Curtiss-Wright Corporation (NYSE: CW) reported financial results

for the fourth quarter and full-year ended December 31, 2016.

Fourth Quarter 2016 Highlights

- Earnings per diluted share of

$1.58;

- Free cash flow of $135 million,

resulting in free cash flow conversion of 192%, as defined

herein;

- Net sales of $566 million;

- Operating income of $106 million, down

2% as compared with the prior year, or up 20% as compared with 2015

pro forma results, as defined herein;

- Operating margin of 18.8%, up 40 basis

points as compared with the prior year, or up 320 basis points as

compared with 2015 pro forma results, as defined herein; and

- Share repurchase of approximately $25

million.

Full-Year 2016 Highlights

- Earnings per diluted share of

$4.20;

- Free cash flow of $376 million,

resulting in free cash flow conversion of 199%, as defined

herein;

- Net sales of $2.11 billion;

- Operating income of $308 million, down

1% as compared with the prior year, or up 6% as compared with 2015

pro forma results, as defined herein;

- Operating margin of 14.6%, up 50 basis

points as compared with the prior year, or up 130 basis points as

compared with 2015 pro forma results, as defined herein;

- Backlog of $2.0 billion increased 1%

from December 31, 2015; and

- Share repurchase of approximately $100

million or 1.2 million shares.

“We concluded the year with a solid fourth quarter performance,

reporting a 20% increase in operating income on essentially flat

sales, when compared with our 2015 pro forma results,” said David

C. Adams, Chairman and CEO of Curtiss-Wright Corporation. “Further,

we produced very strong free cash flow driven by a significant

reduction in working capital, and robust operating margin of 18.8%

that was driven by increased profitability on our defense

electronics products, solid margins on the AP1000 program, and the

benefit of our ongoing margin improvement initiatives.”

“We continue to deliver on our long-term strategy of delivering

solid operating margin expansion and free cash flow generation.

Full-year 2016 operating margin of 14.6% represents an increase of

130 basis points, when compared with our 2015 pro forma results,

demonstrating the benefits of our ongoing margin improvement

initiatives, particularly our segment consolidation activities, as

well as the strong profitability associated with the AP1000

program. As a result of this excellent performance, we achieved our

target to reach the top quartile of our peer group for operating

margin expansion. In addition, we significantly exceeded

expectations with a record $376 million in free cash flow in 2016,

as we efficiently reduced working capital and produced strong free

cash flow during the fourth quarter.”

“For 2017, we expect an improved sales performance, led by

continued solid growth in our defense markets supplemented by the

benefit of our recent acquisition of Teletronics Technology

Corporation (TTC), partially offset by ongoing industry challenges

impacting several of our commercial markets. We remain extremely

focused on driving increased operational efficiencies to help

mitigate top-line headwinds, while also continuing to invest in our

future growth, as we continue our drive for top-quartile financial

performance to generate significant value for our

shareholders.”

Fourth Quarter 2016 Operating Results

from Continuing Operations

(In thousands)

4Q-2016

4Q-2015

Chg vs. 2015

Reported

Chg vs. 2015

Pro Forma*

Sales $ 565,566 $ 588,755 (4%) Flat Operating income 106,173

108,527 (2%) 20% Operating margin 18.8 % 18.4% 40 bps 320 bps

*2015 Pro Forma results exclude the one-time China AP1000

fee of $20 million recognized as revenue and operating income in

the fourth quarter of 2015. This affected the Power segment and

total Curtiss-Wright.

Sales

Sales of $566 million in the fourth quarter decreased $23

million, or 4%, compared with the prior year, primarily reflecting

a $17 million, or 3%, decrease in organic sales, as well as $6

million, or 1%, in unfavorable foreign currency translation. These

results primarily reflect the timing of AP1000 revenue in the Power

segment, as the prior year period included the aforementioned

one-time AP1000 fee. Elsewhere, continued lower demand in the

energy sector within the Commercial/Industrial segment was

partially offset by higher aerospace and ground defense sales in

the Defense segment.

Meanwhile, excluding the aforementioned one-time AP1000 fee,

fourth quarter 2016 sales were essentially flat compared with 2015

pro forma results.

