UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

FOR ANNUAL REPORTS OF EMPLOYEE STOCK PURCHASE, SAVINGS

AND SIMILAR PLANS PURSUANT TO SECTION 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

|

|

|

|

|

þ

|

|

ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended

December 31, 2018

OR

|

|

|

|

|

|

|

|

|

|

|

o

|

|

TRANSITION REPORT PURSUANT TO 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from ______ to ______

Commission file number

1-4879

DIEBOLD, INCORPORATED 401(k) SAVINGS PLAN FOR PUERTO RICO ASSOCIATES

(Full title of the plan)

Diebold Nixdorf, Incorporated, 5995 Mayfair Road PO Box 3077, North Canton, Ohio 44720-8077

(Name of issuer of the securities held by the plan and the address of its principal executive office)

DIEBOLD, INCORPORATED 401(k) SAVINGS PLAN FOR PUERTO RICO ASSOCIATES

Annual Report Index

December 31, 2018 and 2017

The following unaudited financial statements and other information of Diebold, Incorporated 401(k) Savings Plan for Puerto Rico Associates are included herewith:

|

|

|

|

•

|

Statements of Net Assets Available for Benefits as of

December 31, 2018

and

2017

;

|

|

|

|

|

•

|

Statement of Changes in Net Assets Available for Benefits for the year ended

December 31, 2018

; and

|

|

|

|

|

•

|

Notes to Financial Statements

|

The following supplemental schedule of Diebold, Incorporated 401(k) Savings Plan for Puerto Rico Associates included in the Annual Report of the Plan on Form 5500 filed with the Department of Labor as of

December 31, 2018

is included herewith:

|

|

|

|

•

|

Schedule H, Line 4i - Schedule of Assets (Held at End of Year) as of

December 31, 2018

|

All other supplemental schedules and notes for which provision is made in the applicable rules and regulations of the Department of Labor Regulations are not required under the related instructions or are inapplicable and, therefore, have been omitted.

DIEBOLD, INCORPORATED 401(k) SAVINGS PLAN FOR PUERTO RICO ASSOCIATES

Table of Contents

DIEBOLD, INCORPORATED 401(k) SAVINGS PLAN FOR PUERTO RICO ASSOCIATES

Required Information

The Diebold, Incorporated 401(k) Savings Plan for Puerto Rico Associates (the Plan) is subject to the requirements of the Employee Retirement Security Act of 1974 (ERISA). The following financial statements and schedule of the Plan have been prepared in accordance with the financial reporting requirements of ERISA under 29 CFR 2520.104-41. The financial statements and schedule are unaudited as the Plan has claimed a waiver of the annual examination and report of an independent qualified accountant under 29 CFR 2520.104-46.

DIEBOLD, INCORPORATED 401(k) SAVINGS PLAN FOR PUERTO RICO ASSOCIATES

Statements of Net Assets Available for Benefits

December 31, 2018 and 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31,

|

|

|

|

2018

|

|

2017

|

|

|

|

(Unaudited)

|

|

(Unaudited)

|

|

Assets

|

|

|

|

|

|

Investments, at fair value

|

|

$

|

664,318

|

|

|

$

|

698,399

|

|

|

Fully benefit-responsive investment contracts, at contract value

|

|

376,585

|

|

|

291,356

|

|

|

Receivables

|

|

|

|

|

|

Notes receivable - participants

|

|

61,959

|

|

|

71,391

|

|

|

Contribution receivable - participants

|

|

1,262

|

|

|

1,111

|

|

|

Contribution receivable - employer

|

|

558

|

|

|

516

|

|

|

Total receivables

|

|

63,779

|

|

|

73,018

|

|

|

Net assets available for benefits

|

|

$

|

1,104,682

|

|

|

$

|

1,062,773

|

|

See accompanying notes to financial statements.

