U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE

ACT OF 1934

For the Month of February 2024

Nexa Resources S.A.

(Exact Name as Specified in its Charter)

N/A

(Translation of Registrant’s Name)

37A, Avenue J.F. Kennedy

L-1855, Luxembsourg

Grand Duchy of Luxembourg

(Address of principal executive offices)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark

if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark

if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

Indicate by check mark

whether by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked,

indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): Not applicable.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: February 21, 2024

| |

Nexa Resources S.A. |

| |

By:/s/ José Carlos del Valle |

| |

Name: José Carlos del Valle |

| |

Title: Senior Vice President

of Finance and Group Chief Financial Officer |

EXHIBIT INDEX

Nexa

Reports Fourth Quarter and Full Year 2023 Financial Results

Full Year Net Loss of US$289 million and Adjusted EBITDA of US$391 million

Luxembourg, February

21, 2024 – Nexa Resources S.A. (“Nexa Resources”, “Nexa”, or the “Company”)

announces today its results for the three and twelve-month periods ended December 31, 2023.

CEO Message – Ignacio

Rosado

“In 2023, we continued to focus on

increasing efficiency across our organization. We deployed several initiatives, which streamlined our cost base and supported our strategic

priorities. Significant effort was also made on overcoming the challenges we encountered in the ramp-up of our Aripuanã mine, which

is now firmly on track to reach nameplate capacity in mid-2024. We closed the year achieving operational guidance with strong financial

and operational discipline despite a very challenging environment. Metal production and sales were at the high-end and mid-range, respectively,

while mining and smelting costs were in line.

On the ESG front, we hold a strong belief

in our commitments, and we are confident that our ongoing efforts will catalyze our journey to a low-carbon, climate-resilient economy,

fostering a future where our business practices and products seamlessly coexist with the environment.

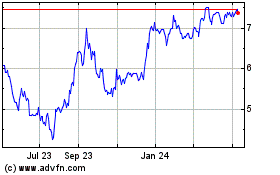

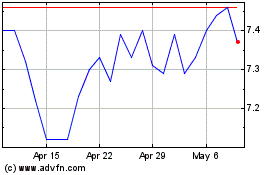

We expect 2024 will likely be another challenging

year for zinc price, due to a sluggish global economic growth, mainly driven by geopolitical instabilities and uncertainties about the

easing of monetary policy by central banks in key economies. However, we will remain focused on our priorities, including completing the

Aripuanã ramp-up, making meaningful progress in the Cerro Pasco integration project, maintaining discipline in capital allocation,

and aiming for continued operational efficiency and positive cash flow generation.

We firmly believe that the long-term

strong fundamentals of our business, together with the unique quality of our assets and the resilient performance culture we are developing

will allow us to continue to improve our performance in the coming years. With this aim in mind, we will keep focused on identifying and

capturing opportunities and strengthening our execution capabilities, advancing our sustainability agenda, and creating value for all

our stakeholders, including the communities in which we operate.”

Summary of Financial

Performance

| US$ million (except per share amounts) |

4Q23 |

3Q23 |

4Q22 |

2023 |

2022 |

| Net revenues |

630 |

649 |

780 |

2,573 |

3,034 |

| Gross profit |

69 |

67 |

84 |

296 |

639 |

| Net income (loss) |

(108) |

(63) |

(81) |

(289) |

76 |

| EBITDA (1) |

4 |

67 |

36 |

143 |

650 |

| Basic and diluted earnings (loss) per share ("EPS") |

(0.71) |

(0.56) |

(0.62) |

(2.18) |

0.37 |

| Adjusted net income (loss) (1) |

(7) |

(49) |

3 |

(41) |

187 |

| Adjusted EBITDA (1) |

105 |

82 |

120 |

391 |

760 |

| Adjusted basic and diluted earnings (loss) per share (1) |

(0.01) |

(0.43) |

(0.04) |

(0.41) |

1.14 |

| Cash provided by operating activities before working capital (1) (2) |

96 |

47 |

141 |

315 |

733 |

| Capex |

111 |

82 |

116 |

309 |

381 |

| Free cash flows (1) |

43 |

14 |

(20) |

(41) |

(246) |

| Total cash (3) |

468 |

422 |

516 |

468 |

516 |

| Net debt (1) |

1,269 |

1,242 |

1,161 |

1,269 |

1,161 |

| Net Debt/LTM Adj. EBITDA |

3.24x |

3.06x |

1.53x |

3.24x |

1.53x |

(1) Refer

to “Use of Non-IFRS Financial Measures” for further information. Adjusted EBITDA, adjusted net income (loss) and adjusted

EPS, exclude the items presented in the “Net income (loss) reconciliation to Adjusted EBITDA” section for further details

on page 16 of this earnings release. For details on segment definition and accounting policy, please refer to explanatory note 2 –

“Information by business segment” in the “Consolidated financial statements at December 31, 2023”.

(2) Working

capital had a positive impact of US$50 million in 4Q23, totaling US$101 million in 2023. Working capital in 4Q22 had a negative impact

of US$10 million, totaling negative US$235 million in 2022.

(3) Cash,

cash equivalents and financial investments.

Earnings Release 4Q23 and 2023 |  |

Executive Summary

Operational Performance

| § | Zinc production of 90kt in 4Q23 rose by 21% compared to 4Q22, mainly explained

by the increase in treated ore volume from all the mines and higher production at the Aripuanã mine. Compared with 3Q23, zinc production

increased by 3%, mainly due to the higher volumes from Cerro Lindo, Atacocha, and Morro Agudo, in addition to further production from

the Aripuanã ramp-up. |

| § | Run-of-mine mining cost in 4Q23 was US$48/t, up 3% from 4Q22, mainly

explained by higher operational costs and higher variable costs. Compared to 3Q23, run-of-mine mining cost was up 10% due to higher variable

costs. |

| § | Mining cash cost net of by-products[1]

in 4Q23 increased to US$0.45/lb compared to US$0.20/lb in 4Q22. This increase was

primarily due to lower by-products credits from our Peruvian mines with a negative impact of US$0.25/lb, higher operational costs explained

by mine development in Cerro Lindo and El Porvenir and higher TCs. Compared to 3Q23, cash cost was up US$0.10/lb due to lower by-products

credits from Cerro Lindo and higher operational costs. |

| § | The smelting segment delivered total production (zinc metal and oxide)

of 144kt in 4Q23, down 8% from 4Q22, mainly driven by lower volumes in Cajamarquilla and Três Marias. Compared to 3Q23, production

was down 4%, also impacted by lower volumes from these two smelters units. |

| § | In 4Q23, zinc metal and oxide sales were 143kt, down 14% from 4Q22 following

lower production volumes, in addition to a slowdown in demand, particularly for zinc oxide in the period. Compared to 3Q23, metal sales

were down 7%, explained by the aforementioned reasons. |

| § | Smelting conversion cost was US$0.29/lb in 4Q23 compared with US$0.25/lb

in 4Q22 explained by higher maintenance and energy costs, and FX impact, which were partially offset by lower personnel costs. Compared

to 3Q23, conversion cost was relatively flat. |

| § | Smelting cash cost1 was US$1.00/lb in 4Q23 compared to US$1.20/lb

in 4Q22. This decrease was driven by lower cost of raw materials explained by lower zinc prices, which was partially offset by lower by-products

contribution. Compared to 3Q23, cash cost decreased by US$0.01/lb. |

Financial Performance

| § | Net revenues in 4Q23 were US$630 million compared with US$780 million

in 4Q22. This decrease was mainly due to lower zinc prices and smelting sales volume. Compared to 3Q23, net revenues decreased by 3% due

to lower smelting sales volume, which was partially offset by higher zinc prices and higher mining production volumes. In 2023, net revenues

amounted to US$2,573 million, down by 15% compared to 2022 due to the aforementioned reasons. |

| § | In 4Q23, net loss was US$108 million, totaling US$289

million in 2023, resulting in basic and diluted loss per share of US$0.71 and

US$2.18, respectively. |

[1]

Our cash cost net of by-products credits is measured with respect to zinc sold.

| 2 |

Earnings Release 4Q23 and 2023 |  |

| § | Adjusted EBITDA[2]

in 4Q23 was US$105 million, compared with US$120 million in 4Q22 and US$82 million

in 3Q23. Compared to 4Q22, the decrease was mainly driven by lower smelting sales volume and zinc prices (zinc down by 17%). Compared

to 3Q23, the increase was due to higher zinc LME prices, partially offset by lower smelting sales volume. In 2023, Adjusted EBITDA amounted

to US$391 million, down by 49% compared to 2022, mainly due to lower LME metal prices, the impact of Aripuanã’s ramp-up and

lower smelting sales volume. |

| § | Adjusted EBITDA for the mining segment in 4Q23 was US$47 million compared

with US$40 million in 3Q23. This increase was mainly driven by higher volumes from Cerro Lindo and higher zinc prices. Compared to 4Q22,

Adjusted EBITDA decreased by 40%. |

| § | In 2023, Adjusted EBITDA for the mining segment totaled US$149 million,

down 66% compared to US$440 million in 2022, mainly driven by lower zinc prices and the impact of the Aripuanã’s ramp-up. |

| § | Adjusted EBITDA for the smelting segment in 4Q23 was US$58 million compared

with US$49 million in 3Q23. This increase was mainly driven by higher zinc prices, positive raw material inventory effect (higher inventory

consumption in addition to lower raw material costs) and higher by-products contribution, which were partially offset by lower sales volume.

