0000049826false00000498262024-07-302024-07-300000049826exch:XNYSus-gaap:CommonStockMember2024-07-302024-07-300000049826exch:XNYSitw:A0.250EuroNotesdue2024Member2024-07-302024-07-300000049826exch:XNYSitw:A0.625EuroNotesdue2027Member2024-07-302024-07-300000049826exch:XNYSitw:A3.250EuroNotesDue2028Member2024-07-302024-07-300000049826exch:XNYSitw:A2.125EuroNotesdue2030Member2024-07-302024-07-300000049826exch:XNYSitw:A1.00EuroNotesdue2031Member2024-07-302024-07-300000049826exch:XNYSitw:A3.375EuroNotesDue2032Member2024-07-302024-07-300000049826exch:XNYSitw:A3.00EuroNotesdue2034Member2024-07-302024-07-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): July 30, 2024

_________________________

ILLINOIS TOOL WORKS INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | |

| Delaware | 1-4797 | | 36-1258310 |

| (State or other jurisdiction of incorporation) | (Commission File No.) | | (I.R.S. Employer Identification No.) |

| | | | | | | |

| 155 Harlem Avenue | Glenview | IL | | | | 60025 |

| (Address of principal executive offices) | | | (Zip Code) |

Registrant's telephone number, including area code: 847-724-7500

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | ITW | New York Stock Exchange |

| 0.250% Euro Notes due 2024 | ITW24A | New York Stock Exchange |

| 0.625% Euro Notes due 2027 | ITW27 | New York Stock Exchange |

| 3.250% Euro Notes due 2028 | ITW28 | New York Stock Exchange |

| 2.125% Euro Notes due 2030 | ITW30 | New York Stock Exchange |

| 1.00% Euro Notes due 2031 | ITW31 | New York Stock Exchange |

| 3.375% Euro Notes due 2032 | ITW32 | New York Stock Exchange |

| 3.00% Euro Notes due 2034 | ITW34 | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On July 30, 2024, Illinois Tool Works Inc. (the "Company") announced its 2024 second quarter results of operations in the press release furnished as Exhibit 99.1.

Non-GAAP Financial Measures

The Company uses free cash flow to measure cash flow generated by operations that is available for dividends, share repurchases, acquisitions and debt repayment. The Company believes this non-GAAP financial measure, along with free cash flow to net income conversion rate, are useful to investors in evaluating the Company’s financial performance and measures the Company's ability to generate cash internally to fund Company initiatives. Free cash flow represents net cash provided by operating activities less additions to plant and equipment. Free cash flow is a measurement that is not the same as net cash flow from operating activities per the statement of cash flows and may not be consistent with similarly titled measures used by other companies. A reconciliation of free cash flow to net cash provided by operating activities is included in the press release furnished as Exhibit 99.1.

The Company uses after-tax return on average invested capital ("After-tax ROIC") to measure the effectiveness of its operations' use of invested capital to generate profits. After-tax ROIC is not defined under U.S. generally accepted accounting principles ("GAAP"). After-tax ROIC is a non-GAAP financial measure that the Company believes is a meaningful metric to investors in evaluating the Company's ability to generate returns from cash invested in its operations and may be different than the method used by other companies to calculate After-tax ROIC. The Company defines After-tax ROIC as operating income after taxes divided by average invested capital, which is annualized when presented in interim periods. Operating income after taxes is a non-GAAP measure consisting of net income before interest expense and other income (expense), on an after-tax basis, which are excluded as they do not represent returns generated by the Company's operations. For comparability, the Company also excluded the discrete tax benefit of $20 million in the second quarter of 2023 from net income and the effective tax rate for the three and six months ended June 30, 2023. Total invested capital represents the net assets of the Company, other than cash and equivalents and outstanding debt which do not represent capital investment in the Company's operations. The most comparable GAAP measure to operating income after taxes is net income. Calculations of net income to average invested capital and After-tax ROIC are included in the press release furnished as Exhibit 99.1.

