Revenue up 28%, ARPU up 19% Year-over-Year

Olo Inc. (NYSE:OLO) (“Olo” or the “Company”), a leading open

SaaS platform for restaurants, today announced financial results

for the second quarter ended June 30, 2024.

“In Q2, Team Olo delivered another strong quarter of financial

and operational performance. We generated revenue and non-GAAP

operating income that exceeded the high-end of their respective

guidance ranges, added new enterprise and emerging enterprise

brands and expanded with existing customers, and announced another

POS integration partnership for Olo Pay and Engage that moves Olo

closer to supporting full-stack payment processing and data

aggregation across off- and on-premise transactions,” said Noah

Glass, Olo’s Founder and CEO. “The breadth of our platform and the

scale of our network help brands to use omni-channel guest data to

drive profitable traffic: a key metric for success in the

restaurant business.”

Second Quarter Financial and Other Highlights

- Total revenue increased 28% year-over-year to $70.5

million.

- Total platform revenue increased 27% year-over-year to $69.6

million.

- Gross profit increased 16% year-over-year to $39.9 million, and

was 57% of total revenue.

- Non-GAAP gross profit increased 16% year-over-year to $44.3

million, and was 63% of total revenue.

- Operating income was $1.0 million, or 1% of total revenue,

compared to operating loss of $21.2 million, or (38)% of total

revenue, a year ago.

- Non-GAAP operating income was $7.6 million, or 11% of total

revenue, compared to $4.5 million, or 8% of total revenue, a year

ago.

- Net income was $5.7 million, or $0.03 per share, compared to a

net loss of $17.1 million, or $0.11 per share a year ago.

- Non-GAAP net income was $9.2 million, or $0.05 per share,

compared to non-GAAP net income of $6.4 million or $0.04 per share

a year ago.

- Cash, cash equivalents, and short- and long-term investments

totaled $387.0 million as of June 30, 2024.

- Average revenue per unit (ARPU) increased 19% year-over-year,

and increased 4% sequentially to approximately $852.

- Dollar-based net revenue retention (NRR) was above 120%.

- Ending active locations were approximately 82,000, up

approximately 1,000 from the quarter ended March 31, 2024.

Second Quarter and Recent Business Highlights

- Announced an expanded point-of-sale (POS) relationship with

TRAY, where TRAY will expand its existing integrations beyond Olo’s

Order suite to include Olo Pay’s full stack payment processing

functionality and Olo Engage’s guest data platform (GDP). Olo now

has expanded Pay and Engage GDP integration partnerships in place

with three POS providers.

- Deployed Olo Order modules with enterprise brands such as

Bonchon, a fast-casual Korean chicken chain, and Mission BBQ, a

fast-casual barbecue concept, and expanded through Olo Pay with

enterprise brands such as Culver’s, El Pollo Loco, Miller’s Ale

House, and Pollo Tropical.

- Deployed Olo products across our Order and Pay suites with more

than a dozen emerging enterprise brands, including &pizza and

DIG.

- Announced 19 product enhancements during Olo’s 2024 Summer

Release event, including Loyalty for Olo Borderless Accounts, a new

feature that allows guests to earn, redeem, and use rewards from a

brand’s existing loyalty program through Olo’s seamless,

passwordless guest checkout solution. Other highlighted features

include Marketing A/B Testing for Email Campaigns and Catering+

Enhanced Order Management. The full list of features announced are

available by visiting

www.olo.com/quarterly-release/summer-2024.

- Olo announced its 2024 Olo for Good annual grant cycle

recipients through its donor-advised fund (DAF) partner, Tides

Foundation, funded by our Pledge 1% commitment and released our

second annual ESG Report. To learn more visit olo.com/esg.

- Total shares repurchased in the quarter were approximately 1.4

million for approximately $6.9 million, bringing total repurchases

to 15.7 million shares for approximately $100.0 million, completing

our initial buyback program.

Financial Outlook

As of July 31, 2024, Olo is issuing the following outlook:

For the third quarter of 2024, Olo expects to report:

- Revenue in the range of $70.8 million to $71.3 million;

and

- Non-GAAP operating income in the range of $6.0 million to $6.4

million.

For fiscal year 2024, Olo expects to report:

- Revenue in the range of $279.5 million to $280.5 million;

and

- Non-GAAP operating income in the range of $25.6 million to

$26.4 million.

