Kennedy Wilson Expands Global Industrial Platform With Acquisition of 300,000 Square Foot Industrial Property in West London

June 25 2024 - 2:01AM

Business Wire

Global real estate investment company Kennedy Wilson (NYSE: KW)

and its partner have acquired Heathrow Estate, a high quality

multi-let industrial property in a prime distribution location in

West London for $111 million, excluding closing costs.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240625845983/en/

The Heathrow Estate (Photo: Business

Wire)

The income producing asset, which comprises a total of

approximately 300,000 square feet of modern warehouse and ancillary

office space, is 84% leased to a diverse mix of occupiers including

Asendia, Tailsco, and HSS Hire. Heathrow Estate provides attractive

short to medium term opportunities to add value through the

extension of existing tenant leases and the leasing of vacant

units. Kennedy Wilson will also undertake an active asset

management strategy to improve on-site services and upgrade

sustainability performance, as well as reviewing the possibility

for future alternate uses.

Situated in West London, Heathrow Estate is strategically

located in an established industrial hub, benefiting from direct

access to Junction 4 of the M4, Heathrow Airport’s Cargo Terminal,

as well as Junctions 13 and 14 of the M25.

This latest acquisition expands Kennedy Wilson’s investment

management program as well as its global industrial platform, which

totals over 12 million square feet and represents $2.1 billion of

AUM. In the UK, Kennedy Wilson manages approximately $1.6 billion

of industrial space, comprising approximately 9 million square

feet, with an occupancy of 98%.

“This acquisition demonstrates our ability to identify

attractive investments in established distribution locations with

strong underlying fundamentals that provide excellent potential for

rental growth,” said Mike Pegler, President, Kennedy Wilson Europe.

“We are pleased to expand our growing global industrial platform,

and we are now focused on executing the business plan while

leveraging our expertise to capture significant reversion through

accretive and targeted capital expenditure.”

Kennedy Wilson has a 10% ownership interest in Heathrow Estate,

which was acquired with equity and a $73 million secured loan, and

will earn customary fees for overseeing the asset management of the

property.

About Kennedy Wilson

Kennedy Wilson (NYSE: KW) is a leading real estate investment

company with over $27 billion of assets under management in high

growth markets across the United States, the UK and Ireland.

Drawing on decades of experience, our relationship-oriented team

excels at identifying opportunities and building value through

market cycles, closing more than $50 billion in total transactions

across the property spectrum since going public in 2009. Kennedy

Wilson owns, operates, and builds real estate within our

high-quality, core real estate portfolio and through our investment

management platform, where we target opportunistic investments

alongside our partners. For further information, please visit

www.kennedywilson.com.

Special Note Regarding Forward-Looking Statements

Statements in this press release that are not historical facts

are “forward-looking statements” within the meaning of U.S. federal

securities laws. These forward-looking statements are estimates

that reflect our management’s current expectations, are based on

our current estimates, expectations, forecasts, projections and

assumptions that may prove to be inaccurate and involve known and

unknown risks. Accordingly, our actual results, performance or

achievement, or industry results, may differ materially and

adversely from the results, performance or achievement, or industry

results, expressed or implied by these forward-looking statements,

including for reasons that are beyond our control. Some of the

forward-looking statements may be identified by words like

“believes”, “expects”, “anticipates”, “estimates”, “plans”,

“intends”, “projects”, “indicates”, “could”, “may” and similar

expressions. These statements are not guarantees of future

performance and involve a number of risks, uncertainties and

assumptions. We assume no duty to update the forward-looking

statements, except as may be required by law.

KW-IR

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240625845983/en/

Investors Daven Bhavsar, CFA Vice President of Investor

Relations +1 (310) 887-3431 dbhavsar@kennedywilson.com European

Media Dido Laurimore and Eve Kirmatzis +44 20 3727 1000

kennedywilson@fticonsulting.com U.S. Media Emily Heidt Vice

President, Communications +1 (310) 887-3499

eheidt@kennedywilson.com

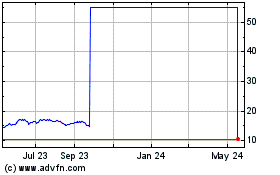

Kennedy Wilson (NYSE:KW)

Historical Stock Chart

From Dec 2024 to Jan 2025

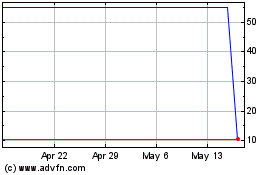

Kennedy Wilson (NYSE:KW)

Historical Stock Chart

From Jan 2024 to Jan 2025