The Company presented diluted net income per share for the three months ended June 30, 2023 excluding the discrete tax benefit of $20 million in the second quarter of 2023. The Company believes this non-GAAP measure enhances investors' understanding of the Company's underlying financial performance and improves comparability with other periods. A reconciliation of this non-GAAP measure to diluted net income per share is included in the press release furnished as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits

| | | | | | | | | | | |

| (d) | Exhibits | | |

| | | |

| Exhibit Number | | Exhibit Description |

| | | |

| | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | |

| | ILLINOIS TOOL WORKS INC. |

| | |

| | |

| Dated: July 30, 2024 | | By: /s/ Michael M. Larsen |

| | Michael M. Larsen |

| | Senior Vice President & Chief Financial Officer |

Exhibit 99.1

ITW Reports Second Quarter 2024 Results

• Revenue of $4.0 billion, a decrease of 1% with flat organic growth

• Operating income of $1.05 billion, an increase of 4.5%

• Operating margin of 26.2%, an increase of 140 bps as enterprise initiatives contributed 140 bps

• GAAP EPS of $2.54, an increase of 2%; Excl. a one-time 2023 tax item, EPS increased 5%

• Narrowing full year GAAP EPS guidance to a range of $10.30 to $10.40 per share

GLENVIEW, IL., July 30, 2024 - Illinois Tool Works Inc. (NYSE: ITW) today reported its second quarter 2024 results and updated guidance for full-year 2024.

“While the demand environment continued to moderate across our portfolio, we delivered a solid quarter with strong operational execution and profitability,” said Christopher A. O’Herlihy, President and Chief Executive Officer. “Our ability to overcome near-term macro challenges and expand our margin and profitability to record levels as evidenced by margin improvement of 140 basis points to 26.2 percent and EPS growth of more than five percent, is a direct result of the focused execution by our team of dedicated ITW professionals around the world.”

“Looking ahead, we are lowering the top-end of our full year GAAP EPS guidance to reflect current levels of demand partially offset by better margin performance. We remain focused on managing and investing for the long-term as we build above-market organic growth, fueled by customer-back innovation, into a core ITW strength,” O’Herlihy concluded.

Second Quarter 2024 Results

Second quarter revenue of $4.0 billion declined by 1.2 percent as organic growth declined 0.1 percent. Foreign currency translation impact reduced revenue by 1.2 percent and acquisitions added 0.1 percent.

GAAP EPS increased 2.4 percent to $2.54 and excluding a one-time tax item in 2023, EPS increased 5.4 percent. Operating income increased 4.5 percent to $1.05 billion, a second quarter record. Operating margin improved 140 basis points to 26.2 percent, a second quarter record, as enterprise initiatives contributed 140 basis points. Operating cash flow was $687 million, and free cash flow was $571 million with a conversion of 75 percent to net income. During the quarter, the company repurchased $375 million of its own shares and the effective tax rate was 24.4 percent.

2024 Guidance

ITW is lowering the top-end of its full year GAAP EPS guidance range of $10.30 to $10.70 per share to a narrower range of $10.30 to $10.40 per share, an increase of six percent compared to the prior year at the midpoint. Based on current levels of demand and foreign currency exchange rates exiting the second quarter, the company is projecting revenue growth and organic growth to be approximately flat for 2024. ITW is raising its operating margin guidance from 26 to 27 percent to a narrower range of 26.5 to 27 percent, an increase of 165 bps at the midpoint with enterprise initiatives projected to contribute more than 100 basis points. Free cash flow is expected to exceed 100 percent of net income and the company plans to repurchase approximately $1.5 billion of its own shares. The projected effective tax rate remains unchanged in the range of 24 to 24.5 percent.