The outlook provided above constitutes forward-looking

information within the meaning of applicable securities laws and is

based on a number of assumptions and subject to a number of risks.

Actual results could vary materially as a result of numerous

factors, including inaccuracies in our assumptions and certain risk

factors, many of which are beyond Olo’s control. Olo assumes no

obligation to update these forward-looking statements. See the

cautionary note regarding “Forward-Looking Statements” below.

Webcast and Conference Call Information

Olo will host a conference call today, July 31, 2024, at 5:00

p.m. Eastern Time to discuss the Company’s financial results and

financial outlook. A live webcast of this conference call will be

available on the “Investor Relations” website at investors.olo.com,

and a replay will be archived on the website as well.

Available Information

Olo announces material information to the public about the

Company, its products and services, and other matters through a

variety of means, including filings with the SEC, press releases,

public conference calls, webcasts, the “Investor Relations” website

at investors.olo.com, and the Company’s X (formerly Twitter)

account @Olo in order to achieve broad, non-exclusionary

distribution of information to the public and for complying with

its disclosure obligations under Regulation FD.

About Olo

Olo (NYSE: OLO) is a leading restaurant technology provider with

ordering, payment, and guest engagement solutions that help brands

increase orders, streamline operations, and improve the guest

experience. Each day, Olo processes millions of orders on its open

SaaS platform, gathering the right data from each touchpoint into a

single source—so restaurants can better understand and better serve

every guest on every channel, every time. Over 700 restaurant

brands trust Olo and its network of more than 400 integration

partners to innovate on behalf of the restaurant community,

accelerating technology’s positive impact and creating a world

where every restaurant guest feels like a regular. Learn more at

olo.com.

Non-GAAP Financial Measures and Other Metrics

Non-GAAP Financial Measures

In this press release, we refer to non-GAAP financial measures

that are derived on the basis of methodologies other than in

accordance with generally accepted accounting principles in the

United States, or GAAP. We use non-GAAP financial measures, as

described below, in conjunction with financial measures prepared in

accordance with GAAP for planning purposes, including in the

preparation of our annual operating budget, as a measure of our

core operating results and the effectiveness of our business

strategy, and in evaluating our financial performance. These

measures provide consistency and comparability with past financial

performance as measured by such non-GAAP figures, facilitate

period-to-period comparisons of core operating results, and assist

shareholders in better evaluating us by presenting

period-over-period operating results without the effect of certain

charges or benefits that may not be consistent or comparable across

periods or compared to other registrants’ similarly named non-GAAP

financial measures and key performance indicators.

A reconciliation of these non-GAAP measures has been provided in

the financial statement tables included in this press release and

investors are encouraged to review the reconciliation. Our use of

non-GAAP financial measures has limitations as an analytical tool,

and these measures should not be considered in isolation or as a

substitute for analysis of our financial results as reported under

GAAP. Because our non-GAAP financial measures are not calculated in

accordance with GAAP, they may not necessarily be comparable to

similarly titled measures employed by other companies.

The following are the non-GAAP financial measures referenced in

this press release and presented in the tables below: non-GAAP

gross profit (total and each line item, and total and each non-GAAP

gross profit item on a margin basis as a percentage of revenue),

non-GAAP operating expenses (each line item and each non-GAAP

operating expense item on a margin basis as a percentage of

revenue), non-GAAP operating income (and on a margin basis as a

percentage of revenue), non-GAAP net income (and on a per share

basis), and free cash flow.

We adjust our GAAP financial measures for the following items:

stock-based compensation expense (non-cash expense calculated by

companies using a variety of valuation methodologies and subjective

assumptions) and related payroll tax expense, certain

litigation-related expenses, net of recoveries (which relate to

legal and other professional fees associated with

litigation-related matters that are not indicative of our core

operations and are not part of our normal course of business), loss

on disposal of assets, capitalized internal-use software and

intangible amortization (non-cash expense), non-cash impairment

charges, restructuring charges, certain severance costs, and

transaction costs (typically incurred within one year of the

related acquisition, as well as the related tax impacts of the

acquisition). Beginning in the second quarter of 2023, we have

included the tax impact of the non-GAAP adjustments in determining

non-GAAP net income. We determined this amount by utilizing a

federal rate plus a net state rate that excluded the impact of net

operating losses, or NOLs, and valuation allowances to calculate a

non-GAAP blended statutory rate, which we then applied to all

non-GAAP adjustments. The prior period non-GAAP net income

presentation has also been revised to include the tax impact of the

non-GAAP adjustments and conforms with the new presentation.

