Ellington Financial Inc. (NYSE: EFC) ("we," "us," or "our")

today reported financial results for the quarter ended June 30,

2024.

Highlights

- Net income attributable to common stockholders of $52.3

million, or $0.62 per common share.1

- $69.1 million, or $0.81 per common share, from the investment

portfolio.

- $68.0 million, or $0.80 per common share, from the credit

strategy.

- $1.1 million, or $0.01 per common share, from the Agency

strategy.

- $4.2 million, or $0.05 per common share, from Longbridge.

- Adjusted Distributable Earnings2 of $28.3 million, or $0.33 per

common share.

- Book value per common share as of June 30, 2024 of $13.92,

including the effects of dividends of $0.39 per common share for

the quarter.

- Dividend yield of 13.0% based on the August 5, 2024 closing

stock price of $12.04 per share, and monthly dividend of $0.13 per

common share declared on July 8, 2024.

- Recourse debt-to-equity ratio3 of 1.6:1 as of June 30, 2024,

adjusted for unsettled purchases and sales. Including all

non-recourse borrowings, which primarily consist of

securitization-related liabilities, debt-to-equity ratio of

8.2:14.

- Cash and cash equivalents of $198.5 million as of June 30,

2024, in addition to other unencumbered assets of $565.1

million.

Second Quarter 2024 Results

"Driven by broad-based contributions from our diversified credit

and Agency portfolios, as well as from our reverse mortgage

platform Longbridge, Ellington Financial generated a non-annualized

economic return of 4.5% for the second quarter, and grew adjusted

distributable earnings and book value per share sequentially," said

Laurence Penn, Chief Executive Officer and President.

"We had notably strong performance in our non-QM loan business,

where tight yield spreads in our April securitization helped

generate a significant gain in our portfolio, and where continued

strong loan demand improved industrywide gain-on-sale margins and

origination volumes, driving excellent results at our affiliate

loan originators. Longbridge also contributed robust earnings for

the quarter, led by the strong performance of proprietary reverse

mortgage loans. Following quarter end, we successfully completed

our second securitization of proprietary reverse mortgage loans

originated by Longbridge, achieving incrementally stronger

execution than our inaugural deal in the first quarter. Our second

quarter results also significantly benefited from the performance

of our residential transition and commercial mortgage loan

strategies, as well as non-Agency RMBS.

"During the quarter, we added attractive investments in a wide

array of our credit strategies, including HELOCs and closed-end

second lien loans, proprietary reverse mortgage loans, commercial

mortgage bridge loans, re-performing and non-performing residential

mortgage loans, CMBS, and CLOs. At the same time, we continued to

cull securities in lower-yielding sectors, including Agency and

non-Agency RMBS.

"Looking forward, our investment pipeline across our diversified

proprietary loan origination channels remains strong, and the loan

originators in which we've invested are not only helping to feed

that pipeline, but they're showing strong profitability as well.

Combine that with our ability to access compelling term,

non-mark-to-market financing in the securitization markets, and I

believe Ellington Financial is well positioned for continued

portfolio and earnings growth over the remainder of the year."

Financial Results

Investment Portfolio Summary

Our investment portfolio generated net income attributable to

common stockholders of $69.1 million, consisting of $68.0 million

from the credit strategy and $1.1 million from the Agency

strategy.

Credit Performance

Our total long credit portfolio, excluding non-retained tranches

of consolidated securitization trusts, decreased to $2.73 billion

as of June 30, 2024, from $2.80 billion as of March 31, 2024. The

decline was driven by the cumulative impact of a non-QM

securitization completed during the second quarter and net sales of

non-Agency and retained non-QM RMBS, and non-QM loans, which more

than offset net purchases of commercial mortgage bridge loans, home

equity lines of credit, or "HELOCs," closed-end second lien loans,

re-performing and non-performing residential mortgage loans, CMBS,

and CLOs.

Strong net interest income5 and net gains from non-QM loans,

retained non-QM RMBS, non-Agency RMBS, and commercial mortgage

loans drove the positive results in our credit strategy in the

second quarter. We also benefited from mark-to-market gains on our

equity investments in the loan originators LendSure and American

Heritage Lending, which reflected strong performance at those

originators driven by increased origination volumes and strong

gain-on-sale margins. With interest rates slightly higher quarter

over quarter, we also had net gains on our interest rate hedges.

Offsetting a portion of all these gains was a modest net loss in

re-performing and non-performing residential mortgage loans.

In our residential mortgage loan portfolio, after excluding the

impacts of the purchase of one non-performing loan portfolio and

the consolidation of another non-performing loan portfolio, our

percentage of delinquent loans increased only slightly quarter over

quarter. In our commercial mortgage loan portfolio (including loans

accounted for as equity method investments) the delinquency

percentage ticked down sequentially. Both of these portfolios

continue to experience low levels of realized credit losses and

strong overall credit performance, though we are monitoring

developments closely and diligently working out a handful of

non-performing commercial mortgage assets.

The net interest margin6 on our credit portfolio decreased

quarter over quarter, to 2.76% from 2.86%. We continued to benefit

from positive carry on our interest rate swap hedges, where we

overall receive a higher floating rate and pay a lower fixed

rate.