Non-GAAP Measures

This earnings release contains certain non-GAAP financial measures. A reconciliation of these measures to the most directly comparable GAAP measures is included in the attached supplemental reconciliation schedule. The estimated guidance of free cash flow to net income conversion rate is based on assumptions that are difficult to predict, and estimated guidance for the most directly comparable GAAP measure and a reconciliation of this forward-looking estimate to its most directly comparable GAAP estimate have been omitted due to the unreasonable efforts required in connection with such a reconciliation and the lack of reliable forward-looking cash flow information. For the same reasons, the company is unable to address the potential significance of the unavailable information, which could be material to future results.

Forward-looking Statements

This earnings release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements may include, without limitation, statements regarding global supply chain challenges, expected impact of inflation including raw material inflation and rising interest rates, the impact of enterprise initiatives, future financial and operating performance, free cash flow and free cash flow to net income conversion rate, organic and total revenue, operating and incremental margin, price/cost impact, statements regarding diluted income per share, expected dividend payments, after-

tax return on invested capital, effective tax rates, exchange rates, expected timing and amount of share repurchases, end market economic and regulatory conditions, the impact of recent or potential acquisitions and/or divestitures, and the Company’s 2024 guidance. These statements are subject to certain risks, uncertainties, assumptions, and other factors, which could cause actual results to differ materially from those anticipated. Important risks that could cause actual results to differ materially from the Company’s expectations include those that are detailed in ITW’s Form 10-K for 2023 and subsequent reports filed with the SEC.

About Illinois Tool Works

ITW (NYSE: ITW) is a Fortune 300 global multi-industrial manufacturing leader with revenue of $16.1 billion in 2023. The company’s seven industry-leading segments leverage the unique ITW Business Model to drive solid growth with best-in-class margins and returns in markets where highly innovative, customer-focused solutions are required. ITW’s approximately 45,000 dedicated colleagues around the world thrive in the company’s decentralized and entrepreneurial culture. www.itw.com

ILLINOIS TOOL WORKS INC. and SUBSIDIARIES

STATEMENT OF INCOME (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| In millions except per share amounts | 2024 | | 2023 | | 2024 | | 2023 |

| Operating Revenue | $ | 4,027 | | | $ | 4,074 | | | $ | 8,000 | | | $ | 8,093 | |

| Cost of revenue | 2,262 | | | 2,344 | | | 4,407 | | | 4,685 | |

| Selling, administrative, and research and development expenses | 686 | | | 690 | | | 1,362 | | | 1,365 | |

| Amortization and impairment of intangible assets | 25 | | | 30 | | | 50 | | | 61 | |

| Operating Income | 1,054 | | | 1,010 | | | 2,181 | | | 1,982 | |

| Interest expense | (75) | | | (69) | | | (146) | | | (129) | |

| Other income (expense) | 26 | | | 20 | | | 42 | | | 30 | |

| Income Before Taxes | 1,005 | | | 961 | | | 2,077 | | | 1,883 | |

| Income Taxes | 246 | | | 207 | | | 499 | | | 415 | |

| Net Income | $ | 759 | | | $ | 754 | | | $ | 1,578 | | | $ | 1,468 | |

| | | | | | | |

| Net Income Per Share: | | | | | | | |

Basic | $ | 2.55 | | | $ | 2.49 | | | $ | 5.29 | | | $ | 4.83 | |

Diluted | $ | 2.54 | | | $ | 2.48 | | | $ | 5.27 | | | $ | 4.81 | |

| | | | | | | |

| Cash Dividends Per Share: | | | | | | | |

Paid | $ | 1.40 | | | $ | 1.31 | | | $ | 2.80 | | | $ | 2.62 | |

Declared | $ | 1.40 | | | $ | 1.31 | | | $ | 2.80 | | | $ | 2.62 | |

| | | | | | | |

| Shares of Common Stock Outstanding During the Period: | | | | | | | |

Average | 297.6 | | | 303.3 | | | 298.3 | | | 304.1 | |

Average assuming dilution | 298.5 | | | 304.2 | | | 299.3 | | | 305.2 | |

ILLINOIS TOOL WORKS INC. and SUBSIDIARIES

STATEMENT OF FINANCIAL POSITION (UNAUDITED)

