UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by

Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| x | Soliciting Material Pursuant to §240.14a-12 |

DESKTOP METAL, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per

Exchange Act Rules 14a-6(i)(1) and 0-11. |

The following is a transcript of a conference

call held by Desktop Metal, Inc. on July 31, 2024:

Desktop Metal, Inc.

Second Quarter 2024 Earnings Conference Call

Wednesday, July 31, 2024, 8:30 AM ET

CORPORATE PARTICIPANTS

Michael Jordan,

Vice President, Finance and Treasury

Ric Fulop,

Chief Executive Officer and Founder

Jason

Cole, Chief Financial Officer

C O R P O R A T E P A R T I

C I P A N T S

Michael Jordan,

Vice President, Finance and Treasury

Ric Fulop,

Chief Executive Officer and Founder

Jason Cole, Chief

Financial Officer

C O N F E R E N C E C A L L

P A R T I C I P A N T S

Danny Eggerichs,

Craig-Hallum Capital Group

P R E S E N T A T I O N

Operator

Greetings, and welcome to the Desktop Metal Second

Quarter 2024 Earnings Conference Call.

At this time, all participants are in a listen-only

mode. A brief question-and-answer session will follow the formal presentation. If anyone should require Operator assistance during the

conference, please press star, zero on your telephone keypad.

As a reminder, this conference is being recorded.

I will now turn over the call.

Michael Jordan

Good morning, and thank you for joining today’s

call.

With me today are Ric Fulop, Founder and CEO of

Desktop Metal, and Jason Cole, CFO of Desktop Metal.

Please note, our financial results press release

and presentation slides referred to on this call are available under the Events and Presentations section of our Investor Relations website.

This call is also being webcast live, with a link at the same site. The webcast and accompanying slides will be available for replay for

12 months following the call.

The content of today’s call is the property

of Desktop Metal. It cannot be reproduced or transcribed without our prior consent.

Before we begin, I’ll refer you to

our Safe Harbor disclaimer on Slide 3 of the presentation and in the financial results press release. As a reminder, today’s call

will include forward-looking statements. These forward-looking statements reflect Desktop Metal’s views and expectations only as

of today, July 31, and actual results may vary materially, based on a number of risks and uncertainties. For more information about

the risks that may impact Desktop Metal’s business and financial results, please refer to the Risk Factors section in the Company’s

Form 10-K and Form 10-Q, in addition to the Company’s other filings with the SEC. We assume no obligation to update or

revise the forward-looking statements.

Additionally, during this presentation and following

Q&A session, we may refer to our results on a non-GAAP basis. Non-GAAP measures are intended to supplement, but not substitute for,

performance measures calculated in accordance with GAAP. Our financial results release contains the financial and other quantitative information

to be discussed today, as well as a reconciliation of the GAAP to non-GAAP measures.

I’ll now turn the call over to Ric.

Ric Fulop

Good morning, everyone, and welcome to Desktop

Metal’s Second Quarter 2024 Earnings Call.

I’d like to

use today’s call to address the most significant development of our Company, the proposed business combination with Nano

Dimension. This decision wasn’t made lightly, and I’d like to walk you through our rationale and the benefits we anticipate

from this merger.

Since the beginning of 2022, Desktop Metal has

worked tirelessly to align our cost structure with macroeconomic realities, making hard decisions about our business. We have reduced

our non-GAAP operating expenses by 48% since the first quarter of 2022, while meaningfully strengthening our non-GAAP gross margins.

By the end of the first quarter, we had delivered

nine quarters of OpEx reduction and brought our cash burn down dramatically. We’ve strategically realigned our business to reflect

a lower growth environment, driven by 11 interest rate hikes, and from a margin perspective, I’m proud of the progress we have

shown.

However, despite these efforts, we have faced

an increasingly challenging business environment as a result of rising rates, slowing CapEx budgets and other macro-related challenges.

