000165013212/312023Q3FALSEhttp://fourcornersproperties.com/20230930#RestaurantRevenueMemberhttp://fourcornersproperties.com/20230930#RestaurantRevenueMemberhttp://fourcornersproperties.com/20230930#RestaurantRevenueMemberhttp://fourcornersproperties.com/20230930#RestaurantRevenueMember.3333P7YP2YP1Yhttp://fasb.org/us-gaap/2023#IntangibleAssetsNetExcludingGoodwillhttp://fasb.org/us-gaap/2023#IntangibleAssetsNetExcludingGoodwillhttp://fasb.org/us-gaap/2023#OtherAssetshttp://fasb.org/us-gaap/2023#OtherAssetsP1YP1YP3Y00016501322023-01-012023-09-3000016501322023-11-02xbrli:shares00016501322023-09-30iso4217:USD00016501322022-12-31iso4217:USDxbrli:shares00016501322023-07-012023-09-3000016501322022-07-012022-09-3000016501322022-01-012022-09-300001650132us-gaap:RealEstateMember2023-07-012023-09-300001650132us-gaap:RealEstateMember2022-07-012022-09-300001650132us-gaap:RealEstateMember2023-01-012023-09-300001650132us-gaap:RealEstateMember2022-01-012022-09-300001650132fcpt:RestaurantMember2023-07-012023-09-300001650132fcpt:RestaurantMember2022-07-012022-09-300001650132fcpt:RestaurantMember2023-01-012023-09-300001650132fcpt:RestaurantMember2022-01-012022-09-300001650132us-gaap:CommonStockMember2023-06-300001650132us-gaap:AdditionalPaidInCapitalMember2023-06-300001650132us-gaap:RetainedEarningsMember2023-06-300001650132us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300001650132us-gaap:NoncontrollingInterestMember2023-06-3000016501322023-06-300001650132us-gaap:RetainedEarningsMember2023-07-012023-09-300001650132us-gaap:NoncontrollingInterestMember2023-07-012023-09-300001650132us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300001650132us-gaap:CommonStockMember2023-07-012023-09-300001650132us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300001650132us-gaap:CommonStockMember2023-09-300001650132us-gaap:AdditionalPaidInCapitalMember2023-09-300001650132us-gaap:RetainedEarningsMember2023-09-300001650132us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001650132us-gaap:NoncontrollingInterestMember2023-09-300001650132us-gaap:CommonStockMember2022-12-310001650132us-gaap:AdditionalPaidInCapitalMember2022-12-310001650132us-gaap:RetainedEarningsMember2022-12-310001650132us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001650132us-gaap:NoncontrollingInterestMember2022-12-310001650132us-gaap:RetainedEarningsMember2023-01-012023-09-300001650132us-gaap:NoncontrollingInterestMember2023-01-012023-09-300001650132us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-09-300001650132us-gaap:CommonStockMember2023-01-012023-09-300001650132us-gaap:AdditionalPaidInCapitalMember2023-01-012023-09-300001650132us-gaap:CommonStockMember2022-06-300001650132us-gaap:AdditionalPaidInCapitalMember2022-06-300001650132us-gaap:RetainedEarningsMember2022-06-300001650132us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-300001650132us-gaap:NoncontrollingInterestMember2022-06-3000016501322022-06-300001650132us-gaap:RetainedEarningsMember2022-07-012022-09-300001650132us-gaap:NoncontrollingInterestMember2022-07-012022-09-300001650132us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-300001650132us-gaap:CommonStockMember2022-07-012022-09-300001650132us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300001650132us-gaap:CommonStockMember2022-09-300001650132us-gaap:AdditionalPaidInCapitalMember2022-09-300001650132us-gaap:RetainedEarningsMember2022-09-300001650132us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300001650132us-gaap:NoncontrollingInterestMember2022-09-3000016501322022-09-300001650132us-gaap:CommonStockMember2021-12-310001650132us-gaap:AdditionalPaidInCapitalMember2021-12-310001650132us-gaap:RetainedEarningsMember2021-12-310001650132us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001650132us-gaap:NoncontrollingInterestMember2021-12-3100016501322021-12-310001650132us-gaap:RetainedEarningsMember2022-01-012022-09-300001650132us-gaap:NoncontrollingInterestMember2022-01-012022-09-300001650132us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-09-300001650132us-gaap:CommonStockMember2022-01-012022-09-300001650132us-gaap:AdditionalPaidInCapitalMember2022-01-012022-09-300001650132fcpt:DardenMember2015-11-09xbrli:purefcpt:propertyfcpt:brand0001650132fcpt:LonghornSanAntonioBusinessMemberfcpt:DardenMember2015-11-090001650132fcpt:RevolvingCreditandTermLoanMemberfcpt:DardenMemberus-gaap:SecuredDebtMember2015-11-092015-11-090001650132fcpt:DardenMember2015-11-092015-11-090001650132srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2023-09-300001650132srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2023-09-300001650132srt:MinimumMemberus-gaap:EquipmentMember2023-09-300001650132us-gaap:EquipmentMembersrt:MaximumMember2023-09-3000016501322022-01-012022-12-310001650132fcpt:RestaurantRevenueCreditCardReceivableMember2023-09-300001650132fcpt:RestaurantRevenueCreditCardReceivableMember2022-12-310001650132srt:MinimumMember2023-01-012023-09-300001650132srt:MaximumMember2023-01-012023-09-300001650132us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberfcpt:DardenMember2023-01-012023-09-300001650132fcpt:OliveGardenMember2023-09-30fcpt:restaurant0001650132fcpt:LeasedPropertiesMemberus-gaap:CustomerConcentrationRiskMemberfcpt:OliveGardenMember2023-01-012023-09-300001650132us-gaap:CustomerConcentrationRiskMemberfcpt:OliveGardenMemberus-gaap:SalesRevenueNetMember2023-01-012023-09-300001650132fcpt:LeasedPropertiesMemberus-gaap:CustomerConcentrationRiskMemberfcpt:LongHornSteakhouseMember2023-01-012023-09-300001650132us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMemberfcpt:LongHornSteakhouseMember2023-01-012023-09-30fcpt:state0001650132stpr:TXus-gaap:SalesRevenueNetMemberus-gaap:GeographicConcentrationRiskMember2023-01-012023-09-300001650132us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredDebtMember2023-09-300001650132fcpt:PropertiesSubjectToLeasesAndOperationsOfKerrowRestaurantBusinessMember2023-09-300001650132fcpt:PropertiesSubjectToLeasesAndOperationsOfKerrowRestaurantBusinessMember2022-12-310001650132fcpt:PropertiesSubjectToLeasesAndOperationsOfKerrowRestaurantBusinessMember2023-01-012023-09-300001650132us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2023-09-300001650132fcpt:PropertiesLeasedUnderTheGroundLeaseMember2023-01-012023-09-300001650132fcpt:PropertiesLeasedUnderTheGroundLeaseMember2023-09-300001650132fcpt:PropertiesSubjectToLeasesAndOperationsOfKerrowRestaurantBusinessMember2022-01-012022-09-300001650132fcpt:PropertiesSubjectToLeasesAndOperationsOfKerrowRestaurantBusinessMember2022-09-300001650132us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMember2022-09-300001650132us-gaap:LeasesAcquiredInPlaceMember2023-09-300001650132us-gaap:LeasesAcquiredInPlaceMember2022-12-310001650132us-gaap:AboveMarketLeasesMember2023-09-300001650132us-gaap:AboveMarketLeasesMember2022-12-310001650132fcpt:LeaseIncentiveMember2023-09-300001650132fcpt:LeaseIncentiveMember2022-12-310001650132fcpt:TenantImprovementsIntangiblesMember2023-09-300001650132fcpt:TenantImprovementsIntangiblesMember2022-12-310001650132fcpt:DirectLeaseMember2023-09-300001650132fcpt:DirectLeaseMember2022-12-310001650132us-gaap:LeasesAcquiredInPlaceMember2023-07-012023-09-300001650132us-gaap:LeasesAcquiredInPlaceMember2022-07-012022-09-300001650132us-gaap:LeasesAcquiredInPlaceMember2023-01-012023-09-300001650132us-gaap:LeasesAcquiredInPlaceMember2022-01-012022-09-300001650132fcpt:AboveMarketAndBelowMarketLeasesMember2023-07-012023-09-300001650132fcpt:AboveMarketAndBelowMarketLeasesMember2022-07-012022-09-300001650132fcpt:AboveMarketAndBelowMarketLeasesMember2023-01-012023-09-300001650132fcpt:AboveMarketAndBelowMarketLeasesMember2022-01-012022-09-300001650132fcpt:LeaseIncentiveMember2023-07-012023-09-300001650132fcpt:LeaseIncentiveMember2022-07-012022-09-300001650132fcpt:LeaseIncentiveMember2023-01-012023-09-300001650132fcpt:LeaseIncentiveMember2022-01-012022-09-300001650132us-gaap:AboveMarketLeasesMember2023-01-012023-09-300001650132fcpt:BelowMarketLeasesMember2023-01-012023-09-300001650132fcpt:TenantImprovementsIntangiblesMember2023-01-012023-09-30fcpt:groundLease0001650132us-gaap:LandMember2023-09-300001650132us-gaap:LandMember2022-12-310001650132us-gaap:LandMembersrt:MinimumMember2023-09-300001650132us-gaap:LandMembersrt:MaximumMember2023-09-300001650132us-gaap:MediumTermNotesMember2023-09-300001650132us-gaap:UnsecuredDebtMember2023-09-300001650132us-gaap:MediumTermNotesMember2022-12-310001650132us-gaap:UnsecuredDebtMember2022-12-310001650132us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2023-09-300001650132us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2022-12-310001650132us-gaap:LineOfCreditMemberus-gaap:LetterOfCreditMember2023-09-300001650132us-gaap:LineOfCreditMemberus-gaap:LetterOfCreditMember2022-12-310001650132us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2023-01-012023-09-300001650132us-gaap:MediumTermNotesMemberfcpt:TermLoanDueNovember2025Member2023-09-300001650132us-gaap:MediumTermNotesMemberfcpt:TermLoanDueNovember2025Member2022-12-310001650132us-gaap:MediumTermNotesMemberfcpt:TermLoanDueNovember2026Member2023-09-300001650132us-gaap:MediumTermNotesMemberfcpt:TermLoanDueNovember2026Member2022-12-310001650132us-gaap:MediumTermNotesMemberfcpt:TermLoanDueJanuary2027Member2023-09-300001650132us-gaap:MediumTermNotesMemberfcpt:TermLoanDueJanuary2027Member2022-12-310001650132us-gaap:MediumTermNotesMemberfcpt:TermLoanDueJanuary2028Member2023-09-300001650132us-gaap:MediumTermNotesMemberfcpt:TermLoanDueJanuary2028Member2022-12-310001650132srt:MinimumMemberus-gaap:MediumTermNotesMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-09-300001650132us-gaap:MediumTermNotesMembersrt:MaximumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-01-012023-09-300001650132fcpt:PrivateSeniorNoteOfferingMemberus-gaap:UnsecuredDebtMember2023-07-120001650132fcpt:SeniorFixedNoteDueJune2024Memberus-gaap:UnsecuredDebtMember2023-09-300001650132fcpt:SeniorFixedNoteDueJune2024Memberus-gaap:UnsecuredDebtMember2022-12-310001650132fcpt:SeniorFixedNotesDueDecember2026Memberus-gaap:UnsecuredDebtMember2023-09-300001650132fcpt:SeniorFixedNotesDueDecember2026Memberus-gaap:UnsecuredDebtMember2022-12-310001650132us-gaap:UnsecuredDebtMemberfcpt:SeniorFixedNoteDueJune2027Member2023-09-300001650132us-gaap:UnsecuredDebtMemberfcpt:SeniorFixedNoteDueJune2027Member2022-12-310001650132us-gaap:UnsecuredDebtMemberfcpt:SeniorFixedNotesDueDecember2028Member2023-09-300001650132us-gaap:UnsecuredDebtMemberfcpt:SeniorFixedNotesDueDecember2028Member2022-12-310001650132us-gaap:UnsecuredDebtMemberfcpt:SeniorFixedNotesDueApril2029Member2023-09-300001650132us-gaap:UnsecuredDebtMemberfcpt:SeniorFixedNotesDueApril2029Member2022-12-310001650132fcpt:SeniorFixedNotesDueJune2029Memberus-gaap:UnsecuredDebtMember2023-09-300001650132fcpt:SeniorFixedNotesDueJune2029Memberus-gaap:UnsecuredDebtMember2022-12-310001650132us-gaap:UnsecuredDebtMemberfcpt:SeniorFixedNotesDueApril2030Member2023-09-300001650132us-gaap:UnsecuredDebtMemberfcpt:SeniorFixedNotesDueApril2030Member2022-12-310001650132us-gaap:UnsecuredDebtMemberfcpt:SeniorFixedNotesDueMarch2031Member2023-09-300001650132us-gaap:UnsecuredDebtMemberfcpt:SeniorFixedNotesDueMarch2031Member2022-12-310001650132fcpt:SeniorFixedNotesDueApril2031Memberus-gaap:UnsecuredDebtMember2023-09-300001650132fcpt:SeniorFixedNotesDueApril2031Memberus-gaap:UnsecuredDebtMember2022-12-310001650132fcpt:SeniorFixedNotesDueMarch2032Memberus-gaap:UnsecuredDebtMember2023-09-300001650132fcpt:SeniorFixedNotesDueMarch2032Memberus-gaap:UnsecuredDebtMember2022-12-310001650132fcpt:SeniorFixedNotesDueJuly2033Memberus-gaap:UnsecuredDebtMember2023-09-300001650132fcpt:SeniorFixedNotesDueJuly2033Memberus-gaap:UnsecuredDebtMember2022-12-310001650132us-gaap:UnsecuredDebtMemberfcpt:TheNotesMember2023-09-300001650132us-gaap:UnsecuredDebtMemberfcpt:TheNotesMember2022-12-310001650132fcpt:TermLoanAndRevolvingCreditFacilityMember2023-09-300001650132fcpt:TermLoanAndRevolvingCreditFacilityMember2022-12-310001650132fcpt:TermLoanAndRevolvingCreditFacilityMember2023-07-012023-09-300001650132fcpt:TermLoanAndRevolvingCreditFacilityMember2022-07-012022-09-300001650132fcpt:TermLoanAndRevolvingCreditFacilityMember2023-01-012023-09-300001650132fcpt:TermLoanAndRevolvingCreditFacilityMember2022-01-012022-09-300001650132us-gaap:UnsecuredDebtMember2023-07-012023-09-300001650132us-gaap:UnsecuredDebtMember2022-07-012022-09-300001650132us-gaap:UnsecuredDebtMember2023-01-012023-09-300001650132us-gaap:UnsecuredDebtMember2022-01-012022-09-300001650132us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:SwapMemberfcpt:VariableRateDebtMember2023-09-300001650132us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:SwapMemberfcpt:VariableRateDebtMember2022-12-310001650132us-gaap:DesignatedAsHedgingInstrumentMember2023-09-30fcpt:swap0001650132fcpt:SwapPeriodOneMemberus-gaap:NondesignatedMember2023-09-300001650132us-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberfcpt:SwapPeriodOneMemberus-gaap:NondesignatedMember2023-09-300001650132fcpt:SwapPeriodTwoMemberus-gaap:NondesignatedMember2023-09-300001650132fcpt:SwapPeriodTwoMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:NondesignatedMember2023-09-300001650132fcpt:SwapPeriodThreeMemberus-gaap:NondesignatedMember2023-09-300001650132fcpt:SwapPeriodThreeMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:NondesignatedMember2023-09-300001650132fcpt:SwapPeriodFourMemberus-gaap:NondesignatedMember2023-09-300001650132fcpt:SwapPeriodFourMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:NondesignatedMember2023-09-300001650132fcpt:SwapPeriodFiveMemberus-gaap:NondesignatedMember2023-09-300001650132fcpt:SwapPeriodFiveMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:NondesignatedMember2023-09-300001650132fcpt:SwapPeriodSixMemberus-gaap:NondesignatedMember2023-09-300001650132fcpt:SwapPeriodSixMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:NondesignatedMember2023-09-300001650132fcpt:SwapPeriodSevenMemberus-gaap:NondesignatedMember2023-09-300001650132fcpt:SwapPeriodSevenMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:NondesignatedMember2023-09-300001650132fcpt:SwapPeriodEightMemberus-gaap:NondesignatedMember2023-09-300001650132fcpt:SwapPeriodNineMemberus-gaap:NondesignatedMember2023-09-300001650132fcpt:SwapPeriodNineMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:NondesignatedMember2023-09-300001650132fcpt:SwapPeriodTenMemberus-gaap:NondesignatedMember2023-09-300001650132fcpt:SwapPeriodTenMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:NondesignatedMember2023-09-300001650132fcpt:SwapPeriodElevenMemberus-gaap:NondesignatedMember2023-09-300001650132fcpt:SwapPeriodElevenMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:NondesignatedMember2023-09-300001650132fcpt:SwapPeriodTwelveMemberus-gaap:NondesignatedMember2023-09-300001650132fcpt:SwapPeriodTwelveMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:NondesignatedMember2023-09-300001650132fcpt:SwapPeriodThirteenMemberus-gaap:NondesignatedMember2023-09-300001650132fcpt:SwapPeriodThirteenMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:NondesignatedMember2023-09-300001650132us-gaap:SubsequentEventMemberfcpt:SwapPeriodFiveMembersrt:ScenarioForecastMemberus-gaap:NondesignatedMember2024-11-300001650132us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2023-01-012023-09-30fcpt:derivativeInstrument0001650132fcpt:PrivateSeniorNoteOfferingMemberus-gaap:UnsecuredDebtMember2023-06-050001650132us-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:CashFlowHedgingMember2023-09-300001650132us-gaap:SwapMember2023-05-250001650132us-gaap:SwapMember2023-05-252023-05-250001650132us-gaap:DesignatedAsHedgingInstrumentMemberfcpt:DerivativeAssetsMemberus-gaap:InterestRateSwapMember2023-09-300001650132us-gaap:DesignatedAsHedgingInstrumentMemberfcpt:DerivativeAssetsMemberus-gaap:InterestRateSwapMember2022-12-310001650132us-gaap:DesignatedAsHedgingInstrumentMemberfcpt:DerivativeLiabilitiesMemberus-gaap:InterestRateSwapMember2023-09-300001650132us-gaap:DesignatedAsHedgingInstrumentMemberfcpt:DerivativeLiabilitiesMemberus-gaap:InterestRateSwapMember2022-12-310001650132us-gaap:DesignatedAsHedgingInstrumentMember2022-12-310001650132us-gaap:InterestRateSwapMember2023-07-012023-09-300001650132us-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMember2023-07-012023-09-300001650132us-gaap:InterestRateSwapMember2022-07-012022-09-300001650132us-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMember2022-07-012022-09-300001650132us-gaap:InterestRateSwapMember2023-01-012023-09-300001650132us-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMember2023-01-012023-09-300001650132us-gaap:InterestRateSwapMember2022-01-012022-09-300001650132us-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMember2022-01-012022-09-3000016501322023-03-132023-03-1300016501322023-06-142023-06-1400016501322023-09-182023-09-180001650132fcpt:AtTheMarketOfferingMember2022-11-070001650132fcpt:AtTheMarketOfferingMember2021-02-280001650132fcpt:AtTheMarketOfferingMember2021-02-012022-11-070001650132fcpt:AtTheMarketOfferingForwardSaleAgreementMember2023-01-012023-09-300001650132fcpt:AtTheMarketOfferingSettledForwardSaleAgreementMember2023-01-012023-09-300001650132fcpt:AtTheMarketOfferingMember2023-07-012023-09-300001650132fcpt:AtTheMarketOfferingMember2023-01-012023-09-300001650132fcpt:AtTheMarketOfferingForwardSaleAgreementMember2022-07-012022-09-300001650132fcpt:AtTheMarketOfferingForwardSaleAgreementMember2022-01-012022-09-300001650132fcpt:AtTheMarketOfferingMember2022-07-012022-09-300001650132fcpt:AtTheMarketOfferingMember2022-01-012022-09-300001650132fcpt:AtTheMarketOfferingMember2023-09-300001650132fcpt:FourCornersPropertyTrustMember2023-09-3000016501322022-06-102022-06-1000016501322022-06-100001650132us-gaap:RestrictedStockUnitsRSUMember2022-12-310001650132us-gaap:RestrictedStockMember2022-12-310001650132us-gaap:PerformanceSharesMember2022-12-310001650132us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-09-300001650132us-gaap:RestrictedStockMember2023-01-012023-09-300001650132us-gaap:PerformanceSharesMember2023-01-012023-09-300001650132us-gaap:RestrictedStockUnitsRSUMember2023-09-300001650132us-gaap:RestrictedStockMember2023-09-300001650132us-gaap:PerformanceSharesMember2023-09-300001650132srt:MinimumMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-09-300001650132us-gaap:RestrictedStockUnitsRSUMembersrt:MaximumMember2023-01-012023-09-300001650132us-gaap:RestrictedStockUnitsRSUMember2023-07-012023-09-300001650132srt:MinimumMemberus-gaap:RestrictedStockMember2023-01-012023-09-300001650132us-gaap:RestrictedStockMembersrt:MaximumMember2023-01-012023-09-300001650132us-gaap:RestrictedStockMember2023-07-012023-09-300001650132us-gaap:PerformanceSharesMember2023-07-012023-09-300001650132srt:MinimumMemberus-gaap:PerformanceSharesMember2023-01-012023-09-300001650132us-gaap:PerformanceSharesMembersrt:MaximumMember2023-01-012023-09-30fcpt:day0001650132us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2023-09-300001650132us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2023-09-300001650132us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2023-09-300001650132us-gaap:FairValueMeasurementsRecurringMember2023-09-300001650132us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel1Member2022-12-310001650132us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel2Member2022-12-310001650132us-gaap:FairValueMeasurementsRecurringMemberus-gaap:FairValueInputsLevel3Member2022-12-310001650132us-gaap:FairValueMeasurementsRecurringMember2022-12-310001650132us-gaap:MediumTermNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberfcpt:TermLoanDueNovember2025Member2023-09-300001650132us-gaap:MediumTermNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfcpt:TermLoanDueNovember2025Member2023-09-300001650132us-gaap:MediumTermNotesMemberfcpt:TermLoanDueNovember2026Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-300001650132us-gaap:MediumTermNotesMemberfcpt:TermLoanDueNovember2026Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-09-300001650132fcpt:TermLoanDueJanuary2027Memberus-gaap:MediumTermNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-300001650132fcpt:TermLoanDueJanuary2027Memberus-gaap:MediumTermNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2023-09-300001650132us-gaap:MediumTermNotesMemberfcpt:TermLoanDueJanuary2028Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