- Orders1 of $5.2 billion; book-to-bill of 1.0x

- Revenue of $5.3 billion, up 13%

- Operating margin of 9.0%; adjusted segment operating margin1

of 15.6%

- Diluted earnings per share (EPS) of $1.92; non-GAAP EPS1 of

$3.24

- 2024 revenue guidance range increases from $20.8B - $21.3B

to $21.0B - $21.3B

- 2024 adjusted segment operating margin1 guidance increases

from >15% to 15.2% - 15.4%*

- 2024 Non-GAAP EPS guidance range increases from $12.70 -

$13.05 to $12.85 - $13.15*

L3Harris Technologies (NYSE: LHX) reported second quarter 2024

diluted EPS of $1.92, on second quarter revenue of $5.3 billion.

Second quarter 2024 non-GAAP diluted EPS1 was $3.24, as compared to

non-GAAP diluted EPS1 of $2.97 for the second quarter of 2023, a 9%

increase. A reconciliation of non-GAAP results are detailed in

tables beginning on page 11.

"We delivered another strong quarter of financial results with

improved margins, reflecting our commitment to operational

excellence and a relentless focus on execution that delivers value

to our customers and shareholders," said Christopher E. Kubasik,

Chair and CEO.

Kubasik added, "As we celebrate the five year anniversary of the

L3 and Harris merger, I'm proud of the progress we've made as the

industry's Trusted Disruptor. Our first half results reflect

progress toward achieving our 2026 financial framework. We are

raising our revenue, margin and EPS guidance for the year,

underscoring the tangible results of our LHX NeXt initiative, which

is focused on streamlining our operations and enhancing our

efficiency while transforming the company."

* A reconciliation is not available. See the note on page 2 and

Non-GAAP Financial Measures on page 6 for more information.

SUMMARY FINANCIAL RESULTS AND 2024 GUIDANCE

Second Quarter

Year to Date

2024 Guidance*

($ millions, except per share data)

2024

2023

Change

2024

2023

Change

Revenue

Space & Airborne Systems

$

1,707

$

1,715

$

3,458

$

3,370

Integrated Mission Systems

1,729

1,735

3,398

3,435

Communication Systems

1,346

1,289

2,640

2,452

Aerojet Rocketdyne

581

—

1,123

—

Corporate eliminations

(64

)

(46

)

(109

)

(93

)

Revenue

$

5,299

$

4,693

13

%

$

10,510

$

9,164

15

%

$21.0B - $21.3B

(Prior: $20.8B - 21.3B)

Operating income

Space & Airborne Systems

$

215

$

168

28

%

$

431

$

355

21

%

Integrated Mission Systems

206

162

27

%

396

347

14

%

Communication Systems

329

325

1

%

639

591

8

%

Aerojet Rocketdyne

75

—

n/a

147

—

n/a

Unallocated items

(349

)

(255

)

(759

)

(500

)

Operating income

$

476

$

400

19

%

$

854

$

793

8

%

Operating margin

9.0

%

8.5

%

50 bps

8.1

%

8.7

%

(60) bps

Adjusted segment operating income1

$

825

$

694

19

%

$

1,613

$

1,332

21

%

Adjusted segment operating margin1

15.6

%

14.8

%

80 bps

15.3

%

14.5

%

80 bps

15.2% - 15.4%

(Prior: > 15%)

Effective tax rate (GAAP)

5.9

%

5.6

%

30 bps

4.1

%

7.4

%

(330) bps

Effective tax rate (non-GAAP1)

12.9

%

13.3

%

(40) bps

13.0

%

13.4

%

(40) bps

EPS

$

1.92

$

1.83

5

%

$

3.40

$

3.60

(6

%)

Non-GAAP EPS1

$

3.24

$

2.97

9

%

$

6.30

$

5.82

8

%

$12.85 - $13.15

(Prior: $12.70 - $13.05)

Cash from operations

$

754

$

414

82

%

$

650

$

764

(15

%)

Adjusted free cash flow1

$

714

$

342

109

%

$

558

$

657

(15

%)

~2.2B

*When we provide our expectation for

adjusted segment operating margin, effective tax rate on non-GAAP

income, non-GAAP EPS and adjusted free cash flow on a

forward-looking basis, a reconciliation of these non-GAAP financial

measures to the corresponding GAAP measures is not available

without unreasonable effort due to the unavailability of items for

exclusion from the GAAP measure. We are unable to address the

probable significance of this information, the variability of which

may have a significant impact on future GAAP results. See Non-GAAP

Financial Measures on page 7 for more information.

