Conagra, General Mills Square off in Battle to Revive Packaged Foods

June 24 2018 - 10:29AM

Dow Jones News

By Annie Gasparro

Investors will learn this week whether Conagra Brands Inc. is

still outpacing General Mills Inc. in the race to revive older food

brands.

General Mills Chief Executive Jeff Harmening is banking on a new

low-calorie, high-protein yogurt to stem losses in its Yoplait

business, where sales plunged 14% in the first nine months of the

company's fiscal year.

At rival Conagra, Chief Executive Sean Connolly has focused on

revamping older brands like Healthy Choice and Banquet frozen meals

and Reddi Wip dessert topping.

"Nobody thought Banquet could be brought back from the dead,"

Mr. Connolly said at a conference last month. "The business is

thriving now."

Conagra on Thursday will reveal whether its latest quarterly

earnings confirm that confidence. General Mills reports

fourth-quarter results on Wednesday. Analysts are likely to ask

about the companies' merger outlook amid reports that Conagra is

interested in acquiring Pinnacle Foods Inc. for its frozen-food

business.

Sales of Conagra's refrigerated and frozen brands have increased

in the past three quarters. At General Mills, yogurt sales fell

sharply over that period.

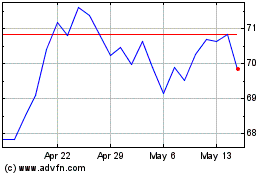

General Mills' stock has fallen 19% over the past year, while

Conagra's shares have risen nearly 4%. The S&P 500's Packaged

Foods & Meats subindex is down 15% over that period.

Analysts expect revenue at General Mills to have risen 2.5% to

$3.9 billion in the company's fourth quarter and earnings to have

fallen 0.5% to 73 cents a share, according to FactSet. Conagra's

sales are projected to have risen 3.5% to $1.93 billion with

earnings up 18% to 44 cents a share.

Conagra earned approval from investors by introducing

higher-quality Banquet meals that the company is selling for more

than the standard 99-cent price for those frozen dinners. It also

reworked Healthy Choice recipes to remove additives and introduced

recyclable, plant-based packaging.

General Mills has tried to bolster its business with a move into

pet food. In February, the company bought Blue Buffalo for $8

billion and said sales in the pet-food aisle were growing faster

than those of established package foods.

But analysts say General Mills needs to turn around its

billion-dollar U.S. yogurt business before its share price does the

same.

General Mills executives have acknowledged that the company was

late to the market with its Yoplait Greek-style yogurt. General

Mills has been selling Yoplait in the U.S. since 1977, but a decade

ago it began losing sales to a budding Greek-yogurt trend that

appealed to Americans because of its higher protein and lower sugar

content.

Now Icelandic, Australian and other exotic yogurt varietals are

putting even more pressure on mainstay brands like Yoplait.

Mr. Harmening has said Yoplait is recovering. At a conference in

May, Mr. Harmening said General Mills had gained market share in

yogurt in the latest 13 weeks. The company says one reason is the

introduction last summer of Oui by Yoplait, a premium yogurt made

without artificial ingredients and sold in glass jars.

"The goal is to keep getting better and to keep changing with

the times, " Mr. Harmening said recently.

The newest yogurt General Mills introduced last week, called YQ

by Yoplait, aims to make up for Yoplait Light, which has lost favor

because of its use of artificial colors and sweeteners.

YQ uses "ultra-filtered" milk that reduces the amount of sugar

it contains and concentrates the protein content to make it

appealing to health-conscious shoppers. Doug Martin, head of

marketing for Yoplait USA, said General Mills wanted to come out

with a new, healthy-oriented yogurt that wouldn't end up "feeling

like new versions of light yogurt."

(END) Dow Jones Newswires

June 24, 2018 11:14 ET (15:14 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

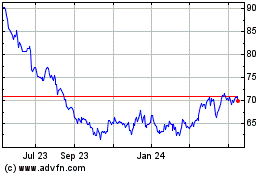

General Mills (NYSE:GIS)

Historical Stock Chart

From Mar 2024 to Apr 2024

General Mills (NYSE:GIS)

Historical Stock Chart

From Apr 2023 to Apr 2024