplement, we will use the net proceeds from the sale of securities described in this

prospectus for general corporate purposes.

When

a particular series of securities is offered, the accompanying prospectus supplement will set forth our intended use for the net proceeds

received from the sale of those securities. Pending application for specific purposes, the net proceeds may be temporarily invested in

marketable securities. The precise amounts and timing of the application of proceeds will depend upon our funding requirements and the

availability of other funds. Except as mentioned in any prospectus supplement, specific allocations of the proceeds to such purposes will

not have been made at the date of that prospectus supplement.

We will not receive any of

the proceeds from the sale of common stock being offered by any of the selling securityholders.

DESCRIPTION OF COMMON STOCK

The

following description of our common stock does not purport to be complete and is subject in all respects to applicable Delaware law and

qualified by reference to the provisions of our Amended and Restated Certificate of Incorporation, as amended (the “Certificate

of Incorporation”), and Amended and Restated Bylaws, as amended (the “Bylaws”). Copies of our Certificate of Incorporation

and Bylaws are incorporated by reference and will be sent to stockholders upon request. Please read “Where You Can Find More Information”

and “Incorporation of Certain Information by Reference” to find out how you obtain a copy of those documents. We encourage

you to read carefully this prospectus, the Certificate of Incorporation, the Bylaws and the other documents we refer to herein for a more

complete understanding of the Company’s common stock.

Authorized and Outstanding Common Stock

Our

authorized capital stock consists of 200,000,000 shares of capital stock, par value $0.0001 per share, of which 190,000,000 shares are

common stock, par value $0.0001 per share (“Common Stock”), and 10,000,000 shares are undesignated preferred stock,

par value $0.0001 per share, and there are 37,586,031 shares of Common Stock outstanding

and no shares of preferred stock outstanding as of May 5, 2023. We are authorized to issue one class of common stock.

Voting Power

Except

as otherwise required by law or as otherwise provided in any certificate of designation for any series of preferred stock, the holders

of Common Stock possess all voting power for the election of our directors and all other matters requiring stockholder action. Holders

of Common Stock are entitled to one vote per share on matters to be voted on by stockholders. Generally,

all matters to be voted on by stockholders must be approved by a majority (or, in the case of election of directors, by a plurality) of

the votes entitled to be cast by all stockholders present in person or represented by proxy, voting together as a single class.

Dividends

Holders

of Common Stock will be entitled to receive such dividends, if any, as may be declared from time to time by our Board of Directors (the

“Board”) in its discretion out of funds legally available therefor. In no event will any stock dividends or stock splits

or combinations of stock be declared or made on Common Stock unless the shares of Common Stock at the time outstanding are treated equally

and identically. We expect to continue pay a quarterly cash dividend of $0.08 per share, or $0.32

on an annualized basis, on our Common Stock for the foreseeable future, but we may elect to retain all of our future earnings, if any,

to finance the growth and development of our business. Any decision to declare and pay dividends in the future will be made at

the discretion of the Board and will depend on, among other things, our results of operations, financial condition, cash requirements,

contractual restrictions and other factors that the Board may deem relevant. In addition, our ability to pay dividends may be limited

by covenants of any existing and future outstanding indebtedness we or our subsidiaries incur.

Liquidation, Dissolution and Winding Up

In

the event of our voluntary or involuntary liquidation, dissolution, distribution of assets or winding-up, the holders of the Common Stock

will be entitled to receive an equal amount per share of all of our assets of whatever kind available for distribution to stockholders,

after the rights of the holders of the preferred stock have been satisfied.

Preemptive or Other Rights

Our

stockholders have no preemptive or other subscription rights and there are no sinking fund or redemption provisions applicable to Common

Stock.

Election of Directors

The

Bylaws provide that our business and affairs be managed by the Board. Our Board is composed of a single class of five directors, each

of whom will generally serve for a term of one year. There is no cumulative voting with respect to the election of directors, with the

result that the holders of more than 50% of the shares voted for the election of directors can elect all of the directors.

DESCRIPTION OF PREFERRED STOCK

The

following is a description of certain general terms and provisions of our preferred stock. The particular terms of any series of preferred

stock offered by us will be described in a prospectus supplement relating to such offering. The following description of our preferred

stock does not purport to be complete and is subject in all respects to applicable Delaware law and qualified by reference to the provisions

of our Certificate of Incorporation, Bylaws and the certificate of designation relating to each series of our preferred stock, which will

be filed with the SEC at or prior to the time of issuance of such series of preferred stock.