Agency Performance

Our total long Agency RMBS portfolio decreased by 31% quarter

over quarter to $457.7 million, driven primarily by net sales.

In April, interest rates and volatility increased over renewed

concerns about inflation and a more hawkish Federal Reserve, which

pushed Agency RMBS yield spreads wider. In May and June, however,

interest rates and volatility generally declined, and Agency RMBS

yield spreads reversed most of their April widening. Overall for

the second quarter, the U.S. Agency MBS Index generated a negative

excess return of (0.08)%. Nevertheless, our Agency RMBS strategy

generated positive results for the quarter, as net gains on

interest rate hedges and net interest income exceeded net losses on

Agency RMBS.

Average pay-ups on our specified pools increased modestly to

0.91% as of June 30, 2024, as compared to 0.89% as of March 31,

2024.

During the quarter, our Agency RMBS asset yields and our

borrowing costs both declined, and we received a larger benefit

from positive carry on our interest rate swap hedges, where we

overall receive a higher floating rate and pay a lower fixed rate.

As a result, the net interest margin6 on our Agency RMBS, excluding

the Catch-up Amortization Adjustment, increased to 1.99% from 1.50%

quarter over quarter.

Longbridge Summary

Our Longbridge segment generated net income attributable to

common stockholders of $4.2 million for the second quarter, driven

by net interest income and net gains on proprietary reverse

mortgage loans, along with positive results from servicing. In HECM

originations, higher volumes were mostly offset by a decline in

gain-on-sale margins, driven by wider yield spreads on newly

originated HMBS. In servicing, tighter yield spreads on more

seasoned HMBS led to improved execution on tail securitizations,

which contributed to the positive results from servicing.

Our Longbridge portfolio, excluding non-retained tranches of a

consolidated securitization trust, increased by 18% sequentially to

$520.8 million as of June 30, 2024, driven primarily by proprietary

reverse mortgage loan originations.

Corporate/Other Summary

In addition to expenses not allocated to either the investment

portfolio or Longbridge segments, our results for the quarter also

reflect a net gain, driven by the increase in interest rates, on

our senior notes. This gain was partially offset by a net loss,

also driven by the increase in interest rates, on the fixed

receiver interest rate swaps that we use to hedge the fixed

payments on both our unsecured long-term debt and our preferred

equity.

1 Includes $(21.0) million of preferred dividends accrued and

certain corporate/other income and expense items not attributed to

either the investment portfolio or Longbridge segments.

2 Adjusted Distributable Earnings is a non-GAAP financial

measure. See "Reconciliation of Net Income (Loss) to Adjusted

Distributable Earnings" below for an explanation regarding the

calculation of Adjusted Distributable Earnings.

3 Excludes U.S. Treasury securities and repo borrowings at

certain unconsolidated entities that are recourse to us. Including

such borrowings, our debt-to-equity ratio, adjusted for unsettled

purchases and sales, based on total recourse borrowings was 1.9:1

as of June 30, 2024.

4 Excludes U.S. Treasury securities and repo borrowings at

certain unconsolidated entities.

5 Excludes any interest income and interest expense items from

interest rate hedges, net credit hedges and other activities,

net.

6 Net interest margin represents the weighted average asset

yield less the weighted average secured financing cost of funds on

such assets. It also includes the effect of actual and accrued

periodic payments on interest rate swaps used to hedge the

assets.

Credit Portfolio(1)

The following table summarizes our credit portfolio holdings as

of June 30, 2024 and March 31, 2024:

June 30, 2024

March 31, 2024

($ in thousands)

Fair Value

%

Fair Value

%

Dollar denominated:

CLOs(2)

$

75,719

1.8

%

$

59,243

1.4

%

CMBS

42,842

1.0

%

22,393

0.5

%

Commercial mortgage loans and

REO(3)(4)

362,914

8.8

%

366,320

8.7

%

Consumer loans and ABS backed by consumer

loans(2)

85,802

2.1

%

83,194

2.0

%

Corporate debt and equity and corporate

loans

32,100

0.8

%

31,140

0.8

%

Debt and equity investments in loan

origination-related entities(6)

37,381

0.9

%

35,967

0.9

%

Forward MSR-related investments

158,031

3.8

%

160,009

3.8

%

Home equity line of credit and closed-end

second lien loans

62,737

1.5

%

—

—

%

Non-Agency RMBS

143,690

3.5

%

210,132

5.0

%

Non-QM loans and retained non-QM

RMBS(7)

1,802,847

43.5

%

1,989,390

47.3

%

Other loans and ABS(5)

23,533

0.6

%

19,674

0.5

%

Residential transition loans and other

residential mortgage loans and REO(3)

1,234,796

29.8

%

1,199,246

28.5

%

Non-Dollar denominated:

CLOs(2)

6,973

0.2

%

5,496

0.1

%

Corporate debt and equity

219

—

%

185

—

%

RMBS(8)

18,138

0.4

%

20,423

0.5

%

Other residential mortgage loans

52,368

1.3

%

—

—

%

Total long credit portfolio

$

4,140,090

100.0

%

$

4,202,812

100.0

%

Less: Non-retained tranches of

consolidated securitization trusts

1,414,389

1,407,035

Total long credit portfolio excluding

non-retained tranches of consolidated securitization trusts

$

2,725,701

$

2,795,777

(1)

This information does not include U.S.