DIEBOLD, INCORPORATED 401(k) SAVINGS PLAN FOR PUERTO RICO ASSOCIATES

Statement of Changes in Net Assets Available for Benefits

For the year ended December 31, 2018

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Unaudited)

|

|

Additions

|

|

|

|

Interest and dividends

|

|

$

|

30,065

|

|

|

Interest income, notes receivable - participants

|

|

2,752

|

|

|

|

|

|

|

Contributions

|

|

|

|

Participants

|

|

60,615

|

|

|

Employer

|

|

29,020

|

|

|

Total contributions

|

|

89,635

|

|

|

Total additions

|

|

122,452

|

|

|

|

|

|

|

Deductions

|

|

|

|

Net depreciation of investments

|

|

79,956

|

|

|

Administrative expenses

|

|

587

|

|

|

Total deductions

|

|

80,543

|

|

|

Net increase during the year

|

|

41,909

|

|

|

|

|

|

|

Net assets available for benefits

|

|

|

|

Beginning of year

|

|

1,062,773

|

|

|

End of year

|

|

$

|

1,104,682

|

|

See accompanying notes to financial statements.

DIEBOLD, INCORPORATED 401(k) SAVINGS PLAN FOR PUERTO RICO ASSOCIATES

Notes to Financial Statements (UNAUDITED)

December 31, 2018 and 2017

(1)

Description of the Plan

The following brief description of the Diebold, Incorporated 401(k) Savings Plan for Puerto Rico Associates (the Plan), provides only general information. Participants should refer to the Plan document for a more complete description of the Plan's provisions.

(a)

General

Effective October 1, 2008, the Plan was established for the exclusive benefit of the employees of Diebold Nixdorf, Incorporated (the Employer, the Company or Diebold Nixdorf) who reside in Puerto Rico. The Plan is subject to certain provisions of the Employee Retirement Security Act of 1974 (ERISA).

(b)

Contributions

The Plan allowed each participant to voluntarily contribute from one to fifty percent (in one percent increments) of pre-tax compensation, but not in excess of the maximum amount permitted by the Puerto Rico Internal Revenue Code of 1994, as amended. The Employer match is set by the Employer's Board of Directors and is evaluated at least annually.

(c)

Participants' Accounts

Each participant directs his or her contributions, as well as any Employer matching contributions, into any of several investment funds within the Plan with a minimum investment in any fund of one percent. Participants' accounts are valued on a daily basis. The Plan utilizes cash equivalents to temporarily hold monies pending settlement for transactions initiated by a participant, contributions received not yet allocated or the value of any distributions payable from the trust.

(d)

Vesting

All participant's pre-tax contributions and earnings are immediately vested and non-forfeitable. For employees hired before July 1, 2003, the Employer's contributions and earnings are immediately vested and non-forfeitable. For employees hired on or after July 1, 2003, the Employer's contributions and earnings are vested in accordance with the following schedule: less than three years service, zero percent; three or more years of service, 100 percent.

(e)

Distribution of Benefits

Upon termination of service with the Employer or a participating affiliate, a participant may elect to receive his or her total vested account balance in a lump sum payment, defer receipt until his/her retirement date, or make a direct rollover to a qualified plan if such total account balance exceeds $5,000. If the vested account balance does not exceed $5,000, the participant may elect to receive his or her total account balance in a lump sum payment or make a direct rollover to a qualified plan. If the account balance is greater than $1,000 and the participant does not elect one of the noted options, the Plan administrator (the Administrator) will pay the distribution in a direct rollover to the individual retirement annuity plan designated by the Administrator. If the account balance is $1,000 or less and the participant does not make a distribution election, the funds are distributed in the form of a cash lump sum. The Administrator or its designee shall make such determination on a periodic basis, at least annually. For any funds invested in the Diebold Nixdorf Company Stock Fund, the participant may make an election to receive cash or the Employer's common shares.

