BNY Mellon Municipal Bond Closed-End Funds Announce Redemption of Auction Preferred Stock

June 30 2023 - 2:13PM

Business Wire

BNY Mellon Investment Adviser, Inc. announced today that each of

BNY Mellon Municipal Income, Inc. (NYX: DMF), BNY Mellon Strategic

Municipal Bond Fund, Inc. (NYSE: DSM) and BNY Mellon Strategic

Municipals, Inc. (NYSE: LEO) (each, a "Fund") will be redeeming all

issued and outstanding shares of the Fund's auction preferred stock

("APS"), pursuant to Section 4(a)(i) of the Fund's Articles

Supplementary classifying and designating the APS (the "Articles

Supplementary"). The Board of Directors of each Fund has approved

the APS redemptions.

The redemption of the APS of each Fund is contingent on the

issuance by the Fund of Variable Rate MuniFund Term Preferred

Shares, par value $0.001 per share, in a private placement. It is

anticipated that Deposit Securities (as defined in the Articles

Supplementary), with an aggregate value equal to the liquidation

price of $25,000 per share plus an amount equal to any accumulated

but unpaid dividends thereon (the "Redemption Price"), will be

deposited with the Funds' custodian bank for the benefit of the

Funds' Auction Agent on or about July 12, 2023 (the "Redemption

Date"); on the date of the deposit all rights of the APS's holders

(except the right to receive the Redemption Price and any

Additional Dividends) will cease and terminate, and the APS will no

longer be outstanding.

Commencing on the applicable Payment Date (as listed below) for

each series, the Funds' Auction Agent will pay to the holders of

record of each such series of APS, in exchange for each outstanding

share thereof, the applicable Redemption Price (as listed below),

but excluding Additional Dividends (as defined in the Articles

Supplementary).

BNY Mellon Municipal Income, Inc.

Series

CUSIP

Number of Shares

Payment Date

Redemption Price*

Series A APS

05589T203

616

July 18, 2023

$25,027

Series B APS

05589T302

593

July 20, 2023

$25,027

_____________ * Estimated based on the AA rated financial

commercial paper interest rate as of June 26, 2023.

BNY Mellon Strategic Municipal Bond Fund, Inc.

Series

CUSIP

Number of Shares

Payment Date

Redemption Price*

Series A APS

09662E208

698

July 17, 2023

$25,027

Series B APS

09662E307

662

July 19, 2023

$25,027

Series C APS

09662E406

612

July 21, 2023

$25,027

_____________ * Estimated based on the AA rated financial

commercial paper interest rate as of June 26, 2023.

BNY Mellon Strategic Municipals, Inc.

Series

CUSIP

Number of Shares

Payment Date

Redemption Price*

Series M APS

05588W207

763

July 17, 2023

$25,027

Series T APS

05588W306

747

July 18, 2023

$25,027

Series W APS

05588W405

660

July 19, 2023

$25,027

Series TH APS

05588W504

566

July 20, 2023

$25,027

Series F APS

05588W603

420

July 21, 2023

$25,027

_____________ * Estimated based on the AA rated financial

commercial paper interest rate as of June 26, 2023.

On and after the Redemption Date of each series of APS, all

shares of such series shall be deemed no longer to be outstanding,

and all rights with respect to the series of APS shall forthwith at

the close of business on the Redemption Date cease and terminate,

except only the right of the holders thereof to receive the

Redemption Price of the shares so redeemed, but without interest,

upon surrender of such shares, and that such holders may be

entitled to Additional Dividends.

Important Information

BNY Mellon Investment Adviser, Inc., the investment adviser for

the Fund, is part of BNY Mellon Investment Management. BNY Mellon

Investment Management is one of the world’s largest asset managers,

with $1.9 trillion in assets under management as of March 31, 2023.

Through an investor-first approach, BNY Mellon Investment

Management brings to clients the best of both worlds: specialist

expertise from seven investment firms offering solutions across

every major asset class, backed by the strength, stability, and

global presence of BNY Mellon. Additional information on BNY Mellon

Investment Management is available on www.bnymellonim.com.

BNY Mellon Investment Management is a division of BNY Mellon,

which has $46.6 trillion in assets under custody and/or

administration as of March 31, 2023. BNY Mellon can act as a single

point of contact for clients looking to create, trade, hold,

manage, service, distribute or restructure investments. BNY Mellon

is the corporate brand of The Bank of New York Mellon Corporation

(NYSE: BK). Additional information is available on

www.bnymellon.com. Follow us on Twitter @BNYMellon or visit our

newsroom at www.bnymellon.com/newsroom for the latest company

news.

Closed-end funds are traded on the secondary market through one

of the stock exchanges. Fund investment returns and principal

values will fluctuate so that an investor’s shares may be worth

more or less than the original cost. Shares of closed-end funds may

trade above (a premium) or below (a discount) the net asset value

(NAV) of the fund’s portfolio. There is no assurance that the Fund

will achieve its investment objective.

This release is for informational purposes only and should not

be considered as investment advice or a recommendation of any

particular security.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230630751574/en/

For Press Inquiries: BNY Mellon Investment Adviser, Inc. Sue

Watt (212) 815-3757 For Other Inquiries: BNY Mellon Securities

Corporation The National Marketing Desk 240 Greenwich Street New

York, New York 10286 1-800-334-6899

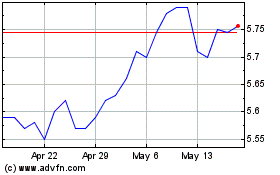

BNY Mellon Strategic Mun... (NYSE:DSM)

Historical Stock Chart

From Dec 2024 to Jan 2025

BNY Mellon Strategic Mun... (NYSE:DSM)

Historical Stock Chart

From Jan 2024 to Jan 2025