From an end market perspective, sales to the defense markets

increased 4%, while sales to the commercial markets decreased 8%,

compared with the prior year. Please refer to the accompanying

tables for a breakdown of sales by end market.

Operating Income

Operating income in the fourth quarter was $106 million, a

decrease of $2 million, or 2%, compared with the prior year. These

results reflect lower operating income on the AP1000 program in the

Power segment, partially offset by improved efficiency in the

Commercial/Industrial segment, despite lower sales, and higher

profitability on our electronics products in the Defense

segment.

Operating margin was 18.8%, an increase of 40 basis points over

the prior year, reflecting the benefits of our ongoing margin

improvement initiatives, despite lower sales.

Excluding the aforementioned one-time AP1000 fee, fourth quarter

2016 operating income increased 20%, while operating margin

improved 320 basis points to 18.8%, compared with 2015 pro forma

results.

Non-segment Expense

Non-segment expenses increased by $2 million compared with the

prior year, principally due to higher corporate expenses.

Net Earnings

Fourth quarter net earnings were flat compared with the prior

year, as lower operating income and higher interest expense were

mainly offset by lower taxes. Our effective tax rate for the

current quarter was 26.3%, a decrease from 28.8% in the prior year,

principally driven by reduction of unrecognized tax benefits and a

reversal of certain valuation allowances offset by lower research

and development credits.

Free Cash Flow

(In thousands)

4Q-2016

4Q-2015 Net cash provided by operating activities $ 155,985

$ 167,170 Capital expenditures (20,649 ) (11,664 )

Free cash flow $ 135,336 $ 155,506

Free cash flow, defined as cash flow from operations less

capital expenditures, was $135 million for the fourth quarter of

2016, a decrease of $20 million compared with the prior year. Net

cash provided by operating activities decreased $11 million to $156

million, primarily due to higher tax payments, partially offset by

improved working capital. Capital expenditures increased by $9

million to $21 million, due to increased investment in a facility

expansion in the Commercial/Industrial segment.

New Orders and Backlog

New orders of $497 million in the fourth quarter decreased 47%

as the prior year period included the receipt of a significant

AP1000 order within the Power segment. Excluding that impact, new

orders increased 5% compared with the prior year. Backlog of $2.0

billion increased 1% from December 31, 2015, primarily due to

growth in the naval defense businesses.

Other Items – Share Repurchase

During the fourth quarter, the Company repurchased 265,900

shares of its common stock for approximately $25 million. For

full-year 2016, the Company repurchased 1.2 million shares of its

common stock for approximately $100 million.

Full-Year 2017 Guidance

The Company is issuing its full-year 2017 financial guidance as

follows:

2016

Reported

2017 Guidance

(Including

TTC)

Total sales $2.11 billion $2.17 - $2.21 billion Operating income

$308 million $316 - $325 million Operating margin 14.6% 14.6% -

14.7% Interest expense $41 million $40 - $41 million Diluted

earnings per share $4.20 $4.30 - $4.40 Diluted shares outstanding

45.0 million 44.9 million Free cash flow $376 million $260 - $280

million

Notes:

- Full-year 2017 guidance includes the

acquisition of TTC, which adds $65 million in sales to the Defense

segment, and is breakeven on operating income and earnings per

share, including purchase accounting costs.

- A more detailed breakdown of the

Company’s 2017 guidance by segment and by market can be found in

the accompanying schedules.

Fourth Quarter 2016 Segment

Performance

Commercial/Industrial

(In thousands)

4Q-2016

4Q-2015 Change Sales $ 278,346 $

289,882 (4%) Operating income 48,474 42,724 13% Operating margin

17.4% 14.7% 270 bps

Sales for the fourth quarter were $278 million, a decrease of

$12 million, or 4%, over the prior year. Organic sales decreased

2%, excluding $5 million in unfavorable foreign currency

translation. In the general industrial market, we experienced

continued lower sales of severe-service valves serving the energy

markets. We also experienced declines in the commercial aerospace

market, primarily due to reduced sales of surface treatment

services as well as lower sales to Boeing. In the naval defense

market, we experienced higher valve revenues supporting the initial

ramp-up on the new CVN-80 aircraft carrier program.