Revenue: Second quarter revenue increased 13%, primarily

driven by the acquisition of Aerojet Rocketdyne (AR) and 1% total

organic growth from increased demand for tactical and broadband

communication products in our Communication Systems (CS) segment.

Growth was also driven by continued demand in Space Systems and

classified Intel & Cyber programs within the Space &

Airborne Systems (SAS) Segment. This growth was offset by lower

volumes in our Airborne Combat Systems business. In the Integrated

Mission Systems (IMS) segment, growth in Maritime programs was

offset by lower volumes associated with our Commercial Aviation

business, the divestiture of which is pending closure.

* A reconciliation is not available. See the note on page 2 and

Non-GAAP Financial Measures on page 6 for more information.

Operating Margin:

GAAP: Second quarter operating

margin increased 50 bps to 9.0% driven by improved operational

performance, partially offset by the impact of increased corporate

unallocated items, including intangible amortization from mergers

and acquisitions and LHX NeXt implementation costs.

Adjusted segment operating margin1:

Expanded 80 bps to 15.6% due to improved operational and program

performance across the SAS, IMS and CS segments, including LHX NeXt

driven cost savings.

EPS:

GAAP: Second quarter EPS increased

5% to $1.92 due to an increase in operating income, partially

offset by the impact of intangible amortization from mergers and

acquisitions, LHX NeXt implementation costs and higher interest

expense.

Non-GAAP1: Increased 9% to $3.24

driven by higher adjusted segment operating income1, partially

offset by higher interest expense.

The largest differences between GAAP and Non-GAAP EPS are

attributable to intangible amortization and LHX NeXt implementation

costs.

Cash Flows:

Cash from Operations: Second

quarter cash from operations was $754 million driven by net income

growth and improved working capital performance.

Adjusted free cash flow1: Delivered

$714 million in adjusted free cash flow1 driven by net income

growth, improved working capital performance and adjustments for

acquisitions and severance related costs.

SEGMENT RESULTS AND GUIDANCE:

SAS

Second Quarter

Year to Date

2024 Guidance*

($ millions)

2024

2023

Change

2024

2023

Change

Revenue

$

1,707

$

1,715

—

%

$

3,458

$

3,370

3

%

~$7,000

Operating margin

12.6

%

9.8

%

280 bps

12.5

%

10.5

%

200 bps

low 12%*

(Prior ~12%)

Revenue: Second quarter revenue was flat year-over-year,

resulting from continued growth in Space Systems and classified

program growth in Intel and Cyber, which was offset by lower

volumes in our Airborne Combat Systems business and lower revenues

from the divestiture of the antenna business. Excluding this

divestiture, organic revenue increased 1%.

Operating Margin: Second quarter operating margin

increased 280 bps largely due to the absence of a non-cash charge

that impacted 2023, improved operational and program performance,

including the impact of the LHX NeXt cost savings initiative.

* A reconciliation is not available. See the note on page 2 and

Non-GAAP Financial Measures on page 6 for more information.

IMS

Second Quarter

Year to Date

2024 Guidance*

($ millions)

2024

2023

Change

2024

2023

Change

Revenue

$

1,729

$

1,735

—

%

$

3,398

$

3,435

(1

)%

$6,500 - $6,700

(Prior $6,400 - $6,600)

Operating margin

11.9

%

9.3

%

260 bps

11.7

%

10.1

%

160 bps

mid 11%*

(Prior low-mid 11%)

Revenue: Second quarter revenue was flat, as higher

volumes on Maritime programs were offset by lower volume in our

Commercial Aviation business.

Operating Margin: Second quarter operating margin

increased 260 bps from improved program performance, including the

impact of LHX NeXt cost savings.

CS

Second Quarter

Year to Date

2024 Guidance*

($ millions)

2024

2023

Change

2024

2023

Change

Revenue

$

1,346

$

1,289

4

%

$

2,640

$

2,452

8

%

$5,300 - 5,400

Operating margin

24.4

%

25.2

%

(80) bps

24.2

%

24.1

%

10 bps

mid 24%*

(Prior low-mid 24%)

Revenue: Second quarter revenue increased 4%, primarily

from higher volumes in Broadband Communications and increased

Department of Defense (DoD) sales in Tactical Communications.