Our

Certificate of Incorporation authorizes our Board to issue, without further stockholder approval, up to 10,000,000 shares of preferred

stock in one or more series, having a par value of $0.0001 per share. As of the date of this prospectus, no shares of our preferred stock

were outstanding.

Our

Board is authorized to fix the designation and relative rights for each series of preferred stock, and the applicable prospectus supplement

will set forth with respect to such series, the following information:

| · | any stated redemption and liquidation values or preference per share; |

| · | any sinking fund provisions; |

| · | any conversion or exchange provisions; |

| · | any participation rights; |

| · | the terms of any other preferences, limitations and restrictions, as are stated in the resolutions adopted

by our Board and as are permitted by the Delaware General Corporation Law (the “DGCL”). |

The

transfer agent and registrar for each series of preferred stock will be described in the applicable prospectus supplement.

DESCRIPTION OF DEBT SECURITIES

The

debt securities may be senior debt securities or subordinated debt securities. The senior debt securities and the subordinated debt securities

are together referred to in this prospectus as the “debt securities.” The form of indenture is filed as an exhibit to the

registration statement of which this prospectus forms a part. We will include in a supplement to this prospectus the specific terms of

each series of debt securities being offered. The statements and descriptions in this prospectus or in any prospectus supplement regarding

provisions of the debt securities and the indenture are summaries thereof, do not purport to be complete and are subject to, and are qualified

in their entirety by reference to, all of the provisions of the indenture (and any amendments or supplements we may enter into from time

to time which are permitted under such indenture) and the debt securities, including the definitions therein of certain terms.

The

debt securities will not be guaranteed by any of our subsidiaries. The indenture does not

limit the aggregate principal amount of debt securities that we may issue and provides that we may issue debt securities from time to

time in one or more series, in each case with the same or various maturities, at par or at a discount. Unless indicated in a prospectus

supplement, we may issue additional debt securities of a particular series without the consent of the holders of the debt securities

of such series outstanding at the time of the issuance. Any such additional debt securities, together with all other outstanding debt

securities of that series, will constitute a single series of debt securities under the indenture.

We

will set forth in a prospectus supplement (including any pricing supplement or term sheet) relating to any series of debt securities being

offered the aggregate principal amount and the following terms of the debt securities, if applicable:

| · | the title and ranking of the debt securities (including the terms of any subordination provisions); |

| · | the price or prices (expressed as a percentage of the principal amount) at which we will sell the debt

securities; |

| · | covenants that we will adhere to in connection with the issuance and maintenance of debt securities; |

| · | events of default, acceleration, waivers of default, and related remedies, rights, and duties; |

| · | form, denomination, issuance, registration, transfer, and replacement of debt securities; |

| · | any other terms of the debt securities, which may supplement, modify or delete any provision of the indenture

as it applies to that series, including any terms that may be required under applicable law or regulations or advisable in connection

with the marketing of the securities; and |

| · | satisfaction and discharge of debt securities. |

We

may issue debt securities that provide for an amount less than their stated principal amount to be due and payable upon declaration of

acceleration of their maturity pursuant to the terms of the indenture. We will provide you with information on the federal income tax

considerations and other special considerations applicable to any of these debt securities in the applicable prospectus supplement.

DESCRIPTION OF WARRANTS

A

warrant is a security that gives the holder the right, upon exercise of the warrant, to purchase a specified number of securities at a

specified exercise price, during a specified exercise period, which is subject to adjustment upon the occurrence of specified events.

We may issue warrants for the purchase of our common stock, preferred stock or debt securities or any combination thereof. Warrants may

be issued independently or together with our common stock, preferred stock or debt securities and may be attached to or separate from

any such offered securities. Each series of warrants will be issued under a separate warrant agreement to be entered into between us and

a bank or trust company, as warrant agent. The warrant agent will act solely as our agent in connection with the warrants. The warrant

agent will not have any obligation or relationship of agency or trust for or with any holders or beneficial owners of warrants. Warrants

will be offered and exercisable for United States dollars only. Warrants will be issued in registered form only. The particular terms

of any warrants will be described in the related prospectus supplement.