Reconciliation of non-GAAP operating income guidance to the most

directly comparable GAAP measures is not available without

unreasonable efforts on a forward-looking basis due to the high

variability, complexity, and low visibility with respect to the

charges excluded from these non-GAAP measures; in particular, the

measures and effects of stock-based compensation expense and

related payroll tax expense specific to equity compensation awards

that are directly impacted by unpredictable fluctuations in our

stock price. We expect the variability of the above charges to have

a significant, and potentially unpredictable, impact on our future

GAAP financial results.

Management believes that it is useful to exclude certain

non-cash charges and non-core operational charges from our non-GAAP

financial measures because: (1) the amount of such expenses in any

specific period may not directly correlate to the underlying

performance of our business operations and we believe does not

relate to ongoing operational performance; and (2) such expenses

can vary significantly between periods.

Free cash flow represents net cash provided by or used in

operating activities, reduced by purchases of property and

equipment and capitalization of internal-use software. Free cash

flow is a measure used by management to understand and evaluate our

liquidity and to generate future operating plans. Free cash flow

excludes items that we do not consider to be indicative of our

liquidity and facilitates comparisons of our liquidity on a

period-to-period basis. We believe providing free cash flow

provides useful information to investors and others in

understanding and evaluating the strength of our liquidity and

future ability to generate cash that can be used for strategic

opportunities or investing in our business from the perspective of

our management and Board of Directors.

Key Performance Indicators

In addition, we also use the following key performance

indicators to help us evaluate our business, identify trends

affecting the business, formulate business plans, and make

strategic decisions.

Average revenue per unit (ARPU): We calculate ARPU by dividing

the total platform revenue in a given period by the average active

locations in that same period. We believe ARPU is an important

metric that demonstrates our ability to grow within our customer

base through the development of our products that our customers

value.

Dollar-based net revenue retention (NRR): We calculate NRR as of

a period-end by starting with the revenue, defined as platform

revenue, from the cohort of all active customers as of 12 months

prior to such period-end, or the prior period revenue. An active

customer is a specific restaurant brand that utilizes one or more

of our modules in a given quarterly period. We then calculate the

platform revenue from these same customers as of the current

period-end, or the current period revenue. Current period revenue

includes any expansion and is net of contraction or attrition over

the last 12 months, but excludes platform revenue from new

customers in the current period. We then divide the total current

period revenue by the total prior period revenue to arrive at the

point-in-time dollar-based NRR. We believe that NRR is an important

metric to our investors, demonstrating our ability to retain our

customers and expand their use of our modules over time, proving

the stability of our revenue base and the long-term value of our

customer relationships.

Active locations: We define an active location as a unique

restaurant location that is utilizing or subscribed to one or more

of our modules in a quarterly period (depending on the module).

Given this definition, active locations in any one quarter may not

reflect (i) the future impact of new customer wins as it can take

some time for their locations to go live with our platform, or (ii)

the customers who have indicated their intent to reduce or

terminate their use of our platform in future periods. Of further

note, not all of our customer locations may choose to utilize our

products, and while we aim to deploy all of a customer’s locations,

not all locations may ultimately deploy.

Gross merchandise volume (GMV): We define GMV as the gross value

of orders processed through our platform.

Gross payment volume (GPV): We define GPV as the gross volume of

payments processed through Olo Pay.

Our management uses GMV and GPV metrics to assess demand for our

products. We also believe GMV and GPV provide investors with useful

supplemental information about the financial performance of our

business, enable comparison of financial results between periods

where certain items may vary independent of business performance,

and allow for greater transparency with respect to key metrics used

by management in operating our business.

Forward-Looking Statements

Statements we make in this press release include statements that

are considered forward-looking within the meaning of Section 27A of

the Securities Act and Section 21E of the Securities Exchange Act,

which may be identified by the use of words such as “anticipates,”

“believes,” “continue,” “estimates,” “expects,” “intends,” “may,”

“plans,” “projects,” “outlook,” “seeks,” “should,” “will,” and

similar terms or the negative of such terms. All statements other

than statements of historical fact are forward-looking statements

for purposes of this release.

