Ford Swings to a Loss, Misses Analysts' Profit Estimates

January 23 2019 - 3:50PM

Dow Jones News

By Mike Colias

Ford Motor Co. said Wednesday its fourth-quarter operating

income dropped 28% amid worsening losses in China and Europe,

underscoring the pressure on the auto maker's stout U.S. business

as Chief Executive Jim Hackett tries to revitalize the company.

The company's operating income, which is adjusted for one-time

items, totaled $1.5 billion, generated entirely by its lending arm

and the North American business. Each of Ford's four other regional

businesses posted losses for the quarter and the year.

Ford's net income swung to a loss of $116 million, from a $2.5

billion profit a year earlier, partly from a nearly $900 million,

noncash hit to the value of its global pension plans, driven by the

stock-market downturn late last year.

Fourth-quarter earnings per share were 30 cents, below the 32

cent average forecast of Wall Street analysts. Ford had disclosed

the fourth-quarter EPS results during a presentation to analysts

last week.

For the full year, Ford's operating income fell 27% to $7

billion. Finance chief Bob Shanks on Wednesday reiterated that 2019

could be an improvement over last year, but that many variables

remain out of the company's control, including trade uncertainty

and commodity costs.

"The external environment has been quite volatile. Policy

matters have been unpredictable," Mr. Shanks told reporters

Wednesday, noting that tariffs cost the company more than $750

million last year.

He cited the risk of the U.K. leaving the European Union without

a trade deal, which he said would hurt Ford's substantial

manufacturing and sales operations in the country.

Mr. Hackett's turnaround plan hinges on restructuring weak parts

of the business around the globe, including Europe, while betting

bigger on trucks and SUVs in the U.S. Ford is also slashing a

cumulative $25.5 billion in costs by 2022 while overhauling its

lineup of vehicles in most major markets after letting some of them

age for longer than they should have, executives have said.

Still, analysts have expressed frustration with the pace of Mr.

Hackett's efforts and have said he should offer more specifics

about his plan. Ford shares tumbled last week after the company

offered an uncertain outlook for 2019. Some analysts said the

effect of the cost-cutting effort has been slow to show up in

Ford's bottom line.

Write to Mike Colias at Mike.Colias@wsj.com

(END) Dow Jones Newswires

January 23, 2019 16:35 ET (21:35 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

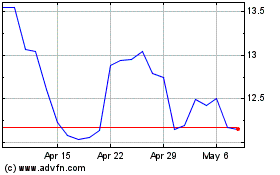

Ford Motor (NYSE:F)

Historical Stock Chart

From Apr 2024 to May 2024

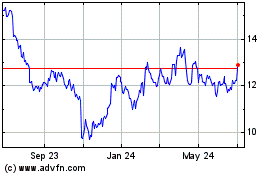

Ford Motor (NYSE:F)

Historical Stock Chart

From May 2023 to May 2024