Treasury securities, securities sold short, or financial

derivatives.

(2)

Includes equity investments in

securitization-related vehicles.

(3)

In accordance with U.S. GAAP, REO is not

considered a financial instrument and as a result is included at

the lower of cost or fair value.

(4)

Includes equity investments in

unconsolidated entities holding commercial mortgage loans and

REO.

(5)

Includes equity investment in an

unconsolidated entity which held certain other loans for

securitization.

(6)

Includes corporate loans to certain loan

origination entities in which we hold an equity investment.

(7)

Retained non-QM RMBS represents RMBS

issued by non-consolidated Ellington-sponsored non-QM loan

securitization trusts, and interests in entities holding such

RMBS.

(8)

Includes an equity investment in an

unconsolidated entity holding European RMBS.

Agency RMBS Portfolio

The following table(1) summarizes our Agency RMBS portfolio

holdings as of June 30, 2024 and March 31, 2024:

June 30, 2024

March 31, 2024

($ in thousands)

Fair Value

%

Fair Value

%

Long Agency RMBS:

Fixed rate

$

413,686

90.4

%

$

609,806

92.0

%

Floating rate

—

—

%

5,043

0.8

%

Reverse mortgages

33,853

7.4

%

36,912

5.6

%

IOs

10,162

2.2

%

10,811

1.6

%

Total long Agency RMBS

$

457,701

100.0

%

$

662,572

100.0

%

(1)

This information does not include U.S.

Treasury securities, securities sold short or financial

derivatives.

Longbridge Portfolio

Longbridge originates reverse mortgage loans, including home

equity conversion mortgage loans, or "HECMs," which are insured by

the FHA and which are eligible for inclusion in GNMA-guaranteed

HECM-backed MBS, or "HMBS." Upon securitization, the HECMs remain

on our balance sheet under GAAP, and Longbridge retains the

mortgage servicing rights associated with the HMBS, or the "HMBS

MSR Equivalent." Longbridge also originates "proprietary reverse

mortgage loans," which are not insured by the FHA, and Longbridge

has typically retained the associated MSRs. We have securitized

some of the proprietary reverse mortgage loans originated by

Longbridge, and we have retained certain of the securitization

tranches in compliance with credit risk retention rules. The

following table(1) summarizes loan-related assets in the Longbridge

segment as of June 30, 2024 and March 31, 2024:

June 30, 2024

March 31, 2024

(In thousands)

HMBS assets(2)

$

8,926,658

$

8,713,835

Less: HMBS liabilities

(8,832,058

)

(8,619,463

)

HMBS MSR Equivalent

94,600

94,372

Unsecuritized HECM loans(3)

103,668

111,617

Proprietary reverse mortgage loans(4)

449,968

365,372

Reverse MSRs

29,538

29,889

Unsecuritized REO

1,375

2,228

Total

679,149

603,478

Less: Non-retained tranches of

consolidated securitization trust

158,397

162,482

Total, excluding non-retained tranches of

consolidated securitization trust

$

520,752

$

440,996

(1)

This information does not include

financial derivatives or loan commitments.

(2)

Includes HECM loans, related REO, and

claims or other receivables.

(3)

As of June 30, 2024, includes $5.1 million

of active HECM buyout loans, $9.9 million of inactive HECM buyout

loans, and $4.3 million of other inactive HECM loans. As of March

31, 2024, includes $9.3 million of active HECM buyout loans, $9.4

million of inactive HECM buyout loans, and $4.5 million of other

inactive HECM loans.

(4)

As of June 30, 2024, includes $181.1

million of securitized proprietary reverse mortgage loans and $4.5

million of cash held in a securitization reserve fund. As of March

31, 2024, includes $184.9 million of securitized proprietary

reverse mortgage loans and $4.7 million of cash held in a

securitization reserve fund.

The following table summarizes Longbridge's origination volumes

by channel for the three-month periods ended June 30, 2024 and

March 31, 2024:

($ In thousands)

June 30, 2024

March 31, 2024

Channel

Units

New Loan Origination

Volume(1)

% of New Loan Origination

Volume

Units

New Loan Origination

Volume(1)

% of New Loan Origination

Volume

Retail

408

$

60,601

20

%

381

$

51,639

25

%

Wholesale and correspondent

1,298

243,937

80

%

983

153,246

75

%

Total

1,706

$

304,538

100

%

1,364

$

204,885

100

%

(1)

Represents initial borrowed amounts on

reverse mortgage loans.

Financing

Our recourse debt-to-equity ratio3, adjusted for unsettled

purchases and sales, decreased to 1.6:1 at June 30, 2024 from 1.8:1

at March 31, 2024. The decline was primarily driven by the

completion of a non-QM securitization in the second quarter, a

decline in borrowings on our smaller Agency RMBS portfolio, and an

increase in shareholders' equity. Our overall debt-to-equity

ratio4, adjusted for unsettled purchases and sales, also decreased

during the quarter, to 8.2:1 as of June 30, 2024, as compared to

8.3:1 as of March 31, 2024.