Compared to 4Q22, Adjusted EBITDA increased by 27%. |

| § | In 2023, Adjusted EBITDA for the smelting segment was US$247 million,

down 24% compared to 2022, mainly due to lower zinc prices and sales volume, as well as higher operating costs. |

| § | Adjusted

net loss in 4Q23, was US$7 million, totaling US$41 million in 2023. Adjusted net loss attributable

to Nexa’s shareholders was US$1 million in 4Q23 and US$54 million in 2023, resulting in adjusted

basic and diluted loss per share of US$0.01 and US$0.41, respectively. Refer to our “Net

income (loss)” section for further details. |

Financial Position,

Investments and Financing

| § | Total cash[3]

at December 31, 2023, was US$468 million compared to US$516 million at December 31,

2022. Our available liquidity in 4Q23 remained at US$788 million, including our undrawn sustainability-linked revolving credit facility

of US$320 million. |

| § | At December 31, 2023, our free cash flow was negative US$41 million,

impacted by the reasons explained above and partially offset by the positive impact of working capital variations of US$101 million, as

a result of initiatives deployed throughout the year relating to inventories levels, as well as trade account receivables payment terms.

Our investments in sustaining CAPEX (including HS&E investments) amounted to US$309 million, including US$80 million related to Aripuanã.

Refer to our “Net cash flows from operating activities excluding working capital variations and free cash flow - Reconciliation”

section for further details. |

| § | Net debt to Adjusted EBITDA ratio for the last twelve months (“LTM”)

increased to 3.24x compared with 3.06x at the end of September 2023 and 1.53x at the end of 4Q22. This increase was mainly explained by

lower LTM Adjusted EBITDA, impacted by the reasons explained above. Total debt slightly increased due to a new US$50 million export financing

line effective in 4Q23. |

Environmental,

Social and Governance (“ESG”) and Corporate Highlights

| § | During 2023, we advanced the waste dry disposal system on an industrial

scale at our Três Marias smelting unit, which consists of filtering the waste pulp for subsequent disposal through the dry stacking

process, as waste disposal in this unit was going directly to its tailings deposit. The initiative achieved excellent results, filtering

an average of 74% of the operation’s material throughout the year. In December 2023, filtration reached more than 90%. And from

2024 onwards, we expect filtration to reach between 95% and 100%. |

[2]

Adjusted EBITDA exclude the items presented in the “Net income (loss) reconciliation to Adjusted EBITDA” section on page 16

of this earnings release – US$101 million in 4Q23, totaling US$248 million in 2023.

[3]

Cash and cash equivalents and financial investments.

| 3 |

Earnings Release 4Q23 and 2023 |  |

| § | In 2Q23, we obtained the authorization from the Regional Superintendence

for the Environment of the State of Minas Gerais to use biofuel to replace fossil fuels, used in all 47 furnaces in the zinc oxide operation

in Três Marias. At the end of 2023, we achieved our goal for the year, to expand the use of biofuel to 12 furnaces. This initiative

supports our goal to reduce scope 1 CO2 emissions by 20% until 2030. |

| § | In July 2023, we registered our carbon emissions on “LMEpassport”,

the London Metal Exchange platform which promotes sustainability and transparency across the base metals sector. Nexa’s zinc production

has one of the lowest carbon footprints recorded in the sector, with an emission intensity of 0.36 tons of CO2 equivalent (scopes 1 and

2) according to the GHG protocol methodology, an achievement that positions Nexa as a global leader in carbon reduction within the zinc

industry. |

| § | In September 2023, Nexa was recognized as a leader in Social Governance

and awarded “Company of the Year - Mining Sector 2023” by Brasil Mineral (a Brazilian magazine specializing in the mining

sector). This recognition was partly in acknowledgement of our training program for 1,987 people in Aripuanã, which focused in

giving support to participants to get back into the job market. |

| § | In October 2023, Nexa announced the successful closing of a US$320 million

sustainability-linked revolving credit facility. The applicable margin is subject to compliance with carbon reduction key performance

indicators, reflecting the company's unwavering commitment to reducing its carbon footprint. Such efforts are consistent with Nexa's ESG

ambitions, targeting net-zero greenhouse gas emissions by 2050, in alignment with the Paris Agreement. |

| § | Also in October 2023, Nexa delivered school material kits to more than

2,700 students from schools in the Cajamarquilla region, from kindergarten to high school. This initiative aims to foster local development

and contribute to the academic degree of children, embracing our commitment to quality education. |

| § | In 4Q23, Nexa carried out medical services campaigns benefiting more

than 1,600 individuals in the Cerro Pasco region in Peru, focusing on vulnerable groups such as children and the elderly. These campaigns

offered General Medicine, Geriatrics, Pediatrics, Gynecology, Dentistry, Ultrasound, Nutrition, Psychology, Laboratory, and Pharmacy.

Our support of these medical initiatives reaffirm our commitment to enhance the quality of life and health of the communities in the areas

where we operate. |

| § | In February 2024, CDP (“Carbon Disclosure Project”)

concluded its 2023 evaluation for the cycle of the year 2022 and announced that our rating in the Climate Change questionnaire was

upgraded, changing from C to B. This result reflects the efforts, disclosure, and transparency of Nexa related to governance,

strategy, risk management, metrics, and targets. |

| § | Nexa declared in February 2023 and paid in March 2023 a distribution

to Nexa’s shareholders of US$25 million in respect of fiscal 2023. Given current low zinc price scenario, Nexa will evaluate and

may consider a dividend payment for fiscal 2024 subject to market conditions and Company’s performance. |

| § | In April 2023, Ms. Renata Penna was promoted to the position of Vice

President of Legal & Governance at Nexa. Ms. Penna joined Nexa as Chief Legal Counsel and Head of Governance in 2017. Nexa is committed

to continue strengthening its leadership, aligned with its business strategy and objectives towards an efficient organization, promoting

a more collaborative, ethical and diverse culture. |

| § | In September 2023, Fitch Ratings affirmed its 'BBB-' rating and 'stable'

outlook for Nexa. |

| § | In December 2023, S&P changed Nexa’s rating and outlook from

'BB+' 'positive' to 'BBB-' 'stable', upgrading the company to investment grade level. |

| § | In January 2024, S&P has affirmed its ' BBB-' rating and 'stable'

outlook for Nexa, while Moody’s has affirmed its 'Ba2' rating and changed Nexa’s outlook from 'stable' to 'negative'. |

| 4 |

Earnings Release 4Q23 and 2023 |  |

Growth Strategy

and Asset Portfolio

§

We remain focused on free cash flow generation and continue to evaluate our capital allocation

framework, which includes priorities related to ESG and HS&E, while ensuring that Nexa’s capital is appropriately allocated

to the highest return assets.

§

The strategic review of our assets continues with initiatives to optimize the portfolio. We continue

to assess risk-return alternatives for our Magistral copper project in Peru and for our Morro Agudo mine in Brazil.