-300001650132us-gaap:MediumTermNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfcpt:TermLoanDueJanuary2028Member2023-09-300001650132fcpt:SeniorFixedNoteDueJune2024Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-300001650132fcpt:SeniorFixedNoteDueJune2024Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-09-300001650132fcpt:SeniorFixedNoteDueDecember2026Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-300001650132us-gaap:EstimateOfFairValueFairValueDisclosureMemberfcpt:SeniorFixedNoteDueDecember2026Memberus-gaap:SeniorNotesMember2023-09-300001650132fcpt:SeniorFixedNoteDueJune2027Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-300001650132us-gaap:EstimateOfFairValueFairValueDisclosureMemberfcpt:SeniorFixedNoteDueJune2027Memberus-gaap:SeniorNotesMember2023-09-300001650132fcpt:SeniorFixedNoteDueDecember2028Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-300001650132us-gaap:EstimateOfFairValueFairValueDisclosureMemberfcpt:SeniorFixedNoteDueDecember2028Memberus-gaap:SeniorNotesMember2023-09-300001650132us-gaap:SeniorNotesMemberfcpt:SeniorFixedNotesDueApril2029Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-300001650132us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMemberfcpt:SeniorFixedNotesDueApril2029Member2023-09-300001650132fcpt:SeniorFixedNoteDueJune2029Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-300001650132us-gaap:EstimateOfFairValueFairValueDisclosureMemberfcpt:SeniorFixedNoteDueJune2029Memberus-gaap:SeniorNotesMember2023-09-300001650132fcpt:SeniorFixedNoteDueApril2030Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-300001650132us-gaap:EstimateOfFairValueFairValueDisclosureMemberfcpt:SeniorFixedNoteDueApril2030Memberus-gaap:SeniorNotesMember2023-09-300001650132fcpt:SeniorFixedNotesDueMarch2031Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-300001650132us-gaap:EstimateOfFairValueFairValueDisclosureMemberfcpt:SeniorFixedNotesDueMarch2031Memberus-gaap:SeniorNotesMember2023-09-300001650132fcpt:SeniorFixedNotesDueApril2031Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-300001650132fcpt:SeniorFixedNotesDueApril2031Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-09-300001650132fcpt:SeniorFixedNotesDueMarch2032Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-300001650132fcpt:SeniorFixedNotesDueMarch2032Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-09-300001650132fcpt:SeniorFixedNotesDueJuly2033Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-300001650132fcpt:SeniorFixedNotesDueJuly2033Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2023-09-300001650132us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2023-09-300001650132us-gaap:LineOfCreditMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:RevolvingCreditFacilityMember2023-09-300001650132us-gaap:MediumTermNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMemberfcpt:TermLoanDueNovember2025Member2022-12-310001650132us-gaap:MediumTermNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfcpt:TermLoanDueNovember2025Member2022-12-310001650132us-gaap:MediumTermNotesMemberfcpt:TermLoanDueNovember2026Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001650132us-gaap:MediumTermNotesMemberfcpt:TermLoanDueNovember2026Memberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001650132fcpt:TermLoanDueJanuary2027Memberus-gaap:MediumTermNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001650132fcpt:TermLoanDueJanuary2027Memberus-gaap:MediumTermNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMember2022-12-310001650132us-gaap:MediumTermNotesMemberfcpt:TermLoanDueJanuary2028Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001650132us-gaap:MediumTermNotesMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberfcpt:TermLoanDueJanuary2028Member2022-12-310001650132fcpt:SeniorFixedNoteDueJune2024Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001650132fcpt:SeniorFixedNoteDueJune2024Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2022-12-310001650132fcpt:SeniorFixedNoteDueDecember2026Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001650132us-gaap:EstimateOfFairValueFairValueDisclosureMemberfcpt:SeniorFixedNoteDueDecember2026Memberus-gaap:SeniorNotesMember2022-12-310001650132fcpt:SeniorFixedNoteDueJune2027Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001650132us-gaap:EstimateOfFairValueFairValueDisclosureMemberfcpt:SeniorFixedNoteDueJune2027Memberus-gaap:SeniorNotesMember2022-12-310001650132fcpt:SeniorFixedNoteDueDecember2028Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001650132us-gaap:EstimateOfFairValueFairValueDisclosureMemberfcpt:SeniorFixedNoteDueDecember2028Memberus-gaap:SeniorNotesMember2022-12-310001650132us-gaap:SeniorNotesMemberfcpt:SeniorFixedNotesDueApril2029Memberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001650132us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMemberfcpt:SeniorFixedNotesDueApril2029Member2022-12-310001650132fcpt:SeniorFixedNoteDueJune2029Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001650132us-gaap:EstimateOfFairValueFairValueDisclosureMemberfcpt:SeniorFixedNoteDueJune2029Memberus-gaap:SeniorNotesMember2022-12-310001650132fcpt:SeniorFixedNoteDueApril2030Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001650132us-gaap:EstimateOfFairValueFairValueDisclosureMemberfcpt:SeniorFixedNoteDueApril2030Memberus-gaap:SeniorNotesMember2022-12-310001650132fcpt:SeniorFixedNotesDueMarch2031Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001650132us-gaap:EstimateOfFairValueFairValueDisclosureMemberfcpt:SeniorFixedNotesDueMarch2031Memberus-gaap:SeniorNotesMember2022-12-310001650132fcpt:SeniorFixedNotesDueApril2031Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001650132fcpt:SeniorFixedNotesDueApril2031Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2022-12-310001650132fcpt:SeniorFixedNotesDueMarch2032Memberus-gaap:SeniorNotesMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001650132fcpt:SeniorFixedNotesDueMarch2032Memberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:SeniorNotesMember2022-12-310001650132us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:CarryingReportedAmountFairValueDisclosureMember2022-12-310001650132us-gaap:LineOfCreditMemberus-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:RevolvingCreditFacilityMember2022-12-31fcpt:segment0001650132fcpt:RealEstateOperationsMemberus-gaap:OperatingSegmentsMember2023-07-012023-09-300001650132us-gaap:OperatingSegmentsMemberfcpt:RestaurantOperationsMember2023-07-012023-09-300001650132us-gaap:IntersegmentEliminationMember2023-07-012023-09-300001650132fcpt:RealEstateOperationsMemberus-gaap:OperatingSegmentsMemberfcpt:RestaurantMember2023-07-012023-09-300001650132us-gaap:OperatingSegmentsMemberfcpt:RestaurantMemberfcpt:RestaurantOperationsMember2023-07-012023-09-300001650132us-gaap:RealEstateMemberfcpt:RealEstateOperationsMemberus-gaap:OperatingSegmentsMember2023-07-012023-09-300001650132us-gaap:RealEstateMemberus-gaap:OperatingSegmentsMemberfcpt:RestaurantOperationsMember2023-07-012023-09-300001650132us-gaap:RealEstateMemberus-gaap:IntersegmentEliminationMember2023-07-012023-09-300001650132us-gaap:IntersegmentEliminationMemberfcpt:RestaurantMember2023-07-012023-09-300001650132fcpt:RealEstateOperationsMemberus-gaap:OperatingSegmentsMember2022-07-012022-09-300001650132us-gaap:OperatingSegmentsMemberfcpt:RestaurantOperationsMember2022-07-012022-09-300001650132us-gaap:IntersegmentEliminationMember2022-07-012022-09-300001650132fcpt:RealEstateOperationsMemberus-gaap:OperatingSegmentsMemberfcpt:RestaurantMember2022-07-012022-09-300001650132us-gaap:OperatingSegmentsMemberfcpt:RestaurantMemberfcpt:RestaurantOperationsMember2022-07-012022-09-300001650132us-gaap:RealEstateMemberfcpt:RealEstateOperationsMemberus-gaap:OperatingSegmentsMember2022-07-012022-09-300001650132us-gaap:RealEstateMemberus-gaap:OperatingSegmentsMemberfcpt:RestaurantOperationsMember2022-07-012022-09-300001650132us-gaap:RealEstateMemberus-gaap:IntersegmentEliminationMember2022-07-012022-09-300001650132us-gaap:IntersegmentEliminationMemberfcpt:RestaurantMember2022-07-012022-09-300001650132fcpt:RealEstateOperationsMemberus-gaap:OperatingSegmentsMember2023-01-012023-09-300001650132us-gaap:OperatingSegmentsMemberfcpt:RestaurantOperationsMember2023-01-012023-09-300001650132us-gaap:IntersegmentEliminationMember2023-01-012023-09-300001650132fcpt:RealEstateOperationsMemberus-gaap:OperatingSegmentsMemberfcpt:RestaurantMember2023-01-012023-09-300001650132us-gaap:OperatingSegmentsMemberfcpt:RestaurantMemberfcpt:RestaurantOperationsMember2023-01-012023-09-300001650132us-gaap:RealEstateMemberfcpt:RealEstateOperationsMemberus-gaap:OperatingSegmentsMember2023-01-012023-09-300001650132us-gaap:RealEstateMemberus-gaap:OperatingSegmentsMemberfcpt:RestaurantOperationsMember2023-01-012023-09-300001650132us-gaap:RealEstateMemberus-gaap:IntersegmentEliminationMember2023-01-012023-09-300001650132us-gaap:IntersegmentEliminationMemberfcpt:RestaurantMember2023-01-012023-09-300001650132fcpt:RealEstateOperationsMemberus-gaap:OperatingSegmentsMember2022-01-012022-09-300001650132us-gaap:OperatingSegmentsMemberfcpt:RestaurantOperationsMember2022-01-012022-09-300001650132us-gaap:IntersegmentEliminationMember2022-01-012022-09-300001650132fcpt:RealEstateOperationsMemberus-gaap:OperatingSegmentsMemberfcpt:RestaurantMember2022-01-012022-09-300001650132us-gaap:OperatingSegmentsMemberfcpt:RestaurantMemberfcpt:RestaurantOperationsMember2022-01-012022-09-300001650132us-gaap:RealEstateMemberfcpt:RealEstateOperationsMemberus-gaap:OperatingSegmentsMember2022-01-012022-09-300001650132us-gaap:RealEstateMemberus-gaap:OperatingSegmentsMemberfcpt:RestaurantOperationsMember2022-01-012022-09-300001650132us-gaap:RealEstateMemberus-gaap:IntersegmentEliminationMember2022-01-012022-09-300001650132us-gaap:IntersegmentEliminationMemberfcpt:RestaurantMember2022-01-012022-09-300001650132fcpt:RealEstateOperationsMember2023-09-300001650132fcpt:RestaurantOperationsMember2023-09-300001650132fcpt:RealEstateOperationsMember2022-12-310001650132fcpt:RestaurantOperationsMember2022-12-310001650132us-gaap:SubsequentEventMember2023-10-012023-11-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2023

