0001846069False00018460692024-05-012024-05-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): May 1, 2024

Nextdoor Holdings, Inc.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | |

| Delaware | 001-40246 | 86-1776836 |

(State or Other Jurisdiction

of Incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

420 Taylor Street

San Francisco, California

(Address of principal executive offices)

(415) 344-0333

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol | Name of each exchange on which registered |

Class A common stock, par value $0.0001 per share | KIND | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 ((§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 7, 2024, Nextdoor Holdings, Inc. (the “Company”) issued a letter to shareholders and press release (together, the “Letter and Press Release”) announcing its financial results for the first quarter ended March 31, 2024. The Company also announced that it would be holding a conference call on May 7, 2024 to discuss its financial results. Copies of the Letter and Press Release are furnished as Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K.

This information included in this Item 2.02 of this Current Report on Form 8-K and the exhibits hereto are being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it been deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(d) On May 1, 2024, the Company’s Board of Directors (the “Board”), following a recommendation from the Nominating, Corporate Governance and Corporate Responsibility Committee of the Board, appointed each of Robert Hohman, Marissa Mayer, and Niraj Shah to serve as a director of the Company, effective May 1, 2024. Mr. Hohman will serve as a Class II director until the earliest to occur of the Company’s 2026 annual meeting of stockholders and until his successor is duly elected and qualified, or until his death, resignation, disqualification or removal. Ms. Mayer and Mr. Shah will each serve as a Class III director until the earliest to occur of the Company’s 2024 annual meeting of stockholders and until her or his successor is duly elected and qualified, or until her or his death, resignation, disqualification or removal. Ms. Mayer and Mr. Shah have been nominated for election at the 2024 annual meeting of stockholders. Mr. Hohman was appointed to the Nominating, Corporate Governance and Corporate Responsibility Committee of the Board and Ms. Mayer was appointed to the Compensation and People Development Committee of the Board.

Each of Mr. Hohman’s, Ms. Mayer’s, and Mr. Shah’s compensation will be as provided under the Company’s non-employee director compensation program, as amended (the “Non-Employee Director Compensation Program”), as described in the Company’s supplement to its definitive proxy statement filed with the Securities and Exchange Commission on or about May 7, 2024. The Non-Employee Director Compensation Program provides for the following:

Cash Compensation

•General Board Service Fee: $40,000

•Lead Independent Director Fee (in addition to General Board Service Fee): $15,000

•Committee Chair Service Fee (in addition to General Board Service Fee; in lieu of Non-Chair Committee Member Service Fee set forth below):

◦Audit and Risk Committee: $27,500

◦Compensation and People Development Committee: $27,500

◦Nominating, Corporate Governance and Corporate Responsibility Committee: $10,000

•Non-Chair Committee Member Service Fee (in addition to General Board Service Fee; in lieu of Committee Chair Service Fee):

◦Audit and Risk Committee: $10,000

◦Compensation and People Development Committee: $10,000

◦Nominating, Corporate Governance and Corporate Responsibility Committee: $4,000

Equity Compensation

•Initial Equity Award: Restricted stock units with a grant date fair value of $350,000, which award vests annually over a two-year period

•Annual Equity Award: Restricted stock units with a grant date fair value of $175,000, which award vests on the date of the next annual meeting of stockholders (or the date immediately prior to the next annual meeting of stockholders if the applicable non-employee director’s service as a director ends at such meeting due to the director’s failure to be re-elected or the director not standing for re-election) and (b) the date that is one year following the grant date

In connection with their appointment as a non-employee director of the Board and consistent with the Non-Employee Director Compensation Program, as amended, each of Mr. Hohman, Ms. Mayer and Mr. Shah will receive, effective July 1, 2024, (i) a pro-rated annual retainer fee of $40,000, which is payable quarterly and (ii) an initial award of restricted stock units having an aggregate grant date fair value of $350,000, which award shall vest annually over a two-year period, subject to their continued service as a director on the Board (the “Initial Award”). Mr. Hohman and Ms. Mayer will also receive the Nominating, Corporate Governance and Corporate Responsibility member fee and Compensation and People Development Committee member fee, respectively. The Initial Award will accelerate in full upon the consummation of a Corporate Transaction (as defined in the Company’s 2021 Equity Incentive Plan).

There is no arrangement or understanding between any of Mr. Hohman, Ms. Mayer and Mr. Shah and any other persons pursuant to which Mr. Hohman, Ms. Mayer or Mr. Shah, respectively, was selected as a director. None of Mr. Hohman, Ms. Mayer or Mr. Shah is a party to any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

The Company plans to enter into its standard form of indemnification agreement with each of Mr. Hohman, Ms. Mayer and Mr. Shah. The form of the indemnification agreement was previously filed by the Company as Exhibit 10.6 to the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on November 12, 2021 and is incorporated by reference herein.

Item 7.01 Regulation FD Disclosure.

On May 7, 2024, the Company issued a press release announcing the appointments of Mr. Hohman, Ms. Mayer and Mr. Shah to the Board. A copy of the press release is attached as Exhibit 99.3 to this Current Report on Form 8-K.

The information in this Item 7.01, including Exhibit 99.3, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of the registrant under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | |

| Exhibit Number | Description |

| 99.1 | |

| 99.2 | |

99.3 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

ADDITIONAL INFORMATION AND WHERE TO FIND IT

The information is being provided to stockholders in addition to the definitive proxy statement filed by the Company with the Securities and Exchange Commission (the “SEC”) on April 26, 2024 in connection with the solicitation of proxies for its 2024 annual meeting of stockholders. The Company plans to supplement the proxy statement to reflect the changes described in this Current Report on Form 8-K. Stockholders are urged to read the proxy statement, including the supplement, and accompanying materials carefully before making a voting decision. The proxy statement, including the supplement, and other documents filed by the Company with the SEC may be obtained free of charge at www.sec.gov and from the Company’s website at investors.nextdoor.com.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| NEXTDOOR HOLDINGS, INC. |

| | |

| | |

Date: May 7, 2024 | By: | /s/ Matt Anderson |

| | Matt Anderson |

| | Chief Financial Officer |

A Letter From Our CEO

Dear Shareholders,

It is a great honor to reconnect with you as Nextdoor’s CEO. Today, I have the same feelings of excitement and possibility as I did when we created this company fourteen years ago. Nextdoor has grown tremendously since then, but I believe our best times are clearly still ahead.