| | | | | | | | | | | |

| In millions | June 30, 2024 | | December 31, 2023 |

| Assets | | | |

| Current Assets: | | | |

| Cash and equivalents | $ | 862 | | | $ | 1,065 | |

| Trade receivables | 3,250 | | | 3,123 | |

| Inventories | 1,819 | | | 1,707 | |

| Prepaid expenses and other current assets | 325 | | | 340 | |

| Total current assets | 6,256 | | | 6,235 | |

| | | |

| Net plant and equipment | 2,011 | | | 1,976 | |

| Goodwill | 4,910 | | | 4,909 | |

| Intangible assets | 641 | | | 657 | |

| Deferred income taxes | 448 | | | 479 | |

| Other assets | 1,311 | | | 1,262 | |

| | $ | 15,577 | | | $ | 15,518 | |

| | | |

| Liabilities and Stockholders' Equity | | | |

| Current Liabilities: | | | |

| Short-term debt | $ | 2,044 | | | $ | 1,825 | |

| Accounts payable | 576 | | | 581 | |

| Accrued expenses | 1,615 | | | 1,663 | |

| Cash dividends payable | 416 | | | 419 | |

| Income taxes payable | 153 | | | 187 | |

| Total current liabilities | 4,804 | | | 4,675 | |

| | | |

| Noncurrent Liabilities: | | | |

| Long-term debt | 6,429 | | | 6,339 | |

| Deferred income taxes | 381 | | | 326 | |

| Noncurrent income taxes payable | — | | | 151 | |

| Other liabilities | 1,001 | | | 1,014 | |

| Total noncurrent liabilities | 7,811 | | | 7,830 | |

| | | |

| Stockholders' Equity: | | | |

| Common stock | 6 | | | 6 | |

| Additional paid-in-capital | 1,636 | | | 1,588 | |

| Retained earnings | 27,866 | | | 27,122 | |

| Common stock held in treasury | (24,622) | | | (23,870) | |

| Accumulated other comprehensive income (loss) | (1,925) | | | (1,834) | |

| Noncontrolling interest | 1 | | | 1 | |

| Total stockholders' equity | 2,962 | | | 3,013 | |

| $ | 15,577 | | | $ | 15,518 | |

ILLINOIS TOOL WORKS INC. and SUBSIDIARIES

SEGMENT DATA (UNAUDITED)

| | | | | | | | | | | |

Three Months Ended June 30, 2024 |

| Dollars in millions | Total Revenue | Operating Income | Operating Margin |

| Automotive OEM | $ | 815 | | $ | 157 | | 19.4 | % |

| Food Equipment | 667 | | 180 | | 27.1 | % |

| Test & Measurement and Electronics | 678 | | 159 | | 23.5 | % |

| Welding | 466 | | 153 | | 32.9 | % |

| Polymers & Fluids | 454 | | 128 | | 28.2 | % |

| Construction Products | 504 | | 148 | | 29.4 | % |

| Specialty Products | 449 | | 144 | | 31.9 | % |

| Intersegment | (6) | | — | | — | % |

| Total Segments | 4,027 | | 1,069 | | 26.6 | % |

| Unallocated | — | | (15) | | — | % |

| Total Company | $ | 4,027 | | $ | 1,054 | | 26.2 | % |

| | | | | | | | | | | |

Six Months Ended June 30, 2024 |

| Dollars in millions | Total Revenue | Operating Income | Operating Margin |

| Automotive OEM | $ | 1,631 | | $ | 319 | | 19.6 | % |

| Food Equipment | 1,298 | | 344 | | 26.5 | % |

| Test & Measurement and Electronics | 1,374 | | 322 | | 23.4 | % |

| Welding | 942 | | 309 | | 32.8 | % |

| Polymers & Fluids | 886 | | 239 | | 27.0 | % |

| Construction Products | 992 | | 291 | | 29.4 | % |

| Specialty Products | 889 | | 274 | | 30.8 | % |

| Intersegment | (12) | | — | | — | % |

| Total Segments | 8,000 | | 2,098 | | 26.2 | % |

| Unallocated | — | | 83 | | — | % |

| Total Company | $ | 8,000 | | $ | 2,181 | | 27.3 | % |

ILLINOIS TOOL WORKS INC. and SUBSIDIARIES

SEGMENT DATA (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2024 vs. Q2 2023 Favorable/(Unfavorable) |