The following table summarizes our outstanding borrowings and

debt-to-equity ratios as of June 30, 2024 and March 31, 2024:

June 30, 2024

March 31, 2024

Outstanding

Borrowings(1)

Debt-to-Equity

Ratio(2)

Outstanding

Borrowings(1)

Debt-to-Equity

Ratio(2)

(In thousands)

(In thousands)

Recourse borrowings(3)(4)

$

2,816,882

1.8:1

$

2,996,346

1.9:1

Non-recourse borrowings(4)

10,417,896

6.6:1

10,188,612

6.6:1

Total Borrowings

$

13,234,778

8.4:1

$

13,184,958

8.5:1

Total Equity

$

1,573,859

$

1,553,156

Recourse borrowings excluding U.S.

Treasury securities, adjusted for unsettled purchases and sales

1.6:1

1.8:1

Total borrowings excluding U.S. Treasury

securities, adjusted for unsettled purchases and sales

8.2:1

8.3:1

(1) Includes borrowings under repurchase

agreements, other secured borrowings, other secured borrowings, at

fair value, and unsecured debt, at par.

(2) Recourse and overall debt-to-equity

ratios are computed by dividing outstanding recourse and overall

borrowings, respectively, by total equity. Debt-to-equity ratios do

not account for liabilities other than debt financings.

(3) Excludes repo borrowings at certain

unconsolidated entities that are recourse to us. Including such

borrowings, our debt-to-equity ratio based on total recourse

borrowings is 1.9:1 and 2.0:1 as of June 30, 2024 and March 31,

2024, respectively.

(4) All of our non-recourse borrowings are

secured by collateral. In the event of default under a non-recourse

borrowing, the lender has a claim against the collateral but not

any of the other assets held by us or our consolidated

subsidiaries. In the event of default under a recourse borrowing,

the lender's claim is not limited to the collateral (if any).

The following table summarizes our operating results by strategy

for the three-month period ended June 30, 2024:

Investment Portfolio

Longbridge

Corporate/Other

Total

Per Share

(In thousands except per share

amounts)

Credit

Agency

Investment Portfolio

Subtotal

Interest income and other income(1)

$

81,983

$

6,858

$

88,841

$

13,592

$

1,915

$

104,348

$

1.22

Interest expense

(43,531

)

(6,207

)

(49,738

)

(8,754

)

(4,631

)

(63,123

)

(0.74

)

Realized gain (loss), net

(11,208

)

(14,200

)

(25,408

)

(24

)

—

(25,432

)

(0.29

)

Unrealized gain (loss), net

30,143

9,140

39,283

3,683

1,868

44,834

0.52

Net change from reverse mortgage loans and

HMBS obligations

—

—

—

19,034

—

19,034

0.22

Earnings in unconsolidated entities

12,042

—

12,042

—

—

12,042

0.14

Interest rate hedges and other activity,

net(2)

4,292

5,507

9,799

3,487

(1,759

)

11,527

0.13

Credit hedges and other activities,

net(3)

(31

)

—

(31

)

—

—

(31

)

—

Income tax (expense) benefit

—

—

—

—

(142

)

(142

)

—

Investment related expenses

(3,306

)

—

(3,306

)

(7,781

)

—

(11,087

)

(0.13

)

Other expenses

(2,006

)

—

(2,006

)

(19,028

)

(10,864

)

(31,898

)

(0.37

)

Net income (loss)

68,378

1,098

69,476

4,209

(13,613

)

60,072

0.70

Dividends on preferred stock

—

—

—

—

(6,825

)

(6,825

)

(0.08

)

Net (income) loss attributable to

non-participating non-controlling interests

(382

)

—

(382

)

—

(4

)

(386

)

—

Net income (loss) attributable to common

stockholders and participating non-controlling interests

67,996

1,098

69,094

4,209

(20,442

)

52,861

0.62

Net (income) loss attributable to

participating non-controlling interests

—

—

—

—

(514

)

(514

)

—

Net income (loss) attributable to common

stockholders

$

67,996

$

1,098

$

69,094

$

4,209

$

(20,956

)

$

52,347

$

0.62

Net income (loss) attributable to common

stockholders per share of common stock

$

0.80

$

0.01

$

0.81

$

0.05

$

(0.24

)

$

0.62

Weighted average shares of common stock

and convertible units(4) outstanding

85,880

Weighted average shares of common stock

outstanding

85,045

(1) Other income primarily consists of

rental income on real estate owned, loan origination fees, and

servicing income.

(2) Includes U.S. Treasury securities, if

applicable.

(3) Other activities include certain

equity and other trading strategies and related hedges, and net

realized and unrealized gains (losses) on foreign currency.

(4) Convertible units include Operating

Partnership units attributable to participating non-controlling

interests.