In Silicon Valley, there is a commonly held belief that companies benefit when their founders return. I believe this is due in part to the value of the “Founder's Mentality” — a phenomenon explored by Bain Partners Chris Zook and James Allen in their book of the same name. They argue that founders possess a set of attitudes and behaviors that is one of the most undervalued secrets of business success. This is precisely the frame of mind that we plan to instill at Nextdoor.

The first element of our Founder’s Mentality is a clear mission and unwavering focus. Nextdoor was conceived on the belief that the neighborhood is one of the most valuable communities in our lives. By applying the power of technology to community, we can create stronger, safer, and happier places to call home. It also unlocks an opportunity for us to build the definitive consumer internet service in local, an enormous space that companies have struggled to solve. We will not waver from this mission nor its outsized ambition, regardless of adversity or obstacles.

The second element of our Founder’s Mentality is an obsession with the details. We are convinced that the magic is in the details, especially for tech companies. Whether through elegant code, crisp pixels, or a delightful user experience — we will be obsessed with the details that enable great product. It’s clear today that our offering needs to be more robust and engaging, and we fully intend to unlock our full product potential to revitalize the business, better meet the needs of users and advertisers, and go all-in on transformative technologies like AI to raise the bar on product excellence.

The third and final element of our Founder’s Mentality is to always act like owners. Owners avoid complexity, bureaucracy, and anything that gets in the way of the clean execution of strategy. Owners treat every dollar like it is their last. And owners hold themselves accountable to performance, the most important commitment of them all. We expect to pair a disciplined approach to capital allocation with a continued focus on achieving our financial commitments. We will seek to be effective and efficient, and embrace the challenge of doing less with more while still creating significant value for shareholders.

Guided by our Founder’s Mentality, Nextdoor will chart a course for the future while retaining the values of the past. We are committed to the transformative power of technology and community. We are committed to delivering a great product that dramatically improves the quality of people’s lives. With that will come business results that increase returns for our shareholders. The path to success may be challenging and there is ample work ahead, but we will keep pushing forward with unrelenting determination. I look forward to clearly communicating our progress along the way.

Sincerely,

Nirav Tolia

Founder, Executive Chair, and incoming CEO

Q1 2024 Financial Highlights

| | | | | | | | |

Q1 revenue of $53M was +7% year-over-year, an acceleration driven by strong revenue retention from self-serve advertisers, partially offset by stable but still-tempered enterprise advertiser growth. We saw sustained improvement in home services, a return to growth in financial services, and increasing contributions from emerging verticals. | Q1 Weekly Active Users (WAU) of 43.4 million grew 2% year-over-year, and 4% quarter-over-quarter, driven by sustained organic Verified Neighbor1 growth and our digital invite strategy. Session depth2 continued to reach new highs in Q1, reflecting users’ deepening engagement on our platform. | Q1 ARPU3 of $1.22 grew 4% year-over-year, a return to growth enabled by our enhanced self-serve capabilities and increased session depth, which drove ad impression growth. Pricing trends were stable, and we are encouraged by strong initial product-market fit with performance-driven mid-market customers beginning to use the Nextdoor Ads Platform. |

1 Verified Neighbors are individuals who have joined Nextdoor and completed the verification process for their account.

2 Session depth reflects the number of ad impression opportunities during each user session.

3 ARPU is defined as average revenue per WAU.

4 Net loss margin is calculated as net loss divided by revenue.

5 Adjusted EBITDA margin is calculated as adjusted EBITDA divided by revenue. A reconciliation of non-GAAP metrics used in this letter to their most comparable GAAP measures is provided at the end of the letter.

Introduction

Q1 was a promising start to the year. We achieved our financial objectives as laid out on our Q4 earnings call in February, and in the quarter we:

•Accelerated revenue growth to 7% year-over-year;

•Improved adjusted EBITDA margin by 17 percentage points year-over-year;

•Increased self-serve revenue to nearly 50% of total revenue, versus just more than 40% in Q4 2023.

And we remain focused on demonstrating the power of our growth algorithm. Specifically, Nextdoor’s financial performance is driven by:

1.Persistent user and engagement growth (WAU, session depth).

2.Strong new advertiser growth, accelerated by improving self-serve capabilities (self-serve revenue grew >30% in Q1).

3.Durable advertiser retention (we retained 92% of our top 50 customers on a year-over-year basis in Q1, and self-serve revenue retention has been an area of strength) as more demand is delivered on our Nextdoor Ad Server.

4.A reduced cost base (as evidenced by our 17 percentage points of Q1 adjusted EBITDA margin improvement) to better enable growth and positive free cash flow.

We executed against each of these measures in Q1, and see further opportunities to improve our growth and margin profile as the year progresses. Given our heightened focus on performance and an improving advertising market backdrop, we remain optimistic about our full-year trajectory. We are focused on execution with increased efficiency — doing more with less — and unlocking our product potential to bring new users to the platform, grow engagement, and deliver better solutions for advertisers.