| Operating Revenue | Automotive OEM | Food Equipment | Test & Measurement and Electronics | Welding | Polymers & Fluids | Construction Products | Specialty Products | Total ITW |

| Organic | 0.4 | % | 2.5 | % | (3.1) | % | (4.7) | % | 2.6 | % | (3.8) | % | 6.7 | % | (0.1) | % |

Acquisitions/

Divestitures | — | % | — | % | 0.8 | % | — | % | — | % | — | % | — | % | 0.1 | % |

| Translation | (1.7) | % | (0.4) | % | (0.9) | % | (0.3) | % | (3.9) | % | (0.5) | % | (0.5) | % | (1.2) | % |

| Operating Revenue | (1.3) | % | 2.1 | % | (3.2) | % | (5.0) | % | (1.3) | % | (4.3) | % | 6.2 | % | (1.2) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Q2 2024 vs. Q2 2023 Favorable/(Unfavorable) |

| Change in Operating Margin | Automotive OEM | Food Equipment | Test & Measurement and Electronics | Welding | Polymers & Fluids | Construction Products | Specialty Products | Total ITW |

| Operating Leverage | — | 50 bps | (90) bps | (70) bps | 50 bps | (80) bps | 130 bps | — |

| Changes in Variable Margin & OH Costs | 210 bps | (100) bps | 190 bps | (50) bps | 130 bps | 150 bps | 390 bps | 140 bps |

| Total Organic | 210 bps | (50) bps | 100 bps | (120) bps | 180 bps | 70 bps | 520 bps | 140 bps |

Acquisitions/

Divestitures | — | — | (50) bps | — | — | — | — | (10) bps |

| Restructuring/Other | 50 bps | (20) bps | (20) bps | 20 bps | 50 bps | (60) bps | 70 bps | 10 bps |

| Total Operating Margin Change | 260 bps | (70) bps | 30 bps | (100) bps | 230 bps | 10 bps | 590 bps | 140 bps |

| | | | | | | | |

| Total Operating Margin % * | 19.4% | 27.1% | 23.5% | 32.9% | 28.2% | 29.4% | 31.9% | 26.2% |

| | | | | | | | |

| * Includes unfavorable operating margin impact of amortization expense from acquisition-related intangible assets | 20 bps | 40 bps | 190 bps | — | 150 bps | 10 bps | 20 bps | 70 bps ** |

| ** Amortization expense from acquisition-related intangible assets had an unfavorable impact of ($0.06) on GAAP earnings per share for the second quarter of 2024. |

ILLINOIS TOOL WORKS INC. and SUBSIDIARIES

SEGMENT DATA (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| H1 2024 vs. H1 2023 Favorable/(Unfavorable) |

| Operating Revenue | Automotive OEM | Food Equipment | Test & Measurement and Electronics | Welding | Polymers & Fluids | Construction Products | Specialty Products | Total ITW |

| Organic | 1.9 | % | 0.6 | % | (2.2) | % | (4.1) | % | 0.9 | % | (5.4) | % | 6.1 | % | (0.4) | % |