Operating Margin: Second quarter operating margin

decreased 80 bps primarily from higher domestic tactical radio mix

and timing of software sales, partially offset by LHX NeXt cost

savings and the favorable impact of legal settlements.

AR

Second Quarter

Year to Date

2024 Guidance*

($ millions)

2024

2023

Change

2024

2023

Change

Revenue

$

581

$

—

$

1,123

$

—

$2,400 - $2,500

Operating margin

12.9

%

—

%

13.1

%

—

%

high 11%*

Revenue and Operating Margin: Second quarter results are

attributed to program execution across Missile Solutions and Space

Propulsion and Power Systems.

* A reconciliation is not available. See the note on page 2 and

Non-GAAP Financial Measures on page 6 for more information.

SUPPLEMENTAL INFORMATION:

2024*

2023

Other Information

Current

Prior

Actuals

FAS/CAS operating adjustment

~$30 million

~$30 million

$110 million

Non-service FAS pension income

~$310 million

~$310 million

$310 million

Net interest expense

~$660 million

~$650 million

$543 million

Effective tax rate on GAAP income

1.9%

Effective tax rate on non-GAAP income1

13.0% - 13.5%

13.0% - 13.5%

13.0%

Average diluted shares

Flat

Flat - up slightly

190.6

Capital expenditures

~2% sales

~2% sales

2% sales

Ad Hoc Business Review Committee: The company entered

into a Cooperation Agreement in December 2023 requiring, among

other items, the formation of an Ad Hoc Business Review Committee

(BRC) to independently review the company’s execution toward

shareholder value creation opportunities. Earlier this month, the

BRC provided its recommendations and informed the full Board of

Directors that it had completed its review. With the work now

complete, the ad hoc BRC has been dissolved per its charter.

* A reconciliation is not available. See the note on page 2 and

Non-GAAP Financial Measures on page 6 for more information.

Non-GAAP Financial Measures

This earnings release contains Non-GAAP Financial Measures

("NGFMs") (as listed on page 16) within the meaning of Regulation G

promulgated by the Securities and Exchange Commission (SEC).

Management believes excluding the adjustments listed on page 16 for

the purposes of calculating certain NGFMs is useful to investors

because these costs do not reflect our ongoing operating

performance; however there is no guarantee that items excluded from

NGFMs will not reoccur in future periods. These adjustments, when

considered together with the unadjusted GAAP financial measures,

provide information that is useful to investors in understanding

period-over-period operating results separate and apart from items

that may, or could, have a disproportionately positive or negative

impact on results in any particular period. Management also

believes that these adjustments to our NGFMs enhance the ability of

investors to analyze L3Harris business trends, to understand

L3Harris performance and to evaluate our initiatives to drive

improved financial performance. We utilize NGFMs as guides in

forecasting, budgeting and long-term planning processes and to

measure operating performance for compensation purposes. NGFMs

should be considered in addition to, and not as a substitute for,

financial measures presented in accordance with GAAP. See

“Reconciliation of Non-GAAP Financial Measures” beginning on page

12 for detail on the adjustments to

our NGFMs. We also provide our expectation of forward-looking

NGFMs. A reconciliation of forward-looking NGFMs to comparable GAAP

measures is not available without unreasonable effort because of

inherent difficulty in forecasting and quantifying the comparable

GAAP measures and the applicable adjustments and other amounts that

would be necessary for such a reconciliation, including due to

potentially high variability, complexity and low visibility as to

the applicable adjustments and other amounts which could have an

unpredictable and potentially disproportionate impact on future

GAAP results, such as the impact of Aerojet Rocketdyne, costs

associated with LHX NeXt, potential divestitures and their timing,

other unusual gains and losses and extent of tax deductibility.

Conference Call and Webcast

L3Harris Technologies will host a call tomorrow, July 26, 2024,

at 8:30 a.m. Eastern Time (ET).

The dial-in numbers for the teleconference are (U.S.)

877-407-6184 and (International) 201-389-0877, and participants

will be directed to an operator. Participants are encouraged to

listen via webcast, which will be broadcast live at

L3Harris.com/investors. A recording of the call will be available

on the L3Harris website, beginning at approximately 12 p.m. ET on

July 26, 2024.

About L3Harris Technologies

L3Harris Technologies is the Trusted Disruptor in the defense

industry. With customers’ mission-critical needs always in mind,

our employees deliver end-to-end technology solutions connecting

the space, air, land, sea and cyber domains in the interest of

national security. Visit L3Harris.com for more information.

