false

0001742924

0001742924

2023-12-19

2023-12-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

____________________________

FORM 8-K

____________________________

CURRENT REPORT

Pursuant to Section

13 or 15(d) of the

Securities Exchange

Act of 1934

Date of Report (Date of earliest event reported):

December 19, 2023

____________________________

LIVENT CORPORATION

(Exact name of registrant as specified in its

charter)

____________________________

| Delaware |

001-38694 |

82-4699376 |

|

(State or other jurisdiction of

incorporation or organization) |

(Commission File Number) |

(I.R.S. Employer

Identification No.) |

| |

|

|

|

1818 Market Street

Philadelphia, Pennsylvania |

|

19103 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: 215-299-5900

____________________________

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

LTHM |

New York Stock Exchange |

Check the appropriate box below if the Form 8-K

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 5.07 | Submission of Matters to a Vote of Security Holders. |

At a special meeting of the stockholders of Livent Corporation, a Delaware

corporation (“Livent” or the “Company”), held on December 19, 2023 at 9:00 a.m. Eastern Time (the

“Special Meeting”), the stockholders of the Company voted on the matters set forth below.

| 1. | Proposal to adopt the Transaction Agreement, dated as of May 10, 2023, as amended by the Amendment to Transaction Agreement, dated

as of August 2, 2023 and the Second Amendment to Transaction Agreement, dated as of November 5, 2023 (and as it may be further amended

from time to time, the “Transaction Agreement”), among Livent, Allkem Limited, an Australian public company limited

by shares, Arcadium Lithium plc, a public limited company incorporated under the laws of the Bailiwick of Jersey (originally known as

Lightning-A Limited, a private limited company incorporated under the laws of the Bailiwick of Jersey and f/k/a as Allkem Livent plc)

(“NewCo”) and Lightning-A Merger Sub, Inc. (“Merger Sub”), and Arcadium Lithium Intermediate IRL

Limited, a private company limited by shares and incorporated and registered in Ireland, pursuant to which, among other transactions,

Merger Sub will merge with and into Livent, with Livent surviving the merger as a wholly owned subsidiary of NewCo (the “Merger”),

and each share of Livent common stock, par value $0.001 per share, other than certain excluded shares, will be converted into the right

to receive 2.406 ordinary shares, par value $1.00 per share, of NewCo (the “NewCo Shares”), and approve the transactions

contemplated by the Transaction Agreement, including the Merger (collectively, the “Transaction”) (the “Transaction

Agreement Proposal”). The proposal was approved based on the following votes: |

| Votes For |

|

Votes Against |

|

Abstentions |

|

Broker Non-Votes |

| 121,945,849 |

|

308,589 |

|

179,469 |

|

0 |

| 2. | Proposal to approve, in a non-binding, advisory vote, the compensation that may be paid or become payable to Livent's named executive

officers in connection with the Transaction. The proposal was approved based on the following votes: |

| Votes For |

|

Votes Against |

|

Abstentions |

|

Broker Non-Votes |

| 113,539,815 |

|

8,525,765 |

|

368,327 |

|

0 |

| 3. | Proposal to approve, in a non-binding, advisory vote, a provision of the articles of association of NewCo setting forth the requirements

for shareholder nominations and other proposals to be considered at an annual general meeting of NewCo or an extraordinary general meeting

of NewCo. The proposal was not approved based on the following votes: |

| Votes For |

|

Votes Against |

|

Abstentions |

|

Broker Non-Votes |

| 39,121,321 |

|

82,970,845 |

|

341,741 |

|

0 |

| 4. | Proposal to approve, in a non-binding, advisory vote, a provision of the articles of association of NewCo to the effect that directors

may be removed from office by ordinary resolution of the NewCo shareholders only for cause. The proposal was not approved based on the

following votes: |

| Votes For |

|

Votes Against |

|

Abstentions |

|

Broker Non-Votes |

| 19,572,604 |

|

102,454,354 |

|

406,949 |

|

0 |

| 5. | Proposal to approve, in a non-binding, advisory vote, a provision of the articles of association of NewCo establishing that the holders

of NewCo Shares representing at least a majority of the voting power of the shares entitled to vote at such meeting will be a quorum of

shareholders. The proposal was approved based on the following votes: |

| Votes For |

|

Votes Against |

|

Abstentions |

|

Broker Non-Votes |

| 121,341,916 |

|

847,404 |

|

244,587 |

|

0 |

| 6. | Proposal to approve one or more adjournments of the Special Meeting to a later date or dates for any purpose if necessary or appropriate,

including if necessary or appropriate to solicit additional proxies if there are insufficient votes to adopt the Transaction Agreement

and approve the Transaction. The proposal was approved based on the following votes; however, this proposal was not necessary following

the approval of the Transaction Agreement Proposal and was therefore not implemented. |

| Votes For |

|

Votes Against |

|

Abstentions |

|

Broker Non-Votes |

| 118,094,934 |

|

4,141,186 |

|

197,787 |

|

0 |

Each proposal is described in detail in Livent’s

definitive proxy statement, dated November 20, 2023, which was filed with the Securities and Exchange Commission on November 20, 2023,

and first mailed to Livent’s stockholders on or about November 20, 2023.

As of the close of business on the record date for the Special Meeting,

which was November 14, 2023, there were 179,920,601 shares of common stock outstanding and entitled to vote at the Special Meeting. Each

share of common stock was entitled to one vote per share. A total of 122,433,907 shares of Livent’s common stock, representing approximately

68.04% of Livent’s shares of common stock outstanding as of the record date for the Special Meeting were represented virtually or

by proxy at the Special Meeting, and constituted a quorum to conduct business at the Special Meeting.