Anti-Takeover

Effects of CERTAIN Provisions of Delaware Law and

Our Certificate of Incorporation and Bylaws

Certain

provisions of the Certificate of Incorporation and Bylaws could have an anti-takeover effect. These provisions are intended to enhance

the likelihood of continuity and stability in the composition of the Board and in the policies formulated by the Board and to discourage

an unsolicited takeover of us if the Board determines that such takeover is not in the best interests of us and our stockholders. However,

these provisions could have the effect of discouraging certain attempts to acquire us or remove incumbent management even if some or a

majority of stockholders deemed such an attempt to be in their best interests.

The

provisions in the Certificate of Incorporation and the Bylaws include: (a) allowing only our board of directors to fill vacant directorships,

including newly created seats; (b) a requirement that special meetings of our stockholders may be called only by a majority of our board

of directors, the chairperson of our board of directors, our Chief Executive Officer or our President, thus prohibiting a stockholder

from calling a special meeting; (c) advance notice procedures for stockholders seeking to bring business before our annual meeting of

stockholders or to nominate candidates for election as directors at our annual meeting of stockholders; (d) the authority of the

Board to issue additional shares of common stock and/or preferred stock without stockholder approval; (e) that the number of directors

on the Board will be fixed exclusively by our Board; and (f) that our Bylaws may be amended by our Board.

The

DGCL contains statutory “anti-takeover” provisions, including Section 203 of the DGCL which applies automatically to

a Delaware corporation unless that corporation elects to opt-out as provided in Section 203. We, as a Delaware corporation, have

not elected to opt-out of Section 203 of the DGCL. Under Section 203 of the DGCL, a stockholder acquiring more than 15% of the

outstanding voting shares of a corporation (an “Interested Stockholder”) but less than 85% of such shares may not engage in

certain business combinations with the corporation for a period of three years subsequent to the date on which the stockholder became

an Interested Stockholder unless prior to such date, the board of directors of the corporation approves either the business combination

or the transaction which resulted in the stockholder becoming an Interested Stockholder, or the business combination is approved by the

board of directors and by the affirmative vote of at least 66 2/3% of the outstanding voting stock that is not owned

by the Interested Stockholder.

Limitation of Liability and Indemnification of Officers and Directors

Pursuant

to provisions of the DGCL, we have adopted provisions in our Certificate of Incorporation that provide that our directors shall not be

personally liable for monetary damages to us or our stockholders for a breach of fiduciary duty as a director to the full extent that

the Securities Act permits the limitation or elimination of the liability of directors.

We

have in effect a directors and officers liability insurance policy indemnifying our directors and officers and the directors and officers

of our subsidiaries within a specific limit for certain liabilities incurred by them, including liabilities under the Securities Act.

We pay the entire premium of this policy. Our Certificate of Incorporation also contains a provision for the indemnification by us of

all of our directors and officers, to the fullest extent permitted by the DGCL.

Exclusive Forum

Our

Bylaws provide that, unless we consent in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware

shall, to the fullest extent permitted by law, be the sole and exclusive forum for (a) any derivative action or proceeding brought on

behalf of the Company, (b) any action asserting a claim of breach of a fiduciary duty owed by any director, officer, other employee or

stockholder of the Company to the Company or the Company’s stockholders, (c) any action asserting a claim arising pursuant to any

provision of the DGCL, the Certificate of Incorporation, or Bylaws or as to which the DGCL confers jurisdiction on the Court of Chancery

of the State of Delaware, (d) any action to interpret, apply, enforce, or determine the validity

of our Certificate of Incorporation or Bylaws, or (e) any action asserting a claim governed by the internal affairs doctrine or

an “internal corporate claim” as that term is defined in Section 115 of the DGCL. If the Court of Chancery of the State

of Delaware does not have jurisdiction over a matter listed foregoing, the exclusive jurisdiction thereof shall be a state court located

within the State of Delaware (or, if no state court located within the State of Delaware has jurisdiction, the federal district court

for the District of Delaware). Any person or entity purchasing or otherwise acquiring any interest in shares of our stock shall be deemed

to have notice of and consented to the foregoing forum selection provisions.

SELLING SECURITYHOLDERS

This prospectus also relates

to the possible resale by certain of our stockholders, who we refer to in this prospectus as the “selling securityholders,”

of up to 3,000,000 shares of our common stock that were issued and outstanding prior to the original date of filing of the registration

statement of which this prospectus forms a part. Certain of the selling securityholders acquired shares of our common stock from Maui

Holdings, LLC, by virtue of Maui Holdings, LLC distributing all of the shares of the Company’s common stock owned by Maui Holdings,

LLC to its respective members, pro rata, based on their ownership of Maui Holdings, LLC and in accordance with the limited liability company

operating agreement thereof. The other remaining selling securityholders acquired shares of our common stock in private offerings pursuant

to exemptions from registration under Section 4(a)(2) of the Securities Act.