§

In 4Q23, we continued to advance the technical studies of the Pasco Integration project. As previously

mentioned, this project is expected to develop a robust organic growth option for Nexa. Technical studies cover a range of work, from

mine planning to major projects to sustain and expand production, such as mine design and studies for underground interconnection, shaft

upgrade and plant engineering assessment, as well as key routes to improve capacity to provide a long-term solution for tailings storage

facilities (“TSF”). Furthermore, we continue to advance with the necessary environmental studies and permits. We expect to

start and complete the project approval process with our technical committee and board of directors in 2024.

2023 Results and

Guidance

Production, Sales

and Cash Cost Guidance

As

previously disclosed in our press release dated February 01, 2024, we reported

solid 2023 operational results, and provided our production and metal sales guidance for the three-year period 2024-2026, as well as

cash costs, capital expenditures and other operating expenses guidance for 2024.

| § | 2023 mining production guidance was achieved, with all metals in the

upper range of the guidance. Zinc production totaled 333kt in 2023. Cerro Lindo and Morro Agudo mines achieved the upper range of the

guidance, while El Porvenir and Vazante mines exceeded the annual guidance, and Atacocha mine was slightly below the lower range. Aripuanã

reached the middle range of the guidance (following the guidance revision disclosed in October 2023). |

| § | We achieved the upper range of the annual guidance for copper, lead,

and silver production of 33kt, 65kt and 10MMoz, respectively. |

Mining segment – production

| Mining production |

|

2023 |

|

Guidance 2023 |

| (Metal in concentrate) |

|

| |

|

|

|

|

|

|

|

| Zinc |

kt |

|

333 |

|

299 |

- |

334 |

| Cerro Lindo |

|

|

78 |

|

69 |

- |

79 |

| El Porvenir |

|

|

56 |

|

51 |

- |

55 |

| Atacocha |

|

|

8.2 |

|

9 |

- |

11 |

| Vazante |

|

|

146 |

|

131 |

- |

144 |

| Morro Agudo |

|

|

23 |

|

17 |

- |

23 |

| Aripuanã |

|

|

22 |

|

20 |

- |

23 |

| |

|

|

|

|

|

|

|

| Copper |

kt |

|

33 |

|

29 |

- |

33 |

| Cerro Lindo |

|

|

29 |

|

25 |

- |

28 |

| El Porvenir |

|

|

0.4 |

|

0.2 |

- |

0.3 |

| Aripuanã |

|

|

4.4 |

|

4.2 |

- |

5.0 |

| |

|

|

|

|

|

|

|

| Lead |

kt |

|

65 |

|

53 |

- |

65 |

| Cerro Lindo |

|

|

13 |

|

11 |

- |

13 |

| El Porvenir |

|

|

25 |

|

20 |

- |

26 |

| Atacocha |

|

|

11 |

|

10 |

- |

12 |

| Vazante |

|

|

1.4 |

|

1.1 |

- |

1.2 |

| Morro Agudo |

|

|

8.3 |

|

4.9 |

- |

6.1 |

| Aripuanã |

|

|

6.3 |

|

5.7 |

- |

6.9 |

| |

|

|

|

|

|

|

|

| Silver |

MMoz |

|

10 |

|

9.1 |

- |

10 |

| Cerro Lindo |

|

|

3.5 |

|

3.5 |

- |

3.8 |

| El Porvenir |

|

|

4.3 |

|

3.7 |

- |

4.5 |

| Atacocha |

|

|

1.4 |

|

1.0 |

- |

1.2 |

| Vazante |

|

|

0.6 |

|

0.3 |

- |

0.4 |

| Aripuanã |

|

|

0.5 |

|

0.4 |

- |

0.5 |

| 5 |

Earnings Release 4Q23 and 2023 |  |

Smelting segment – sales

| Smelting sales |

|

2023 |

|

Guidance 2023 |

| |

|

|

|

|

|

|

|

| Metal Sales |

kt |

|

590 |

|

580 |

- |

605 |

| Zinc metal |

|

|

556 |

|

545 |

- |

565 |

| Zinc oxide |

|

|

34 |

|

35 |

- |

40 |

Metal

sales of 590kt in 2023 achieved the middle range of the annual guidance driven by lower production volumes of our smelters compared to

2022, in addition to overall lower demand. Zinc metal sales of 556kt were also in the middle range of the guidance, while zinc oxide sales

of 34kt were slightly below the lower range, mainly explained by a slowdown in domestic demand.

Cash Costs

| Mining Operating costs |

|

Cost ROM

(US$/t) |

|

Cash Cost

(US$/lb) |

|

Cost ROM

(US$/t) |

|

Cash Cost

(US$/lb) |

| |

|

|

|

| |

2023 |

|

2023 |

|

2023e |

|

2023e |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Mining (1) |

|

45.2 |

|

0.40 |

|

43.9 |

- |

46.4 |

|

0.35 |

- |

0.38 |

| Cerro Lindo |

|

40.6 |

|

(0.06) |

|

40.1 |

- |

42.1 |

|

(0.12) |

- |

(0.10) |

| El Porvenir |

|

62.8 |

|

0.29 |

|

57.3 |

- |

60.7 |

|

0.26 |

- |

0.28 |

| Atacocha |

|

32.9 |

|

(0.44) |

|

33.1 |

- |

35.4 |

|

(0.45) |

- |

(0.38) |

| Vazante |

|

57.1 |

|

0.61 |

|

57.2 |

- |

59.0 |

|

0.59 |

- |

0.65 |

| Morro Agudo |

|

37.9 |

|

0.82 |

|

35.0 |

- |

38.2 |

|

0.80 |

- |

0.94 |

(1) C1 Weighted Cash cost net

of by-products credits is measured with respect to zinc sold per mine.

| Smelting Operating costs |

|

Conversion cost

(US$/lb) |

|

Cash Cost

(US$/lb) |

|

Conversion cost

(US$/lb) |

|

Cash Cost

(US$/lb) |

| |

|

|

|

| |

2023 |

|

2023 |

|

2023e |

|

2023e |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Smelting (2) |

|

0.30 |

|

1.10 |

|

0.29 |

- |

0.32 |

|

1.07 |

- |

1.12 |

| Cajamarquilla |

|

0.28 |

|

1.03 |

|

0.27 |

- |

0.29 |

|

1.04 |

- |

1.08 |

| Três Marias |

|

0.26 |

|

1.16 |

|

0.27 |

- |

0.30 |

|

1.08 |

- |

1.13 |

| Juiz de Fora |

|

0.50 |

|

1.21 |

|

0.45 |

- |

0.49 |

|

1.19 |

- |

1.28 |

(2) C1 Weighted Cash cost net

of by-products credits is measured with respect to zinc sold per smelter.

| 6 |

Earnings Release 4Q23 and 2023 |  |

| § | In 2023, run-of-mine mining costs of US$45.2/t was in line with our

2023 guidance, and C1 cash cost of US$0.40/lb, was slightly higher than our 2023 guidance. For further information, please see the section

“Business performance – Mining segment”. |

| § | Smelting C1 cash cost of US$1.10/lb and Conversion cost of US$0.30/lb

in 2023 were in line with our 2023 guidance. For further information, please see the section “Business performance – Smelting

segment”. |

Capital Expenditures

(“CAPEX”) Guidance

| § | Nexa invested US$111 million in 4Q23, totaling US$309

million in 2023. Of this amount, 95% of the investment was classified

as sustaining, which includes CAPEX to sustain operations, HS&E and mine development. |

| § | At Aripuanã, sustaining and HS&E CAPEX in 4Q23 accounted

for US$28 million, totaling US$80 million in 2023. Of this amount, US$6 million was invested in mine development in the quarter, totaling

US$23 million in 2023. |

| § | The appreciation of the Brazilian real against the U.S. dollar had a

negative impact of US$1.7 million in the quarter, totaling a negative impact of US$5.4 million in 2023. |

| CAPEX |

|

2023 |

|

Guidance 2023 |

| (US$ million) |

|

|

| Non-Expansion |

|

316 |

|

303 |

| Sustaining (1) |

|

293 |

|

268 |

| HS&E |

|

16 |

|

26 |

| Others (2) |

|

7 |

|

10 |

| |

|

|

|

|

| Expansion projects (3) |

|

4 |

|

7 |

| Reconciliation to Financial Statements (4) |

|

(11) |

|

- |

| TOTAL |

|

309 |

|

310 |

(1) Investments

in tailing dams are included in sustaining expenses.

(2) Modernization,

IT and others.

(3) Including

Vazante deepening, among other several projects to improve operational performance.