The following table summarizes our operating results by strategy

for the three-month period ended March 31, 2024:

Investment Portfolio

Longbridge

Corporate/Other

Total

Per Share

(In thousands except per share

amounts)

Credit

Agency

Investment Portfolio

Subtotal

Interest income and other income(1)

$

84,269

$

7,069

$

91,338

$

12,132

$

1,877

$

105,347

$

1.24

Interest expense

(43,121

)

(9,763

)

(52,884

)

(8,558

)

(4,597

)

(66,039

)

(0.77

)

Realized gain (loss), net

(6,379

)

(12,154

)

(18,533

)

—

—

(18,533

)

(0.22

)

Unrealized gain (loss), net

3,466

797

4,263

(8,356

)

1,829

(2,264

)

(0.03

)

Net change from reverse mortgage loans and

HMBS obligations

—

—

—

27,515

—

27,515

0.32

Earnings in unconsolidated entities

2,226

—

2,226

—

—

2,226

0.03

Interest rate hedges and other activity,

net(2)

8,259

16,123

24,382

15,712

(5,538

)

34,556

0.41

Credit hedges and other activities,

net(3)

(4,449

)

—

(4,449

)

(592

)

—

(5,041

)

(0.06

)

Income tax (expense) benefit

—

—

—

—

(61

)

(61

)

—

Investment related expenses

(2,973

)

—

(2,973

)

(10,263

)

—

(13,236

)

(0.16

)

Other expenses

(170

)

—

(170

)

(18,836

)

(11,413

)

(30,419

)

(0.36

)

Net income (loss)

41,128

2,072

43,200

8,754

(17,903

)

34,051

0.40

Dividends on preferred stock

—

—

—

—

(6,654

)

(6,654

)

(0.08

)

Net (income) loss attributable to

non-participating non-controlling interests

(185

)

—

(185

)

(38

)

(4

)

(227

)

—

Net income (loss) attributable to common

stockholders and participating non-controlling interests

40,943

2,072

43,015

8,716

(24,561

)

27,170

0.32

Net (income) loss attributable to

participating non-controlling interests

—

—

—

—

(255

)

(255

)

—

Net income (loss) attributable to common

stockholders

$

40,943

$

2,072

$

43,015

$

8,716

$

(24,816

)

$

26,915

$

0.32

Net income (loss) attributable to common

stockholders per share of common stock

$

0.48

$

0.03

$

0.51

$

0.10

$

(0.29

)

$

0.32

Weighted average shares of common stock

and convertible units(4) outstanding

85,269

Weighted average shares of common stock

outstanding

84,468

(1) Other income primarily consists of

rental income on real estate owned, loan origination fees, and

servicing income.

(2) Includes U.S. Treasury securities, if

applicable.

(3) Other activities include certain

equity and other trading strategies and related hedges, and net

realized and unrealized gains (losses) on foreign currency.

(4) Convertible units include Operating

Partnership units attributable to participating non-controlling

interests.

About Ellington Financial

Ellington Financial invests in a diverse array of financial

assets, including residential and commercial mortgage loans and

mortgage-backed securities, reverse mortgage loans, mortgage

servicing rights and related investments, consumer loans,

asset-backed securities, collateralized loan obligations,

non-mortgage and mortgage-related derivatives, debt and equity

investments in loan origination companies, and other strategic

investments. Ellington Financial is externally managed and advised

by Ellington Financial Management LLC, an affiliate of Ellington

Management Group, L.L.C.

Conference Call

We will host a conference call at 11:00 a.m. Eastern Time on

Wednesday, August 7, 2024, to discuss our financial results for the

quarter ended June 30, 2024. To participate in the event by

telephone, please dial (800) 579-2543 at least 10 minutes prior to

the start time and reference the conference ID EFCQ224.

International callers should dial (785) 424-1789 and reference the

same conference ID. The conference call will also be webcast live

over the Internet and can be accessed via the "For Investors"

section of our web site at www.ellingtonfinancial.com. To listen to

the live webcast, please visit www.ellingtonfinancial.com at least

15 minutes prior to the start of the call to register, download,

and install necessary audio software. In connection with the

release of these financial results, we also posted an investor

presentation, that will accompany the conference call, on our

website at www.ellingtonfinancial.com under "For

Investors—Presentations."

A dial-in replay of the conference call will be available on

Wednesday, August 7, 2024, at approximately 2:00 p.m. Eastern Time

through Wednesday, August 14, 2024 at approximately 11:59 p.m.

Eastern Time. To access this replay, please dial (800) 695-0974.

International callers should dial (402) 220-1459. A replay of the

conference call will also be archived on our web site at

www.ellingtonfinancial.com.

Cautionary Statement Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements involve

numerous risks and uncertainties. Our actual results may differ

from our beliefs, expectations, estimates, and projections and,

consequently, you should not rely on these forward-looking

statements as predictions of future events. Forward-looking

statements are not historical in nature and can be identified by

words such as "believe," "expect," "anticipate," "estimate,"

"project," "plan," "continue," "intend," "should," "would,"