Perspectives on Q1

Revenue of $53M grew 7% year-over-year, driven mostly by strong growth from self-serve advertisers. We note continued improvement in key verticals, highlighted by improving growth in home services and financial services, and strength across multiple emerging verticals. Another encouraging sign in Q1 was that ARPU returned to growth, improving by 4% year-over-year to $1.22, as we saw continued strong growth in ad impressions delivered, and a strong product-market fit for SMB and mid-market advertisers now benefiting from our self-serve capabilities.

Q1 performance was largely attributable to the following factors: (1) WAU growth again supported by robust organic Verified Neighbor growth, (2) strong impression growth amplified by record session depth, which grew year-over-year and accelerated sequentially, (3) increasing average spend levels from SMB and mid-market advertisers, (4) improving momentum in several key verticals, including home services and financial services, which showed positive year-over-year growth for the first time in two years, and (5) reduced operating expenses and early benefits from our more efficient self-serve go-to-market strategy.

User growth. We again saw superb top of funnel acquisition in Q1. WAU grew to 43.4M, up 2% year-over-year and 4% sequentially, as our digital invite strategy continues to drive new users to join the platform and encourages them to invite others to do the same. We sustained WAU momentum throughout the quarter, boosted by seasonal factors and an intra-quarter initiative to re-engage with some dormant users, ensuring growth despite a tough year-over-year comparison.

Engagement. Continued increases in session depth, which is one measure of how deeply users are engaging, indicate our progress on improving content relevance, and in turn increase platform stickiness. Q1 session depth was +36% year-over-year, and was coupled with an increasing percentage of users scrolling through their feeds. Our platform meets very important needs: 75% of Nextdoor users agree that the platform makes them feel connected to their community and 68% are motivated to check Nextdoor to be informed and get things done.6 We can do more — and our efforts to unlock more of Nextdoor’s untapped product potential will make our platform even more valuable and vital for users, further deepen engagement, and drive content views and impression opportunities across all of our surfaces.

Ads platform. Our advertising platform is increasingly delivering robust, easy to use, local solutions. As of the end of Q1, 100% of our self-serve customers, which include SMB and about half of our total mid-market customers, are using Nextdoor Ads Manager to onboard and manage campaigns, and benefiting from improved ad delivery and performance on the Nextdoor Ad Server. We continue to make progress, and expect to start migrating over our managed enterprise and mid-market customers later this year.

Delivering advertiser value. With a user base that has scale, growing engagement, and high purchase intent, we have amassed unique first-party data that can be used in multiple ways, from advertising segmentation to artificial intelligence. Further, our maturing advertising platform allows us to offer a more compelling value proposition for a wider range of advertisers. We have spoken frequently about how crucial our ad platform is to our strategic and monetization objectives, and we have now also made our platform considerably more developer-friendly. From our Ads API and Conversion API launches, to our Nextdoor Developer Site, to our overhauled and improved U.S. B2B website, we have made it easier for advertisers to connect to Nextdoor and realize the benefits of advertising on our unique platform.

__________________

6 Source: Nextdoor Insights Series, 2024.

Self-serve continues to scale. We are seeing early signs that our ads platform is beginning to drive revenue growth, suggesting we are delivering value for advertisers using our platform. Self-serve contributed nearly 50% of total revenue in Q1, up from the low-40% range in Q4 2023 and 40% in Q1 2023. This jump has been enabled by the aforementioned customer migration to our ads platform and strong product-market fit with agencies, and we expect our share of revenue coming from self-serve will rise over time. Though still in progress, our customer migration to our Nextdoor Ads Manager and Nextdoor Ad Server has brought early performance benefits for our advertisers, and for Nextdoor. We have seen increases in revenue, clicks, and impressions, and, crucially, a 70% reduction in the number of first party repeat ads delivered. Among mid-market advertisers using self-serve, our increased capabilities allowed us to grow new logos by more than 50% year-over-year in Q1, increase average spend, and deepen relationships with new advertising agencies. Our approach is clearly resonating with these advertisers. As a next step for those interested in learning more, we have uploaded a brief, informal video walk-through of the Nextdoor Ads Manager platform and user experience to our main IR page, investors.nextdoor.com.

Adjusted EBITDA was $(14)M, and Adjusted EBITDA margin improved by 17 percentage points year-over-year. Margin improvement was driven by higher revenue, increased leverage on our hosting costs, and lower personnel costs. One of our primary productivity measures, revenue per employee, improved by nearly 40% year-over-year. We expect continued strength in this measure, will drive efficiencies in infrastructure and R&D expenses, and see opportunities to drive further margin improvement.

Balance sheet, cash flow, and capital allocation. We ended Q1 with $498M in cash and cash equivalents and marketable securities and remain well-capitalized, with a strong balance sheet, zero debt, and a now-faster path to generating positive free cash flow by the end of Q4’24 (previously Q4’25). Following the activation of our expanded buyback program in early March 2024, we repurchased 4.4M shares at an average share price of $2.19. At quarter-end, our current authorization had $163 million remaining, and we continue to be active buyers of our shares.

Looking Ahead

Nextdoor is the perfect AI fishbowl. Nextdoor is already deploying generative artificial intelligence (AI) at scale via our Kindness Reminder, which uses the technology to help users write posts that are more likely to drive positive community engagement. We have embedded generative AI in our recently deployed Nextdoor Ads Manager, allowing businesses to formulate advertising copy quickly and easily. Longer-term, we think our AI potential is much larger and more interesting, as Nextdoor has the potential to be one of the world’s largest consumer applications of both generative and predictive AI. We have proprietary data, a local large language model (LLM), and consumer distribution at scale — all fully owned and under the same roof. This makes Nextdoor a kind of completely self-sufficient AI "test-kitchen," with all the needed ingredients in place to leverage this technology in new and valuable ways over time.