(4) The

amounts are mainly related to capitalization of interest net of advanced payments for imported materials and tax credits.

Exploration &

Project Evaluation and Other Expenses Guidance

| § | In 4Q23, we invested US$24 million in exploration and project evaluation,

totaling US$92 million in 2023. This was US$8 million below our guidance due to our optimization initiatives throughout the year. |

| § | In addition, we have invested US$7 million in technology, related to

projects to improve our current operations and US$13 million to continue contributing to the social and economic development of our host

communities. |

| § | As part of our long-term strategy, we will maintain our efforts to replace

and increase mineral reserves and resources. We expect to continue advancing with exploration activities, primarily focusing on identifying

new ore bodies and upgrading resources classification through infill drilling campaigns. |

| 7 |

Earnings Release 4Q23 and 2023 |  |

| Other Operating Expenses |

|

2023 |

|

Guidance 2023 |

| (US$ million) |

|

|

| Exploration |

|

57 |

|

49 |

| Mineral Exploration |

|

39 |

|

30 |

| Mineral rights |

|

5 |

|

5 |

| Sustaining (mine development) |

|

14 |

|

14 |

| |

|

|

|

|

| Project Evaluation |

|

35 |

|

50 |

| Três Marias Project |

|

14 |

|

15 |

| |

|

|

|

|

| Exploration & Project Evaluation |

|

92 |

|

100 |

| |

|

|

|

|

| Other |

|

21 |

|

20 |

| Technology |

|

7 |

|

6 |

| Communities |

|

13 |

|

14 |

Note: Exploration and project evaluation expenses

consider several stages of development, from mineral potential definition, R&D, and subsequent scoping and pre-feasibility studies

(FEL1 and FEL2).

| 8 |

Earnings Release 4Q23 and 2023 |  |

Guidance 2024-2026

As

previously disclosed in our press release dated February 01, 2024, we announced

our 2023 operational results, and provided our production and metal sales guidance for the three-year period 2024-2026, as well as our

cash costs, capital expenditures and other operating expenses guidance for 2024.

Guidance is based on several assumptions

and estimates and is subject to the continuous evaluation of several factors, including but not limited to metal prices; operational performance;

maintenance and input costs; and exchange rates.

Nexa will continue to monitor risks associated

with global supply chain disruptions, which could be exacerbated, among other factors, by the ongoing Russia-Ukraine war, the Israel-Hamas

conflict, unusual weather conditions, the global recession, and its potential impact on the demand for our products, inflationary cost

pressure, metal prices, community protests, and changes to the political situation or regulatory frameworks in the countries in which

we operate that could affect our production levels and our costs. Refer to “Risks and Uncertainties” and “Cautionary

Statement on Forward-Looking Statements” for further information.

Mining Segment

| Mining production |

|

2023 |

|

2024e |

|

2025e |

|

2026e |

| (Metal in concentrate) |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Zinc |

kt |

|

333 |

|

323 |

- |

381 |

|

326 |

- |

381 |

|

330 |

- |

378 |

| Cerro Lindo |

|

|

78 |

|

73 |

- |

86 |

|

78 |

- |

86 |

|

82 |

- |

94 |

| El Porvenir |

|

|

56 |

|

51 |

- |

57 |

|

59 |

- |

72 |

|

43 |

- |

50 |

| Atacocha |

|

|

8 |

|

8 |

- |

9 |

|

9 |

- |

11 |

|

17 |

- |

20 |

| Vazante |

|

|

146 |

|

130 |

- |

148 |

|

122 |

- |

139 |

|

121 |

- |

140 |

| Morro Agudo |

|

|

23 |

|

18 |

- |

23 |

|

- |

- |

- |

|

- |

- |

- |

| Aripuanã |

|

|

22 |

|

42 |

- |

57 |

|

58 |

- |

72 |

|

67 |

- |

75 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Copper |

kt |

|

33 |

|

30 |

- |

35 |

|

28 |

- |

35 |

|

24 |

- |

29 |

| Cerro Lindo |

|

|

29 |

|

24 |

- |

28 |

|

24 |

- |

28 |

|

19 |

- |

23 |

| El Porvenir |

|

|

0.4 |

|

0.2 |

- |

0.3 |

|

0.4 |

- |

0.5 |

|

0.3 |

- |

0.4 |

| Aripuanã |

|

|

4.4 |

|

5.7 |

- |

7.3 |

|

4.1 |

- |

5.9 |

|

4.4 |

- |

6.4 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Lead |

kt |

|

65 |

|

66 |

- |

82 |

|

67 |

- |

78 |

|

71 |

- |

83 |

| Cerro Lindo |

|

|

13 |

|

11 |

- |

13 |

|

12 |

- |

13 |

|

9.5 |

- |

11 |

| El Porvenir |

|

|

25 |

|

23 |

- |

28 |

|

23 |

- |

24 |

|

24 |

- |

28 |

| Atacocha |

|

|

11 |

|

11 |

- |

12 |

|

12 |

- |

15 |

|

15 |

- |

17 |

| Vazante |

|

|

1.4 |

|

1.0 |

- |

1.4 |

|

1.0 |

- |

1.2 |

|

1.0 |

- |

1.1 |

| Morro Agudo |

|

|

8.3 |

|

4.3 |

- |

6.6 |

|

- |

- |

- |

|

- |

- |

- |

| Aripuanã |

|

|

6.3 |

|

16 |

- |

20 |

|

19 |

- |

24 |

|

22 |

- |

25 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Silver |

MMoz |

|

10 |

|

11 |

- |

13 |

|

11 |

- |

13 |

|

11 |

- |

13 |

| Cerro Lindo |

|

|

3.5 |

|

4.0 |

- |

4.2 |

|

3.7 |

- |

4.0 |

|

2.6 |

- |

3.0 |

| El Porvenir |

|

|

4.3 |

|

4.6 |

- |

5.4 |

|

4.3 |

- |

4.7 |

|

4.8 |

- |

5.7 |

| Atacocha |

|

|

1.4 |

|

1.1 |

- |

1.2 |

|

1.2 |

- |

1.5 |

|

1.2 |

- |

1.4 |

| Vazante |

|

|

0.6 |

|

0.3 |

- |

0.5 |

|

0.3 |

- |

0.4 |

|

0.4 |

- |

0.4 |

| Aripuanã |

|

|

0.5 |

|

1.0 |

- |

1.5 |

|

1.5 |

- |

1.9 |

|

1.7 |

- |

2.2 |

| 9 |

Earnings Release 4Q23 and 2023 |  |

Smelting Segment

| Smelting sales |

|

2023 |

|

2024e |

|

2025e |

|

2026e |

| |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Zinc metal |

kt |

|

556 |

|

545 |

- |

565 |

|

545 |

- |

565 |

|

545 |

- |

565 |

| Cajamarquilla |

|

|

326 |

|

315 |

- |

325 |

|

315 |

- |

325 |

|

315 |

- |

325 |

| Três Marias |

|

|

147 |

|

155 |

- |

160 |

|

155 |

- |

160 |

|

155 |

- |

160 |

| Juiz de Fora |

|

|

82 |

|

75 |

- |

80 |

|

75 |

- |

80 |

|

75 |

- |

80 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Zinc oxide |

kt |

|

34 |

|

35 |

- |

40 |

|

35 |

- |

40 |

|

35 |

- |

40 |

| Três Marias |

|

|

34 |

|

35 |

- |

40 |

|

35 |

- |

40 |

|

35 |

- |

40 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Metal Sales |

kt |

|

590 |

|

580 |

- |

605 |

|

580 |

- |

605 |

|

580 |

- |

605 |

2024 Cash Costs

| Mining Operating costs |

|

Cost ROM

(US$/t) |

|

Cash Cost

(US$/lb) |

|

Cost ROM

(US$/t) |

|

Cash Cost

(US$/lb) |

| |

|

|

|

| |

2023 |

|

2023 |

|

2024e |

|

2024e |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Mining (1) |

|

45.2 |

|

0.40 |

|

44.0 |

- |

51.4 |

|

0.23 |

- |

0.42 |

| Cerro Lindo |

|

40.6 |

|

(0.06) |

|

41.0 |

- |

45.0 |

|

(0.22) |

- |

0.03 |

| El Porvenir |

|

62.8 |

|

0.29 |

|

58.4 |

- |

71.6 |

|

(0.02) |

- |

0.25 |

| Atacocha |

|

32.9 |

|

(0.44) |

|

34.3 |

- |

43.2 |

|

(0.27) |

- |

(0.02) |

| Vazante |

|

57.1 |

|

0.61 |

|

55.8 |

- |

63.6 |

|

0.52 |

- |

0.60 |

| Morro Agudo |

|

37.9 |

|

0.82 |

|

27.9 |

- |

40.0 |

|

0.80 |

- |

1.24 |

(1) C1 Weighted Cash cost net of

by-products credits is measured with respect to zinc sold per mine.