Operating income in the fourth quarter was $49 million, up 13%

from the prior year, while operating margin improved 270 basis

points to 17.4%. The increase in operating income and margin

primarily reflects higher sales and improved profitability for

industrial vehicle products driven by our ongoing margin

improvement initiatives. We also experienced higher profitability

for sensors and controls products, despite lower sales, due to

ongoing margin improvement initiatives. This performance was

partially offset by lower profitability for surface treatment

services, based on lower sales. In addition, favorable foreign

currency translation added $1 million to current quarter operating

income.

Defense

(In thousands)

4Q-2016

4Q-2015 Change Sales $ 133,353 $

126,818 5% Operating income 34,015 31,000 10% Operating margin

25.5% 24.4% 110 bps

Sales for the fourth quarter were $133 million, an increase of

$7 million, or 5%, from the prior year. Organic sales increased 6%

from the prior year, excluding approximately $1 million in

unfavorable foreign currency translation. In the aerospace defense

market, we experienced higher sales of embedded computing products

on various helicopter and Intelligence, Surveillance and

Reconnaissance (ISR) programs. In the ground defense market, our

results reflect higher sales of our turret drive stabilization

systems for armored tanks to international customers. These

increases were partially offset by lower naval defense market sales

of helicopter handling systems on the DDG-51 program.

Operating income in the fourth quarter was $34 million, an

increase of $3 million, or 10%, compared with the prior year, while

operating margin increased 110 basis points to 25.5%. These

improvements in operating income and margin were driven primarily

by higher sales and favorable mix for our defense electronics

products, as well as the benefits of our ongoing margin improvement

initiatives. Favorable foreign currency translation added

approximately $1 million to current quarter operating income.

Power

(In thousands)

4Q-2016

4Q-2015 Change Sales $ 153,867 $

172,055 (11%) Operating income 31,600 40,476 (22%) Operating margin

20.5% 23.5% (300 bps)

Sales for the fourth quarter were $154 million, a decrease of

$18 million, or 11%, from the prior year. These results primarily

reflect the timing of AP1000 revenue within the power generation

market, as the prior year period included the aforementioned

one-time AP1000 fee. Excluding that impact, sales were up 1%

compared with 2015 pro forma results, as higher AP1000 production

revenues mainly offset lower aftermarket sales supporting currently

operating nuclear reactors. Naval defense market sales were flat,

as higher revenues for pumps and generators, most notably

supporting the ramp-up on the new Ohio-class replacement submarine

program, were offset by lower revenues on the CVN-79 aircraft

carrier program as production is nearing completion, and the

Virginia-class submarine program, based on the timing of

production.

Operating income in the fourth quarter was $32 million, a

decrease of $9 million, or 22%, compared with the prior year, while

operating margin decreased 300 basis points to 20.5%. These results

primarily reflect lower profitability on the AP1000 program, as the

prior year period included the aforementioned one-time AP1000 fee.

Excluding that impact, operating income increased 54%, while

operating margin improved 700 basis points to 20.5%, compared with

2015 pro forma results. This performance was primarily driven by

higher AP1000 production volumes, as well as improved profitability

in the aftermarket power generation business, despite relatively

flat sales.

Conference Call & Webcast

Information

The Company will host a conference call to discuss fourth

quarter and full-year 2016 financial results and expectations for

2017 guidance at 9:00 a.m. EST on Thursday, February 16, 2017. A

live webcast of the call and the accompanying financial

presentation will be made available on the internet by visiting the

Investor Relations section of the Company’s website at www.curtisswright.com.

