UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934

| For the month of |

January |

|

2025 |

| Commission File Number |

001-41722 |

|

|

| MAC COPPER LIMITED |

| (Translation of registrant’s name into English) |

| |

3rd Floor, 44 Esplanade

St. Helier, Jersey, JE4 9WG

Tel: +(817) 698-9901 |

| (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Incorporation By Reference

This Report on Form 6-K, including all exhibits hereto, shall be deemed

to be incorporated by reference into the registration statement on Form F-3 (Registration No. 333-276216) (including any prospectuses

forming a part of such registration statement) and to be a part thereof from the date on which this report is furnished, to the extent

not superseded by documents or reports subsequently filed or furnished.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

|

|

MAC

COPPER LIMITED |

| |

|

|

(Registrant) |

| |

|

|

|

| Date: |

January 28, 2025 |

|

By: |

/s/

Michael James McMullen |

| |

|

|

|

Name: |

Michael James McMullen |

| |

|

|

|

Title: |

Chief Executive Officer |

Exhibit 99.1

28 January 2025

MAC COPPER LIMITED

ANNOUNCES DECEMBER 2024 QUARTERLY REPORT

RECORD QUARTERLY PRODUCTION

AND RECORD LOW CASH COST

ST. HELIER, Jersey - (BUSINESS

WIRE) – MAC Copper Limited (NYSE: MTAL; ASX:MAC)

MAC Copper Limited ARBN 671 963

198 (NYSE: MTAL; ASX: MAC), a private limited company incorporated under the laws of Jersey, Channel Islands (“MAC”

or the “Company”) is pleased to release its December 2024 quarterly activities report (“Q4 2024”

or “December quarter”).

HIGHLIGHTS

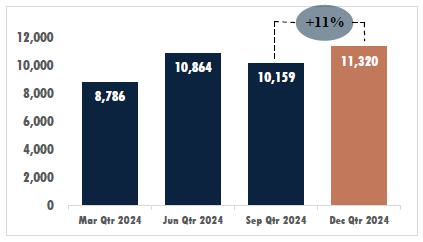

Record quarterly production

of 11,320 tonnes at a 4.1% Cu grade

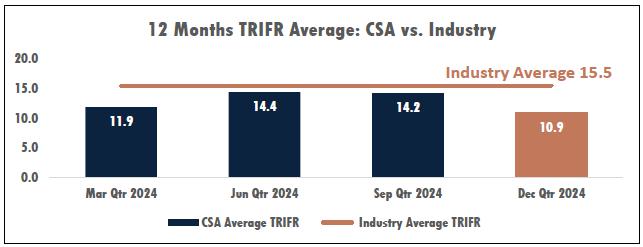

| · | Material

improvement in TRIFR to 10.9 in Q4 2024 from a TRIFR of 14.2 recorded in Q3 2024 |

| · | Strongest

quarterly production under MAC’s ownership beating the previous record set in Q2 2024 |

| · | 11,320

tonnes of copper produced for Q4 2024 (an 11% increase QoQ) at a grade of 4.1% Cu |

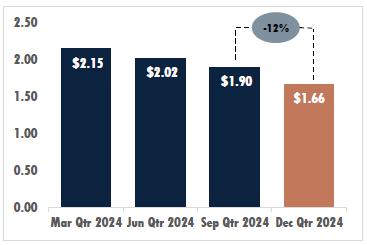

| · | C1

of US$1.66/lb1 for Q4 2024 decreased by 12% (US$1.90/lb in Q3 2024), driven

by increased production, continued improved cost management and operational efficiencies

|

| · | 41,128

tonnes of copper produced in 2024 (above the mid-point of 2024 production guidance) and an