Note: Consolidated cash costs do not include

Aripuanã. Given we are expecting Aripuanã’s ramp-up to be completed in mid-2024, we are not providing guidance at

this time.

| Smelting Operating costs |

|

Conversion cost

(US$/lb) |

|

Cash Cost

(US$/lb) |

|

Conversion cost

(US$/lb) |

|

Cash Cost

(US$/lb) |

| |

|

|

|

| |

2023 |

|

2023 |

|

2024e |

|

2024e |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Smelting (2) |

|

0.30 |

|

1.10 |

|

0.29 |

- |

0.32 |

|

1.07 |

- |

1.18 |

| Cajamarquilla |

|

0.28 |

|

1.03 |

|

0.29 |

- |

0.32 |

|

1.02 |

- |

1.13 |

| Três Marias |

|

0.26 |

|

1.16 |

|

0.25 |

- |

0.27 |

|

1.12 |

- |

1.23 |

| Juiz de Fora |

|

0.50 |

|

1.21 |

|

0.38 |

- |

0.42 |

|

1.17 |

- |

1.28 |

(2) C1 Weighted Cash cost net

of by-products credits is measured with respect to zinc sold per smelter.

2024 CAPEX

| CAPEX |

|

Guidance 2024 |

| (US$ million) |

|

| Non-Expansion |

|

307 |

| Sustaining (1) |

|

261 |

| HS&E |

|

24 |

| Others (2) |

|

21 |

| |

|

|

| Expansion projects (3) |

|

4 |

| TOTAL |

|

311 |

(1) Investments in tailing

dams are included in sustaining expenses.

| 10 |

Earnings Release 4Q23 and 2023 |  |

(2) Modernization, IT and others.

(3) Includes Vazante deepening

(US$2.4 million), among other several projects to improve operational performance.

2024 Exploration &

Project Evaluation and Other Expenses

| Other Operating Expenses |

|

Guidance 2024 |

| (US$ million) |

|

| Exploration |

|

58 |

| Mineral Exploration |

|

42 |

| Mineral rights |

|

6 |

| Sustaining (mine development) |

|

10 |

| |

|

|

| Project Evaluation |

|

14 |

| |

|

|

| Exploration & Project Evaluation |

|

72 |

| |

|

|

| Other |

|

21 |

| Technology |

|

4 |

| Communities |

|

17 |

Note: Exploration and project evaluation expenses

consider several stages of development, from mineral potential definition, R&D, and subsequent scoping and pre-feasibility studies

(FEL1 and FEL2).

| 11 |

Earnings Release 4Q23 and 2023 |  |

Earnings Release

4Q23 and 2023

This Earnings Release should be read

in conjunction with the “Consolidated financial statements at December 31, 2023”. This document contains forward-looking statements.

Table of contents

| Consolidated performance |

13 |

| Business performance – Mining |

19 |

| Business performance – Smelting |

31 |

| Liquidity and Indebtedness |

39 |

| Cash flows |

41 |

| Others |

42 |

| Market scenario |

44 |

| Risks and Uncertainties |

46 |

| Use of Non-IFRS Financial Measures |

47 |

| Cautionary Statement on Forward-Looking Statements |

49 |

| Appendix |

51 |

UPCOMING EVENT

Earnings Conference

Call

Date: Thursday, February 22, 2024

– 9:00am (EST)

Dial In

US: +1-833-816-1265

Canada: +1-647-484-8814

Brazil: +55 11 3181-8565

International: +1-412-317-5635

Conference ID: Nexa Resources

Live audio webcast with slide presentation

will be available on:

https://ir.nexaresources.com

| 12 |

Earnings Release 4Q23 and 2023 |  |

Consolidated performance

Selected financial

information

US$ million

(except where otherwise indicated) |

4Q23 |

3Q23 |

4Q22 |

2023 |

2022 |

| |

|

|

|

|

|

| Net Revenues |

630 |

649 |

780 |

2,573 |

3,034 |

| Mining |

282 |

273 |

315 |

1,090 |

1,248 |

| Smelting |

454 |

484 |

606 |

1,947 |

2,467 |

| Intersegment results | Adjustments |

(106) |

(107) |

(142) |

(464) |

(681) |

| |

|

|

|

|

|

| Cost of Sales |

(561) |

(583) |

(696) |

(2,277) |

(2,395) |

| Mining |

(283) |

(246) |

(303) |

(1,028) |

(905) |

| Current Operations |

(233) |

(203) |

(228) |

(833) |

(830) |

| Aripuanã |

(51) |

(43) |

(75) |

(195) |

(75) |

| Smelting |

(404) |

(439) |

(543) |

(1,727) |

(2,191) |

| Intersegment results | Adjustments |

126 |

102 |

150 |

478 |

701 |

| |

|

|

|

|

|

| Selling, general and administrative |

(33) |

(33) |

(41) |

(127) |

(146) |

| Mining |

(16) |

(16) |

(15) |

(62) |

(64) |

| Smelting |

(15) |

(15) |

(16) |

(61) |

(60) |

| Intersegment results | Adjustments |

(1) |

(2) |

(10) |

(4) |

(21) |

| |

|

|

|

|

|

| Depreciation and amortization |

83 |

72 |

78 |

298 |

291 |

| Mining |

63 |

51 |

59 |

220 |

205 |

| Smelting |

20 |

20 |

18 |

78 |

79 |

| Intersegment results | Adjustments |

(0) |

0 |

1 |

1 |

8 |

| |

|

|

|

|

|

| Adjusted EBITDA (1) |

105 |

82 |

120 |

391 |

760 |

| Mining |

47 |

40 |

78 |

149 |

440 |

| Smelting |

58 |

49 |

46 |

247 |

326 |

| Intersegment results | Adjustments |

(1) |

(7) |

(4) |

(5) |

(6) |

| Adj. EBITDA margin (%) |

16.7% |

12.6% |

15.4% |

15.2% |

25.1% |

| |

|

|

|

|

|

| Net income (loss) |

(108) |

(63) |

(81) |

(289) |

76 |

| Attributable to Nexa's shareholders |

(93) |

(74) |

(82) |

(289) |

49 |

| Attributable to non-controlling interests |

(14) |

10 |

0 |

0 |

27 |

| |

|

|

|

|

|

| Basic and diluted earnings (loss) per share |

(0.71) |

(0.56) |

(0.62) |

(2.18) |

0.37 |

| |

|

|

|

|

|

| Adjusted net income (loss) (1) |

(7) |

(49) |

3 |

(41) |

187 |

| Attributable to Nexa's shareholders |

(1) |

(57) |

(6) |

(54) |

151 |

| Attributable to non-controlling interests |

(6) |

8 |

9 |

13 |

35 |

| |

|

|

|

|

|

| Adjusted basic and diluted earnings (loss) per share (1) |

(0.01) |

(0.43) |

(0.04) |

(0.41) |

1.14 |

(1) Refer to “Use of Non-IFRS Financial

Measures” for further information. Adjusted EBITDA, adjusted net income (loss) and adjusted EPS, exclude the items presented in

the “Net income (loss) reconciliation to Adjusted EBITDA” section for further details on page 16 of this earnings release.

For details on segment definition and accounting policy, please refer to explanatory note 2 – “Information by business segment”

in the “Consolidated financial statements at December 31, 2023”.

| 13 |

Earnings Release 4Q23 and 2023 |  |

Net revenues

In 4Q23, net revenues were US$630 million,

19% lower year-over-year, primarily due to lower zinc prices and lower smelting sales volume. The LME average price for zinc was down

by 17%, while copper and lead rose by 2% and 1%, respectively, compared to the same period in 2022 – for more information on metal

prices, refer to the “Market Scenario” section.

Compared to 3Q23, net revenues decreased

by 3%, mainly due to lower smelting sales volume, which was partially offset by higher zinc prices and higher mining production volumes.