Acquisitions/

Divestitures | — | % | — | % | 0.8 | % | — | % | — | % | — | % | (1.1) | % | — | % |

| Translation | (1.3) | % | 0.1 | % | (0.7) | % | (0.1) | % | (3.2) | % | (0.4) | % | — | % | (0.8) | % |

| Operating Revenue | 0.6 | % | 0.7 | % | (2.1) | % | (4.2) | % | (2.3) | % | (5.8) | % | 5.0 | % | (1.2) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| H1 2024 vs. H1 2023 Favorable/(Unfavorable) |

| Change in Operating Margin | Automotive OEM | Food Equipment | Test & Measurement and Electronics | Welding | Polymers & Fluids | Construction Products | Specialty Products | Total ITW |

| Operating Leverage | 40 bps | 20 bps | (60) bps | (60) bps | 20 bps | (90) bps | 120 bps | (20) bps |

| Changes in Variable Margin & OH Costs | 250 bps | (80) bps | 80 bps | 40 bps | 130 bps | 220 bps | 300 bps | 290 bps |

| Total Organic | 290 bps | (60) bps | 20 bps | (20) bps | 150 bps | 130 bps | 420 bps | 270 bps |

Acquisitions/

Divestitures | — | — | (50) bps | — | — | — | 30 bps | — |

| Restructuring/Other | 30 bps | (10) bps | (10) bps | 10 bps | 30 bps | (30) bps | 50 bps | 10 bps |

| Total Operating Margin Change | 320 bps | (70) bps | (40) bps | (10) bps | 180 bps | 100 bps | 500 bps | 280 bps |

| | | | | | | | |

| Total Operating Margin % * | 19.6% | 26.5% | 23.4% | 32.8% | 27.0% | 29.4% | 30.8% | 27.3% |

| | | | | | | | |

| * Includes unfavorable operating margin impact of amortization expense from acquisition-related intangible assets | 30 bps | 50 bps | 190 bps | — | 150 bps | 10 bps | 20 bps | 70 bps ** |

| ** Amortization expense from acquisition-related intangible assets had an unfavorable impact of ($0.13) on GAAP earnings per share for the first half of 2024. |

ILLINOIS TOOL WORKS INC. and SUBSIDIARIES

GAAP to NON-GAAP RECONCILIATIONS (UNAUDITED)

AFTER-TAX RETURN ON AVERAGE INVESTED CAPITAL (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| Dollars in millions | 2024 | | 2023 | | 2024 | | 2023 |

| Numerator: | | | | | | | |

| Net Income | $ | 759 | | | $ | 754 | | | $ | 1,578 | | | $ | 1,468 | |

| Discrete tax benefit related to the second quarter 2023 | — | | | (20) | | | — | | | (20) | |

Interest expense, net of tax (1) | 57 | | | 53 | | | 111 | | | 99 | |

Other (income) expense, net of tax (1) | (20) | | | (15) | | | (32) | | | (23) | |

| Operating income after taxes | $ | 796 | | | $ | 772 | | | $ | 1,657 | | | $ | 1,524 | |

| | | | | | | |

| Denominator: | | | | | | | |

| Invested capital: | | | | | | | |

| Cash and equivalents | $ | 862 | | | $ | 922 | | | $ | 862 | | | $ | 922 | |

| Trade receivables | 3,250 | | | 3,216 | | | 3,250 | | | 3,216 | |

| Inventories | 1,819 | | | 1,921 | | | 1,819 | | | 1,921 | |

| | | | | | | |

| Net plant and equipment | 2,011 | | | 1,901 | | | 2,011 | | | 1,901 | |

| Goodwill and intangible assets | 5,551 | | | 5,595 | | | 5,551 | | | 5,595 | |

| Accounts payable and accrued expenses | (2,191) | | | (2,215) | | | (2,191) | | | (2,215) | |

| Debt | (8,473) | | | (8,222) | | | (8,473) | | | (8,222) | |

| Other, net | 133 | | | (24) | | | 133 | | | (24) | |

| Total net assets (stockholders' equity) | 2,962 | | | 3,094 | | | 2,962 | | | 3,094 | |

| Cash and equivalents | (862) | | | (922) | | | (862) | | | (922) | |

| Debt | 8,473 | | | 8,222 | | | 8,473 | | | 8,222 | |

| Total invested capital | $ | 10,573 | | | $ | 10,394 | | | $ | 10,573 | | | $ | 10,394 | |

| | | | | | | |

Average invested capital (2) | $ | 10,480 | | | $ | 10,366 | | | $ | 10,357 | | | $ | 10,292 | |

| | | | | | | |

Net income to average invested capital (3) | 29.0 | % | | 29.1 | % | | 30.5 | % | | 28.5 | % |