or

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 1-37538

Four Corners Property Trust, Inc.

(Exact name of registrant as specified in its charter)

| | | | | |

Maryland | 47-4456296 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | | | | |

591 Redwood Highway, | Suite 3215, | Mill Valley, | CA | 94941 |

| (Address of principal executive offices) |

(415) 965-8030

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of Exchange on Which Registered |

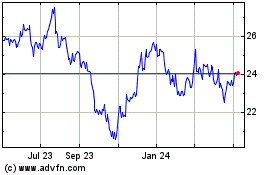

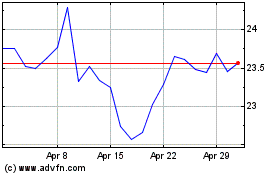

| Common Stock, $0.0001 par value per share | FCPT | New York Stock Exchange |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). x Yes ¨ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | |

| Large accelerated filer | ☒ | Accelerated filer | ☐ | Non-accelerated filer | ☐ |

Smaller reporting company | ☐ | Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐Yes ☒ No

Number of shares of common stock outstanding as of November 2, 2023: 90,565,195

FOUR CORNERS PROPERTY TRUST, INC.

FORM 10 - Q

THREE AND NINE MONTHS ENDED SEPTEMBER 30, 2023

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| Part I | FINANCIAL INFORMATION | |

| Item 1. | Financial Statements: | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| Part II | OTHER INFORMATION | |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Item 5. | | |

| Item 6. | | |

| | |

| | |

| | |

| | |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

FOUR CORNERS PROPERTY TRUST, INC.