Closing thoughts. We are committed to delivering value for advertisers, users, and shareholders. With a focus on increasing the velocity and output of our R&D and product teams and ensuring more effective and efficient resource allocation, we will unlock our full product potential, making our product more engaging and our business more robust. We look forward to the rest of 2024 — and beyond.

Financial Outlook

FY 2024 Outlook

•We expect FY 2024 revenue in a range between $229 million and $235 million.

•We expect FY 2024 adjusted EBITDA margin will improve by 15 percentage points year-over-year, versus our prior expectation of a 10 percentage point improvement.

•We expect to generate positive free cash flow7 in Q4 2024, compared to our prior expectation of generating positive free cash flow in Q4 2025.

Q2 2024 Outlook

•We expect Q2 2024 revenue will be approximately $58 million.

•We expect Q2 2024 adjusted EBITDA loss will be approximately ($13) million.

The following factors inform our financial guidance and initial expectations for the business this year:

•OpEx and margins. Our expected FY 2024 year-over-year adjusted EBITDA margin improvement will be driven by savings related to our Q4’23 cost reduction plan, savings related to reduced rent and corporate restructuring, and additional efficiencies and productivity improvements. We continue to expect full year 2024 operating expenses will be lower than full year 2023.

•Capital allocation. We continue to repurchase shares, and expect limited FY 2024 share dilution.

___________________

7 We define free cash flow as operating cash flow less capital expenditures.

Q1 2024 Conference Call and Webcast

We will host a Q&A webcast on Tuesday, May 7, 2024, at 2:00 pm PT/5:00 pm ET to discuss these results and outlook. An audio webcast archive will be available following the live webcast for approximately one year on Nextdoor’s Investor Relations website at investors.nextdoor.com. Thank you for your support in building stronger neighborhoods across the globe and for being active users in your neighborhood. We look forward to your questions and comments.

We use our Investor Relations website (investors.nextdoor.com), our X handle (twitter.com/Nextdoor), and our LinkedIn Home Page (linkedin.com/company/nextdoor-com) as a means of disseminating or providing notification of, among other things, news or announcements regarding our business or financial performance, investor events, press releases, and earnings releases and as a means of disclosing material nonpublic information and for complying with our disclosure obligations under Regulation FD. The content of our websites and information that we may post on or provide to online and social media channels, including those mentioned above, and information that can be accessed through our websites or these online and social media channels are not incorporated by reference into this shareholder letter or in any report or document we file with the SEC, and any references to our websites or these online and social media channels are intended to be inactive textual references only.

Safe Harbor Statement

This shareholder letter includes forward-looking statements, which are statements other than statements of historical facts and statements in the future tense. These statements include, but are not limited to, statements regarding our future performance and our market opportunity, including expected financial results for the second quarter of 2024 and full year 2024, trends and expectations regarding our business and operating results, the expected cost reductions associated with the reduction in force, our capital allocation strategy, our business strategy and plans, and our objectives and future operations, including our expansion into new markets.

Forward-looking statements are based upon various estimates and assumptions, as well as information known to us as of the date of this shareholder letter, and are subject to risks and uncertainties. Accordingly, actual results could differ materially due to a variety of factors, including: our ability to scale our business and monetization efforts; our ability to expand business operations abroad; our limited operating history; risks associated with managing our growth; our ability to achieve and maintain profitability in the future; the effects of the highly competitive market in which we operate; the impact of macroeconomic conditions on our business; our ability to attract new and retain existing customers and users, or renew and expand our relationships with them; our ability to anticipate and satisfy customer preferences; market acceptance of our platform; our ability to successfully develop and timely introduce new products and services; our ability to achieve our objectives of strategic and operational initiatives; cybersecurity risks to our various systems and software; the impact of privacy and data security laws; and other general market, political, economic, and business conditions.

Additional risks and uncertainties that could affect our financial results and business are more fully described in our Annual Report on Form 10-K for the period ended December 31, 2023 filed with the SEC on February 27, 2024, our Quarterly Report on Form 10-Q for the period ended March 31, 2024, expected to be filed on or about May 7, 2024, and our other SEC filings, which are available on the Investor Relations page of our website at investors.nextdoor.com and on the SEC’s website at www.sec.gov.

All forward-looking statements contained herein are based on information available to us as of the date hereof and you should not rely upon forward-looking statements as predictions of future events. The events and circumstances reflected in the forward-looking statements may not be achieved or occur. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, performance, or achievements. We undertake no obligation to update any of these forward-looking statements for any reason after the date of this shareholder letter or to conform these statements to actual results or revised expectations, except as required by law. Undue reliance should not be placed on the forward-looking statements in this shareholder letter.

A Note on Guidance

We have not reconciled our adjusted EBITDA, adjusted EBITDA margin, or free cash flow outlook to GAAP net loss, GAAP net loss margin or net cash used in operating activities, respectively, because certain items that impact these measures are uncertain or out of our control and cannot be reasonably predicted. In particular, with respect to adjusted EBITDA and adjusted EBITDA margin, stock-based compensation expense is impacted by the future fair market value of our common stock and other factors, all of which are difficult to predict, subject to frequent change, or not within our control. The actual amount of these expenses during 2024 will have a significant impact on our future GAAP financial results. Accordingly, a reconciliation of adjusted EBITDA outlook to net loss, adjusted EBITDA margin to GAAP net loss margin and free cash flow to net cash used in operating activities is not available without unreasonable efforts.