After-tax return on average invested capital (3) | 30.4 | % | | 29.8 | % | | 32.0 | % | | 29.6 | % |

(1) Effective tax rate used for interest expense and other (income) expense for the three months ended June 30, 2024 and 2023 was 24.4% and 23.6%, respectively. Effective tax rate used for interest expense and other (income) expense for the six months ended June 30, 2024 and 2023 was 24.0% and 23.1%, respectively.

(2) Average invested capital is calculated using the total invested capital balances at the start of the period and at the end of each quarter within each of the periods presented.

(3) Returns for the three months ended June 30, 2024 and 2023 were converted to an annual rate by multiplying the calculated return by 4. Returns for the six months ended June 30, 2024 and 2023 were converted to an annual rate by multiplying the calculated return by 2.

After-tax ROIC for the six months ended June 30, 2024 included 170 basis points of favorable impact related to the cumulative effect of the change from the LIFO method of accounting to the FIFO method for certain U.S. businesses ($117 million pre-tax, or $88 million after-tax) in the first quarter of 2024.

A reconciliation of the tax rate for the three and six months ended June 30, 2023, excluding the second quarter 2023 discrete tax benefit of $20 million related to amended 2021 U.S. taxes, is as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, 2023 | | June 30, 2023 |

| Dollars in millions | Income Taxes | | Tax Rate | | Income Taxes | | Tax Rate |

| As reported | $ | 207 | | | 21.4 | % | | $ | 415 | | | 22.0 | % |

| Discrete tax benefit related to the second quarter 2023 | 20 | | | 2.2 | % | | 20 | | | 1.1 | % |

| As adjusted | $ | 227 | | | 23.6 | % | | $ | 435 | | | 23.1 | % |

AFTER-TAX RETURN ON AVERAGE INVESTED CAPITAL (UNAUDITED)

| | | | | |

| Twelve Months Ended |

| Dollars in millions | December 31, 2023 |

| Numerator: | |

| Net income | $ | 2,957 | |

| Discrete tax benefit related to the second quarter 2023 | (20) | |

Interest expense, net of tax (1) | 204 | |

Other (income) expense, net of tax (1) | (38) | |

| Operating income after taxes | $ | 3,103 | |

| |

| Denominator: | |

| Invested capital: | |

| Cash and equivalents | $ | 1,065 | |

| Trade receivables | 3,123 | |

| Inventories | 1,707 | |

| Net plant and equipment | 1,976 | |

| Goodwill and intangible assets | 5,566 | |

| Accounts payable and accrued expenses | (2,244) | |

| Debt | (8,164) | |

| Other, net | (16) | |

| Total net assets (stockholders' equity) | 3,013 | |

| Cash and equivalents | (1,065) | |

| Debt | 8,164 | |

| Total invested capital | $ | 10,112 | |

| |

Average invested capital (2) | $ | 10,214 | |

| |

| Net income to average invested capital | 29.0 | % |

| After-tax return on average invested capital | 30.4 | % |

(1) Effective tax rate used for interest expense and other (income) expense for the year ended December 31, 2023 was 23.2%.

(2) Average invested capital is calculated using the total invested capital balances at the start of the period and at the end of each quarter within the period presented.