CONSOLIDATED BALANCE SHEETS

(In thousands, except share and per share data)

| | | | | | | | | | | | | | |

| | September 30, 2023 (Unaudited) | | December 31, 2022 |

| ASSETS | | | | |

| Real estate investments: | | | | |

| Land | | $ | 1,235,943 | | | $ | 1,115,827 | |

| Buildings, equipment and improvements | | 1,700,513 | | | 1,539,875 | |

| Total real estate investments | | 2,936,456 | | | 2,655,702 | |

| Less: Accumulated depreciation | | (730,014) | | | (706,702) | |

| Total real estate investments, net | | 2,206,442 | | | 1,949,000 | |

| Intangible lease assets, net | | 122,132 | | | 106,206 | |

| Total real estate investments and intangible lease assets, net | | 2,328,574 | | | 2,055,206 | |

| Real estate held for sale | | 3,150 | | | 7,522 | |

| Cash and cash equivalents | | 5,675 | | | 26,296 | |

| Straight-line rent adjustment | | 63,844 | | | 61,027 | |

| Derivative assets | | 31,292 | | | 35,276 | |

| Deferred tax assets | | 1,221 | | | 988 | |

| Other assets | | 22,138 | | | 12,272 | |

| Total Assets | | $ | 2,455,894 | | | $ | 2,198,587 | |

| | | | |

| LIABILITIES AND EQUITY | | | | |

| Liabilities: | | | | |

| Term loan and revolving credit facility, net of deferred financing costs | | $ | 455,342 | | | $ | 424,134 | |

| Senior unsecured notes, net of deferred financing costs | | 670,756 | | | 571,343 | |

| Dividends payable | | 30,724 | | | 29,064 | |

| Rent received in advance | | 13,204 | | | 11,710 | |

| Derivative liabilities | | — | | | 9 | |

| Other liabilities | | 32,224 | | | 24,017 | |

| Total liabilities | | 1,202,250 | | | 1,060,277 | |

| | | | |

| Equity: | | | | |

Preferred stock, par value 0.0001 per share; 25,000,000 authorized, zero shares issued and outstanding | | — | | | — | |

Common stock, par value 0.0001 per share; 500,000,000 shares authorized, 90,565,195 and 85,637,293 shares issued and outstanding, respectively | | 9 | | | 9 | |

| Additional paid-in capital | | 1,235,247 | | | 1,104,522 | |

| Retained earnings (accumulated deficit) | | (19,165) | | | 576 | |

| Accumulated other comprehensive income | | 35,314 | | | 30,944 | |

| Noncontrolling interest | | 2,239 | | | 2,259 | |

| Total equity | | 1,253,644 | | | 1,138,310 | |

| Total Liabilities and Equity | | $ | 2,455,894 | | | $ | 2,198,587 | |

| | | | |

The accompanying notes are an integral part of this financial statement.

1

FOUR CORNERS PROPERTY TRUST, INC.

CONSOLIDATED STATEMENTS OF INCOME

(In thousands, except share and per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | | |

| Rental revenue | | $ | 57,243 | | | $ | 48,719 | | | $ | 162,267 | | | $ | 143,526 | |

| Restaurant revenue | | 7,596 | | | 7,289 | | | 23,196 | | | 22,304 | |

| Total revenues | | 64,839 | | | 56,008 | | | 185,463 | | | 165,830 | |

| Operating expenses: | | | | | | | | |

| General and administrative | | 5,498 | | | 4,917 | | | 17,153 | | | 14,884 | |

| Depreciation and amortization | | 13,418 | | | 10,588 | | | 37,411 | | | 30,420 | |

| Property expenses | | 2,916 | | | 1,999 | | | 8,742 | | | 5,835 | |

| Restaurant expenses | | 7,229 | | | 6,790 | | | 21,721 | | | 20,725 | |

| Total operating expenses | | 29,061 | | | 24,294 | | | 85,027 | | | 71,864 | |

| Interest expense | | (12,276) | | | (9,177) | | | (32,245) | | | (26,583) | |

| Other income | | 283 | | | 164 | | | 809 | | | 250 | |

| Realized gain on sale | | 318 | | | 1,828 | | | 2,053 | | | 7,584 | |

Income tax benefit (expense) | | 89 | | | 23 | | | (50) | | | (209) | |

| Net income | | 24,192 | | | 24,552 | | | 71,003 | | | 75,008 | |

| Net income attributable to noncontrolling interest | | (31) | | | (34) | | | (92) | | | (105) | |

| Net Income Available to Common Shareholders | | $ | 24,161 | | | $ | 24,518 | | | $ | 70,911 | | | $ | 74,903 | |

| | | | | | | | |

| Basic net income per share: | | $ | 0.27 | | | $ | 0.30 | | | $ | 0.81 | | | $ | 0.93 | |

| Diluted net income per share: | | $ | 0.27 | | | $ | 0.30 | | | $ | 0.80 | | | $ | 0.92 | |

| Weighted average number of common shares outstanding: | | | | | | | | |

| Basic | | 90,366,861 | | | 81,884,974 | | | 87,872,205 | | | 80,797,829 | |

| Diluted | | 90,595,872 | | | 82,119,447 | | | 88,105,134 | | | 81,011,737 | |

| Dividends declared per common share | | $ | 0.3400 | | | $ | 0.3325 | | | $ | 1.0200 | | | $ | 0.9975 | |

The accompanying notes are an integral part of this financial statement.

2

FOUR CORNERS PROPERTY TRUST, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(In thousands, except for share and per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net income | | $ | 24,192 | | | $ | 24,552 | | | $ | 71,003 | | | $ | 75,008 | |

| Other comprehensive income: | | | | | | | | |

| Effective portion of change in fair value of derivative instruments | | 6,609 | | | 17,151 | | | 12,020 | | | 39,151 | |

| Reclassification adjustment of derivative instruments included in net income | | (3,007) | | | (104) | | | (7,645) | | | 2,700 | |

| Other comprehensive income | | 3,602 | | | 17,047 | | | 4,375 | | | 41,851 | |

| Comprehensive income | | 27,794 | | | 41,599 | | | 75,378 | | | 116,859 | |

| Less: comprehensive income attributable to noncontrolling interest | | | | | | | | |

| Net income attributable to noncontrolling interest | | 31 | | | 34 | | | 92 | | | 105 | |

| Other comprehensive income attributable to noncontrolling interest | | 45 | | | 24 | | | 5 | | | 59 | |

| Comprehensive income attributable to noncontrolling interest | | 76 | | | 58 | | | 97 | | | 164 | |

| Comprehensive Income Attributable to Common Shareholders | | $ | 27,718 | | | $ | 41,541 | | | $ | 75,281 | | | $ | 116,695 | |

The accompanying notes are an integral part of this financial statement.

3

FOUR CORNERS PROPERTY TRUST, INC.

CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY

(In thousands, except share data)

(Unaudited)

For the Three Months Ended September 30, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Additional Paid-in Capital | | Retained Earnings (Accumulated Deficit) | | Accumulated Other Comprehensive Income (Loss) | | Noncontrolling Interest | | Total |

| | Shares | | Par Value |

Balance at

June 30, 2023 | | 90,565,846 | | | $ | 9 | | | $ | 1,233,775 | | | $ | (12,602) | | | $ | 31,757 | | | $ | 2,202 | | | $ | 1,255,141 | |

| Net income | | — | | | — | | | — | | | 24,161 | | | — | | | 31 | | | 24,192 | |

| Other comprehensive income | | — | | | — | | | — | | | — | | | 3,557 | | | 45 | | | 3,602 | |

| | | | | | | | | | | | | | |

| ATM proceeds, net of issuance costs | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Dividends and distributions to equity holders | | — | | | — | | | — | | | (30,724) | | | — | | | (39) | | | (30,763) | |

| Stock-based compensation, net | | (651) | | | — | | | 1,472 | | | — | | | — | | | — | | | 1,472 | |

Balance at

September 30, 2023 | | 90,565,195 | | | $ | 9 | | | $ | 1,235,247 | | | $ | (19,165) | | | $ | 35,314 | | | $ | 2,239 | | | $ | 1,253,644 | |

For the Nine Months Ended September 30, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Additional Paid-in Capital | | Retained Earnings (Accumulated Deficit) | | Accumulated Other Comprehensive Income (Loss) | | Noncontrolling Interest | | Total |

| | Shares | | Par Value |

Balance at

December 31, 2022 | | 85,637,293 | | | $ | 9 | | | $ | 1,104,522 | | | $ | 576 | | | $ | 30,944 | | | $ | 2,259 | | | $ | 1,138,310 | |

| Net income | | — | | | — | | | — | | | 70,911 | | | — | | | 92 | | | 71,003 | |

| Other comprehensive income | | — | | | — | | | — | | | — | | | 4,370 | | | 5 | | | 4,375 | |

| | | | | | | | | | | | | | |

| ATM proceeds, net of issuance costs | | 4,787,970 | | | — | | | 128,184 | | | — | | | — | | | — | | | 128,184 | |

| Dividends and distributions to equity holders | | — | | | — | | | — | | | (90,652) | | | — | | | (117) | | | (90,769) | |

| Stock-based compensation, net | | 139,932 | | | — | | | 2,541 | | | — | | | — | | | — | | | 2,541 | |

Balance at

September 30, 2023 | | 90,565,195 | | | $ | 9 | | | $ | 1,235,247 | | | $ | (19,165) | | | $ | 35,314 | | | $ | 2,239 | | | $ | 1,253,644 | |

The accompanying notes are an integral part of this financial statement.