Forward-Looking Statements

Statements in this earnings release that are not historical

facts are forward-looking statements that reflect management's

current expectations, assumptions and estimates of future

performance and economic conditions. Such statements are made in

reliance on the safe harbor provisions of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934. Forward-looking statements in this earnings release

include but are not limited to: potential divestitures and their

timing; 2024 guidance; 2026 financial framework; anticipated LHX

NeXt initiative costs and savings targets and their impacts;

supplemental financial information for 2024; and other statements

regarding the business outlook and financial performance guidance

that are not historical facts. The company cautions investors that

any forward-looking statements are subject to risks and

uncertainties that may cause actual results and future trends to

differ materially from those matters expressed in or implied by

such forward-looking statements, including but not limited to:

competitive markets and U.S. Government spending priorities;

changes in the mix of fixed-price, cost-plus and time-and-material

type contracts and the impact of a significant increase in or

sustained period of increased inflation; the termination, impact of

regulations, failure to fund, or negative audit findings for U.S.

Government contracts; uncertain economic conditions; the

consequences of future geo-political events; the impact of

government investigations; the risks of doing business

internationally; disruptions to our supply chain; the attraction

and retention of key employees; the ability to develop new products

and services and technologies that achieve market acceptance;

natural disasters or other significant business disruptions;

inability to achieve the expected results of LHX NeXt; indebtedness

and ability to make payments on, repay or service indebtedness;

unfunded defined benefit plans liability; the level of returns on

defined benefit plan assets, changes in interest rates and other

market factors; changes in effective tax rate or additional tax

exposures; the ability to obtain export licenses or make sales to

foreign governments; unforeseen environmental issues; the outcome

of litigation or arbitration; potential claims related to

infringement of intellectual property rights or environmental

remediation or other contingencies; expanded operations, including

related to handling of dangerous materials; risks related to other

strategic transactions, including pending and contemplated

divestitures. Further information relating to these and other

factors that may impact the company's results, future trends and

forward-looking statements are disclosed in the company's filings

with the SEC. The forward-looking statements contained in this

earnings release are made as of the date of this earnings release,

and the company disclaims any intention or obligation, other than

imposed by law, to update or revise any forward-looking statements,

whether as a result of new information, future events, or

otherwise. Persons reading this earnings release are cautioned not

to place undue reliance on forward-looking statements.

Financial Tables

To see the entire earnings tables, please see:

https://www.l3harris.com/resources/second-quarter-2024-results

1Key terms and Non-GAAP measures - see definitions at the end of

this earnings release

Key Terms and Non-GAAP Definitions

Description

Definition

Amortization of acquisition-related

intangibles and additional cost of revenue related to the fair

value step-up in inventory sold

Consists of amortization of identifiable

intangible assets acquired in connection with business

combinations. Amortization charges are recorded over the estimated

useful life of the related acquired intangible asset, and thus are

generally recorded over multiple years.

Additional cost of revenue related to the

fair value step-up in inventory is the difference between the

balance sheet value of inventory from the acquiree and the

acquisition date fair value.

Merger, acquisition, and

divestiture-related expenses

Transaction and integration expenses

associated with TDL and AR acquisitions. Also, includes external

costs related to pursuing acquisition and divestiture portfolio

optimization, non-transaction costs related to divestitures and

salaries of employees in roles established for and dedicated to

planned divestiture and acquisition activity.

Asset group and business

divestiture-related losses, net and impairment of goodwill and

other assets

In 2023, includes a gain on sale of our

Visual Information Solutions business, impairment of contract

assets and other assets related to the restructuring of a customer

contract and impairment of in-process research and development

associated with a facility closure. In 2024, includes loss on sale

and impairment of goodwill recognized in connection with the sale

of our antenna and related businesses and a loss associated with

the pending divestiture of our Commercial Aviation Solutions

business.

LHX NeXt implementation costs

Costs associated with reducing costs and

transforming the Company and its systems and processes to increase

agility and competitiveness. Costs related to the LHX NeXt

initiative are expected to continue through 2025, and are expected

to include workforce optimization costs ($1M in 2Q24 and $65M in

2Q24 YTD) and incremental IT expenses for implementation of new

systems, third-party consulting expenses and other related costs,

including costs related to personnel dedicated to this project

($47M in 2Q24 and $110M in 2Q24 YTD), totaling $400M. We expect

gross run-rate savings of $1B exiting year 3.