A reconciliation of the 2023 effective tax rate excluding the second quarter 2023 discrete tax benefit of $20 million related to amended 2021 U.S. taxes is as follows:

| | | | | | | | | | | |

| Twelve Months Ended |

| December 31, 2023 |

| Dollars in millions | Income Taxes | | Tax Rate |

| As reported | $ | 866 | | | 22.6 | % |

| Discrete tax benefit related to the second quarter 2023 | 20 | | | 0.6 | % |

| As adjusted | $ | 886 | | | 23.2 | % |

FREE CASH FLOW (UNAUDITED)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| Dollars in millions | 2024 | | 2023 | | 2024 | | 2023 |

| Net cash provided by operating activities | $ | 687 | | | $ | 790 | | | $ | 1,276 | | | $ | 1,518 | |

| Less: Additions to plant and equipment | (116) | | | (85) | | | (211) | | | (198) | |

| Free cash flow | $ | 571 | | | $ | 705 | | | $ | 1,065 | | | $ | 1,320 | |

| | | | | | | |

| Net income | $ | 759 | | | $ | 754 | | | $ | 1,578 | | | $ | 1,468 | |

| | | | | | | |

| Net cash provided by operating activities to net income conversion rate | 91 | % | | 105 | % | | 81 | % | | 103 | % |

| Free cash flow to net income conversion rate | 75 | % | | 94 | % | | 67 | % | | 90 | % |

ADJUSTED NET INCOME PER SHARE - DILUTED (UNAUDITED)

| | | | | |

| Three Months Ended |

| June 30, 2023 |

| As reported | $ | 2.48 | |

| Discrete tax benefit related to the second quarter 2023 | (0.07) | |

| As adjusted | $ | 2.41 | |

v3.24.2

Document and Entity Information Document

|

Jul. 30, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 30, 2024

|

| Entity Registrant Name |

ILLINOIS TOOL WORKS INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-4797

|

| Entity Tax Identification Number |

36-1258310

|

| Entity Address, Address Line One |

155 Harlem Avenue

|

| Entity Address, City or Town |

Glenview

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60025

|

| City Area Code |

847

|

| Local Phone Number |

724-7500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000049826

|

| Amendment Flag |

false

|

| NEW YORK STOCK EXCHANGE, INC. | Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

ITW

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 0.250% Euro Notes due 2024 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.250% Euro Notes due 2024

|

| Trading Symbol |

ITW24A

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 0.625% Euro Notes due 2027 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

0.625% Euro Notes due 2027

|

| Trading Symbol |

ITW27

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 3.250% Euro Notes due 2028 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

3.250% Euro Notes due 2028

|

| Trading Symbol |

ITW28

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 2.125% Euro Notes due 2030 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

2.125% Euro Notes due 2030

|

| Trading Symbol |

ITW30

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 1.00% Euro Notes due 2031 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

1.00% Euro Notes due 2031

|

| Trading Symbol |

ITW31

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 3.375% Euro Notes due 2032 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

3.375% Euro Notes due 2032

|

| Trading Symbol |

ITW32

|

| Security Exchange Name |

NYSE

|

| NEW YORK STOCK EXCHANGE, INC. | 3.00% Euro Notes due 2034 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

3.00% Euro Notes due 2034

|

| Trading Symbol |

ITW34

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

dei_EntityListingsExchangeAxis=exch_XNYS |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=itw_A0.250EuroNotesdue2024Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=itw_A0.625EuroNotesdue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=itw_A3.250EuroNotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=itw_A2.125EuroNotesdue2030Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=itw_A1.00EuroNotesdue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=itw_A3.375EuroNotesDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=itw_A3.00EuroNotesdue2034Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

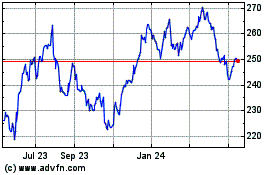

Illinois Tool Works (NYSE:ITW)

Historical Stock Chart

From Oct 2024 to Nov 2024

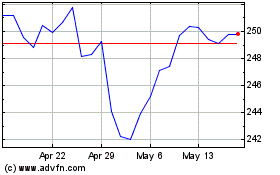

Illinois Tool Works (NYSE:ITW)

Historical Stock Chart

From Nov 2023 to Nov 2024