M&T Bank Expands Use of nCino with Adoption of Continuous Credit Monitoring Solution Powered by Rich Data Co’s Explainable AI Platform

May 15 2024 - 6:30AM

nCino, Inc. (NASDAQ: NCNO), a pioneer in cloud banking for the

global financial services industry, today announced that M&T

Bank Corporation (“M&T”) (NYSE:MTB) an existing and

long-standing nCino customer, is expanding its use of the nCino

platform and integrating nCino’s Continuous Credit Monitoring

Solution into its operations. The solution is powered by nIQ and

leverages Rich Data Co’s (RDC) AI decisioning platform.

nCino’s Continuous Credit Monitoring Solution leverages RDC’s

explainable AI platform and is designed to bring transparency to

every decision, giving M&T more comprehensive insights into

cash flow health, credit risk, and lending opportunities at both

the customer and portfolio levels. This will enable M&T to

detect more early warning signs and have access to additional data

when making decisions throughout the customer relationship

lifecycle. This innovative solution is set to transform how M&T

manages credit risk and loan performance across its portfolio.

"M&T Bank is committed to delivering enhanced credit risk

management solutions to our Commercial and Business Banking

clients, leveraging data to drive additional automation, and

provide intelligent, actionable insights,” said Nicholas Batyko,

Engineering Director, M&T Bank.

“By adopting nCino’s Continuous Credit Monitoring Solution, we

are further enhancing our ability to manage credit risk through the

automation of early warning indicators. This scalable capability

will provide insights to our employees to drive even more timely

and tailored banking experiences," said Sarah Hudak, Director of

Credit Product Delivery, M&T Bank.

nCino's solution, enriched by RDC's AI technology streamlines

early warnings, customer reviews and uncovers new, lower-risk

lending opportunities.

"Partnering with nCino and M&T Bank to bring this innovative

solution to life has been a rewarding experience," said Julian

Bloomfield, Chief Revenue Officer at RDC. "Our AI-driven platform

forecasts future serviceability, enables deeper, more meaningful

banker-customer interactions and greatly improves credit outcomes.

This collaboration showcases the potential of joint efforts in

enhancing efficiency and innovation in the banking industry,

ensuring superior service delivery to customers."

Through this collaboration, nCino is setting a new standard in

how financial institutions manage credit risk. "Our goal is to

transform the approach to credit risk management, moving it from a

reactive to a proactive stance," said Sean Desmond, Chief Product

Officer at nCino. "nCino not only streamlines operations by

automating previously manual tasks but also bridges the gap between

ambition and achievement by providing real-time, actionable

insights that empower strategic decision-making."

Last year nCino announced a global reseller agreement with RDC,

and subsequently became an investor in the company to leverage

RDC’s decisioning capabilities. The integrated capabilities enhance

nCino’s Cloud Banking Platform, extending the ability for nIQ to

further embed advanced intelligence into banking workflows to more

efficiently, accurately, and holistically assess portfolio health

and credit risk.

About nCino nCino (NASDAQ:

NCNO) is the worldwide leader in cloud banking. Through its single

software-as-a-service (SaaS) platform, nCino helps financial

institutions serving corporate and commercial, small business,

consumer, and mortgage customers modernize and more effectively

onboard clients, make loans, manage the loan lifecycle, and open

accounts. Transforming how financial institutions operate through

innovation, reputation and speed, nCino is partnered with more than

1,800 financial services providers globally. For more information,

visit www.ncino.com.

About Rich Data Co.Rich Data Co (RDC) is an

industry leader in artificial intelligence (AI) decisioning for

business and commercial lenders. The RDC AI platform enables

banks to make high-quality lending decisions efficiently and

safely. Leveraging advanced explainable AI technology, the

platform delivers efficiency and transparency in both origination

and portfolio management decisions. With the RDC platform, banks

can deliver more meaningful customer interactions, improve credit

outcomes, and increase lending. For more information,

visit richdataco.com.

Media ContactsNatalia Moosepress@ncino.com

Safe Harbor StatementThis press release

contains forward-looking statements within the safe harbor

provisions of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements generally include actions, events,

results, strategies and expectations and are often identifiable by

use of the words “believes,” “expects,” “intends,” “anticipates,”

“plans,” “seeks,” “estimates,” “projects,” “may,” “will,” “could,”

“might,” or “continues” or similar expressions. Any forward-looking

statements contained in this press release are based upon nCino’s

historical performance and its current plans, estimates, and

expectations, and are not a representation that such plans,

estimates, or expectations will be achieved. These forward-looking

statements represent nCino’s expectations as of the date of this

press release. Subsequent events may cause these expectations to

change and, except as may be required by law, nCino does not

undertake any obligation to update or revise these forward-looking

statements. These forward-looking statements are subject to known

and unknown risks and uncertainties that may cause actual results

to differ materially including, among others, risks and

uncertainties relating to the market adoption of our solution and

privacy and data security matters. Additional risks and

uncertainties that could affect nCino’s business and financial

results are included in reports filed by nCino with the U.S.

Securities and Exchange Commission (available on our web site at

www.ncino.com or the SEC's web site at www.sec.gov). Further

information on potential risks that could affect actual results

will be included in other filings nCino makes with the SEC from

time to time.

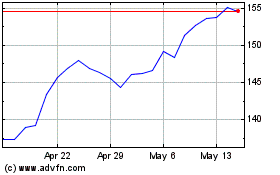

M&T Bank (NYSE:MTB)

Historical Stock Chart

From Dec 2024 to Jan 2025

M&T Bank (NYSE:MTB)

Historical Stock Chart

From Jan 2024 to Jan 2025