"could," "goal," "objective," "will," "may," "seek" or similar

expressions or their negative forms, or by references to strategy,

plans, or intentions. Forward-looking statements are based on our

beliefs, assumptions and expectations of our future operations,

business strategies, performance, financial condition, liquidity

and prospects, taking into account information currently available

to us. These beliefs, assumptions, and expectations are subject to

risks and uncertainties and can change as a result of many possible

events or factors, not all of which are known to us. If a change

occurs, our business, financial condition, liquidity, results of

operations and strategies may vary materially from those expressed

or implied in our forward-looking statements. The following factors

are examples of those that could cause actual results to vary from

our forward-looking statements: changes in interest rates and the

market value of our investments, market volatility, changes in

mortgage default rates and prepayment rates, our ability to borrow

to finance our assets, changes in government regulations affecting

our business, our ability to maintain our exclusion from

registration under the Investment Company Act of 1940, our ability

to maintain our qualification as a real estate investment trust, or

"REIT," and other changes in market conditions and economic trends,

such as changes to fiscal or monetary policy, heightened inflation,

slower growth or recession, and currency fluctuations. Furthermore,

forward-looking statements are subject to risks and uncertainties,

including, among other things, those described under Item 1A of our

Annual Report on Form 10-K, which can be accessed through our

website at www.ellingtonfinancial.com or at the SEC's website

(www.sec.gov). Other risks, uncertainties, and factors that could

cause actual results to differ materially from those projected may

be described from time to time in reports we file with the SEC,

including reports on Forms 10-Q, 10-K and 8-K. We undertake no

obligation to update or revise any forward-looking statements,

whether as a result of new information, future events, or

otherwise.

ELLINGTON FINANCIAL INC.

CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS

(UNAUDITED)

Three-Month Period

Ended

Six-Month Period Ended

June 30, 2024

March 31, 2024

June 30, 2024

(In thousands, except per share

amounts)

NET INTEREST INCOME

Interest income

$

100,470

$

101,520

$

201,990

Interest expense

(66,874

)

(70,464

)

(137,338

)

Total net interest income

33,596

31,056

64,652

Other Income (Loss)

Realized gains (losses) on securities and

loans, net

(22,968

)

(17,208

)

(40,176

)

Realized gains (losses) on financial

derivatives, net

6,313

3,478

9,791

Realized gains (losses) on real estate

owned, net

(1,877

)

(1,372

)

(3,249

)

Unrealized gains (losses) on securities

and loans, net

40,271

5,573

45,844

Unrealized gains (losses) on financial

derivatives, net

7,902

30,365

38,267

Unrealized gains (losses) on real estate

owned, net

882

(679

)

203

Unrealized gains (losses) on other secured

borrowings, at fair value, net

(1,516

)

(12,524

)

(14,040

)

Unrealized gains (losses) on unsecured

borrowings, at fair value

1,868

1,829

3,696

Net change from HECM reverse mortgage

loans, at fair value

146,706

205,497

352,202

Net change related to HMBS obligations, at

fair value

(127,672

)

(177,982

)

(305,654

)

Other, net

7,652

7,508

15,161

Total other income (loss)

57,561

44,485

102,045

EXPENSES

Base management fee to affiliate, net of

rebates

5,811

5,730

11,541

Investment related expenses:

Servicing expense

5,782

5,688

11,470

Debt issuance costs related to Other

secured borrowings, at fair value

—

3,113

3,113

Other

5,305

4,435

9,740

Professional fees

2,438

2,970

5,407

Compensation and benefits

16,353

14,643

30,996

Other expenses

7,296

7,076

14,373

Total expenses

42,985

43,655

86,640

Net Income (Loss) before Income Tax

Expense (Benefit) and Earnings from Investments in Unconsolidated

Entities

48,172

31,886

80,057

Income tax expense (benefit)

142

61

202

Earnings (losses) from investments in

unconsolidated entities

12,042

2,226

14,268

Net Income (Loss)

60,072

34,051

94,123

Net Income (Loss) attributable to

non-controlling interests

900

482

1,382

Dividends on preferred stock

6,825

6,654

13,479

Net Income (Loss) Attributable to

Common Stockholders

$

52,347

$

26,915

$

79,262

Net Income (Loss) per Common

Share:

Basic and Diluted

$

0.62

$

0.32

$

0.94

Weighted average shares of common stock

outstanding

85,045

84,468

84,756

Weighted average shares of common stock

and convertible units outstanding

85,880

85,269

85,574

ELLINGTON FINANCIAL INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(UNAUDITED)

As of

(In thousands, except share and per share

amounts)

June 30, 2024

March 31, 2024

December 31, 2023(1)