Information about the

selling securityholders, where applicable, including their identities, the amount of shares of common stock owned by each selling securityholder

prior to the offering, the number of shares of our common stock to be offered by each selling securityholder and the amount of common

stock to be owned by each selling securityholder after completion of the offering, will be set forth in an applicable prospectus supplement,

documents incorporated by reference or in a free writing prospectus we file with the SEC. The applicable prospectus supplement will also

disclose whether any of the selling securityholders have held any position or office with, have been employed by or otherwise have had

a material relationship with us during the three years prior to the date of the prospectus supplement.

The selling securityholders

may not sell any shares of our common stock pursuant to this prospectus until we have identified such selling securityholders and the

shares being offered for resale by such selling securityholders in a subsequent prospectus supplement. However, the selling securityholders

may sell or transfer all or a portion of their shares of our common stock pursuant to any available exemption from the registration requirements

of the Securities Act.

PLAN OF DISTRIBUTION

We

or any of the selling securityholders may sell securities in any one or more of the following ways (or in any combination) from time to

time:

| · | to or through one or more underwriters or dealers; |

| · | directly to a limited number of purchasers or to a single purchaser, including through a specific bidding,

auction or other process; or |

| · | through agents, brokers or dealers. |

The

applicable prospectus supplement will set forth the terms of the offering of such securities that we or any of the selling securityholders

sell, including:

| · | the name or names of any underwriters, dealers or agents and the amounts of securities underwritten or

purchased by each of them; |

| · | the public offering price of the securities and the proceeds to us or any of the selling securityholders,

as applicable, and any discounts, commissions or concessions allowed or reallowed or paid to dealers; |

| · | describing any compensation in the form of discounts, concessions or commissions or otherwise received

from us or any of the selling securityholders by each of such underwriter, dealer or agent and in the aggregate to all underwriters, dealers

and agents; |

| · | identifying the amounts underwritten; |

| · | identifying the nature of the underwriter’s obligation to take the securities; |

| · | identifying any over-allotment option under which the underwriters may purchase additional securities

from us or any of the selling securityholders; |

| · | identifying any quotation systems or securities exchanges on which the securities may be quoted or listed;

and |

| · | identifying any other facts material to the transaction. |

Any

public offering price and any discounts or concessions allowed or reallowed or paid to dealers may be changed from time to time.

We

or any of the selling securityholders may effect the distribution of the securities from time to time in one or more transactions either:

| · | at a fixed price or at prices that may be changed; |

| · | at market prices prevailing at the time of sale; |

| · | at prices relating to such prevailing market prices; or |

Any

underwritten offering may be on a best efforts or a firm commitment basis. If underwriters are used in the sale of any securities, the

securities will be acquired by the underwriters for their own account and may be resold from time to time in one or more transactions,

including, without limitation, negotiated transactions, at a fixed public offering price or at varying prices determined at the time of

sale. The securities may be either offered to the public through underwriting syndicates represented by managing underwriters, or directly

by underwriters without a syndicate. Generally, the underwriters’ obligations, if any, to purchase the securities will be subject

to certain conditions precedent. Subject to certain conditions, the underwriters will be obligated to purchase all of the securities if

they purchase any of the securities (other than any securities purchased upon exercise of any option to purchase additional securities

or any over-allotment option). Any public offering price and any discounts or concessions allowed, reallowed or paid to dealers may be

changed from time to time.

If

a dealer is used in an offering of securities, we or the selling securityholders may sell the securities to the dealer, as principal.

The dealer may then resell the securities to the public at varying prices to be determined by the dealer at the time of sale. The prospectus

supplement may set forth the name of the dealer and the terms of the transactions.

We

or the selling securityholders may sell the securities directly or through agents, underwriters and dealers that we or any of the

selling securityholders designate from time to time. The applicable prospectus supplement will name any agent, underwriter or dealer

involved in the offer or sale of the securities and will describe any commissions payable by us or any of the selling

securityholders to the agent. Generally, any agent, underwriter or dealer will be acting on a best efforts basis for the period of

its appointment.