In 2023, net revenues amounted to US$2,573

million, down by 15% compared to 2022, as a result of lower zinc prices with a negative impact of US$491 million based on our sales volumes

of 590kt in 2023 and the average zinc price difference of US$832/t between 2023 and 2022, lower copper prices of US$11 million, and lower

smelting sales volume of US$92 million, which was partially offset by higher mining production volumes of US$18 million due to higher

copper and lead sales.

Cost of Sales

In 4Q23, cost of sales amounted to US$561

million, down by 19% year-over-year, mainly due to lower zinc prices, positively impacting our smelting raw material purchase, and lower

smelting sales, which were partially offset by higher mining sales volumes driving overall higher cost of sales for the mining segment.

Compared to 3Q23, cost of sales decreased by 4% explained by lower smelting sales volume, which was partially offset by higher zinc prices,

impacting the purchase of the zinc concentrate in our smelting segment, and higher mining sales volumes.

In 2023, cost of sales amounted to US$2,277

million, down by 5% compared to 2022, mainly due to lower smelting production and, consequently, sales, and zinc prices, positively impacting

the purchase of the zinc concentrate in our smelting segment, partially offset by higher mining production volumes.

Mineral exploration

and project evaluation

In 4Q23, mineral exploration and project

evaluation investments were US$24 million, compared to US$23 million in 4Q22. In 2023, mineral exploration and project evaluation investment

amounted to US$92 million.

For additional information about our

exploration results in the fourth quarter and full year 2023, please refer to our 4Q23 and 2023 Exploration Report published on February

08, 2024.

SG&A

In 4Q23, SG&A expenses of US$33 million

were down by 20% compared to 4Q22, mainly driven by lower commercial expenses, partially offset by higher third-party services in support

areas, and decreased by 1% when compared to 3Q23. In 2023, SG&A expenses amounted to US$127 million,

down by 13% compared to 2022, partially a result of our organizational redesign that occurred in 2022 and lower third-party services in

support areas.

Adjusted EBITDA

In 4Q23, Adjusted EBITDA was US$105 million

compared with US$120 million in 4Q22. The main factors that contributed to this decrease were (i) lower smelting sales volume of US$21

million; (ii) the negative net price effect of US$14 million, primarily related to lower LME metal prices; (iii) lower by-products contribution

of US$12 million, primarily related to lower payable value of sulphuric acid, lower copper and lead prices, partially offset by higher

copper and lead sales volumes, particularly in Aripuanã; and (iv) the negative impact of FX variation of US$9 million, which was

partially offset by (v) the positive net impact of US$24 million in costs, mainly due to higher zinc concentrate volumes from our own

mines, higher TCs applied to concentrate purchases from third-parties and a better smelting raw material mix consumption, partially offset

by higher cost of sales expenses in Aripuanã in the quarter compared to 4Q22; and (vi) lower community

expenses in Peru and lower contingencies provisions in our Brazilian smelters.

| 14 |

Earnings Release 4Q23 and 2023 |  |

Compared to 3Q23, Adjusted EBITDA increased

by 28%. This increase was mainly driven by (i) the positive net price effect of US$22 million due to higher zinc prices and positive raw

material inventory effect; (ii) the positive hedge effect of US$5 million; and (iii) higher by-products contribution of US$4 million driven

by higher copper and lead sales volume in Peru, which were partially offset by (iv) lower smelting sales volume due to lower production

in Cajamarquilla and Três Marias.

In 2023, Adjusted EBITDA was US$391 million

compared with US$760 million in 2022, primarily driven by (i) lower LME metal prices with a negative impact of US$208 million; (ii) the

negative impact in costs of US$90 million, mainly due to higher operational costs mainly in Aripuanã, related to concentrate and

stockpile costs due to the ramp-up phase, (iii) lower smelting sales volume with a negative impact of US$30 million due to lower production,

as result of unplanned roaster maintenance in Cajamarquilla and Três Marias, in addition to silicate circuit instabilities in Três

Marias; (iv) the negative impact of US$19 million due to lower by-products contribution; and (v) the negative impact of FX variation of

US$16 million.

| 15 |

Earnings Release 4Q23 and 2023 |  |

Net income (loss) reconciliation

to Adjusted EBITDA

| US$ million |

4Q23 |

3Q23 |

4Q22 |

2023 |

2022 |

| Net Income (loss) |

(107.6) |

(63.4) |

(81.4) |

(289.2) |

76.4 |

| Depreciation, amortization and depletion |

82.9 |

72.1 |

77.9 |

298.4 |

290.9 |

| Share in the results of associates |

(6.1) |

(6.3) |

(1.9) |

(23.5) |

(1.9) |

| Net financial results |

31.5 |

64.4 |

17.9 |

161.6 |

133.7 |

| Taxes on income |

3.8 |

0.4 |

23.3 |

(4.3) |

151.0 |

| EBITDA |

4.4 |

67.1 |

35.8 |

143.0 |

650.2 |

| Fair value of offtake agreement (2) |

(1.3) |

(1.0) |

(7.7) |

(2.3) |

(24.3) |

| Impairment loss of long-lived assets (3) |

55.5 |

1.9 |

32.8 |

114.6 |

32.5 |

| Pre-operating and ramp-up expenses during the commissioning and ramp-up of greenfield projects (Aripuanã) (4) |

10.1 |

3.5 |

46.8 |

15.5 |

87.5 |

| Impairment of other assets (5) |

0.0 |

0.0 |

9.3 |

0.0 |

9.3 |

| Loss on sale of property, plant and equipment (6) |

2.6 |

(0.1) |

0.2 |

3.7 |

0.7 |

| Remeasurement in estimates of asset retirement obligations (7) |

(0.4) |

(2.6) |

3.0 |

(3.1) |

(6.2) |

| Remeasurement adjustment of streaming agreement (8) |

7.8 |

2.3 |

0.0 |

10.1 |

10.6 |

| Energy forward contracts – MTM (9) |

8.2 |

(2.3) |

0.0 |

15.7 |

0.0 |

| Provisions – Value added tax ("VAT") discussions (10) |

10.9 |

12.8 |

0.0 |

86.9 |

0.0 |

| Dams obligations (11) |

7.0 |

0.0 |

0.0 |

7.0 |

0.0 |

| Adjusted EBITDA (1) |

104.9 |

81.7 |

120.2 |

391.2 |

760.3 |

(1) Adjusted EBITDA excludes the items presented

above in the “Net income (loss) reconciliation to Adjusted EBITDA”. For details on segment definition and accounting policy,

please refer to explanatory note 2 – “Information by business segment” in the “Consolidated financial statements

at December 31, 2023”.

(2) Non-cash adjustment: Derivative financial

instrument related to the “Offtake agreement” described on page 42 of this earnings release.

(3) Non-cash adjustment: Cash generating unit

and individual PP&E assets impairment loss.

(4) Expenses related to pre-operating and ramp-up

expenses incurred during the commissioning and ramp-up phases of greenfield projects which have not achieved their nameplate capacity

are not indicative of the Company’s normal operating activities. Once Aripuanã operation is stabilized and operational at

its nameplate capacity, such effects will no longer be excluded.

(5) Non-cash adjustment: Value-added-taxes impairment

loss.

(6) Non-cash adjustment: Results from sale and

disposal of certain non-current assets.

(7) Non-cash adjustment: Asset retirement obligation

remeasurement of discount rate and updated studies that are not subject to capitalization.

(8) Non-cash adjustment: Remeasurement of contractual

obligation related to the forward sale contract of Cerro Lindo's Silver contained in the ore.

| 16 |

Earnings Release 4Q23 and 2023 |  |

(9) Non-cash adjustment: The fair value adjustment

of the energy surplus resulting from electric energy purchase contracts of the company’s subsidiary, Pollarix.

(10) Expenses related to the impact of accruals

related to VAT discussions.

(11) Expenses related to the impact of the provisions

related to dams obligations.

Net financial

results

The net

financial result in 4Q23 was US$32 million in expenses compared to US$64 million in expenses in 3Q23, mainly driven by FX rate gains,

partially offset by higher financial expenses, including interests on provisions, accrued interest related to our two outstanding corporate

bonds and other financial expenses[4],

and lower financial income (interest on financial investments and cash equivalents).