(Tables to Follow)

CURTISS-WRIGHT CORPORATION and

SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS

(UNAUDITED) ($'s in thousands, except per share data)

Three Months

Ended Year Ended December 31, Change

December 31, Change 2016 2015 $

% 2016 2015 $

% Product sales $ 470,211 $ 483,512 $ (13,301 ) (3%)

$ 1,714,358 $ 1,796,802 $ (82,444 ) (5%) Service sales 95,355

105,243 (9,888 ) (9%) 394,573 408,881

(14,308 ) (3%) Total net sales 565,566 588,755 (23,189 ) (4%)

2,108,931 2,205,683 (96,752 ) (4%) Cost of product sales

294,195 291,895 2,300 1% 1,100,287 1,156,596 (56,309 ) (5%) Cost of

service sales 62,646 72,546 (9,900 ) (14%) 258,161

265,832 (7,671 ) (3%) Total cost of sales 356,841

364,441 (7,600 ) (2%) 1,358,448 1,422,428 (63,980 ) (4%)

Gross profit 208,725 224,314 (15,589 ) (7%) 750,483 783,255 (32,772

) (4%) Research and development expenses 14,125 15,204

(1,079 ) (7%) 58,592 60,837 (2,245 ) (4%) Selling expenses 26,203

31,042 (4,839 ) (16%) 111,228 121,482 (10,254 ) (8%) General and

administrative expenses 62,224 69,541 (7,317 ) (11%)

272,565 290,319 (17,754 ) (6%) Operating

income 106,173 108,527 (2,354 ) (2%) 308,098 310,617 (2,519 ) (1%)

Interest expense 10,554 9,085 1,469 16% 41,248 36,038 5,210

14% Other income, net 293 10 283 NM 1,111

615 496 NM Earnings before income taxes

95,912 99,452 (3,540 ) (4%) 267,961 275,194 (7,233 ) (3%) Provision

for income taxes (25,244 ) (28,690 ) 3,446 (12%) (78,579 )

(82,946 ) 4,367 (5%) Earnings from continuing operations $

70,668 $ 70,762 $ (94 ) 0% $ 189,382 $ 192,248

$ (2,866 ) (1%) Loss from discontinued operations,

net of tax (2,053 ) (913 ) (1,140 ) NM (2,053 ) (46,787 ) 44,734 NM

Net earnings $ 68,615

$ 69,849 $ (1,234 ) (2%) $ 187,329 $ 145,461

$ 41,868 29% Basic earnings per share Earnings

from continuing operations $ 1.60 $ 1.56 $ 4.27 $ 4.12 Earnings

from discontinued operations (0.05 ) (0.02 ) (0.05 ) (1.00 ) Total

$ 1.55 $ 1.54 $ 4.22 $ 3.12

Diluted earnings per share Earnings from continuing operations $

1.58 $ 1.53 $ 4.20 $ 4.04 Earnings from discontinued operations

(0.05 ) (0.02 ) (0.05 ) (0.99 ) Total $ 1.53 $ 1.51 $

4.15 $ 3.05 Dividends per share $ 0.13

$ 0.13 $ 0.52 $ 0.52 Weighted

average shares outstanding: Basic 44,173 45,245 44,389 46,624

Diluted 44,783 46,143 45,045 47,616

NM- not

meaningful

CURTISS-WRIGHT CORPORATION and

SUBSIDIARIES CONDENSED CONSOLIDATED BALANCE SHEETS

(UNAUDITED) ($'s in thousands, except par value)

December 31, December

31, Change 2016 2015 %

Assets Current assets: Cash and cash equivalents $ 553,848 $

288,697 92% Receivables, net 463,062 566,289 (18%) Inventories

366,974 379,591 (3%) Other current assets 30,927 40,306

(23%) Total current assets 1,414,811 1,274,883

11% Property, plant, and equipment, net 388,903 413,644 (6%)

Goodwill 951,057 972,606 (2%) Other intangible assets, net 271,461

310,763 (13%) Other assets 11,549 17,715 (35%)

Total assets $ 3,037,781 $

2,989,611

2%

Liabilities Current liabilities: Current portion of

long-term and short term debt $ 150,668 $ 1,259 NM Accounts payable

177,911 163,286 9% Accrued expenses 130,239 131,863 (1%) Income

taxes payable 18,274 7,956 130% Deferred revenue 170,143 181,671

(6%) Other current liabilities 28,027 37,190 (25%)