Orders

Represents the total value of funded and

unfunded contract awards received from the U.S. Government, plus

the total value of funded and unfunded contract awards received

from customers other than the U.S. Government. This includes

incremental funding and adjustments to previous awards, and

excludes unexercised contract options and potential orders under

ordering-type contracts, such as indefinite delivery, indefinite

quantity (IDIQ) contracts.

Organic revenue

Organic revenue excludes the impact of

completed divestitures and first year revenue associated with

acquisitions; refer to non-GAAP financial measure (NGFM)

reconciliations in the tables accompanying this earnings release

and to the disclosures in the non-GAAP section of this earnings

release for more information. Organic revenue is reconciled in

table 4.

Adjusted segment operating income and

margin

Adjusted segment operating income and

margin on a consolidated basis represents operating income and

margin (GAAP measures) excluding the FAS/CAS operating adjustment;

corporate unallocated items; amortization of acquisition-related

intangibles; additional cost of revenue related to the fair value

step-up in inventory sold; merger, acquisition, and

divestiture-related expenses; asset group and business

divestiture-related losses (gains), net, impairment of goodwill and

other assets; and LHX NeXt implementation costs. Refer to the

disclosures in the non-GAAP financial measures section of this

earnings release for more information. Adjusted segment operating

income and margin is reconciled in table 5.

Non-GAAP EPS

Non-GAAP EPS represents EPS (net income

per diluted common share attributable to L3Harris Technologies,

Inc. common shareholders, a GAAP measure) adjusted for amortization

of acquisition-related intangibles; additional cost of revenue

related to the fair value step-up in inventory sold; merger,

acquisition, and divestiture-related expenses; asset group and

business divestiture-related losses (gains), net, impairment of

goodwill and other assets; and LHX NeXt implementation costs. Refer

to the disclosures in the non-GAAP financial measures section of

this earnings release for more information. Non-GAAP EPS is

reconciled in table 7.

Adjusted Free Cash Flow (FCF)

Adjusted FCF represents net cash provided

by operating activities (a GAAP measure) less capital expenditures

(additions to property, plant and equipment less proceeds from sale

of property, plant and equipment, net), cash used for merger,

acquisition, and severance. Adjusted FCF is reconciled in table

8.

Cash used for merger, acquisition, and

severance

Cash related to merger and acquisition

expenses as discussed in the "merger, acquisition, and

divestiture-related expenses" heading above and cash related to

severance costs included in our LHX NeXt implementation costs.

Non-GAAP income before income taxes

Non-GAAP income before income taxes

represents income before income taxes, a GAAP measure, adjusted for

amortization of acquisition-related intangibles; additional cost of

revenue related to the fair value step-up in inventory sold;

merger, acquisition, and divestiture-related expenses; asset group

and business divestiture-related losses (gains), net, impairment of

goodwill and other assets; and LHX NeXt implementation costs. Refer

to the disclosures in the non-GAAP financial measures section of

this earnings release for more information.

Effective tax rate on non-GAAP income

Effective tax rate on non-GAAP income

represents the effective tax rate (tax expense as a percentage of

income before income taxes, a GAAP measure) adjusted for the tax

effect associated with amortization of acquisition-related

intangibles; additional cost of revenue related to the fair value

step-up in inventory sold; merger, acquisition, and

divestiture-related expenses; asset group and business

divestiture-related losses (gains), net, impairment of goodwill and

other assets; and LHX NeXt implementation costs. Refer to the

disclosures in the non-GAAP financial measures section of this

earnings release for more information. Non-GAAP effective tax rate

is reconciled in table 6.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725558614/en/

Investor Relations Contact: Daniel Gittsovich,

321-724-3170 investorrelations@l3harris.com

Media Relations Contact: Sara Banda, 321-306-8927

media@l3harris.com

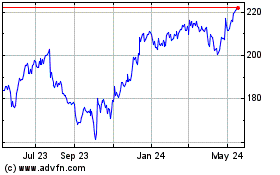

L3Harris Technologies (NYSE:LHX)

Historical Stock Chart

From Nov 2024 to Dec 2024

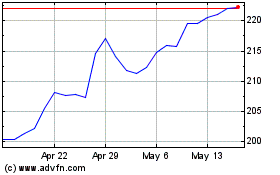

L3Harris Technologies (NYSE:LHX)

Historical Stock Chart

From Dec 2023 to Dec 2024