The foreign

exchange variation had a positive impact of US$17 million versus a negative impact of US$27 million in 3Q23, mainly explained by the 3%

appreciation of the Brazilian real against the U.S. dollar[5]

in 3Q23 versus the previous quarter.

Excluding the effect of the foreign exchange

variation, the net financial results in 4Q23 were an expense of US$48 million compared to an expense of US$37 million in the previous

quarter.

| US$ thousand |

4Q23 |

3Q23 |

4Q22 |

| |

|

|

|

| Financial income |

4,827 |

8,359 |

6,174 |

| |

|

|

|

| Financial expenses |

(53,090) |

(45,316) |

(43,395) |

| |

|

|

|

| Other financial items, net |

16,718 |

(27,400) |

19,368 |

| Foreign exchange gain (loss) |

16,904 |

(26,882) |

19,773 |

| |

|

|

|

| Net financial result |

(31,545) |

(64,357) |

(17,853) |

| Net financial result excluding FX |

(48,449) |

(37,475) |

(37,626) |

Net income (loss)

Net loss

was US$108 million in 4Q23 compared to net loss of US$81 million in 4Q22 and net loss of US$63 million in 3Q23, mainly driven by the decrease

in operating income when compared to 3Q23, the recognition of an impairment loss[6]

and provisions on VAT discussions in 4Q23. In 2023, net loss was US$289 million compared to net income

of US$76 million in 2022.

Excluding the miscellaneous adjustments

presented below and detailed above in the Net income (loss) reconciliation to Adjusted EBITDA section, adjusted net loss was US$7 million

in the quarter. In 2023, adjusted net loss totaled US$41 million.

Adjusted net loss attributable to Nexa’s

shareholders was US$1 million in 4Q23 and US$54 million in 2023, resulting in adjusted loss per share of US$0.01 and

US$0.41, respectively.

[4]

For details on other financial expenses, please refer to the Legal Matters section of this Earnings Release and explanatory note 9 (iv)

in the “Consolidated financial statements at December 31, 2023”.

[5]

In 4Q23, the Brazilian real / U.S. dollar (end of period) exchange rate was R$4.841/US$1.00 compared to R$5.007/US$1.00 in 3Q23.

[6]

Note: For details on Impairment Loss and Provisions on VAT Discussions, please refer to the “Consolidated

financial statements at December 31, 2023”.

| 17 |

Earnings Release 4Q23 and 2023 |  |

US$ million

(except where otherwise indicated) |

4Q23 |

3Q23 |

4Q22 |

2023 |

2022 |

| Net Income (loss) |

(107.6) |

(63.4) |

(81.4) |

(289.2) |

76.4 |

| Attributable to Nexa's shareholders |

(93.4) |

(73.7) |

(81.7) |

(289.4) |

49.1 |

| Attributable to non-controlling interests |

(14.2) |

10.4 |

0.3 |

0.2 |

27.3 |

| Basic and diluted earnings (loss) per share |

(0.71) |

(0.56) |

(0.62) |

(2.18) |

0.37 |

| |

|

|

|

|

|

| Miscellaneous adjustments (1) |

100.5 |

14.6 |

84.4 |

248.1 |

110.2 |

| Attributable to Nexa’s shareholders |

92.0 |

16.6 |

75.8 |

235.1 |

102.3 |

| Attributable to non-controlling interests |

8.6 |

(2.0) |

8.6 |

13.0 |

7.9 |

| Basic and diluted miscellaneous adjustments per share |

0.69 |

0.13 |

0.57 |

1.78 |

0.77 |

| |

|

|

|

|

|

| Adjusted net income (loss) |

(7.1) |

(48.8) |

2.9 |

(41.1) |

186.6 |

| Attributable to Nexa's shareholders |

(1.4) |

(57.2) |

(5.9) |

(54.2) |

151.4 |

| Attributable to non-controlling interests |

(5.7) |

8.4 |

8.8 |

13.2 |

35.2 |

| Weighted average number of outstanding shares - in thousand |

132,439 |

132,439 |

132,439 |

132,439 |

132,439 |

| Adjusted basic and diluted earnings (loss) per share |

(0.01) |

(0.43) |

(0.04) |

(0.41) |

1.14 |

(1) Miscellaneous adjustments include: (i)

Fair value of offtake agreement; (ii) Impairment loss of long-lived assets; (iii) Aripuanã pre-operating expenses and ramp-up impacts;

(iv) Impairment of other assets; (v) Loss on sale of property, plant and equipment; (vi) Remeasurement in estimates of asset retirement

obligations; (vii) Remeasurement adjustment of streaming agreement; and (viii) Other adjustments.

| 18 |

Earnings Release 4Q23 and 2023 |  |

Business Performance

Mining segment

| Consolidated |

|

4Q23 |

3Q23 |

4Q22 |

4Q23 vs. 4Q22 |

2023 |

2022 |

2023 vs. 2022 |

| Ore Mined |

kt |

3,522 |

3,284 |

3,173 |

11.0% |

12,959 |

12,073 |

7.3% |

| Treated Ore |

kt |

3,700 |

3,470 |

3,281 |

12.8% |

13,847 |

12,343 |

12.2% |

| |

|

|

|

|

|

|

|

|

| Grade |

|

|

|

|

|

|

|

|

| Zinc |

% |

2.90 |

3.03 |

2.68 |

22 bps |

2.89 |

2.78 |

11 bps |

| Copper |

% |

0.35 |

0.37 |

0.35 |

(0 bps) |

0.34 |

0.34 |

(0 bps) |

| Lead |

% |

0.65 |

0.67 |

0.63 |

2 bps |

0.66 |

0.62 |

5 bps |

| Silver |

oz/t |

1.01 |

1.01 |

1.02 |

(1.8%) |

1.02 |

1.07 |

(4.8%) |

| Gold |

oz/t |

0.005 |

0.005 |

0.005 |

2.7% |

0.005 |

0.005 |

2.9% |

| |

|

|

|

|

|

|

|

|

| Production | metal contained |

|

|

|

|

|

|

|

| Zinc |

kt |

90.2 |

87.4 |

74.9 |

20.5% |

333.2 |

296.4 |

12.4% |

| Copper |

kt |

9.4 |

9.3 |

9.3 |

0.6% |

33.4 |

33.2 |

0.5% |

| Lead |

kt |

17.6 |

16.5 |

15.7 |

12.1% |

65.2 |

57.4 |

13.5% |

| Silver |

MMoz |

2.7 |

2.6 |

2.6 |

7.5% |

10.3 |

10.0 |

3.3% |

| Gold |

koz |

7.7 |

6.6 |

6.9 |

12.0% |

27.6 |

27.2 |

1.5% |

| Zinc Equivalent (1) |

kt |

165.3 |

160.8 |

145.9 |

13.4% |

611.1 |

564.7 |

8.2% |

Note: Until 3Q23 the reference price

used for conversion was 2022 LME average prices. All numbers were updated to reflect the 2023 LME average prices.

(1) Consolidated mining production in

kt of zinc equivalent is calculated by converting copper, lead, silver, and gold contents to a zinc equivalent grade, assuming 2023 LME

average prices: Zn: US$1.20/lb; Cu: US$3.85/lb; Pb: US$0.97/lb; Ag: US$23.4/oz; Au: US$1,943/oz.

In 4Q23, treated ore volume was 3,700kt

up 13% year-over-year, explained by higher ore mined and better plant performance in Cerro Lindo, El Porvenir, Vazante, Morro Agudo and

Aripuanã, except in Atacocha, which was relatively flat.

Compared to 3Q23, treated ore volume increased

by 7%, mainly driven by the Cerro Lindo, Atacocha, Morro Agudo and Aripuanã mines.

The ore throughput, year-over-year, increased

at Cerro Lindo (+3%), El Porvenir (+2%), Vazante (+3%) and Morro Agudo (+37%), while Atacocha remained at the same levels compared to

4Q22.

Zinc production of 90kt in the quarter

rose by 21% from 4Q22, mainly explained by the increase in treated ore volume, average zinc and lead grades and the start-up of the Aripuanã

mine. Compared with 3Q23, zinc production rose by 3%, mainly due to the higher volumes from Cerro Lindo, Atacocha and Morro Agudo, in

addition to further production from the Aripuanã ramp-up phase.

Copper production of 9kt increased by

1% from 4Q22 and 3Q23, as a result of the Aripuanã ramp-up.