4

For the Three Months Ended September 30, 2022

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Additional Paid-in Capital | | Retained Earnings (Accumulated Deficit) | | Accumulated Other Comprehensive Income (Loss) | | Noncontrolling Interest | | Total |

| | Shares | | Par Value |

Balance at

June 30, 2022 | | 80,543,986 | | | $ | 8 | | | $ | 964,607 | | | $ | 9,740 | | | $ | 14,945 | | | $ | 2,248 | | | $ | 991,548 | |

| Net income | | — | | | — | | | — | | | 24,518 | | | — | | | 34 | | | 24,552 | |

| Other comprehensive income | | — | | | — | | | — | | | — | | | 17,023 | | | 24 | | | 17,047 | |

| | | | | | | | | | | | | | |

| ATM proceeds, net of issuance costs | | 2,277,782 | | | — | | | 61,903 | | | — | | | — | | | — | | | 61,903 | |

| Dividends and distributions to equity holders | | — | | | — | | | — | | | (27,487) | | | — | | | (38) | | | (27,525) | |

| Stock-based compensation, net | | 816 | | | — | | | 1,206 | | | — | | | — | | | — | | | 1,206 | |

Balance at

September 30, 2022 | | 82,822,584 | | | $ | 8 | | | $ | 1,027,716 | | | $ | 6,771 | | | $ | 31,968 | | | $ | 2,268 | | | $ | 1,068,731 | |

For the Nine Months Ended September 30, 2022

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Common Stock | | Additional Paid-in Capital | | Retained Earnings (Accumulated Deficit) | | Accumulated Other Comprehensive Income (Loss) | | Noncontrolling Interest | | Total |

| | Shares | | Par Value |

Balance at

December 31, 2021 | | 80,279,217 | | | $ | 8 | | | $ | 958,737 | | | $ | 12,753 | | | $ | (9,824) | | | $ | 2,218 | | | $ | 963,892 | |

| Net income | | — | | | — | | | — | | | 74,903 | | | — | | | 105 | | | 75,008 | |

| Other comprehensive income | | — | | | — | | | — | | | — | | | 41,792 | | | 59 | | | 41,851 | |

| | | | | | | | | | | | | | |

| ATM proceeds, net of issuance costs | | 2,451,206 | | | — | | | 66,257 | | | — | | | — | | | — | | | 66,257 | |

| Dividends and distributions to equity holders | | — | | | — | | | — | | | (80,885) | | | — | | | (114) | | | (80,999) | |

| Stock-based compensation, net | | 92,161 | | | — | | | 2,722 | | | — | | | — | | | — | | | 2,722 | |

Balance at

September 30, 2022 | | 82,822,584 | | | $ | 8 | | | $ | 1,027,716 | | | $ | 6,771 | | | $ | 31,968 | | | $ | 2,268 | | | $ | 1,068,731 | |

The accompanying notes are an integral part of this financial statement.

5

FOUR CORNERS PROPERTY TRUST, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| | 2023 | | 2022 |

| Cash flows - operating activities | | | | |

| Net income | | $ | 71,003 | | | $ | 75,008 | |

| Adjustments to reconcile net income to cash provided by operating activities: | | | | |

| Depreciation and amortization | | 37,411 | | | 30,420 | |

| Realized gain on sale | | (2,053) | | | (7,584) | |

| Non-cash revenue adjustments | | 1,510 | | | 1,600 | |

| Amortization of financing costs | | 1,720 | | | 1,460 | |

| Stock-based compensation expense | | 4,798 | | | 3,739 | |

| Deferred income taxes | | (232) | | | (57) | |

| Changes in assets and liabilities: | | | | |

| Derivative assets and liabilities | | 8,350 | | | 477 | |

| Straight-line rent adjustment | | (4,358) | | | (4,939) | |

| Rent received in advance | | 1,494 | | | 559 | |

| | | | |

| Other assets and liabilities | | 9,056 | | | 8,604 | |

| Net cash provided by operating activities | | 128,699 | | | 109,287 | |

| Cash flows - investing activities | | | | |

| Purchases of real estate investments | | (328,469) | | | (171,835) | |

| Proceeds from sale of real estate investments | | 24,087 | | | 20,365 | |

| Advance refunds on acquisition of operating real estate | | (35) | | | (459) | |

| Net cash used in investing activities | | (304,417) | | | (151,929) | |

| Cash flows - financing activities | | | | |

| Net proceeds from ATM equity issuance | | 128,184 | | | 66,257 | |

| | | | |

| Proceeds from issuance of senior notes | | 100,000 | | | 125,000 | |

| Payment of deferred financing costs | | (1,098) | | | (1,062) | |

| Proceeds from revolving credit facility | | 118,000 | | | 28,000 | |

| Repayment of revolving credit facility | | (88,000) | | | (64,000) | |

| Payment of dividends to shareholders | | (88,991) | | | (80,053) | |

| Distributions to non-controlling interests | | (117) | | | (114) | |

| | | | |

| Employee shares withheld for taxes | | (2,257) | | | (1,017) | |

| Net cash provided by financing activities | | 165,721 | | | 73,011 | |

Net (decrease) increase in cash and cash equivalents, including restricted cash | | (9,997) | | | 30,369 | |

| Cash and cash equivalents, including restricted cash, at beginning of period | | 26,296 | | | 6,300 | |

| Cash and cash equivalents, including restricted cash, at end of period | | $ | 16,299 | | | $ | 36,669 | |

| Supplemental disclosures: | | | | |

| Interest paid | | $ | 33,031 | | | $ | 17,318 | |

| Income taxes paid | | $ | 355 | | | $ | 358 | |

| Operating lease payments received (lessor) | | $ | 152,648 | | | $ | 135,546 | |

| Operating lease payments remitted (lessee) | | $ | 678 | | | $ | 680 | |

| Non-cash activities: | | | | |

| Dividends declared but not paid | | $ | 30,724 | | | $ | 27,487 | |

| Change in fair value of derivative instruments | | $ | (3,975) | | | $ | 41,374 | |

The accompanying notes are an integral part of this financial statement.

6

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

NOTE 1 – ORGANIZATION

Four Corners Property Trust, Inc. (together with its consolidated subsidiaries, “FCPT”) is an independent, publicly traded, self-administered company, primarily engaged in the ownership, acquisition and leasing of restaurant and retail properties. Substantially all of our business is conducted through Four Corners Operating Partnership, LP (“FCPT OP”), a Delaware limited partnership of which we are the initial and substantial limited partner. Our wholly owned subsidiary, Four Corners GP, LLC (“FCPT GP”), is its sole general partner.

Any references to “the Company,” “we,” “us,” or “our” refer to FCPT as an independent, publicly traded, self-administered company.

FCPT was incorporated as a Maryland corporation on July 2, 2015 as a wholly owned indirect subsidiary of Darden Restaurants, Inc., (together with its consolidated subsidiaries “Darden”), for the purpose of owning, acquiring and leasing properties on a triple-net basis, for use in the restaurant and other retail industries. On November 9, 2015, Darden completed a spin-off of FCPT whereby Darden contributed to us 100% of the equity interest in entities that owned 418 properties in which Darden operates restaurants, representing five of their brands, and six LongHorn Steakhouse restaurants located in the San Antonio, Texas area (the “Kerrow Restaurant Operating Business”) along with the underlying properties or interests therein associated with the Kerrow Restaurant Operating Business. In exchange, we issued to Darden all of our common stock and paid to Darden $315.0 million in cash. Subsequently, Darden distributed all of our outstanding shares of common stock pro rata to holders of Darden common stock whereby each Darden shareholder received one share of our common stock for every three shares of Darden common stock held at the close of business on the record date, which was November 2, 2015, as well as cash in lieu of any fractional shares of our common stock which they would have otherwise received.

We believe that we have been organized and have operated in conformity with the requirements for qualification and taxation as a real estate investment trust (a “REIT”) for federal income tax purposes commencing with our taxable year ended December 31, 2016, and we intend to continue to operate in a manner that will enable us to maintain our qualification as a REIT. To qualify as a REIT, we must meet a number of organizational and operational requirements, including a requirement that we distribute at least 90% of our REIT taxable income to our shareholders, subject to certain adjustments and excluding any net capital gain. As a REIT, we will not be subject to federal corporate income tax on that portion of net income that is distributed to our shareholders. However, FCPT’s taxable REIT subsidiaries (“TRS”) will generally be subject to federal, state, and local income taxes. We made our REIT election upon the filing of our 2016 tax return.

NOTE 2 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation and Basis of Presentation

The accompanying consolidated financial statements (the “Consolidated Financial Statements”) include the accounts of Four Corners Property Trust, Inc. and its consolidated subsidiaries. All intercompany accounts and transactions have been eliminated in consolidation.