(f)

Notes Receivable - Participants

Loan transactions are treated as transfers between the various funds and the Loan Fund. Under the terms of the Plan, active participants of the Plan may borrow against their total account balance except for their balance in the Retiree Medical Funding Account. The minimum amount of any loan is $1,000 and the maximum is $50,000 or 50 percent of a participant's current vested balance (in $100 increments), whichever is less. The loans are secured by the balance in the participant's account. Loan payments, which include principal and interest, are made through equal payroll deductions over the loan period of two to five years. The notes receivable from participants are measured at their unpaid principal balance plus any accrued but unpaid interest.

DIEBOLD, INCORPORATED 401(k) SAVINGS PLAN FOR PUERTO RICO ASSOCIATES

Notes to Financial Statements (UNAUDITED)

December 31, 2018 and 2017

A loan is considered to default on the last day of the cure period, which is the last day of the calendar quarter next following the calendar quarter in which payment is not made, if all amounts due and owing under the terms of the loan are not paid in full by such date. Upon default, the outstanding balance of the loan together with unpaid, accrued interest is deemed a lien against the total account maintained on behalf of the participant and no contributions or distributions of any kind may be thereafter made during default. In the event a payment is not made when due, the maturity date of the loan shall accelerate and the outstanding principal amount of the loan, together with all accrued interest, is immediately due and the Administrator deems the participant loan to be a taxable distribution.

(g)

Withdrawals

A financial hardship provision is available, enabling a participant to withdraw an amount to cover an immediate financial need, if certain criteria are met.

(h)

Expenses

All costs and expenses incident to the administration of the Plan are paid by the Administrator or, at the discretion of the Administrator, paid from the assets of the Plan, except for loan processing and administration fees associated with the Loan Fund, which are borne by the individual loan participants.

(i)

Forfeited Accounts

Forfeited accounts are used to reduce future employer contributions or administrative expenses.

(2)

Summary of Significant Accounting Policies

(a)

Basis of Presentation

The accompanying financial statements have been prepared on an accrual basis in accordance with accounting principles generally accepted in the United States of America (U.S. GAAP). The Administrator has evaluated subsequent events through the date the Plan financial statements are issued. There were no subsequent events that have occurred which would require adjustments to or disclosure in the Plan financial statements.

(b)

Recently Issued Accounting Guidance

In February 2017, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2017-06,

Plan Accounting: Defined Benefit Plan (Topic 960), Defined Contribution Pension Plans (Topic 962), Health and Welfare Benefit Plans (Topic 965): Employee Benefit Plan Master Trust Reporting

(ASU 2017-06) with the objective to clarify the presentation requirements for interests in master trusts and add requirements to make information presented more useful to the reader. The amendments in this update require that interests in master trusts and any change in interest to be presented as separate line items in the statement of net assets available for benefits and in the statement of changes in net assets available for benefits, respectively. The amendment supplements the existing requirement to disclose the master trust’s balances in each general type of investments by requiring the disclosure of the amount of interest in each of the general types of investments. The amendments also requires the disclosure of the master trust’s other asset and liability balances, and the plan’s interest in those balances. This guidance is effective for fiscal years beginning after December 15, 2018. The adoption of ASU 2017-06 is not expected to have a material impact on the financial statements of the Plan.

In August 2018, the FASB issued ASU 2018-13,

Fair Value Measurement (Topic 820): Disclosure Framework - Changes to the Disclosure Requirements for Fair Value Measurement

, which is part of the FASB disclosure framework project to improve the effectiveness of disclosures in the notes to the financial statements. The amendments in the new guidance remove, modify and add certain disclosure requirements related to fair value measurements covered in Topic 820,

Fair Value Measurement

. The new standard is effective for fiscal years, and interim periods within those fiscal years, beginning after December 15, 2019. Early adoption is permitted for either the entire standard or only the requirements that modify or eliminate the disclosure requirements, with certain requirements applied prospectively, and all other requirements applied retrospectively to all periods presented. The Company is currently evaluating the impact of adopting this guidance.