Lead production increased by 12% year-over-year

and 7% quarter-over-quarter, mainly driven by Cerro Lindo and Aripuanã.

In 2023, treated ore volume increased

by 12% year-over-year to 13,847kt, mainly explained by the higher ore throughput in all mines, except Cerro Lindo. Zinc average grade

was up 11bps to 2.89%. Zinc production totaled 333kt, 12% higher than in 2022. Copper production was 0.5% higher and lead production increased

by 13% to 65kt.

| 19 |

Earnings Release 4Q23 and 2023 |  |

Cerro Lindo

Cerro Lindo

(100% basis) |

|

4Q23 |

3Q23 |

2Q23 |

1Q23 |

2023 |

4Q22 |

3Q22 |

2Q22 |

1Q22 |

2022 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Ore Mined |

kt |

1,617 |

1,515 |

1,595 |

1,254 |

5,981 |

1,581 |

1,558 |

1,698 |

1,425 |

6,262 |

| Treated Ore |

kt |

1,644 |

1,540 |

1,530 |

1,277 |

5,991 |

1,589 |

1,594 |

1,661 |

1,392 |

6,236 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Grade |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Zinc |

% |

1.70 |

1.63 |

1.31 |

1.38 |

1.51 |

1.49 |

1.42 |

1.58 |

1.71 |

1.55 |

| Copper |

% |

0.58 |

0.63 |

0.57 |

0.48 |

0.57 |

0.65 |

0.55 |

0.66 |

0.57 |

0.61 |

| Lead |

% |

0.32 |

0.32 |

0.33 |

0.25 |

0.31 |

0.28 |

0.37 |

0.35 |

0.34 |

0.33 |

| Silver |

oz/t |

0.83 |

0.81 |

0.83 |

0.72 |

0.80 |

0.70 |

0.94 |

0.99 |

0.92 |

0.89 |

| Gold |

oz/t |

0.003 |

0.002 |

0.002 |

0.002 |

0.002 |

0.003 |

0.002 |

0.003 |

0.003 |

0.002 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Production | metal contained |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Zinc |

kt |

24.6 |

21.7 |

16.9 |

15.0 |

78.2 |

20.7 |

19.9 |

22.7 |

21.1 |

84.4 |

| Copper |

kt |

7.9 |

8.1 |

7.4 |

5.2 |

28.6 |

9.1 |

7.4 |

9.5 |

6.8 |

32.8 |

| Lead |

kt |

3.8 |

3.6 |

3.6 |

2.1 |

13.0 |

3.2 |

4.7 |

4.4 |

3.4 |

15.6 |

| Silver |

MMoz |

1.0 |

0.9 |

0.9 |

0.6 |

3.5 |

0.8 |

1.1 |

1.2 |

1.0 |

4.1 |

| Gold |

koz |

1.2 |

0.7 |

0.8 |

0.7 |

3.4 |

0.9 |

1.0 |

1.1 |

1.1 |

4.1 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Zinc sales |

kt |

25.3 |

20.8 |

17.5 |

14.8 |

78.4 |

19.9 |

19.7 |

22.9 |

23.4 |

85.9 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Costs |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Cost of sales |

US$ mm |

98.1 |

88.6 |

86.5 |

81.6 |

354.8 |

99.0 |

94.6 |

105.9 |

97.0 |

396.5 |

| Cost ROM (2) |

US$/t |

41.5 |

41.3 |

39.8 |

39.6 |

40.6 |

42.2 |

40.1 |

38.2 |

41.0 |

40.3 |

| Cash cost (1) |

US$/lb |

0.06 |

(0.18) |

(0.13) |

(0.02) |

(0.06) |

(0.38) |

0.37 |

(0.59) |

(0.34) |

(0.25) |

| Sustaining cash cost (1) |

US$/lb |

0.29 |

0.07 |

0.15 |

0.23 |

0.19 |

(0.04) |

0.59 |

(0.39) |

(0.19) |

(0.03) |

| |

|

|

|

|

|

|

|

|

|

|

|

| CAPEX |

US$ mm |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Sustaining |

|

11.2 |

9.1 |

9.4 |

8.0 |

37.7 |

12.8 |

8.6 |

9.4 |

7.3 |

38.1 |

| Other |

|

1.7 |

2.0 |

1.5 |

0.4 |

5.6 |

2.1 |

1.0 |

0.8 |

0.5 |

4.3 |

(1) Our cash cost and sustaining cash cost

are net of by-products credits, measured with respect to zinc sold per mine. For a cash cost reconciliation to COGS, please refer to Appendix

– All in Sustaining Cash Cost | Mining.

(2) Our cost per ROM is measured with respect

to treated ore volume. Refer to “Use of Non-IFRS Financial Measures” for further information.

Zinc production of 25kt increased 19%

year-over-year and 14% quarter-over-quarter, mainly due to higher treated ore. Additionally, in 4Q23, areas with better zinc grades were

prioritized (according to the mine sequencing plan), which resulted in higher zinc production.

Zinc head grade averaged 1.70% in the

quarter, up 20bps and 7bps compared to 4Q22 and 3Q23, respectively.

| 20 |

Earnings Release 4Q23 and 2023 |  |

Copper production of 8kt decreased by

13% and 3% compared to 4Q22 and 3Q23, respectively, mainly explained by lower copper grades.

Copper average grade was 0.58%, down 7bps

and 5bps from 4Q22 and 3Q23, respectively.

Lead production was 3.8kt, up 19% year-over-year

and 6% quarter-over-quarter, driven by higher treated ore and higher average grade in the period.

In 2023, zinc production totaled 78kt,

down 7% compared to 2022, mainly due to the performance of the 1H23 impacted by the cyclone Yaku. Copper and lead production were down

13% and 17%, to 29kt and 13kt, respectively, as daily production for all metals was significantly reduced in 1Q23.

Cost

Cost of sales was US$98 million in 4Q23

compared to US$99 million in the same period last year, mainly due to lower depreciation and amortization, which was partially offset

by higher operational costs, such as third-party services. Compared to 3Q23, cost of sales increased by 11%, mainly driven by higher sales

and produced volumes, which contributed to higher variable costs in the period, in addition to higher depreciation and amortization.

Run-of-mine mining cost was US$41.5/t

in the quarter, down 2% year-over-year mainly explained by higher treated ore volumes. Compared to 3Q23, cost ROM was relatively flat.

Cash cost net of by-products in 4Q23 increased

to US$0.06/lb compared with US$(0.38)/lb in 4Q22 and US$(0.18)/lb in 3Q23. The performance year-over-year was mainly explained by lower

by-products contribution. Compared to 3Q23, cash cost was higher due to higher zinc volumes and lower by-products contribution.

CAPEX

In 4Q23, sustaining capital expenditures

amounted to US$11 million, mainly related to mining development, tailings deposit, maintenance, and other mining infrastructure expenses,

totaling US$38 million in 2023.

El Porvenir

El Porvenir

(100% basis) |

|

4Q23 |

3Q23 |

2Q23 |

1Q23 |

2023 |

4Q22 |

3Q22 |

2Q22 |

1Q22 |

2022 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Ore Mined |

kt |

562 |

568 |

546 |

544 |

2,220 |

551 |

529 |

520 |

513 |

2,114 |

| Treated Ore |

kt |

562 |

568 |

546 |

544 |

2,220 |

550 |

527 |

521 |

514 |

2,112 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Grade |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Zinc |

% |

2.83 |

2.89 |

2.89 |

2.82 |

2.86 |

2.61 |

2.77 |

2.86 |

2.96 |

2.80 |

| Copper |

% |

0.16 |

0.16 |

0.17 |

0.15 |

0.16 |

0.13 |

0.16 |

0.17 |

0.18 |

0.16 |

| Lead |

% |

1.39 |

1.36 |

1.35 |

1.38 |

1.37 |

1.38 |

1.34 |

1.34 |

1.31 |

1.34 |

| Silver |

oz/t |

2.20 |

2.22 |

2.42 |

2.55 |

2.34 |

2.64 |

2.45 |

2.35 |

2.41 |

2.46 |

| Gold |

oz/t |

0.010 |

0.010 |

0.011 |

0.011 |

0.011 |

0.012 |

0.011 |

0.011 |

0.013 |

0.012 |

| |

|

|

|

|

|

|