increase of 14% compared to 20232 with an average grade of 3.9% and a C1 of

US$1.92/lb for the year |

| · | 2025

C1 forecast to be positively impacted by3: |

| o | a circa 70% reduction in TC/RC benchmarks

(~US$0.16/lb impact) and |

| o | operational costs benefits due to the lower

A$:US$ exchange rate (+/-1 US$ cent = US$0.03/lb) |

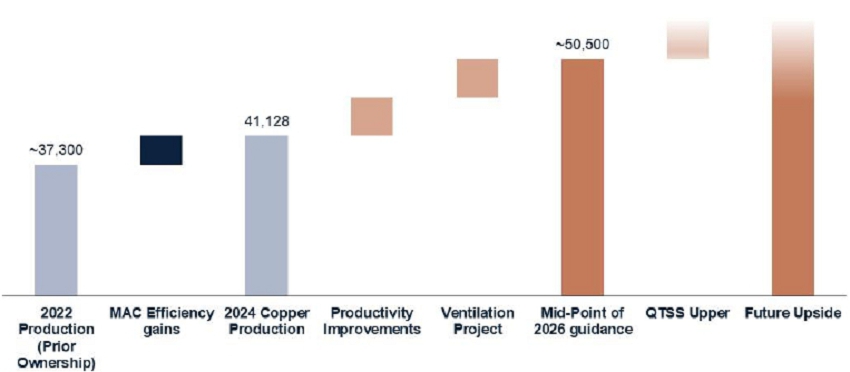

Targeting copper production

of >50ktpa by 2026

| · | Growing

copper production by ~23% by 20264 with key projects delivering the further

step change |

| · | Ventilation

project – work well underway, advancing with completion targeted by Q3 2026 |

| · | QTS

South Upper – development commenced in Q4 2024, ore mining expected to commence from

Q4 2025 |

Generating material operational

free cash flow

| · | Operational

free cash flow for Q4 2024 of ~US$30M (~A$48M) including sustaining capex |

| · | Sustaining

capital expenditure of ~US$12M for Q4 2024 and ~US$50M for 2024 |

Increased liquidity and balance

sheet strength

| · | Raised

US$103M (A$150M5) (before costs) at A$18.00 per CDI as announced on 9 October

2024 |

| · | Cash

and cash equivalents of ~US$172M (~A$276M) after repayment of ~US$8.3M in senior debt principal

|

| · | Liquidity

of US$213M (~A$340M) includes ~US$6.5M of outstanding QP receipts, ~US$5.6M of unsold concentrate

and the Polymetals (“POL”) investment as at 31 December 2024 |

| · | POL

announced it secured financing to fund it’s mine restart by mid-2025 – the value of MAC’s investment in POL has increased

to A$6.4M, up more than 125% since its initial investment. |

| · | Reached

agreement with Sprott to repay Mezzanine debt early at MAC’s option from 1 January

2025 |

1 See “Non-IFRS financial information”

and refer to table 2 for reconciliation of C1 Cash Cost

2 Comparing 2024 CSA Copper Mine production to the total

2023 production (including production pre-MAC ownership)

3 Using 2024 unaudited results as a base, the impact of

this reduction amounts is noted as an impact if these TC/RC and exchange rate movements were to be applied to these unaudited 2024 results

4 Comparing 2024 actuals and mid-point of current 2026

production guidance range

5 Placement proceeds converted into US$ based on an A$:US$

exchange rate of 0.6869, representing the average exchange rate for the week from 30 September to 4 October 2024 (inclusive)

| Page 1 |

ESG UPDATE

Safety

Achieved a Total Recordable Injury

Frequency Rate (TRIFR) of 10.9 in Q4 2024 which is a material improvement from an average TRIFR of 14.2 in Q3 2024. This was a positive

end to 2024 with no recordable injuries recorded for the quarter.

Total incidents recorded have

also reduced significantly during the quarter with increased awareness from extensive training

and coaching as well as increased leadership field safety interactions which is having a beneficial effect on safety.

Figure 1 - CSA Copper Mine Recordable Injuries

by Quarter6

Sustainability Report

MAC recognizes the importance

of our environmental, social and governance responsibilities and that sustainability strategies more broadly is integral to the way we

operate and essential to the accomplishment of our goals.

As a result, in 2024 MAC completed

a materiality assessment and stakeholder analysis to identify the key environmental, social and governance issues material to the business

and important to our stakeholders.

To this end, we will be publishing

our inaugural annual sustainability report at the same time as our annual report in Q1 2025 which will provide an overview of our material

ESG topics, a summary of current performance and an outline of future activities and initiatives to improve our reporting and disclosures

over time. The contents of the sustainability report are not intended to be incorporated by reference into our annual report or in any

other report or document we file or furnish with the Securities and Exchange Commission, and any reference to the sustainability report

is intended to be an inactive textual reference only.

Regulatory

Progress continues toward submission

of the CSA Annual Rehabilitation Report due in April 2025. There have been no reportable environmental incidents during the December

2024 quarter and no reportable environmental incidents for 2024.

Construction activities on the

Stage 10 embankment raise have been ongoing in the December 2024 quarter. Works on foundation preparation and development of the key

trench within the West Mound have begun. West Mound works are planned for completion in Q1 2025 prior to progressing to the East Mound

construction.