DIEBOLD, INCORPORATED 401(k) SAVINGS PLAN FOR PUERTO RICO ASSOCIATES

Notes to Financial Statements (UNAUDITED)

December 31, 2018 and 2017

(c)

Investment Valuation and Investment Income

The Plan's investments are stated at fair value as of the last business day of the Plan year, except for a fully benefit-responsive investment contracts (FBRIC) held by the Plan that is reported at contract value (see note 3). Shares of registered investment companies are valued at quoted market prices. The Plan holds cash and cash equivalents at year-end as a result of pending transactions, which are valued at the net asset value (NAV) of shares held by the Plan. The Plan's investment options include a collective investment trust of Diebold Nixdorf common shares in which the Company's defined contribution plans participate on a unit basis. Diebold Nixdorf common shares are traded on a national securities exchange and participation units in The Diebold Nixdorf Common Stock Fund are valued at the last reported sales price on the last business day of the plan year. The valuation per share of Diebold Nixdorf Company common shares was

$2.49

and

$16.35

at

December 31, 2018

and

2017

, respectively. The valuation per unit of The Diebold Nixdorf Stock Fund was

$0.92

and

$5.73

at

December 31, 2018

and

2017

, respectively.

Investment contracts held by a defined contribution plan are required to be reported at fair value, except for a FBRIC held by the Plan that is reported at contract value (see note 3). Contract value is the relevant measurement attribute for that portion of the net assets available for benefits of a defined contribution plan attributable to a FBRIC because contract value is the amount participants would receive if they were to initiate permitted transactions under the terms of the Plan.

Realized and unrealized gains and losses derived from investment activities are allocated among the individual accounts in proportion to their respective balances immediately preceding the valuation date and included in net appreciation of investments. Realized gains and losses are calculated as the difference between the historical cost and the market value at either the end of the Plan year or when sold.

(d)

Notes Receivable - Participants

Participant loans are classified as notes receivable - participants and are measured at their unpaid principal balance plus any accrued interest. No allowance for credit losses has been recorded as of

December 31, 2018

and

2017

.

Interest charged, which is based on the prime interest rate plus one percent as of the loan effective date, is determined by the Employer and had an interest rate ranging from

4.25

and

6.25

percent at

December 31, 2018

and ranging from 4.25 and 5.25 percent at December 31,

2017

.

(e)

Benefit Payments

Benefits are recorded when paid. Also in the event a participant loan payment is not made when due, the Administrator deems the participant loan to be a taxable distribution. Consequently, the participant loan balance is reduced and a benefit payment is recorded.

(f)

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets available for benefits and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of changes in assets available for benefits during the reporting period. Actual results could differ from those estimates.

(g)

Risks and Uncertainties

The Plan invests in various investment securities. Investment securities are exposed to various risks such as interest rate, market and credit risk. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants' account balances and the amounts reported in the Statements of Net Assets Available for Benefits.

(3)

Investments

All investments as of

December 31, 2018

and

2017

are participant-directed.

DIEBOLD, INCORPORATED 401(k) SAVINGS PLAN FOR PUERTO RICO ASSOCIATES

Notes to Financial Statements (UNAUDITED)

December 31, 2018 and 2017

At

December 31, 2018

and

2017

, the Plan has an interest in a fully benefit-responsive group annuity contract as part of the Invesco Stable Value Retirement Trust (the Invesco Trust) option established and maintained by Invesco National Trust Company (the Invesco Trustee), a national trust bank organized and existing under the laws of the United States.

The crediting rate of the contract resets every quarter based on the performance of the underlying investment portfolio. To the extent that the Invesco Trust has unrealized gains and losses (that are accounted for, under contract value accounting, through the value of the synthetic contract), the interest crediting rate may differ from then-current market rates. An investor currently redeeming Invesco units may forgo a benefit, or avoid a loss, related to a future crediting rate different from then-current market rates. Investments in mutual funds and bond trusts are valued at the net asset value of each fund or trust determined as of the close of the New York Stock Exchange (generally 4 p.m., Eastern time) on the valuation date.

