Equinor to commence first tranche of the 2024 share buy-back programme

February 06 2024 - 11:47PM

Equinor (OSE: EQNR, NYSE: EQNR) will on 8 February 2024

commence the first tranche of up to USD 1.2 billion of the share

buy-back programme for 2024, as announced at the Capital Market

Update 7 February 2024.

In this first tranche of the share buy-back programme for 2024,

shares for up to USD 396 million will be purchased in the market,

implying a total first tranche of up to USD 1.2 billion including

shares to be redeemed from the Norwegian State. The tranche will

end no later than 5 April 2024.

Equinor announces a two-year share buy-back programme of total

USD 10-12 billion for 2024-2025, with up to USD 6 billion for 2024,

including shares to be redeemed from the Norwegian State. The share

buy-back programme will be subject to market outlook and balance

sheet strength and be structured into tranches where Equinor will

buy back shares for a certain value in USD over a defined period.

For the first tranche in 2024, Equinor is entering into a

non-discretionary agreement with a third party who will execute

repurchases of shares and make its trading decisions independently

of the company.

Commencement of new share buy-back tranches after the first

tranche in 2024 will be decided by the board of directors on a

quarterly basis in line with the company’s dividend policy and will

be subject to existing and new board authorisations for share

buy-back from the company’s annual general meeting and agreement

with the Norwegian State regarding share buy-back (as further

described below).

The purpose of the share buy-back programme is to reduce the

issued share capital of the company. All shares purchased as part

of the first tranche for 2024 will thus be cancelled through a

capital reduction at the annual general meeting of the company in

May 2024.

Further information about the share buy-back programme

and the first tranche:

The first tranche of the share buy-back programme for 2024 is

based on an authorisation granted to the board of directors at the

annual general meeting of the company held on 10 May 2023.

According to this authorisation, the maximum number of shares to be

purchased in the market is 94 million of which 39,964,807 remain

available per commencement of the first tranche in 2024 (taken into

account buy-backs made under previous tranches). The minimum price

that can be paid per share is NOK 50, and the maximum price is NOK

1,000. The authorisation is valid until the earliest of 30 June

2024 and the annual general meeting of the company in 2024.

An agreement between Equinor and the Norwegian State regulates

the State’s participation in the share buy-back: at the annual

general meeting of the company in 2024, the State will, as per

proposal by the board of directors, vote for the cancellation of

shares purchased in the market pursuant to the board authorisation,

and the redemption and cancellation of a proportionate number of

its shares in order to maintain its ownership share in the company

at 67%. The price to be paid to the State for redemption of the

State’s shares shall be the volume-weighted average of the price

paid by Equinor for shares purchased in the market plus an interest

rate compensation, adjusted for any dividends paid.

In the first tranche in 2024, shares will be purchased on the

Oslo Stock Exchange and possibly other trading venues within the

EEA. Transactions will be conducted in accordance with applicable

safe harbour conditions, and as further set out in the Norwegian

Securities Trading Act of 2007, EU Commission Regulation (EC) No

2016/1052 and the Oslo Stock Exchange's Guidelines for buy-back

programmes and price stabilisation from February 2021.

The board of directors will propose to the annual general

meeting to be held in May 2024, to cancel shares purchased in the

market in this first tranche in 2024 and to redeem and cancel a

proportionate number of the State’s shares per the agreement with

the State. Based on renewal of this agreement, shares purchased

under subsequent tranches of the share buy-back programme for 2024

and 2025 and a proportionate number of the State’s shares will

follow a similar process at the annual general meetings of the

company in 2025 and 2026, respectively.

This is information that Equinor is obliged to make public

pursuant to the EU Market Abuse Regulation and that is subject to

the disclosure requirements pursuant to Section 5-12 the Norwegian

Securities Trading Act.

Further information from:

Investor relationsBård Glad Pedersen, senior vice president

Investor Relations,+47 918 01 791

MediaSissel Rinde, vice president Media Relations,+47 412

60 584

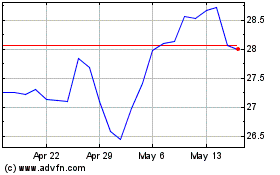

Equinor ASA (NYSE:EQNR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Equinor ASA (NYSE:EQNR)

Historical Stock Chart

From Dec 2023 to Dec 2024