Condensed Consolidated

Balance Sheets

in thousands, except per share data (unaudited)

| | | | | | | | | | | |

| March 31, | | December 31 |

| 2024 | | 2023 |

| | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 69,670 | | | $ | 60,233 | |

| Marketable securities | 428,123 | | | 470,868 | |

| Accounts receivable, net of allowance of $380 and $385 as of March 31, 2024 and December 31, 2023, respectively | 26,057 | | | 26,233 | |

| Prepaid expenses and other current assets | 16,376 | | | 9,606 | |

| Total current assets | 540,226 | | | 566,940 | |

| Restricted cash, non-current | 11,171 | | | 11,171 | |

| Property and equipment, net | 7,157 | | | 8,082 | |

| Operating lease right-of-use assets | 55,788 | | | 56,968 | |

| Intangible assets, net | 859 | | | 1,301 | |

| Goodwill | 1,211 | | | 1,211 | |

| Other assets | 16,669 | | | 8,891 | |

| Total assets | $ | 633,081 | | | $ | 654,564 | |

| | | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 2,121 | | | $ | 1,895 | |

| Operating lease liabilities, current | 6,398 | | | 6,208 | |

| Accrued expenses and other current liabilities | 24,185 | | | 27,308 | |

| Total current liabilities | 32,704 | | | 35,411 | |

| Operating lease liabilities, non-current | 58,716 | | | 60,378 | |

| Other liabilities, non-current | 219 | | | 218 | |

| Total liabilities | 91,639 | | | 96,007 | |

| | | |

| Stockholders’ equity: | | | |

| Class A common stock, $0.0001 par value; 2,500,000 shares authorized, 189,631 and 186,415 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively | 19 | | | 19 | |

| Class B common stock, $0.0001 par value; 500,000 shares authorized, 201,251 and 201,960 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively | 20 | | | 20 | |

| Additional paid-in capital | 1,335,525 | | | 1,323,595 | |

| Accumulated other comprehensive income | 159 | | | 943 | |

| Accumulated deficit | (794,281) | | | (766,020) | |

| Total stockholders’ equity | 541,442 | | | 558,557 | |

| | | |

| Total liabilities and stockholders’ equity | $ | 633,081 | | | $ | 654,564 | |

Condensed Consolidated Statements of Operations

in thousands, except per share data (unaudited)

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| | | | | | | |

| Revenue | $ | 53,146 | | | $ | 49,771 | | | | | |

| Costs and expenses: | | | | | | | |

| Cost of revenue | 9,978 | | | 9,913 | | | | | |

| Research and development | 31,319 | | | 32,982 | | | | | |

| Sales and marketing | 29,872 | | | 29,209 | | | | | |

| General and administrative | 16,726 | | | 16,479 | | | | | |

| Total costs and expenses | 87,895 | | | 88,583 | | | | | |

| Loss from operations | (34,749) | | | (38,812) | | | | | |

| Interest income | 6,846 | | | 5,513 | | | | | |

| Other income (expense), net | (159) | | | (116) | | | | | |

| Loss before income taxes | (28,062) | | | (33,415) | | | | | |

| Provision for income taxes | 199 | | | 301 | | | | | |

| Net loss | $ | (28,261) | | | $ | (33,716) | | | | | |

| | | | | | | |

| Net loss per share attributable to Class A and Class B common stockholders, basic and diluted | $ | (0.07) | | | $ | (0.09) | | | | | |

| Weighted average shares used in computing net loss per share attributable to Class A and Class B common stockholders, basic and diluted | 392,219 | | | 373,025 | | | | | |

Condensed Consolidated Statements of Cash Flows

in thousands (unaudited)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| | | |

| Cash flows from operating activities | | | |

| Net loss | $ | (28,261) | | | $ | (33,716) | |

| Adjustments to reconcile net loss to net cash used in operating activities: | | | |

| Depreciation and amortization | 1,387 | | | 1,451 | |

| Stock-based compensation | 19,506 | | | 15,816 | |

| Bad debt expense | (15) | | | (6) | |

| Accretion of investments | (1,878) | | | (1,907) | |

| Other | 362 | | | (269) | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable, net | 191 | | | 1,731 | |

| Prepaid expenses and other assets | (1,731) | | | 2,573 | |

| Operating lease right-of-use assets | 1,180 | | | 1,311 | |

| Accounts payable | 226 | | | 498 | |

| Operating lease liabilities | (1,472) | | | (1,489) | |

| Accrued expenses and other liabilities | (3,122) | | | 292 | |

| Net cash used in operating activities | (13,627) | | | (13,715) | |

| Cash flows from investing activities | | | |

| Purchases of property and equipment | (20) | | | (59) | |

| Purchases of marketable securities | (52,637) | | | (190,007) | |

| Sales of marketable securities | 28,770 | | | 42,684 | |

| Maturities of marketable securities | 67,277 | | | 172,047 | |

| Loan to Opportunity Finance Network | (7,500) | | | — | |

| Net cash provided by investing activities | 35,890 | | | 24,665 | |

| Cash flows from financing activities | | | |

| Proceeds from exercise of stock options | 2,830 | | | 537 | |

| Proceeds from issuance of common stock under employee stock purchase plan | 606 | | | 1,076 | |

| Tax withholdings on release of restricted stock units | (1,261) | | | — | |

| Repurchase of common stock | (9,751) | | | — | |

| Prepayment under share repurchase program | (5,317) | | | — | |

| Net cash provided by (used in) financing activities | (12,893) | | | 1,613 | |

| Effect of exchange rate changes on cash and cash equivalents | 67 | | | 19 | |

| Net increase in cash, cash equivalents, and restricted cash | 9,437 | | | 12,582 | |

| Cash, cash equivalents, and restricted cash at beginning of period | 71,404 | | | 55,236 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 80,841 | | | $ | 67,818 | |

Non-GAAP Financial Measures

To supplement our condensed consolidated financial statements, which are prepared in accordance with GAAP, we present non-GAAP cost of revenue, non-GAAP research and development, non-GAAP sales and marketing, non-GAAP general and administrative, adjusted EBITDA and adjusted EBITDA margin in this shareholder letter. Our use of non-GAAP financial measures has limitations as an analytical tool, and these measures should not be considered in isolation or as a substitute for analysis of financial results as reported under GAAP.