Certain events limit the ability of the Plan to transact with the issuer at contract value. These events include, but are not limited to, partial or complete legal termination of the Invesco Trust or a unit holder, tax disqualification of the Invesco Trust or unit holder and certain Invesco Trust amendments if the issuer's consent is not obtained. As of

December 31, 2018

, the occurrence of an event outside the normal operation of the Invesco Trust that would cause a withdrawal from an investment contract is not considered to be probable.

In general, issuers may terminate the contract and settle at other than contract value if there is a change in the qualification status of participant, Employer or Plan, a breach of material obligations under the contract and misrepresentation by the contract holder or failure of the underlying portfolio to conform to the pre-established investment guidelines.

(4)

Fair Value Measurements

The fair value framework requires the categorization of assets and liabilities into three levels based upon the assumptions (inputs) used to value the assets or liabilities. Level 1 provides the most reliable measure of fair value, whereas level 3 generally requires significant management judgment. The three levels are defined as follows:

Level 1: Unadjusted quoted prices in active markets for identical assets or liabilities.

Level 2: Unadjusted quoted prices in active markets for similar assets or liabilities, unadjusted quoted prices for identical or similar assets or liabilities in markets that are not active or inputs, other than quoted prices in active markets, that are observable either directly or indirectly.

Level 3: Unobservable inputs for which there is little or no market data.

Investments measured at fair value on a recurring basis are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements Using

|

|

Fair Value at

|

|

|

|

Level 1

|

|

Level 2

|

|

December 31, 2018

|

|

Mutual funds

|

|

$

|

649,037

|

|

|

$

|

—

|

|

|

$

|

649,037

|

|

|

Common stock

|

|

|

|

|

|

|

|

Diebold Nixdorf Company Stock Fund

|

|

—

|

|

|

4,051

|

|

|

4,051

|

|

|

Total

|

|

$

|

649,037

|

|

|

$

|

4,051

|

|

|

$

|

653,088

|

|

|

|

|

|

|

|

|

|

|

Investments measured using NAV per share practical expedient

|

|

|

|

11,230

|

|

|

|

|

|

|

|

|

|

|

Total investments

|

|

|

|

|

|

|

$

|

664,318

|

|

DIEBOLD, INCORPORATED 401(k) SAVINGS PLAN FOR PUERTO RICO ASSOCIATES

Notes to Financial Statements (UNAUDITED)

December 31, 2018 and 2017

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair Value Measurements Using

|

|

Fair Value at

|

|

|

|

Level 1

|

|

Level 2

|

|

December 31, 2017

|

|

Mutual funds

|

|

$

|

630,380

|

|

|

$

|

—

|

|

|

$

|

630,680

|

|

|

Common stock

|

|

|

|

|

|

|

|

Diebold Nixdorf Company Stock Fund

|

|

—

|

|

|

60,774

|

|

|

60,774

|

|

|

Total

|

|

$

|

630,380

|

|

|

$

|

60,774

|

|

|

$

|

691,454

|

|

|

|

|

|

|

|

|

|

|

Investments measured using NAV per share practical expedient

|

|

|

|

6,945

|

|

|

|

|

|

|

|

|

|

|

Total investments

|

|

|

|

|

|

|

$

|

698,399

|

|

The classification of fair value measurements within the hierarchy is based upon the lowest level of input that is significant to the measurement. Investments that were measured at NAV per share are not classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the Plan's total investments at fair value. Valuation methodologies used for assets measured at fair value are as follows:

|

|

|

|

•

|

Cash, cash equivalents and mutual funds are valued at the NAV of shares held by the Plan at year end as determined by the closing price reported on the active market on which the individual securities are traded.

|

|

|

|

|

•

|

Stock fund is valued at the last reported share price of participation units held by the Plan at year end as determined by the closing price reported on the active market on which the individual securities are traded.