We

may also sell the securities offered by any applicable prospectus supplement in “at-the-market offerings” within the meaning

of Rule 415 of the Securities Act, to or through a market maker or into an existing trading market, on an exchange or otherwise. If a

broker is used in the sale of the securities, the broker will not acquire the securities, and we will sell the securities directly to

the purchasers in the applicable market. The prospectus supplement will set forth the terms of the arrangements with the broker.

We

or any of the selling securityholders may sell the securities directly to one or more purchasers without using any underwriters, dealers

or agents. In that event, no underwriters or agents would be involved. In addition, we or any of the selling securityholders may enter

into derivative, sale or forward sale transactions with third parties, or sell securities not covered by this prospectus to third parties

in privately negotiated transactions. If the applicable prospectus supplement indicates, in connection with such a transaction, the third

parties may, pursuant to this prospectus and the applicable prospectus supplement, sell securities covered by this prospectus and the

applicable prospectus supplement. If so, a third party may use securities borrowed from us or any of the selling securityholders to settle

such sales and may use securities received from us or others to settle those sales to close out any related short positions. The third

party in such sale transactions will be an underwriter and will be identified in the applicable prospectus supplement (or a post-effective

amendment). We or any of the selling securityholders may also loan or pledge securities covered by this prospectus and the applicable

prospectus supplement to third parties, who may sell the loaned securities or, in an event of default in the case of a pledge, sell the

pledged securities pursuant to this prospectus and the applicable prospectus supplement. We or any of the selling securityholders may

also sell the securities directly, in which event, no underwriters or agents will be involved.

In

the sale of the securities, underwriters, dealers or agents may receive compensation in the form of commissions, discounts or concessions

from us or any of the selling securityholders. Underwriters, dealers or agents may also receive compensation from the purchasers of securities

for whom they act as agents or to whom they sell as principals, or both. Any underwriters, broker-dealers and agents that participate

in the distribution of the securities may be deemed to be “underwriters” as defined in the Securities Act. Any commissions

paid or any discounts or concessions allowed to any such persons, and any profits they receive on resale of the securities, may be deemed

to be underwriting discounts and commissions under the Securities Act. Compensation as to a particular underwriter, dealer or agent might

be in excess of customary commissions and will be in amounts to be negotiated in connection with transactions involving securities. In

effecting sales, broker-dealers engaged by us may arrange for other broker-dealers to participate in the resales. Maximum compensation

to any underwriters, brokers, dealers or agents will not exceed any applicable FINRA limitations.

Agents,

underwriters and dealers may be entitled under relevant agreements with us or to indemnification by us against certain liabilities,

including liabilities under the Securities Act, or to contribution with respect to payments which such agents, underwriters and dealers

may be required to make in respect thereof. The terms and conditions of any indemnification or contribution will be described in

the applicable prospectus supplement.

Underwriters

or agents may purchase and sell the securities in the open market. These transactions may include over-allotments, stabilizing transactions,

syndicate covering transactions and penalty bids. Over-allotments involve sales in excess of the offering size, which creates a short

position. Stabilizing transactions consist of bids or purchases for the purpose of preventing or retarding a decline in the market price

of the securities and are permitted so long as the stabilizing bids do not exceed a specified maximum. Syndicate covering transactions

involve the placing of any bid on behalf of the underwriting syndicate or the effecting of any purchase to reduce a short position created

in connection with an offering. The underwriters or agents also may impose a penalty bid, which permits them to reclaim selling concessions

allowed to syndicate members or certain dealers if they repurchase the securities in stabilizing or covering transactions. These activities

may stabilize, maintain or otherwise affect the market price of the securities, which may be higher than the price that might otherwise

prevail in the open market. These activities, if begun, may be discontinued at any time. These transactions may be effected on any exchange

on which the securities are traded, in the over-the-counter market or otherwise.

Agents,

dealers and underwriters may be customers of, engage in transactions with, or perform services for us in the ordinary course of business.

The

specific terms of any lock-up provisions in respect of any given offering of common stock will be described in the applicable prospectus

supplement.

The

place and time of delivery for securities will be set forth in the accompanying prospectus supplement for such securities. To comply with

applicable state securities laws, the securities offered by this prospectus will be sold, if necessary, in such jurisdictions only through

registered or licensed brokers or dealers. In addition, securities may not be sold in some states unless they have been registered or

qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied

with.