6 Industry TRIFR source: Mine Safety

performance report 2022-2023, Resource regulator Department of Regional NSW

| Page 2 |

PRODUCTION AND COST SUMMARY

Table 1 – Production and cost summary

(unaudited)

| |

Units |

Q1

2024 |

Q2

2024 |

Q3

2024 |

Q4 2024 |

QoQ

Change

(%) |

Full year

2024 |

| Copper

Production |

Tonnes |

8,786 |

10,864 |

10,159 |

11,320 |

11.4% |

41,128 |

| Sustaining

capital |

US$

million |

$13.0 |

$12.8 |

$12.5 |

$12.4 |

(0.8%) |

$50.7 |

| Cash

cost (C1)7 |

US$/lb |

$2.15 |

$2.028 |

$1.90 |

$1.66 |

(12.4%) |

$1.92 |

| Total

cash cost9 |

US$/lb |

$3.17 |

$2.72 |

$2.71 |

$2.31 |

(14.9%) |

$2.70 |

| Group

Net Debt10 |

US$

million |

$253 |

$232 |

$232 |

$132 |

(42.9%) |

$132 |

MAC Copper Limited’s CEO, Mick McMullen,

said:

“As a result

of our team’s focus on safety, it gives me great pleasure to be able to report that we closed the financial year with a TRIFR of

10.9. This is a material improvement on the previous quarter and represents the heightened awareness and focus of our people benefiting

from extensive training and coaching with increased field safety leadership interactions as well.

Nothing is more important than the health and well-being of our people, and the communities we are proud to be a part of; safety culture

takes time to take effect, and we are now seeing this show up in our TRIFR.

Our CSA Copper Mine

operational team delivered another record quarterly production volume for the December quarter, achieving copper production of 11,320

tonnes which is an increase of 11.4% over the September quarter. It was also pleasing to see that our C1 reduced by 12.4% quarter on

quarter to a record low under MAC ownership of US$1.66/lb. Higher grade stopes at the CSA Copper Mine continue to form a large proportion

of our annual production and played a key role again during the quarter, with milled copper grade achieved of 4.1%.

This also marks an

excellent end to the 2024 year with the CSA Copper mine producing 41,128 tonnes of copper at a low C1 cost of US$1.92/lb, with 2024 production

above the mid-point of the production guidance range previously announced with a strong finish to the year.

Furthermore, we have

established the platform to grow our Copper production by a further ~23% to over 50,000 tonnes of copper production per annum by 2026

as our growth projects including the expansion of the mine to include QTS South Upper and the Ventilation project are brought online

Q4 2025 and Q3 2026 respectively.

We will provide updated

production guidance when we report our revised R+R at the end of February 2025.

As announced on 9

October 2024, MAC raised approximately A$150 million (approximately US$103 million) (before costs) at an issue price of A$18.00 per New

CDI. The placement was well supported with support from new and existing institutional and sophisticated investors both in Australia

and offshore, which is a testament to the high-quality nature of the CSA Copper Mine. Proceeds of the Placement together with the potential

to repay the Mezzanine in H1 2025 will enable MAC to simplify and de-lever the balance sheet further. We thank all shareholders for their

continued support.

The operational performance delivered

to date confirms the CSA Copper Mine as a high-quality, free cash flow generating, long life copper asset with capital growth projects

unlocking further significant growth in production by 2026. The performance of the site team throughout 2024 has showcased just what

this mine can do when operations perform the way we know it can, and the Board and I would like to express our thanks to the entire team

for yet another strong performance.

MAC is positioned for growth and further

operational improvements to drive costs down from what is already a highly competitive cost position. We have some exciting growth opportunities

in the upper parts of the mine and as our drilling continues to expand the mineralized footprint we are pushing the Capital Vent Project

hard to unlock our mining potential at the lower levels of the mine.”

7 See “Non-IFRS Information”

and refer to table 2 for reconciliation of C1 Cash Cost

8 Q2 2024 adjusted post finalisation of half year accounts with additional freight and TC/RCs included accrued for recognition of June

pre-sales

9 Excludes corporate costs from parent entity. See “Non-IFRS financial information” and refer to table 2 for reconciliation

of Total Cash Cost.

10 Senior Debt + Mezzanine Facility – Cash and cash equivalents (excluding streams)

| Page 3 |

OPERATIONAL AND COST UPDATE

Table 2 - Quarterly Operational Performance

of the CSA Copper Mine (unaudited)