ASSETS

Cash and cash equivalents

$

198,513

$

187,467

$

228,927

Restricted cash

6,098

6,343

1,618

Securities, at fair value

1,127,684

1,328,848

1,518,377

Loans, at fair value

12,846,106

12,644,232

12,306,636

Loan commitments, at fair value

5,623

3,917

2,584

Forward MSR-related investments, at fair

value

158,031

160,009

163,336

Mortgage servicing rights, at fair

value

29,538

29,889

29,580

Investments in unconsolidated entities, at

fair value

163,182

125,366

116,414

Real estate owned

25,248

19,999

22,085

Financial derivatives–assets, at fair

value

162,165

150,343

143,996

Reverse repurchase agreements

85,671

183,607

173,145

Due from brokers

22,036

17,099

51,884

Investment related receivables

195,557

200,059

480,249

Other assets

67,201

75,422

77,099

Total Assets

$

15,092,653

$

15,132,600

$

15,315,930

LIABILITIES

Securities sold short, at fair value

$

51,858

$

165,118

$

154,303

Repurchase agreements

2,301,976

2,517,747

2,967,437

Financial derivatives–liabilities, at fair

value

44,064

40,425

61,776

Due to brokers

74,946

62,646

62,442

Investment related payables

38,977

32,329

37,403

Other secured borrowings

217,225

180,918

245,827

Other secured borrowings, at fair

value

1,585,838

1,569,149

1,424,668

HMBS-related obligations, at fair

value

8,832,058

8,619,463

8,423,235

Unsecured borrowings, at fair value

269,069

270,936

272,765

Base management fee payable to

affiliate

5,811

5,730

5,660

Dividend payable

15,158

15,168

11,528

Interest payable

17,174

25,177

22,933

Accrued expenses and other liabilities

64,640

74,638

90,341

Total Liabilities

13,518,794

13,579,444

13,780,318

EQUITY

Preferred stock, par value $0.001 per

share, 100,000,000 shares authorized; 14,757,222, 14,757,222 and

14,757,222 shares issued and outstanding, and $368,931, $368,931

and $368,931 aggregate liquidation preference, respectively

355,551

355,551

355,551

Common stock, par value $0.001 per share,

300,000,000, 200,000,000, and 200,000,000 shares authorized,

respectively; 85,041,913, 85,056,648 and 83,000,488 shares issued

and outstanding, respectively(2)

85

85

83

Additional paid-in-capital

1,541,002

1,540,857

1,514,797

Retained earnings (accumulated

deficit)

(343,853

)

(363,034

)

(353,360

)

Total Stockholders' Equity

1,552,785

1,533,459

1,517,071

Non-controlling interests

21,074

19,697

18,541

Total Equity

1,573,859

1,553,156

1,535,612

TOTAL LIABILITIES AND EQUITY

$

15,092,653

$

15,132,600

$

15,315,930

SUPPLEMENTAL PER SHARE

INFORMATION:

Book Value Per Common Share (3)

$

13.92

$

13.69

$

13.83

(1) Derived from audited financial

statements as of December 31, 2023.

(2) Common shares issued and outstanding

at June 30, 2024 exclude 14,735 common shares repurchased during

the quarter.

(3) Based on total stockholders' equity

less the aggregate liquidation preference of our preferred stock

outstanding.

Reconciliation of Net Income (Loss) to Adjusted Distributable

Earnings

We calculate Adjusted Distributable Earnings as U.S. GAAP net

income (loss) as adjusted for: (i) realized and unrealized gain

(loss) on securities and loans, REO, mortgage servicing rights,

financial derivatives (excluding periodic settlements on interest

rate swaps), any borrowings carried at fair value, and foreign

currency transactions; (ii) incentive fee to affiliate; (iii)

Catch-up Amortization Adjustment (as defined below); (iv) non-cash

equity compensation expense; (v) provision for income taxes; (vi)

certain non-capitalized transaction costs; and (vii) other income

or loss items that are of a non-recurring nature. For certain

investments in unconsolidated entities, we include the relevant

components of net operating income in Adjusted Distributable

Earnings. The Catch-up Amortization Adjustment is a quarterly

adjustment to premium amortization or discount accretion triggered

by changes in actual and projected prepayments on our Agency RMBS

(accompanied by a corresponding offsetting adjustment to realized

and unrealized gains and losses). The adjustment is calculated as

of the beginning of each quarter based on our then-current

assumptions about cashflows and prepayments, and can vary

significantly from quarter to quarter. Non-capitalized transaction

costs include expenses, generally professional fees, incurred in

connection with the acquisition of an investment or issuance of

long-term debt. For the contribution to Adjusted Distributable

Earnings from Longbridge, we adjust Longbridge's contribution to

our net income in a similar manner, but we include in Adjusted

Distributable Earnings certain realized and unrealized gains

(losses) from Longbridge's origination business ("gain-on-sale

income").

Adjusted Distributable Earnings is a supplemental non-GAAP

financial measure. We believe that the presentation of Adjusted

Distributable Earnings provides information useful to investors,

because: (i) we believe that it is a useful indicator of both

current and projected long-term financial performance, in that it

excludes the impact of certain current-period earnings components

that we believe are less useful in forecasting long-term

performance and dividend-paying ability; (ii) we use it to evaluate

the effective net yield provided by our investment portfolio, after

the effects of financial leverage and by Longbridge, to reflect the

earnings from its reverse mortgage origination and servicing

operations; and (iii) we believe that presenting Adjusted

Distributable Earnings assists investors in measuring and

evaluating our operating performance, and comparing our operating

performance to that of our residential mortgage REIT and mortgage

originator peers. Please note, however, that: (I) our calculation

of Adjusted Distributable Earnings may differ from the calculation

of similarly titled non-GAAP financial measures by our peers, with

the result that these non-GAAP financial measures might not be

directly comparable; and (II) Adjusted Distributable Earnings

excludes certain items that may impact the amount of cash that is

actually available for distribution.

In addition, because Adjusted Distributable Earnings is an

incomplete measure of our financial results and differs from net

income (loss) computed in accordance with U.S. GAAP, it should be

considered supplementary to, and not as a substitute for, net

income (loss) computed in accordance with U.S. GAAP.

Furthermore, Adjusted Distributable Earnings is different from

REIT taxable income. As a result, the determination of whether we

have met the requirement to distribute at least 90% of our annual

REIT taxable income (subject to certain adjustments) to our

stockholders, in order to maintain our qualification as a REIT, is

not based on whether we distributed 90% of our Adjusted

Distributable Earnings.