We use these non-GAAP financial measures in conjunction with financial measures prepared in accordance with GAAP for planning purposes, including in the preparation of our annual operating budget, as a measure of our core operating results and the effectiveness of our business strategy, and in evaluating our financial performance. These measures provide consistency and comparability with past financial performance, facilitate period-to-period comparisons of core operating results, and also facilitate comparisons with other peer companies, many of which use similar non-GAAP financial measures to supplement their GAAP results. In addition, adjusted EBITDA is widely used by investors and securities analysts to measure a company's operating performance. We exclude the following items from one or more of our non-GAAP financial measures: stock-based compensation expense (non-cash expense calculated by companies using a variety of valuation methodologies and subjective assumptions), depreciation and amortization (non-cash expense), interest income, provision for income taxes, and, if applicable, acquisition-related costs.

Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool. In particular, (1) stock-based compensation expense has recently been, and will continue to be for the foreseeable future, a significant recurring expense for our business and an important part of our compensation strategy, (2) although depreciation and amortization expense are non-cash charges, the assets subject to depreciation and amortization may have to be replaced in the future, and our non-GAAP measures do not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements, and (3) adjusted EBITDA does not reflect: (a) changes in, or cash requirements for, our working capital needs; (b) interest expense, or the cash requirements necessary to service interest or principal payments on our debt, which reduces cash available to us; or (c) tax payments that may represent a reduction in cash available to us. The non-GAAP measures we use may be different from non-GAAP financial measures used by other companies, limiting their usefulness for comparison purposes. We compensate for these limitations by providing specific information regarding the GAAP items excluded from these non-GAAP financial measures. A reconciliation of these non-GAAP measures has been provided below:

Non-GAAP Financial Measures

in thousands (unaudited)

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| | | | | | | |

| Net loss | $ | (28,261) | | | $ | (33,716) | | | | | |

| % Margin | (53 | %) | | (68 | %) | | | | |

| Depreciation and amortization | $ | 1,387 | | | $ | 1,451 | | | | | |

| Stock-based compensation | 19,506 | | | 15,816 | | | | | |

| Interest income | (6,846) | | | (5,513) | | | | | |

| Provision for income taxes | 199 | | | 301 | | | | | |

| Adjusted EBITDA | $ | (14,015) | | | $ | (21,661) | | | | | |

| % Margin | (26 | %) | | (44 | %) | | | | |

| Cost of Revenue Reconciliation: | | | | | | | |

| Cost of Revenue, GAAP | $ | 9,978 | | | $ | 9,913 | | | | | |

| Stock-based compensation | (709) | | | (630) | | | | | |

| Cost of Revenue, Non-GAAP | $ | 9,269 | | | $ | 9,283 | | | | | |

| % of revenue, GAAP | 19 | % | | 20 | % | | | | |

| % of revenue, Non-GAAP | 17 | % | | 19 | % | | | | |

| Research and Development Reconciliation: | | | | | | | |

| Research and Development, GAAP | $ | 31,319 | | | $ | 32,982 | | | | | |

| Stock-based compensation | (10,007) | | | (8,457) | | | | | |

| Depreciation and amortization | (442) | | | (494) | | | | | |

| Research and Development, Non-GAAP | $ | 20,870 | | | $ | 24,031 | | | | | |

| % of revenue, GAAP | 59 | % | | 66 | % | | | | |

| % of revenue, Non-GAAP | 39 | % | | 48 | % | | | | |

| Sales and Marketing Reconciliation: | | | | | | | |

| Sales and Marketing, GAAP | $ | 29,872 | | | $ | 29,209 | | | | | |

| Stock-based compensation | (3,352) | | | (2,433) | | | | | |

| Depreciation and amortization | (770) | | | (778) | | | | | |

| Sales and Marketing, Non-GAAP | $ | 25,750 | | | $ | 25,998 | | | | | |

| % of revenue, GAAP | 56 | % | | 59 | % | | | | |

| % of revenue, Non-GAAP | 48 | % | | 52 | % | | | | |

| General and Administrative Reconciliation: | | | | | | | |

| General and Administrative, GAAP | $ | 16,726 | | | $ | 16,479 | | | | | |

| Stock-based compensation | (5,438) | | | (4,296) | | | | | |

| Depreciation and amortization | (175) | | | (179) | | | | | |

| General and Administrative, Non-GAAP | $ | 11,113 | | | $ | 12,004 | | | | | |

| % of revenue, GAAP | 31 | % | | 33 | % | | | | |

| % of revenue, Non-GAAP | 21 | % | | 24 | % | | | | |

| Total Operating Expenses Reconciliation: | | | | | | | |

| Operating Expenses, GAAP | $ | 87,895 | | | $ | 88,583 | | | | | |

| Stock-based compensation | (19,506) | | | (15,816) | | | | | |

| Depreciation and amortization | (1,387) | | | (1,451) | | | | | |

| Total Operating Expenses, Non-GAAP | $ | 67,002 | | | $ | 71,316 | | | | | |

| % of revenue, GAAP | 165 | % | | 178 | % | | | | |

| % of revenue, Non-GAAP | 126 | % | | 143 | % | | | | |

Nextdoor Reports First Quarter 2024 Results

•Revenue of $53 million, +7% year-over-year; Q1 WAU of 43.4 million, +2% year-over-year

•GAAP net loss of $28 million; Operating cash flow of $(14) million; Adjusted EBITDA margin improved by 17 percentage points year-over-year

•Raises full-year Adjusted EBITDA guidance; Now expects positive free cash flow1 in Q4'24

SAN FRANCISCO, CA, May 7, 2024 — Nextdoor Holdings, Inc. (NYSE: KIND) today announced financial results for the first quarter ended March 31, 2024.