While we believe additive manufacturing has incredible potential and will continue to grow over the next decade, the past year-and-a-half

has been very challenging, putting significant pressure on our financial position. As a result, we’ve seen our balance sheet continue

to be under pressure, limiting our ability to invest in growth and innovation.

We began to notice a concerning trend towards

the end of the second quarter, with customers becoming hesitant to engage in closing deals due to our weakening financial outlook, making

it more difficult to reach our profitability targets. This feedback from the market was a clear signal that we needed to take action.

It became increasingly apparent that remaining a standalone company with a constrained balance sheet was not a viable long-term strategy.

Since the terminated merger agreement with Stratasys in September 2023, we explored raising additional capital to strengthen our

balance sheet, but the financing alternatives available to the Company would have created significant dilution to shareholders or ceding

control via structure to debt holders, which would have destroyed a lot of our remaining equity value. It didn’t help to have short

selling activity that we believe drove down the value of our equity significantly.

In evaluating our options, we had to consider

the broader context of additive manufacturing as an industry. It’s worth noting that profitability has been elusive across all the

public companies in the additive sector. While we have declined in value in line with most of our peers, the situation could have been

worse, and, in fact, it has been for some players in our space. For example, four of our western publicly traded companies in additive

manufacturing have failed or were delisted in the last two quarters, given deteriorating market conditions, leading to an even more pronounced

loss of equity value for those businesses, and we do not want to be in that bucket. We also considered a variety of divestitures, but

given valuations and market sentiment towards additive manufacturing, there were no good immediately actionable alternatives. At the moment,

not a single one of the public companies in additive manufacturing has achieved meaningful profitability or scale, and scale with the

right portfolio, balance sheet, technology and go-to-market is going to be required to build a sustainable company in this industry.

This industry-wide challenge underscored the need

for a bold move to support the long-term success of the technologies we have pioneered and our ability to maximize the equity value to

our shareholders.

We looked at all the options in front of us and

given these factors, we believe that the proposed business combination with Nano Dimension, which provided a 27% premium at the time the

transaction was announced, subject to adjustment, still represents the best path forward for Desktop Metal shareholders. This merger offers

several key benefits that we expect will strengthen our competitive position and create significant long-term shareholder value.

First and foremost, this combination will establish

a true leader in the additive manufacturing space. By bringing together our complementary product portfolios and technologies, we’ll

create an entity with enhanced scale and a stronger balance sheet. This combination will allow us to better serve our customers and compete

more effectively by offering a more complete portfolio of products. We have gotten to know the Nano Dimension team over the past two-and-a-half

years. Nano Dimension is a well-run company with a strong Management Team. They have delivered superior organic growth versus our industry

in 2023.

Secondly, we believe this merger will accelerate

the industry’s transition into mass production. By pooling our resources, expertise and technologies, we’ll be better positioned

to drive innovation and develop products for customers that address the evolving needs of manufacturers looking to adopt additive manufacturing

for production applications.

Lastly, and perhaps most importantly, this merger

will create a well-capitalized company with a stronger financial profile to properly support our customers. The increased scale and operational

efficiencies we expect to achieve will put us on a clearer path to profitability, while providing the resources needed to fuel growth

and innovation.

Finally, I would like to address the timing

and structure of the deal. Over the past two-and-a-half years, we’ve had discussions with 10 different companies on potential combinations.

None resulted in offers that were actionable or that our Board deemed superior to remaining an independent company, other than the proposed

Stratasys merger or this transaction. In the first quarter, we believed there was a chance for the market to recover and economic pace

from projects would start to close faster as rates would come down, but it quickly became clear as we got closer to the end of Q2 that

we had to do a deal to protect the value of the equity. We considered an all-equity deal, especially since our whole industry is at an

all-time low, but this was not a viable option in the end. Given our past experience with the failed vote from Stratasys, our view was

that an all-cash transaction would present the highest certainty, and an all-cash transaction would enable those Desktop Metal shareholders

who have conviction regarding the industry’s long-term potential to make their own investment decisions whether to purchase Nano

stock in order to take advantage of future growth opportunities.