The Consolidated Financial Statements reflect all adjustments which are, in the opinion of management, necessary to a fair presentation of the results for the interim periods presented. These adjustments are considered to be of a normal, recurring nature.

Reclassifications

Certain amounts previously reported under specific financial statement captions have been reclassified to be consistent with the current period presentation. As of September 30, 2023, we have conformed the prior presentation of the Long-term debt, net of deferred financing costs to the current format for comparability purposes.

Use of Estimates

The preparation of these Consolidated Financial Statements requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, and the reported amounts of revenue and expenses during the reporting period. The estimates and assumptions used

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Unaudited)

in the accompanying Consolidated Financial Statements are based on management’s evaluation of the relevant facts and circumstances. Actual results may differ from the estimates and assumptions used in preparing the accompanying Consolidated Financial Statements, and such differences could be material.

Real Estate Investments, Net

Real estate investments, net are recorded at cost less accumulated depreciation. Building components are depreciated over estimated useful lives ranging from seven to fifty-five years using the straight-line method. Leasehold improvements, which are reflected on our Consolidated Balance Sheets as a component of buildings, equipment, and improvements, net are amortized over the lesser of the non-cancelable lease term or the estimated useful lives of the related assets using the straight-line method. Equipment is depreciated over estimated useful lives ranging from two to fifteen years also using the straight-line method. Real estate development and construction costs for newly constructed restaurant and retail locations are capitalized in the period in which they are incurred. Gains and losses on the disposal of land, buildings, and equipment are included in realized gain on sale, net, in our accompanying Consolidated Statements of Income (“Income Statements”).

Our accounting policies regarding land, buildings, equipment, and improvements, include our judgments regarding the estimated useful lives of these assets, the residual values to which the assets are depreciated or amortized, the determination of what constitutes a reasonably assured lease term, and the determination as to what constitutes enhancing the value of or increasing the life of existing assets. These judgments and estimates may produce materially different amounts of reported depreciation and amortization expense if different assumptions were used. As discussed further below, these judgments may also impact our need to recognize an impairment charge on the carrying amount of these assets as the cash flows associated with the assets are realized, or as our expectations of estimated future cash flows change.

Acquisition of Real Estate

The Company evaluates acquisitions to determine whether transactions should be accounted for as asset acquisitions or business combinations in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Update (“ASU”) 2017-01. The Company has determined the land, building, site improvements, and in-places leases (if any) of assets acquired were each single assets as the building and property improvements are attached to the land and cannot be physically removed and used separately from the land without incurring significant costs or reducing their fair value. Additionally, the Company has not acquired a substantive process used to generate outputs. As substantially all of the fair value of the gross assets acquired are concentrated in a single identifiable asset and there were no processes acquired, the acquisitions do not qualify as a business and are accounted for as asset acquisitions. Related transaction costs are generally capitalized and amortized over the useful life of the acquired assets.

The Company allocates the purchase price (including acquisition and closing costs) of real estate acquisitions to land, building, and improvements based on their relative fair values. The determination of the building fair value is on an ‘as-if-vacant’ basis. Value is allocated to acquired lease intangibles (if any) based on the costs avoided and revenue recognized by acquiring the property subject to lease and avoiding an otherwise ‘dark period’. In making estimates of fair values for this purpose, the Company uses a third-party specialist that obtains various information about each property, as well as the pre-acquisition due diligence of the Company and prior leasing activities at the site.

Lease Intangibles

Lease intangibles, if any, acquired in conjunction with the purchase of real estate represent the value of in-place leases and above- or below-market leases. For real estate acquired subject to existing lease agreements, acquired lease intangibles are valued based on the Company’s estimates of costs related to tenant acquisition and the asset carrying costs, including lost revenue, that would be incurred during the time it would take to locate a tenant if the property were vacant, considering current market conditions and costs to execute similar leases at the time of the acquisition. Above-market and below-market lease intangibles are recorded based on the present value of the difference between the contractual amounts to be paid pursuant to the leases at the time of acquisition of the real estate and the Company’s estimate of current market lease rates for the property, measured over a period equal to the remaining initial term of the lease.

In-place lease intangibles are amortized on a straight-line basis over the remaining initial term of the related lease and included in depreciation and amortization expense. Above-market lease intangibles are amortized over the remaining initial

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Unaudited)

terms of the respective leases as a decrease in rental revenue. Below-market lease intangibles are generally amortized as an increase to rental revenue over the remaining initial term of the respective leases, but may be amortized over the renewal periods if the Company believes it is likely the tenant will exercise the renewal option. Should a lease terminate early, the unamortized portion of any related lease intangible is immediately recognized as an impairment loss included in depreciation and amortization expense. To date, the Company has not had significant early terminations.

Finance ground lease assets are also included in lease intangible assets, net on the Consolidated Balance Sheets. See Leases below for additional information.

Impairment of Long-Lived Assets

Land, buildings and equipment and certain other assets, including definite-lived intangible assets, are reviewed for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. Such events and changes may include macroeconomic conditions, including those caused by global pandemics, which may result in property operational disruption and indicate that the carrying amount may not be recoverable. Recoverability of assets to be held and used is measured by a comparison of the carrying amount of the assets to the future undiscounted net cash flows expected to be generated by the assets. Identifiable cash flows are measured at the lowest level for which they are largely independent of the cash flows of other groups of assets and liabilities, generally at the restaurant and retail level. If these assets are determined to be impaired, the amount of impairment recognized is measured by the amount by which the carrying amount of the assets exceeds their fair value. Fair value is generally determined by appraisals or sales prices of comparable assets.

The judgments we make related to the expected useful lives of long-lived assets and our ability to realize undiscounted cash flows in excess of the carrying amounts of these assets are affected by factors such as the ongoing maintenance and improvements of the assets, changes in economic conditions, changes in usage or operating performance, desirability of the restaurant and retail sites and other factors, such as our ability to sell our assets held for sale. As we assess the ongoing expected cash flows and carrying amounts of our long-lived assets, significant adverse changes in these factors could cause us to realize a material impairment loss.

Exit or disposal activities include the cost of disposing of the assets and are generally expensed as incurred. Upon disposal of the assets, any gain or loss is recorded in the same caption within our Income Statements as the original impairment. Provisions for impairment are included in depreciation and amortization expense in the accompanying Income Statements. We did not record impairment expense during the nine months ended September 30, 2023 or 2022.

Real Estate Held for Sale

Real estate is classified as held for sale when the sale is probable, will be completed within one year, purchase agreements are executed, the buyer has a significant deposit at risk, and no financing contingencies exist which could prevent the transaction from being completed in a timely manner. Restaurant and retail sites and certain other assets to be disposed of are included in assets held for sale when the likelihood of disposing of these assets within one year is probable. Assets whose disposal is not probable within one year remain in land, buildings, equipment and improvements until their disposal within one year is probable. Disposals of assets that have a major effect on our operations and financial results or that represent a strategic shift in our operating businesses meet the requirements to be reported as discontinued operations. Real estate held for sale is reported at the lower of carrying amount or fair value, less estimated costs to sell. One property was held for sale at September 30, 2023, and two properties were held for sale at December 31, 2022.

Cash, Cash Equivalents, and Restricted Cash

We consider all highly liquid investments with a maturity of three months or less when purchased to be cash equivalents. Cash and cash equivalents can consist of cash and money market accounts. Restricted cash consists of 1031 tax deferred real estate exchange proceeds and is included in Other assets in our Consolidated Balance Sheets.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Unaudited)

The following table provides a reconciliation of cash, cash equivalents, and restricted cash in our Consolidated Balance Sheets to the total amount shown in our Consolidated Statements of Cash Flows:

| | | | | | | | | | | | | | |

| | September 30, | | December 31, |

| (In thousands) | | 2023 | | 2022 |

| Cash and cash equivalents | | $ | 5,675 | | | $ | 26,296 | |

| Restricted cash (included in Other assets) | | 10,624 | | | — | |

| Total Cash, Cash Equivalents, and Restricted Cash | | $ | 16,299 | | | $ | 26,296 | |

Debt

The Company’s debt consists of non-amortizing term loans, a revolving credit facility and senior, unsecured, fixed rate notes (collectively referred to as “Debt”). Debt is carried at unpaid principal balance, net of deferred financing costs. All of our debt is currently unsecured and interest is paid monthly on our non-amortizing term loans and revolving credit facility and semi-annually on our senior fixed rate notes.

Deferred Financing Costs

Financing costs related to debt are deferred and amortized over the remaining life of the debt using the effective interest method. These costs are presented as a direct deduction from their related liabilities in the Consolidated Balance Sheets.

See Note 6 - Debt, Net of Deferred Financing Costs for additional information.