Nextdoor's highlighted metrics for the quarter ended March 31, 2024 include:

•Total Weekly Active Users (WAU) of 43.4 million increased 2% year-over-year.

•Revenue of $53 million increased 7% year-over-year.

•Net loss was $28 million, compared to $34 million in the year-ago period.

•Adjusted EBITDA loss was $14 million, compared to $22 million in the year-ago period.

•Ending cash, cash equivalents, and marketable securities were $498 million as of March 31, 2024.

"Q1 was a promising start to the year. WAU grew to 43.4 million, up 2% year-over-year and 4% sequentially, and engagement remains strong, as session depth improved by 36% year-over-year," said Nextdoor Executive Chair and incoming CEO Nirav Tolia.

"Our advertising platform is driving higher self-serve customer spend and retention, our reduced cost base is unlocking margin improvement, and our balance sheet, with nearly $500 million of cash and investments, remains a strength. Given that momentum, we have increased our full-year adjusted EBITDA guidance and accelerated our timeline for generating positive free cash flow by 12 months. I am excited about our trajectory and renewed focus, and am confident that Nextdoor is well-positioned for the next phase of our growth."

For more detailed information on our operating and financial results for the first quarter ended March 31, 2024, as well as our outlook for Q2 and fiscal year 2024, please reference our Shareholder Letter posted to our Investor Relations website located at investors.nextdoor.com.

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| (in thousands) | 2024 | | 2023 | | | | |

| Revenue | $ | 53,146 | | | $ | 49,771 | | | | | |

| Loss from operations | $ | (34,749) | | | $ | (38,812) | | | | | |

| Net loss | $ | (28,261) | | | $ | (33,716) | | | | | |

Adjusted EBITDA(1) | $ | (14,015) | | | $ | (21,661) | | | | | |

1 We define free cash flow as operating cash flow less capital expenditures.

(1) The following is a reconciliation of net loss, the most comparable GAAP measure, to adjusted EBITDA for the periods presented above:

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| (in thousands) | 2024 | | 2023 | | | | |

| Net loss | $ | (28,261) | | | $ | (33,716) | | | | | |

% Margin | (53) | % | | (68) | % | | | | |

| Depreciation and amortization | 1,387 | | | 1,451 | | | | | |

| Stock-based compensation | 19,506 | | | 15,816 | | | | | |

| Interest income | (6,846) | | | (5,513) | | | | | |

| Provision for income taxes | 199 | | | 301 | | | | | |

| Adjusted EBITDA | $ | (14,015) | | | $ | (21,661) | | | | | |

% Margin | (26) | % | | (44) | % | | | | |

Nextdoor will host a conference call at 2:00 p.m. PT/5:00 p.m. ET today to discuss these results and outlook. A live webcast of our first quarter 2024 earnings release call will be available in the Events & Presentations section of Nextdoor’s Investor Relations website. After the live event, the audio recording for the webcast can be accessed on the same website for approximately one year.

Nextdoor uses its Investor Relations website (investors.nextdoor.com), its X handle (twitter.com/Nextdoor), and its LinkedIn Home Page (linkedin.com/company/nextdoor-com) as a means of disseminating or providing notification of, among other things, news or announcements regarding its business or financial performance, investor events, press releases, and earnings releases, and as a means of disclosing material nonpublic information and for complying with its disclosure obligations under Regulation FD.

Non-GAAP Financial Measures

To supplement our condensed consolidated financial statements, which are prepared in accordance with GAAP, we present certain non-GAAP financial measures, such as adjusted EBITDA and adjusted EBITDA margin, in this press release. Our use of non-GAAP financial measures has limitations as an analytical tool, and these measures should not be considered in isolation or as a substitute for analysis of financial results as reported under GAAP.

We use non-GAAP financial measures in conjunction with financial measures prepared in accordance with GAAP for planning purposes, including in the preparation of our annual operating budget, as a measure of our core operating results and the effectiveness of our business strategy, and in evaluating our financial performance. Non-GAAP financial measures provide consistency and comparability with past financial performance, facilitate period-to-period comparisons of core operating results, and also facilitate comparisons with other peer companies, many of which use similar non-GAAP financial measures to supplement their GAAP results. In addition, adjusted EBITDA is widely used by investors and securities analysts to measure a company's operating performance. We exclude the following items from one or more of our non-GAAP financial measures: stock-based compensation expense (non-cash expense calculated by companies using a variety of valuation methodologies and subjective assumptions), depreciation and amortization

(non-cash expense), interest income, provision for income taxes, and, if applicable, acquisition-related costs.

Investors are cautioned that there are material limitations associated with the use of non-GAAP financial measures as an analytical tool. In particular, (1) stock-based compensation expense has recently been, and will continue to be for the foreseeable future, a significant recurring expense for our business and an important part of our compensation strategy, (2) although depreciation and amortization expense are non-cash charges, the assets subject to depreciation and amortization may have to be replaced in the future, and our non-GAAP measures do not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements, and (3) adjusted EBITDA does not reflect: (a) changes in, or cash requirements for, our working capital needs; (b) interest expense, or the cash requirements necessary to service interest or principal payments on our debt, which reduces cash available to us; or (c) tax payments that may represent a reduction in cash available to us. The non-GAAP measures we use may be different from non-GAAP financial measures used by other companies, limiting their usefulness for comparison purposes. We compensate for these limitations by providing specific information regarding the GAAP items excluded from these non-GAAP financial measures.