Total current liabilities 675,262 523,225 29%

Long-term debt, net 815,630 951,946 (14%) Deferred tax liabilities,

net 49,722 54,447 (9%) Accrued pension and other postretirement

benefit costs 107,151 103,723 3% Long-term portion of environmental

reserves 14,024 14,017 0% Other liabilities 84,801 86,830

(2%) Total liabilities 1,746,590 1,734,188 1%

Stockholders' equity Common stock, $1 par value $

49,187 $ 49,190 0% Additional paid in capital 129,483 144,923 (11%)

Retained earnings 1,754,907 1,590,645 10% Accumulated other

comprehensive loss (291,756 ) (225,928 ) 29% Less: cost of treasury

stock (350,630 ) (303,407 ) 16% Total stockholders' equity

1,291,191 1,255,423 3%

Total

liabilities and stockholders' equity $ 3,037,781

$ 2,989,611

2%

NM- not meaningful

CURTISS-WRIGHT CORPORATION and

SUBSIDIARIES SEGMENT INFORMATION (UNAUDITED) ($'s in

thousands)

Three Months Ended

Year Ended December 31, December 31,

Change Change 2016 2015 %

2016 2015 %

Sales:

Commercial/Industrial $ 278,346 $ 289,882 (4 %) $ 1,118,768 $

1,184,791 (6 %) Defense 133,353 126,818 5 % 466,654 477,413 (2 %)

Power 153,867 172,055 (11 %) 523,509 543,479 (4 %)

Total sales $ 565,566 $ 588,755

(4 %) $ 2,108,931 $

2,205,683 (4 %)

Operating income

(expense):

Commercial/Industrial $ 48,474 $ 42,724 13 % $ 156,550 $ 171,525 (9

%) Defense 34,015 31,000 10 % 98,291 98,895 (1 %) Power 31,600

40,476 (22 %) 76,472 74,987 2 %

Total segments

$ 114,089 $ 114,200

0

%

$ 331,313 $ 345,407

(4

%)

Corporate and other (7,916) (5,673) (40 %) (23,215) (34,790) 33 %

Total operating income $ 106,173

$ 108,527 (2 %) $ 308,098

$ 310,617 (1 %)

Operating

margins:

Commercial/Industrial 17.4% 14.7% 14.0% 14.5% Defense 25.5% 24.4%

21.1% 20.7% Power 20.5% 23.5% 14.6% 13.8%

Total

Curtiss-Wright 18.8% 18.4% 14.6%

14.1% Segment margins 20.2% 19.4% 15.7% 15.7%

CURTISS-WRIGHT CORPORATION and

SUBSIDIARIES SALES BY END MARKET (UNAUDITED) ($'s in

thousands)

Three Months Ended

Year Ended December 31, December 31,

Change Change 2016 2015 %

2016 2015 % Defense markets: Aerospace

$ 79,857 $ 75,656 6 % $ 296,287 $ 304,521 (3 %) Ground 25,626

24,307 5 % 84,280 85,722 (2 %) Naval 104,610 103,813 1 % 401,279

388,686 3 % Other 3,699 2,140 73 % 11,884 8,340 42 %

Total

Defense $ 213,792 $ 205,916

4 % $ 793,730 $ 787,269

1 % Commercial markets: Aerospace $

98,206 $ 103,985 (6 %) $ 397,258 $ 398,529 0 % Power Generation

123,345 141,547 (13 %) 408,376 436,396 (6 %) General Industrial

130,223 137,307 (5 %) 509,567 583,489 (13 %)

Total

Commercial $ 351,774 $ 382,839

(8 %) $ 1,315,201 $

1,418,414 (7 %)

Total Curtiss-Wright $ 565,566 $

588,755 (4 %) $ 2,108,931

$ 2,205,683 (4 %)

Use of Non-GAAP Financial Information (Unaudited)

The Corporation supplements its financial information determined

under U.S. generally accepted accounting principles (GAAP) with

certain non-GAAP financial information. Curtiss-Wright believes

that these non-GAAP measures provide investors with additional

insight into the Company’s ongoing business performance. These

non-GAAP measures should not be considered in isolation or as a

substitute for the related GAAP measures, and other companies may

define such measures differently. Curtiss-Wright encourages

investors to review its financial statements and publicly-filed

reports in their entirety and not to rely on any single financial

measure. The following definitions are provided:

Organic Revenue and Organic Operating

Income

The Corporation discloses organic revenue and organic operating

income because the Corporation believes it provides investors with

insight as to the Company’s ongoing business performance. Organic

revenue and organic operating income are defined as revenue and

operating income excluding the impact of foreign currency

fluctuations and contributions from acquisitions made during the

last twelve months.