Unless

otherwise specified in the related prospectus supplement, each series of securities that we sell will be a new issue with no established

trading market, other than the common stock, which is listed on the New York Stock Exchange. Any common stock sold pursuant to a prospectus

supplement will be listed on the New York Stock Exchange, subject to applicable notices. We may elect to apply for quotation or listing

of any other class or series of our securities on a quotation system or an exchange but we are not obligated to do so. It is possible

that one or more underwriters may make a market in a class or series of our securities, but such underwriters will not be obligated to

do so and may discontinue any market making at any time without notice. Any such activities will be described in the prospectus supplement.

Therefore, no assurance can be given as to the liquidity of, or the trading market for, any other class or series of our securities.

WHERE YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and current reports, proxy statements and other information with the SEC. Our SEC filings are available to the

public over the Internet at the SEC’s website at www.sec.gov. Copies of certain information filed by us with the SEC

are also available on our website at www.cadre-holdings.com. Information accessible on or through our website is not a part of this

prospectus (other than the documents that we file with the SEC that are expressly incorporated by reference into this prospectus).

This

prospectus and any prospectus supplement are part of a registration statement that we filed with the SEC and do not contain all of the

information in the registration statement. You should review the information and exhibits in the registration statement for further information

on us and our consolidated subsidiaries and the securities that we are offering. Forms of any indenture or other documents establishing

the terms of the offered securities are filed as exhibits to the registration statement of which this prospectus forms a part or under

cover of a Current Report on Form 8-K and incorporated in this prospectus by reference. Statements in this prospectus or any

prospectus supplement about these documents are summaries and each statement is qualified in all respects by reference to the document

to which it refers. You should read the actual documents for a more complete description of the relevant matters.

This

prospectus omits certain information that is contained in the registration statement on file with the SEC, of which this prospectus is

a part. For further information with respect to us and our securities, reference is made to the registration statement, including the

exhibits incorporated therein by reference or filed therewith. Statements herein contained concerning the provisions of any document are

not necessarily complete and, in each instance, reference is made to the copy of such document filed as an exhibit or incorporated by

reference to the registration statement. Each such statement is qualified in its entirety by such reference.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” information from other documents that we file with it, which means that we can

disclose important information to you by referring you to those documents. The information incorporated by reference is considered to

be part of this prospectus. Information in this prospectus supersedes information incorporated by reference that we filed with the SEC

prior to the date of this prospectus, while information that we file later with the SEC will automatically update and supersede the information

in this prospectus. We incorporate by reference into this prospectus and the registration statement of which this prospectus is a part

the information or documents listed below that we have filed with the SEC (Commission File No. 001-40698):

| · | our Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on March 15, 2023; |

| · | our

Quarterly Report on Form 10-Q for the quarter ended March 31, 2023, filed with the SEC on

May 9, 2023; |

| · | our

information specifically incorporated by reference into our Annual Report on Form 10-K for

the year ended December 31, 2022 from our Definitive Proxy Statement on Schedule 14A filed

with the SEC on April 21, 2023; and |

| · | the description of our common stock contained in our Registration Statement on Form 8-A12B, filed with

the SEC on October 29, 2021 under the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), including, without

limitation, any amendment or report filed for the purpose of updating such description. |

We

also incorporate by reference any future filings (other than any filings or portions of such reports that are not deemed “filed”

under the Exchange Act in accordance with the Exchange Act and applicable SEC rules, including current reports furnished under Item 2.02

or Item 7.01 of Form 8-K and exhibits furnished on such form that are related to such items unless such Form 8-K expressly provides to

the contrary) made with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act on or after the date on which

the registration statement that includes this prospectus was initially filed with the SEC (including all such documents we may file with

the SEC after the date of the initial registration statement and prior to the effectiveness of the registration statement) and until

we file a post-effective amendment which indicates the termination of the offering of the securities made by this prospectus and the

accompanying prospectus supplement shall be deemed to be incorporated by reference into this prospectus and to be part hereof from the

date of filing of those documents. Information in such future filings updates and supplements the information provided in this prospectus

and the accompanying prospectus supplement. Any statements in any such future filings will automatically be deemed to modify and supersede

any information in any document we previously filed with the SEC that is incorporated or deemed to be incorporated herein by reference

to the extent that statements in the later filed document modify or replace such earlier statements.

You

may obtain copies of any of these filings by contacting us at the address and telephone number indicated below.

