Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

November 01 2023 - 3:17PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of November 2023

Commission file number: 001-32749

FRESENIUS MEDICAL CARE AG & Co. KGaA

(Translation of registrant's name into English)

Else-Kröner Strasse 1

61346 Bad Homburg

Germany

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F

x Form 40-F

¨

EXHIBITS

The following exhibits are being furnished with

this Report:

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto

duly authorized.

DATE: November 1, 2023

| |

|

Fresenius

Medical Care AG & Co. KGaA, |

| |

|

a partnership limited by shares, represented by: |

| |

|

|

| |

|

fresenius medical care

management ag, its |

| |

|

General Partner |

| |

|

|

| |

By: |

/s/ Helen Giza |

| |

Name: |

Helen Giza |

| |

Title: |

Chief Executive Officer and Chair of the Management

Board of the General Partner |

| |

|

|

| |

By: |

/s/ Martin Fischer |

| |

Name: |

Martin Fischer |

| |

Title: |

Chief Financial Officer and member of the Management

Board of the General Partner |

Exhibit 99.1

ADHOC RELEASE

Fresenius Medical Care AG & Co. KGaA raises outlook for

operating income in fiscal year 2023

Bad Homburg, November 1,

2023 | Fresenius Medical Care AG & Co. KGaA ("Fresenius Medical Care” or the "Company") has decided today,

to raise the outlook for operating income in fiscal year 2023. The background to the decision are the positive effects of the turnaround

measures and the accelerated improvements in operational performance in the first nine months of 2023, as well as the solid business outlook

for the fourth quarter of 2023.

In the first nine months of the fiscal year 2023, the positive earnings

development was mainly driven by successful implementation of turnaround measures, resulting in increased operational efficiencies, savings

from the FME25 transformation program and a solid organic growth.

The Company previously expected for fiscal year 2023 operating income

to remain flat or decline by up to a low-single digit percentage rate, compared to previous year.

Fresenius Medical Care now expects for fiscal year 2023 operating income

to increase by a low single-digit percentage rate compared to previous year (2022 basis: € 1,540 million).

All other elements of the outlook for the fiscal year 2023, as published

on August 2, 2023, remain unchanged.

The Company’s target to achieve an operating income margin of

10 to 14% by 2025 remains unchanged, too.

Note: Operating income, as referred

to in the outlook, is on a constant currency basis and excluding special items. Special items will be provided as separate KPI (“Operating

income excluding special items”) to capture effects that are unusual in nature and have not been foreseeable or not foreseeable

in size or impact at the time of giving guidance. These items are excluded to ensure comparability of the figures presented with the

Company’s financial targets which have been defined excluding special items.

For FY 2022, special items included costs related to the FME25 transformation program, the impact of the war in Ukraine, the impact of

hyperinflation in Turkiye, the Humacyte investment remeasurement, and the net gain related to InterWell Health. Additionally, FY 2022

basis for Outlook 2023 and 2025 was adjusted for Provider Relief Funding by the U. S. government. For FY 2023, special items include

costs related to the FME25 transformation program, the Humacyte investment remeasurement, the costs associated with the legal conversion

and effects from legacy portfolio optimization.

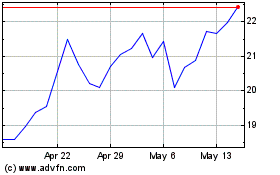

Fresenius Medical Care (NYSE:FMS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Fresenius Medical Care (NYSE:FMS)

Historical Stock Chart

From Mar 2024 to Mar 2025