On December 19, 2023, Livent issued a press release

announcing the results of the Special Meeting. A copy of this press release is attached hereto as Exhibit 99.1 to this report and is incorporated

by reference herein.

Forward-Looking

Statements

Safe

Harbor Statement under the Private Securities Litigation Reform Act of 1995: Certain statements in this Current Report on Form 8-K (this

“Form 8-K”) are forward-looking statements. In some cases, we have identified forward-looking statements by such words

or phrases as “will likely result,” “is confident that,” “expect,” “expects,” “should,”

“could,” “may,” “will continue to,” “believe,” “believes,” “anticipates,”

“predicts,” “forecasts,” “estimates,” “projects,” “potential,” “intends”

or similar expressions identifying “forward-looking statements” within the meaning of the Private Securities Litigation Reform

Act of 1995, including the negative of those words and phrases. Such forward-looking statements are based on our current views and assumptions

regarding future events, future business conditions and the outlook for the Company based on currently available information. There are

important factors that could cause Livent’s actual results, level of activity, performance or achievements to differ materially

from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements, including the

factors described under the caption entitled “Risk Factors” in Livent's 2022 Form 10-K filed with the Securities and Exchange

Commission (“SEC”) on February 24, 2023, as well as other SEC filings and public communications. Although Livent believes

the expectations reflected in the forward-looking statements are reasonable, Livent cannot guarantee future results, level of activity,

performance or achievements. Moreover, neither Livent nor any other person assumes responsibility for the accuracy and completeness of

any of these forward-looking statements. Livent is under no duty to update any of these forward-looking statements after the date of

this Form 8-K to conform its prior statements to actual results or revised expectations.

| Item 9.01 |

Financial Statements and Exhibits |

Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

|

LIVENT CORPORATION |

| |

|

|

| |

|

By: |

/s/ Gilberto Antoniazzi |

| |

|

|

Name:

Title: |

Gilberto Antoniazzi

Vice President and Chief Financial Officer |

Dated: December 19, 2023

Exhibit 99.1

Livent and Allkem Shareholders Approve Merger

of Equals

December 19, 2023

PHILADELPHIA, December 19, 2023

– Livent Corporation (NYSE: LTHM, “Livent”) and Allkem Limited (ASX|TSX: AKE, “Allkem”) announced that

they have obtained all requisite shareholder approvals necessary to complete the merger of equals transaction previously announced on

May 10, 2023. The two companies expect to close the merger on January 4, 2024 and begin operating under the name Arcadium Lithium plc

(NYSE:ALTM) (ASX:LTM).

“The strong support of Livent and

Allkem shareholders for this transformational merger is a testament to the compelling value proposition of Arcadium Lithium,” said

Paul Graves, President and CEO of Livent and future Chief Executive Officer of Arcadium Lithium. “We look forward to closing the

merger and pursuing the opportunities to create greater long-term, sustainable value for all of our stakeholders.”

The final voting results on all proposals

voted on at Livent’s special meeting will be filed with the SEC in a Form 8-K and will also be available at https://ir.livent.com.

About Livent

For nearly eight decades, Livent has partnered with its customers to safely and sustainably use lithium to power the world. Livent

is one of only a small number of companies with the capability, reputation, and know-how to produce high-quality finished lithium compounds

that are helping meet the growing demand for lithium. The Company has one of the broadest product portfolios in the industry, powering

demand for green energy, modern mobility, the mobile economy, and specialized innovations, including light alloys and lubricants. Livent

has a combined workforce of approximately 1,350 full-time, part-time, temporary, and contract employees and operates manufacturing sites

in the United States, England, China and Argentina. For more information, visit Livent.com.

Important Information and Legal Disclaimer:

Forward-Looking Statements

Safe Harbor Statement under the Private

Securities Litigation Reform Act of 1995: Certain statements in this news release are forward-looking statements. In some cases, we have

identified forward-looking statements by such words or phrases as "will likely result," "is confident that," "expect,"

"expects," "should," "could," "may," "will continue to," "believe," "believes,"

"anticipates," "predicts," "forecasts," "estimates," "projects," "potential,"

"intends" or similar expressions identifying "forward-looking statements" within the meaning of the Private Securities

Litigation Reform Act of 1995, including the negative of those words and phrases. Such forward-looking statements are based on our current

views and assumptions regarding future events, future business conditions and the outlook for the Company based on currently available

information. There are important factors that could cause Livent's actual results, level of activity, performance or achievements to

differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements,

including the factors described under the caption entitled "Risk Factors" in Livent's 2022 Form 10-K filed with the Securities

and Exchange Commission ("SEC") on February 24, 2023, as well as other SEC filings and public communications. Although Livent

believes the expectations reflected in the forward-looking statements are reasonable, Livent cannot guarantee future results, level of

activity, performance or achievements. Moreover, neither Livent nor any other person assumes responsibility for the accuracy and completeness

of any of these forward-looking statements. Livent is under no duty to update any of these forward-looking statements after the date

of this news release to conform its prior statements to actual results or revised expectations.

Media contact:

Juan Carlos Cruz +1.215.299.6725

juan.carlos.cruz@livent.com

Investor contact:

Daniel Rosen +1.215.299.6208

daniel.rosen@livent.com

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

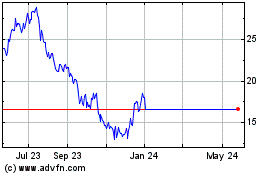

Livent (NYSE:LTHM)

Historical Stock Chart

From Nov 2024 to Dec 2024

Livent (NYSE:LTHM)

Historical Stock Chart

From Dec 2023 to Dec 2024