The alternative of not closing a transaction now,

with Nano and its strong balance sheet, and cooperative management, may lead to a fatal prognosis and results for our Company’s

existence. We firmly believe that this business combination with Nano Dimension is the right strategic move for Desktop Metal shareholders

at this critical juncture, and our entire team is excited about making this combination successful and working with the team at Nano to

make customers successful. As Q2 ended, the only other alternatives available to us would have destroyed much of the remaining equity

value and put our Company and customer base at risk. As a large shareholder, I, too, am saddened to see the decline over time in

valuations of our companies in this industry, but we’ve had limited standalone financing options and came to the conclusion that

partnering with Nano was the best outcome for our shareholders. We strongly believe that this is the best move for our shareholders.

We’re excited about the potential of this

merger and are confident it creates the best value for our shareholders, customers and employees. I and our team are looking forward to

partnering with the Nano team and growing this market and building a profitable company at scale.

With that, I’ll hand the call over

to Jason to cover our financials.

Jason Cole

Thanks, Ric, and thank you, everyone, for joining

us today.

My remarks today will be relatively brief, given

the pending merger agreement with Nano Dimension. I do want to reiterate my confidence that this transaction represents the best option

for all of our stakeholders. We have done a great job in appropriately sizing our cost basis, and recall, we have executed on approximately

$150 million in annualized cost savings. The success of these programs since the beginning of 2022 is highlighted by our adjusted operating

margin and declining costs and cash burn.

Despite these efforts, the broader macroenvironment

has heavily penalized growth companies like ours, and the additive manufacturing industry, as a whole, has experienced that to a greater

degree than most. One of the most compelling reasons we felt the transaction was right and necessary was during the second quarter. We

heard from our customers that they were not going to continue to do business with us until we addressed our balance sheet. This theme

replayed itself throughout several customer conversations and is apparent in our second quarter revenue number.

With that, and beginning in the financial summary

section, you will see our performance for the second quarter of 2024. Please note, we will be referring to several financial metrics on

a non-GAAP basis, and a reconciliation to GAAP data is included in the filed appendix within our slides.

Consolidated revenue for the second quarter of

2024 was $38.9 million, compared to $53.3 million in the second quarter of 2023. The year-on-year decline was led by weaker hardware sales,

while consumables and services were roughly flat year-on-year. The weaker hardware sales were driven by the macroeconomic conditions impacting

the additive manufacturing industry.

Non-GAAP gross margins were 29.2% for the second

quarter of 2024, compared to 31% in the prior year period. Non-GAAP gross margins fell 180 basis points, compared with the prior year

period, driven by weaker cost absorption the lower revenue. Sequentially, Non-GAAP gross margin decreased from 30.5% in the first quarter

of 2024, on lower revenues in Q2 of 2024.

On the next slide, non-GAAP operating expenses

were $27.0 million for the second quarter of 2024. Through cost optimization, we reduced non-GAAP operating expenses sequentially by $1.6

million and year-over-year by $7.7 million, improving by 5.6% and 22.2%, respectively.

Adjusted EBITDA for the second quarter of 2024

was negative $13.2 million, improving year-over-year by $1.8 million, compared to the second quarter of 2023.

Turning to the balance sheet, we closed 2Q with

$46.7 million in cash, with outflows elevated in the quarter by deal-related spend.

We are no longer providing guidance for the remainder

of 2024 due to the pending acquisition with Nano Dimension.

With that, we will take some questions. Operator?

Operator

Thank you to our hosts. Ladies and gentlemen,

we will now begin the question-and-answer session. Should you have a question, please press the star, followed by the one on your touchtone

phone. You will hear a prompt that your hand has been raised. Should you wish to decline from the polling process, please press the star,

followed by two. If you are using a speakerphone, please lift the handset before pressing any keys. One moment, please, for your first

question.