We intend these forward-looking statements to be covered by the

safe harbor provisions for forward-looking statements contained in

Section 27A of the Securities Act and Section 21E of the Securities

Exchange Act and are making this statement for purposes of

complying with those safe harbor provisions. These statements

include, but are not limited to, our financial guidance for the

third quarter of 2024 and the full year 2024, our future

performance and growth and market opportunities, including new

products and continued module adoption among new and existing

customers, the continued expansion of ARPU, our expectations

regarding the growth of active locations, revenue expectations for

our Order, Pay, and Engage suites, our business strategy,

statements regarding the amount, timing, and sources of funding for

the share repurchase program, and our expectations regarding other

financial and operational metrics and advancements in our industry.

Accordingly, actual results could differ materially or such

uncertainties could cause adverse effects on our results.

Forward-looking statements are based upon various estimates and

assumptions, as well as information known to us as of the date of

this press release, and are subject to risks and uncertainties,

including but not limited to: the effects of public health crises,

macroeconomic conditions, including inflation, changes in

discretionary spending, fluctuating interest rates, geopolitical

instability, and overall market uncertainty; our ability to acquire

new customers, have existing customers (including our emerging

enterprise customers) adopt additional modules, and successfully

retain existing customers; our ability to compete effectively with

existing competitors, new market entrants, and customers generally

developing their own solutions to replace our products; our ability

to develop and release new and successful products and services,

and develop and release successful enhancements, features, and

modifications to our existing products and services; the continued

growth of Olo Pay; the costs and success of our sales and marketing

efforts, and our ability to promote our brand; our long and

unpredictable sales cycles; our ability to identify, recruit, and

retain skilled personnel; our ability to effectively manage our

growth, including any international expansion; our ability to

realize the anticipated benefits of past or future investments,

strategic transactions, or acquisitions, and the risk that the

integration of these acquisitions may disrupt our business and

management; our ability to protect our intellectual property rights

and any costs associated therewith; the growth rates of the markets

in which we compete and our ability to expand our market

opportunity; our actual or perceived failure to comply with our

obligations related to data privacy, cybersecurity, and processing

payment transactions; the impact of new and existing laws and

regulations on our business; changes to our strategic relationships

with third parties; our reliance on a limited number of delivery

service providers and aggregators; our ability to generate revenue

from our product offerings and the effects of fluctuations in our

level of client spend retention; the durability of the growth we

experienced in the past, guest preferences for digital ordering and

customer adoption of multiple modules; and other general market,

political, economic, and business conditions. Actual results could

differ materially from those predicted or implied, and reported

results should not be considered an indication of future

performance. Additionally, these forward-looking statements,

particularly our guidance, involve risks, uncertainties, and

assumptions, including those related to our customers’ spending

decisions and guest ordering behavior. Significant variations from

the assumptions underlying our forward-looking statements could

cause our actual results to vary, and the impact could be

significant.

Additional risks and uncertainties that could affect our

financial results and forward-looking statements are included under

the caption “Risk Factors” in our Quarterly Report on Form 10-Q for

the quarter ended June 30, 2024 that will be filed following this

press release, our Annual Report on Form 10-K for the year ended

December 31, 2023, and our other SEC filings, which are available

on our “Investor Relations” website at investors.olo.com and on the

SEC website at www.sec.gov. Undue reliance should not be placed on

the forward-looking statements in this press release. All

forward-looking statements contained herein are based on

information available to us as of the date hereof, and we do not

assume any obligation to update these statements as a result of new

information or future events.

OLO INC.

Condensed Consolidated Balance

Sheets (Unaudited)

(in thousands, except share

and per share amounts)