CSA

Copper Mine Metrics

(unaudited) |

Units |

Q1

2024 |

Q2

2024 |

Q3

2024 |

Q4

2024 |

QoQ

%

variance |

2024 |

| U/g

development – Capital |

Metres |

466 |

449 |

735 |

464 |

(37%) |

2,114 |

| U/g

development – Operating |

Metres |

703 |

611 |

359 |

449 |

25% |

2,121 |

| Rehab |

Metres |

246 |

113 |

145 |

246 |

69% |

751 |

| Total

development |

Metres |

1,415 |

1,173 |

1,239 |

1,159 |

(7%) |

4,986 |

| Ore

Mined |

Tonnes |

256,031 |

271,469 |

238,937 |

285,613 |

20% |

1,052,050 |

| Tonnes

Milled |

Tonnes |

260,297 |

266,936 |

260,953 |

284,490 |

9% |

1,072,676 |

| Copper

grade processed |

% |

3.5% |

4.2% |

4.0% |

4.1% |

2% |

3.9% |

| Copper

Recovery |

% |

97.6% |

97.9% |

97.2% |

97.9% |

1% |

97.7% |

| Copper

Produced |

Tonnes |

8,786 |

10,864 |

10,159 |

11,320 |

11% |

41,128 |

| Silver

Produced |

Ounces |

102,182 |

134,072 |

112,299 |

114,019 |

2% |

462,572 |

| Copper

Sold |

Tonnes |

8,112 |

12,984 |

10,244 |

8,987 |

(12%) |

40,326 |

| Achieved

Copper price11 |

US$/lb |

3.87 |

4.41 |

4.18 |

4.18 |

0% |

4.19 |

Achieved Copper price

(including hedging) |

US$/lb |

3.81 |

4.24 |

4.04 |

4.02 |

(0%) |

4.06 |

| Mining

Cost |

US$/t

Mined |

$95.7 |

$91.9 |

$85.9 |

$75.2 |

(12%) |

86.9 |

| Processing

Cost |

US$/t

Milled |

$25.7 |

$31.9 |

$26.3 |

$25.7 |

(2%) |

27.4 |

| G+A

Cost |

US$/t

Milled |

$33.1 |

$25.6 |

$27.5 |

$24.9 |

(9%) |

27.7 |

| Total

Operating Cost |

US$/t

milled |

$154.6 |

$149.3 |

$139.6 |

$125.8 |

(10%) |

142.0 |

| Development

Cost |

US$/metre |

$15,478 |

$9,330 |

$12,825 |

$12,633 |

(2%) |

12,625 |

| Capital

Expenditure12 |

US$

million |

$13.0 |

$12.8 |

$12.5 |

$12.4 |

(1%) |

50.6 |

| Tonnes

Milled per employee |

t/employee |

184 |

186 |

174 |

191 |

10% |

187 |

| Mining

|

US$/lb

prod |

1.27 |

1.04 |

0.92 |

0.86 |

(6%) |

1.01 |

| Processing |

US$/lb

prod |

0.35 |

0.36 |

0.31 |

0.29 |

(4%) |

0.32 |

| General

and Admin |

US$/lb

prod |

0.44 |

0.28 |

0.32 |

0.28 |

(11%) |

0.33 |

| Treatment

and refining |

US$/lb

prod |

0.17 |

0.26 |

0.23 |

0.19 |

(18%) |

0.22 |

| Work

in Progress inventory |

US$/lb

prod |

(0.14) |

0.03 |

0.02 |

0.00 |

(118%) |

(0.02) |

| Freight

and other costs |

US$/lb

prod |

0.17 |

0.21 |

0.24 |

0.15 |

(38%) |

0.19 |

| Silver

Credits |

US$/lb

prod |

(0.10) |

(0.16) |

(0.14) |

(0.11) |

(21%) |

(0.13) |

| C1

Cash Cost |

US$/lb

prod |

2.15 |

2.0213 |

1.90 |

1.66 |

(12%) |

1.92 |

| Leases |

US$/lb

prod |

0.08 |

0.07 |

0.07 |

0.06 |

(16%) |

0.07 |

| Inventory

WIP |

US$/lb

prod |

0.14 |

(0.03) |

(0.02) |

0.00 |

(118%) |

0.02 |

| Royalties |

US$/lb

prod |

0.13 |

0.13 |

0.20 |

0.08 |

(60%) |

0.14 |

| Sustaining

capital |

US$/lb

prod |

0.67 |

0.53 |

0.56 |

0.50 |

(11%) |

0.56 |

| Total

Cash Cost |

US$/lb

prod |

3.17 |

2.72 |

2.71 |

2.31 |

(15%) |

2.70 |

| Total

Revenue |

US$

millions |

66.0

|

120.0 |

87.5 |

74.9 |

(27%) |

348.4 |

Unless stated otherwise all

references to dollar or $ are in USD.