Three Months Ended December

31, 2016 vs. 2015 Commercial/Industrial

Defense Power Total

Curtiss-Wright Sales

Operating

income

Sales

Operating

income

Sales

Operating

income

Sales

Operating

income

Organic (2 %) 12 % 6 % 7 % (11 %) (22 %) (3 %) (3 %) Acquisitions 0

% 0 % 0 % 0 % 0 % 0 % 0 % 0 % Foreign Currency (2 %) 1 % (1 %) 3 %

0 % 0 % (1 %) 1 % Total (4 %) 13 % 5 % 10 % (11 %) (22 %) (4 %) (2

%)

Year Ended December 31, 2016 vs.

2015 Commercial/Industrial Defense Power

Total Curtiss-Wright Sales

Operating

income

Sales

Operating

income

Sales

Operating

income

Sales

Operating

income

Organic (5 %) (11 %) (1 %) (6 %) (4 %) 2 % (4 %) (4 %) Acquisitions

0 % 0 % 0 % 0 % 0 % 0 % 0 % 0 % Foreign Currency (1 %) 2 % (1 %) 5

% 0 % 0 % 0 % 3 % Total (6 %) (9 %) (2 %) (1 %) (4 %) 2 % (4 %) (1

%)

Free Cash Flow and Free Cash Flow

Conversion

The Corporation discloses free cash flow because it measures

cash flow available for investing and financing activities. Free

cash flow represents cash available to repay outstanding debt,

invest in the business, acquire businesses, return capital to

shareholders and make other strategic investments. Free cash flow

is defined as cash flow provided by operating activities less

capital expenditures. The Corporation discloses free cash flow

conversion because it measures the proportion of net earnings

converted into free cash flow and is defined as free cash flow

divided by net earnings from continuing operations.

CURTISS-WRIGHT CORPORATION and

SUBSIDIARIES NON-GAAP FINANCIAL DATA (UNAUDITED) ($'s in

thousands)

Three Months Ended Year Ended December

31, December 31, 2016 2015 2016

2015 Net cash provided by operating activities $

155,985 $ 167,170 $ 423,197 $ 162,479 Capital expenditures (20,649

) (11,664 ) (46,776 ) (35,512 ) Free cash flow $ 135,336 $

155,506 $ 376,421 $ 126,967 Pension

Payment — — — 145,000 Adjusted free

cash flow $ 135,336 $ 155,506 $ 376,421 $

271,967 Free Cash Flow Conversion 192 % 220 % 199 %

141 %

CURTISS-WRIGHT CORPORATION 2017

Guidance (from Continuing Operations) As of February 15,

2017 ($'s in millions, except per share data)

2017 Guidance (2)

2015

Reported

2015 Pro

Forma (1)

2016

Reported

(Including

TTC)

Low High

Sales:

Commercial/Industrial $ 1,185 $ 1,185 $ 1,119 $ 1,100 $ 1,120

Defense 477 477 467 540 550 Power 543 523 524

525 535

Total sales $ 2,206

$ 2,186 $ 2,109 $ 2,165

$ 2,205

Operating

income:

Commercial/Industrial $ 172 $ 172 $ 157 $ 158 $ 163 Defense 99 99

98 103 106 Power 75 55 76 77 79

Total segments 345 325 331 337

347 Corporate and other (35 ) (35 ) (23 ) (21 ) (23 )

Total operating income $ 311 $

291 $ 308 $ 316

$ 325 Interest expense $ 36 $ 36

$ 41 $ 40 $ 41

Earnings before income taxes 275

255 268 278 284 Provision for income

taxes (83 ) (77 ) (79 ) (85 ) (87 )

Net earnings $

192 $ 178 $ 189

$ 193 $ 197

Reported diluted earnings per share $ 4.04

$ 3.74 $ 4.20 $ 4.30

$ 4.40 Diluted shares outstanding 47.6 47.6 45.0 44.9

44.9 Effective tax rate 30.1 % 30.1 % 29.3 % 30.5 % 30.5 %

Operating

margins:

Commercial/Industrial 14.5 % 14.5 % 14.0 % 14.3 % 14.5 % Defense

20.7 % 20.7 % 21.1 % 19.0 % 19.2 % Power 13.8 % 10.5 % 14.6 % 14.6

% 14.7 %

Total operating margin 14.1 %

13.3 % 14.6 % 14.6 %

14.7 % Notes: Full year

amounts may not add due to rounding (1) Our 2015 Pro

Forma results exclude the one-time China AP1000 fee of $20 million

recognized as revenue and operating income in the fourth quarter of

2015, as we believe that the removal more accurately reflects our

core operations and provides a more comprehensive understanding of

our financial results. This affects the Power segment and Total

Curtiss-Wright. (2) Full-year 2017 guidance includes

the acquisition of TTC, which adds $65 million in sales to the

Defense segment, and is breakeven on operating income and earnings

per share, including purchase accounting costs.

CURTISS-WRIGHT CORPORATION 2017 Sales Growth

Guidance by End Market (from Continuing Operations) As of

February 15, 2017 2017 % Change vs

2016 (Including TTC)

Defense

Markets

Aerospace 28 - 30% Ground (4 - 6%) Navy (3 - 5%)

Total

Defense 7 to 9% (Including Other Defense)

Commercial

Markets

Commercial Aerospace Flat Power Generation 3 - 5% General

Industrial (1 - 3%)

Total Commercial 0 to 2%

Total Curtiss-Wright Sales 3 to 5%

Notes: Full year amounts may not add due to

rounding. Full-year 2017 guidance includes the

acquisition of TTC, which adds $65 million in sales, primarily to

the aerospace defense market and to a lesser extent to the

commercial aerospace market.

About Curtiss-Wright Corporation

Curtiss-Wright Corporation (NYSE: CW) is a global innovative

company that delivers highly engineered, critical function products

and services to the commercial, industrial, defense and energy

markets. Building on the heritage of Glenn Curtiss and the Wright

brothers, Curtiss-Wright has a long tradition of providing reliable

solutions through trusted customer relationships. The company

employs approximately 8,000 people worldwide. For more information,

visit www.curtisswright.com.

Certain statements made in this press release, including

statements about future revenue, financial performance guidance,

quarterly and annual revenue, net income, operating income growth,

future business opportunities, cost saving initiatives, the

successful integration of the Company’s acquisitions, and future

cash flow from operations, are forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements present management's expectations, beliefs,

plans and objectives regarding future financial performance, and

assumptions or judgments concerning such performance. Any

discussions contained in this press release, except to the extent

that they contain historical facts, are forward-looking and

accordingly involve estimates, assumptions, judgments and

uncertainties. Such forward-looking statements are subject to

certain risks and uncertainties that could cause actual results to

differ materially from those expressed or implied. Readers are

cautioned not to place undue reliance on these forward-looking

statements, which speak only as of the date hereof. Such risks and

uncertainties include, but are not limited to: a reduction in

anticipated orders; an economic downturn; changes in the

competitive marketplace and/or customer requirements; a change in

government spending; an inability to perform customer contracts at

anticipated cost levels; and other factors that generally affect

the business of aerospace, defense contracting, electronics,

marine, and industrial companies. Such factors are detailed in the

Company's Annual Report on Form 10-K for the fiscal year ended

December 31, 2015, and subsequent reports filed with the Securities

and Exchange Commission.

This press release and additional information are available at

www.curtisswright.com.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170215006260/en/

Curtiss-Wright CorporationJim Ryan,

704-869-4621Jim.Ryan@curtisswright.com

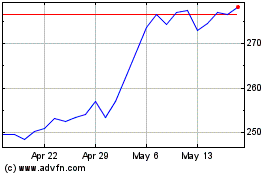

Curtiss Wright (NYSE:CW)

Historical Stock Chart

From Nov 2024 to Dec 2024

Curtiss Wright (NYSE:CW)

Historical Stock Chart

From Dec 2023 to Dec 2024