About Nextdoor

Nextdoor (NYSE: KIND) is the neighborhood network. Neighbors, businesses of all sizes, and public agencies in more than 335,000 neighborhoods across 11 countries turn to Nextdoor to connect to the neighborhoods that matter to them so that they can thrive. As a purpose-driven company, Nextdoor leverages innovative technology to cultivate a kinder world where everyone has a neighborhood they can rely on — both online and in the real world. Download the app or join the neighborhood at nextdoor.com. For more information and assets, visit nextdoor.com/newsroom.

Contacts

Nextdoor Investor Relations:

John T. Williams

ir@nextdoor.com

or visit investors.nextdoor.com

Nextdoor Media Relations:

Antonia Gray

press@nextdoor.com

Nextdoor Appoints Marissa Mayer, Niraj Shah, and Robert Hohman to Board of Directors

New appointments bring substantial product-centric operational and leadership experience in the technology space to Nextdoor’s Board

SAN FRANCISCO, CA, May 7, 2024 — Nextdoor Holdings, Inc. (NYSE: KIND), the essential neighborhood app, is pleased to announce the appointment of three additional members to its board of directors: Marissa Mayer, Founder/CEO of Sunshine and former President and Chief Executive Officer of Yahoo!, Niraj Shah, Chief Executive Officer, Co-Chairman and Co-Founder of Wayfair, and Robert Hohman, Co-Founder and Chairman of Glassdoor.

“We are delighted to welcome Ms. Mayer, Mr. Shah, and Mr. Hohman to Nextdoor’s board. Each of these executives has significant experience leading successful technology companies at scale,” said Nirav Tolia, Nextdoor Executive Chair and incoming CEO. “With proven product-centric operational expertise, we are thrilled that they have chosen to join Nextdoor’s board at this exciting time.”

Ms. Mayer has served as Chief Executive Officer of Sunshine Products, Inc. (a technology startup focused on making the everyday tasks of sharing photos, events, groups and contacts magical) since she co-founded the company in 2018. She previously served as Chief Executive Officer, President and a member of the board of directors of Yahoo!, Inc. from July 2012 to June 2017. Before joining Yahoo!, Ms. Mayer spent 13 years at Google, Inc., from 1999 to 2012, where she held various roles of increasing responsibility including Vice President, Local, Maps and Locations Services, and Vice President, Search Products and User Experience. Ms. Mayer has also served on the boards of directors of Walmart Inc. since 2012 and AT&T, Inc. since 2024. Ms. Mayer holds a B.S. in symbolic systems and an M.S. in Computer Science with a specialization in artificial intelligence from Stanford University.

Mr. Shah is co‑founder, Chief Executive Officer and Co-Chairman of the Board of Directors of Wayfair Inc., a leading global online destination for the home. Prior to co-founding Wayfair in 2002, Mr. Shah served as Chief Executive Officer for Simplify Mobile Corporation, an enterprise software company he co‑founded in 2001, and Entrepreneur‑in‑Residence at Greylock Partners, a venture capital firm, in 2001. Mr. Shah served in various roles at iXL Enterprises, Inc., including as Chief Operating Officer and a director, from 1998 to 2000, and as Chief Executive Officer of Spinners Incorporated, an IT consulting company he co‑founded, from 1995 to 1998. In addition to his roles at Wayfair, Mr. Shah currently serves on the board of directors of the Shah Charitable Foundation, the Cornell Tech Council and the Massachusetts Competitive Partnership. Mr. Shah received a B.S. in engineering from Cornell University.

Mr. Hohman founded Glassdoor, Inc., a digital platform which provides reputational, compensation, and other information on companies provided by users, in 2007 and has served as its Chairman since January 2020. Prior to his service as Chairman, Mr. Hohman was Glassdoor’s Chief Executive Officer from June 2007 to January 2020. Mr. Hohman also currently serves as an

advisor to Riot Games, Inc., a video game developer company, and Executive Producer of Tweaking Cat Studios, a family gaming studio. Mr. Hohman previously served on the audit committee and the board of directors of OpenTable, Inc. from 2012 to 2014. Prior to founding Glassdoor in 2007, Mr. Hohman served in management roles at Hotwire, Inc. and Expedia Group, Inc. Mr. Hohman received a B.S. and M.S. in Computer Science from Stanford University.

Nextdoor uses its Investor Relations website (investors.nextdoor.com), its X handle (twitter.com/Nextdoor), and its LinkedIn Home Page (linkedin.com/company/nextdoor-com) as a means of disseminating or providing notification of, among other things, news or announcements regarding its business or financial performance, investor events, press releases, and earnings releases, and as a means of disclosing material nonpublic information and for complying with its disclosure obligations under Regulation FD.

About Nextdoor

Nextdoor (NYSE: KIND) is the neighborhood network. Neighbors, businesses of all sizes, and public agencies in more than 335,000 neighborhoods across 11 countries turn to Nextdoor to connect to the neighborhoods that matter to them so that they can thrive. As a purpose-driven company, Nextdoor leverages innovative technology to cultivate a kinder world where everyone has a neighborhood they can rely on — both online and in the real world. Download the app or join the neighborhood at nextdoor.com. For more information and assets, visit nextdoor.com/newsroom.

Contacts

Nextdoor Investor Relations:

John T. Williams

ir@nextdoor.com

or visit investors.nextdoor.com

Nextdoor Media Relations:

Antonia Gray

press@nextdoor.com

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

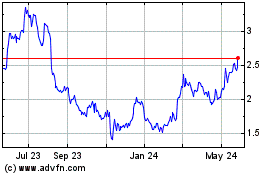

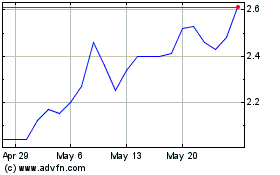

Nextdoor (NYSE:KIND)

Historical Stock Chart

From Apr 2024 to May 2024

Nextdoor (NYSE:KIND)

Historical Stock Chart

From May 2023 to May 2024