Documents

incorporated by reference are available from us without charge, excluding all exhibits unless an exhibit has been specifically incorporated

by reference into this prospectus, by requesting them in writing or by telephone at:

Cadre Holdings, Inc.

Attention: Corporate Secretary

13386 International Pkwy

Jacksonville, Florida 32218

(904) 741-5400

EXPERTS

The

consolidated financial statements of Cadre Holdings, Inc. as of December 31, 2022 and 2021, and for the years then ended, have been incorporated

by reference herein and in the registration statement in reliance upon the report of KPMG LLP, independent registered public accounting

firm, incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing.

LEGAL MATTERS

The

validity of the securities offered hereby by or on behalf of the Company will be passed upon for us by Kane Kessler, P.C., New York, New

York. Additional legal matters may be passed upon for us, the selling securityholders or any underwriters, dealers or agents, by counsel

that we will name in the applicable prospectus supplement.

Robert

L. Lawrence, Esq., a member of Kane Kessler, P.C., owns 81,167 shares of the Company’s common

stock.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The

expenses to be paid by us in connection with the distribution of securities of Cadre Holdings, Inc. (the “Registrant”) being

registered are as set forth in the following table:

| Registration Fee - Securities and Exchange Commission |

|

$ |

40,462.13 |

|

| Legal Fees and Expenses |

|

|

* |

|

| Accounting Fees and Expenses |

|

|

* |

|

| Printing and Engraving Fees and Expenses |

|

|

* |

|

| Blue Sky Fees |

|

|

* |

|

| Miscellaneous |

|

|

* |

|

| Total |

|

$ |

40,462.13 |

|

| * | The foregoing sets forth the general categories of fees and expenses (other than underwriting discounts and commissions) that we anticipate

we will incur in connection with the offering of securities under this registration statement. Because an indeterminate amount of securities

is covered by this registration statement, certain expenses in connection with the issuance and distribution of securities are not currently

determinable. An estimate of the aggregate fees and expenses in connection with each sale of securities being offered will be included

in the applicable prospectus supplement. |

Item 15. Indemnification of Directors and Officers

Section 145(a)

of the DGCL provides, in general, that a corporation may indemnify any person who was or is a party to or is threatened to be made a party

to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative (other than

an action by or in the right of the corporation), because he or she is or was a director, officer, employee or agent of the corporation,

or is or was serving at the request of the corporation as a director, officer, employee or agent of another corporation, partnership,

joint venture, trust or other enterprise, against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement

actually and reasonably incurred by the person in connection with such action, suit or proceeding, if he or she acted in good faith and

in a manner he or she reasonably believed to be in or not opposed to the best interests of the corporation and, with respect to any criminal

action or proceeding, had no reasonable cause to believe his or her conduct was unlawful.

Section 145(b)

of the DGCL provides, in general, that a corporation may indemnify any person who was or is a party or is threatened to be made a party

to any threatened, pending or completed action or suit by or in the right of the corporation to procure a judgment in its favor because

the person is or was a director, officer, employee or agent of the corporation, or is or was serving at the request of the corporation

as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise, against expenses

(including attorneys’ fees) actually and reasonably incurred by the person in connection with the defense or settlement of such

action or suit if he or she acted in good faith and in a manner he or she reasonably believed to be in or not opposed to the best interests

of the corporation, except that no indemnification shall be made with respect to any claim, issue or matter as to which he or she

shall have been adjudged to be liable to the corporation unless and only to the extent that the Court of Chancery or other adjudicating

court determines that, despite the adjudication of liability but in view of all of the circumstances of the case, he or she is fairly

and reasonably entitled to indemnity for such expenses that the Court of Chancery or other adjudicating court shall deem proper.

Section 145(g)

of the DGCL provides, in general, that a corporation may purchase and maintain insurance on behalf of any person who is or was a director,

officer, employee or agent of the corporation, or is or was serving at the request of the corporation as a director, officer, employee

or agent of another corporation, partnership, joint venture, trust or other enterprise against any liability asserted against such person

and incurred by such person in any such capacity, or arising out of his or her status as such, whether or not the corporation would have

the power to indemnify the person against such liability under Section 145 of the DGCL.

The

Registrant’s Certificate of Incorporation limits the Registrant’s directors’ and officers’ liability to the fullest

extent permitted under the DGCL and other applicable laws.