Derivative Instruments and Hedging Activities

We enter into derivative instruments for risk management purposes only, including derivatives designated as hedging instruments as required by FASB ASC Topic 815, Derivatives and Hedging, and those utilized as economic hedges. Our use of derivative instruments is currently limited to interest rate hedges. These instruments are generally structured as hedges of the variability of cash flows related to forecasted transactions (cash flow hedges). We do not enter into derivative instruments for trading or speculative purposes, where changes in the cash flows of the derivative are not expected to offset changes in cash flows of the hedged item. All derivatives are recognized on the balance sheet at fair value. For those derivative instruments for which we intend to elect hedge accounting, at the time the derivative contract is entered into, we document all relationships between hedging instruments and hedged items, as well as our risk-management objective and strategy for undertaking the various hedge transactions. This process includes linking all derivatives designated as cash flow hedges to specific assets and liabilities on the consolidated balance sheet or to specific forecasted transactions. We also formally assess, both at the hedge’s inception and on an ongoing basis, whether the derivatives used in hedging transactions are highly effective in offsetting changes in cash flows of hedged items.

To the extent our derivatives are effective in offsetting the variability of the hedged cash flows, and otherwise meet the cash flow hedge accounting criteria in accordance with United States generally accepted accounting principles (“U.S. GAAP”), changes in the derivatives’ fair value are not included in current earnings but are included in accumulated other comprehensive income, net of tax. These changes in fair value will be reclassified into earnings at the time of the forecasted transaction. Ineffectiveness measured in the hedging relationship is recorded in earnings in the period in which it occurs.

See Note 7 - Derivative Financial Instruments for additional information.

Other Assets and Liabilities

Other assets primarily consist of right of use operating lease assets, pre-acquisition costs, restricted cash, prepaid assets, food and beverage inventories for use by our Kerrow operating subsidiary, escrow deposits, and accounts receivable. Other liabilities primarily consist of accrued compensation, accrued interest expense, accrued operating expenses, intangible lease liabilities, and operating lease liabilities.

See Note 8 - Supplemental Detail for Certain Components of Consolidated Balance Sheets for additional information.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Unaudited)

Leases

Effective January 1, 2019, the Company adopted FASB Accounting Standards Codification 842, Leases, including effective amendments (“ASC 842”). All significant lease arrangements are generally recognized at lease commencement. For leases where the Company is the lessee upon adoption of ASC 842, operating or finance lease right-of-use (“ROU”) assets and lease liabilities are recognized at commencement based on the present value of lease payments over the lease term. ROU assets represent our right to use an underlying asset during the reasonably certain lease term and lease liabilities represent our obligation to make lease payments arising from the lease. Our lease terms may include options to extend or terminate the lease when it is reasonably certain that we will exercise that option. Lease expense is recognized on a straight-line basis over the lease term.

As part of certain real estate investment transactions, the Company may enter into long-term ground leases as a lessee. The Company recognizes a ground lease (or right-of-use) asset and related lease liability for each of these ground leases. Ground lease assets and lease liabilities are recognized based on the present value of the lease payments. The Company uses its estimated incremental borrowing rate, which is the estimated rate at which the Company could borrow on a collateralized basis with similar payments over a similar term, in determining the present value of the lease payments.

For leases where the Company is the lessor, we determine the classification upon commencement. At September 30, 2023, all such leases are classified as operating leases. These operating leases may contain both lease and non-lease components. The Company accounts for lease and non-lease components as a single component.

See Note 5 - Leases for additional information.

Revenue Recognition

Rental Revenue

For those net leases that provide for periodic and determinable increases in base rent, base rental revenue is recognized on a straight-line basis over the applicable lease term when collectability is probable. Recognizing rental revenue on a straight-line basis generally results in recognized revenues during the first half of a lease term exceeding the cash amounts contractually due from our tenants, creating a deferred rent receivable.

In certain circumstances, the Company may offer tenant allowance funds in exchange for increasing rent, extending the term, and including annual sales reporting among other items. These tenant allowance funds are classified as lease incentives upon payment and are amortized as a reduction to revenue over the lease term. Lease incentives are included in intangible lease assets, net, on our Consolidated Balance Sheets. The Company paid lease incentives of $0.2 million to tenants during the three and nine months ended September 30, 2023. During the year ended December 31, 2022, the Company paid lease incentives of $0.1 million to tenants.

We assess the collectability of our lease receivables, including deferred rents receivable, on several factors, including payment history, the financial strength of the tenant and any guarantors, historical operations and operating trends of the property, and current economic conditions. If our evaluation of these factors indicates it is not probable that we will be able to recover substantially all of the receivable, we derecognize the deferred rent receivable asset and record that revenue as a reduction in rental revenue. If we determine the lease receivable will not be collected due to a credit concern, we reduce the recorded revenue for the period and related accounts receivable.

For those leases that provide for periodic increases in base rent only if certain revenue parameters or other substantive contingencies are met, the increased rental revenue is recognized as the related parameters or contingencies are met, rather than on a straight-line basis over the applicable lease term. Costs paid by the lessor and reimbursed by the lessees are included in variable lease payments and presented on a gross basis within rental revenue. Sales taxes collected from lessees and remitted to governmental authorities are presented on a net basis within rental revenue.

Restaurant Revenue

Restaurant revenue represents food, beverage, and other products sold and is presented net of the following discounts: coupons, employee meals, complimentary meals and gift cards. Revenue from restaurant sales, whether received in cash or by credit card, is recognized when food and beverage products are sold. At September 30, 2023 and December 31, 2022, credit card receivables, included in other assets, totaled $227 thousand and $195 thousand, respectively. We recognize sales from our

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Unaudited)

gift cards when the gift card is redeemed by the customer. Sales taxes collected from customers and remitted to governmental authorities are presented on a net basis within restaurant revenue on our Consolidated Income Statements.

Restaurant Expenses

Restaurant expenses include restaurant labor, general and administrative expenses, rent expense, and food and beverage costs. Food and beverage costs include inventory, warehousing, related purchasing and distribution costs. Vendor allowances received in connection with the purchase of a vendor’s products are recognized as a reduction of the related food and beverage costs as earned.

Realized Gain on Sale

The Company recognizes gain on sale of real estate in accordance with FASB ASU No. 2017-05, “Clarifying the Scope of Asset Derecognition Guidance and Accounting for Partial Sales of Nonfinancial Assets.” The Company evaluates each transaction to determine if control of the asset, as well as other specified criteria, has been transferred to the buyer to determine proper timing of revenue recognition, as well as transaction price allocation. During the three months ended September 30, 2023, the Company sold two properties, which resulted in a realized gain of $318 thousand. During the nine months ended September 30, 2023, the Company sold six properties, which resulted in a realized gain of $2.1 million. During the three months ended September 30, 2022, the Company sold four properties, which resulted in a realized gain of $1.8 million. During the nine months ended September 30, 2022, the Company sold seven properties, which resulted in a realized gain of $7.6 million.

Income Taxes

We believe that we have been organized and have operated in conformity with the requirements for qualification and taxation as a REIT commencing with our taxable year ended December 31, 2016, and we intend to continue to operate in a manner that will enable us to maintain our qualification as a REIT. So long as we qualify as a REIT, we generally will not be subject to federal income tax on our net income that we distribute currently to our shareholders. To maintain our qualification as a REIT, we are required under the Code to distribute at least 90% of our REIT taxable income (without regard to the deduction for dividends paid and excluding net capital gains) to our shareholders and meet certain other requirements. If we fail to qualify as a REIT in any taxable year, we will be subject to federal income tax on our taxable income at regular corporate rates. Even if we qualify as a REIT, we may also be subject to certain state, local and franchise taxes. Under certain circumstances, federal income and excise taxes may be due on our undistributed taxable income.

The Kerrow Restaurant Operating Business is a TRS and is taxed as a C corporation.

See Note 9 - Income Taxes for additional information.

Earnings Per Share

Basic earnings per share (“EPS”) are computed by dividing net income allocated to common shareholders by the weighted-average number of common shares outstanding for the reporting period. Diluted EPS reflects the potential dilution that could occur if securities or other contracts to issue common stock were exercised or converted into common stock. No effect is shown for any securities that are anti-dilutive. Net income allocated to common shareholders represents net income less income allocated to participating securities and non-controlling interests. None of the Company’s equity awards are participating securities.

See Note 10 - Equity for additional information.

Noncontrolling Interest

Noncontrolling interest represents the aggregate limited partnership interests in FCPT OP held by third parties. In accordance with GAAP, the noncontrolling interest of FCPT OP is shown as a component of equity on our Consolidated Balance Sheets, and the portion of income allocable to third parties is shown as net income attributable to noncontrolling interests in our Income Statements and Consolidated Statements of Comprehensive Income (Loss) (“Comprehensive Income Statement”). The Company follows the guidance issued by the FASB regarding the classification and measurement of redeemable securities. At FCPT OP’s option, it may satisfy this redemption with cash or by exchanging non-registered shares of

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

(Unaudited)

FCPT common stock on a one-for-one basis. Accordingly, the Company has determined that the common OP units meet the requirements to be classified as permanent equity. A reconciliation of equity attributable to noncontrolling interest is disclosed in our Consolidated Statements of Changes in Equity.

See Note 10 - Equity for additional information.

Stock-Based Compensation