|

|

|

|

|

•

|

Common collective trusts are measured using the NAV per share practical expedient and are valued at the NAV of units held by the Plan at year-end. The common collective trust fund represents the Plan's investment in a collective fund for qualified plans that approximates the risk and return of the S&P Midcap 400 Index. The NAV, as provided by the trustee of the common collective trust, is used as a practical expedient to estimate fair value. The NAV is based on the fair value of the underlying investments held by the fund less its liabilities. This practical expedient would not be used when it is determined to be probable that the fund will sell the investment for an amount different that the reported NAV. Participant transaction (purchases and sales) may occur daily.

|

The methods described above may produce a fair value calculation that may not be indicative of the net realizable value or reflective of future fair values. Furthermore, while the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

During

December 31, 2018

and

2017

, there were no transfers between levels or changes in the methodologies used for assets measured at fair value.

(5)

Tax Status

The Department of the Treasury of Puerto Rico has determined and informed the Employer by a letter dated March 17, 2009, that the Plan and related trust are designed in accordance with applicable sections of the Puerto Rico Internal Revenue Code of 1994, as amended (Code). Although the Plan has been amended since receiving the letter, the Administrator believes that the Plan is designed and currently being operated in compliance with the applicable requirements of the Code. Therefore, no provision for income taxes has been included in the Plan's financial statements.

On January 1, 2011, Puerto Rico adopted a new tax code called the "Internal Revenue Code of a New Puerto Rico." This new Puerto Rico Code introduces numerous changes that affect employee benefits such as the Plan. The Company is working with Puerto Rico counsel to adopt all necessary provisions and filed a request in July 2014 with the Puerto Rico Treasury Department (Hacienda) as required. Due to the substantial backlog relating to request, the determination status of the Plan is pending.

DIEBOLD, INCORPORATED 401(k) SAVINGS PLAN FOR PUERTO RICO ASSOCIATES

Notes to Financial Statements (UNAUDITED)

December 31, 2018 and 2017

(6)

Plan Termination

Although it has not expressed any intent to do so, the Employer reserves the right at any time, by action of its Board of Directors, to terminate the Plan or discontinue contributions thereto. In the event of Plan termination, participants would become 100 percent vested in their Employer contributions.

(7)

Party-In-Interest Transactions

The Pending Settlement Fund is designed to temporarily hold monies pending settlement for transactions initiated by the participant. The Merrill Lynch Bank Deposit Program is designed to temporarily hold monies related to contributions received not yet allocated or the value of any distributions payable from the trust. The Diebold Nixdorf Company Stock Fund is designed primarily for investment in common shares of the Company.

Effective January 21, 2019, the Company match for the Plan was suspended.

DIEBOLD, INCORPORATED 401(K) SAVINGS PLAN FOR PUERTO RICO ASSOCIATES

Schedule H, Line 4i – Schedule of Assets (Held at End of Year)

December 31, 2018

EIN: 34-0183970

PLAN NUMBER: 015

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

(b)

|

(c)

|

|

(d)

|

(e)

|

|

|

Identity of Issue, Borrower,

Lessor, or Similar Party

|

Description of Investment including Maturity Date, Rate of Interest, Collateral, Par, or Maturity Value

