The company is the first digital banking

platform to surpass this milestone outside of Asia and is honoring

its customers in Brazil, Mexico, and Colombia with a tech-first

campaign

Nubank announced today that it has surpassed 100 million

customers in Brazil, Mexico, and Colombia, making it the first

digital banking platform to reach this milestone outside of Asia.

The achievement comes on the heels of record 2023 financial

results, with over US$1 billion in net profit and over US$8 billion

in revenues, which attest to the solidity, efficiency, and

scalability of Nubank’s business model.

Currently, Nubank serves more than 92 million customers in

Brazil, over 7 million in Mexico, and close to 1 million in

Colombia, with record levels of satisfaction. According to internal

analyses, the company's NPS (Net Promoter Score) is nearly three

times higher than incumbents and other major local fintechs.

True to its mission of "fighting complexity to empower people”,

Nubank is leveraging tech and innovation to drive competition in

the sector, and transform millions of lives through inclusion and

improved financial management. The company’s digital model has

helped its customers save more than 11 billion dollars in banking

fees in 2023 and to spare more than 440 million hours of waiting in

service queues over the past seven years1.

In Brazil, in a twelve month period, Nubank promoted the

financial inclusion of 5.7 million people in the credit card

market2. After breaking the access barrier, research showed that

60% of Brazilian customers improved their financial journey in the

first 24 months, through frequent and responsible use of credit

cards and other financial products3.

"In 2013, we had set ourselves the ambitious goal to reach one

million customers in five years, which seemed almost impossible at

the time. In a decade, we have surpassed 100 million, which is a

testament to the trust our customers place in us and to the power

of a truly customer-centric business model. These 100 million

customers have written their stories together with ours, and we

want to honor them in a special way," explains David Vélez, founder

and CEO of Nubank.

Nubank is launching “You at the center of everything”, a

campaign that leverages technology and innovation to highlight real

customers’ journeys through an activation on the Exosphere – the

exterior of Sphere in Las Vegas and the largest LED screen in the

world.

The Exosphere activation shows 360 degrees of images of Nubank

customers on the exterior of the venue - which is nearly 112 meters

high and more than 157 meters wide. The faces are formed by purple

particles, each of which represents one of Nubank's 100 million

customers. Together, they illustrate that Nubank is composed of all

their individual stories. Nubank customers will be featured from

May 7th to the 14th on the Exosphere, kickstarting additional local

campaigns and customer engagement in Brazil, Mexico, and Colombia.

Nubank’s 100 Million campaign materials are available at

www.nubank.com.br/100M.

“Being customer-centric has been guiding us since the very

beginning. Today, we want our customers to see themselves the way

we see them: at the center of everything. In reaching this

milestone, we want to focus on the real people and individual

stories of empowerment and advance our mission to help improve

people’s lives," emphasizes Cristina Junqueira, co-founder and

Chief Growth Officer of Nubank.

A record journey to 100 million customers

Nubank was born in 2013 in Brazil with the mission to fight

complexity to empower people in their daily lives by reinventing

financial services, using technology to solve problems, and putting

a bank in people's pockets. Betting against a general fintech trend

to begin operations with savings, the company launched a credit

card with no fees, with the goal to tackle the most challenging

financial vertical first: lending. The other key differential is

the 100% cloud-native platform, which allows for scalable growth

with a low cost structure, and powers some of the fastest data

processing capabilities in the industry for product design, credit

and risk models, and personalization.

The company surpassed one million customers in Brazil two years

after launching its first product, three years ahead of forecast

and mostly through organic member-get-member dynamics. The savings

account, launched in 2017, unlocked further growth by enabling a

suite of products: personal loans, SME solutions, investments, and

crypto. Today, the portfolio includes marketplace and insurance,

among others.

Starting in 2019, Nubank began to expand internationally, in

Mexico and Colombia, leveraging the unique combination of

cloud-native technology, customer centricity, efficient business

model, and brand love. The Mexican customer base is growing faster

than Brazil at similar stages for Savings and Credit Card, and is

in its journey to obtain a banking license to keep expanding its

product portfolio into investments, payroll products and higher

credit lines, among others. In Colombia, the company introduced its

savings product earlier in the year, which already has over 500,000

customers signed into the launch list.

Footnotes

1 Internal data, to be made available in our ESG report -

waiting hours: BR since 2017; Mexico since 2019; and Colombia since

2021

2 2023 Data Nubank report, data related to the period between

July, 2021 and July, 2022

3 Study conducted in partnership with Mastercard and the Boston

Consulting Group, with customers who started banking January–June

2021 and monitoring financial health up to 24 months after. All

data analysis and collection of customer data by Nubank was

conducted in accordance with applicable privacy and data protection

legislation.

About Nu

Nu is the world’s largest digital banking platform outside of

Asia, serving over 100 million customers across Brazil, Mexico, and

Colombia. The company has been leading an industry transformation

by leveraging data and proprietary technology to develop innovative

products and services. Guided by its mission to fight complexity

and empower people, Nu caters to customers’ complete financial

journey, promoting financial access and advancement with

responsible lending and transparency. The company is powered by an

efficient and scalable business model that combines low cost to

serve with growing returns. Nu’s impact has been recognized in

multiple awards, including Time 100 Companies, Fast Company’s Most

Innovative Companies, and Forbes World’s Best Banks. For more

information, please visit

https://international.nubank.com.br/about/.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240508557544/en/

Investors Relations Jorg Friedemann

investors@nubank.com.br

Media Relations Leila Suwwan press@nubank.com.br

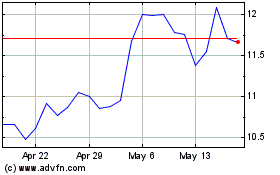

Nu (NYSE:NU)

Historical Stock Chart

From Nov 2024 to Dec 2024

Nu (NYSE:NU)

Historical Stock Chart

From Dec 2023 to Dec 2024