In setting our dividends, our Board of Directors considers our

earnings, liquidity, financial condition, REIT distribution

requirements, and financial covenants, along with other factors

that the Board of Directors may deem relevant from time to

time.

The following table reconciles, for the three-month periods

ended June 30, 2024 and March 31, 2024, our Adjusted Distributable

Earnings to the line on our Condensed Consolidated Statement of

Operations entitled Net Income (Loss), which we believe is the most

directly comparable U.S. GAAP measure:

:

Three-Month Period

Ended

June 30, 2024

March 31, 2024

(In thousands, except per share

amounts)

Investment Portfolio

Longbridge

Corporate/Other

Total

Investment Portfolio

Longbridge

Corporate/Other

Total

Net Income (Loss)

$

69,476

$

4,209

$

(13,613

)

$

60,072

$

43,200

$

8,754

$

(17,903

)

$

34,051

Income tax expense (benefit)

—

—

142

142

—

—

61

61

Net income (loss) before income tax

expense (benefit)

69,476

4,209

(13,471

)

60,214

43,200

8,754

(17,842

)

34,112

Adjustments:

Realized (gains) losses, net(1)

34,875

—

1,059

35,934

29,254

—

1,620

30,874

Unrealized (gains) losses, net(2)

(50,663

)

1,441

(2,679

)

(51,901

)

(25,945

)

449

(106

)

(25,602

)

Unrealized (gains) losses on reverse MSRs,

net of hedging (gains) losses(3)

—

(394

)

—

(394

)

—

(13,943

)

—

(13,943

)

Negative (positive) component of interest

income represented by Catch-up Amortization Adjustment

(720

)

—

—

(720

)

1,297

—

—

1,297

Non-capitalized transaction costs and

other expense adjustments(4)

1,081

181

321

1,583

923

4,068

500

5,491

(Earnings) losses from investments in

unconsolidated entities

(12,042

)

—

—

(12,042

)

(2,226

)

—

—

(2,226

)

Adjusted distributable earnings from

investments in unconsolidated entities(5)

3,272

—

—

3,272

816

—

—

816

Total Adjusted Distributable Earnings

$

45,279

$

5,437

$

(14,770

)

$

35,946

$

47,319

$

(672

)

$

(15,828

)

$

30,819

Dividends on preferred stock

—

—

6,825

6,825

—

—

6,654

6,654

Adjusted Distributable Earnings

attributable to non-controlling interests

486

23

278

787

216

(2

)

225

439

Adjusted Distributable Earnings

Attributable to Common Stockholders

$

44,793

$

5,414

$

(21,873

)

$

28,334

$

47,103

$

(670

)

$

(22,707

)

$

23,726

Adjusted Distributable Earnings

Attributable to Common Stockholders, per share

$

0.53

$

0.06

$

(0.26

)

$

0.33

$

0.56

$

(0.01

)

$

(0.27

)

$

0.28

(1)

Includes realized (gains) losses on

securities and loans, REO, financial derivatives (excluding

periodic settlements on interest rate swaps), and foreign currency

transactions which are components of Other Income (Loss) on the

Condensed Consolidated Statement of Operations.

(2)

Includes unrealized (gains) losses on

securities and loans, REO, financial derivatives (excluding

periodic settlements on interest rate swaps), borrowings carried at

fair value, MSR-related investments, and foreign currency

translations which are components of Other Income (Loss) on the

Condensed Consolidated Statement of Operations.

(3)

Represents net change in fair value of the

HMBS MSR Equivalent and Reverse MSRs attributable to changes in

market conditions and model assumptions. This adjustment also

includes net (gains) losses on certain hedging instruments, which

are components of realized and/or unrealized gains (losses) on

financial derivatives, net on the Condensed Consolidated Statement

of Operations.

(4)

For the three-month period ended June 30,

2024, includes $1.1 million of non-capitalized transaction costs,

$0.3 million of non-cash equity compensation expense, and $0.2

million of various other expenses. For the three-month period ended

March 31, 2024, includes $3.1 million of debt issuance costs

related to the securitization of reverse mortgage loans, $0.9

million of non-capitalized transaction costs, $0.6 million of

merger and other business transition-related expenses, $0.3 million

of non-cash equity compensation expense, and $0.6 million of

various other expenses.

(5)

Includes net interest income and operating

expenses for certain investments in unconsolidated entities.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240806005948/en/

Investors: Ellington Financial Investor Relations (203) 409-3575

info@ellingtonfinancial.com or Media: Amanda Shpiner/Grace

Cartwright Gasthalter & Co. for Ellington Financial (212)

257-4170 ellington@gasthalter.com

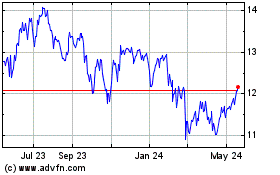

Ellington Financial (NYSE:EFC)

Historical Stock Chart

From Oct 2024 to Nov 2024

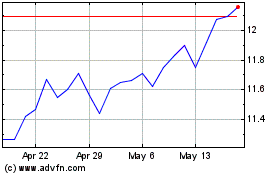

Ellington Financial (NYSE:EFC)

Historical Stock Chart

From Nov 2023 to Nov 2024