11 Realised provisional sales price

excluding hedging impact

12 Sustainable capex

13 Q2 2024 adjusted post finalisation

of half year accounts with additional freight and TCRCs included accrued for recognition of June pre-sales

| Page 4 |

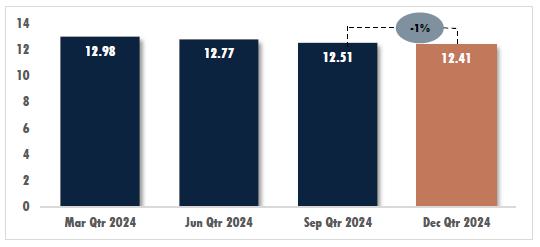

Q4 2024 demonstrated consistent

mining processes that delivered above 10kt of copper production for three consecutive quarters. Production further benefited from a grade

of 4.1% for Q4 2024 with copper grade for the month of December 2024 recorded at 4.52%. The grade achieved continues to demonstrate the

high-quality ore body present at CSA mine.

The double lift stope extraction

method was again successfully deployed during Q4 2024 after being implemented in the previous quarters, resulting in less mining dilution

achieved with stronger grades and less total ore tonnes for the same metal. Total ore mined of ~286kt is around a 20% increase quarter

on quarter, together with the higher grade processed leading to higher copper production.

Figure 2 - CSA Copper Mine Quarterly Copper

Production (tonnes)

The average received copper price after hedge settlements was slightly lower compared with the prior quarter with Q4 2024 at

US$4.02/lb, compared to US$4.04/lb for Q3 2024, with the average spot copper price over the December quarter at ~US$4.16/lb.

In addition, the average A$:US$

exchange rate of ~US$65 cents for Q4 2024 declined by ~2.5% compared to Q3 2024 to ~US$67 cents which also marginally improved our US$

reported C1 cost, with the A$:US$ exchange rate further weakening to ~US$62 cents by the end of 2024.

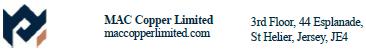

C1 cash costs decreased by ~12%

quarter on quarter from US$1.90/lb in the September quarter to US$1.66/lb for Q4 2024. The higher production tonnes, as detailed above,

resulted in a positive impact to C1 costs of approximately US$0.19/lb, whilst the overall cost variance had a positive impact of approximately

US$0.05/lb.

| Page 5 |

Figure 3 - CSA Copper Mine C1 Cash Costs14

- US$/lb produced

MAC management continues to implement

additional productivity measures to further reduce C1 costs as is evident in the declining C1 achieved over the course of 2024, as depicted

above. Q4 2024 reflects a 23% drop in C1 as compared to the March quarter of US$2.15/lb which is a strong result given general cost trends

within the copper industry that many of our peers are experiencing.

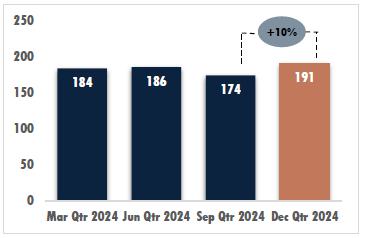

Figure 4 provides an illustration

of tonnes milled per employee which increased ~10% quarter on quarter in line with increased ore processed which also drove down the

mining unit rate per tonne by around 12%.

| Figure 4 - CSA Mine Tonnes Milled per Employee | Figure 5

- CSA Mine Mining Unit Rate US$/t |

| | |

|  |

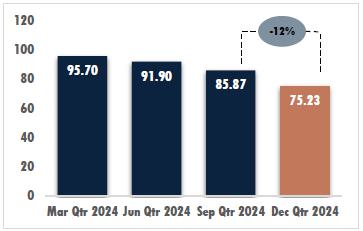

Apart from copper production,

the largest driver of C1 costs is the mining unit rate as mining accounts for approximately 60% of total site operating costs.

Mining unit rates are trending down with better

cost control initiatives implemented combined with additional tonnes mined in Q4 2024. Capital metres decreased as focus shifted to extracting

ore for Q4 2024.

14 See “Non-IFRS Information”

and refer to table 2 for reconciliation of C1 Cash Cost

| Page 6 |

| Figure 6 - CSA Copper Mining Development Costs US$/metre |

Figure 7 - CSA Copper Mine Capital Development metres |

Processing costs per tonne milled

decreased slightly in December 2024 quarter. Tonnes processed for the quarter were 285kt (a 9% increase quarter on quarter) at recovery

rate of 97.8%.

G&A unit rates decreased

in the current quarter predominately driven by the increase in ore processed.

| Figure 8 - CSA Copper Mine Processing Unit Rate US$/t |

Figure 9 - CSA Copper Mine Site G+A Unit Rate US$/t |

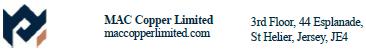

As seen in Figure 10, sustaining

capital spend (including capitalized development) decreased slightly over the quarter. Sustaining Capital costs during the quarter included

diamond drilling, stage 10 TSF works and primary vent rises.

Figure 10 - CSA Copper Mine Site Sustaining

Capital US$M

| Page 7 |

TREASURY UPDATE

Cash position, liquidity and debt facilities

The Company’s unaudited

cash holding at the end of Q4 2024 was ~US$172 million or ~A$276 million for an unaudited net debt position of ~US$132 million or 15%

net gearing.

The increase in cash position

at quarter end is largely driven by the cash generated by operations of ~US$42 million or ~A$69 million with an equity raise completed

on 9 October 2024 amounting to US$103 million (~A$150 million) (before costs).

There were ~$14.5 million of

cash received for copper concentrate sold to Glencore on 23 December 2024 for which we received the cash but will not account for as

revenue until early January 2025.

The unaudited cash position also

reflects another ~US$8.3 million repaid on the Senior Debt Facility at the end of the quarter, ~US$8.1 million in interest payments for

the Senior debt (US$3.4 million) and Mezzanine facility (US$4.7 million).

As of 31 December 2024, the pro-forma

liquidity was ~US$213 million (~A$340 million) which includes cash of ~US$172 million (A$213 million), US$25 million (A$40 million) undrawn

revolving facility, ~US$16 million (A$28 million) of outstanding Quotational Period receipts, unsold concentrate and the strategic investment

held in POL at valuation as at 31 December 2024 of ~A$6.4 million (~US$4 million).

Sprott Mezzanine Facility Early Repayment

As announced on 17 December 2024, MAC Copper

Limited has agreed amendments with Sprott Private Resource Lending || (Collector-2), LP (“Sprott”) to permit early

repayment of its Mezzanine facility. This amendment underscores our commitment to the ongoing simplification and de-leveraging of our

balance sheet.

The agreement allows MAC Copper

to repay the Mezzanine from 1 January 2025 onwards instead of 15 June 2025 onwards.

MAC Copper will make a decision

regarding earlier repayments based on its cash balance and financial forecasts in H1 2025 which will be communicated to the market once

determined.

FX Impact on OPEX

Given MAC is dual listed in Australia

and the US, our financial performance is affected by movements in A$:US$ exchange rate with site costs predominantly Australian dollar

based.

Results provided over 2024 were

compiled at an average A$:US$ exchange rate of ~US$66cents, with a high of ~US$69cents noted in September 2024. At the end of 2024 we

note that the Australian dollar has dropped to ~US$62cents.

As an estimate, utilising 2024

unaudited results as a baseline, the impact of a US$1 cent movement on the A$:US$ exchange rate would have an impact of ~US$2.7M on total

operating costs, being a ~US$0.03/lb impact on C1.

TC/RC renegotiated pricing

Benchmark Treatment Charge and Refining Charge

(“TC/RC”) pricing has been renegotiated and a new benchmark set for 2025, as such, from 1 January 2025 Copper refining

charges will decrease by >70% to approximately US$21/t for the TC and US$0.21/ refined lb of copper for the RC.

Using 2024 unaudited results

as a base, the impact of this reduction amounts to ~US$14.6 million per annum in savings equating to a reduction in C1 cost of ~US$0.16/lb

year on year.

The impact of this change on

the proforma 2024 results would be to reduce the 2024 C1 to ~US$1.76/lb from US$1.92/lb based on the new 2025 pricing if it was to be

applied to 2024 (proforma C1 for Q4 2024 would be ~US$1.52/lb).

| Page 8 |

Figure 11 – Q4 2024 Cash flow waterfall (US$M)

Hedging

In adherence to our Debt Facility

Agreement, MAC Copper previously implemented a hedging program covering the period to June 2026. During the quarter, the Company delivered

3,105 tonnes of copper into the hedge book at a price of US$3.72/lb. A summary of our open hedge positions as at 31 December 2024 is

included below.

Table 3 – Hedge position

| |

Copper |

| |

2025 |

2026 |

Total |

| Future

Sales (t) |

12,420 |

5,175 |

18,595 |

| Future

Sales ($/t) |

3.72 |

3.72 |

3.72 |

| Page 9 |

PROJECTS AND EXPLORATION UPDATE

Pathway to >50,000 tonne per annum of copper

production

The CSA mine is already benefiting

from productivity improvements initiated under MAC ownership such as double stope lifts and other operational efficiencies noted in previous

announcements aimed at reducing waste and ensuring efficient delivery of ore. To further progress towards becoming a 50ktpa+ producer

two key projects have been identified as detailed below. Both projects are designed to deliver on our strategic goal of uplifting production

to 50kpta+ and unlock the full potential of the CSA mine.

Cu Production Bridge (Tonnes)

Projects updates

Ventilation project update

The Capital Vent Upgrade Project

is designed to support increased mining activity to 1.7Mtpa, improving access to lower mine levels and ensuring operational longevity

beyond the current reserve life. The project remains a key enabler for sustained production growth at CSA.

Total spend in Q4 was US$3.0

million, with 233m of development completed. Progress continued on establishing access to the first raise bore location, additional geotechnical

drilling was completed, and procurement of ventilation fans advanced.

The project is progressing well,

with development successfully integrated into existing operations. Early works in high-activity mining areas have supported a structured

ramp-up, ensuring alignment with operational priorities. The slowest development rates are in the early stages of the project as development

interacts with existing mining, and as development moves out away from the operations development rates are picking up as planned.

Development is progressing well

across multiple levels, with stripping, rehabilitation, and fan installations underway to enhance infrastructure and support operational

efficiency. Key design enhancements and coordinated planning have optimised integration with active mining zones. Work will continue

in 2025 to finalise critical infrastructure and further expand ventilation capacity in alignment with the long-term mine plan.

| Page 10 |

QTS South Upper update

The QTSSU deposit presents an

opportunity for incremental copper production at CSA Mine, representing an additional mining area not currently connected to the mine,

located approximately 150m below the surface. Drilling to upgrade this deposit from resource to reserve has been completed, with ore

mining expected to commence by Q4 2025.

Total spend in Q4 was US$0.6

million, primarily allocated to project startup and equipment costs.

The first development cut was

taken in the December quarter, marking a significant milestone in the project's progression.

All key project team members

are now in place, and the installation of new services from the surface has been completed.

The underground substation has

been installed, and back-stripping activities are underway in preparation for the secondary fan installation.

Development will continue throughout

Q1 2025 as the project ramps up.

| Page 11 |

CONFERENCE CALL DETAILS

The Company will host a conference

call and webcast to discuss the Company’s fourth quarter 2024 results on Tuesday, January 28, 2025 at 5:00 pm (New York time) /

Wednesday, January 29, 2025 at 9:00 am (Sydney time).

Details for the conference call

and webcast are included below.

Webcast

Participants can access the webcast at the following link https://event.choruscall.com/mediaframe/webcast.html?webcastid=D8OmknEn

Conference Call

For expedited access to the call, participants

should register at https://dpregister.com/sreg/10195707/fe3e823b2f and avoid the call queue. Alternatively, if you prefer to speak

with an operator, dial one of the numbers below and request the operator connect to the MAC Copper Limited call.

| Toll Free Dial In: |

1-833-816-1269 |

| Australia: |

+1-800-822-994 |

Replay

A replay of the webcast will

be available for three months via the webcast link above and or by visiting the Events section of the company’s website.

-ENDS-

This report is authorised for

release by the Board of Directors.

CONTACTS

Mick

McMullen

Chief Executive Officer

MAC Copper Limited

investors@metalsacqcorp.com |

Morné

Engelbrecht

Chief Financial Officer

MAC Copper Limited

|

| Page 12 |

ABOUT MAC COPPER LIMITED

MAC Copper Limited (NYSE: MTAL) is a company focused

on operating and acquiring metals and mining businesses in high quality, stable jurisdictions that are critical in the electrification

and decarbonization of the global economy.

Estimates of Mineral Resources and Ore Reserves

and Production Target

This release contains estimates

of Ore Reserves and Mineral Resources as well as a Production Target. The Ore Reserves, Mineral Resources and Production Target are reported

in MAC’s ASX Announcement dated 23 April 2024 titled ‘Updated Resource and Reserve Statement and Production Guidance’

(the R&R Announcement). The Company is not aware of any new information or data that materially affects the information included

in the R&R Announcement, and that all material assumptions and technical parameters underpinning the estimates or Ore Reserves and

Mineral Resources in the R&R Announcement continue to apply and have not materially changed. The material assumptions underpinning

the Production Target in the R&R Announcement continue to apply and have not materially changed. It is a requirement of the ASX Listing

Rules that the reporting of ore reserves and mineral resources in Australia comply with the JORC Code. Investors outside Australia should

note that while exploration results, mineral resources and ore reserves estimates of MAC in this presentation comply with the JORC Code,

they may not comply with the relevant guidelines in other countries and, in particular, do not comply with (i) National Instrument 43-101

(Standards of Disclosure for Mineral Projects) of the Canadian Securities Administrators; or (ii) the requirements adopted by the Securities

and Exchange Commission (SEC) in its Subpart 1300 of Regulation S-K. Information contained in this presentation describing mineral deposits

may not be comparable to similar information made public by companies subject to the reporting and disclosure requirements of Canadian

or US securities laws.