As of June 30,

2024

As of December 31,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

269,439

$

278,218

Short-term investments

91,266

84,331

Accounts receivable, net of expected

credit losses of $5,248 and $2,785, respectively

60,198

70,264

Contract assets

446

412

Deferred contract costs

5,148

4,743

Prepaid expenses and other current

assets

20,664

12,769

Total current assets

447,161

450,737

Property and equipment, net of accumulated

depreciation and amortization of $14,720 and $10,111,

respectively

25,745

22,055

Intangible assets, net of accumulated

amortization of $10,244 and $8,264, respectively

15,758

17,738

Goodwill

207,781

207,781

Contract assets, noncurrent

947

352

Deferred contract costs, noncurrent

5,770

5,806

Operating lease right-of-use assets

10,646

12,529

Long-term investments

26,322

25,748

Other assets, noncurrent

51

73

Total assets

$

740,181

$

742,819

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

6,486

$

4,582

Accrued expenses and other current

liabilities

57,678

68,240

Unearned revenue

1,871

1,533

Operating lease liabilities, current

2,700

2,859

Total current liabilities

68,735

77,214

Unearned revenue, noncurrent

441

57

Operating lease liabilities,

noncurrent

12,727

13,968

Other liabilities, noncurrent

—

109

Total liabilities

81,903

91,348

Stockholders’ equity:

Class A common stock, $0.001 par value;

1,700,000,000 shares authorized at June 30, 2024 and December 31,

2023; 108,640,187 and 108,469,679 shares issued and outstanding at

June 30, 2024 and December 31, 2023, respectively. Class B common

stock, $0.001 par value; 185,000,000 shares authorized at June 30,

2024 and December 31, 2023; 53,393,616 and 54,891,834 shares issued

and outstanding at June 30, 2024 and December 31, 2023,

respectively

162

163

Preferred stock, $0.001 par value;

20,000,000 shares authorized at June 30, 2024 and December 31,

2023

—

—

Additional paid-in capital

870,733

867,152

Accumulated deficit

(212,456

)

(215,829

)

Accumulated other comprehensive loss

(161

)

(15

)

Total stockholders’ equity

658,278

651,471

Total liabilities and stockholders’

equity

$

740,181

$

742,819

OLO INC.

Condensed Consolidated

Statements of Operations (Unaudited)

(in thousands, except share

and per share amounts)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Revenue:

Platform

$

69,600

$

54,603

$

135,365

$

105,974

Professional services and other

904

648

1,650

1,517

Total revenue

70,504

55,251

137,015

107,491

Cost of revenue:

Platform

29,788

19,721

58,116

37,334

Professional services and other

811

1,058

1,786

2,194

Total cost of revenue

30,599

20,779

59,902

39,528

Gross profit

39,905

34,472

77,113

67,963

Operating expenses:

Research and development

16,957

18,298

33,956

38,771

General and administrative

8,664

18,469

21,420

35,679

Sales and marketing

13,307

12,194

27,920

25,075

Restructuring charges

—

6,682

—

6,682

Total operating expenses

38,928

55,643

83,296

106,207

Income (loss) from operations

977

(21,171

)

(6,183

)

(38,244

)

Other income, net:

Interest income

4,844

4,155

9,751

7,609

Interest expense

(15

)

(53

)

(84

)

(122

)

Other income, net

—

—

3

—

Total other income, net

4,829

4,102

9,670

7,487

Income (loss) before income taxes

5,806

(17,069

)

3,487

(30,757

)

Provision for income taxes

77

7

114

25

Net income (loss)

$

5,729

$

(17,076

)

$

3,373

$

(30,782

)

Net income (loss) per share attributable

to Class A and Class B common stockholders:

Basic

$

0.04

$

(0.11

)

$

0.02

$

(0.19

)

Diluted

$

0.03

$

(0.11

)

$

0.02

$

(0.19

)

Weighted-average Class A and Class B

common shares outstanding:

Basic

161,197,680

162,324,314

161,766,287

162,005,150

Diluted

170,472,824

162,324,314

171,608,366

162,005,150

OLO INC.

Condensed Consolidated

Statements of Cash Flows (Unaudited)

(in thousands)

Six Months Ended June

30,

2024

2023

Operating activities

Net income (loss)

$

3,373

$

(30,782

)

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation and amortization

6,589

4,462

Stock-based compensation

21,256

28,828

Provision for expected credit losses

3,265

1,079

Non-cash lease expense

1,320

1,436

Loss on disposal of assets

—

38

Non-cash impairment charges

1,079

—

Other non-cash operating activities,

net

(1,221

)

(1,553

)

Changes in operating assets and

liabilities:

Accounts receivable

6,800

(9,101

)

Contract assets

(628

)

(207

)

Prepaid expenses and other current and

noncurrent assets

(7,827

)

620

Deferred contract costs

(369

)

(1,954

)