The

Registrant has entered into indemnification agreements with each of its directors and executive officers. These agreements provide that

the registrant will indemnify each of its directors and such officers to the fullest extent permitted by law and its charter and its bylaws.

The

Registrant also maintains a general liability insurance policy, which will cover certain liabilities of directors and officers of the

registrant arising out of claims based on acts or omissions in their capacities as directors or officers.

Item 16. Exhibits and Financial Statement Schedules

The

following exhibits are included herein or incorporated by reference:

| (1) | To be filed, if necessary, by post-effective amendment to this Registration Statement or incorporated

by reference from documents filed or to be filed with the Securities and Exchange Commission under the Securities Exchange Act of 1934. |

| (3) | To be filed separately pursuant to the requirements of Section 305(b)(2) of the Trust Indenture Act of

1939, as amended |

Item 17. Undertakings

| (a) | The undersigned registrant hereby undertakes: |

| (1) | to file, during any period in which offers or sales are being made, a post-effective amendment to this

registration statement: |

| (i) | to include any prospectus required by Section 10(a)(3) of the Securities Act of 1933; |

| (ii) | to reflect in the prospectus any facts or events arising after the effective date of the registration

statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change

in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities

offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or

high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the SEC pursuant to Rule 424(b)

if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set

forth in the “Calculation of Registration Fee” table in the effective registration statement; and |

| (iii) | to include any material information with respect to the plan of distribution not previously disclosed

in the registration statement or any material change to such information in the registration statement; |

provided, however, that paragraphs

(a)(1)(i), (a)(1)(ii), and (a)(1)(iii) above do not apply if the information required to be included in a post-effective amendment by

those subsections is contained in reports filed with or furnished to the SEC by the registrant pursuant to Section 13 or Section 15(d)

of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of

prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

| (2) | That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective

amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities

at that time shall be deemed to be the initial bona fide offering thereof. |

| (3) | To remove from registration by means of a post-effective amendment any of the securities being registered

which remain unsold at the termination of the offering. |

| (4) | That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser: |

| (i) | each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of this

registration statement as of the date the filed prospectus was deemed part of and included in this registration statement; and |

| (ii) | each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration

statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing

the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration

statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of

sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any

person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating

to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall

be deemed to be the initial bona fide offering thereof, provided, however, that no statement made in a registration statement or prospectus

that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration

statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such

effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration

statement or made in any such document immediately prior to such effective date. |

| (5) | That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any

purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities

of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities

to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned

registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser: |

| (i) | any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required

to be filed pursuant to Rule 424; |

| (ii) | any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant

or used or referred to by the undersigned registrant; |

| (iii) | the portion of any other free writing prospectus relating to the offering containing material information

about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and |

| (iv) | any other communication that is an offer in the offering made by the undersigned registrant to the purchaser. |

| (b) | The undersigned registrant hereby undertakes that, for purposes of determining any liability under the

Securities Act of 1933, each filing of the registrant’s Annual Report pursuant to Section 13(a) or Section 15(d) of the Securities

Exchange Act of 1934 that is incorporated by reference in the registration statement shall be deemed to be a new registration statement

relating to the securities offered herein, and the offering of such securities at that time shall be deemed to be the initial bona fide

offering thereof. |

| (c) | Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to

directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been

advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the

Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other

than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the

successful defense of any action, suit or proceeding), is asserted by such director, officer or controlling person in connection with

the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling

precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed

in the Securities Act of 1933 and will be governed by the final adjudication of such issue. |

| (d) | The undersigned registrant hereby undertakes to file an application for the purpose of to file, if applicable,

an application for the purpose of determining the eligibility of the trustee to act under subsection (a) of Section 310 of the Trust Indenture

Act of 1939 (the “Act”) in accordance with the rules and regulations prescribed by the SEC under Section 305(b)(2) of the

Act. |

SIGNATURES

Pursuant to the requirements

of the Securities Act, the undersigned registrant certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form S-3 and has duly caused this Amendment No. 1 to this registration statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of Jacksonville, State of Florida, on May 16, 2023.

| |

CADRE HOLDINGS, INC. |

| |

|

| |

By: |

/s/ Warren B. Kanders |

| |

|

Name: |

Warren B. Kanders |

| |

|

Title: |

Chief Executive Officer |

Pursuant to the requirements

of the Securities Act of 1933, as amended, this registration statement has been signed by the following persons in the capacities and

on the dates indicated: