U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE

ACT OF 1934

For the Month of October 2023

Nexa Resources S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s Name)

37A, Avenue J.F. Kennedy

L-1855, Luxembourg

Grand Duchy of Luxembourg

(Address of principal executive offices)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark

if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark

if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Indicate by check mark

whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked,

indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: October 23, 2023

| Nexa Resources S.A. |

| By:/s/ José Carlos del Valle |

| Name: José Carlos del Valle |

| Title: Senior Vice President of Finance and Group Chief Financial Officer |

EXHIBIT INDEX

Nexa Reports Third Quarter 2023

Exploration Results

Luxembourg,

October 23, 2023 – Nexa Resources S.A. (“Nexa Resources”,

“Nexa”, or the “Company”) is pleased to provide today the drilling and assay results from the third quarter of

2023. This document contains forward-looking statements.

Summary

Nexa’s drilling strategy for 2023

is focused on near-mine expansion brownfield and infill drilling, including Aripuanã, which is in the ramp-up stage. Additional

exploratory drilling is also planned for greenfield projects with a favorable perspective.

We invested in our exploration program

a total amount of US$24.1 million cumulatively for the 9M23 period, with US$9.6 million invested in 3Q23. This represents 74% of the US$32.6

million projected for the year, our initial budget was US$35.2 million. The difference between the initially budgeted investment amount

and the revised amount projected for 2023 is explained by a review undertaken to our mineral exploration guidance in light of the challenging

backdrop of lower LME metal prices. As previously released, in order to accommodate the revised level of investment, we have postponed

the start of drilling at Hilarión from June 2023 to 3Q23, and drilling at Florida Canyon has been postponed to 4Q23, compared to

our previous estimate of a start in 3Q23. Furthermore, some areas of other regional exploration projects were deprioritized. Our initial

plan envisaged 97,290 meters of drilling and, after the review mentioned above, our target for this year was reduced to 88,196 meters.

Despite this review and in accordance with the meterage forecast monitored monthly, we performed in line with what was initially projected

for 3Q23.

At the end of 3Q23, 215,238 meters of

cumulative drilling production was carried out, including 69,614 meters of exploratory drilling and 145,624 meters of mining infill drilling.

Total exploratory drilling carried out in 3Q23 was 28,573 meters, including 16,790 meters drilled in Peru, 8,896 meters in Brazil, and

the remaining 2,887 meters in Namibia. Exploratory drilling scheduled for 4Q23 includes 14,507 meters in Peru with twelve rigs, 2,075

meters in Brazil with four rigs, and 2,000 meters in Namibia with two rigs, totaling 18,582 meters.

Commenting on the report, Jones Belther,

Senior Vice President of Mineral Exploration & Business Development, said: “Our brownfield exploration programs have progressed

as planned and the results are confirming our expectations of extending the life of mine of our current operations. Drilling results at

Cerro Lindo confirmed the extent of mineralization at depth in Orebody 8, with an intercept of 11.5 meters grading 2.87% Zn, 0.34% Pb,

0.12% Cu and 8.16 g/t Ag. At Aripuanã, the Babaçu exploration infill drilling confirmed thick and high-grade intercepts

such as 21.1 meters with 11.56% Zn, 5.08% Pb, 0.18% Cu, 50.24 g/ t Ag and 0.21 g/t Au, 4.8 meters with 21.59% Zn, 13.25% Pb, 0.07% Cu,

453.32 g/t Ag and 0.28 g/t Au, and 10.9 meters with 14.00% Zn, 4.51% Pb, 0.04% Cu, 130.08 g/t Ag and 0.16 g/t Au. All drilled holes feature

multiple mineralized intervals with high polymetallic content. At the Pasco complex, the Integración orebody continues to be expanded

in depth in holes at multiple intersections, such as 3.2 meters with 10.59% Zn, 0.18% Pb, 0.26% Cu, 43.79 g/t Ag and 0.39 g/t Au, and

6.6 meters with 9.43% Zn, 1.02% Pb, 0.12% Cu, 32.77 g/t Ag and 0.08 g/t Au”.

Exploration Report – 3Q23 |  |

| | |

Cerro Lindo

In 3Q23, the exploration program continued

to focus on the extensions of known ore bodies to the southeast of Cerro Lindo, and on the Pucasalla target, 4.5 km to the northwest of

the mine, and started drilling tests at the Patahuasi Millay target, located 500 meters to the northwest of Cerro Lindo mine. There are

currently five operating drill rigs.

During the period, a total of 7,769 meters

of exploration drilling and 18,027 meters of mining infill drilling were carried out, totaling 22,336 meters and 43,877 meters in 9M23,

respectively.

During 3Q23, our focus was on expanding

the mineralization of Orebody 8, as well as identifying new mineralized zones in the Pucasalla target and its extensions. Drilling results

confirmed the extent of mineralization at depth in Orebody 8, with an intercept of 11.5 meters grading 2.87% Zn, 0.34% Pb, 0.12% Cu, 8.16

g/t Ag and 0.03 g/t Au in hole PECLD06984. Another target that we started drilling in the period was Patahuasi Millay, its hole has not

yet been completed and, therefore, the results will be presented in the next quarter.

Note: Intervals with assays not reported

here have no consistent samples > 2.0% Zinc + Lead or assay results are pending. True widths of the mineralized intervals are unknown

at this time. NSI refers to no significant intercept. PAR refers to pending assay results.

| | |

| 2 |

Exploration Report – 3Q23 |  |

| | |

In 4Q23, we will continue drilling inside

the mine, at Orebody 8, drilling to the southeast and deepening, and drilling at Patahuasi Millay target, where the first drilling identified

areas with the presence of sphalerite. At surface, we will continue to drill the Pucasalla target to the southeast and the Pucasalla East

target. A total of 5,837 meters of drilling with four rigs is planned for 4Q23.

Vazante

The brownfield exploration at Vazante aims

to expand existing mineralized zones and explore new areas to define new mineralized zones near the mine. In 3Q23, 1,429 meters of exploratory

drilling were completed in the Extremo Norte and Sucuri areas, and at the Vazante Sul target with two rigs, totaling 7,198 meters in 9M23.

An additional 10,843 meters of mining infill drilling was carried out with three rigs at the Vazante mine, totaling 29,066 meters in 9M23.

The Vazante brownfiled drilling program

focused on two main fronts: near mine drilling with the objective of expanding the mineralization of known ore bodies (Extremo Norte and

Sucuri Norte) and the regional drilling program that seeks the continuity of the Vazante hydrothermal breccia in its southern extension.

Drill holes from the near mine drilling

program identified the continuity of mineralization, both at the Extremo Norte and Sucuri Norte targets, as evidenced by the results found

in hole BRVZEND000058 intercepting 2.2 meters with 15.29% Zn and 0.21% Pb (Extremo Norte) and the underground hole MVZMV420P13875D25 (Sucuri)

which intercepted three mineralized zones: 2.5 meters with 9.60% Zn and 0.22% Pb, 3.9 meters with 5.09% Zn and 0.16% Pb and 2.7 meters

with 10.51% Zn and 0.12% Pb.

| | |

| 3 |

Exploration Report – 3Q23 |  |

| | |

Note: Intervals with assays not reported

here have no consistent samples > 3.0% Zinc or assay results are pending. True widths of the mineralized intervals are unknown at this

time. NSI refers to no significant intercept. PAR refers to pending assay results.

| | |

| 4 |

Exploration Report – 3Q23 |  |

| | |

In 4Q23, 275 meters of surface drilling

is planned with one rig with the objective of seeking the continuity of the Vazante fault and identifying mineralization south of the

mine, in order to complete the drilling program at the Vazante Sul target.

Aripuanã

The Aripuanã exploration strategy

focuses on upgrading the Mineral Resources at the Babaçu deposit and expanding our Mineral Reserves.

During 3Q23, a total of 7,467 meters of

exploration infill drilling and 12,881 meters of mining infill drilling were executed, totaling 19,599 meters of exploration drilling

and 31,384 meters of mining infill in 9M23.

The high production of the five rigs in

operation contributed to the completion of more than 1,000 meters than was initially scheduled.

The results intercepted by drill holes throughout

3Q23 show that we are in line with the proposal to expand Mineral Reserves, with emphasis on hole BRAPD000187 intercepting 21.1 meters

with 11.56% Zn, 5.08% Pb, 0.18% Cu, 50.24 g/ t Ag and 0.21 g/t Au, and drill hole BRAPD000215 intercepting 4.8 meters with 21.59% Zn,

13.25% Pb, 0.07% Cu, 453.32 g/t Ag and 0.28 g/t Au, and hole BRAPD000196, which intercepted 10.9 meters with 14.00% Zn, 4.51% Pb, 0.04%

Cu, 130.08 g/t Ag and 0.16 g/t Au. All drilled holes have multiple mineralized intervals with high polymetallic content, as shown in the

table below.

| | |

| 5 |

Exploration Report – 3Q23 |  |

| | |

Note: Intervals with assays not reported

here have no consistent samples > 3.0% Zinc or >0.5% Copper or >0.5 g/t Gold or assay results are pending. True widths of the

mineralized intervals are unknown at this time. PAR refers to pending assay results.

| | |

| 6 |

Exploration Report – 3Q23 |  |

| | |

| | |

| 7 |

Exploration Report – 3Q23 |  |

| | |

| | |

| 8 |

Exploration Report – 3Q23 |  |

| | |

In 4Q23, we will focus on completing

an exploratory infill drilling program totaling 1,800 meters with three rigs for the reclassification of Inferred Mineral Resources to

Indicated Mineral Resources at the Babaçu deposit and to support our goal of increasing the mine's Mineral Reserves.

El Porvenir

The exploration drilling strategy at El

Porvenir continues to focus on extending existing satellite mineralized bodies along with the strike and at depth. In 3Q23, 1,879 meters

of exploratory underground drilling was carried out with one rig and 9,903 meters of mining infill drilling, totaling 7,982 meters and

34,441 meters in 9M23, respectively.

The drilling program, which focused on

the extension of known mineralization at the Integración body, had only 800 meters scheduled for this quarter, but due to the positive

results arising out of this last program, it was extended, scheduling a further 2,400 meters divided between 3Q23 and 4Q23.

We continue drilling the Integración

body from the 3300 level and results intercepted during 3Q23 confirmed the extent of mineralization with high metallic content, as evidenced

in hole PEEPD02613 with multiple intercepts: 3.2 meters with 10.59% Zn, 0.18% Pb, 0.26% Cu, 43.79 g/t Ag and 0.39 g/t Au, and 6.6 meters

with 9.43% Zn, 1.02% Pb, 0.12% Cu, 32.77 g/t Ag and 0.08 g/t Au, in addition to other results presented in the main intersections table

below.

| | |

| 9 |

Exploration Report – 3Q23 |  |

| | |

Note: Intervals with assays not reported

here have no consistent samples > 2.0% Zinc + Lead or assay results are pending. True widths of the mineralized intervals are unknown

at this time. NSI refers to no significant intercept. PAR refers to pending assay results.

| | |

| 10 |

Exploration Report – 3Q23 |  |

| | |

| | |

| 11 |

Exploration Report – 3Q23 |  |

| | |

In 4Q23, we are scheduled to carry out 1,200

meters of drilling with one rig to complete the El Porvenir brownfield drilling program at the Integración target, aiming to expand

mineralization in the lower zones of the mine.

Atacocha

Due to community protests, the drilling

program planned for 3Q23 was not carried out, drilling will resume in 4Q23, but only with 1,000 meters with one rig at the Asunción

and Chercher ore bodies.

Morro Agudo

In 3Q23, 1,818 meters of mining infill

drilling was carried out in the underground mine at Morro Agudo, totaling 4,959 meters in 9M23. No exploratory drilling was carried out

in the Morro Agudo/Bonsucesso areas.

Hilarión

The 2023 exploration drilling program

started in 3Q23 totaling 2,448 meters with two rigs at the El Padrino and Chaupijanca Norte targets. Drilling began at the Chaupijanca

Norte target, completing the PEHILD000060 drill hole with the objective of exploring the continuity of the Hilarión Oeste mineralization

in the Southeast trend, intercepting a 4.4-meter vein with 4.85% Zn, 2.25% Pb, 0.13 % Cu, 33.10 g/t Ag and 0.01 g/t Au, and other intercepts

shown in the main intersections table. In September, drilling began at the El Padrino target, with the aim of finding areas with higher

Cu content. The PEPADD000001 drillhole intercepted mineralized zones of Skarn and porphyry, respectively, with the presence of marmatite

and galena, a stockwork zone of veins of quartz-pyrite, molybdenite and chalcopyrite and at greater depth an intrusive quartz monzonite

with a porphyritic texture. We drilled more meters than planned, anticipating production with the use of two drill rigs.

| | |

| 12 |

Exploration Report – 3Q23 |  |

| | |

Note: Intervals with assays not reported

here have no consistent samples > 2.0% Zinc + Lead or assay results are pending. True widths of the mineralized intervals are unknown

at this time. NSI refers to no significant intercept. PAR refers to pending assay results.

| | |

| 13 |

Exploration Report – 3Q23 |  |

| | |

In 4Q23, a total of 2,050 meters of exploratory

drilling is planned with two rigs, including 1,500 meters at the Chaupijanca target and 550 meters at the El Padrino target. At the Chaupijanca

South target, we plan to investigate areas with favorable structures for mineralization that on the surface appear as lenticular bodies

of massive sulfides measuring 12.3 meters @11.06% Zn, 2.57% Pb, 3.05% Cu, and 437.93 g/t Ag.

Florida Canyon

There were no drilling activities at Florida

Canyon in 3Q23. Drilling began on the last business day of 3Q23. The delay in starting the drilling program was due to the lack of availability

of a helicopter contracted to mobilize drilling materials in early September. As a result, the entire drilling program in the project

was postponed until 4Q23. In September, construction and maintenance of the motorized trail, which aims to reach the La Florida Annex

also began, with a current progress of 25% opening. The completion of this activity is scheduled for November. The maintenance and opening

program aim to reduce logistical costs with the transportation of inputs and drilling equipment.

In 4Q23, we plan to drill 2,770 meters with

two rigs to test the southern extension of the current Florida Canyon Mineral Resources deposit.

| | |

| 14 |

Exploration Report – 3Q23 |  |

| | |

Namibia

During 3Q23, drilling activities focused

on the Deblin and Ondjondjo targets of the Namibia North project. Exploratory work in Namibia is targeting high-grade copper sediment

deposits along the fertile Tsumeb belt.

Otavi Project

No drilling activities were carried out

at the Otavi project during 3Q23. Geophysical survey was executed in strategic areas to support drilling activities in 2024.

Namibia North

Project

During 3Q23, drilling activity not only

continued to focus on the extensions of the known mineralization from the Deblin trend, but we also started exploratory drilling on new

targets along important copper trends in the belt. Exploratory work in Namibia is targeting high-grade copper sediment deposits along

the fertile OML (Otavi Mountainlands belt). A total of 2,887 meters of exploratory drilling was carried out during 3Q23, totaling 3,765

meters in 9M23.

In 3Q23, exploration drilling in Deblin

target performed 1,211 meters in three holes to test Deblin mineralization extension. NANAND000057 identified strong hydrothermal alteration

envelope along with visible copper displays, which suggests mineralization is still open to the west.

Still under the Deblin Exploratory License,

exploratory drilling started at the Ondjondjo target located only six kilometers from Deblin. During the period, a total of 949 meters

of exploratory drilling were carried out at this target, with NANAND000062 confirming evidence of polymetallic content (Cu-Zn-Pb). The

drillholes samples are pending assays results.

Additionally, as part of the project’s

exploratory drilling program, a second rig is currently drilling at the Otavi Valley target, which is located near the former Kombat mine

and several know copper prospects.

Note: Intervals with assays not reported

here have no consistent samples > 0.5% Copper or assay results are pending. True widths of the mineralized intervals are unknown at

this time. NSI refers to no significant intercept. PAR refers to pending assay results.

| | |

| 15 |

Exploration Report – 3Q23 |  |

| | |

We

will move forward with our drilling program in 4Q23, intensifying drilling with two rigs, to further investigate polymetallic mineralization

identified at the Ondjondjo target with 2,000 meters and to test prospective structures at the Otavi Valley target.

Note 1 – Laboratory

Reference

The laboratories used to test our assays

were: ALS Global for Brazil, Namibia, and Peruvian Greenfield and brownfield projects; Certimin S.A. for Cerro Lindo; and Inspectorate

Limited for El Porvenir.

Technical Information

Jose Antonio Lopes, MAusIMM (Geo): 224829,

a mineral resources manager, a qualified person for purposes of National Instrument 43-101 – Standards of Disclosure for Mineral

Projects and a Nexa employee, has approved the scientific and technical information contained in this news release.

Further information, including key assumptions,

parameters, and methods used to estimate Mineral Reserves and Mineral Resources of the mines and/or projects referenced in the tables

above can be found in the applicable technical reports, each of which is available at www.sedar.com under Nexa’s SEDAR profile.

About Nexa

Nexa is a large-scale, low-cost integrated

zinc producer with over 65 years of experience developing and operating mining and smelting assets in Latin America. Nexa currently owns

and operates five long-life mines - three located in the Central Andes of Peru and two located in the state of Minas Gerais in Brazil

- and it is ramping up Aripuanã, its sixth mine in Mato Grosso, Brazil. Nexa also currently owns and operates three smelters, two

located in Minas Gerais, Brazil and one in Peru, Cajamarquilla, which is the largest smelter in the Americas.

Nexa was among the top five producers

of mined zinc globally in 2022 and one of the top five metallic zinc producers worldwide in 2022, according to Wood Mackenzie.

| | |

| 16 |

Exploration Report – 3Q23 |  |

| | |

Cautionary Statement

on Forward-Looking Statements

This news release contains certain forward-looking

information and forward-looking statements as defined in applicable securities laws (collectively referred to in this news release as

“forward-looking statements”). All statements other than statements of historical fact are forward-looking statements. The

words “believe,” “will,” “may,” “may have,” “would,” “estimate,”

“continues,” “anticipates,” “intends,” “plans,” “expects,” “budget,”

“scheduled,” “forecasts” and similar words are intended to identify estimates and forward-looking statements.

Forward-looking statements are not guarantees and involve known and unknown risks, uncertainties and other factors which may cause the

actual results, performance or achievements of NEXA to be materially different from any future results, performance or achievements expressed

or implied by the forward-looking statements. Actual results and developments may be substantially different from the expectations described

in the forward-looking statements for a number of reasons, many of which are not under our control, among them, the activities of our

competition, the future global economic situation, weather conditions, market prices and conditions, exchange rates, and operational and

financial risks. The unexpected occurrence of one or more of the abovementioned events may significantly change the results of our operations

on which we have based our estimates and forward-looking statements. Our estimates and forward-looking statements may also be influenced

by, among others, legal, political, environmental or other risks that could materially affect the potential development of our projects,

including risks related to outbreaks of contagious diseases or health crises impacting overall economic activity regionally or globally.

These forward-looking statements related

to future events or future performance and include current estimates, predictions, forecasts, beliefs and statements as to management’s

expectations with respect to, but not limited to, the business and operations of the Company and mining production our growth strategy,

the impact of applicable laws and regulations, future zinc and other metal prices, smelting sales, CAPEX, expenses related to exploration

and project evaluation, estimation of mineral reserves and/or mineral resources, mine life and our financial liquidity.

Forward-looking statements are necessarily

based upon a number of factors and assumptions that, while considered reasonable and appropriate by management, are inherently subject

to significant business, economic and competitive uncertainties and contingencies and may prove to be incorrect. Statements concerning

future production costs or volumes are based on numerous assumptions of management regarding operating matters and on assumptions that

demand for products develops as anticipated, that customers and other counterparties perform their contractual obligations, full integration

of mining and smelting operations, that operating and capital plans will not be disrupted by issues such as mechanical failure, unavailability

of parts and supplies, labor disturbances, interruption in transportation or utilities, adverse weather conditions, and other COVID-19

related impacts, and that there are no material unanticipated variations in metal prices, exchange rates, or the cost of energy, supplies

or transportation, among other assumptions.

We assume no obligation to update forward-looking

statements except as required under securities laws. Estimates and forward-looking statements involve risks and uncertainties and do not

guarantee future performance, as actual results or developments may be substantially different from the expectations described in the

forward-looking statements. Further information concerning risks and uncertainties associated with these forward-looking statements and

our business can be found in our public disclosures filed under our profile on SEDAR+ (www.sedarplus.com) and on EDGAR (www.sec.gov).

For further information,

please contact:

Investor Relations Team

ir@nexaresources.com

| | |

| 17 |

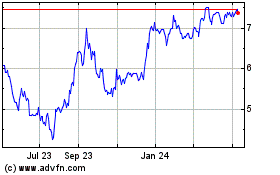

Nexa Resources (NYSE:NEXA)

Historical Stock Chart

From Mar 2024 to Apr 2024

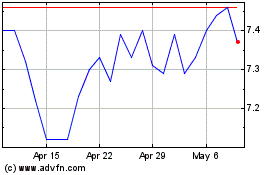

Nexa Resources (NYSE:NEXA)

Historical Stock Chart

From Apr 2023 to Apr 2024