Our first question comes from the line of Mr. Greg

Palm of Craig-Hallum Capital Group. Please go ahead.

Danny Eggerichs

Yes, thanks. This is Danny Eggerichs on for Greg

today. Appreciate you taking the questions. I guess I’ll just start with—you said you kind of had challenges closing deals

at the end of the quarter, and, obviously, you mentioned that some customers were just hesitant and uncomfortable with your financial

position as a company. Just wondering if there’s any way to maybe break down more, how much of it was that versus maybe a continued

softening in the macro versus that hesitancy based on your financial position.

Ric Fulop

Danny, the types of products that we sell, particularly

on the Binder Jet side, many times are over $1 million, so large companies really scrutinize these large of investments. I would say,

if you want an average mix of what that was, we have to probably get back to you and actually do a real count, but it’s something

that we felt.

Danny Eggerichs

Okay, got it. Maybe just touching quickly on balance

sheet, cash burn. Obviously, another $20 million cash burn this quarter. How should we be thinking about that? Is there maybe increased

focus or emphasis on that in the next couple quarters, maybe in the case that the deal does get pushed to ‘25, and a greater emphasis

on driving down that cash burn, so there’s less of an impact on potentially drawing on that loan?

Jason Cole

Yes, I can take that one. It’s a good

question. The cash burn in 2Q was elevated in part, but the principal reason it was elevated cash outflows related to the deal, and the

10 people we were speaking to, per Ric, we had conversations with a lot of folks over the quarter and that elevated some of our traditional

fees related to deals, legal, and so forth.

Ric Fulop

You also have to account—you’ve got

the interest payment that we pay on Q2 and Q4, as well.

Jason Cole

That’s

right.

Danny Eggerichs

Okay, that’s

helpful. I’ll leave it there. Thanks.

Jason Cole

Thanks, Danny.

Operator

Thank you. There

are no further questions at this time. I’d now like to turn over the call back over to Mr. Ric Fulop for final closing comments.

Ric Fulop

I want to thank everybody for joining the call

and, again, for your support over the years. All right. Thank you.

Operator

Thank you, Mr. Ric Fulop.

Ladies and gentlemen, this concludes your conference

for today. We thank you for participating and ask that you please disconnect your lines. I hope you all have a great day ahead.

Forward-Looking

Statements

This communication contains

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

Such forward-looking

statements include statements relating to the proposed transaction between the Company and Nano, including statements regarding the benefits

of the transaction and the anticipated timing of the transaction, and information regarding the Company’s business, including expectations

regarding outlook and all underlying assumptions, Nano’s and the Company’s objectives, plans and strategies, information relating

to operating trends in markets where the Company operates, statements that contain projections of results of operations or of financial

condition and all other statements other than statements of historical fact that address activities, events or developments that the Company

intends, expects, projects, believes or anticipates will or may occur in the future. Such statements are based on management’s beliefs

and assumptions made based on information currently available to management. All statements in this communication, other than statements

of historical fact, are forward-looking statements that may be identified by the use of the words “outlook,” “guidance,”

“expects,” “believes,” “anticipates,” “should,” “estimates,” “may,”

“will,” “intends,” “projects,” “could,” “would,” “estimate,” “potential,”