Forward Looking Statements

This release includes “forward-looking

statements.” The forward-looking information is based on the Company’s expectations, estimates, projections and opinions

of management made in light of its experience and its perception of trends, current conditions and expected developments, as well as

other factors that management of the Company believes to be relevant and reasonable in the circumstances at the date that such statements

are made, but which may prove to be incorrect. Assumptions have been made by the Company regarding, among other things: the price of

copper, continuing commercial production at the CSA Copper Mine without any major disruption, the receipt of required governmental approvals,

the accuracy of capital and operating cost estimates, the ability of the Company to operate in a safe, efficient and effective manner

and the ability of the Company to obtain financing as and when required and on reasonable terms. Readers are cautioned that the foregoing

list is not exhaustive of all factors and assumptions which may have been used by the Company. Although management believes that the

assumptions made by the Company and the expectations represented by such information are reasonable, there can be no assurance that the

forward-looking information will prove to be accurate.

MAC’s actual results may

differ from expectations, estimates, and projections and, consequently, you should not rely on these forward-looking statements as predictions

of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,”

“believes,” “predicts,” “potential,” “continue,” and similar expressions (or the negative

versions of such words or expressions) are intended to identify such forward- looking statements. These forward-looking statements include,

without limitation, MAC’s expectations with respect to future performance of the CSA Copper Mine. These forward-looking statements

involve significant risks and uncertainties that could cause the actual results to differ materially from those discussed in the forward-looking

statements. Most of these factors are outside MAC’s control and are difficult to predict. Factors that may cause such differences

include, but are not limited to: the supply and demand for copper; the future price of copper; the timing and amount of estimated future

production, costs of production, capital expenditures and requirements for additional capital; cash flow provided by operating activities;

unanticipated reclamation expenses; claims and limitations on insurance coverage; the uncertainty in Mineral Resource estimates; the

uncertainty in geological, metallurgical and geotechnical studies and opinions; infrastructure risks; and other risks and uncertainties

indicated from time to time in MAC’s other filings with the SEC and the ASX. MAC cautions that the foregoing list of factors is

not exclusive. MAC cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date

made. MAC does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking

statements to reflect any change in its expectations or any change in events, conditions, or circumstances on which any such statement

is based.

More information on potential factors that

could affect MAC’s or CSA Copper Mine’s financial results is included from time to time in MAC’s public reports

filed with the SEC and the ASX. If any of these risks materialize or MAC’s assumptions prove incorrect, actual results could

differ materially from the results implied by these forward-looking statements. There may be additional risks that MAC does not

presently know, or that MAC currently believes are immaterial, that could also cause actual results to differ from those contained

in the forward-looking statements. In addition, forward-looking statements reflect MAC’s expectations, plans or forecasts of

future events and views as of the date of this communication. MAC anticipates that subsequent events and developments will cause its

assessments to change. However, while MAC may elect to update these forward-looking statements at some point in the future, MAC

specifically disclaims any obligation to do so, except as required by law. These forward-looking statements should not be relied

upon as representing MAC’s assessment as of any date subsequent to the date of this communication. Accordingly, undue reliance

should not be placed upon the forward-looking statements.

| Page 13 |

Non-IFRS financial information

MAC’s results are reported

under International Financial Reporting Standards (IFRS), noting the results in this report have not been audited or reviewed. This release

may also include certain non-IFRS measures including C1, Total Cash costs and Free Cash Flow. These C1, Total Cash cost and Free Cash

Flow measures are used internally by management to assess the performance of our business, make decisions on the allocation of our resources

and assess operational management. Non-IFRS measures have not been subject to audit or review and should not be considered as an indication

of or alternative to an IFRS measure of financial performance.

C1 Cash Cost

C1 costs are defined as the costs

incurred to produce copper at an operational level. This includes costs incurred in mining, processing and general and administration

as well freight and realisation and selling costs. By-product revenue is credited against these costs to calculate a dollar per pound

metric. This metric is used as a measure operational efficiency to illustrate the cost of production per pound of copper produced.

Total Cash Cost

Total cash costs include C1 cash

costs plus royalties and sustaining capital less inventory WIP movements. This metric is used as a measure operational efficiency to

further illustrate the cost of production per pound of copper produced whilst incurring government-based royalties and capital to sustain

operations.

Free Cash Flow

Free cash flow is defined as

net cash provided by operating activities less additions to property, plant, equipment and mineral interests. This measure, which is

used internally to evaluate our underlying cash generation performance and the ability to repay creditors and return cash to shareholders,

provides investors with the ability to evaluate our underlying performance.

| Page 14 |

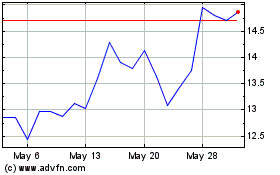

MAC Copper (NYSE:MTAL)

Historical Stock Chart

From Feb 2025 to Mar 2025

MAC Copper (NYSE:MTAL)

Historical Stock Chart

From Mar 2024 to Mar 2025