Accounts payable

1,904

5,476

Accrued expenses and other current

liabilities

(10,596

)

12,069

Operating lease liabilities

(1,400

)

(1,557

)

Unearned revenue

722

393

Other liabilities, noncurrent

(109

)

19

Net cash provided by operating

activities

24,158

9,266

Investing activities

Purchases of property and equipment

(367

)

—

Capitalized internal-use software

(6,831

)

(7,279

)

Purchases of investments

(60,498

)

(72,941

)

Sales and maturities of investments

54,064

62,262

Net cash used in investing activities

(13,632

)

(17,958

)

Financing activities

Cash received for employee payroll tax

withholdings

3,316

3,039

Cash paid for employee payroll tax

withholdings

(3,282

)

(3,105

)

Proceeds from exercise of stock options

and purchases under employee stock purchase plan

2,842

6,803

Repurchase of common stock

(22,181

)

(30,099

)

Net cash used in financing activities

(19,305

)

(23,362

)

Net decrease in cash and cash

equivalents

(8,779

)

(32,054

)

Cash and cash equivalents, beginning of

period

278,218

350,073

Cash and cash equivalents, end of

period

$

269,439

$

318,019

OLO INC.

Reconciliation of GAAP to

Non-GAAP Results (Unaudited)

(in thousands, except for

percentages and share and per share amounts)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Gross profit and gross margin

reconciliation:

Platform gross profit, GAAP

$

39,812

$

34,882

$

77,249

$

68,640

Plus: Stock-based compensation expense and

related payroll tax expense

1,339

1,751

2,898

3,650

Plus: Capitalized internal-use software

and intangible amortization

3,010

1,825

5,649

3,475

Platform gross profit, non-GAAP

44,161

38,458

85,796

75,765

Services gross profit, GAAP

93

(410

)

(136

)

(677

)

Plus: Stock-based compensation expense and

related payroll tax expense

54

182

183

380

Services gross profit, non-GAAP

147

(228

)

47

(297

)

Total gross profit, GAAP

39,905

34,472

77,113

67,963

Total gross profit, non-GAAP

44,308

38,230

85,843

75,468

Platform gross margin, GAAP

57

%

64

%

57

%

65

%

Platform gross margin, non-GAAP

63

%

70

%

63

%

71

%

Services gross margin, GAAP

10

%

(63

)%

(8

)%

(45

)%

Services gross margin, non-GAAP

16

%

(35

)%

3

%

(20

)%

Total gross margin, GAAP

57

%

62

%

56

%

63

%

Total gross margin, non-GAAP

63

%

69

%

63

%

70

%

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Sales and marketing

reconciliation:

Sales and marketing, GAAP

$

13,307

$

12,194

$

27,920

$

25,075

Less: Stock-based compensation expense and

related payroll tax expense

1,568

2,131

3,125

4,698

Less: Intangible amortization

342

341

683

682

Less: Certain severance costs

—

—

—

121

Sales and marketing, non-GAAP

11,397

9,722

24,112

19,574

Sales and marketing as % total revenue,

GAAP

19

%

22

%

20

%

23

%

Sales and marketing as % total revenue,

non-GAAP

16

%

18

%

18

%

18

%

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Research and development

reconciliation:

Research and development, GAAP

$

16,957

$

18,298

$

33,956

$

38,771

Less: Stock-based compensation expense and

related payroll tax expense

2,743

3,759

5,877

8,510

Less: Non-cash capitalized software

impairment

517

—

517

—

Research and development, non-GAAP

13,697

14,539

27,562

30,261

Research and development as % total

revenue, GAAP

24

%

33

%

25

%

36

%

Research and development as % total

revenue, non-GAAP

19

%

26

%

20

%

28

%

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

General and administrative

reconciliation:

General and administrative, GAAP

$

8,664

$

18,469

$

21,420

$

35,679

Less: Stock-based compensation expense and

related payroll tax expense

4,923

5,672

9,672

10,754

Less: Certain litigation-related expenses,

net of recoveries

(8,462

)

2,975

(9,834

)

3,859

Less: Non-cash impairment charge

associated with corporate headquarters

563

—

563

—

Less: Intangible amortization

40

41

81

82

Less: Certain severance costs

—

—

—

709

Less: Loss on disposal of assets

—

—

—

38

Less: Transaction costs

—

322

—

358

General and administrative, non-GAAP

11,600

9,459

20,938

19,879

General and administrative as % total

revenue, GAAP

12

%

33

%

16

%

33

%

General and administrative as % total

revenue, non-GAAP

16

%

17

%

15

%

18

%

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Operating income (loss)

reconciliation:

