General Motors Third-Quarter Earnings More Than Double -- 2nd Update

October 25 2016 - 8:49AM

Dow Jones News

By Mike Colias

General Motors Co. doubled net income and notched record revenue

in the third quarter amid strong truck sales in the U.S., but

Brexit fallout threatens to derail the auto maker's drive to post

its first annual profit in European operations since 1998.

GM on Tuesday posted net income attributable to common

shareholders of $2.77 billion for the period ended Sept. 30, up

from $1.36 billion reported in the same period a year ago. The

Detroit auto maker said operating profit excluding one-time factors

equaled $1.72 a share, breezing past Wall Street expectations of

$1.45 a share.

Revenue rose 10% to $42.83 billion, a quarterly record for the

company and substantially higher than analyst forecasts of $39.3

billion for the period. Shares of GM rose above $33 in premarket

trading, higher than the initial public offering price in 2010.

The results provide a view into GM nearly three years after Mary

Barra took over as chief executive and encountered a costly safety

crisis that dented earnings and cost billions of dollars to

resolve. While missing a Europe profit target will cloud the

company's string of record earnings performances in recent

quarters, GM has emerged as one of the most profitable mainline car

companies in the world.

It benefited from continued strong pricing on big pickups and

SUVs in North America, its most profitable models, as well as

healthier margins on freshly redesigned cars such as the Chevrolet

Malibu. A sales surge in China, stoked by a government tax

incentive, helped offset pricing pressures from weak demand for

small cars and commercial vans.

GM, however, posted an operating loss of $142 million in Europe,

three months after recording its first quarterly profit in the

region in five years. GM said currency declines and other industry

weakness tied to the U.K.'s vote to exit from the European Union

shaved about $100 million from its business in the quarter and that

it expects the drag to be $300 million in the fourth quarter.

The Brexit impact likely will derail GM's longstanding goal of

turning a profit on the continent in 2016, the first time since

1998. Other auto makers, including the Nissan Motor Co./ Renault SA

alliance, have signaled concerns about the U.K.'s auto industry in

recent months.

"Breaking even this year is going to be very, very challenging,"

Chief Financial Officer Chuck Stevens said while discussing

European operations Tuesday. He said the company had been on pace

to earn money in Europe before the Brexit vote and said GM will

take "whatever actions necessary" to blunt Brexit's impact.

The company could implement cost cuts and change the model mix.

It levied a 2.5% increase in the U.K. on Oct. 1.

The auto maker maintained its annual operating profit guidance,

saying it will finish the year at the higher end of a range that

represents annual record earnings.

GM's broader outlook stands in contrast to the gloomy view from

rival Ford Motor Co., which cut third-quarter guidance on

expectation of weaker demand and is idling several assembly plants

to trim inventories. GM, meanwhile, ratcheted up production 14% in

the quarter, according to an IHS Automotive estimate.

Underpinning the strength is Ms. Barra's strategy to focus on

sales to retail customers, rather than rentals, an effort to

improve vehicle residual values and the image of its brands. The

move has cost the company market share, but has led to margins that

far exceeded 10% for North America in most quarters.

GM's operating income in North America rose 6% as average

purchase prices across models and brands increased nearly $1,500

from a year earlier Still, profit margin in North America dipped to

11.2%, from 11.8%, as the auto maker sold more cars than a year

earlier amid a marketing push for redesigned nameplates like the

Chevy Cruze and Malibu.

In China, GM's operating income was flat at $459 million. Its

profit margin fell to 8.7%, from 9.8%, as stronger sales of its

higher-priced Cadillac and Buick brands were offset by weak car

demand and declining prices on older models. Some analysts expect

sales in China to cool if a sales-tax break on vehicles with

smaller engines expires at year-end as expected.

GM trimmed losses in South America to $121 million, from $217

million, amid continued belt-tightening in the troubled region. GM

has raised prices to offset declining volume and said wholesale

deliveries rose in Brazil, the region's largest market.

Write to Mike Colias at Mike.Colias@wsj.com

(END) Dow Jones Newswires

October 25, 2016 09:34 ET (13:34 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

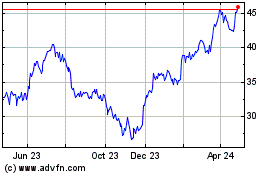

General Motors (NYSE:GM)

Historical Stock Chart

From Mar 2024 to Apr 2024

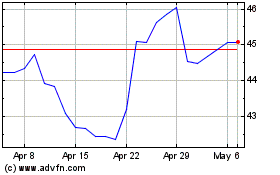

General Motors (NYSE:GM)

Historical Stock Chart

From Apr 2023 to Apr 2024