|

Shares/Units

|

Cost

|

Current Value

|

|

|

American Balanced Fund

|

Registered Investment Company

|

14

|

|

**

|

$

|

347

|

|

|

|

Federated International Fund

|

Registered Investment Company

|

363

|

|

**

|

10,430

|

|

|

|

Invesco Diversified Fund

|

Registered Investment Company

|

4,388

|

|

**

|

76,665

|

|

|

|

Janus Triton Fund

|

Registered Investment Company

|

59

|

|

**

|

1,498

|

|

|

|

John Hancock Disciplined Fund

|

Registered Investment Company

|

160

|

|

**

|

2,802

|

|

|

|

Loomis Sayles Bond Fund

|

Registered Investment Company

|

7,170

|

|

**

|

92,425

|

|

|

|

Loomis Sayles Small Cap Value Fund

|

Registered Investment Company

|

112

|

|

**

|

2,721

|

|

|

|

Oppenheimer Developing Markets Fund

|

Registered Investment Company

|

148

|

|

**

|

5,582

|

|

|

|

T Rowe Price Blue Chip Growth Fund

|

Registered Investment Company

|

251

|

|

**

|

24,149

|

|

|

|

Vanguard Institutional Index

|

Registered Investment Company

|

1,013

|

|

**

|

230,560

|

|

|

|

Vanguard PRIMECAP Fund

|

Registered Investment Company

|

23

|

|

**

|

2,759

|

|

|

|

Vanguard Institutional Target Retirement 2015 Fund

|

Registered Investment Company

|

731

|

|

**

|

15,080

|

|

|

|

Vanguard Institutional Target Retirement 2020 Fund

|

Registered Investment Company

|

10

|

|

**

|

201

|

|

|

|

Vanguard Institutional Target Retirement 2025 Fund

|

Registered Investment Company

|

2

|

|

**

|

37

|

|

|

|

Vanguard Institutional Target Retirement 2030 Fund

|

Registered Investment Company

|

2,497

|

|

**

|

53,030

|

|

|

|

Vanguard Institutional Target Retirement 2035 Fund

|

Registered Investment Company

|

551

|

|

**

|

11,734

|

|

|

|

Vanguard Institutional Target Retirement 2040 Fund

|

Registered Investment Company

|

746

|

|

**

|

15,935

|

|

|

|

Vanguard Institutional Target Retirement 2045 Fund

|

Registered Investment Company

|

2,955

|

|

**

|

63,273

|

|

|

|

Vanguard Institutional Target Retirement 2050 Fund

|

Registered Investment Company

|

1,167

|

|

**

|

25,027

|

|

|

|

Vanguard Target Retirement 2055 Fund

|

Registered Investment Company

|

108

|

|

**

|

2,318

|

|

|

|

Vanguard Institutional Target Retirement Income Fund

|

Registered Investment Company

|

1

|

|

**

|

31

|

|

|

|

Vanguard Total Bond Market Index Fund

|

Registered Investment Company

|

1,189

|

|

**

|

12,433

|

|

|

|

Invesco Stable Value Retirement Trust

|

Common / Collective Trust

|

376,585

|

|

**

|

376,585

|

|

|

|

Northern Trust S&P 400 Index Fund

|

Common / Collective Trust

|

42

|

|

**

|

11,230

|

|

|

*

|

Diebold Nixdorf Company Stock Fund

|

Company Stock Fund

|

4,418

|

|

**

|

4,051

|

|

|

*

|

Participant Loans

|

2 – 5 years; 4.50% to 6.25%

|

—

|

|

—

|

61,959

|

|

|

|

|

|

|

|

$

|

1,102,862

|

|

* Party-in-interest

** Information not required pursuant to instructions to Form 5500 for participant-directed funds

Signatures

Diebold, Incorporated 401(k) Savings Plan for Puerto Rico Associates.

Pursuant to the requirements of the Securities Exchange Act of 1934, the Benefits Committee of Diebold Nixdorf, Incorporated, the Administrator of the Plan, has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

DIEBOLD, INCORPORATED 401(k) SAVINGS PLAN FOR PUERTO RICO ASSOCIATES

|

|

|

|

|

|

Date: June 28, 2019

|

|

By:

/s/ Jeffrey Rutherford

|

|

|

|

Jeffrey Rutherford

|

|

|

|

Senior Vice President and Chief Financial Officer

|

|

|

|

(Principal Financial Officer)

|

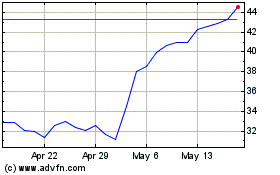

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Diebold Nixdorf (NYSE:DBD)

Historical Stock Chart

From Apr 2023 to Apr 2024