Operating income (loss), GAAP

$

977

$

(21,171

)

$

(6,183

)

$

(38,244

)

Plus: Stock-based compensation expense and

related payroll tax expense

10,627

13,495

21,755

27,992

Plus: Certain litigation-related expenses,

net of recoveries

(8,462

)

2,975

(9,834

)

3,859

Plus: Non-cash impairment charge

associated with corporate headquarters

563

—

563

—

Plus: Non-cash capitalized internal-use

software impairment

517

—

517

—

Plus: Capitalized internal-use software

and intangible amortization

3,392

2,207

6,413

4,239

Plus: Restructuring charges

—

6,682

—

6,682

Plus: Certain severance costs

—

—

—

830

Plus: Loss on disposal of assets

—

—

—

38

Plus: Transaction costs

—

322

—

358

Operating income, non-GAAP

7,614

4,510

13,231

5,754

Operating margin, GAAP

1

%

(38

)%

(5

)%

(36

)%

Operating margin, non-GAAP

11

%

8

%

10

%

5

%

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net income (loss)

reconciliation:

Net income (loss), GAAP

$

5,729

$

(17,076

)

$

3,373

$

(30,782

)

Plus: Stock-based compensation expense and

related payroll tax expense

10,627

13,495

21,755

27,992

Plus: Certain litigation-related expenses,

net of recoveries

(8,462

)

2,975

(9,834

)

3,859

Plus: Non-cash impairment charge

associated with corporate headquarters

563

—

563

—

Plus: Non-cash capitalized internal-use

software impairment

517

—

517

—

Plus: Capitalized internal-use software

and intangible amortization

3,392

2,207

6,413

4,239

Plus: Restructuring charges

—

6,682

—

6,682

Plus: Certain severance costs

—

—

—

830

Plus: Loss on disposal of assets

—

38

Plus: Transaction costs

—

322

—

358

Less: Tax impact of non-GAAP adjustments

(1)

(3,207

)

(2,243

)

(5,806

)

(3,450

)

Net income, non-GAAP

9,159

6,362

16,981

9,766

Fully diluted net income (loss) per share

attributable to Class A and Class B common stockholders, GAAP

$

0.03

$

(0.11

)

$

0.02

$

(0.19

)

Fully diluted weighted average Class A and

Class B common shares outstanding, GAAP

170,472,824

162,324,314

171,608,366

162,005,150

Fully diluted net income per share

attributable to Class A and Class B common stockholders,

non-GAAP

$

0.05

$

0.04

$

0.10

$

0.05

Fully diluted Class A and Class B common

shares outstanding, non-GAAP

170,472,824

177,843,165

171,608,366

178,069,754

_________________

(1) We utilized a federal rate plus a net

state rate that excluded the impact of NOLs and valuation

allowances to calculate our non-GAAP blended statutory rate of

25.85% and 26.06% for the six months ended June 30, 2024 and 2023,

respectively.

OLO INC.

Non-GAAP Free Cash Flow

(Unaudited)

(in thousands)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Net cash provided by operating

activities

$

18,131

$

2,019

$

24,158

$

9,266

Purchase of property and equipment

(299

)

—

(367

)

—

Capitalized internal-use software

(3,682

)

(3,897

)

(6,831

)

(7,279

)

Non-GAAP free cash flow

$

14,150

$

(1,878

)

$

16,960

$

1,987

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731034762/en/

Media Olo@icrinc.com

Investor Relations InvestorRelations@olo.com

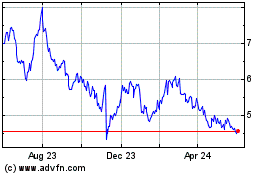

Olo (NYSE:OLO)

Historical Stock Chart

From Oct 2024 to Nov 2024

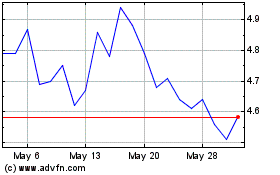

Olo (NYSE:OLO)

Historical Stock Chart

From Nov 2023 to Nov 2024