“continue,” “plan,” “target,” or the negative of these words or similar expressions. These forward-looking

statements involve known and unknown risks and uncertainties, which may cause the Company’s actual results and performance to be

materially different from those expressed or implied in the forward-looking statements. Factors and risks that may cause the Company’s

or Nano’s actual results or performance to be materially different from those expressed or implied in the forward-looking statements

include, but are not limited to, (i) the ultimate outcome of the proposed transaction between the Company and Nano, including the

possibility that the Company’s stockholders will reject the proposed transaction; (ii) the effect of the announcement of the

proposed transaction on the ability of the Company to operate its business and retain and hire key personnel and to maintain favorable

business relationships; (iii) the timing of the proposed transaction; (iv) the occurrence of any event, change or other circumstance

that could give rise to the termination of the proposed transaction; (v) the ability to satisfy closing conditions to the completion

of the proposed transaction (including any necessary stockholder approvals); (vi) other risks related to the completion of the proposed

transaction and actions related thereto; (vii) those factors and risks described in Item 3.D “Key Information - Risk Factors,”

Item 4 “Information on the Company”, and Item 5 “Operating and Financial Review and Prospects” in Nano’s

Annual Report on Form 20-F for the year ended December 31, 2023 and Part 1, Item 1A, “Risk Factors” in

the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and Part II, Item 1A, “Risk

Factors” in Desktop Metal’s most recent Quarterly Reports on Form 10-Q, each filed with the SEC, and in the Company’s

other filings with the SEC.

While the list of factors

presented here is, and the list of factors to be presented in the Proxy Statement are, considered representative, no such list should

be considered to be a complete statement of all potential risks and uncertainties. For additional information about other factors that

could cause actual results to differ materially from those described in the forward-looking statements, please refer to the Company’s

periodic reports and other filings with the SEC, including the risk factors identified in the Company’s Annual Report Form 10-K,and

the Company’s most recent Quarterly Reports on Form 10-Q. The forward-looking statements included in this communication are

made only as of the date hereof. The Company undertakes no obligation to update any forward-looking statements to reflect subsequent events

or circumstances, except as required by law.

No Offer or Solicitation

This communication is

not intended to and shall not constitute an offer to buy or sell or the solicitation of an offer to buy or sell any securities, or a solicitation

of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would

be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall

be made, except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Additional Information

about the Transaction and Where to Find It

In connection with the

proposed transaction, the Company intends to file with the SEC the Proxy Statement. The Company may also file other relevant documents

with the SEC regarding the proposed transaction. This document is not a substitute for the Proxy Statement or any other document that

the Company may file with the SEC. The definitive Proxy Statement (if and when available) will be mailed to stockholders of the Company.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT MAY BE FILED WITH THE

SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE

THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain

free copies of the Proxy Statement (if and when available) and other documents containing important information about the Company and

the proposed transaction, once such documents are filed with the SEC through the website maintained by the SEC at http://www.sec.gov.

Copies of the documents filed with the SEC by the Company will be available free of charge on the Company’s website at https://ir.desktopmetal.com/sec-filings/all-sec-filings.

Participants in

the Solicitation

The Company, Nano and

certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect

of the proposed transaction. Information about the directors and executive officers of the Company is set forth in the Company’s

proxy statement for its 2024 Annual Meeting of Stockholders, which was filed with the SEC on April 23, 2024. Information about

the directors and executive officers of Nano is set forth in Nano’s Annual Report on Form 20-F, which was filed with the SEC

on March 21, 2024. Other information regarding persons why may be deemed to be participants in the solicitation of Desktop Metal’s

stockholders in connection with the proposed transaction and any direct or indirect interests they may have in the proposed transaction

will be set forth in Desktop Metal’s definitive proxy statement for its special meeting of stockholders when it is filed with the

SEC.

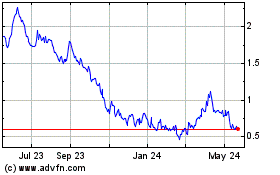

Desktop Metal (NYSE:DM)

Historical Stock Chart

From Oct 2024 to Nov 2024

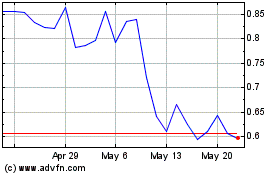

Desktop Metal (NYSE:DM)

Historical Stock Chart

From Nov 2023 to Nov 2024